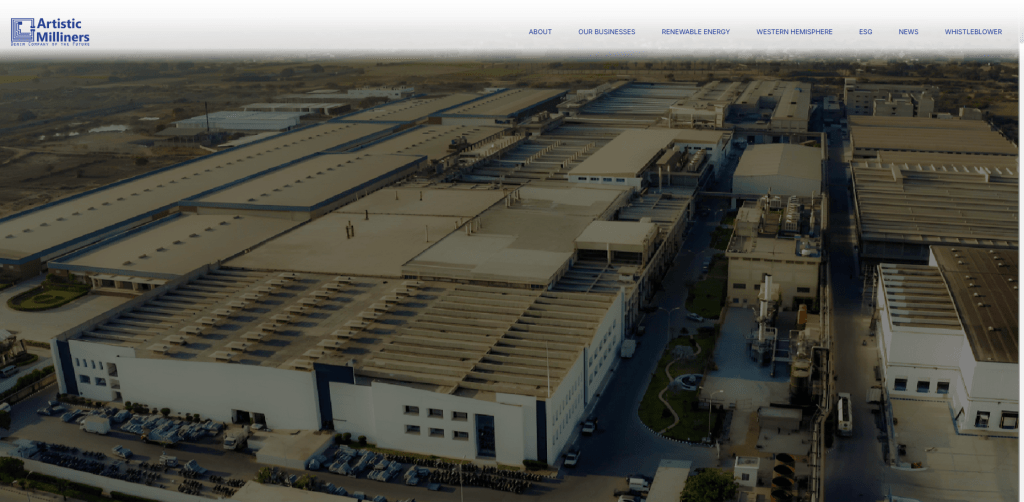

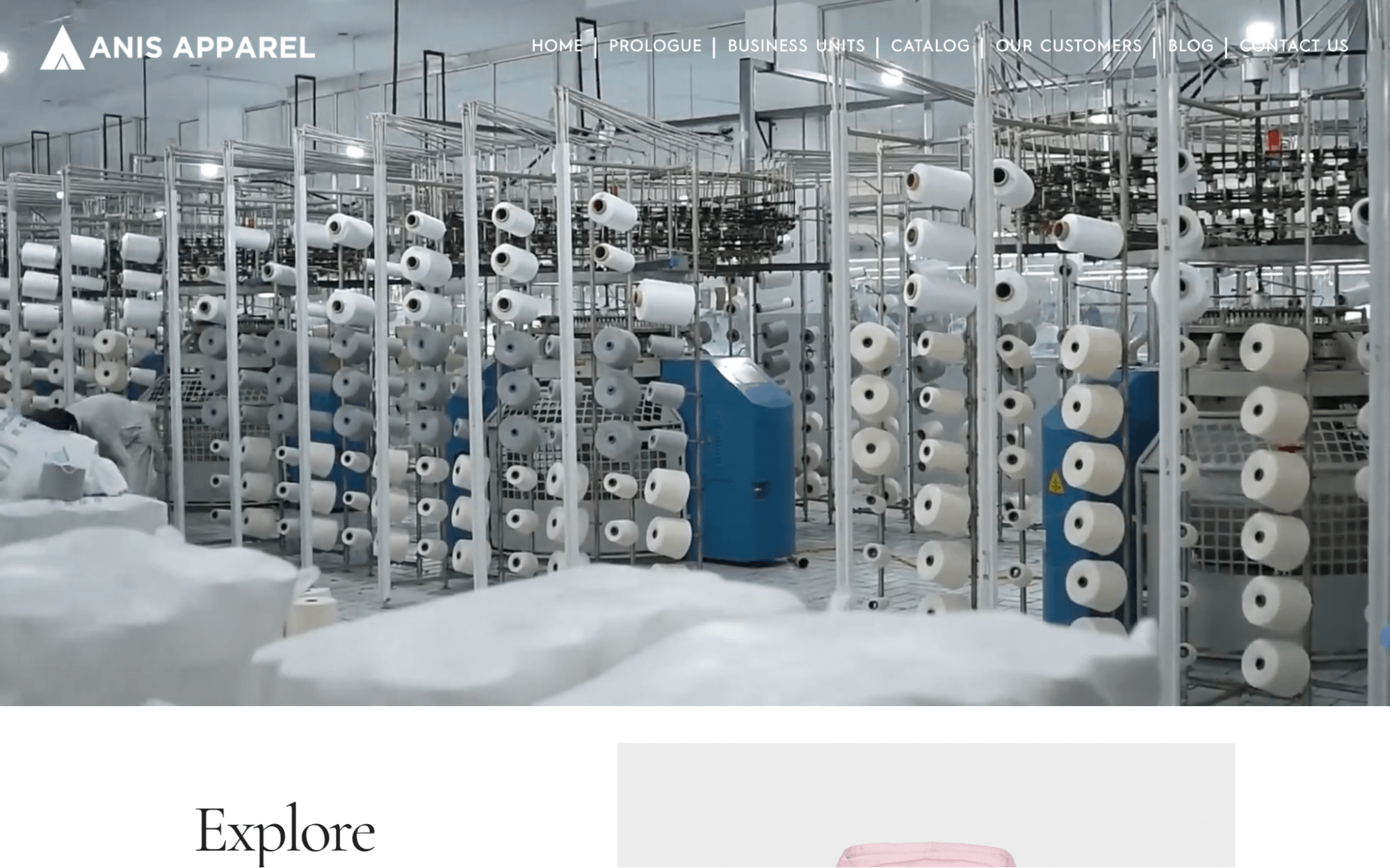

The Pakistani apparel manufacturing industry has emerged as a key player in global textile supply chains, driven by competitive labor costs, a growing base of skilled artisans, and increasing foreign demand. According to Mordor Intelligence, the Pakistan Apparel Market is projected to grow at a CAGR of over 8.5% from 2023 to 2028, fueled by rising exports and domestic consumption. Additionally, Grand View Research reports that Pakistan remains among the top 20 global apparel exporters, with knit and woven apparel accounting for a significant share of textile exports—reaching approximately USD 13 billion in FY2022. With over 400 large-scale garment manufacturers and thousands of small to medium enterprises, the country offers a diverse and vertically integrated sourcing landscape. As global brands seek cost-effective and agile production hubs, Pakistan’s clothing manufacturers are increasingly investing in sustainable practices, automation, and compliance certifications to meet international standards. Below are nine of the top clothing manufacturers in Pakistan shaping this dynamic sector.

Top 9 Clothing In Pakistan Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Pakistan Readymade Garments Manufacturers and Exporters …

Domain Est. 1999 | Founded: 1981

Website: prgmea.org

Key Highlights: Established in 1981, PRGMEA advises and serves garment manufacturers and exporters.It has over 500 member companies exporting value-added garments and textiles….

