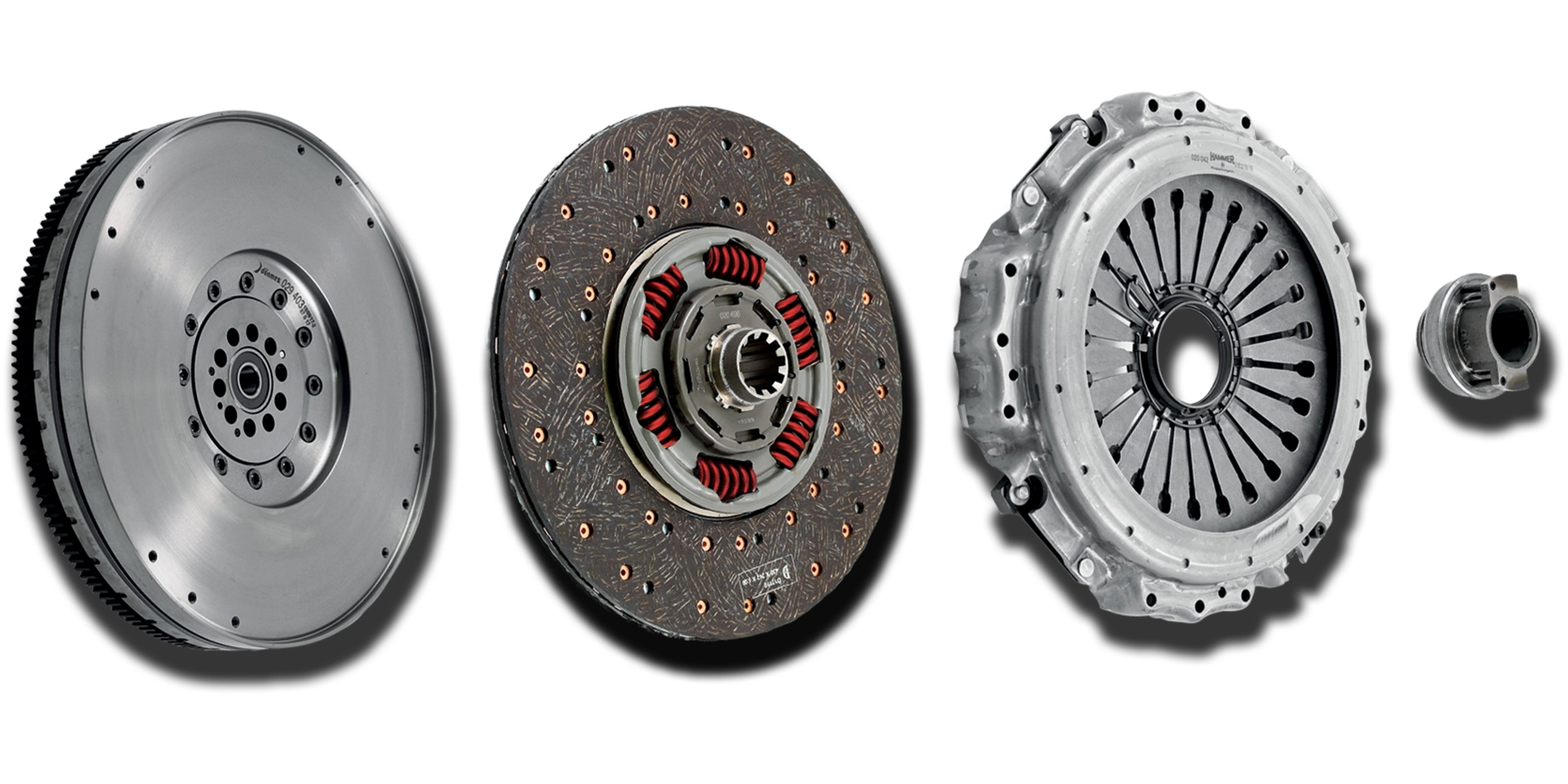

The global automotive clutch system market is experiencing steady growth, driven by increasing vehicle production, rising demand for manual and automated manual transmissions (AMT), and the need for improved fuel efficiency and drivability. According to a report by Mordor Intelligence, the clutch market was valued at USD 14.8 billion in 2023 and is projected to grow at a CAGR of over 4.2% from 2024 to 2029. Similarly, Grand View Research estimates that the global clutch market size was valued at USD 15.3 billion in 2022 and is expected to expand at a CAGR of 4.5% during the forecast period of 2023 to 2030. With the rising demand for high-performance, durable clutch components—especially in commercial vehicles, off-road machinery, and performance automobiles—the manufacturing landscape for clutch plates and pressure plates has become increasingly competitive. This growth trajectory underscores the importance of reliable, innovative suppliers in maintaining drivetrain efficiency and vehicle performance. As OEMs and aftermarket distributors seek trusted partners, a handful of manufacturers have emerged as leaders, combining advanced materials, precision engineering, and large-scale production capabilities to dominate the space.

Top 4 Clutch Plate And Pressure Plate Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Clutch Pressure Plate Archives

Domain Est. 2017

Website: americanprimemfginc.com

Key Highlights: 30-day returnsPRESSURE PLATE, HYDRAULIC CLUTCH (2058-0030 ) … A black plastic disc with a hole in the center. PRESSURE PLATE, SPORTSTER (1058-0001). $91.06 ……

#2 EXEDY Globalparts Corporation

Domain Est. 2002

Website: exedyusa.com

Key Highlights: EXEDY is not only a leader in providing high-quality clutches but we also manufacture various other vehicle parts….

#3 Hammer Kupplungen

Domain Est. 2002

Website: hammerkupplungen.com

Key Highlights: We Have Made Durability and Performance the Standard. · Clutch Kit · Volan · Clutch Discs · Clutch Pressure Plate · Clutch Release Bearing · Turbo · Special Designs ……

#4 LuK by Schaeffler

Domain Est. 2006

Website: vehiclelifetimesolutions.schaeffler.us

Key Highlights: We carry a comprehensive product portfolio of complete clutch sets, pressure plates, discs, slave and master cylinders and release bearings….

Expert Sourcing Insights for Clutch Plate And Pressure Plate

2026 Market Trends for Clutch Plate and Pressure Plate

