The global coin counting machines market is experiencing steady growth, driven by increasing automation in financial institutions, retail sectors, and cash-intensive industries. According to Mordor Intelligence, the coin counting machines market was valued at approximately USD 1.3 billion in 2023 and is projected to grow at a CAGR of over 4.5% during the forecast period from 2024 to 2029. This expansion is fueled by the rising demand for accuracy, efficiency, and time-saving solutions in cash handling operations. Additionally, technological advancements such as integration with IoT, cloud-based reporting, and enhanced security features are reshaping the competitive landscape. As banks, casinos, and large retailers adopt automated coin processing systems, the need for reliable and high-performance coin counter machines has never been greater—placing manufacturers at the forefront of innovation and service delivery. Against this backdrop, identifying the top 10 coin counter machine manufacturers becomes essential for stakeholders seeking scalability, precision, and long-term ROI in their cash management infrastructure.

Top 10 Coins Counter Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 CTcoin – Coin Handling Technology and Know-How

Domain Est. 1997

Website: ctcoin.com

Key Highlights: We have 30 years of experience in DESIGNING OEM COIN COUNTING & SORTING solutions. Increase your efficiency and save time using our Coin handling know-how….

#2 Coin Counter

Domain Est. 1997

Website: magner.com

Key Highlights: Patented alloy count sensor technology detects coins by 16 different parameters for the highest degree of accuracy while automatically rejecting foreign coins, ……

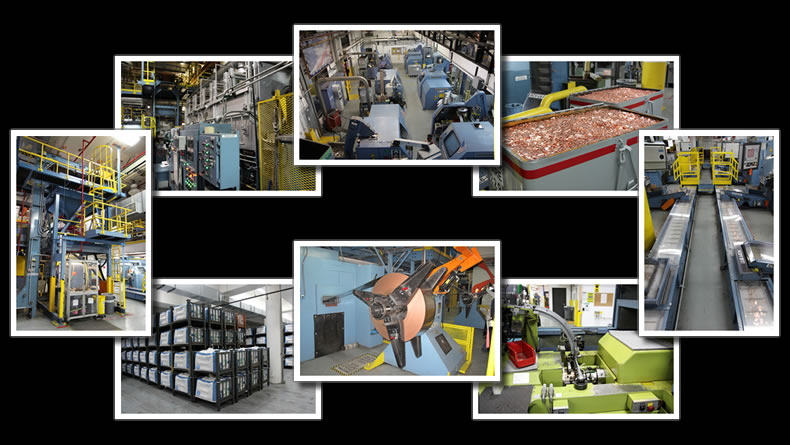

#3 Cummins Allison Money Counters, Coin Sorters, Currency Scanners

Domain Est. 1996

Website: prod.cumminsallison.com

Key Highlights: Cummins Allison is a leading innovator of technologies and equipment for counting coins, counting money, sorting money, sorting coins, imaging checks, ……

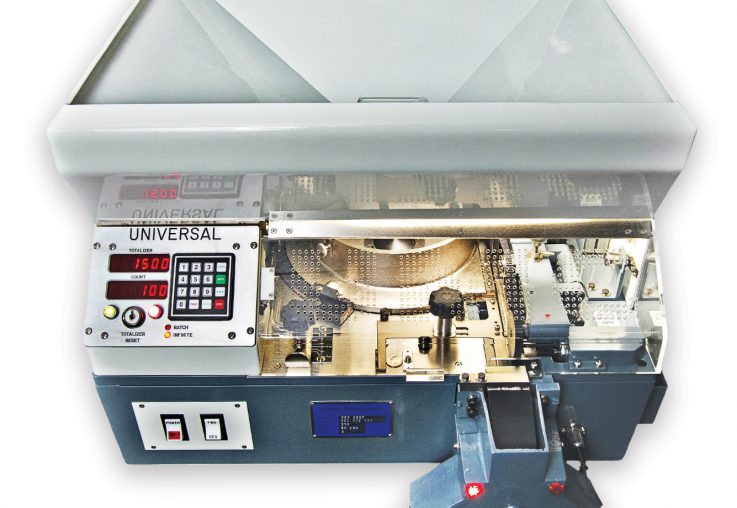

#4 Universal Machine Company

Domain Est. 1997

Website: coincounters.com

Key Highlights: Portable Coin Counter A durable electronic coin counter and packager with many features that can be easily transported to and from the work site….

#5 Coin Counter & Sorter Machine

Domain Est. 1999

Website: kloppcoin.com

Key Highlights: KLOPP Coin Counters and Coin Sorters are built to last, made from cast aluminum and hardened steel. KLOPP machines are proudly manufactured in America with a 1- ……

#6 Semacon Currency Counter and Coin Counter Money Handling …

Domain Est. 2000

Website: semacon.com

Key Highlights: Every Semacon machine undergoes extensive burn-in, rigorous quality assurance testing and precision calibration at our US manufacturing facility….

