The global apparel manufacturing market, particularly outerwear, has experienced steady expansion over the past decade, driven by rising consumer demand for functional, sustainable, and fashion-forward garments. According to a 2023 report by Grand View Research, the global clothing manufacturing market size was valued at USD 1.5 trillion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Within this sector, coat manufacturing has seen increased specialization due to seasonal demand, technological advancements in fabric innovation, and the growing emphasis on ethical sourcing and supply chain transparency. Mordor Intelligence reports that the Asia-Pacific region dominates production, accounting for over 50% of global manufacturing output, while North America and Europe continue to lead in premium and technical outerwear demand. As brands seek reliable, scalable, and compliant manufacturing partners, identifying top-tier coat manufacturers has become critical for maintaining competitive advantage and ensuring product quality. The following list highlights eight leading coat manufacturers known for their operational excellence, innovation, and global reach.

Top 8 Coat Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Clothing Manufacturers

Domain Est. 2016

Website: createfashionbrand.com

Key Highlights: CFB Textile is a B2B clothing manufacturer in Portugal, producing luxury blanks, private label apparel, and fully custom garments for international brands. Our ……

#2 Coats Group plc

Domain Est. 1994

Website: coats.com

Key Highlights: Coats is a world-leading Tier 2 manufacturer and trusted partner for the apparel and footwear industries. We deliver essential materials, components, ……

#3 Moncler US Online Shop

Domain Est. 2003

Website: moncler.com

Key Highlights: Discover Moncler’s down jackets and clothing, merging fashion with high performance fabrics. Shop online the collections for men, women, and children.Missing: manufacturers manufa…

#4 Coats Digital

Domain Est. 2019

Website: coatsdigital.com

Key Highlights: Our trusted fashion supply chain software improves brand and garment manufacturers speed to market, agility, efficiency and sustainability….