The global market for clutch plates and pressure plates is poised for significant transformation by 2026, driven by evolving vehicle technologies, shifting consumer preferences, and stringent environmental regulations. As critical components of manual and automated manual transmissions (AMTs), clutch systems remain essential in both passenger and commercial vehicles, though their role is adapting amid the rise of electrification and advanced drivetrain solutions.

Rising Demand in Emerging Economies

One of the key drivers shaping the clutch plate and pressure plate market through 2026 is the continued expansion of automotive production and sales in emerging economies such as India, Southeast Asia, and parts of Africa and Latin America. These regions exhibit strong demand for cost-effective, fuel-efficient vehicles with manual transmissions, where clutch components are standard. As urbanization and infrastructure development accelerate, commercial vehicle fleets—especially light and medium-duty trucks—will rely heavily on durable clutch systems, supporting steady market growth.

Impact of Electrification and Hybridization

While the global shift toward electric vehicles (EVs) poses a long-term challenge to traditional clutch component demand—since most EVs use single-speed transmissions without clutch systems—hybrid vehicles represent a transitional opportunity. Many hybrid powertrains, particularly parallel and plug-in hybrids, still incorporate internal combustion engines (ICEs) paired with automated manual or dual-clutch transmissions (DCTs). These configurations require high-performance clutch plates and pressure plates designed for frequent start-stop cycles and seamless power transitions. As a result, manufacturers are investing in heat-resistant materials and advanced friction technologies to meet the reliability demands of hybrid applications.

Technological Innovations and Material Advancements

By 2026, innovation in materials and manufacturing processes will play a crucial role in enhancing clutch performance and longevity. Increased adoption of organic, ceramic, and sintered metal friction materials will allow for better thermal management, reduced wear, and improved torque capacity. Lightweight composite pressure plates, enabled by advanced metallurgy and precision machining, will support fuel efficiency goals by reducing rotating mass. Additionally, smart clutch systems incorporating sensors for wear monitoring and adaptive control are expected to gain traction in premium and commercial vehicle segments.

