The global automotive market continues to expand, driven by rising demand for electric vehicles, advancements in autonomous driving technologies, and increasing urbanization—particularly in emerging economies. According to Grand View Research, the global automotive market size was valued at USD 3.5 trillion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth trajectory creates significant opportunities for Contract Manufacturing Companies (CMCs) in the automotive sector, especially as OEMs increasingly outsource production to optimize costs and accelerate time-to-market.

As supply chain complexities rise and original equipment manufacturers focus on core competencies like R&D and brand management, CMCs have become strategic partners in vehicle and component production. From precision machining to complete vehicle assembly, these manufacturers offer scalable, technology-enabled solutions that meet stringent quality and regulatory standards. Fueled by Industry 4.0 adoption and smart manufacturing practices, leading automotive CMCs are now integral to innovation and sustainability initiatives across the automotive value chain.

In this context, the following analysis highlights the top seven CMCs shaping the future of automotive manufacturing—companies that combine advanced engineering capabilities, global operational footprints, and a proven track record of serving major automotive brands. Their influence is only set to grow as the industry navigates the shift toward electrification, connected vehicles, and on-demand production models.

Top 7 Cmc Automotive Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 CMC MOTOR

Domain Est. 2007

Website: cmc-motor.com

Key Highlights: CMC is not only known for Mitsubishi Japan’s sole distributor and exclusive business partner in Taiwan but also Taiwan’s 2nd largest vehicles manufacturer….

#2 CMC classic model cars, miniature, cmc

Founded: 1995

Website: cmc-modelcarshop.de

Key Highlights: The official website of the model car manufacturer CMC, classic model cars, which produces models since 1995 in an incomparable quality of loving care….

#3 Award

Domain Est. 1998

Website: classic-motor-cars.co.uk

Key Highlights: CMC is a family owned business, and we are all crazy about Classic, Modern Classic and Prestige cars. Our unique group of talented artisans all love what they ……

#4 CMC Model Cars USA

Domain Est. 2012

Website: cmcmodelcarsusa.com

Key Highlights: We are the ONLY genuine distributor of CMC model cars in the USA, Canada, and South America. We specialize in producing the finest scale model cars on the ……

#5 Authorized Formula One Merchandise

Domain Est. 2015

Website: cmcmotorsports.com

Key Highlights: As an official retailer of authentic F1 merchandise, CMC Motorsports® is proud to offer customers the latest motorsport apparel and accessories….

#6 Terms & Conditions

Domain Est. 2019

Website: cmc-auto.com

Key Highlights: Effective Date: September 19, 2019. CMC AUTOMOTIVE Website Terms and Conditions of Use. PLEASE READ THESE TERMS AND CONDITIONS OF USE ……

