The global CNC laser marking machine market is experiencing robust growth, driven by increasing demand for precision, traceability, and automation across industries such as automotive, electronics, medical devices, and aerospace. According to a report by Mordor Intelligence, the laser marking systems market was valued at USD 974.8 million in 2022 and is projected to reach USD 1,485.6 million by 2028, growing at a CAGR of 7.3% during the forecast period. This expansion is fueled by the rising need for permanent, high-contrast marking solutions and the integration of Industry 4.0 technologies into manufacturing processes. As adoption accelerates, manufacturers are investing heavily in advanced fiber, CO₂, and UV laser systems capable of high-speed, non-contact marking with minimal maintenance. In this evolving landscape, a select group of global manufacturers has emerged as leaders, combining innovation, reliability, and scalable solutions to meet growing industrial demands. The following list highlights the top 10 CNC laser marking machine manufacturers shaping the future of industrial identification and traceability.

Top 10 Cnc Laser Marking Machine Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Focus on laser

Website: hanslaser.net

Key Highlights: Laser marking machines Laser cutting machines Laser welding machines Automation Laser generator Semiconductor packaging equipment 3D printers Motor….

#2 DXTECH Official

Website: dxtech.com

Key Highlights: DXTECH has more than 16 years of experience to manufacture advanced CNC laser machines, such as the CNC laser cutting machine, laser engraving machine, and ……

#3 Wattsan

Website: wattsan.com

Key Highlights: Wattsan is a manufacturer of laser and cnc milling machines of European quality at affordable prices with worldwide delivery….

#4 LaserStar Technologies

Website: laserstar.net

Key Highlights: LaserStar Technologies designs and manufactures high-performance laser welding, marking, and cutting systems for industrial, jewelry, ……

#5 Fiber Laser Cutting Machine and CO2 Laser Cutter Manufacturer …

Website: gwklaser.com

Key Highlights: Leading manufacturer of laser cutting machine, CO2 laser cutter, laser welding machine, laser bending machine and laser cleaning machine, etc….

#6 Laser Marking for All Industries

Website: lasermarktech.com

Key Highlights: Discover innovative laser marking solutions tailored for various industries. Explore our cutting-edge technology as leaders in laser marking and engraving….

#7 Universal Laser Systems

Website: ulsinc.com

Key Highlights: Solve Material Processing Challenges. Overcome your most demanding and complex applications. ULS helps companies evaluate the feasibility of laser technology….

