The global cocoa butter market is experiencing steady expansion, driven by rising demand from the confectionery, cosmetics, and pharmaceutical industries. According to Grand View Research, the global cocoa butter market was valued at USD 2.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. This growth is fueled by increasing consumer preference for natural ingredients in skincare products and the continued popularity of premium chocolate worldwide. As demand intensifies, reliable cocoa bean oil manufacturers play a critical role in ensuring consistent supply and high-quality output. Sourcing transparency, production capacity, and sustainable practices have become key differentiators among leading suppliers. Based on market presence, production scale, and industry reputation, here are the top 9 cocoa bean oil manufacturers shaping the global supply chain.

Top 9 Cocoa Bean Oil Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 COCOA PROCESSING IN THE NETHERLANDS

Domain Est. 2012

Website: crownofholland.com

Key Highlights: Crown of Holland specializes in processing certified organic cocoa beans using whole-bean roasting technology and nib roasting technology….

#2 Sustainable Procurement of Cocoa|Sustainability|FUJI OIL CO …

Website: fujioil.co.jp

Key Highlights: This section introduces the Sustainable Procurement of Cocoa areas of FUJI OIL. Fuji Oil Co., Ltd. is a company that deals with food ingredients in four ……

#3 Global Food and Beverage Ingredient Supplier Driving Sustainable …

Domain Est. 1997

Website: ofi.com

Key Highlights: ofi is a global food and beverage ingredient supplier partnering with brands to deliver more sustainable ingredients, innovative solutions, and traceable ……

#4 Source Cocoa Sustainably

Domain Est. 1998

Website: ferrero.com

Key Highlights: Ferrero’s cocoa is 100% certified, we support cocoa farmers and help them to improve their livelihood and adopt sustainable agricultural practices….

#5 Cocoa Bean

Domain Est. 1999

Website: kumarmetal.com

Key Highlights: Cocoa Bean Processes for Oilseeds Cocoa beans are nutrient-rich seeds that fuel the global chocolate industry and supply cocoa butter and powder….

#6 JB Cocoa

Domain Est. 2004

Website: jbcocoa.com

Key Highlights: JB Cocoa is the brand of premium cocoa ingredient products by JB Foods Limited, the public-listed Group on the Singapore Exchange (SGX:BEW)….

#7 A global agri

Domain Est. 2016

Website: cofcointernational.com

Key Highlights: COFCO International is a global agri-business, committed to responsibly source, process and distribute agri-commodities including grains, oilseeds, ……

#8 Cocoabean

Domain Est. 2020

Website: cocoabean.in

Key Highlights: Buy organically grown cocoa beans from our farm in the Idukki district, Kerala. Single-origin, fermented cocoa beans Online in India….

#9 FTN Cocoa Processors Plc

Website: ftncocoa.com.ng

Key Highlights: FTN Cocoa processors Plc was formerly registered as Fantastic Traders Nigeria Limited, a Limited Liability Company Which was incorporated in 1991….

Expert Sourcing Insights for Cocoa Bean Oil

2026 Market Trends for Cocoa Bean Oil

The global cocoa bean oil market is poised for notable shifts and growth by 2026, driven by evolving consumer preferences, supply chain dynamics, and sustainability imperatives. Below is an analysis of key trends expected to shape the market landscape in that year.

Rising Demand in Premium Confectionery and Cosmetics

Cocoa bean oil, prized for its rich texture, stability, and natural origin, continues to see increasing demand beyond its traditional use in chocolate manufacturing. In 2026, the premium confectionery sector is expanding its reliance on high-quality cocoa butter to meet consumer demand for artisanal and organic chocolates. Simultaneously, the cosmetics and personal care industry is driving growth, as cocoa bean oil’s emollient properties make it a sought-after ingredient in high-end skincare products such as balms, lotions, and lip care items. This dual-market pull is expected to bolster prices and stimulate investment in sustainable extraction methods.

Supply Constraints and Price Volatility

The cocoa supply chain remains vulnerable to climate change, political instability in key producing regions (particularly West Africa), and fluctuating yields. By 2026, persistent underinvestment in farming infrastructure and aging cocoa trees are likely to contribute to supply shortages. This constrained supply, coupled with rising global demand, is projected to maintain upward pressure on cocoa bean oil prices. Industry stakeholders are increasingly turning to forward contracts and hedging strategies to manage volatility, while some manufacturers are exploring alternative fats—though consumer preference for authentic cocoa butter limits substitution in premium segments.

