The global coil valves market is experiencing robust growth, driven by rising demand for automation across industrial, HVAC, and process sectors. According to Grand View Research, the global solenoid valve market—which includes coil valves—was valued at USD 3.9 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Similarly, Mordor Intelligence forecasts a CAGR of over 6.5% for the solenoid valve market during the forecast period of 2023–2028, underpinned by increasing adoption in automotive, oil & gas, and water treatment applications. As industries prioritize precision control, energy efficiency, and system reliability, coil valves have become critical components in fluid control systems. This accelerating demand has intensified competition among manufacturers, spurring innovation and advancements in materials, response time, and IoT integration. In this evolving landscape, the following eight companies have emerged as leading coil valves manufacturers, distinguished by their global footprint, technological capabilities, and market share.

Top 8 Coil Valves Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 China Pulse Jet Valves, Solenoid Valve Coils, Pneumatic Solenoid …

Domain Est. 2015

Website: brandopneumatic.com

Key Highlights: Ningbo Brando Hardware Co., Ltd is a professional manufacturer, designer and exporter of various solenoid valves and valve accessories in China….

#2 Industrial solenoid valves

Domain Est. 1995

Website: danfoss.com

Key Highlights: Danfoss offers an exceptionally wide range of high performance solenoid valves, available in direct-operated, servo-operated and assisted lift versions….

#3 Humphrey Products

Domain Est. 2000

Website: humphrey-products.com

Key Highlights: Specializing in the design and manufacture of pneumatic and fluid control valves, valve systems and customized products for industry….

#4 Sun Hydraulics

Domain Est. 1994

Website: sunhydraulics.com

Key Highlights: QuickDesign streamlines your custom design process, delivering complete designs in as little as ten minutes….

#5 Solenoid Coils

Domain Est. 1995

Website: ph.parker.com

Key Highlights: Solenoid Coils convert electrical energy into linear motion to open or close a valve. They are used on Parker Solenoid and Pressure Regulating Valves. Full ……

#6 Solenoid Coils

Domain Est. 1997

Website: nassmagnet.com

Key Highlights: nass magnet GmbH is a market leader for modular and compact electromagnetic components. We develop and manufacture electromagnetic pilot controls and valves ……

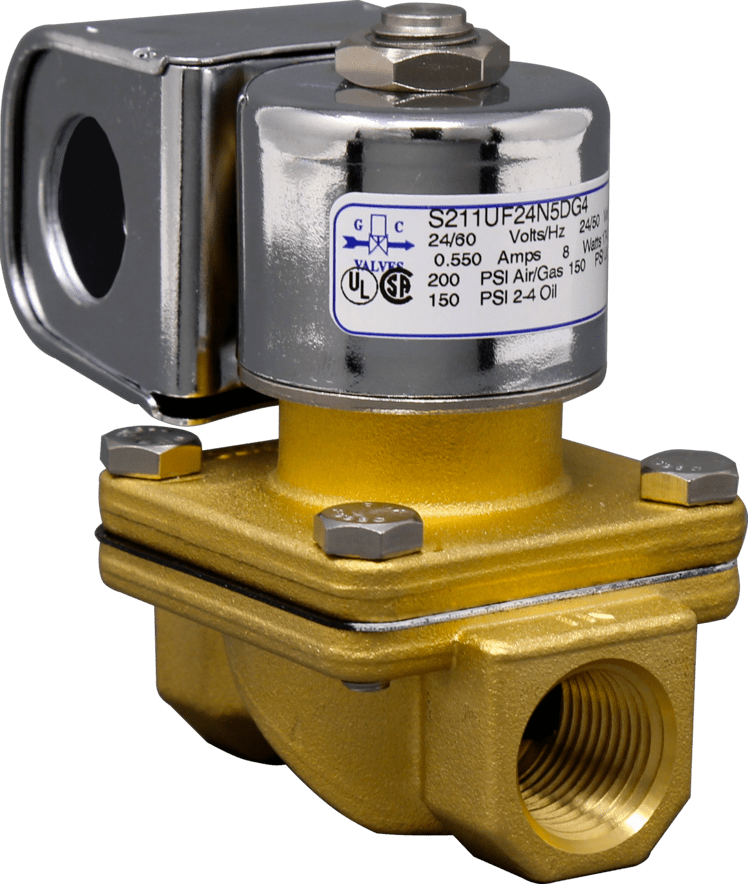

#7 GC Valves

Domain Est. 1997

Website: gcvalves.com

Key Highlights: GC Valves provides a wide range of valves and manifolds for a variety of applications, such as carwash, water quality, misting, and medical….

