The global cinder block market has experienced steady growth, driven by rising infrastructure development and urbanization, particularly in emerging economies. According to a report by Mordor Intelligence, the global concrete blocks and bricks market was valued at USD 35.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2029. This expansion is fueled by increasing demand for affordable housing, commercial construction, and sustainable building materials that leverage the durability and thermal efficiency of cinder blocks. As the construction sector continues to prioritize cost-effective and scalable solutions, manufacturers are investing in automation, eco-friendly production processes, and product innovation. With competitive dynamics intensifying, identifying the leading players becomes crucial for contractors, developers, and procurement professionals seeking reliable supply chains and high-performance materials. Here’s a data-driven look at the top 10 cinder block manufacturers shaping the industry today.

Top 10 Cinder Block Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Angelus Block

Domain Est. 1996

Website: angelusblock.com

Key Highlights: Angelus Block 3D Unit Library Now Live. Generate and Download SketchUp and ACAD Unit Models. See More!…

#2 OBERFIELDS LLC

Domain Est. 1997

Website: oberfields.com

Key Highlights: Sunbury, OH – home to our concrete masonry products under the Best Block® brand. Oberfields serves hardscape contractors and an extensive distributor network ……

#3 Basalite Concrete Products

Domain Est. 2000

Website: basalite.com

Key Highlights: Basalite Concrete Products is one of the largest manufacturers of concrete masonry products in the Western United States. Product lines include structural block ……

#4 CRH is North America’s largest manufacturer of building materials

Domain Est. 2017

Website: crhamericas.com

Key Highlights: We are the leading provider of building materials and products in North America that build, connect, and improve our world. · Americas Building Products Multi- ……

#5 Leading Supplier of Concrete & Building Materials

Domain Est. 1996

Website: cemexusa.com

Key Highlights: Trusted building materials supplier and concrete supplier, Cemex US delivers ready-mix concrete, aggregates, and sustainable solutions nationwide for ……

#6 Pavers, Retaining Walls, Masonry Block

Domain Est. 1996

Website: superliteblock.com

Key Highlights: Superlite Block is a member of the nationwide network of Oldcastle APG, a CRH company, manufacturing facilities that produces Architectural Masonry and Concrete…

#7 RCP Block & Brick

Domain Est. 1996

Website: rcpblock.com

Key Highlights: For over 75 years, RCP Block & Brick has proudly provided the largest selection of hardscape and masonry supplies to San Diego County and the Temecula Valley….

#8 A-1 Block

Domain Est. 1999

Website: a1block.com

Key Highlights: A-1 Block produces top-quality concrete block and ready-mix, plus the greatest variety of architectural, masonry, screen wall, and retaining wall products ……

#9 County Materials Corporation

Domain Est. 2002

Website: hub.countymaterials.com

Key Highlights: County Materials: your source for American-made concrete construction and landscape products used to build the communities where Americans live, work, ……

#10 Best Block

Domain Est. 1998

Website: bestblock.com

Key Highlights: Best Block. Nearest Manufacturer. Texas | change. Arizona. Coolidge. 15540 N Kenworthy Rd. Coolidge, AZ 85128. Phone: 520-424-2242. Phoenix. 3035 S. 35th Ave….

Expert Sourcing Insights for Cinder Block

H2: Market Trends for Cinder Blocks in 2026

As we approach 2026, the global cinder block market is undergoing a significant transformation influenced by evolving construction demands, sustainability imperatives, and technological advancements. Despite increasing competition from alternative building materials, cinder blocks remain a staple in residential, commercial, and infrastructure development—particularly in emerging economies. Below are key market trends shaping the cinder block industry in 2026:

-

Increased Demand in Emerging Markets

Rapid urbanization in regions such as Southeast Asia, Sub-Saharan Africa, and Latin America continues to drive demand for affordable and durable construction materials. Cinder blocks, known for their cost-effectiveness and ease of use, are preferred in low- to mid-rise buildings. Governments investing in affordable housing and public infrastructure are further accelerating market growth. -

