The global CNG (Compressed Natural Gas) fuel pump market is experiencing robust growth, driven by increasing demand for cleaner transportation fuels and stringent government regulations aimed at reducing vehicular emissions. According to Mordor Intelligence, the global CNG vehicle market was valued at USD 38.67 billion in 2023 and is projected to grow at a CAGR of over 5.8% during the forecast period from 2024 to 2029. This expansion is mirrored in the infrastructure segment, where CNG fueling stations and dispensing equipment—particularly fuel pumps—are seeing accelerated adoption across public transit, commercial fleets, and personal vehicles. As countries in Asia-Pacific, Latin America, and the Middle East invest heavily in natural gas infrastructure, manufacturers of CNG fuel pumps are scaling production and innovation to meet rising demand. This growing ecosystem has led to increased competition and technological advancement among key players, making it essential to identify the top-performing manufacturers shaping the future of clean fueling. Based on market presence, technological capabilities, and global reach, the following list outlines the top 10 CNG fuel pump manufacturers leading the charge in this evolving industry landscape.

Top 10 Cng Fuel Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

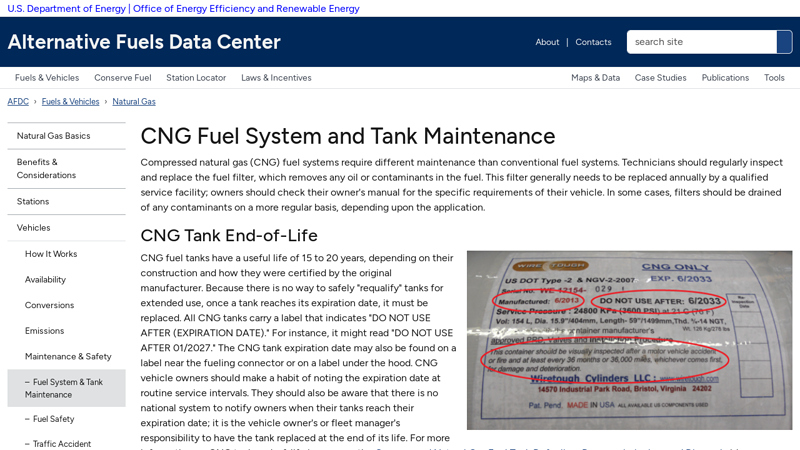

#1 CNG Fuel System and Tank Maintenance

Domain Est. 1999

Website: afdc.energy.gov

Key Highlights: CNG fuel tanks have a useful life of 15 to 20 years, depending on their construction and how they were certified by the original manufacturer….

#2 Westport Fuel Systems

Domain Est. 2003

Website: wfsinc.com

Key Highlights: Westport Fuel Systems. Our global team develops and supplies advanced LPG, CNG, LNG and H2 systems and components for OEM, DOEM, and AM sectors worldwide….

#3 Encore CNG Fuel Dispenser

Domain Est. 1994

Website: gilbarco.com

Key Highlights: Maximize options. Minimize cost. ANGI Energy Systems’ Encore CNG Dispenser makes it easy to bring Compressed Natural Gas (CNG) to your fueling station….

#4 Compressed Natural Gas(CNG)

Domain Est. 1996

Website: iocl.com

Key Highlights: CNG has a higher octane rating and has efficacy advantage over diesel and petrol. CNG fuel burns cleanly and is non-corrosive, resulting in longevity of pipes, ……

#5 CNG

Domain Est. 2000

Website: bennettpump.com

Key Highlights: Bennett CNG Dispensers are designed to provide customers with a familiar fueling experience by incorporating the same interactive features used on traditional ……

#6 Quantum Fuel Systems

Domain Est. 2000

Website: qtww.com

Key Highlights: Quantum delivers clean energy storage solutions for CNG, RNG, and hydrogen—powering sustainable, low-emission transportation for fleets and industries….