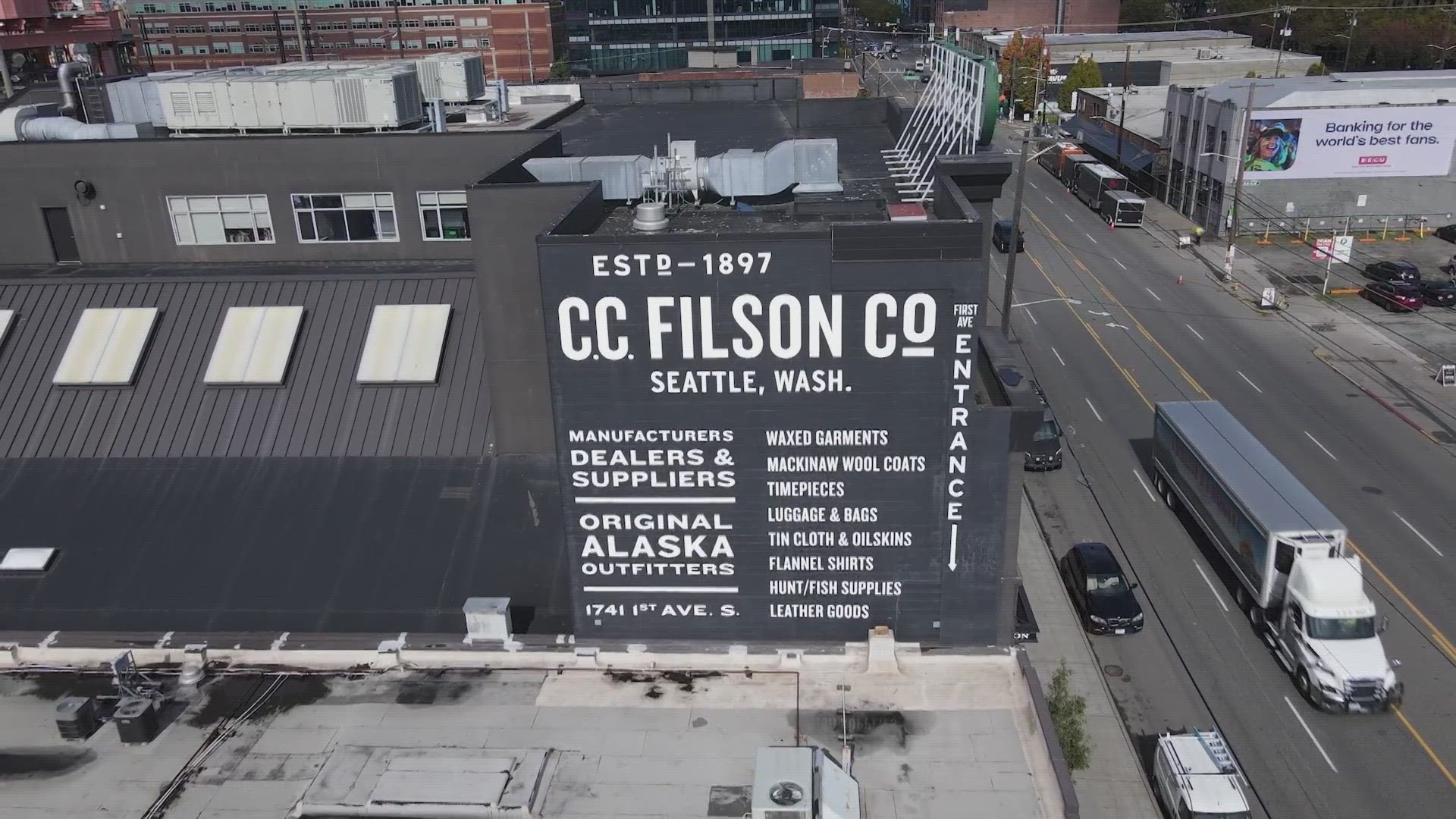

#5 Filson

Domain Est. 1996

Website: filson.com

Key Highlights: Free delivery over $195 · Free 30-day returnsFilson unfailing goods are made with the best materials and craftsmanship. Building a legacy of quality and durability since 1897….

#6 Bernardo Fashions

Domain Est. 2000

Website: bernardofashions.com

Key Highlights: Free delivery over $70 · 30-day returns…

#7 The Jacket Maker

Domain Est. 2013

Website: thejacketmaker.com

Key Highlights: Shop Finest Quality Men’s & Women’s Leather Jackets or Customize Your Own Jackets. Made to Measure Option & Free Shipping World Wide On All Orders….

#8 Coats Company

Domain Est. 2022

Website: coatscompany.com

Key Highlights: Coats Company offers premium tire changers, wheel balancers, and auto lifts, all American-made for precision, durability, and efficiency in professional ……

Expert Sourcing Insights for Coat

H2 2026 Market Trends for Coats

The global coat market in H2 2026 is poised for significant evolution, driven by shifting consumer behaviors, technological advancements, and heightened environmental consciousness. Key trends shaping the industry include:

1. Sustainability as a Core Requirement (Not a Niche):

By H2 2026, sustainable practices will no longer be a differentiator but a baseline expectation. Consumers will demand full transparency in sourcing (e.g., traceable wool, recycled down), circular business models (repair, resale, rental), and certified low-impact materials. Brands failing to demonstrate measurable progress in reducing carbon footprint and water usage will face reputational and commercial risks. Expect wider adoption of bio-based fabrics (e.g., mushroom leather alternatives) and closed-loop recycling systems.

2. Tech-Integrated Performance & Smart Coatings:

Functional innovation will accelerate, with coats incorporating advanced materials that offer adaptive insulation (responding to temperature), moisture-wicking with antimicrobial properties, and embedded solar charging for wearable devices. Durable water-repellent (DWR) finishes will shift toward non-PFAS, biodegradable alternatives due to regulatory pressure. Smart textiles with heating elements powered by compact, washable batteries will gain mainstream traction, especially in outerwear for urban commuters and outdoor enthusiasts.

3. Hybrid & Multi-Functional Design:

The post-pandemic emphasis on versatility continues. Coats designed for multiple seasons (e.g., reversible linings, detachable hoods/sleeves) and hybrid use (e.g., office-to-outdoor, travel-friendly packability) will dominate. Modular systems allowing customization (e.g., interchangeable panels) will appeal to consumers seeking personalized utility and longevity.