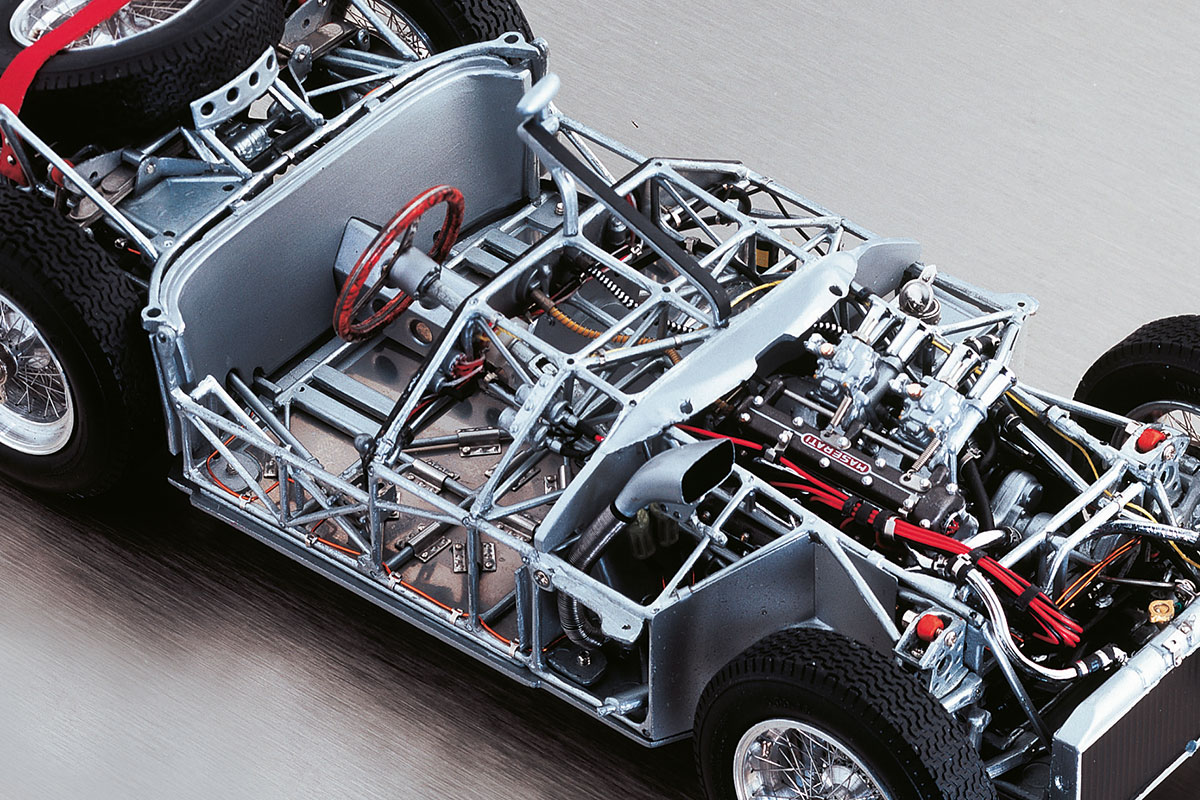

#7 About us

Website: cmc-modelcars.de

Key Highlights: Our models are constructed as their originals. From historical drawings with high quality materials – down to the smallest details….

Expert Sourcing Insights for Cmc Automotive

H2 2026 Market Trends Analysis for CMC Automotive

As the global automotive industry continues to evolve rapidly, CMC Automotive is positioned at a pivotal juncture in H2 2026. Several macroeconomic, technological, and regulatory trends are shaping the competitive landscape. This analysis outlines the key market dynamics influencing CMC Automotive during the second half of 2026.

1. Accelerated Shift Toward Electric Vehicles (EVs)

By H2 2026, the global transition to electric mobility has intensified, driven by stricter emissions regulations in Europe, North America, and parts of Asia. CMC Automotive has responded by expanding its EV lineup, including the launch of two new battery-electric models in mid-2026. Consumer demand for affordable, long-range EVs is growing, particularly in Southeast Asia and emerging markets—regions where CMC holds a strong distribution network. However, competition from Chinese EV manufacturers offering lower-priced models presents a challenge to CMC’s market share in price-sensitive segments.

2. Supply Chain Resilience and Localization

Ongoing geopolitical tensions and trade restrictions have prompted CMC Automotive to further localize its supply chain. In H2 2026, the company completed the expansion of its battery cell manufacturing facility in Thailand, reducing dependency on external suppliers and enhancing cost efficiency. This strategic move aligns with regional governments’ incentives for domestic EV production and improves delivery timelines across ASEAN markets.

3. Advancements in Connected and Smart Mobility

Vehicle connectivity and over-the-air (OTA) software updates have become standard expectations. CMC Automotive integrated its next-generation infotainment system—powered by its proprietary CMC Connect OS—into all new models in H2 2026. The platform supports AI-driven driver assistance, real-time traffic optimization, and seamless integration with smart city infrastructure in pilot cities like Bangkok and Ho Chi Minh City. These features enhance customer retention and open new revenue streams through subscription-based services.