Sustainability and Ethical Sourcing Imperatives

Environmental, social, and governance (ESG) concerns are reshaping procurement strategies. By 2026, major chocolate and cosmetic brands are expected to enforce stricter traceability standards, requiring certified sustainable cocoa—such as Fair Trade, Rainforest Alliance, or UTZ-certified sources. Blockchain and digital tracking technologies are becoming more prevalent to verify ethical sourcing and combat deforestation. Consumers, particularly in North America and Europe, are increasingly demanding transparency, pushing companies to invest in community-based agroforestry and farmer livelihood programs to ensure long-term supply resilience.

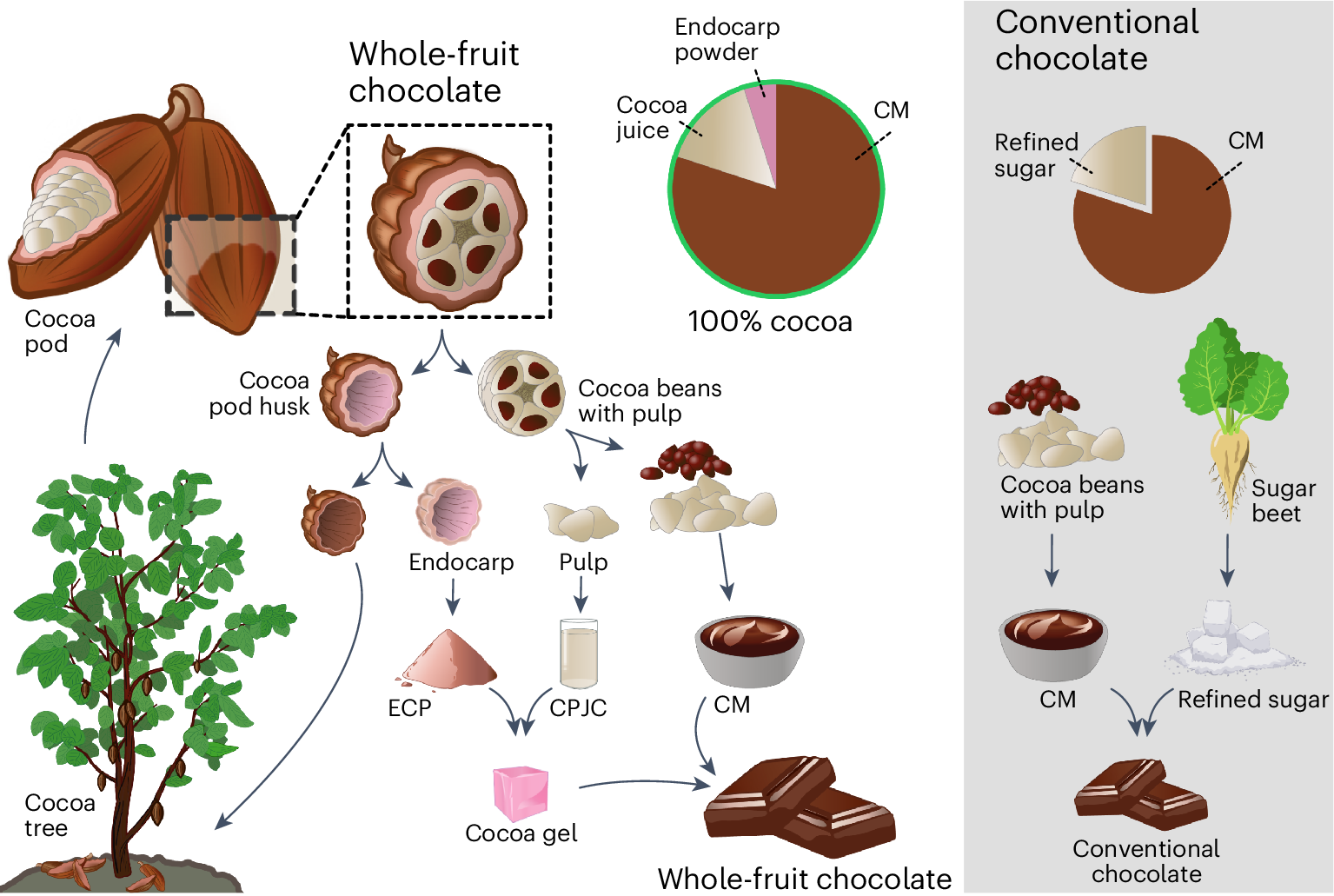

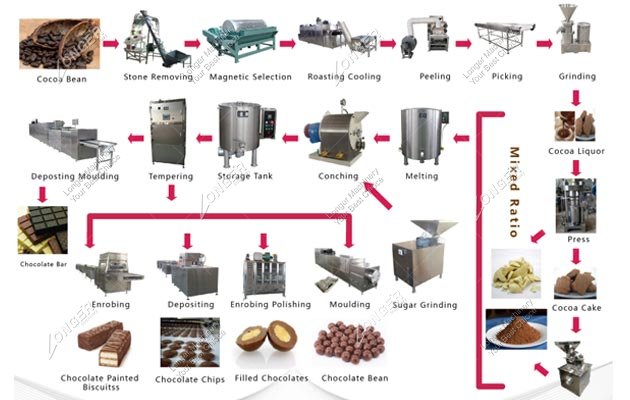

Innovation in Extraction and Byproduct Utilization

Technological advancements are improving the efficiency of cocoa bean oil extraction, reducing waste and energy consumption. In 2026, innovations such as supercritical CO₂ extraction and enzymatic processing are gaining traction, enabling higher yields and purer oil fractions. Additionally, the valorization of cocoa byproducts—like cocoa cake and husks—is creating new revenue streams. These developments not only enhance profitability but also support circular economy models, aligning with broader sustainability goals.

Regional Market Dynamics

While West Africa dominates cocoa bean production, Asia-Pacific is emerging as a key growth market for cocoa bean oil consumption, driven by rising disposable incomes and Western-style dietary influences. China and India are witnessing expanding premium chocolate and cosmetics sectors, increasing local refining capacity. Meanwhile, Europe remains the largest consumer and refiner of cocoa bean oil, with stringent regulatory standards shaping product quality and labeling requirements.

In conclusion, the 2026 cocoa bean oil market will be defined by strong demand, supply challenges, and a heightened focus on sustainability. Stakeholders who invest in traceability, innovation, and farmer support systems are likely to gain competitive advantage in this evolving landscape.

Common Pitfalls in Sourcing Cocoa Bean Oil: Quality and Intellectual Property Concerns