#7 PayComplete

Domain Est. 2007

Website: paycomplete.com

Key Highlights: Market leading cash management solutions. We combine our portfolio of innovative and smart hardware solutions with leading edge software….

#8 Mach™ 3

Domain Est. 2010

Website: glory-global.com

Key Highlights: Counting and sorting at up to 1,500 coins per minute, the Mach™ 3 accelerates coin processing increasing accuracy and efficiency. Its compact size means it can ……

#9 Cummins Allison to CPI

Domain Est. 2013

Website: cranepi.com

Key Highlights: You’re in the right place. All Cummins Allison websites have been integrated into this CPI website. You’ll find everything you need here….

#10 Cash and Coin Organizer and Handling Products l NADEX Coins

Domain Est. 2017

Expert Sourcing Insights for Coins Counter Machine

2026 Market Trends for Coin Counting Machines

The global coin counting machine market is poised for significant transformation by 2026, driven by technological advancements, evolving consumer behaviors, and shifting financial landscapes. Key trends shaping the industry include:

Accelerated Adoption of Cashless and Hybrid Payment Systems

While digital payments continue to rise, coin counting machines are adapting by integrating with mobile wallets and banking apps. By 2026, machines offering instant digital deposits or prepaid card loading—rather than cash payouts—will dominate, appealing to banks and retailers seeking to reduce cash handling costs and improve transaction speed.

Expansion into Emerging Markets and Retail Environments

Growth in developing economies with high cash dependency will drive demand for affordable and durable coin counters. Supermarkets, convenience stores, and transit hubs in regions like Southeast Asia, Latin America, and Africa will increasingly deploy self-service kiosks to enhance customer convenience and streamline operations.

Smart Technology Integration and IoT Connectivity

Next-generation coin counting machines will leverage IoT for real-time monitoring, predictive maintenance, and centralized management across multiple locations. AI-powered fraud detection, automatic coin denomination recognition, and remote software updates will become standard, improving accuracy and reducing downtime for operators.

Sustainability and Operational Efficiency Focus

As environmental concerns grow, manufacturers will emphasize energy-efficient designs and recyclable materials. Additionally, compact, modular machines with lower maintenance requirements will be favored by financial institutions and retailers aiming to optimize space and reduce operational costs.

Increased Competition and Service-Based Revenue Models

The market will see intensified competition between established players and fintech startups, leading to innovation in user experience and pricing models. Subscription-based services—where customers pay per use or via monthly plans—will gain traction, shifting the revenue focus from hardware sales to recurring service income.

In summary, by 2026, the coin counting machine market will evolve from standalone hardware solutions to integrated, intelligent financial service platforms, aligning with the broader digital transformation of the global payments ecosystem.

Common Pitfalls When Sourcing a Coin Counting Machine (Quality and Intellectual Property)

Sourcing a coin counting machine—whether for deployment in retail, banking, or self-service kiosks—can be fraught with risks if not approached carefully. Two critical areas where buyers often encounter problems are machine quality and intellectual property (IP) concerns. Overlooking these aspects can result in poor performance, legal exposure, and financial losses.

Poor Build Quality and Component Reliability

One of the most frequent pitfalls is selecting a coin counter based on price alone without assessing the actual build quality. Low-cost machines often use substandard materials and components, such as plastic gears instead of metal, or low-resolution sensors. These compromises lead to frequent jams, inaccurate counts, and shortened operational lifespans—especially under high-volume use. Buyers may also neglect environmental durability (e.g., resistance to dust, humidity, or temperature fluctuations), which is crucial for outdoor or high-traffic installations.

Inadequate Testing and Calibration Standards

Many suppliers, particularly from less-regulated markets, fail to provide machines that have undergone rigorous testing or third-party validation. Without proper calibration and quality assurance processes, machines may miscount coins, fail to detect counterfeit currency, or malfunction under real-world conditions. This not only damages user trust but can lead to financial discrepancies and reputational harm.

Lack of After-Sales Support and Spare Parts Availability

Even high-quality machines require maintenance and occasional part replacement. Sourcing from suppliers without reliable technical support or accessible spare parts can render machines inoperable during downtime. Some vendors disappear or go out of business, leaving buyers stranded with unsupported hardware—especially common with generic or white-label models.

Use of Counterfeit or Reverse-Engineered Technology

A significant IP-related risk arises when sourcing coin counters from manufacturers that use reverse-engineered technology or counterfeit components. Some machines may appear functionally similar to reputable brands but incorporate cloned firmware or copied mechanical designs. This not only compromises performance but exposes the buyer to legal liability if the original IP holders pursue infringement claims.

Infringement of Patented Mechanisms or Software

Coin counting technology often involves patented mechanisms for coin separation, validation, and counting. Unwittingly purchasing a machine that uses patented technology without proper licensing can result in cease-and-desist orders, product seizures, or costly litigation. This is particularly risky when sourcing from regions with lax IP enforcement, where manufacturers may disregard patent protections.

