The global CO₂ laser market is experiencing robust growth, driven by increasing demand across industrial, medical, and commercial applications. According to Grand View Research, the global CO₂ laser market size was valued at USD 3.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. This upward trajectory is fueled by rising adoption in cutting, engraving, and marking applications within the automotive, electronics, and packaging industries. Parallel advancements in fiber optic delivery systems have enhanced the precision and efficiency of CO₂ lasers, prompting increased integration with fiber optic components. As a result, manufacturers specializing in CO₂ laser fiber optic technology are playing a pivotal role in enabling next-generation material processing solutions. Below, we profile the top 10 CO₂ laser fiber optic manufacturers leveraging innovation, scalability, and technical expertise to lead this evolving landscape.

Top 10 Co2 Laser Fiber Optic Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 ULO Optics

Website: ulooptics.com

Key Highlights: As the leading European manufacturer of infrared optics, ULO supplies a full range of optics for CO2 laser manufacturers and CO2 laser users….

#2 Focus on laser

Website: hanslaser.net

Key Highlights: The fiber optic laser oscillator marker has advantage of high beam quality and high reliability. It is suitable for processing fields that need high marking ……

#3 CO2 Laser Optics

Website: ophiropt.com

Key Highlights: Ophir CO 2 laser optics encompass a full range of high-performance OEM and replacement optics for 9.4, 10.2 and 10.6 μm spectral ranges….

#4 IPG Photonics

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

#5 CO2 Lasers

Website: coherent.com

Key Highlights: A huge range of products, with powers from 20 W to 8 kW, various wavelengths, and pulsed or CW operation, all designed for high reliability and uptime….

#6 American Photonics 100% Made in USA

Website: americanphotonics.com

Key Highlights: 100% Made in USA CO2 laser lenses, Si Mirror, Nozzles, Protective Window, Fiber Laser Engraving, K40 Upgrade, Replacement Parts for Trumpf®, OmTech® & more….

#7 Laser Optics

Website: sumitool.com

Key Highlights: Sumitomo Electric Industries, Laser Optics Sales Group for Lenses, Mirrors, Diffractive Optical Elements….

#8 Reusable and Single

Website: bostonscientific.com

Key Highlights: The CO 2 laser fibers are designed to be used for a wide variety of specialties including otolaryngology, head & neck, otology and gynecology….

#9 Reci Laser

Website: reci-laser.com

Key Highlights: A series high-power single-mode continuous-wave fiber laser is developed and produced by Reci Laser. The average power exceeds 1000W….

