The global foam board market, particularly closed cell foam boards, is experiencing robust growth driven by rising demand in construction, HVAC, and refrigeration industries. According to Grand View Research, the global rigid foam market size was valued at USD 90.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. Closed cell foam boards—known for their superior thermal insulation, moisture resistance, and structural strength—are a significant contributor to this expansion. Mordor Intelligence further projects the insulation materials market to grow at a CAGR of over 5.8% during the forecast period (2023–2028), citing increased building energy efficiency regulations and infrastructure development in emerging economies as key drivers. As demand surges, manufacturers specializing in high-performance closed cell foam boards are scaling innovation and capacity. Here’s a data-driven look at the top 10 manufacturers leading this segment through product quality, global reach, and technological advancement.

Top 10 Closed Cell Foam Board Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

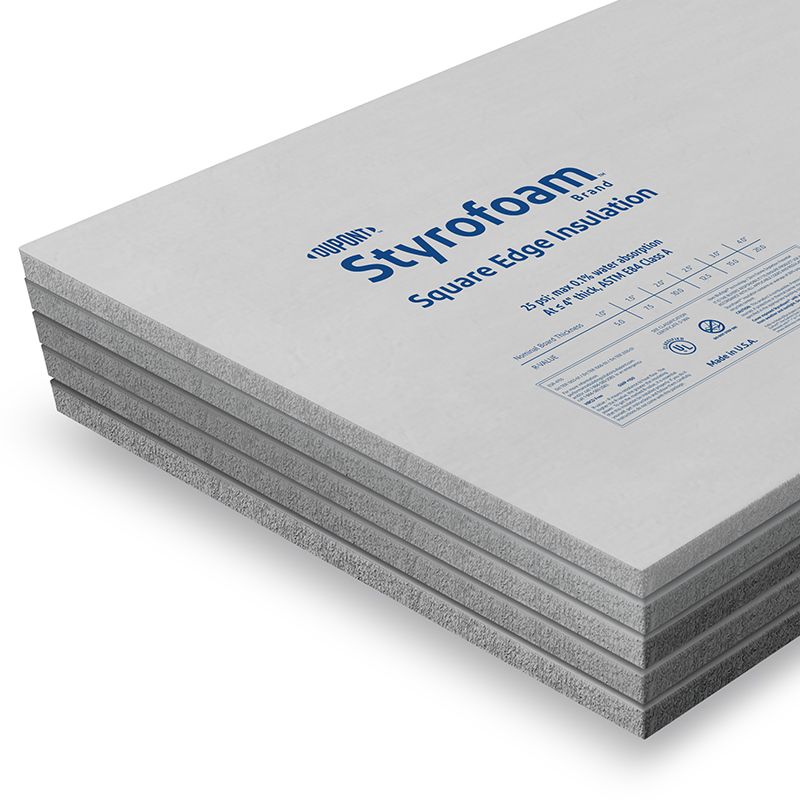

#1 Styrofoam™ Brand XPS Insulation

Domain Est. 1987

Website: dupont.com

Key Highlights: Its unique closed-cell structure and rigid foam board technology enables XPS to meet core thermal, moisture, air and vapor performance requirements. The history ……

#2 Rmax Insulation

Domain Est. 1996

Website: rmax.com

Key Highlights: Rmax Polyiso is your one step, continuous Insulation solution. Reduces construction time • Saves labor and material • Reduces carbon footprint….

#3 Worldwide Foam

Domain Est. 2008

Website: worldwidefoam.com

Key Highlights: We offer one-day lead time from our seven strategic locations while providing the widest ranges of closed cell cross-linked polyethylene foam….

#4 R

Domain Est. 1994

Website: henry.com

Key Highlights: Henry R-Tech is an engineered rigid insulation consisting of a superior closed-cell, lightweight and resilient expanded polystyrene (EPS) core….