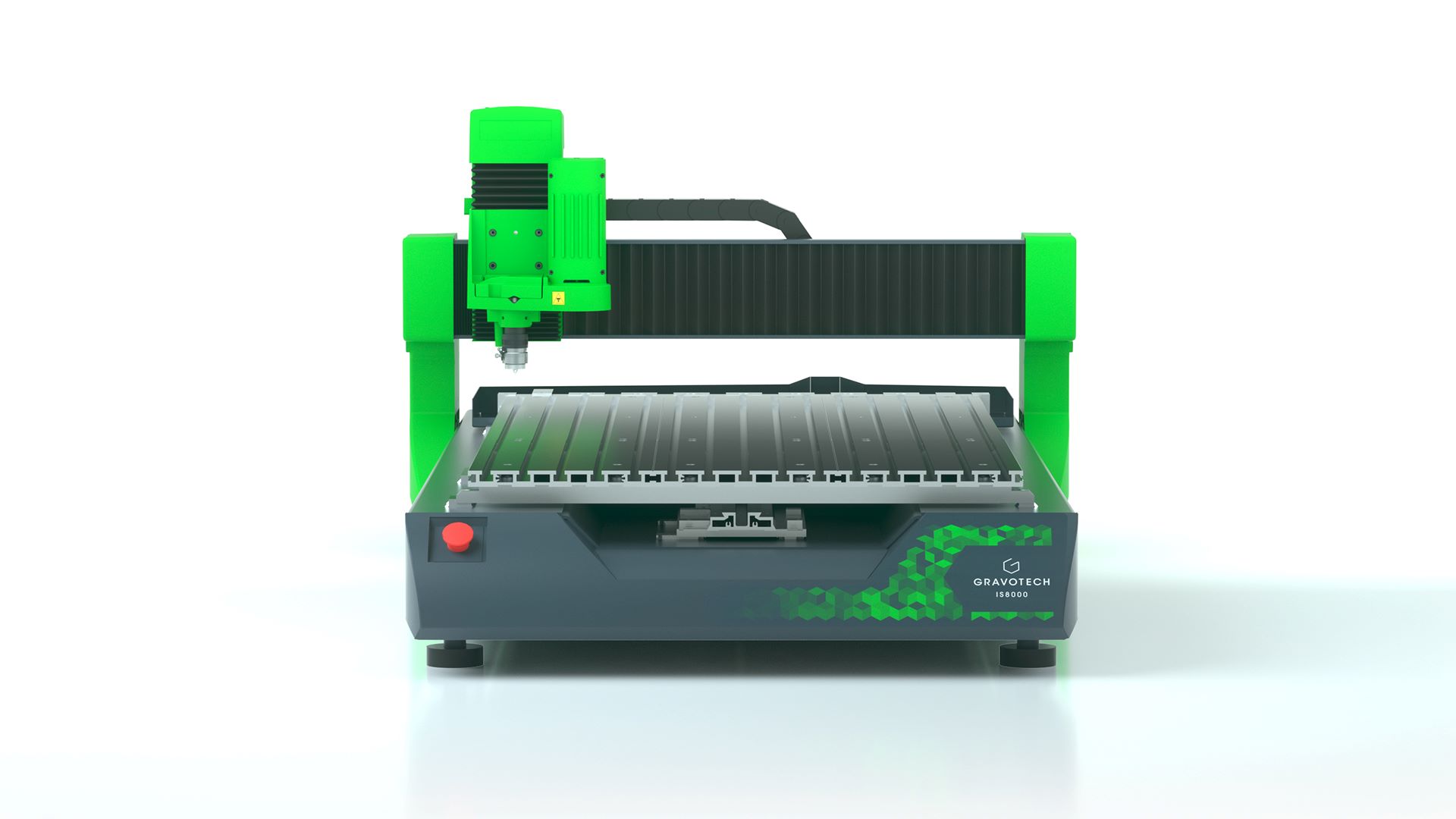

#8 Gravotech

Website: gravotech.us

Key Highlights: Gravotech designs, manufactures, and distributes innovative engraving, marking, and cutting solutions….