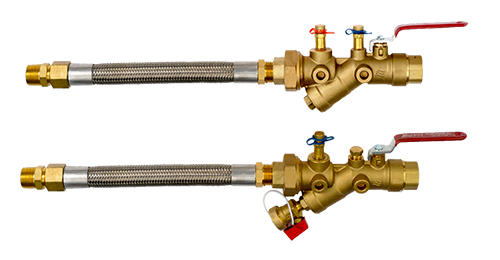

#8 IMI Flow Design

Domain Est. 2017

Website: imiflowdesign.com

Key Highlights: We are Innovators of new engineering and manufacturing techniques, dedicated to quality and continued growth….

Expert Sourcing Insights for Coil Valves

H2: 2026 Market Trends for Coil Valves

The global coil valves market is poised for significant transformation by 2026, driven by advancements in automation, energy efficiency demands, and increasing adoption across industrial and commercial sectors. Coil valves—electromechanical components that control fluid or gas flow using solenoid-actuated mechanisms—are gaining traction due to their reliability, precision, and integration capabilities with smart systems.

1. Rising Demand in HVAC and Refrigeration Systems

A major growth driver for coil valves through 2026 is the expanding HVAC (Heating, Ventilation, and Air Conditioning) and refrigeration industries. With stricter energy efficiency regulations and the global push toward sustainable building technologies, coil valves are being increasingly incorporated into variable refrigerant flow (VRF) systems and heat pumps. Their ability to modulate refrigerant flow precisely enhances system performance and reduces energy consumption, aligning with green building standards such as LEED and BREEAM.

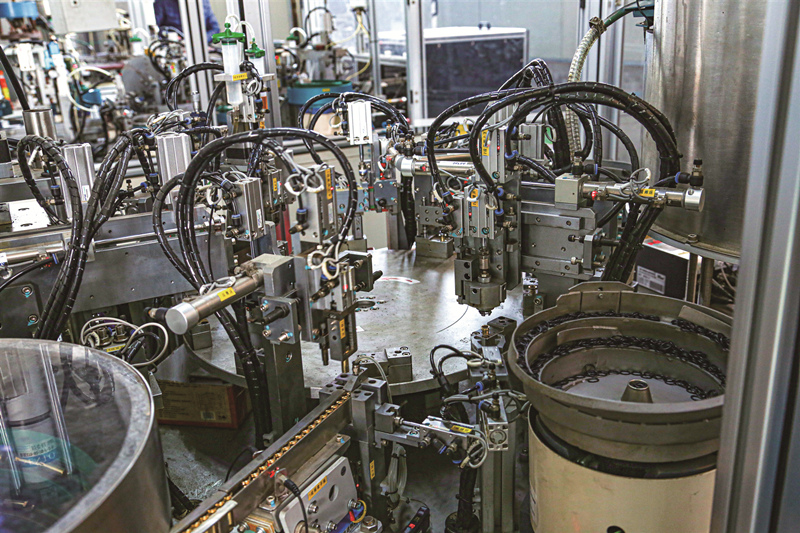

2. Growth in Industrial Automation

The proliferation of Industry 4.0 and smart manufacturing is accelerating the integration of coil valves in automated production lines. By 2026, manufacturers are expected to adopt more intelligent fluid control systems, where coil valves play a critical role in pneumatic and hydraulic circuits. Demand is particularly strong in automotive assembly, food and beverage processing, and pharmaceutical manufacturing, where precision and hygiene are paramount.

3. Technological Advancements and Miniaturization

Innovation in materials and design is leading to smaller, more efficient coil valves with faster response times and lower power consumption. By 2026, compact coil valves with improved corrosion resistance and extended service life are expected to dominate niche applications, including medical devices and semiconductor manufacturing. The use of advanced polymers and additive manufacturing (3D printing) is also streamlining production and enabling customized valve configurations.

4. Shift Toward Smart and IoT-Enabled Valves

The integration of IoT (Internet of Things) sensors and wireless communication protocols into coil valves is a key trend shaping the 2026 landscape. Smart coil valves can provide real-time diagnostics, predictive maintenance alerts, and remote control via centralized building or plant management systems. This connectivity enhances operational efficiency and reduces downtime, making them highly desirable in smart infrastructure and process industries.