4. Regional Climate Responsiveness & Localization:

Brands will increasingly tailor collections to hyper-local climate patterns affected by extreme weather events. This includes lighter-weight technical shells for regions experiencing milder winters and ultra-protective, insulated options for areas facing intensified cold snaps. Supply chains will shorten, with more regional manufacturing to reduce emissions and respond faster to local demand fluctuations.

5. Digital Influence & AI-Driven Personalization:

Virtual try-on via AR, AI-powered size/fit recommendations, and digital product passports (blockchain-backed) will become standard in e-commerce. Social media, particularly short-form video, will drive micro-trends, but longevity will be prioritized over fleeting virality. Subscription models for coat rotation may emerge in affluent urban markets.

6. Premiumization & Emotional Value:

Despite economic headwinds, the “buy less, buy better” ethos will strengthen. Consumers will invest in high-quality, timeless coats with strong brand narratives around craftsmanship, heritage, and ethical production. Emotional resonance—coats designed for comfort, nostalgia, or self-expression—will compete with pure functionality.

In summary, H2 2026 will see the coat market pivot decisively toward sustainability, intelligent functionality, and personalized value, with technology and transparency acting as critical enablers across all segments.

Common Pitfalls Sourcing Coats: Quality and Intellectual Property Concerns

Sourcing coats, especially from overseas manufacturers, involves navigating several potential pitfalls related to quality control and intellectual property (IP) protection. Failing to address these areas adequately can result in substandard products, legal disputes, and reputational damage. Below are key challenges to watch for:

Quality-Related Pitfalls

Inconsistent Material Standards

Suppliers may use lower-grade fabrics, linings, or insulation than specified to reduce costs. Without rigorous material verification and third-party testing, brands risk receiving coats that wear out quickly, lack durability, or fail in extreme weather conditions.

Poor Craftsmanship and Construction

Manufacturing shortcuts—such as weak stitching, uneven seams, improper zipper installation, or misaligned patterns—can compromise both the appearance and functionality of coats. These defects are often missed without on-site quality audits or pre-production sample approvals.

Inadequate Quality Control Processes

Some suppliers lack standardized quality assurance protocols. Relying solely on the manufacturer’s internal checks without independent inspections (e.g., pre-shipment inspections) increases the risk of large shipments being rejected upon arrival.

Seasonal and Environmental Variability

Coats must perform in specific climates, but suppliers might not test products under real-world conditions. For example, a winter coat may claim water resistance but fail in heavy snow without proper testing for breathability and insulation retention.

Intellectual Property-Related Pitfalls

Unauthorized Production and Grey Market Sales

Suppliers may overproduce units beyond the agreed order quantity and sell them independently under your brand or to third parties. This dilutes brand value and can flood markets with unauthorized inventory.

Design Copying and Counterfeiting

Detailed technical specifications and prototypes shared with manufacturers can be used to replicate your designs for competing brands—or worse, sold to competitors. Without strong contractual safeguards, your unique coat designs are vulnerable.

Weak or Unenforceable Contracts

Many sourcing agreements lack clear IP ownership clauses, confidentiality terms, or penalties for infringement. This makes it difficult to pursue legal action if your designs are stolen or copied, especially in jurisdictions with lax IP enforcement.

Lack of Trademark and Design Registration

Operating in countries without registered trademarks or design patents leaves your brand exposed. Even if a contract exists, enforcement is nearly impossible without formal IP registration in key manufacturing and sales regions.

Mitigation Strategies

To avoid these pitfalls, brands should:

– Conduct due diligence on suppliers, including factory audits and references.

– Implement detailed technical specifications and approve physical prototypes.

– Use third-party quality inspection services at multiple production stages.

– Draft comprehensive contracts with clear IP ownership, confidentiality, and anti-circumvention clauses.

– Register trademarks, design patents, and utility models in relevant jurisdictions.

– Limit access to sensitive design information on a need-to-know basis.