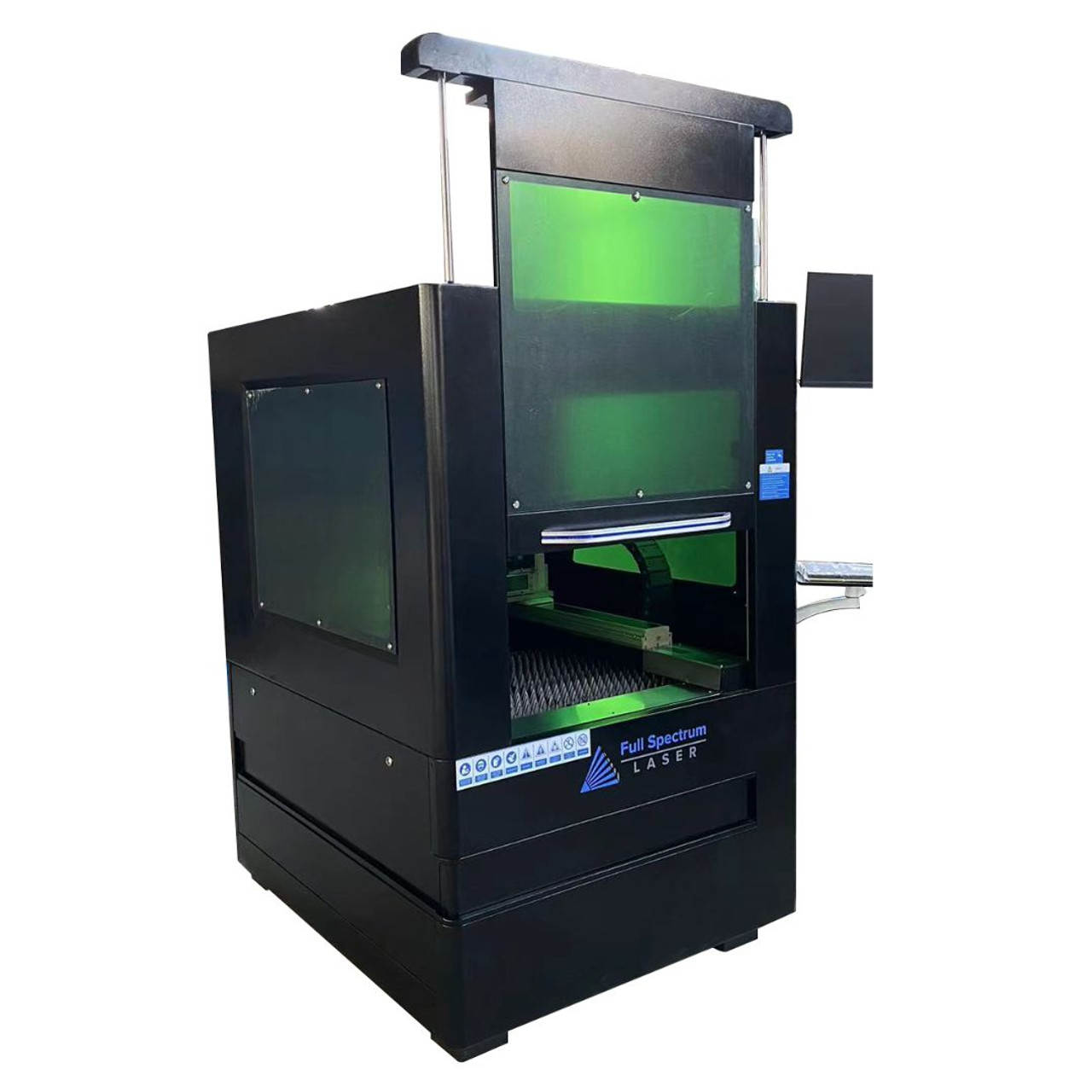

#9 Full Spectrum Laser

#10 Laser Cutting, Engraving & Marking Machines

Website: thunderlaser.com

Key Highlights: Thunder Bolt Plus. The best home desktop laser engraving machine. Up to 1500mm/s speed and a design so small that just two people can easily lift it….

Expert Sourcing Insights for Cnc Laser Marking Machine

H2: 2026 Market Trends for CNC Laser Marking Machines

The global market for CNC (Computer Numerical Control) laser marking machines is poised for significant transformation by 2026, driven by technological advancements, expanding industrial automation, and rising demand across diverse sectors. This analysis explores key market trends shaping the industry in 2026 under the H2 framework—highlighting growth drivers, technological innovations, regional dynamics, competitive landscape, and emerging challenges.

1. Accelerated Adoption in Advanced Manufacturing

By 2026, CNC laser marking machines are increasingly integrated into smart factories and Industry 4.0 ecosystems. The demand for precision, traceability, and permanent marking in manufacturing processes—especially in automotive, aerospace, electronics, and medical devices—is fueling adoption. The trend toward product serialization and compliance with regulatory standards (e.g., UDI in healthcare) is pushing manufacturers to invest in high-speed, accurate laser marking solutions.

2. Technological Innovations Driving Efficiency

Advancements in fiber laser technology, software integration, and AI-powered control systems are enhancing machine performance. Key trends include:

– Higher Power and Speed: Fiber laser sources with increased wattage enable faster marking on challenging materials like hardened metals and ceramics.

– Improved Precision and Resolution: Ultrafine beam control allows for micro-marking and 2D data matrix codes on small components.

– Smart Connectivity: CNC laser systems are being equipped with IoT capabilities for real-time monitoring, predictive maintenance, and remote diagnostics.

– User-Friendly Software: Integration with CAD/CAM systems and intuitive interfaces improves accessibility for non-specialist operators.

3. Regional Market Expansion

Asia-Pacific remains the dominant market, with China, India, and Southeast Asian countries leading demand due to rapid industrialization and growth in electronics and automotive manufacturing. North America and Europe are witnessing steady growth, driven by reshoring initiatives and stricter product traceability regulations. Emerging markets in Latin America and Africa are also showing increased interest, particularly in the food & beverage and pharmaceutical sectors.

4. Rising Demand for Customization and Flexibility

Manufacturers are increasingly seeking modular and adaptable CNC laser marking systems that can handle multiple materials and part geometries. The ability to switch between marking, engraving, and etching applications without hardware changes is a competitive advantage. Hybrid systems combining laser marking with other CNC operations are gaining traction in multi-process production lines.