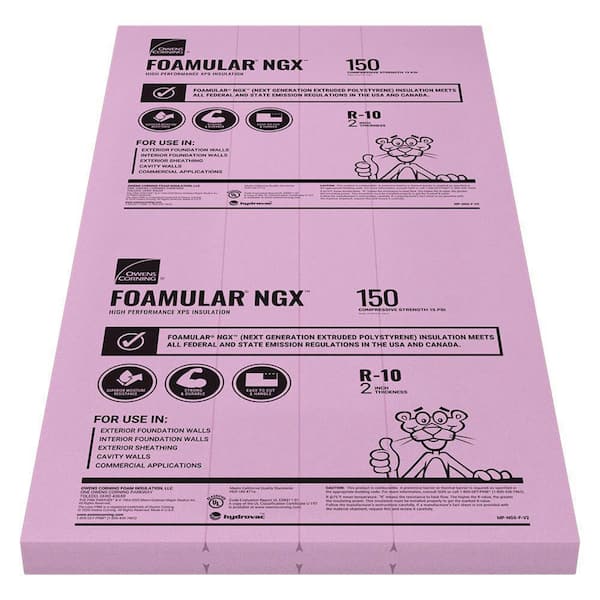

#5 foamular® ngx® 150

Domain Est. 1996

Website: owenscorning.com

Key Highlights: Closed-cell, durable insulation · Moisture-resistant rigid foam board · Versatile for multiple construction needs · Easy to cut, shape, and install · Available in 1 ……

#6 R-TECH Insulation Panels

Domain Est. 1998

Website: insulfoam.com

Key Highlights: R-Tech Panels are an engineered rigid insulation consisting of a superior closed-cell, lightweight and resilient expanded polystyrene (EPS) with advanced ……

#7 Closed Cell Foam Products

Domain Est. 1998

Website: insulfab.net

Key Highlights: Closed cell foam and sponge rubber products have been used for gasketing, cushioning, insulating, and padding applications for years….

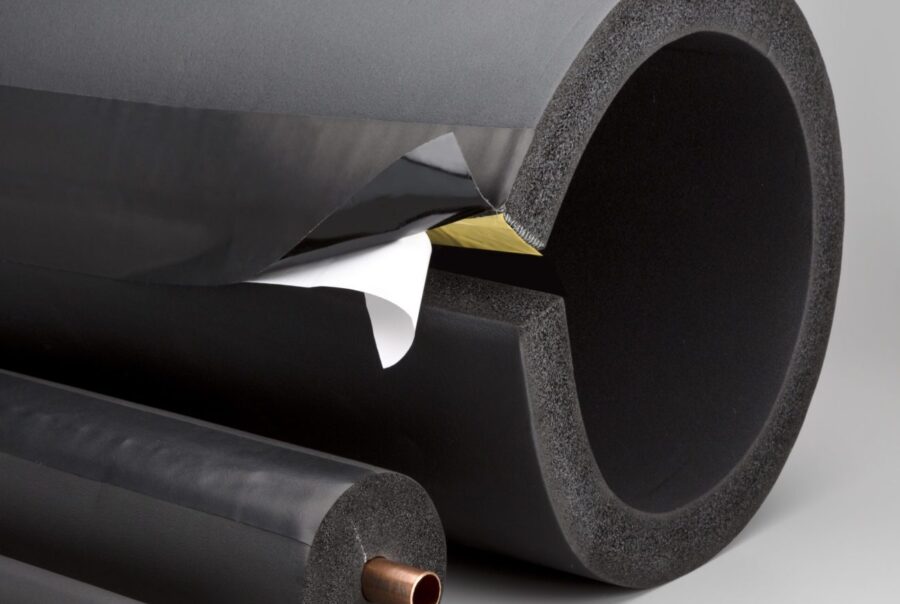

#8 Aeroflex USA

Domain Est. 2000

Website: aeroflexusa.com

Key Highlights: Closed-Cell Elastomeric Foam Insulation uniquely formulated for success in mechanical, refrigeration, HVAC, and plumbing systems….