Proactively addressing quality and IP risks ensures that sourced coats meet brand standards and remain legally protected throughout the supply chain.

Logistics & Compliance Guide for Coats

This guide outlines the essential logistics and compliance considerations for the transportation, handling, and regulatory adherence related to coats (apparel outerwear). Adhering to these guidelines ensures efficient operations, legal compliance, and product quality throughout the supply chain.

Product Classification and Documentation

Correct classification of coats is foundational for compliance. Determine the appropriate Harmonized System (HS) code based on material composition (e.g., wool, cotton, synthetic), style (e.g., parka, trench coat), and function. Accurate classification directly impacts import/export duties, tariffs, and applicable trade regulations. Ensure all shipping documentation—including commercial invoices, packing lists, and certificates of origin—is complete, consistent, and compliant with destination country requirements.

Labeling and Country-of-Origin Requirements

Coats must meet labeling regulations in the target market. This includes permanent labels indicating fiber content (e.g., “60% Wool, 40% Polyester”), country of origin, care instructions, and manufacturer/importer information. Regulations vary by region; for example, the U.S. requires FTC-compliant labels, while the EU follows the Textile Regulation (EU) No 1007/2011. Non-compliant labeling can result in shipment rejection or fines.

Packaging and Handling Standards

Use protective packaging to prevent damage during transit. Coats should be folded or hung in sturdy polybags and packed in corrugated cartons with appropriate padding. Clearly label outer packaging with handling instructions (e.g., “Fragile,” “Do Not Crush,” “This Side Up”) and essential shipment details. Implement anti-theft and anti-counterfeiting measures where applicable, especially for premium brands.

Import and Export Compliance

Verify that the export and import of coats comply with bilateral trade agreements, sanctions, and embargoes. Obtain necessary export licenses if required. Screen all parties in the supply chain against restricted entity lists (e.g., OFAC, EU sanctions lists). Ensure adherence to customs valuation rules and proper use of Incoterms® (e.g., FOB, DDP) to clarify responsibilities between buyer and seller.

Environmental and Safety Regulations

Comply with environmental standards such as REACH (EU) and CPSIA (U.S.) regarding restricted substances in textiles (e.g., azo dyes, phthalates). Coats with functional elements (e.g., fur trims, flame-resistant coatings) may be subject to additional regulations. Properly declare any components derived from endangered species (e.g., fur, leather) under CITES if applicable.

Transportation and Inventory Management

Optimize logistics by selecting appropriate transport modes (air, sea, or ground) based on lead times, cost, and coat value. Monitor inventory levels to prevent overstocking while ensuring availability. Utilize warehouse management systems (WMS) to track stock, manage batch/lot numbers, and support traceability in case of recalls.

Returns and Reverse Logistics

Establish a clear returns process for defective or unsold coats. Inspect returned items for compliance with quality and hygiene standards before restocking or disposal. Ensure reverse logistics operations adhere to waste management regulations, especially for non-reusable textiles. Consider sustainability initiatives such as recycling or donation programs.

Audits and Continuous Improvement

Conduct regular internal and third-party audits to verify compliance with logistics and regulatory standards. Stay updated on changes in international trade laws, customs procedures, and environmental regulations. Train supply chain personnel on compliance protocols and leverage technology (e.g., blockchain, RFID) to enhance transparency and efficiency.

In conclusion, sourcing coat manufacturers requires a strategic approach that balances quality, cost, reliability, and sustainability. Conducting thorough research, evaluating supplier credentials, and visiting production facilities—either in person or virtually—are essential steps to ensure the chosen manufacturer aligns with your brand’s standards and values. Factors such as minimum order quantities, production lead times, compliance with ethical and environmental standards, and effective communication are critical to building a successful long-term partnership.

Ultimately, selecting the right coat manufacturer not only impacts product quality and profitability but also shapes your brand’s reputation in the market. By prioritizing transparency, due diligence, and ongoing collaboration, businesses can secure a reliable supply chain that supports growth, innovation, and customer satisfaction in the competitive apparel industry.