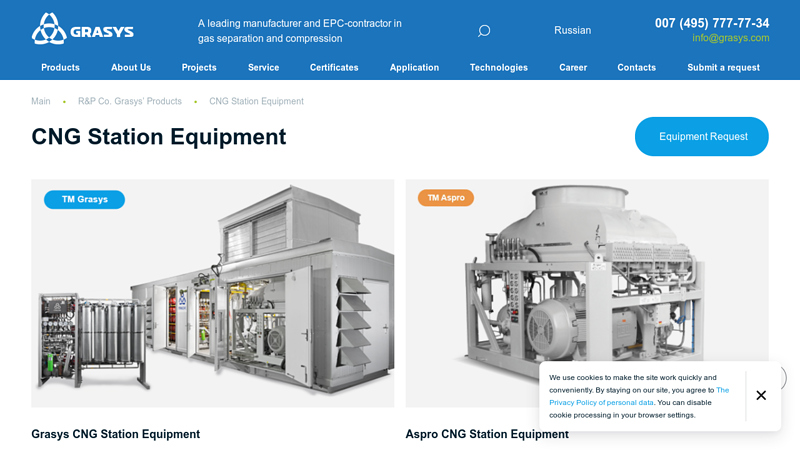

#7 CNG station equipment

Domain Est. 2004

Website: grasys.com

Key Highlights: Grasys CNG stations are available in a variety of designs and can be supplied either in a containerised version or as individual modules….

#8 CNG Dispensing Systems for Natural Gas Vehicles

Domain Est. 2008

Website: angienergy.com

Key Highlights: At ANGI Energy, we provide cutting-edge CNG dispensing solutions designed for efficiency, safety, and seamless integration….

#9 Compressed Natural Gas: CNG Fuel for Vehicles

Domain Est. 2017

Website: think-gas.com

Key Highlights: CNG promotes better engine health, improves mileage, and enhances safety while reducing vehicular pollution….

#10 Cummins Clean Fuel Technologies

Domain Est. 2022

Website: cumminscleantech.com

Key Highlights: Cummins Clean Fuel Technologies provides innovative, complete CNG fuel system solutions for trucks. Contact us today to learn more….

Expert Sourcing Insights for Cng Fuel Pump

H2: 2026 Market Trends for CNG Fuel Pumps

The global Compressed Natural Gas (CNG) fuel pump market is expected to experience significant transformation by 2026, driven by a confluence of environmental regulations, energy security concerns, and technological advancements. As countries intensify their efforts to reduce greenhouse gas emissions and transition to cleaner energy sources, CNG continues to emerge as a viable transitional fuel—particularly in the transportation and industrial sectors. This analysis outlines the key market trends shaping the CNG fuel pump industry in 2026 under the H2 framework: Hydrogen Readiness, Hybrid Infrastructure, and Heavy-Duty Transportation Demand.

1. Hydrogen Readiness (H2 as a Strategic Enabler)

While CNG fuel pumps are designed for natural gas delivery, the infrastructure and technology developed for CNG are increasingly being adapted for hydrogen (H2) compatibility. By 2026, many CNG fuel pump manufacturers are investing in dual-fuel or hydrogen-blended (HCNG – Hydrogen-Compressed Natural Gas) dispensing systems. This “hydrogen readiness” allows existing CNG stations to transition smoothly toward hydrogen integration, reducing the need for entirely new infrastructure. As governments in Europe, North America, and parts of Asia expand hydrogen mobility strategies, CNG pump providers are positioning themselves as key enablers of the hydrogen economy. Retrofitting CNG pumps to handle up to 20–30% hydrogen blends is becoming a standard offering, driven by pilot programs and emission reduction mandates.