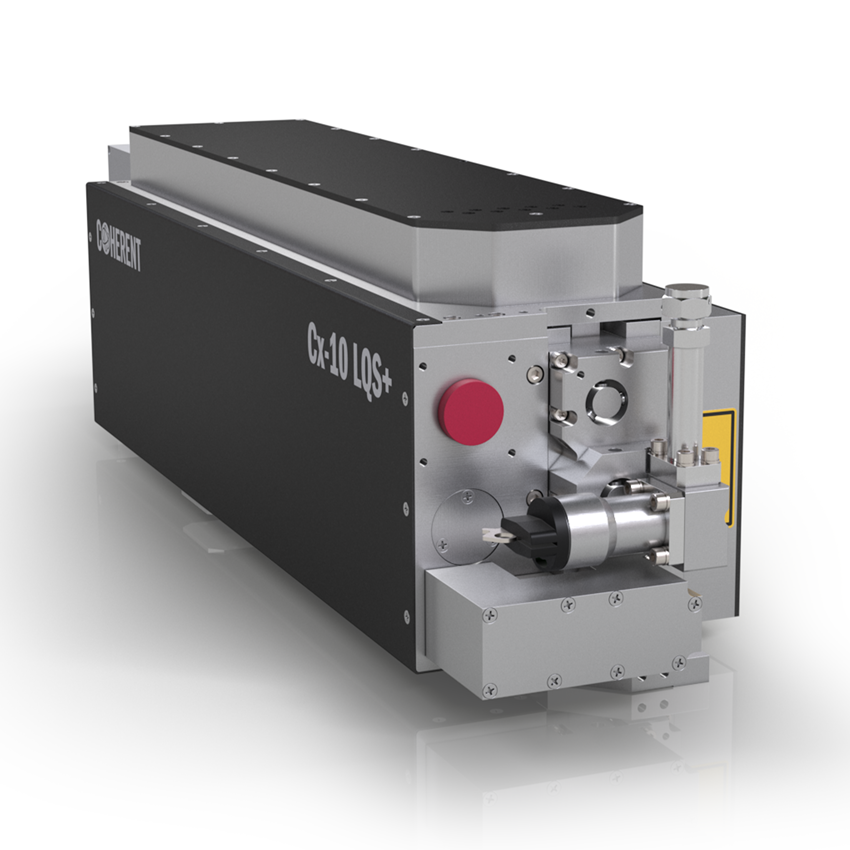

#10 CO2 Lasers

Website: novantaphotonics.com

Key Highlights: Discover Precision CO₂ Lasers. Experience extreme precision and reliability with industry-leading carbon dioxide (CO₂) lasers and systems by Novanta ……

Expert Sourcing Insights for Co2 Laser Fiber Optic

H2: Market Trends for CO2 Laser Fiber Optic Technology in 2026

As of 2026, the CO2 laser and fiber optic technology landscape continues to evolve, driven by advancements in industrial automation, materials processing, and telecommunications infrastructure. While CO2 lasers and fiber optic systems are distinct technologies—CO2 lasers operating in the mid-infrared spectrum (typically 10.6 µm) and fiber lasers in the near-infrared (around 1 µm)—their integration and parallel development are shaping key market trends, particularly in hybrid manufacturing environments and specialized communication applications.

1. Convergence in Industrial Manufacturing

One of the most prominent trends in 2026 is the strategic co-deployment of CO2 lasers and fiber optic–delivered laser systems in high-precision manufacturing. Although fiber lasers dominate in metal cutting and welding due to their efficiency and beam quality, CO2 lasers remain critical for non-metal processing—including plastics, wood, glass, and ceramics—where their longer wavelength is more effectively absorbed.

Manufacturers are increasingly adopting hybrid laser workstations that integrate both CO2 and fiber laser sources via fiber optic beam delivery (where applicable) to optimize material versatility. This trend is particularly visible in the automotive, aerospace, and consumer electronics sectors, where diverse materials require adaptable processing solutions.

2. Advancements in Beam Delivery and Flexibility

Fiber optic beam delivery, traditionally limited to solid-state and fiber lasers due to material constraints, has seen innovations that extend its utility in supporting CO2 laser systems indirectly. While CO2 lasers cannot be transmitted through standard silica fibers, hollow-core photonic crystal fibers (HC-PCFs) and articulated arm systems with enhanced flexibility are being improved to offer quasi-fiber-like delivery options.

In 2026, HC-PCFs capable of guiding mid-IR wavelengths with lower losses are gaining traction in medical and scientific applications, such as laser surgery and spectroscopy, where precise delivery of CO2 laser beams is essential. These developments blur the line between traditional CO2 delivery methods and fiber-optic-inspired flexibility, opening new market niches.

3. Growth in Medical and Aesthetic Applications

The medical sector remains a robust driver for CO2 laser technology, particularly in dermatology, gynecology, and minimally invasive surgery. In 2026, compact, fiber-coupled CO2 systems (using advanced waveguide or hollow fibers) are enabling greater precision and accessibility in outpatient clinics and aesthetic centers.

Market demand is fueled by rising consumer interest in non-invasive cosmetic procedures and technological improvements that reduce recovery time. Companies are investing in modular systems that combine CO2 laser sources with fiber-based scanning handpieces, enhancing usability and safety.