Ambiguous Ownership of Customized Designs

When working with OEMs to develop custom coin counting solutions, buyers may assume they own the design or software. However, contracts that fail to explicitly transfer IP rights can leave the buyer without ownership or usage rights. This limits scalability, future modifications, and the ability to switch manufacturers, creating long-term dependency on the original supplier.

Failure to Verify Regulatory Compliance

Beyond IP, non-compliance with regional regulations (e.g., CE, FCC, or metrology standards) can also constitute a quality and legal pitfall. Machines that lack proper certification may be barred from use in certain markets, leading to costly recalls or fines.

Conclusion

To avoid these pitfalls, buyers should conduct thorough due diligence: verify the supplier’s reputation, demand proof of quality certifications, insist on clear IP ownership terms, and ensure ongoing support availability. Investing time in vetting both the technical and legal aspects of coin counting machines pays dividends in reliability, compliance, and long-term operational success.

Logistics & Compliance Guide for Coin Counter Machine

This guide outlines the essential logistics and compliance considerations for the transportation, installation, operation, and maintenance of coin counter machines. Adhering to these guidelines ensures regulatory compliance, operational efficiency, and risk mitigation.

Regulatory Compliance

Ensure full adherence to local, national, and international regulations governing financial equipment, currency handling, and data security. Key compliance areas include anti-money laundering (AML) laws, financial reporting requirements (e.g., Currency Transaction Reports for large cash deposits), and data privacy standards such as GDPR or CCPA when customer information is collected. Machines must also comply with financial equipment certification standards (e.g., NTEP in the U.S. for commercial use) where applicable.

Import and Export Controls

When shipping coin counter machines across borders, verify compliance with customs regulations and import/export restrictions. Provide accurate product classification (HS codes), documentation (commercial invoice, packing list), and proof of conformity with destination country standards. Be aware of restrictions on electronic financial devices in certain jurisdictions and ensure the equipment does not contain prohibited components.

Transportation and Handling

Use secure, climate-controlled freight services to prevent damage during transit. Package machines in reinforced containers with shock-absorbing materials to protect sensitive internal components. Clearly label shipments as fragile and upright. Coordinate with carriers experienced in handling financial equipment. Maintain chain-of-custody documentation throughout transit to safeguard against theft or loss.

Installation and Site Requirements

Install machines in secure, environmentally controlled locations with stable power supply and limited unauthorized access. Ensure flooring can support the machine’s weight, especially in high-traffic areas. Follow manufacturer specifications regarding ventilation, temperature, and humidity. Integrate with existing security systems (CCTV, alarms) and establish restricted access protocols for maintenance personnel.

Operational Security Protocols

Implement strict operational controls, including dual custody for cash handling, routine audits, and tamper-evident seals on machine access points. Train staff on fraud detection, counterfeit coin identification, and proper machine operation. Maintain detailed transaction logs and ensure machines are regularly inspected for signs of tampering or malfunction.

Maintenance and Calibration

Schedule regular preventive maintenance according to the manufacturer’s guidelines. Use only certified technicians for repairs and calibration to ensure accuracy and compliance. Document all maintenance activities and retain records for audit purposes. Periodically verify coin counting accuracy using certified test coins or calibration tools.

Data Management and Reporting

Configure machines to securely store transaction data with proper encryption and access controls. Ensure data retention policies align with legal requirements (typically 5–7 years for financial records). Generate compliance reports as needed for regulatory submissions, and integrate with accounting or banking software where applicable, following secure data transfer protocols.

End-of-Life Disposal

Decommission machines securely by wiping all internal data storage and physically destroying hard drives if necessary. Follow e-waste disposal regulations for electronic components. Obtain certificates of destruction and proper recycling documentation. Notify relevant internal compliance teams and, if required, regulatory bodies of equipment retirement.

Conclusion: Sourcing a Coin Counting Machine

In conclusion, sourcing a coin counting machine is a strategic investment that can significantly enhance operational efficiency, accuracy, and customer satisfaction—particularly for businesses that handle high volumes of coin transactions, such as banks, retail stores, credit unions, and laundromats. After evaluating key factors such as accuracy, speed, capacity, maintenance requirements, cost, and integration capabilities, it is evident that selecting the right machine depends on the specific needs and scale of the organization.

Automated coin counters not only reduce the time and labor associated with manual counting but also minimize human errors and the risk of cash handling discrepancies. Additionally, advanced models offer valuable features like denomination sorting, connectivity to accounting systems, and audit trails, which contribute to better financial control and reporting.

When sourcing a coin counter machine, it is essential to partner with reputable suppliers, consider long-term maintenance and support, and assess the total cost of ownership. Whether opting for a standalone unit or a networked solution, the right machine will deliver a strong return on investment through improved workflow, reduced labor costs, and enhanced service delivery.

Ultimately, by carefully aligning machine specifications with organizational goals, businesses can streamline cash operations and position themselves for greater efficiency and scalability in cash management.