4. Rising Importance of Sustainability and ESG

Environmental, Social, and Governance (ESG) performance has become a critical factor for investors and consumers alike. In H2 2026, CMC Automotive achieved carbon neutrality across its manufacturing operations in Vietnam and Thailand, supported by solar energy adoption and closed-loop recycling processes. The company also launched a battery recycling initiative in partnership with local governments, reinforcing its commitment to a circular economy.

5. Growth in Shared and Flexible Mobility Solutions

Urban congestion and changing consumer preferences have fueled demand for mobility-as-a-service (MaaS) platforms. CMC Automotive expanded its collaboration with regional ride-hailing and car-sharing platforms, deploying a fleet of 10,000 EVs for shared mobility use in Indonesia and the Philippines. This strategic pivot not only increases brand visibility but also provides valuable usage data to inform future product development.

6. Economic and Regulatory Uncertainties

Despite positive momentum, CMC faces headwinds from fluctuating raw material prices—particularly lithium and nickel—and potential changes in import tariffs across key markets. Additionally, evolving safety and data privacy regulations in ASEAN require continuous compliance investment, especially as autonomous driving technologies progress toward Level 3 deployment.

Conclusion

In H2 2026, CMC Automotive demonstrates resilience and agility by adapting to dynamic market forces. Its focus on electrification, digital innovation, and regional supply chain integration positions the company as a competitive player in the ASEAN automotive sector. To sustain growth, CMC must continue investing in R&D, strengthen strategic partnerships, and deepen its customer-centric approach in an increasingly technology-driven industry.

Common Pitfalls When Sourcing from CMC Automotive (Quality, IP)

Sourcing components or services from CMC Automotive—or any automotive supplier—requires careful due diligence, especially concerning quality assurance and intellectual property (IP) protection. Overlooking key risks can lead to production delays, safety issues, legal disputes, and reputational damage. Below are critical pitfalls to avoid in these two crucial areas.

Quality-Related Pitfalls

Inadequate Quality Management System (QMS) Verification

One of the most common mistakes is assuming that a supplier meets automotive standards without thorough validation. CMC Automotive may claim ISO/TS 16949 or IATF 16949 certification, but failing to audit their actual implementation can result in inconsistent product quality. Always conduct on-site audits or require third-party audit reports to confirm compliance.

Insufficient Production Process Controls

Even with a certified QMS, suppliers may lack robust process controls for critical manufacturing steps. Pitfalls arise when sourcing without reviewing process capability studies (e.g., Cp/Cpk values), control plans, or failure mode and effects analysis (FMEA). Without these, defects may go undetected until late in the supply chain.

Poor Incoming Material Traceability

CMC Automotive might source raw materials or sub-components from lower-tier suppliers with questionable quality. If traceability systems (e.g., batch/lot tracking) are weak, identifying the root cause of defects becomes difficult, increasing the risk of recalls and long-term supply disruptions.

Inconsistent Testing and Validation

Relying solely on supplier-provided test reports without independent validation is risky. Automotive components must endure rigorous environmental, durability, and safety testing. Failure to require periodic third-party testing or on-site witnessed testing may result in non-compliant parts entering production.

Intellectual Property (IP)-Related Pitfalls

Lack of Clear IP Ownership Agreements

A major risk occurs when contracts do not explicitly define who owns the IP for tooling, designs, or custom-developed components. Without a written agreement, CMC Automotive could claim partial ownership or reuse designs for other clients, undermining your competitive advantage.

Inadequate Protection of Proprietary Designs and Specifications

Sharing sensitive technical data without a strong Non-Disclosure Agreement (NDA) and data security protocols exposes your IP to theft or unauthorized use. Ensure that all shared information is marked confidential and access is limited to authorized personnel.

Tooling and Fixtures Mismanagement

Tooling created for your parts may remain in CMC Automotive’s possession unless ownership is clearly transferred. This creates dependency and leverage for the supplier. Always specify in contracts that tooling paid for by your company is your property and must be returned or replicated upon request.

