The global coaxial cable market is experiencing steady growth, driven by increasing demand for high-speed data transmission across telecommunications, broadband, and enterprise networks. According to Grand View Research, the global coaxial cable market size was valued at USD 10.3 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth is fueled by the continued deployment of hybrid fiber-coaxial (HFC) networks, rising internet penetration, and the need for reliable connectivity in both residential and commercial sectors. As service providers modernize infrastructure to support bandwidth-intensive applications like streaming, cloud computing, and 5G backhaul, the role of high-performance coaxial cable routers has become increasingly critical. In this evolving landscape, a select group of manufacturers are leading innovation, scalability, and product reliability. Below, we spotlight the top 9 coaxial cable router manufacturers shaping the future of connectivity through technological advancement and strategic market presence.

Top 9 Coaxial Cable Router Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 CommScope

Domain Est. 1994

Website: commscope.com

Key Highlights: Cable Assemblies. Cable Assemblies. Deliver optimal high-speed performance with a variety of cable assemblies, including coaxial, fiber and hybrid options….

#2 Cable Modems

Domain Est. 1994

Website: netgear.com

Key Highlights: Free delivery · Free 30-day returnsGet more from your internet plan with a NETGEAR cable modem. Own your equipment, avoid rental fees, and enjoy faster internet speeds. Replace yo…

#3 Wireless Communication Products Distributor & Value

Domain Est. 1995

Website: tessco.com

Key Highlights: Tessco is a value-added supplier of wireless communications products for network infrastructure, site support, and fixed & mobile broadband networks….

#4 Coaxial cable

Domain Est. 1996

Website: l-com.com

Key Highlights: 3-day delivery · 30-day returnsWe design, manufacture and assemble coaxial cable products. Whether it’s for entertainment systems, GPS, video security systems, telecom or WAN/LAN,…

#5 Coax & Triax Cable

Domain Est. 1997

Website: belden.com

Key Highlights: Offering a wide-range of AWGs, shielding, jacketing and armoring, there is a Belden Coax/Triax cable to suit every application. Designed for unparalleled ……

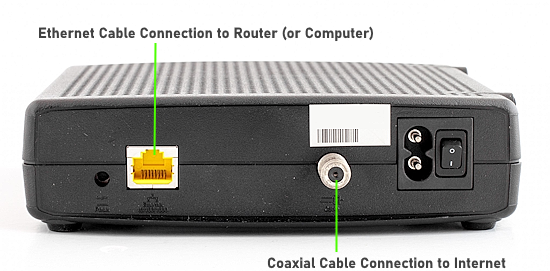

#6 TC7650

Domain Est. 2002

Website: tp-link.com

Key Highlights: Free delivery over $49 30-day returnsThe modem features innovative 24×8 channel bonding providing data rates up to 1029 Mbps for downstream, and 206 Mbps for upstrea,gives you spee…

#7 Coaxial Cable, Made In USA

Domain Est. 2007

Website: primuscable.com

Key Highlights: Free delivery 30-day returnsCoaxial Cable, Made in USA includes RG59, RG6, and RG11 coaxial cable for security and broadband video networking….

#8 Start

Domain Est. 2009

Website: incoax.com

Key Highlights: InCoax re-purposes existing property coaxial networks in fiber and fixed wireless access (FWA) extension deployments….

#9 dr.com

Website: dr-com.com

Key Highlights: CATV Coaxial Cable are a type of cable that is used by cable TV & that is common for data communications. Taking a round cross-section of the cable, one would ……

Expert Sourcing Insights for Coaxial Cable Router

H2: Market Trends for Coaxial Cable Routers in 2026

The coaxial cable router market is poised for notable transformation by 2026, driven by evolving broadband demands, advancements in network infrastructure, and competition from emerging technologies. While fiber and wireless solutions continue to expand, coaxial cable routers remain relevant—particularly within hybrid fiber-coaxial (HFC) networks—making them a critical component in the broadband ecosystem. The following trends are expected to shape the coaxial cable router market in 2026:

-

Increased Adoption of DOCSIS 4.0 Technology

By 2026, DOCSIS 4.0 will be widely deployed across major cable operators, enabling multi-gigabit speeds (up to 10 Gbps downstream and 6 Gbps upstream) over existing coaxial infrastructure. This advancement extends the lifespan of coaxial networks and increases demand for DOCSIS 4.0-compatible routers. These next-generation coaxial cable routers will support full-duplex (FDX) and extended spectrum (ESD) capabilities, making them attractive for high-bandwidth applications such as 8K streaming, cloud gaming, and smart homes. -

Hybrid Network Architectures (Fiber-to-the-Distribution-Point + Coaxial)

Many service providers are adopting distributed access architectures (DAA) that combine fiber deeper into the network with coaxial last-mile delivery. This hybrid approach reduces latency and improves reliability, ensuring coaxial cable routers remain a viable last-mile solution. In 2026, routers designed for DAA environments will dominate the market, featuring enhanced modulation schemes, remote PHY integration, and better support for network virtualization. -