Sourcing cocoa bean oil—often referred to as cocoa butter—requires careful attention to both quality assurance and intellectual property (IP) considerations. Failure to address these areas can lead to supply chain disruptions, product inconsistencies, legal disputes, and reputational damage. Below are the key pitfalls to avoid:

Quality-Related Pitfalls

1. Inconsistent Fatty Acid Profile and Melting Point

Cocoa butter is prized for its unique triglyceride composition, particularly the presence of SOS (stearic-oleic-stearic) triglycerides, which give it a sharp melting point near body temperature (~34–38°C). Sourcing from unreliable suppliers may result in cocoa butter with altered profiles due to adulteration, improper processing, or blending with substitutes (e.g., shea or palm stearin). This affects product texture, stability, and performance in confectionery or cosmetics.

2. Contamination and Residual Solvents

Improper extraction methods—especially solvent-based processes—can leave harmful residues (e.g., hexane) in the final product. Additionally, contamination from pesticides, heavy metals (e.g., cadmium), or microbial agents (e.g., aflatoxins) may occur if beans are sourced from regions with poor agricultural practices or inadequate post-harvest handling.

3. Oxidative Rancidity and Shelf Life Issues

Cocoa butter is susceptible to oxidation due to its unsaturated fat content. Poor storage conditions (exposure to light, heat, or oxygen) during transport or warehousing can accelerate rancidity, leading to off-flavors and reduced efficacy in formulations. Suppliers lacking robust packaging (e.g., nitrogen-flushed, opaque containers) increase this risk.

4. Adulteration and Substitution

Due to high global demand and limited supply, cocoa butter is frequently adulterated with cheaper fats (e.g., cocoa butter equivalents, or CBEs). Without rigorous third-party testing (e.g., GC analysis for triglyceride profile, DSC for melting behavior), buyers may unknowingly receive non-compliant materials unsuitable for premium applications.

Intellectual Property-Related Pitfalls

1. Unauthorized Use of Proprietary Blends or Processes

Some suppliers may offer cocoa butter processed using patented extraction or fractionation methods. Sourcing such materials without verifying IP rights could expose the buyer to infringement claims, especially if the final product is commercialized in regulated markets (e.g., EU, US). Always request documentation on process IP status.