2. Hybrid Infrastructure Development

The CNG fuel pump market is evolving toward multi-modal refueling stations that support not only CNG but also LNG, electric charging, and H2. By 2026, hybrid fueling stations—especially in urban transit corridors and freight hubs—are becoming more common. This trend is particularly evident in countries like India, China, and the U.S., where fleet operators seek flexibility in fuel choice. CNG pump manufacturers are partnering with EV charging providers and hydrogen developers to offer integrated solutions. These hybrid stations increase the economic viability of CNG pumps by maximizing site utilization and attracting diverse vehicle types, from city buses to long-haul trucks.

3. Heavy-Duty Transportation Demand

The heavy-duty transportation sector is a key growth driver for CNG fuel pumps in 2026. With tightening emissions standards (e.g., Euro 7, EPA Phase 3), logistics and public transit companies are turning to CNG as a cost-effective, lower-carbon alternative to diesel. Urban bus fleets, refuse trucks, and regional delivery vehicles are increasingly CNG-powered, necessitating an expanded network of high-capacity CNG fuel pumps. Moreover, the rise of renewable natural gas (RNG) enhances the environmental appeal of CNG, making it a preferred choice for corporate sustainability goals. This sustained demand in commercial fleets supports continued investment in CNG refueling infrastructure and advanced pump technologies, including faster filling systems and smart monitoring capabilities.

Additional Trends Supporting Growth:

– Regulatory Support: National clean air policies and subsidies for CNG vehicle adoption in emerging markets are boosting pump installations.

– Technological Innovation: Smart CNG pumps with IoT integration, remote diagnostics, and digital payment systems are improving user experience and operational efficiency.

– Geographic Expansion: Growth is strongest in Asia-Pacific (especially India and Southeast Asia) and Latin America, where fuel cost savings and air quality concerns are accelerating CNG adoption.

Conclusion

By 2026, the CNG fuel pump market will not only sustain its role in natural gas mobility but also serve as a strategic bridge to a broader hydrogen and low-carbon fuel ecosystem. The H2-driven trends—hydrogen readiness, hybrid infrastructure, and heavy-duty transportation demand—are redefining the value proposition of CNG fuel pumps, ensuring their relevance in the evolving global energy landscape.

When sourcing CNG (Compressed Natural Gas) fuel pumps, especially with an eye toward future compatibility with hydrogen (H₂) infrastructure or technology, several common pitfalls can compromise performance, safety, compliance, and long-term value. Here’s a breakdown of key risks related to quality and intellectual property (IP), with specific considerations for H₂-readiness:

🔧 1. Quality Pitfalls in Sourcing CNG Fuel Pumps

a. Inadequate Material Compatibility

- Issue: CNG pumps are typically designed for natural gas (mostly methane), but hydrogen (H₂) is far more aggressive due to its small molecular size and potential for hydrogen embrittlement.

- Pitfall: Using pumps with materials (e.g., certain steels, elastomers) that degrade under H₂ exposure leads to leaks, seal failure, or catastrophic breakdown.

- H₂ Consideration: Even if currently using CNG, sourcing H₂-compatible materials (e.g., stainless steel 316L, H₂-resistant seals like PTFE or Kalrez) ensures future-proofing.

b. Poor Manufacturing Standards

- Issue: Low-cost suppliers may cut corners on precision machining or quality control.

- Pitfall: Inconsistent tolerances lead to leaks, poor compression, or high maintenance.

- H₂ Impact: Hydrogen’s low viscosity and high diffusivity amplify sealing and leakage issues — poor QC becomes a critical safety risk.

c. Lack of Certification & Compliance

- Issue: Not all pumps meet regional or international standards (e.g., ISO 15500, SAE J2600, PED, ATEX).

- Pitfall: Non-certified equipment may fail inspections or cause liability issues.

- H₂ Link: Hydrogen systems require even stricter certifications (e.g., ISO 17268 for H₂ components). Sourcing CNG pumps without H₂ certification pathways limits upgrade options.

d. Insufficient Pressure & Duty Cycle Ratings

- Issue: CNG pumps typically operate at ~250 bar; H₂ dispensing can go up to 700 bar.