Growing Demand in Multi-Dwelling Units (MDUs) and Rental Markets

Coaxial cable routers are widely used in MDUs due to established coaxial cabling in older buildings. As urbanization increases and rental housing expands, especially in North America and Europe, demand for managed, high-performance coaxial routers will rise. Service providers offering bundled internet, TV, and voice services will continue to leverage coaxial infrastructure, driving router replacements and upgrades. -

Integration with Wi-Fi 6E and Wi-Fi 7

Coaxial cable routers in 2026 will increasingly integrate with Wi-Fi 6E and the emerging Wi-Fi 7 standards. This convergence allows for seamless in-home distribution of high-speed internet delivered via coaxial lines. Routers will feature advanced mesh capabilities, multi-gigabit Ethernet ports, and intelligent traffic management to support bandwidth-intensive applications without bottlenecks. -

Competition from Fiber and 5G Fixed Wireless Access (FWA)

Despite technological advancements, coaxial cable routers face stiff competition. Fiber-to-the-Home (FTTH) deployments are accelerating, offering superior speed and latency. Additionally, 5G FWA solutions are emerging as a viable alternative in underserved areas. However, the high cost of replacing existing coaxial infrastructure ensures that coaxial routers will maintain a significant market share, particularly in regions where cable broadband is well-established. -

Focus on Energy Efficiency and Sustainability

Regulatory and consumer pressure for greener technology will push manufacturers to develop energy-efficient coaxial cable routers. By 2026, more models will feature adaptive power modes, recyclable materials, and compliance with global environmental standards (e.g., ENERGY STAR, EPEAT). This trend supports long-term sustainability goals within the telecommunications sector. -

Rise of Managed and Smart Routers

Internet Service Providers (ISPs) are increasingly deploying managed coaxial routers with remote diagnostics, automatic updates, and parental controls. These routers improve customer experience and reduce support costs. In 2026, AI-driven network optimization and cybersecurity features (e.g., built-in firewalls, IoT device protection) will become standard in premium coaxial router models. -

Regional Market Variations

- North America: Will lead in DOCSIS 4.0 adoption, with major players like Comcast and Charter upgrading their networks, driving router replacement cycles.

- Europe: Mixed adoption due to varying infrastructure; some regions will transition to fiber, while others maintain coaxial systems.

- Asia-Pacific: Growth will be limited in urban areas with fiber dominance, but rural and legacy markets may still rely on coaxial solutions.

- Latin America and Africa: Coaxial cable routers will see moderate growth where cable TV infrastructure exists, though affordability and infrastructure challenges remain.

Conclusion

While the long-term future of broadband may lean toward fiber and wireless, coaxial cable routers are expected to remain a key player through 2026 due to ongoing investments in HFC networks and DOCSIS 4.0. The market will shift toward smarter, faster, and more integrated devices that coexist with newer technologies. Vendors who innovate in performance, security, and sustainability will capture the most value in this transitional phase of broadband evolution.

Common Pitfalls When Sourcing Coaxial Cable Routers (Quality and IP Considerations)

Sourcing coaxial cable routers—especially those designed for hybrid fiber-coaxial (HFC) networks or DOCSIS-based internet delivery—requires careful attention to both hardware quality and IP (Internet Protocol) capabilities. Overlooking key factors can lead to poor performance, security vulnerabilities, and increased long-term costs. Below are common pitfalls to avoid.

Inadequate Quality Standards and Build

One of the most frequent mistakes is selecting routers based solely on price without evaluating build quality. Low-cost coaxial routers may use substandard components such as inferior RF amplifiers or heat-prone processors, leading to signal degradation, overheating, and frequent downtime. Poor shielding can also result in electromagnetic interference (EMI), affecting signal integrity and overall network stability.

Overlooking DOCSIS Compatibility

Not all coaxial routers support the latest DOCSIS (Data Over Cable Service Interface Specification) standards. Deploying a router with outdated DOCSIS 3.0 instead of DOCSIS 3.1 or 4.0 limits bandwidth potential and future scalability. This mismatch can cause bottlenecks, especially in high-demand environments, and may necessitate premature hardware upgrades.

Insufficient IP Feature Set

Many sourced routers lack advanced IP capabilities such as IPv6 support, Quality of Service (QoS), VLAN tagging, or robust firewall features. This can impair network performance, hamper application prioritization (e.g., for VoIP or video streaming), and expose the network to security threats. Ensure the router supports modern IP protocols and can integrate into existing network architectures.

Poor Security and Firmware Updates

Budget coaxial routers often come with outdated firmware and limited security features. Devices without regular security patches or lacking support for WPA3, intrusion detection, or secure boot processes are vulnerable to exploitation. Always verify the manufacturer’s track record for firmware updates and vulnerability management.

Inaccurate Performance Claims

Vendors may exaggerate throughput or range capabilities under ideal conditions that don’t reflect real-world usage. For example, advertised speeds may assume perfect signal quality on the coax line, which is rarely the case in practice. Always seek independent performance reviews and test under actual deployment conditions.