Aftermarket Growth and Replacement Demand

The aftermarket segment for clutch plates and pressure plates is projected to grow robustly by 2026. With a large base of existing ICE vehicles still on the road—especially in developing markets—replacement demand remains strong. Clutch systems typically require servicing every 50,000 to 100,000 kilometers, creating a recurring revenue stream for component suppliers. Moreover, rising vehicle utilization in ride-hailing and last-mile delivery services accelerates wear, further boosting aftermarket demand.

Competitive Landscape and Regional Dynamics

Asia-Pacific is expected to dominate the clutch plate and pressure plate market in 2026, driven by high-volume automotive manufacturing in China, India, and Japan. European and North American markets, while more mature, will focus on high-value, technologically advanced clutch systems for performance and commercial vehicles. Leading manufacturers such as ZF Friedrichshafen, Schaeffler, EXEDY Corporation, and Valeo are likely to expand their portfolios through R&D in hybrid-compatible and automated clutch solutions.

Sustainability and Regulatory Pressures

Environmental regulations targeting CO₂ emissions and fuel efficiency are pushing automakers to optimize every aspect of vehicle performance. Clutch manufacturers are responding by developing low-friction, high-efficiency components that contribute to improved fuel economy. Additionally, sustainability initiatives are driving interest in recyclable materials and energy-efficient production methods across the supply chain.

Conclusion

In summary, the 2026 market for clutch plates and pressure plates will be characterized by a dual trajectory: steady demand in emerging markets and ICE-based vehicles, alongside strategic adaptation to hybridization and advanced transmission technologies. While full electrification may eventually reduce reliance on traditional clutch systems, innovation, regional diversity, and aftermarket needs will sustain the sector’s relevance and growth through the mid-2020s.

Common Pitfalls Sourcing Clutch Plate and Pressure Plate (Quality, IP)

When sourcing clutch plates and pressure plates—critical components in vehicle powertrain systems—buyers often encounter challenges related to quality inconsistencies and intellectual property (IP) concerns. Being aware of these pitfalls helps ensure reliable performance, compliance, and long-term cost efficiency.

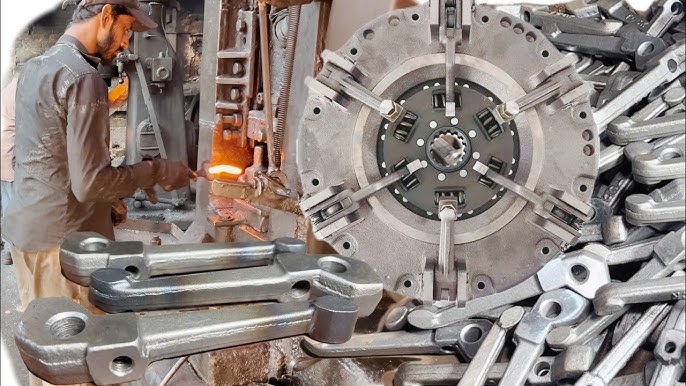

1. Compromised Quality from Low-Cost Suppliers

Many suppliers, especially in emerging markets, offer attractively low prices for clutch components. However, cost-cutting often leads to substandard materials (e.g., inferior friction materials, weak spring steel) and poor manufacturing processes. This can result in premature wear, slippage, overheating, or catastrophic failure under load. Buyers may unknowingly receive products that do not meet OEM specifications or international standards (e.g., SAE, DIN).

2. Lack of Certification and Traceability

Reputable clutch components should come with certifications (such as ISO/TS 16949, IATF 16949) and full material traceability. However, some suppliers provide falsified or generic documentation, making it difficult to verify compliance. Without proper traceability, diagnosing field failures or managing recalls becomes nearly impossible.

3. Inconsistent Dimensional Tolerances and Fitment Issues

Even if a clutch plate or pressure plate passes initial inspection, variations in dimensional tolerances can cause improper fitment, uneven wear, or vibration. These inconsistencies are common with non-OEM or copycat manufacturers who reverse-engineer parts without access to original design data.

