The septic tank manufacturing industry is experiencing steady growth, driven by increasing urbanization, expanding infrastructure in developing regions, and rising awareness of sustainable wastewater management. According to a 2023 report by Grand View Research, the global septic tank market was valued at USD 8.7 billion and is projected to expand at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. This growth is fueled by regulatory mandates promoting proper sanitation systems, particularly in rural and off-grid areas where centralized sewage networks are unavailable. With demand rising for durable, eco-friendly, and low-maintenance solutions, manufacturers are investing in advanced materials such as fiberglass, polyethylene, and precast concrete to improve efficiency and longevity. As competition intensifies, a select group of companies have emerged as industry leaders, combining innovation, scalability, and compliance with environmental standards. Based on market presence, product range, and technological advancement, the following nine companies represent the top manufacturers shaping the future of decentralized wastewater treatment worldwide.

Top 9 Co Septic Tank Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Septic Tank Overview

Domain Est. 1997 | Founded: 1980

Website: norwesco.com

Key Highlights: Septic Tank Overview. The world’s leading manufacturer of polyethylene tanks, Norwesco has been producing polyethylene septic tanks since 1980….

#2

Domain Est. 1998

Website: akindustries.com

Key Highlights: AK also manufactures a comprehensive line of polyethylene septic tanks, sump pits, basins, and plumbing accessories. Beyond our standard offerings, we ……

#3 Norweco

Domain Est. 1998

Website: norweco.com

Key Highlights: Norwalk Wastewater Equipment Company (Norweco) is a manufacturer of water and wastewater treatment products, systems and chemicals….

#4 On

Domain Est. 2000

Website: cdphe.colorado.gov

Key Highlights: Septic tank manufacturer acceptance letters. 4300 Cherry Creek Drive South Denver, CO 80246. : 303-692-2000. Information….

#5 Orenco Systems

Domain Est. 1995

Website: orenco.com

Key Highlights: Orenco researches, designs, and manufactures innovative onsite, low maintenance, decentralized wastewater collection and treatment technologies….

#6 CXT Precast Concrete Septic Tank

Domain Est. 1996

Website: lbfoster.com

Key Highlights: Our 1000-gallon single-compartment concrete tank is designed for professional-grade performance in both residential and commercial applications across West ……

#7 Septic Solutions

Domain Est. 2003

Website: septicsolutions.com

Key Highlights: Free delivery 30-day returnsSeptic Solutions is the premier online source of septic system supplies and wastewater products. Boasting over 1500 products related to wastewater treat…

#8 Contech Engineered Solutions

Domain Est. 2012

Website: conteches.com

Key Highlights: We manufacture engineered solutions for complex civil infrastructure challenges and create lasting value for project stakeholders through unrivaled expertise, ……

#9 Infiltrator Water Technologies

Domain Est. 2015

Website: infiltratorwater.com

Key Highlights: Choose an Infiltrator septic system for better performance. Our flexible, scalable wastewater treatment solutions lead the industry in innovation….

Expert Sourcing Insights for Co Septic Tank

H2: Projected 2026 Market Trends for Co-Septic Tanks

The market for co-septic tanks—integrated wastewater treatment systems designed for shared or clustered residential and commercial use—is expected to experience significant evolution by 2026, driven by urbanization, environmental regulations, and sustainable infrastructure development. Below is an analysis of key trends shaping the co-septic tank market in 2026:

1. Increased Adoption in Semi-Urban and Rural Areas

As governments in emerging economies expand sanitation access under initiatives like the UN Sustainable Development Goal 6 (Clean Water and Sanitation), co-septic tanks are emerging as a cost-effective and scalable solution. In regions with limited centralized sewer infrastructure—such as parts of Southeast Asia, Sub-Saharan Africa, and Latin America—co-septic systems allow multiple households or small communities to share a single, efficient treatment unit. By 2026, this trend is projected to accelerate due to rising rural electrification and improved construction capabilities.

2. Integration with Smart Monitoring Technologies

The 2026 co-septic tank market will see growing integration of IoT (Internet of Things) sensors and remote monitoring systems. These technologies enable real-time tracking of tank levels, sludge accumulation, and effluent quality, reducing maintenance costs and preventing overflows. Smart co-septic systems are expected to gain traction in eco-villages, gated communities, and smart city projects, offering predictive maintenance alerts and data analytics for local authorities.

3. Regulatory Push for Environmentally Compliant Systems

Environmental regulations are tightening globally, with a focus on reducing groundwater contamination and greenhouse gas emissions from wastewater. By 2026, many countries are expected to mandate the use of co-septic tanks with advanced treatment capabilities—such as aerobic treatment units (ATUs) or bio-digesters—over traditional septic tanks. Compliance with standards like ISO 24521 and national effluent discharge norms will become a key market differentiator.