#9 SOPRA

Domain Est. 2002

Website: soprema.us

Key Highlights: SOPRA-XPS 30 is a thermal insulation board made of rigid extruded polystyrene with shiplap or square edges on its four sides. It is composed of closed cell foam ……

#10 Accufoam

Domain Est. 2014

Website: accufoam.com

Key Highlights: High-performance spray foam insulation made in America. Accufoam delivers industry-leading open and closed cell systems engineered for superior efficiency, ……

Expert Sourcing Insights for Closed Cell Foam Board

H2: Emerging Market Trends in Closed Cell Foam Board for 2026

The closed cell foam board market is poised for significant transformation by 2026, driven by evolving construction standards, environmental regulations, and technological advancements. This analysis explores key trends expected to shape the industry landscape over the coming years.

-

Increased Demand from Green Building Initiatives

By 2026, the global push for energy-efficient and sustainable buildings is expected to significantly boost demand for closed cell foam board insulation. With superior thermal resistance (R-values of 6–7 per inch), moisture resistance, and structural rigidity, closed cell foam boards align with stringent energy codes such as Title 24 in California and the EU’s Energy Performance of Buildings Directive (EPBD). Adoption in net-zero energy buildings and passive house designs is projected to grow, particularly in North America and Western Europe. -

Regulatory Pressure Driving Low-GWP Blowing Agents

Environmental regulations targeting high global warming potential (GWP) blowing agents—such as HFCs—are accelerating the shift toward next-generation alternatives. By 2026, manufacturers are expected to widely adopt low-GWP hydrofluoroolefins (HFOs) or hydrocarbons (e.g., isopentane) in foam production. This transition, mandated by the Kigali Amendment and regional policies like the EU F-Gas Regulation, will influence product formulations and manufacturing costs but enhance market competitiveness for environmentally compliant solutions. -

Growth in Retrofit and Renovation Markets

As aging infrastructure and rising energy costs drive building envelope upgrades, the renovation sector is becoming a key growth driver. Closed cell foam boards are increasingly favored in retrofit applications due to their thin profile, high insulating performance, and ability to act as an air and vapor barrier. Urban redevelopment projects and government incentives for energy retrofits in regions like the U.S., Germany, and Japan will further stimulate demand. -

Expansion in Cold Chain and Industrial Applications

Beyond construction, closed cell foam boards are gaining traction in cold storage facilities, refrigerated transport, and industrial piping insulation. With the global cold chain logistics market expanding due to e-commerce and pharmaceutical distribution needs, demand for high-performance insulation materials with low moisture absorption will rise. Polyisocyanurate (polyiso) and extruded polystyrene (XPS) are expected to dominate these niche segments. -

Regional Market Diversification

While North America and Europe remain dominant due to strict building codes, faster growth is anticipated in Asia-Pacific—particularly in China, India, and Southeast Asia—driven by urbanization and industrialization. Local production capacity expansions and partnerships with international manufacturers are expected to reduce import dependency and tailor products to regional climatic conditions. -

Innovation in Composite and Fire-Resistant Solutions

Product innovation will focus on enhancing fire performance and integrating multi-functional properties. By 2026, closed cell foam boards with built-in fire-retardant facers or intumescent coatings are likely to gain favor, especially in high-rise construction. Additionally, hybrid panels combining foam cores with metal, gypsum, or fiber-reinforced facers will cater to demand for structural insulation panels (SIPs) and modular construction. -

Supply Chain Resilience and Raw Material Volatility

Ongoing fluctuations in petrochemical feedstock prices and geopolitical disruptions may impact production costs. Companies are expected to invest in backward integration, recycling technologies, and regional supply chain diversification to mitigate risks. Closed-loop recycling of XPS and polyiso waste could emerge as a small but growing segment, supported by circular economy policies.

In conclusion, the closed cell foam board market in 2026 will be defined by sustainability, regulatory compliance, and technological innovation. Companies that adapt to low-GWP production, expand into emerging markets, and offer high-performance, code-compliant solutions will be best positioned for long-term growth.

Common Pitfalls Sourcing Closed Cell Foam Board (Quality, IP)

Sourcing closed cell foam board involves navigating several critical challenges related to both material quality and intellectual property (IP) protection. Overlooking these pitfalls can lead to project delays, increased costs, performance failures, or legal complications.