Sustainability and Green Building Standards

The construction industry’s shift toward eco-friendly practices is influencing cinder block production. Manufacturers are increasingly incorporating recycled materials—such as fly ash, slag, and construction waste—into block formulations. These “green” cinder blocks reduce carbon footprints and align with global green building certifications like LEED and BREEAM, boosting market appeal. -

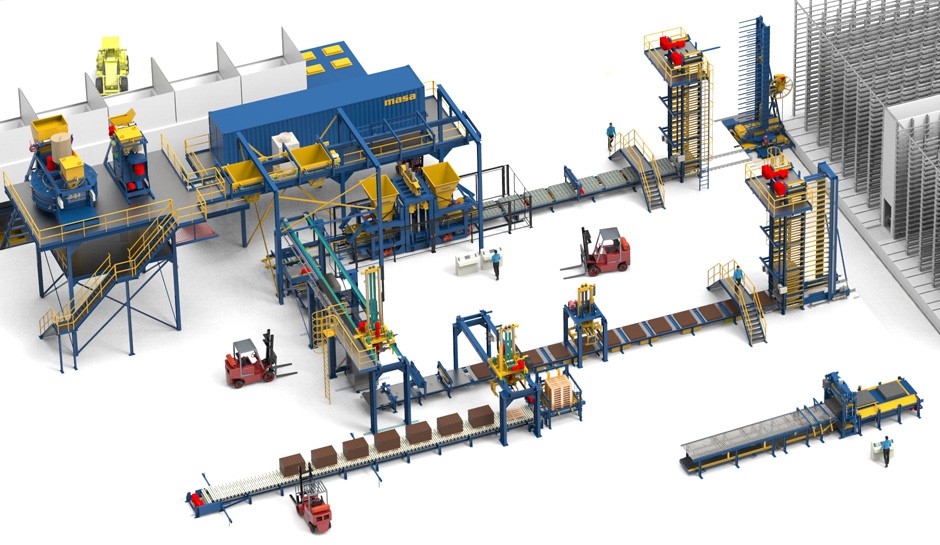

Advancements in Manufacturing Technology

Automation and modular production systems are enhancing efficiency and consistency in cinder block manufacturing. In 2026, more producers are adopting IoT-enabled machinery and AI-driven quality control systems to minimize waste, lower labor costs, and meet tighter project timelines. This technological integration is improving scalability, especially for large-scale construction projects. -

Competition from Alternative Materials

While cinder blocks maintain a strong market position, they face growing competition from materials like autoclaved aerated concrete (AAC), insulated concrete forms (ICFs), and cross-laminated timber (CLT). These alternatives offer superior insulation, lighter weight, and faster installation. However, the affordability and widespread familiarity with cinder blocks help retain their dominance in price-sensitive markets. -