4. Growth in Modular and Prefabricated Solutions

The demand for faster, more scalable wastewater solutions will drive innovation in modular co-septic tank designs. These prefabricated systems, often made from durable materials like fiberglass-reinforced plastic (FRP) or polyethylene, can be quickly installed with minimal site disruption. The construction industry’s shift toward modular and off-site building methods will further boost adoption in housing developments, resorts, and industrial parks.

5. Focus on Resource Recovery and Circular Economy

By 2026, co-septic systems are expected to play a role in resource recovery strategies. Advanced models will increasingly incorporate biogas capture from anaerobic digestion and nutrient recycling (e.g., converting sludge into fertilizer). This aligns with circular economy principles and supports sustainability goals in both public and private sector developments.

6. Rising Private Sector and PPP Involvement

Public-private partnerships (PPPs) are anticipated to grow in the sanitation sector, particularly in developing markets. Private companies are investing in co-septic infrastructure as part of urban development projects, often bundling wastewater management with housing, tourism, or industrial parks. This trend will drive innovation, improve service quality, and expand market reach.

7. Regional Market Expansion and Localization

While North America and Europe will continue to modernize existing systems with upgrades and smart features, the fastest growth is expected in Asia-Pacific (especially India, Indonesia, and the Philippines) and Africa. Local manufacturing and adaptation of co-septic tank designs to regional soil, climate, and usage patterns will become critical success factors.

Conclusion

By 2026, the co-septic tank market will be characterized by technological innovation, regulatory alignment, and a strong emphasis on sustainability and scalability. As decentralized wastewater solutions gain prominence, co-septic tanks will play a pivotal role in bridging sanitation gaps and supporting resilient community infrastructure worldwide.

Common Pitfalls When Sourcing Co-Located Septic Tanks (Quality & Intellectual Property)

Sourcing co-located septic tanks—where multiple parties share a single septic system—introduces unique challenges beyond standard procurement. Overlooking these can lead to long-term performance issues, legal disputes, and financial liabilities. Key pitfalls in quality and intellectual property considerations include:

Quality-Related Pitfalls

Inadequate System Sizing and Design for Combined Loads

A frequent error is underestimating the cumulative wastewater volume and peak usage from all connected properties. Using generic sizing tables without detailed load calculations can result in undersized tanks, leading to frequent overflows, system failure, and environmental contamination.

Mismatched Construction Standards and Materials

When multiple stakeholders source components separately or at different times, inconsistencies in tank material (e.g., concrete vs. polyethylene), wall thickness, or structural reinforcements may occur. This compromises overall system integrity and longevity, especially under variable soil and load conditions.

Poor Installation Practices Due to Shared Responsibility

Lack of a single accountable party during installation often leads to coordination gaps—such as improper backfilling, misaligned inlet/outlet pipes, or inadequate slope in connecting lines. These flaws reduce efficiency and increase maintenance needs.

Lack of Uniform Maintenance Agreements

Without a clear, binding maintenance plan, contributors may neglect servicing. This leads to sludge buildup, clogging, and premature system failure, with disputes over responsibility and cost allocation.

Intellectual Property (IP) Pitfalls

Unlicensed Use of Proprietary System Designs

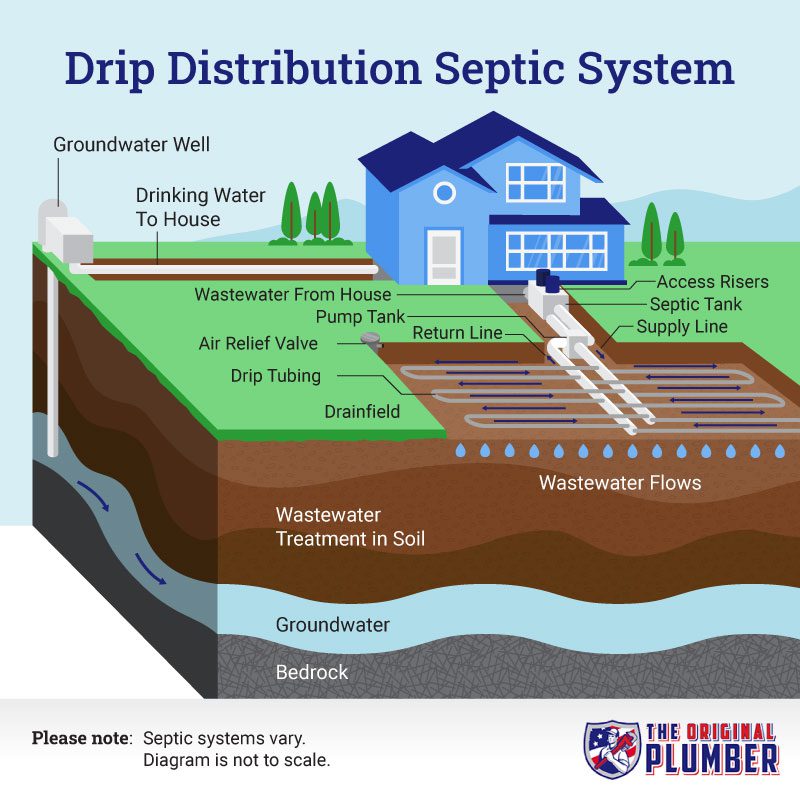

Some advanced septic systems (e.g., aerobic treatment units or drip distribution systems) incorporate patented technologies. Sourcing a co-located system without verifying IP rights—especially if a third-party engineer specifies a branded solution—can expose all stakeholders to infringement claims.