Poor Material Quality and Inconsistent Performance

One of the most prevalent risks is receiving foam boards that do not meet specified performance standards. Suppliers—especially lower-tier or offshore manufacturers—may provide materials with inconsistent density, closed cell content, or dimensional stability. This can result in reduced thermal insulation (higher lambda values), poor moisture resistance, or structural weakness under load. Buyers often assume compliance based on datasheets, but without independent certification (e.g., ASTM, ISO, or local building codes) and third-party testing, the actual product may underperform, especially in demanding applications like roofing or below-grade insulation.

Misrepresentation of Product Specifications

Some suppliers exaggerate or falsify technical claims such as R-value, compressive strength, or fire resistance. For example, a foam board may be advertised with a high R-value per inch, but in reality, long-term thermal resistance (LTTR) testing may show significant degradation over time. Buyers who rely solely on marketing materials without verifying test reports risk installing substandard insulation that fails to meet energy code requirements or building performance goals.

Lack of Traceability and Certification

Reputable closed cell foam boards—such as extruded polystyrene (XPS) or polyisocyanurate (polyiso)—often carry certifications from bodies like UL, Intertek, or ICC-ES. Sourcing from suppliers unable to provide valid certification documents increases the risk of counterfeit or non-compliant products. This not only affects building safety and code compliance but can also void warranties and insurance coverage.

Intellectual Property Infringement Risks

Another critical concern is the inadvertent sourcing of foam board products that infringe on patented technologies. Major manufacturers invest heavily in proprietary formulations, manufacturing processes (e.g., specific blowing agents or cell structure control), and facer technologies. Sourcing from unauthorized or copycat producers may expose the buyer to legal liability, especially in regions with strong IP enforcement. Using a product that mimics a patented design—such as a specific edge detail or fire-retardant additive formulation—can lead to cease-and-desist orders, product recalls, or litigation.

Supply Chain Transparency and Origin Ambiguity

Opaque supply chains make it difficult to verify both quality and IP legitimacy. Foam boards sourced through intermediaries or private-label manufacturers may obscure the actual producer, making it hard to audit manufacturing practices or validate IP compliance. This is particularly problematic when sourcing from regions with weak regulatory oversight or lax enforcement of IP rights.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Require full technical documentation, including test reports and certifications.

– Conduct independent material testing, especially for large or critical projects.

– Source from reputable, directly verified manufacturers with transparent supply chains.

– Perform IP due diligence, including patent landscaping for key product features.

– Include quality and IP warranty clauses in procurement contracts.

By proactively addressing these common sourcing pitfalls, organizations can ensure they receive high-performance, compliant, and legally secure closed cell foam board products.

Logistics & Compliance Guide for Closed Cell Foam Board

Overview

Closed Cell Foam Board, commonly used in construction, refrigeration, and industrial applications for insulation and sealing, presents unique challenges in logistics and regulatory compliance due to its flammability, chemical composition, and environmental impact. This guide outlines key considerations for the safe and compliant handling, transportation, storage, and disposal of closed cell foam boards such as polyisocyanurate (PIR), polyurethane (PUR), and extruded polystyrene (XPS).

Regulatory Classification & Documentation

Closed cell foam boards may be subject to multiple regulations depending on composition, additives (e.g., flame retardants), and country of destination. Key documentation includes:

- Safety Data Sheet (SDS): Must be provided per OSHA HazCom (29 CFR 1910.1200) in the U.S. and CLP/GHS regulations in the EU. The SDS details hazards, first aid, firefighting measures, and handling precautions.

- Product Certification: Boards used in construction must often carry certifications such as:

- UL, FM, or Intertek listings for fire performance.

- LEED/EPD documentation if marketed as environmentally sustainable.

- REACH & RoHS (EU): Ensure compliance with restrictions on hazardous substances, particularly brominated flame retardants or plasticizers.

- TSCA (U.S.): Verify compliance with Toxic Substances Control Act, especially for chemical components like isocyanates or blowing agents (e.g., HFCs, HCFOs).