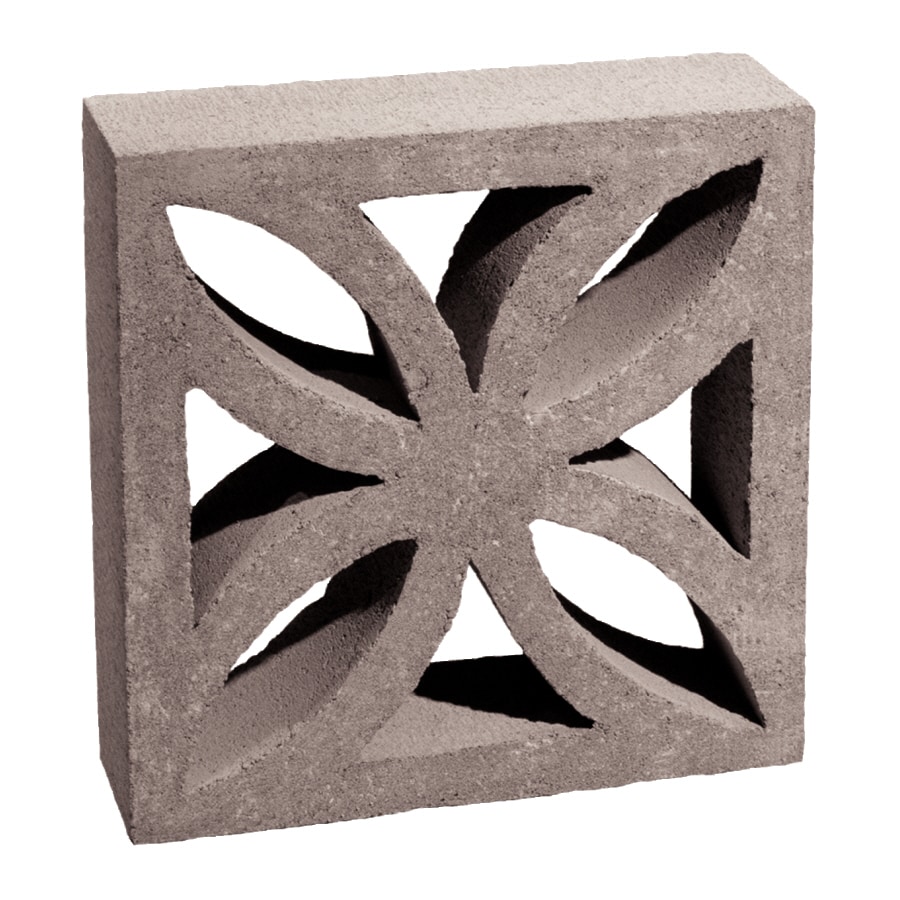

Focus on Design and Aesthetic Innovation

To counter perceptions of cinder blocks as purely utilitarian, manufacturers are introducing architecturally finished blocks with textured surfaces, colors, and interlocking designs. These aesthetic enhancements allow cinder blocks to be used in visible exterior applications, expanding their use in modern and sustainable architectural designs. -

Regulatory and Safety Standards

Stricter building codes—especially in earthquake-prone and high-wind regions—are pushing for improved structural performance. In response, reinforced cinder blocks and hybrid systems that combine steel or fiber reinforcement are gaining traction. Compliance with regional safety standards is becoming a key differentiator among producers. -

Supply Chain Resilience and Localized Production

Post-pandemic supply chain disruptions have prompted companies to localize production and reduce dependency on imported raw materials. In 2026, many cinder block manufacturers are establishing regional plants close to raw material sources and construction hubs, improving delivery times and reducing transportation emissions.

Conclusion:

The cinder block market in 2026 remains resilient, adapting to environmental, technological, and economic shifts. While challenges from alternative materials and sustainability pressures persist, innovation and strategic alignment with infrastructure growth are positioning cinder blocks as a relevant and evolving component of the global construction landscape.

Common Pitfalls Sourcing Cinder Block (Quality, IP)

Poor Material Quality and Inconsistent Composition

One major pitfall when sourcing cinder blocks is encountering substandard material quality. Cinder blocks made with inconsistent aggregate ratios—especially those with high ash or slag content—can exhibit reduced compressive strength, increased brittleness, and higher susceptibility to moisture absorption. These inconsistencies often stem from unregulated or informal manufacturing processes. Buyers may receive blocks that fail to meet ASTM or local building code standards, leading to compromised structural integrity and long-term durability issues in construction projects.

Lack of Standardization and Certification

Many suppliers, particularly in developing markets or informal supply chains, do not provide certified cinder blocks that comply with recognized industry standards (e.g., ASTM C90 or equivalent). The absence of third-party testing or quality assurance documentation makes it difficult to verify block strength, density, or dimensional accuracy. Without standardized specifications, construction teams risk receiving non-uniform blocks that complicate masonry work and may result in costly rework or safety hazards.

Intellectual Property (IP) and Brand Misrepresentation

While cinder blocks themselves are typically generic building materials, sourcing can involve IP-related risks when suppliers falsely represent products as originating from reputable manufacturers or certified production lines. Counterfeit branding or misleading labeling—such as claiming blocks meet specific environmental or engineering certifications—can expose buyers to legal and reputational risks. Additionally, using proprietary block designs (e.g., interlocking or insulated systems) without proper licensing may infringe on patented technologies, leading to IP disputes.