4. Environmental and Energy Efficiency Pressures

Regulatory and sustainability trends are influencing laser technology adoption. Fiber lasers are generally more electrically efficient (30–50%) compared to CO2 lasers (10–15%), leading to a shift toward fiber systems in energy-sensitive applications. However, CO2 lasers are finding renewed relevance in applications involving recycled or composite materials, where their wavelength provides superior cut quality.

In response, manufacturers are optimizing CO2 laser designs with RF excitation, sealed-tube configurations, and integrated cooling systems to improve efficiency and reduce environmental impact—helping them remain competitive in a sustainability-focused market.

5. Expansion in Emerging Markets and Automation

Emerging economies in Southeast Asia, India, and Latin America are witnessing increased adoption of laser processing technologies, driven by industrial modernization and government incentives. While fiber laser systems dominate new installations due to lower operating costs, CO2 lasers maintain a foothold in packaging, textile, and signage industries.

Furthermore, the integration of both CO2 and fiber lasers into automated production lines—connected via IoT platforms and AI-driven process optimization—is a defining trend of 2026. Real-time monitoring, predictive maintenance, and adaptive beam control are enhancing throughput and reducing downtime across both laser types.

6. Research and Development in Hybrid Photonics

R&D efforts are focused on hybrid photonic systems that combine the benefits of CO2 lasers with fiber optic control and sensing. For example, fiber Bragg gratings (FBGs) are being used to monitor thermal effects during CO2 laser processing, enabling closed-loop feedback systems that improve precision.

Additionally, quantum cascade lasers (QCLs) and interband cascade lasers (ICLs), which can emit in the mid-IR range, are being explored as solid-state alternatives to CO2 lasers, potentially offering fiber compatibility and longer lifetimes. Though not yet displacing CO2 lasers, these technologies are shaping long-term market expectations.

Conclusion

In 2026, the CO2 laser and fiber optic market is characterized by specialization, integration, and innovation. While fiber lasers continue to dominate in metal processing and telecommunications, CO2 lasers maintain a strong presence in non-metal applications and medical fields. The trend toward hybrid systems, improved delivery methods, and smart manufacturing is enabling both technologies to coexist and complement each other in advanced industrial ecosystems. As material science and photonics continue to advance, the boundary between CO2 and fiber-based solutions is expected to further blur, creating new opportunities for synergistic development.

Common Pitfalls When Sourcing CO2 Laser Fiber Optic Components (Quality & IP)

Sourcing CO2 laser fiber optic components involves navigating technical, quality, and intellectual property (IP) challenges. Failing to address these can lead to compromised performance, legal risks, and supply chain disruptions. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Material Specifications

CO2 laser transmission requires specialized materials such as chalcogenide or polycrystalline fibers (e.g., zinc selenide), not standard silica fibers. A common mistake is sourcing fibers designed for near-infrared lasers, which absorb CO2 wavelengths (typically 9.4–10.6 μm), causing rapid degradation and failure. Always verify material compatibility with mid-infrared wavelengths.

2. Poor Core-Cladding Interface and Surface Quality

Imperfections in the fiber’s core-cladding boundary or surface polish increase scattering and absorption, reducing power transmission and increasing the risk of thermal damage. Suppliers may cut corners on manufacturing precision—request certification of surface roughness and core concentricity.

3. Insufficient Power Handling and Thermal Management

Many suppliers overstate maximum power ratings. Without proper cooling or robust jacketing, fibers can overheat, crack, or delaminate. Ensure specifications include tested power thresholds under continuous-wave (CW) and pulsed conditions, and confirm availability of compatible cooling housings.

4. Inconsistent Beam Delivery and Mode Quality

Low-quality fibers can distort beam profiles, affecting cutting or engraving precision. Verify beam quality metrics (M² factor) and output mode stability over time. Poor alignment or connector tolerances can also introduce losses.

5. Lack of Environmental and Mechanical Durability Testing

Fibers used in industrial settings must withstand vibration, bending, and temperature fluctuations. Some suppliers provide lab-tested components that fail in real-world applications. Request compliance with industrial standards (e.g., IEC, MIL-STD) and proof of lifecycle testing.