- Pitfall: Selecting a CNG pump without scalable pressure capability or robust cooling may hinder future H₂ integration.

- Recommendation: Source pumps with modular or upgradable designs that can adapt to higher pressures.

💡 2. Intellectual Property (IP) Pitfalls

a. Proprietary Technology Lock-in

- Issue: Some suppliers use closed-source firmware, proprietary communication protocols, or patented internal designs.

- Pitfall: Limits your ability to service, integrate, or modify the pump — especially problematic when integrating with H₂ control systems.

- H₂ Consideration: Hydrogen refueling stations require advanced control logic (e.g., temperature compensation, pressure ramping). Proprietary IP may block interoperability.

b. Lack of Documentation & Reverse Engineering Risk

- Issue: Suppliers may withhold technical drawings, material specs, or API documentation.

- Pitfall: You cannot validate H₂ compatibility or ensure long-term maintenance.

- IP Risk: Attempting reverse engineering to fill gaps may infringe on patents or trade secrets.

c. Unclear IP Ownership in Custom Designs

- Issue: If you co-develop or customize a pump for H₂ compatibility, unclear contracts may leave IP ownership with the supplier.

- Pitfall: Losing rights to improvements limits your ability to scale, license, or protect your investment.

d. Counterfeit or Clone Components

- Issue: In global supply chains, knock-offs of reputable CNG pumps are common.

- Pitfall: Clones may mimic appearance but fail under H₂ conditions due to substandard materials.

- IP & Safety Risk: Using counterfeit parts voids warranties and may lead to safety incidents — especially dangerous with H₂.

✅ Best Practices for Sourcing (with H₂ in Mind)

-

Demand H₂-Ready Specifications

Even for CNG use, select pumps rated for hydrogen service or with dual-certification (CNG + H₂). -

Require Full Technical Disclosure

Insist on material data sheets (MDS), pressure ratings, and compatibility with H₂ per ISO 23930. -

Verify Certifications

Look for TÜV, UL, or CSA certification for H₂ applications, not just CNG. -

Negotiate IP Clauses

Ensure contracts clarify ownership of modifications, access to firmware, and right to repair/upgrade. -

Partner with Future-Ready Suppliers

Choose vendors actively involved in hydrogen mobility projects or with H₂ product lines. -

Conduct Failure Mode Testing

Perform hydrogen exposure testing on seals and metals, even if currently using CNG.

🚨 Summary: Key Red Flags

| Pitfall | Risk with H₂ |

|——–|————-|

| Non-H₂-rated materials | Embrittlement, leaks, explosion risk |

| Proprietary firmware | Blocks integration with H₂ control systems |

| Lack of certification | Regulatory non-compliance |

| Poor QC | Safety failures amplified by H₂ properties |

| IP lock-in | Limits innovation and scalability |

By proactively addressing quality and IP concerns during CNG pump sourcing — with hydrogen compatibility in mind — you reduce long-term costs, enhance safety, and position your infrastructure for the clean energy transition.

It appears there may be a confusion in your request: CNG (Compressed Natural Gas) and H₂ (Hydrogen) are two distinct fuels with different properties, infrastructure requirements, and compliance standards. CNG is primarily methane (CH₄), while H₂ refers to hydrogen gas, used in hydrogen fueling systems.

If you are seeking a logistics and compliance guide for a hydrogen (H₂) fueling station—possibly mistyped as “CNG Fuel Pump. Use H₂”—then the following guide applies to hydrogen (H₂) fueling infrastructure, covering logistics, safety, regulations, and compliance.

🚗 Hydrogen (H₂) Fueling Station: Logistics & Compliance Guide

1. Overview

Hydrogen (H₂) fueling stations dispense compressed gaseous hydrogen to fuel cell electric vehicles (FCEVs). Unlike CNG stations, H₂ infrastructure requires unique handling due to hydrogen’s high flammability, low ignition energy, embrittlement risks, and high-pressure storage (typically 350–700 bar).