5. Sustainability and Energy Efficiency

Environmental concerns are influencing machine design. By 2026, energy-efficient lasers, reduced maintenance needs, and longer component lifespans are becoming selling points. The non-contact, chemical-free nature of laser marking aligns with green manufacturing initiatives, further boosting market appeal.

6. Competitive Landscape and Market Consolidation

The market is becoming more competitive, with established players (e.g., Trumpf, Han’s Laser, IPG Photonics) expanding their portfolios and startups introducing cost-effective, compact systems. Strategic partnerships, mergers, and R&D investments are common, particularly in software development and automation integration.

7. Challenges and Barriers

Despite growth, the market faces challenges:

– High initial investment costs for advanced systems.

– Skilled labor shortages for operation and maintenance.

– Intense price competition in emerging markets.

– Regulatory compliance complexities across regions.

Conclusion

By 2026, the CNC laser marking machine market is expected to grow at a robust CAGR, underpinned by digital transformation in manufacturing and the need for durable, high-precision marking solutions. Companies that invest in innovation, sustainability, and global support networks will be best positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing CNC Laser Marking Machines (Quality and Intellectual Property)

Sourcing a CNC laser marking machine from international suppliers—especially in competitive markets—can present significant risks related to product quality and intellectual property (IP) protection. Being aware of these pitfalls is essential for making a sound investment and safeguarding your business interests.

Poor Build Quality and Component Substitution

Many suppliers offer attractively priced machines that may appear identical to high-end models but use inferior components. Common issues include underpowered or mislabeled laser sources, low-grade optics, and substandard motion systems, which lead to inconsistent marking performance, frequent breakdowns, and shorter machine lifespan. Always request detailed specifications, verify component brands (e.g., Raycus, IPG for lasers), and, if possible, conduct on-site inspections or request third-party quality audits.

Misrepresentation of Laser Specifications

Suppliers may exaggerate laser power (e.g., advertising a 50W laser that actually performs like a 30W unit) or mark speed to make their machines seem more competitive. This can result in the machine failing to meet your production requirements. Request test samples under real-world conditions and insist on verifiable performance data before purchase.

Lack of Compliance and Safety Certifications

Some machines, particularly from less-regulated manufacturers, may lack essential safety certifications such as CE, FDA, or ISO standards. Using non-compliant equipment can pose safety risks, result in legal liabilities, and prevent deployment in regulated industries or certain markets. Always verify that the machine meets the safety and regulatory requirements of your target region.

Inadequate Software and Control Systems

The software that controls the laser marking machine is crucial for ease of use, integration, and functionality. Some suppliers use outdated, unlicensed, or poorly developed software that lacks essential features or is incompatible with common design formats. This can hinder productivity and integration into existing workflows. Evaluate the software interface, check for compatibility with your design tools (e.g., AutoCAD, CorelDRAW), and confirm licensing legitimacy.

Intellectual Property Risks and Counterfeit Equipment

A major concern when sourcing from certain regions is the potential for IP infringement. Some suppliers illegally replicate branded machines or use counterfeit components, exposing buyers to legal risks if the equipment is found to violate patents or trademarks. Additionally, using counterfeit parts can void warranties and compromise performance. Conduct due diligence on the supplier’s reputation, request proof of IP compliance, and consider engaging legal counsel for high-value purchases.

Limited After-Sales Support and Spare Parts Availability

Even if the machine performs well initially, poor technical support, delayed spare parts delivery, or language barriers can severely impact uptime and maintenance. Some suppliers disappear after the sale or offer minimal support. Ensure the supplier provides clear service agreements, training, and access to spare parts—preferably through a local distributor.

Hidden Costs and Unclear Warranty Terms

Low initial pricing can be misleading. Hidden costs may include shipping, import duties, installation, training, and extended warranty fees. Additionally, warranty terms may be vague or exclude critical components like the laser source. Always request a detailed breakdown of all costs and a written warranty specifying coverage duration, service response times, and exclusions.

By recognizing these common pitfalls and performing thorough due diligence—including supplier vetting, sample testing, and legal review—you can significantly reduce the risks associated with sourcing CNC laser marking machines and ensure a reliable, compliant, and IP-safe investment.

Logistics & Compliance Guide for CNC Laser Marking Machine

Overview

This guide provides essential logistics and compliance considerations for the international shipping, importation, and operation of CNC Laser Marking Machines. Adhering to these guidelines ensures regulatory compliance, smooth customs clearance, and safe delivery.