Lack of Scalability and Management Tools

Coaxial routers intended for enterprise or service provider use should support centralized management via SNMP, TR-069, or cloud platforms. Sourcing devices without remote monitoring or configuration capabilities can make network administration inefficient and error-prone, especially in large-scale deployments.

Ignoring Environmental and Regulatory Compliance

Some routers may not meet regional regulatory standards (e.g., FCC, CE) or environmental requirements (e.g., temperature tolerance, ingress protection). Using non-compliant hardware can result in legal issues, service interruptions, or hardware failure in harsh conditions.

Conclusion

To avoid these pitfalls, prioritize quality certifications, verify DOCSIS and IP specifications, assess long-term support, and evaluate real-world performance data before sourcing coaxial cable routers. Investing in reliable, feature-rich hardware upfront reduces operational risks and total cost of ownership.

Logistics & Compliance Guide for Coaxial Cable Router

Product Classification & HS Code

Identify the Harmonized System (HS) code for the coaxial cable router to ensure accurate international classification. Typical classification may fall under HS Code 8517.62 (Transmission apparatus for radio-broadcasting or television, including coaxial network equipment). Confirm with local customs authorities, as variations may apply based on specific functionality (e.g., data transmission vs. signal distribution).

Import/Export Regulations

Verify compliance with import/export regulations in both origin and destination countries. Obtain any required export licenses, especially if the router contains encryption technology. Check for trade restrictions, sanctions, or embargoes applicable to target markets. Maintain up-to-date records of shipping documentation, including commercial invoices, packing lists, and certificates of origin.

Regulatory Compliance Certifications

Ensure the coaxial cable router meets regional regulatory standards prior to distribution:

– FCC (USA): Comply with Part 15 rules for radio frequency devices; obtain FCC ID certification.

– CE (Europe): Conform to EMC Directive (2014/30/EU), RoHS (2011/65/EU), and RED (2014/53/EU) as applicable.

– ISED (Canada): Meet ICES-003 standards for electromagnetic compatibility.

– Other Regions: Adhere to local requirements such as KC (South Korea), PSE (Japan), or RCM (Australia/New Zealand).

Product Labeling & Marking

Affix required labels including:

– Manufacturer name and contact information

– Model and serial numbers

– Regulatory marks (e.g., FCC, CE, RCM)

– Power ratings (voltage, current, frequency)

– Safety warnings per IEC 60950-1 or IEC 62368-1

Ensure labels are durable, legible, and permanently affixed to the product and packaging.

Packaging & Shipping Requirements

Use packaging that provides adequate protection against shock, moisture, and static discharge during transit. Clearly mark packages with handling labels (e.g., “Fragile,” “This Side Up”). Include compliance with ISTA 3A or equivalent shipping standards. Confirm that packaging materials comply with environmental regulations (e.g., no restricted substances per RoHS).

Environmental & Sustainability Compliance

Adhere to waste electrical and electronic equipment (WEEE) directives in applicable regions. Provide consumer take-back or recycling information. Ensure product design supports energy efficiency (e.g., meets ENERGY STAR or EU Ecodesign standards if applicable). Document compliance with substance restrictions (e.g., RoHS, REACH SVHC).

Documentation & Record Retention

Maintain a technical file or declaration of conformity (DoC) for each regulatory region. Keep records of test reports, certifications, and compliance audits for a minimum of 10 years. Ensure all documentation is accessible for regulatory inspections or customs verification.

Logistics & Supply Chain Security

Implement secure logistics practices to prevent tampering or counterfeiting. Use tamper-evident packaging where appropriate. Comply with C-TPAT (USA), AEO (EU), or other customs-secure supply chain programs if applicable. Track shipments with real-time monitoring and ensure chain of custody integrity.

End-of-Life Management

Establish processes for handling end-of-life products in accordance with local e-waste regulations. Partner with certified e-waste recyclers. Communicate recycling options to customers through user manuals and websites.

Updates & Recalls

Establish a system to monitor regulatory changes and product performance. If non-compliance or safety issues arise, initiate corrective actions promptly, including field notifications or recalls per jurisdictional requirements (e.g., CPSC in the U.S., RAPEX in the EU).

In conclusion, sourcing a coaxial cable router requires careful consideration of compatibility, performance, and reliability to ensure a stable and high-speed internet connection. It is essential to verify that the router supports DOCSIS standards compatible with your Internet Service Provider (ISP), particularly DOCSIS 3.0 or higher for optimal speed and bandwidth. Additionally, evaluating factors such as channel bonding capacity, Wi-Fi standards (e.g., Wi-Fi 5 or Wi-Fi 6), security features, and scalability for future needs will contribute to a more efficient and future-proof networking solution. Sourcing from reputable manufacturers and authorized vendors ensures product quality, warranty support, and compliance with industry standards. Ultimately, a well-informed sourcing decision enhances network performance, reduces downtime, and provides a strong foundation for both current and future connectivity demands.