2. Misrepresentation of Origin and Certification Claims

Claims such as “Fair Trade,” “Organic,” or “Single-Origin” carry legal and certification-based IP implications. Suppliers may falsely label products to command premium pricing. Using such mislabeled cocoa butter can result in regulatory penalties, loss of certification, or consumer litigation—particularly under truth-in-labeling laws.

3. Breach of Confidentiality in Custom Formulations

When developing customized cocoa butter derivatives (e.g., fractionated or enzymatically modified oils), sourcing partners may gain access to sensitive formulation data. Without strong non-disclosure agreements (NDAs) and clear IP ownership clauses in supply contracts, there is a risk of reverse engineering or unauthorized use by the supplier or their affiliates.

4. Geographical Indication (GI) and Trademark Infringement

Certain cocoa-producing regions (e.g., “Chuao” in Venezuela) have protected geographical indications. Using cocoa butter labeled with protected terms without authorization may constitute trademark or GI infringement, especially in export markets with strict enforcement.

Mitigation Strategies

- Demand Certifications: Require ISO, FSSC 22000, Organic, Fair Trade, or Rainforest Alliance certifications.

- Enforce Testing Protocols: Implement routine GC, DSC, and peroxide value testing upon receipt.

- Audit Suppliers: Conduct on-site audits of processing facilities to verify quality controls and IP compliance.

- Legal Safeguards: Include IP indemnification clauses, origin verification, and confidentiality terms in sourcing agreements.

By proactively addressing these quality and IP pitfalls, businesses can secure a reliable, compliant, and high-performing cocoa bean oil supply chain.

Logistics & Compliance Guide for Cocoa Bean Oil

Overview and Key Specifications

Cocoa Bean Oil, also known as cocoa butter, is a natural fat extracted from cocoa beans (Theobroma cacao). It is widely used in the food, pharmaceutical, and cosmetics industries due to its stability, pleasant aroma, and emollient properties. Proper logistics and compliance management are essential to ensure product integrity, regulatory adherence, and efficient supply chain operations.

Regulatory Compliance Requirements

International Standards

Cocoa Bean Oil must comply with international food safety and quality standards, including:

– Codex Alimentarius Standard for Cocoa Butter (CODEX STAN 24-1973): Defines purity, composition, and labeling requirements.

– ISO 12966 Series: Specifies analytical methods for fats and oils, including cocoa butter.

– REACH and CLP (EU Regulations): Applicable for import into the European Union; ensures safe handling and classification of chemical substances.

Regional Regulatory Frameworks

- United States (FDA): Regulated as a food ingredient under 21 CFR § 184.1275. Must be produced in compliance with Current Good Manufacturing Practices (cGMPs). GRAS (Generally Recognized As Safe) status applies.

- European Union: Must meet Regulation (EC) No 1333/2008 (Food Additives) and Regulation (EC) No 852/2004 (Hygiene of Foodstuffs). Labeled according to EU INCI nomenclature in cosmetics.

- Other Regions: Countries such as Canada (CFIA), Australia (FSANZ), and Japan (MHLW) have specific import requirements including certification of origin, free sale certificates, and compositional testing.

Labeling and Documentation

- Accurate labeling including product name, INCI name (Theobroma Cacao Seed Butter), batch number, net weight, origin, expiration date, and storage conditions.

- Declaration of allergens if processed in facilities handling common allergens (e.g., nuts, soy).

- Certificates of Analysis (CoA), Phytosanitary Certificate (if required), and Certificate of Origin must accompany shipments.

Logistics and Transportation Guidelines

Packaging Requirements

- Use food-grade packaging materials (e.g., HDPE drums, lined fiberboard drums, or bulk flexitanks) to prevent contamination.

- Ensure airtight sealing to protect against moisture, light, and oxidation.

- For pharmaceutical or cosmetic grades, packaging must meet GMP standards and be tamper-evident.

Storage Conditions

- Store in a cool, dry, and dark environment (ideally 15–20°C / 59–68°F).

- Avoid exposure to direct sunlight and high temperatures to prevent melting or rancidity.

- Keep away from strong-smelling substances due to cocoa butter’s susceptibility to odor absorption.

Transportation

- Use climate-controlled (reefer) containers for long-distance or tropical route shipments to maintain solid state.