Shipping & Packaging Requirements

- Secure Packaging: Use robust, wooden export crates with internal foam or foam-in-place cushioning to protect the laser head, control panel, and optical components.

- Moisture Protection: Include desiccant packs and moisture barrier bags to prevent condensation during transit.

- Labeling: Clearly label the package as “Fragile,” “This Side Up,” and include handling symbols per ISTA standards. Include the model number, serial number, and sender/recipient details.

- Shipping Method: Choose air freight for speed or sea freight for cost-efficiency, depending on urgency and destination. Ensure proper insurance coverage.

International Trade Compliance

- Export Classification: Determine the correct Export Control Classification Number (ECCN). CNC Laser Marking Machines may fall under ECCN 2B201 (laser processing systems) depending on power and capability, subject to EAR regulations.

- Licenses & Permits: Verify if an export license is required based on destination country and end-use. Certain countries may require a license under U.S. Department of Commerce (BIS) or equivalent national authority.

- Import Documentation: Prepare commercial invoice, packing list, bill of lading/airway bill, and certificate of origin. Include technical specifications such as laser class, power output (watts), and wavelength.

- Customs Tariff Codes: Use the correct HS Code (e.g., 8456.30 for laser cutting or engraving machines) to determine import duties and taxes.

Laser Safety Regulations

- Laser Classification: Most CNC laser markers are Class 1 or Class 4, depending on enclosure. Class 4 lasers require strict safety measures.

- Compliance Standards: Ensure the machine meets IEC 60825-1 (laser safety) and ANSI Z136.1 (U.S. laser safety standard).

- CE Marking (EU): Required for machines sold in the European Union. Compliance with the Machinery Directive (2006/42/EC), EMC Directive (2014/30/EU), and LVD (2014/35/EU) is mandatory.

- FDA Registration (USA): If exporting to the U.S., register the laser product with the FDA’s Center for Devices and Radiological Health (CDRH) under 21 CFR 1040.10 and 1040.11.

Electrical & Environmental Compliance

- Voltage & Frequency: Confirm compatibility with local power supply (e.g., 220V/50Hz vs. 110V/60Hz). Include voltage converters or transformers if needed.

- EMC Certification: Ensure electromagnetic compatibility (EMC) certification for the destination market (e.g., FCC for the U.S., CE for EU).

- RoHS & REACH: Verify compliance with hazardous substance restrictions (RoHS Directive 2011/65/EU and REACH in the EU).

- WEEE Compliance: Provide information on proper disposal and recycling under the Waste Electrical and Electronic Equipment directive (EU).

Installation & Operational Compliance

- Site Preparation: Ensure proper ventilation, stable power supply, and grounding. Class 4 lasers require a controlled access area with interlocks and warning signs.

- Training & Documentation: Provide operator manuals, safety instructions, and compliance certificates (CE, FCC, etc.) in the local language.

- Local Regulations: Check national or regional requirements for laser use in industrial settings (e.g., OSHA in the U.S., HSE in the UK).

After-Sales & Support

- Warranty & Service: Clarify warranty terms, spare parts availability, and service support in the destination country.

- Compliance Updates: Monitor changes in trade regulations, laser safety standards, or import policies that may affect ongoing operations.

Conclusion

Proper logistics planning and compliance with international regulations are critical for the successful deployment of CNC Laser Marking Machines. Partner with experienced freight forwarders, legal advisors, and compliance experts to ensure full adherence to all applicable rules and standards.

Conclusion for Sourcing a CNC Laser Marking Machine

Sourcing a CNC laser marking machine is a strategic investment that can significantly enhance manufacturing efficiency, product traceability, and brand authenticity. After evaluating various suppliers, machine specifications, laser types (fiber, CO2, or UV), power requirements, software compatibility, and after-sales support, it is essential to select a machine that aligns with your production demands, material types, and long-term operational goals.

Key considerations such as marking precision, speed, durability, ease of integration into existing workflows, and compliance with industry standards should guide the final decision. Opting for a reputable supplier with proven technical expertise and responsive customer service ensures reliable performance and minimal downtime.

In conclusion, a well-sourced CNC laser marking machine not only improves marking quality and consistency but also contributes to increased productivity and competitiveness in the market. Conducting thorough due diligence during the sourcing process will maximize return on investment and support sustainable growth in an increasingly automated industrial environment.