4. Use of Counterfeit or Grey Market Parts

Counterfeit components that mimic well-known brands (e.g., Sachs, LUK, Exedy) are prevalent in global supply chains. These parts may carry fake branding and packaging but deliver poor performance and safety risks. Sourcing from unauthorized distributors increases exposure to grey market goods that lack warranty or technical support.

5. Intellectual Property (IP) Infringement Risks

Manufacturers or suppliers may produce clutch components that replicate patented designs, spring configurations, or friction material compositions without licensing. Purchasing such IP-infringing parts can expose buyers—especially OEMs or tier suppliers—to legal liability, customs seizures, or reputational damage. This is particularly risky when sourcing from regions with weak IP enforcement.

6. Inadequate Testing and Validation Data

Reliable suppliers conduct dynamic balancing, torsional vibration, thermal cycling, and endurance testing. However, many budget suppliers skip or falsify test reports. Without access to valid performance data, buyers cannot confidently assess product durability or suitability for specific applications.

7. Poor After-Sales Support and Warranty Enforcement

Low-cost suppliers may offer warranties that are difficult to claim due to unclear terms, lack of local service centers, or refusal to honor claims. This leaves buyers bearing the cost of replacements, downtime, or customer complaints.

8. Supply Chain Transparency and Ethical Sourcing Gaps

Some suppliers source raw materials or subcomponents from unethical or unverified sources. This includes conflict minerals or labor practices that conflict with corporate ESG (Environmental, Social, Governance) standards. Lack of transparency increases compliance risks, especially for multinational companies.

To avoid these pitfalls, buyers should conduct thorough supplier audits, demand third-party certification, insist on IP compliance statements, and perform sample testing. Partnering with reputable, certified manufacturers—even at a higher initial cost—reduces long-term risk and total cost of ownership.

Logistics & Compliance Guide for Clutch Plate and Pressure Plate

Overview

Clutch plates and pressure plates are critical components in vehicle transmission systems, enabling smooth engagement and disengagement of the engine from the drivetrain. Due to their mechanical nature and global distribution, shipping these parts involves navigating various logistics and compliance requirements. This guide outlines key considerations for the safe, efficient, and compliant transportation of clutch plates and pressure plates across international and domestic supply chains.

Product Classification and HS Codes

Accurate product classification is essential for customs clearance and tariff assessment.

- Harmonized System (HS) Code: Typically 8708.39.00 (Other parts and accessories of clutches and shafts, for vehicles of headings 8701 to 8705).

Note: Specific codes may vary by country and exact product specifications (e.g., material, vehicle type). Confirm with local customs authorities. - Proper Shipping Name: “Clutch Assembly Components” or “Automotive Transmission Parts” — non-hazardous.

- UN Number: Not applicable (non-hazardous goods).

Packaging and Handling Requirements

Proper packaging ensures product integrity and reduces damage during transit.

- Material: Use sturdy corrugated cardboard boxes with internal dividers or foam inserts to prevent movement.

- Protection: Apply anti-rust coatings or vapor corrosion inhibitors (VCI) for metal components, especially for sea freight.

- Labeling: Clearly label packages with:

- Product name and part number

- Net and gross weight

- “Fragile” and “This Side Up” indicators

- Handling instructions (e.g., avoid moisture)

- Unit Load: Palletize shipments for stability. Secure with stretch wrap and corner boards. Use wooden or plastic pallets compliant with ISPM 15 (for international shipments).

Transportation Modes

Select the appropriate mode based on cost, speed, and destination.

- Air Freight: Preferred for urgent or high-value orders. Faster but more expensive. Ensure packaging meets IATA standards.

- Ocean Freight: Cost-effective for large volumes. Use FCL (Full Container Load) or LCL (Less than Container Load). Protect against humidity and salt exposure.

- Road/Rail: Ideal for regional or domestic distribution. Ensure secure loading and compliance with local transport regulations.

Import/Export Documentation

Complete and accurate documentation is vital to avoid delays.