#2 ZK INTERNATIONAL

Domain Est. 2012

Website: zk-international.com

Key Highlights: ZK INTERNATIONAL Company manufacturer and exporter of High Quality Apparel & Textile Clothing. We Provide Customized Clothing with Low MOQs. Pakistan # 1 ……

#3 Premier Denim Manufacturing Company in Pakistan

Domain Est. 2013

Website: samadapparel.com

Key Highlights: As a comprehensive apparel manufacturer in Pakistan, we ensure seamless fulfillment with precision and expertise at every step of the process….

#4 Fashion Villaz

Domain Est. 2015

Website: fashionvillaz.com

Key Highlights: Clothing & Garments Manufacturer based in Pakistan. Producing Shirts, Jackets, Workwear, and Knitwear products. Accepting small MOQ….

#5 Umar Garments

Domain Est. 2016 | Founded: 1990

Website: umar-garments.com

Key Highlights: Umar Garments was established in 1990 and today is one of the leading Pakistan garments manufactures and exporters.From thread and drawcords to the complete ……

#6 Garment Manufacturers

Domain Est. 2024

Website: gnbgarments.com

Key Highlights: Discover GNB Garments, a leading garment manufacturer offering high-quality t-shirts, sweatshirts, and jackets. With operations in Pakistan and the USA, ……

#7 Best Clothing Manufacturer

Domain Est. 2022

Website: stitchcares.com

Key Highlights: We are a custom clothing manufacturer offering high-quality, private label apparel with low MOQs and global shipping. Start your brand today….