Intellectual Property (IP)-Related Pitfalls

1. Sourcing from Unlicensed Manufacturers

Several patented technologies govern low-loss CO2 fiber transmission, including specific fiber compositions, cladding methods, and termination techniques. Using components from manufacturers without proper licensing exposes your company to IP infringement claims, especially in regulated markets like the EU or U.S.

2. Ambiguous IP Ownership in Custom Designs

When co-developing or customizing fiber assemblies, contracts must clearly define IP ownership. Suppliers may claim rights to design improvements, limiting your freedom to manufacture or modify the component later. Ensure agreements include IP assignment clauses.

3. Inadequate Documentation and Traceability

Reputable suppliers provide detailed technical documentation, including material certifications and test reports. Lack of traceability can raise red flags during audits or IP disputes. Verify that components come with full compliance and origin documentation.

4. Risk of Reverse-Engineered or Counterfeit Components

In emerging markets, some suppliers offer low-cost fibers that may be reverse-engineered from protected designs. These components often underperform and carry legal risks. Conduct due diligence on supplier credibility and request proof of IP clearance.

5. Export Controls and Licensing Restrictions

Certain high-performance laser components may be subject to export regulations (e.g., ITAR, EAR). Sourcing from non-compliant suppliers can lead to shipment delays or legal penalties. Confirm that both supplier and product comply with applicable trade laws.

Mitigation Strategies

- Partner with established, certified suppliers with verifiable references in CO2 laser applications.

- Require third-party testing reports for optical and mechanical performance.

- Conduct IP landscape reviews before finalizing suppliers.

- Include clear IP and quality warranties in procurement contracts.

Avoiding these pitfalls ensures reliable performance, regulatory compliance, and protection against legal exposure in CO2 laser system integration.

H2: Logistics & Compliance Guide for CO2 Laser Fiber Optic Systems

Introduction

CO2 laser systems utilizing fiber optic beam delivery represent advanced technology used in industrial cutting, engraving, and medical applications. Due to their high-powered nature, specific regulatory, safety, and logistical requirements must be followed during shipping, import/export, installation, and operation. This guide outlines critical logistics and compliance considerations under the H2 classification framework.

H2.1 Regulatory Classification & Product Categorization

-

Laser Classification (IEC 60825-1 / FDA 21 CFR 1040.10):

CO2 lasers are typically Class 4 lasers—posing significant risks of eye and skin injury, fire, and hazardous emissions. Systems must be labeled accordingly and include safety interlocks, emission indicators, and protective housings. -

HS Code (Harmonized System):

Most CO2 laser systems fall under:

HS 8515.21 – Electrical, ultrasonic, electron beam, laser, and other welding, soldering, or cutting machines.

Note: Final classification may vary by country; consult local customs for exact code. -

Export Control (e.g., EAR/ITAR):

High-power lasers may be controlled under the U.S. Export Administration Regulations (EAR), especially if power exceeds 500 watts or has potential military applications. Check ECCN (Export Control Classification Number); likely 6A003.b.4 for certain high-energy lasers.

H2.2 Packaging & Shipping Requirements

-

Fragile & Sensitive Equipment:

CO2 laser systems require shock-absorbent packaging with custom crating, internal bracing, and humidity control. Fiber optic components are especially sensitive to bending and contamination. -

Labeling:

Packages must display: - “FRAGILE – LASER EQUIPMENT”

- “THIS SIDE UP”

- “DO NOT DROP”

- Class 4 Laser Warning Label

-

Handling instructions for fiber optics (e.g., “Minimum Bend Radius: X cm”)

-

Environmental Protection:

Use desiccants and vapor barriers to prevent moisture damage. Avoid extreme temperatures during transit. -

Carrier Requirements:

Coordinate with freight carriers experienced in handling scientific/industrial lasers. Air transport may require IATA Dangerous Goods compliance if batteries (e.g., for control units) are included.

H2.3 Import & Customs Compliance

- Documentation:

Prepare: - Commercial Invoice (clearly stating HS code, value, and technical specs)

- Packing List

- Certificate of Origin

- Manufacturer’s Declaration of Conformity (CE, FDA, etc.)