- Commercial Invoice: Includes value, quantity, description, and Incoterms® (e.g., FOB, CIF).

- Packing List: Details weight, dimensions, and number of packages.

- Bill of Lading (B/L) or Air Waybill (AWB): Proof of carriage contract.

- Certificate of Origin: May be required for tariff preferences under trade agreements.

- Import/Export Licenses: Generally not required for clutch components, but verify based on destination country regulations.

Regulatory and Compliance Considerations

Ensure adherence to regional and international standards.

- Safety & Environmental Standards:

- REACH (EU): Confirm no restricted substances (e.g., certain heavy metals) are present.

- RoHS (EU): Applies if electrical components are integrated (rare for standard clutch plates).

- EPA & DOT (USA): No specific emissions rules, but labeling and handling must comply with general automotive part standards.

- Quality Standards:

- ISO 9001: Recommended for manufacturing and logistics providers.

- TS 16949 / IATF 16949: Automotive-specific quality management standard—preferred for OEM suppliers.

- Country-Specific Requirements:

- China: May require CCC certification if part of a complete system; individual components typically exempt.

- India: BIS certification not usually required for clutch plates, but verify under Automotive Component category.

- Middle East: SASO (Saudi Arabia) or GSO (GCC) conformity may apply—check per shipment.

Incoterms® Guidance

Define responsibilities between buyer and seller.

- FOB (Free On Board): Seller delivers goods to port; buyer assumes risk and cost thereafter.

- CIF (Cost, Insurance, and Freight): Seller covers shipping and insurance to destination port.

- DAP (Delivered at Place): Seller delivers to buyer’s designated location, cleared for export but not import.

- Recommendation: Use DAP or DDP (Delivered Duty Paid) for simplified buyer experience, especially in B2B logistics.

Customs Clearance Process

- Pre-Arrival Submission: Submit documents electronically to customs authorities before arrival.

- Duties and Taxes: Calculate based on HS code and declared value. Use duty drawback programs if applicable.

- Inspection Risk: Low for mechanical components, but possible random checks. Maintain accurate records.

Reverse Logistics and Returns

Establish a process for defective or excess parts.

- Warranty Claims: Include return authorization (RMA) process.

- Return Packaging: Use original or equivalent protective packaging.

- Documentation: Include return reason and original invoice number.

Sustainability and ESG Considerations

- Recyclable Packaging: Use recyclable cardboard and minimal plastic.

- Carbon Footprint: Optimize load efficiency and consider carbon-offset shipping options.

- Supplier Audits: Ensure logistics partners comply with environmental and labor standards.

Conclusion

Shipping clutch plates and pressure plates requires attention to packaging, documentation, and regulatory compliance. By classifying goods correctly, using robust logistics partners, and staying updated on regional regulations, businesses can ensure on-time delivery, avoid customs penalties, and maintain quality standards across global markets. Always consult with customs brokers or freight forwarders for country-specific nuances.

Conclusion for Sourcing Clutch Plate and Pressure Plate:

After a comprehensive evaluation of potential suppliers, cost considerations, quality standards, and lead times, it is evident that sourcing clutch plates and pressure plates requires a strategic balance between performance, durability, and cost-efficiency. Opting for suppliers who adhere to international quality certifications (such as ISO/TS 16949) ensures reliability and consistency in product performance, especially under demanding operating conditions.

OEM (Original Equipment Manufacturer) sources offer guaranteed compatibility and high-quality materials, making them ideal for applications requiring maximum reliability. However, they often come at a higher cost. Alternatively, reputable aftermarket suppliers can provide cost-effective solutions without significant compromise on quality, provided rigorous quality control and testing protocols are in place.

Strategic sourcing should also consider total cost of ownership, including logistics, inventory management, and potential downtime due to component failure. Establishing long-term partnerships with suppliers who offer technical support, consistent supply, and scalability will enhance operational efficiency.

In conclusion, the optimal sourcing strategy involves selecting a balanced mix of high-quality OEM and pre-qualified aftermarket suppliers, supported by ongoing performance monitoring and supplier audits. This approach ensures reliable supply, cost efficiency, and long-term durability of clutch system components.