#8 Best Custom Clothing Manufacturer in Pakistan

Domain Est. 2023

Website: clothingsupplierandmanufacturer.com

Key Highlights: We are one of the best custom clothing manufacturer in Pakistan. We are also ranked as best clothing manufacturers for startups….

#9 10 Best Clothing Manufacturers & Apparel Fatories in Pakistan

Domain Est. 2023

Website: appareify.com

Key Highlights: Apparel Zone is a Pakistan clothing manufacturer that specializes in producing knitted & woven garments such as jeans, shirts, shorts, and hoodies. The company ……

Expert Sourcing Insights for Clothing In Pakistan

2026 Market Trends for Clothing in Pakistan

The clothing industry in Pakistan is poised for significant transformation by 2026, driven by evolving consumer preferences, technological advancements, and economic shifts. This analysis explores key trends expected to shape the apparel market in Pakistan over the coming years.

Rising Demand for Ethical and Sustainable Fashion

By 2026, sustainability is projected to become a major differentiator in Pakistan’s clothing market. With increasing awareness of environmental issues and ethical labor practices, consumers — particularly urban millennials and Gen Z — are showing a preference for brands that prioritize eco-friendly materials, fair wages, and transparent supply chains. Local brands are beginning to adopt organic cotton, recycled fabrics, and low-impact dyes, supported by both domestic advocacy and international buyer expectations.

Growth of E-Commerce and Digital Retail

The digital revolution is rapidly reshaping how Pakistanis shop for clothing. By 2026, e-commerce platforms such as Daraz, OLX, and emerging niche fashion apps are expected to capture a significantly larger share of apparel sales. Improved internet penetration, mobile payment solutions like JazzCash and EasyPaisa, and social media marketing (especially via Instagram and TikTok) are empowering new and established brands to reach wider audiences. Virtual try-ons and AI-driven size recommendations are also becoming more common, enhancing the online shopping experience.

Localization and Revival of Traditional Textiles

Pakistani consumers are increasingly valuing cultural identity in fashion. By 2026, there will be a stronger market pull toward locally designed clothing featuring traditional textiles such as khaddar, ajrak, jamawar, and Sindhi embroidery. Designers and brands are blending heritage craftsmanship with modern silhouettes to appeal to both domestic and diaspora markets. Government and private initiatives promoting local artisanship are expected to further boost this trend.

Expansion of Fast Fashion with Local Adaptation

While fast fashion continues to grow, it is adapting to the Pakistani context. International fast-fashion models are being localized by mid-tier domestic brands offering trendy, affordable clothing tailored to local tastes and modest fashion norms. These brands are improving turnaround times and leveraging social media influencers to drive rapid product cycles. However, concerns over quality and sustainability may temper unchecked growth.

Increased Investment in Domestic Manufacturing and Export

Pakistan’s clothing market is not only driven by domestic consumption but also by export potential. By 2026, the government’s focus on improving textile infrastructure and attracting foreign investment — particularly under the China-Pakistan Economic Corridor (CPEC) — is expected to bolster manufacturing capabilities. Enhanced automation, better energy efficiency, and compliance with international standards will position Pakistan as a competitive alternative to other Asian manufacturing hubs.

Gender-Neutral and Inclusive Fashion Gaining Ground

A growing segment of younger, urban consumers is embracing gender-fluid and inclusive fashion. By 2026, more Pakistani designers and retailers are likely to introduce unisex collections and adaptive clothing. While still a niche, this movement reflects broader societal shifts toward inclusivity and personal expression, especially in metropolitan areas like Karachi, Lahore, and Islamabad.