5. Regional Market Dynamics

Asia-Pacific is expected to lead global demand for coil valves by 2026, fueled by rapid industrialization, urbanization, and government investments in infrastructure in countries like China, India, and South Korea. Meanwhile, North America and Europe are focusing on retrofitting existing systems with energy-efficient and smart valve technologies to meet environmental targets under initiatives like the European Green Deal and U.S. energy conservation standards.

6. Supply Chain and Sustainability Pressures

Environmental regulations are pushing manufacturers to adopt eco-friendly materials and reduce the carbon footprint of valve production. By 2026, companies are likely to emphasize recyclable components, lead-free designs, and energy-efficient manufacturing processes. Additionally, supply chain resilience—highlighted by recent global disruptions—will drive localization of production and increased inventory buffering among key players.

Conclusion

By 2026, the coil valves market will be characterized by technological sophistication, energy efficiency, and digital integration. Companies that invest in R&D, embrace smart manufacturing, and align with sustainability goals will be best positioned to capitalize on expanding opportunities across HVAC, industrial automation, and emerging high-tech sectors.

Common Pitfalls in Sourcing Coil Valves: Quality and IP Risks

Sourcing coil valves—particularly solenoid or electromagnetic valves used in HVAC, industrial automation, and fluid control systems—can be fraught with risks if not managed carefully. Two of the most critical areas where organizations encounter problems are quality inconsistencies and intellectual property (IP) exposure. Overlooking these aspects can lead to system failures, safety hazards, financial losses, and legal complications.

Quality-Related Pitfalls

-

Inconsistent Material Specifications

Many low-cost suppliers use substandard materials (e.g., inferior brass, plastic components, or low-grade seals) that degrade quickly under pressure, temperature extremes, or chemical exposure. This leads to premature valve failure, leaks, or contamination in sensitive systems. -

Lack of Certification and Testing Documentation

Reputable coil valves should comply with international standards such as ISO, UL, CE, or RoHS. Suppliers may claim compliance without providing verifiable test reports or certifications, putting buyers at risk of non-compliance and product recalls. -

Poor Electromagnetic Coil Performance

Coils sourced from unreliable manufacturers may have inconsistent resistance, overheating issues, or reduced duty cycles. This results in unreliable actuation, increased energy consumption, and shortened service life. -

Inadequate Environmental Protection (IP Rating Misrepresentation)

The Ingress Protection (IP) rating indicates resistance to dust and water. A common pitfall is suppliers overstating or misrepresenting IP ratings (e.g., claiming IP65 when the valve is only IP54). This can lead to catastrophic failures in outdoor or washdown environments. -

Insufficient Lifecycle and Durability Testing

High-quality coil valves undergo millions of operational cycles during testing. Some suppliers skip or falsify durability tests, leading to valves that fail well before their expected service life.

Intellectual Property (IP) Risks

-

Design and Specification Theft

When sharing detailed technical drawings, performance requirements, or proprietary designs with suppliers—especially overseas manufacturers—there is a risk of IP theft. Suppliers may replicate or sell the design to competitors without authorization. -

Use of Counterfeit or Clone Components

Some suppliers use reverse-engineered or counterfeit valves that mimic well-known brands. These not only compromise performance and safety but may also expose the buyer to IP infringement lawsuits if the cloned design is patented. -

Lack of IP Clauses in Contracts

Failure to include clear IP ownership and confidentiality clauses in supply agreements leaves buyers vulnerable. Without proper legal safeguards, the supplier may claim partial ownership or use shared designs for other clients. -

Third-Party Manufacturing Without Oversight

Suppliers may subcontract manufacturing to unauthorized or unqualified third parties, increasing the risk of IP leakage and quality deviations. Without audit rights, buyers lose visibility and control over where and how components are made. -

Open-Source or Publicly Shared Designs

In collaborative development or prototyping phases, designs may be shared on public platforms or with multiple vendors without NDAs, inadvertently exposing proprietary innovations to competitors.

Mitigation Strategies

- Conduct thorough supplier audits and request material test reports (MTRs) and IP certifications.

- Verify IP ratings through independent testing or third-party certification bodies.

- Use non-disclosure agreements (NDAs) and clear contractual terms defining IP ownership.

- Limit technical disclosure to “need-to-know” specifications and use watermarked or controlled design files.

- Work with suppliers that allow factory audits and have transparent manufacturing chains.

By proactively addressing quality and IP concerns during the sourcing process, organizations can ensure reliable performance, regulatory compliance, and protection of their intellectual assets.