2. Key Regulatory Frameworks (Global & Regional)

A. International Standards

- ISO 19880 Series – Gaseous hydrogen fueling stations

- ISO 19880-1: General requirements

- ISO 19880-2: Vehicle refueling connectors

- ISO 19880-9: Fueling protocols (H2NG)

- ISO 16111: Transportable gas storage devices — Hydrogen

- IEC 60079: Explosive atmospheres (ATEX/IECEx for electrical equipment)

B. United States

- NFPA 2: Hydrogen Technologies Code – Covers production, storage, dispensing

- CGA G-5.5: Compressed Hydrogen Gas Standard

- OSHA 29 CFR 1910 – Process Safety Management (PSM), Hazard Communication

- EPA & DOT Regulations:

- DOT 49 CFR Parts 100–185 (Hazardous Materials Transportation)

- EPA Clean Air Act (station emissions reporting)

- State Regulations (e.g., California’s CalGEM, CARB, Fire Code)

C. European Union

- AFID (Alternative Fuels Infrastructure Directive) – Mandates H₂ refueling network expansion

- PED (Pressure Equipment Directive 2014/68/EU)

- ATEX Directive 2014/34/EU – Equipment in explosive atmospheres

- National fire and building codes (e.g., DVGW in Germany, ATEX in France)

D. Japan & South Korea

- High Pressure Gas Safety Act (Japan)

- KGS Standards (Korean Gas Safety Corporation)

- JIS Z 8118: Hydrogen fueling stations

3. Site Selection & Logistics

A. Location Requirements

- Minimum setback distances from buildings, roads, property lines (per NFPA 2 or local code)

- Ventilation: Outdoor or well-ventilated indoor (to avoid H₂ accumulation)

- Seismic and environmental risk assessment (flood zones, fault lines)

B. Zoning & Permits

- Zoning approval for hazardous materials use

- Building permits, fire department permit, environmental clearance

- Utility interconnection agreements (power, water if electrolysis used)

4. System Components & Technical Logistics

| Component | Description | Compliance Standard |

|——–|————-|———————|

| Hydrogen Supply | On-site electrolysis, tube trailer delivery, pipeline | ISO 16111, CGA-3.3 |

| Compression | Multi-stage compressors (mechanical/electrochemical) | API 618, ISO 10440 |

| Storage | High-pressure tanks (500–900 bar), Type I–IV cylinders | ASME BPVC, ISO 11439 |

| Dispensers | Similar to gasoline pumps, with H₂-specific nozzles | SAE J2601 (fueling protocol) |

| Piping & Valves | Stainless steel or H₂-compatible materials (avoid embrittlement) | CGA G-5.5, ISO 22734 |

| Ventilation & Leak Detection | H₂ sensors, purge systems, emergency shutdown | NFPA 72, IEC 60079 |

5. Safety & Risk Mitigation

A. Design Safety

- Flame arrestors, pressure relief devices (PRDs), rupture disks

- Leak detection system (H₂ sensors at low points—H₂ rises but can pool in enclosed spaces)

- Emergency shutoff valves (ESD) and isolation zones

B. Operational Safety

- No-smoking zones, grounding/bonding protocols

- PPE: flame-resistant clothing, face shields

- Training: HAZMAT, emergency response (NFPA 472)

C. Fire Protection

- Automatic fire suppression systems

- Fire-rated barriers and exclusion zones

- Coordination with local fire department (pre-incident planning)

6. Environmental & Emissions Compliance

- Green Hydrogen Certification (if using renewable energy)

- e.g., EU RFNBO (Renewable Fuels of Non-Biological Origin)

- Venting & Flaring – Minimize routine H₂ venting; report incidental releases

- Water Use – Electrolyzers require high-purity water (monitor discharge)