Price Sensitivity Amid Inflation and Economic Challenges

Despite growing aspirations, economic volatility remains a key constraint. Inflation and currency depreciation could limit purchasing power, making affordability a critical factor. Consumers are expected to remain price-sensitive, favoring value-for-money options, sales, and locally produced garments over expensive imported brands. This dynamic will push brands to innovate in cost-efficient production and marketing strategies.

Conclusion

By 2026, Pakistan’s clothing market will be shaped by a confluence of tradition and innovation. Sustainability, digitalization, cultural pride, and economic pragmatism will define consumer behavior and industry responses. Brands that successfully balance affordability with quality, heritage with modernity, and local relevance with global standards are likely to lead the evolving fashion landscape in Pakistan.

Common Pitfalls Sourcing Clothing in Pakistan (Quality, IP)

Sourcing clothing from Pakistan offers cost advantages and access to skilled labor, but it comes with several potential pitfalls, particularly concerning quality control and intellectual property (IP) protection. Being aware of these challenges is crucial for brands and retailers to safeguard their reputation and legal rights.

Quality Inconsistencies

One of the most frequent challenges is inconsistent product quality. While Pakistan has modern manufacturing facilities, many factories—especially smaller ones—may lack standardized quality control processes. Variations can occur in fabric composition, stitching, color fastness, sizing accuracy, and finishing. Relying solely on samples without thorough pre-production and in-line inspections can result in large shipments that fail to meet brand standards, leading to costly rejections or customer dissatisfaction.

Lack of Traceability and Transparency

Some suppliers may not provide full transparency in their supply chain, making it difficult to trace raw materials or verify sustainable and ethical practices. This opacity increases the risk of receiving substandard fabrics or garments produced under poor working conditions, which can damage a brand’s reputation, especially in markets with strict compliance requirements.

Intellectual Property Risks

Protecting designs and brand IP is a significant concern when sourcing from Pakistan. Informal copying of patterns, logos, and garment designs is not uncommon, especially if confidentiality agreements are not enforced. Without registered trademarks or design patents in Pakistan, brands may find it difficult to take legal action against counterfeit production or unauthorized replication of their products. Additionally, some factories may produce “inspired-by” versions of popular designs for multiple clients, diluting brand uniqueness.

Communication and Cultural Misunderstandings

Miscommunication due to language barriers or differing business practices can exacerbate quality and IP issues. Expectations around deadlines, sampling, and compliance may not be clearly understood, leading to errors or deviations from the original design. Building strong relationships with reliable agents or sourcing partners who understand both local practices and international standards can help mitigate these risks.

Inadequate Legal Recourse

Enforcing contracts and IP rights in Pakistan can be complex and time-consuming. Legal frameworks exist, but enforcement may be weak, particularly in cross-border disputes. Brands often find limited recourse if a supplier breaches an agreement or infringes on IP, especially without local legal representation.

To avoid these pitfalls, buyers should conduct thorough due diligence on suppliers, implement rigorous quality assurance protocols, secure IP through registrations and contracts, and consider third-party audits or representation to ensure compliance and protect their interests.

Logistics & Compliance Guide for Clothing in Pakistan

Import Regulations and Documentation

To import clothing into Pakistan, businesses must comply with regulations set by the Federal Board of Revenue (FBR) and the Pakistan Customs. Key requirements include:

- Import License: Not required for most clothing items, but certain restricted goods may need prior approval.

- Commercial Invoice: Must detail product description, quantity, value, and HS code.

- Packing List: Itemized list of contents in each package.

- Bill of Lading (B/L) or Air Waybill (AWB): Proof of shipment and contract of carriage.

- Certificate of Origin: Required for preferential tariff treatment under trade agreements (e.g., China-Pakistan FTA).

- Import Declaration Form (IDF): Filed through the Pakistan Single Window (PSW) system.

Classification and Tariff Structure

Clothing items are classified under the Harmonized System (HS) codes, typically in Chapters 61, 62, and 63. Accurate classification is essential for determining applicable duties and taxes.

- Customs Duty: Varies by fabric type and garment category (e.g., cotton, synthetic, wool). Rates range from 5% to 30%.