Inadequate Supply Chain Transparency

Opacity in the supply chain increases the risk of receiving low-quality or misrepresented products. Without clear traceability from manufacturer to end-user, it becomes difficult to verify claims about block composition, production methods, or compliance with environmental and labor standards. This lack of transparency also complicates accountability when defects arise, especially in large-scale or public infrastructure projects where quality assurance is critical.

Environmental and Regulatory Non-Compliance

Some cinder blocks are produced using recycled industrial byproducts (like coal ash), which may contain trace contaminants. Sourcing blocks without proper environmental testing can lead to regulatory issues, especially in jurisdictions with strict indoor air quality or hazardous material regulations. Additionally, blocks produced using non-compliant methods may not qualify for green building certifications (e.g., LEED), undermining sustainability goals.

Conclusion

To mitigate these pitfalls, buyers should prioritize suppliers with verifiable quality certifications, conduct independent material testing, and ensure clear contractual terms around specifications and IP rights. Due diligence in vetting manufacturers and maintaining supply chain transparency is essential for ensuring both structural reliability and legal compliance.

Logistics & Compliance Guide for Cinder Block

Cinder blocks, also known as concrete masonry units (CMUs), are widely used in construction for foundations, walls, and structural support. Proper logistics and compliance management are essential to ensure safety, efficiency, and adherence to regulations throughout the supply chain. This guide outlines key considerations for transporting, storing, handling, and complying with relevant standards when working with cinder blocks.

Transportation & Handling

Proper transportation and handling of cinder blocks minimize damage, reduce waste, and ensure worker safety.

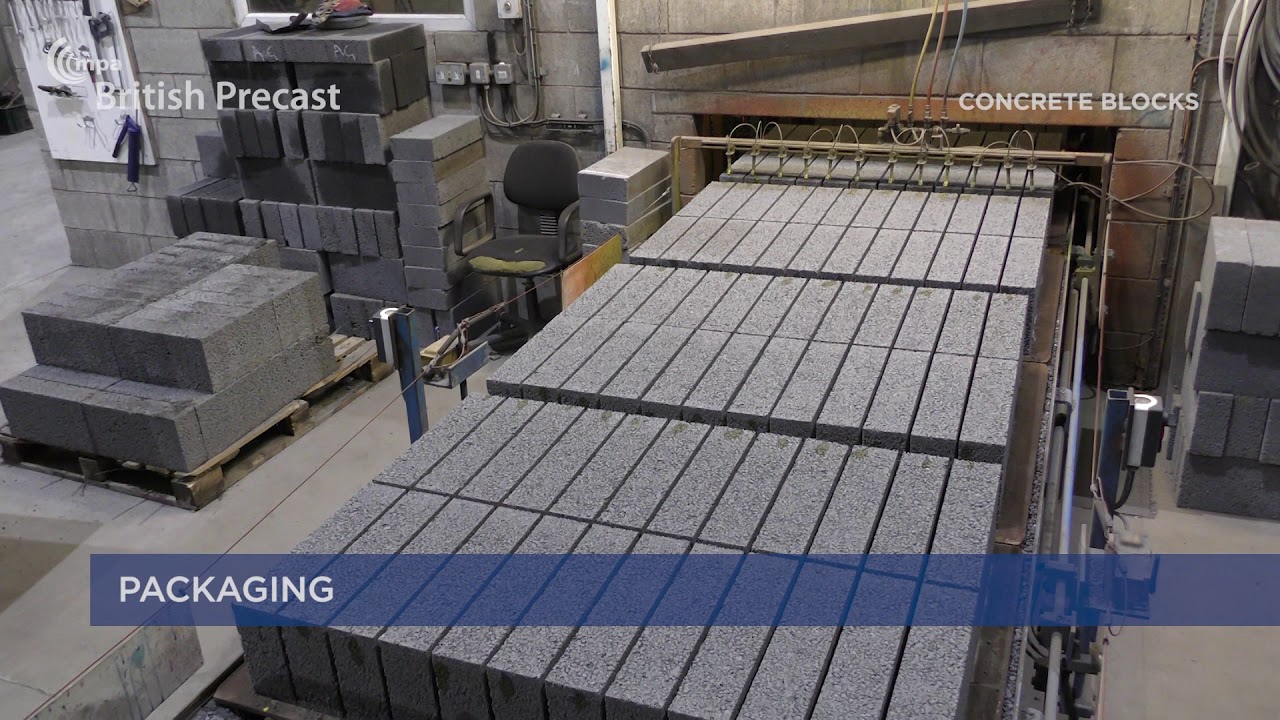

- Packaging and Palletization: Cinder blocks should be securely stacked on wooden or plastic pallets and wrapped with stretch film or strapped to prevent shifting during transit.