- Carbon Footprint Reporting – Required under EU Taxonomy or California LCFS

7. Transportation & Supply Chain (Logistics)

A. Hydrogen Delivery Methods

| Method | Pressure | Range | Use Case |

|——–|———|——-|——–|

| Tube Trailers | 200–500 bar | <300 km | Small to medium stations |

| Liquid H₂ Tankers | Cryogenic (-253°C) | Long-haul | High-volume stations |

| Pipeline | Continuous | Fixed network | Industrial clusters |

- DOT/ADR/RID Compliance for transport:

- UN 1049 (Hydrogen, compressed)

- Special permits for high-pressure transport

- Driver training (49 CFR 172.704)

8. Certification & Auditing

- Third-Party Certification:

- TÜV, UL, CSA, or equivalent for equipment and station design

- Initial & Periodic Inspections:

- Pressure vessels (ASME/NB inspection)

- Electrical systems (NEC/IEC)

- Operational Audits:

- PSM (Process Safety Management) audits every 3–5 years (OSHA)

9. Training & Personnel

- Required Training:

- Hydrogen properties & hazards

- Equipment operation (dispensing, compression)

- Emergency response (fire, leaks)

- Lockout/Tagout (LOTO), confined space entry

- Certifications:

- H2Tools.org training modules

- NFPA-certified hydrogen safety professional (optional)

10. Documentation & Recordkeeping

- Equipment manuals and certification

- P&IDs (Piping & Instrumentation Diagrams)

- Risk Assessment (HAZOP, FMEA)

- Maintenance logs (compressors, sensors, valves)

- Incident reports and drills

- Regulatory filings (EPA, DOT, fire marshal)

11. Future-Proofing & Interoperability

- SAE J2601 – Standard fueling protocol (ensures vehicle compatibility)

- H2 Refueling Protocol (H2RP) – For fast-fill operations

- Digital Integration:

- Payment systems, usage tracking, remote monitoring

- Cybersecurity compliance (NIST, IEC 62443)

Summary Checklist

✅ Site compliant with setback and zoning rules

✅ Equipment certified to ISO/NFPA/CGA standards

✅ Leak detection and ESD systems installed

✅ Trained and certified personnel

✅ Emergency response plan in place

✅ All permits obtained (fire, environmental, building)

✅ Hydrogen supply chain secured and compliant

✅ Regular audits and maintenance scheduled

Resources

- H2Tools.org – Safety & standards database

- NFPA 2 Free Access

- IEA Hydrogen TCP

- Hydrogen Fueling Station Handbook (DOE)

⚠️ Note: If you actually meant CNG station using hydrogen-blended fuel (H₂NG), separate guidelines apply for hydrogen blending (e.g., up to 20% H₂ in natural gas). Let me know if this is the case for a tailored guide.

Let me know your region (e.g., USA, EU, APAC) for jurisdiction-specific compliance details.

Conclusion on Sourcing CNG Fuel Pumps:

Sourcing CNG (Compressed Natural Gas) fuel pumps requires a strategic approach that balances quality, cost, reliability, and compliance with regulatory standards. After evaluating suppliers, technical specifications, and market availability, it is evident that selecting the right CNG fuel pump involves careful consideration of compatibility with vehicle or equipment requirements, durability under high-pressure conditions, and adherence to safety certifications such as ISO, CE, or EPA standards.

Procuring from reputable manufacturers—whether domestic or international—ensures performance consistency and access to technical support and warranty services. Additionally, establishing relationships with suppliers who offer scalable solutions and after-sales service can significantly reduce downtime and maintenance costs over the pump’s lifecycle.

In conclusion, successful sourcing of CNG fuel pumps hinges on thorough due diligence, prioritizing safety and efficiency, and aligning supplier capabilities with operational needs. As the demand for cleaner energy solutions grows, investing in high-quality, reliable CNG fuel pumps supports both environmental sustainability and long-term operational efficiency.