- Sales Tax: 17% on imported garments (as of 2024, subject to change).

- Additional Customs Duty (ACD): May apply based on product type and origin.

- Regulatory Duty: Imposed on certain categories to protect local industry.

Always verify the latest rates via the FBR’s SROs (Statutory Regulatory Orders).

Prohibited and Restricted Items

Certain clothing items are restricted or prohibited:

- Used clothing and second-hand garments are strictly prohibited.

- Military-style uniforms or insignia may require special authorization.

- Items with obscene or politically sensitive designs may be seized.

Customs Clearance Process

- Pre-Arrival Filing: Submit documents via the Pakistan Single Window (PSW) before goods arrival.

- Assessment: Customs evaluates declared value and classification.

- Examination: Physical or non-intrusive inspection may be conducted.

- Duty Payment: Settle customs duties and taxes through authorized banks.

- Release: Goods released upon clearance confirmation.

Engaging a licensed customs clearing agent (Customs House Agent) is recommended.

Labeling and Standards Compliance

Imported clothing must meet labeling requirements:

- Fiber Content: Must be clearly labeled in Urdu or English.

- Country of Origin: Must be visible on the garment.

- Care Instructions: Recommended, especially for exports to regulated markets.

- PSQCA Standards: While not mandatory for all garments, compliance with Pakistan Standards and Quality Control Authority (PSQCA) may be required for children’s wear or specific textiles.

Value Determination and Anti-Dumping Measures

- Transaction Value Method: Customs uses the actual price paid for valuation.

- Anti-Dumping Duties: Imposed on certain textile imports (e.g., from specific countries) to prevent unfair pricing. Verify if your product category is affected.

Inland Transportation and Warehousing

After customs clearance:

- Use licensed freight forwarders for transit.

- Bonded warehouses can be used for deferred duty payment (up to 6 months).

- Ensure proper packaging to prevent damage during transport in varying climate conditions.

Local Distribution and Sales Tax Registration

- Sales Tax Registration: Mandatory if annual turnover exceeds PKR 10 million.

- Filing Returns: Monthly returns via IRIS portal.

- Retail Compliance: Ensure retail outlets display proper pricing and tax information.

Environmental and Ethical Considerations

While not legally mandated for import, adherence to ethical sourcing and sustainable practices is increasingly important:

- Avoid products involving child or forced labor.

- Consider eco-labeling and sustainable packaging for brand reputation.

Key Government Agencies

- Federal Board of Revenue (FBR) – Oversees customs and taxation.

- Pakistan Customs – Manages import/export procedures.

- Pakistan Single Window (PSW) – Digital platform for trade documentation.

- PSQCA – Quality standards and conformity assessment.

Tips for Smooth Operations

- Stay updated on FBR notifications and SROs.

- Partner with experienced logistics and customs agents.

- Maintain accurate records for audits.

- Monitor changes in trade policy, especially under IMF programs or regional agreements.

By following this guide, importers can ensure efficient logistics and full compliance when bringing clothing products into Pakistan.

In conclusion, sourcing clothing manufacturers in Pakistan presents a compelling opportunity for global brands and retailers seeking high-quality, cost-effective apparel production. With a strong textile heritage, abundant raw materials—particularly cotton—and a skilled workforce, Pakistan has established itself as a reliable player in the global garment manufacturing industry. The country offers competitive pricing, compliance with international standards, and a growing focus on sustainable and ethical production practices.

Key advantages include vertical integration in textile production, timely delivery, and increasing expertise in producing a wide range of garments—from casual wear to formal and technical apparel. However, successful sourcing requires due diligence in selecting reputable manufacturers, understanding local regulations, and building strong, transparent partnerships. Engaging with certified factories, leveraging trade platforms, and conducting on-site audits can further mitigate risks.

Overall, with its strategic location, government support for export industries, and continuous improvements in infrastructure and compliance, Pakistan is a promising destination for fashion brands looking to diversify their supply chains and achieve both quality and scalability in apparel manufacturing.