Logistics & Compliance Guide for Coil Valves

This guide outlines key logistics considerations and compliance requirements for the handling, transportation, storage, and regulatory adherence related to coil valves across the supply chain.

Product Classification and HS Codes

Accurate product classification is essential for international shipping and customs clearance. Coil valves are typically classified under Harmonized System (HS) codes related to electromagnetic valves or solenoid valves. Common classifications include:

– HS 8505.20: Electromagnetic valves for motors or other apparatus.

– HS 8481.80: Other valves, including solenoid valves, for liquids or gases.

Verify the correct HS code based on valve specifications (e.g., material, application, voltage) with local customs authorities or a customs broker to avoid delays or penalties.

Packaging and Handling Requirements

Proper packaging ensures coil valves arrive undamaged and meet safety standards:

– Use anti-static packaging for coil components to prevent electrostatic discharge (ESD) damage.

– Secure valves in rigid, corrugated boxes with internal cushioning (foam or molded inserts).

– Clearly label packages with handling instructions: “Fragile,” “Do Not Stack,” and “Protect from Moisture.”

– Include desiccants in packaging if shipping to humid environments or for long transit times.

Storage Conditions

Store coil valves in controlled environments to maintain performance and compliance:

– Temperature: 5°C to 40°C (41°F to 104°F).

– Humidity: Below 80% relative humidity, non-condensing.

– Environment: Dry, clean, and free from corrosive gases, dust, or vibration.

– Avoid direct sunlight and electromagnetic interference.

– Store in original packaging until ready for installation.

Transportation Regulations

Adhere to transportation standards for safe and compliant shipment:

– Air (IATA): Classify coils per IATA Dangerous Goods Regulations if containing magnetic materials. Most standard coil valves are non-hazardous but must be tested for magnetic field strength.

– Sea (IMDG): Generally non-regulated unless part of a hazardous system. Include proper marine protection if shipping in saltwater environments.

– Ground (ADR/RID): No special classification typically required, but follow general cargo safety practices.

Regulatory Compliance

Ensure coil valves meet regional and international standards:

– CE Marking (EU): Comply with the Machinery Directive (2006/42/EC), Low Voltage Directive (2014/35/EU), and RoHS (2011/65/EU) for restricted substances.

– UL/CSA (North America): Certified to UL 60730 or CSA C22.2 No. 24 for automatic electrical controls.

– REACH (EU): Confirm absence of Substances of Very High Concern (SVHCs) in materials.

– EAC (Eurasian Union): Compliance with TR CU 010/2011 on machinery safety and TR CU 020/2011 on electromagnetic compatibility.

Documentation Requirements

Maintain accurate documentation for customs, traceability, and compliance:

– Commercial Invoice and Packing List

– Certificate of Conformity (CoC) for applicable standards

– RoHS and REACH Declarations of Compliance

– Material Safety Data Sheet (MSDS), if applicable

– Test reports (e.g., IP rating, dielectric strength)

Import/Export Controls

Check for any export restrictions based on technology or destination:

– Verify if valves contain controlled components (e.g., rare earth magnets) subject to export licensing (e.g., EAR in the U.S.).

– Screen end-users and destinations against denied party lists (e.g., U.S. BIS, EU Consolidated List).

Environmental and End-of-Life Compliance

Follow sustainability guidelines:

– Design for disassembly and recyclability.

– Provide end-of-life handling instructions per WEEE (EU) or local e-waste regulations.

– Offer take-back or recycling programs where required.

Quality and Traceability

Implement quality control and traceability systems:

– Assign batch/lot numbers to each production run.

– Maintain records of testing, inspection, and calibration.

– Support full traceability from raw materials to final product per ISO 9001 requirements.

By following this guide, businesses can ensure efficient logistics operations and full compliance when distributing coil valves globally.

Conclusion for Sourcing Coil Valves:

Sourcing coil valves requires a strategic approach that balances technical specifications, quality standards, cost-efficiency, and supplier reliability. It is essential to clearly define the application requirements—such as voltage, pressure rating, media compatibility, and environmental conditions—to ensure optimal performance and longevity of the valves. Evaluating suppliers based on their reputation, certifications, lead times, and after-sales support helps mitigate risks and ensures consistent supply chain integrity. Additionally, considering total cost of ownership rather than upfront price alone leads to more sustainable procurement decisions. By leveraging market research, engaging with qualified manufacturers, and establishing long-term partnerships, organizations can secure high-quality coil valves that meet operational demands and contribute to efficient system performance.