- Prevent thermal degradation by avoiding temperature fluctuations; maintain consistent storage below 25°C (77°F).

- Ensure compliance with IATA, IMDG, and ADR regulations if transporting in bulk or across borders.

Shelf Life and Handling

- Typical shelf life: 12–24 months when stored properly.

- Handle with clean, dry equipment to avoid microbial contamination.

- Rotate stock using FIFO (First In, First Out) inventory management.

Quality Assurance and Testing Protocols

Mandatory Testing Parameters

- Purity: Free fatty acid content (max 1.75%), moisture and volatile matter (max 0.5%).

- Melting Point: 32–35°C (89.6–95°F) – a key quality indicator.

- Peroxide Value: Should not exceed 10 meq O₂/kg to ensure freshness.

- Iodine Value: 33–40 (g I₂/100g) – confirms composition.

- Microbial Testing: Absence of Salmonella, E. coli, and yeast/mold limits per food safety standards.

Third-Party Certification

- Obtain certifications such as:

- Organic (USDA, EU Organic)

- Fair Trade, Rainforest Alliance, or UTZ (for sustainable sourcing)

- Kosher and Halal (for religious compliance)

- Non-GMO Project Verified (if applicable)

Import and Export Compliance

Export Documentation

- Commercial Invoice, Packing List, Bill of Lading/Air Waybill.

- Phytosanitary Certificate (often required by importing countries).

- Certificate of Free Sale (for non-EU countries).

- Fumigation Certificate (if wooden packaging is used – ISPM 15 compliant).

Import Procedures

- Verify destination country’s import license requirements.

- Pre-notify customs authorities where required (e.g., EU’s RASFF for food safety alerts).

- Engage a licensed customs broker to ensure tariff classification under HS Code 1804.00 (Cocoa Butter).

Risk Management and Contingency Planning

Supply Chain Risks

- Climate variability affecting cocoa harvests.

- Geopolitical instability in key producing regions (e.g., West Africa).

- Price volatility due to global cocoa market fluctuations.

Mitigation Strategies

- Diversify sourcing from multiple certified suppliers.

- Maintain buffer stock for critical operations.

- Use forward contracts to hedge against price changes.

Recall and Traceability

- Implement full traceability from farm to finished product using batch coding.

- Establish a product recall plan in compliance with local regulatory requirements.

Sustainability and Ethical Sourcing

Responsible Sourcing Practices

- Source from suppliers adhering to environmental and labor standards.

- Prioritize direct trade or certified sustainable cocoa programs.

- Monitor supply chains for deforestation risks (aligned with EU Deforestation Regulation – EUDR).

Carbon Footprint and Packaging

- Optimize transport routes to reduce emissions.

- Use recyclable or biodegradable packaging where feasible.

Conclusion

Successful logistics and compliance for Cocoa Bean Oil require a holistic approach that integrates regulatory adherence, quality control, and ethical sourcing. By following this guide, stakeholders can ensure product safety, minimize risks, and support sustainable trade practices across global markets. Regular audits and staff training are recommended to maintain compliance and operational excellence.

Conclusion for Sourcing Cocoa Bean Oil

Sourcing cocoa bean oil, also known as cocoa butter, requires a strategic approach that balances quality, sustainability, ethical considerations, and cost-efficiency. As a high-value ingredient widely used in cosmetics, pharmaceuticals, and fine chocolate production, the origin and production methods of cocoa butter significantly impact its properties and marketability.

Sustainable and ethical sourcing is increasingly important, given the well-documented challenges in cocoa farming, including deforestation, child labor, and inequitable farmer compensation. Prioritizing suppliers that adhere to certifications such as Fair Trade, Rainforest Alliance, or Organic ensures environmental protection and social responsibility. Direct trade relationships and transparent supply chains further enhance traceability and support long-term partnerships with cocoa-producing communities.

Additionally, understanding regional differences—such as the distinct flavor and quality profiles of cocoa butter from West Africa, South America, or Southeast Asia—allows for better alignment with product requirements. Engaging with reliable suppliers, conducting regular audits, and staying informed about market trends and regulatory standards are crucial for consistent supply and risk mitigation.

In conclusion, successfully sourcing cocoa bean oil goes beyond procurement; it involves a commitment to sustainability, quality, and ethical integrity. By building responsible sourcing practices, companies can secure a premium product while contributing positively to the global cocoa industry and its stakeholders.