Ambiguous Ownership of Custom Engineering Plans

When a shared system requires custom design, the ownership of engineering drawings and technical specifications may be unclear. If the design firm retains IP rights, future modifications or expansions may require costly licensing or re-engineering.

Lack of Licensing for Monitoring or Control Software

Modern co-located systems may include remote monitoring, sensor networks, or automated controls. Failing to secure proper software licenses for all end users can lead to compliance issues and operational disruptions.

Insufficient Documentation for Compliance and Transfer

Incomplete records of design approvals, material certifications, and IP clearances complicate future property transfers, regulatory audits, or system upgrades. This can delay sales or trigger re-inspection requirements.

Mitigating these pitfalls requires thorough due diligence, clear contractual agreements, and engagement of qualified professionals to ensure both technical quality and legal compliance in co-located septic tank projects.

Logistics & Compliance Guide for Co Septic Tank

This guide outlines the essential logistics and compliance considerations for the installation, operation, maintenance, and decommissioning of septic tanks in Colorado (Co). Adherence to state and local regulations is critical to protect public health and the environment.

Regulatory Framework

Colorado septic tank regulations are primarily governed by the Colorado Department of Public Health and Environment (CDPHE) through the Colorado Water Quality Control Commission (WQCC) regulations, specifically Regulation 83 and Regulation 71. Local health departments (LHDs) have authority to implement and enforce these rules with possible additional local requirements.

Siting and Design Requirements

All septic system designs must meet minimum separation distances from wells, property lines, surface water, and bedrock as defined by CDPHE. Design must consider soil type, percolation rate, groundwater depth, and lot size. Professional site evaluation and engineering design are required for most systems, particularly alternative or advanced treatment systems.

Permitting Process

Prior to construction, a permit must be obtained from the local county health department. The application typically includes site plans, soil evaluation reports, engineering design (if applicable), and property ownership details. Permit fees vary by jurisdiction. Systems serving commercial facilities or multi-family dwellings may require additional review.

Installation Standards

Installation must comply with CDPHE standards and local codes. Contractors must be licensed or registered with the state or local authority. Tanks must be watertight, structurally sound, and installed level with proper inlet/outlet baffles. All components must be certified to meet NSF/ANSI Standard 46 or equivalent. Final inspections are required before system use.

Operation and Maintenance

Regular maintenance is mandatory to ensure system performance and longevity. Septic tanks should be pumped every 3 to 5 years depending on household size and tank capacity. Homeowners are responsible for maintenance records. Only non-toxic, biodegradable products should be used; disposal of chemicals, grease, or non-degradable materials is prohibited.

Inspections and Compliance Monitoring

Local health departments conduct periodic inspections, especially during property transfers or real estate transactions. Compliance with maintenance schedules and system performance is verified. Non-compliant systems may require repair or replacement, and failure to comply can result in notices, fines, or enforcement actions.

System Upgrades and Repairs

Failing or undersized systems must be upgraded or repaired according to current CDPHE standards. Repairs often require a new permit and engineering evaluation. Financial assistance programs may be available through local or state initiatives for low-income homeowners.

Decommissioning Procedures

Abandoned septic tanks must be properly decommissioned to prevent safety hazards and environmental contamination. This typically involves pumping the tank, removing or crushing the tank, and backfilling with approved material. A decommissioning permit and inspection may be required by the local health department.

Recordkeeping and Reporting

Homeowners and service providers must maintain records of pumpings, inspections, repairs, and permits for a minimum of five years. These records must be available upon request by health officials. Real estate disclosures must include septic system status and maintenance history.

Resources and Contacts

For more information, consult your local county health department or visit the CDPHE website. Licensed installers and certified inspectors can be found through state or local licensing databases. Educational materials on septic system care are available through CDPHE and Colorado State University Extension.

Conclusion for Sourcing a Concrete Septic Tank:

In conclusion, sourcing a concrete septic tank requires careful consideration of quality, compliance, supplier reliability, and long-term durability. Concrete septic tanks offer proven strength, longevity, and resistance to environmental stress, making them a preferred choice for both residential and commercial applications. When sourcing, it is essential to select certified manufacturers or suppliers who adhere to local building codes and environmental standards. Factors such as proper sizing, transportation logistics, installation support, and warranty terms should also be evaluated to ensure optimal performance and compliance. By partnering with reputable suppliers and conducting thorough due diligence, property developers, contractors, and homeowners can secure a reliable, cost-effective, and sustainable wastewater solution that meets current needs and future regulatory demands.