Transportation & Shipping Requirements

Closed cell foam boards are generally classified as non-hazardous for transport when solid and untreated. However, compliance with carrier and international standards is critical:

- IMDG/ADR/IATA Regulations: If boards contain residual blowing agents or are classified as flammable solids, they may require hazardous materials declaration. Most standard foam boards are non-regulated when shipped as solid panels.

- Packaging: Boards must be shrink-wrapped or banded to prevent shifting. Use moisture-resistant wrapping to avoid degradation during transit.

- Labeling: Include:

- Product name and specifications.

- Manufacturer information.

- Handling labels (e.g., “Protect from Moisture,” “Do Not Stack Excessively”).

- Fire hazard warnings if applicable (e.g., “Flammable – Keep Away from Open Flame”).

Storage & Handling

Proper storage prevents degradation, fire risk, and worker exposure:

- Indoor, Dry Environment: Store in a cool, dry place away from direct sunlight and moisture to prevent warping or mold.

- Ventilation: Ensure adequate ventilation in storage areas, especially when cutting or handling, to avoid inhalation of dust or fumes.

- Fire Safety:

- Keep away from ignition sources (welding, open flames).

- Store at least 3 feet from combustible materials.

- Fire extinguishers (Class A/B) must be accessible.

- Stacking: Limit stack height to manufacturer recommendations to prevent collapse or edge damage. Use pallets and avoid uneven surfaces.

Environmental & Disposal Compliance

Disposal is tightly regulated due to potential environmental hazards:

- Waste Classification: In the EU, classify under Waste Framework Directive (2008/98/EC). In the U.S., determine if foam waste is hazardous under RCRA (typically non-hazardous unless contaminated).

- Recycling Options:

- Some XPS and PUR foams can be recycled through specialized processors.

- Confirm local municipal or industrial recycling programs.

- Landfill Restrictions: Several regions restrict landfilling of construction foams; check local regulations (e.g., EU Landfill Directive).

- Incineration: Only permitted in facilities equipped to handle halogenated emissions (if brominated flame retardants are present).

Worker Safety & Training

Employees involved in handling, cutting, or installing foam boards must be trained on:

- PPE Requirements: Use NIOSH-approved respirators (N95 or higher for dust), safety goggles, and gloves when cutting or sanding.

- Ventilation Protocols: Use local exhaust ventilation when machining foam.

- Fire Response Training: Employees should know emergency procedures, including evacuation and use of fire suppression systems.

Import/Export Considerations

International shipments require additional diligence:

- Customs Documentation: Include HS codes (e.g., 3921.12 for rigid polyurethane sheets).

- Country-Specific Standards:

- U.S.: Comply with ICC-ES or ASTM E84 for flame spread.

- EU: CE marking per Construction Products Regulation (CPR) EN 13165.

- Canada: Meet CAN/ULC-S102 for surface burning characteristics.

- Restricted Substances: Verify ban on certain blowing agents (e.g., HCFCs under Montreal Protocol) or flame retardants (e.g., HBCDD in the EU).

Conclusion

Closed Cell Foam Board logistics and compliance demand attention to chemical safety, environmental regulations, and fire risk management. Proactive documentation, proper handling, and adherence to regional standards ensure legal compliance and worker safety throughout the supply chain. Regular audits and updates to regulatory changes are recommended to maintain compliance.

Conclusion for Sourcing Closed Cell Foam Board

After a comprehensive evaluation of suppliers, material specifications, cost structures, and performance requirements, sourcing closed-cell foam board is a strategic decision that balances thermal efficiency, moisture resistance, durability, and cost-effectiveness. The selected supplier meets essential criteria, including consistent product quality, compliance with industry standards (such as ASTM C578), and the ability to provide material in required thicknesses and densities. Additionally, their reliability in lead times, environmental certifications, and logistical support ensures operational continuity and sustainability goals are met.

In conclusion, the chosen sourcing option offers a dependable supply of high-performance closed-cell foam board suitable for demanding applications in construction, insulation, and industrial uses. Ongoing supplier performance monitoring and periodic market reviews are recommended to maintain cost efficiency and adapt to future material advancements or project requirements.