-

Technical User Manual (for customs review)

-

Duties & Tariffs:

Duty rates vary by country. For example: - EU: Typically 0–2% for industrial machinery under preferential trade agreements.

-

USA: Subject to Section 301 tariffs if originating from China—verify current status.

-

Local Approvals:

Some countries require pre-shipment inspection (PSI) or verification of safety standards (e.g., CE, CCC, KC mark).

H2.4 Safety & Installation Compliance

- Installation Site Requirements:

- Adequate ventilation (to manage ozone and fumes)

- Fire suppression systems

- Non-reflective, flame-resistant surfaces

-

Emergency stop access and interlock integration

-

Laser Safety Officer (LSO):

Required in many jurisdictions for Class 4 lasers. The LSO oversees safety protocols, training, and compliance audits. -

Protective Measures:

- Install laser safety barriers and interlocked enclosures

- Provide appropriate laser safety eyewear (OD 5+ at 10.6 µm wavelength)

-

Use beam dumps and proper fiber routing

-

Fiber Optic Handling:

- Avoid tight bends (follow manufacturer’s minimum bend radius)

- Protect connectors from dust and contamination

- Use protective caps during transport and maintenance

H2.5 Operational & Environmental Compliance

-

Emissions Control:

Ensure adequate fume extraction systems are installed and maintained. Filter particulates and volatile organic compounds (VOCs) generated during laser processing. -

Noise & Radiation:

Confirm system meets local noise regulations. CO2 lasers emit non-ionizing radiation—ensure shielding prevents exposure. -

Waste Disposal:

Used optics, filters, and consumables may be classified as hazardous waste depending on materials processed. Follow local disposal regulations.

H2.6 Training & Documentation

-

User Training:

Mandatory training on laser safety, emergency procedures, and fiber optic handling. Maintain training records. -

Compliance Documentation:

- Laser Safety Program (per ANSI Z136.1 or equivalent)

- Risk Assessment Report

- Maintenance Logs

- Calibration Records

Conclusion

Compliance with global logistics and regulatory standards is essential for the safe and legal deployment of CO2 laser fiber optic systems. Engage with regulatory experts, freight forwarders, and local authorities early in the supply chain to ensure smooth shipment, import, installation, and operation. Regular audits and staff training will maintain ongoing compliance and operational safety.

Conclusion for Sourcing CO2 Laser Fiber Optic Components:

Sourcing CO2 laser systems with fiber optic beam delivery requires careful evaluation due to the inherent technical differences between CO2 lasers and fiber-based technologies. While fiber optic delivery is standard and highly efficient for solid-state lasers (such as fiber and Nd:YAG lasers), CO2 lasers operate at a longer wavelength (10.6 μm), which is incompatible with conventional silica glass optical fibers. Instead, CO2 lasers typically rely on articulated arms or specialized hollow-core waveguides for beam transmission.

When sourcing components for a CO2 laser system, it is essential to understand that true “fiber optic” delivery for CO2 lasers involves alternative technologies such as hollow flexible waveguides or photonic bandgap fibers, which are less common, more fragile, and often more expensive than traditional beam delivery methods. These alternatives may offer increased flexibility and ease of integration in some applications but come with trade-offs in power handling, beam quality, and durability.

Therefore, sourcing decisions should be guided by application requirements—such as precision, power needs, integration complexity, and operating environment. For most industrial applications, articulated arm delivery remains the most reliable and cost-effective solution for CO2 lasers. However, in niche applications where flexibility and compact design are critical, emerging fiber-like delivery options may be viable, provided suppliers are carefully vetted for technical capability and long-term support.

In summary, while the concept of fiber optic delivery for CO2 lasers is technically feasible through specialized components, it is not as mature or universally practical as in near-infrared laser systems. Buyers should prioritize compatibility, reliability, and lifecycle costs, ensuring that suppliers provide proven solutions tailored to their specific operational needs.