Reverse Engineering and Unauthorized Production

Without contractual prohibitions and monitoring, there’s a risk that CMC Automotive could reverse engineer your components or produce them for competitors. Include strict clauses against reverse engineering and conduct periodic compliance checks to prevent IP leakage.

Weak Export Control and Compliance

If your components involve technology with export restrictions (e.g., dual-use items), ensure CMC Automotive complies with international regulations like ITAR or EAR. Non-compliance could lead to legal liabilities and disruption of supply.

Conclusion

To mitigate these pitfalls, establish a comprehensive sourcing strategy that includes rigorous supplier qualification, clear contractual terms on quality and IP, regular audits, and continuous monitoring. Engaging legal and technical experts during the onboarding process can prevent costly issues down the line when sourcing from CMC Automotive or similar suppliers.

Logistics & Compliance Guide for CMC Automotive

This guide outlines the essential logistics procedures and compliance requirements for CMC Automotive to ensure efficient operations, regulatory adherence, and customer satisfaction.

Supply Chain Management

Establish a robust supply chain framework by partnering with reliable suppliers and distributors. Maintain accurate inventory records using an integrated ERP system to track parts and materials. Implement Just-in-Time (JIT) inventory practices where applicable to reduce holding costs while ensuring parts availability for production and service operations.

Transportation & Distribution

Utilize certified logistics partners for inbound and outbound shipments. Ensure all transportation methods meet safety standards and environmental regulations. Track shipments in real time using GPS-enabled logistics platforms. Optimize delivery routes to reduce fuel consumption and improve delivery times. Maintain proper documentation, including bills of lading and delivery confirmations.

Import/Export Compliance

Adhere to international trade regulations when shipping parts or vehicles across borders. Ensure all export documentation (commercial invoices, packing lists, certificates of origin) is accurate and complete. Comply with customs requirements in destination countries, including tariff classifications and import permits. Designate a trained export compliance officer to oversee adherence to EAR, ITAR, and other relevant regulations.

Regulatory Standards and Safety

Ensure all vehicle modifications, parts, and materials comply with local and international safety standards (e.g., FMVSS in the U.S., ECE regulations in Europe). Maintain certifications for quality management systems such as ISO 9001. Conduct regular audits of production and logistics processes to verify compliance with environmental, health, and safety regulations.

Environmental Compliance

Follow environmental regulations related to hazardous materials handling, waste disposal, and emissions. Properly label and store lubricants, batteries, and chemical products. Partner with certified waste management providers for recycling and disposal. Document all environmental compliance efforts to support audits and regulatory reporting.

Recordkeeping & Documentation

Maintain comprehensive records for at least seven years, including shipping logs, compliance certifications, inspection reports, and supplier agreements. Store documents securely, with digital backups to ensure accessibility and disaster recovery. Implement version control for all compliance-related documentation.

Training & Accountability

Provide regular training for logistics and operations staff on compliance protocols, safety procedures, and updated regulations. Assign clear responsibilities for compliance oversight across departments. Conduct internal audits annually to identify gaps and implement corrective actions promptly.

Incident Response & Corrective Actions

Establish a formal process for reporting and addressing logistics or compliance incidents. Investigate discrepancies, delays, or regulatory violations immediately. Document root causes and implement preventive measures to avoid recurrence. Report significant compliance breaches to relevant authorities as required.

Conclusion for Sourcing CMC Automotive:

In conclusion, sourcing from CMC Automotive presents a strategic opportunity for companies seeking reliable, cost-effective, and high-quality automotive components. With a strong manufacturing base, adherence to international quality standards, and a proven track record in supplying to global markets, CMC Automotive demonstrates the capability to meet diverse automotive supply chain demands. Their focus on innovation, scalability, and customer-centric solutions positions them as a competitive supplier in the evolving automotive industry. However, due diligence in assessing production capacity, quality control processes, and supply chain resilience remains essential. When managed effectively, a partnership with CMC Automotive can enhance supply chain efficiency, reduce costs, and support long-term growth objectives in the global automotive sector.