- Load Securing: Use tie-down straps or load bars to secure pallets on flatbed or enclosed trailers. Ensure even weight distribution to maintain vehicle stability.

- Forklift & Equipment Use: Only trained personnel should operate forklifts or material handlers. Use appropriate attachments (e.g., brick clamps) to avoid breakage.

- Loading/Unloading Safety: Workers must wear protective gear (gloves, steel-toed boots, and high-visibility vests). Avoid manual lifting of heavy stacks; use mechanical aids whenever possible.

Storage Guidelines

Improper storage can compromise block integrity and create safety hazards.

- Location: Store cinder blocks on a level, well-drained surface. Avoid direct ground contact; use pallets or wooden skids to prevent moisture absorption.

- Covering: Protect stored blocks from rain, snow, and prolonged exposure to moisture with waterproof tarps or indoor storage. Moisture can weaken blocks and promote mold.

- Stacking Limits: Follow manufacturer recommendations for maximum stack height (typically 8–10 courses high). Stacking too high increases collapse risk and makes retrieval difficult.

- Access and Organization: Maintain clear aisles for equipment access. Separate different block types or sizes to reduce handling errors.

Regulatory & Safety Compliance

Adherence to local, national, and industry regulations ensures legal operation and worker protection.

- OSHA Standards (U.S.): Comply with OSHA 29 CFR 1926 for construction safety, including requirements for material handling, fall protection, and hazard communication.

- DOT Regulations: When transporting cinder blocks commercially, ensure compliance with Department of Transportation (DOT) rules for weight limits, vehicle safety, and load securement.

- Environmental Regulations: Manage dust and debris during handling. Follow EPA guidelines for stormwater runoff if stored outdoors; prevent contamination from concrete fines.

- Workplace Safety Plans: Implement site-specific safety plans that include training on proper lifting techniques, equipment operation, and emergency procedures.

Quality & Inspection Protocols

Maintain product integrity through regular inspection and quality control.

- Incoming Inspection: Check delivered blocks for cracks, chipping, or dimensional inaccuracies before acceptance.

- Batch Traceability: Retain delivery tickets and supplier documentation to trace materials in case of compliance audits or quality issues.

- ASTM Standards: Ensure cinder blocks meet relevant ASTM standards (e.g., ASTM C90 for load-bearing units) for compressive strength, absorption, and durability.

Sustainability & Waste Management

Environmental responsibility is increasingly important in construction logistics.

- Recycling: Crushed cinder blocks can be recycled as aggregate for road base or drainage layers. Partner with local recycling facilities.

- Waste Reduction: Accurate ordering and careful handling reduce breakage and excess material. Track waste metrics to improve efficiency.

- Carbon Footprint: Optimize delivery routes and consolidate shipments to reduce fuel consumption and greenhouse gas emissions.

Documentation & Recordkeeping

Maintain thorough records to support compliance and operational efficiency.

- Delivery Logs: Record delivery dates, quantities, batch numbers, and condition upon arrival.

- Inspection Reports: Document any damage or non-conformities and actions taken.

- Training Records: Keep logs of employee training on handling, safety, and compliance procedures.

- Compliance Certificates: Retain supplier certifications confirming adherence to ASTM, DOT, or other relevant standards.

By following this logistics and compliance guide, businesses and construction teams can ensure the safe, efficient, and lawful handling of cinder blocks throughout the project lifecycle.

In conclusion, sourcing cinder block suppliers requires a strategic approach that balances quality, cost, reliability, and logistics. After evaluating multiple suppliers, it is essential to choose partners that not only meet technical and durability standards but also offer consistent supply performance and responsive customer service. Conducting thorough due diligence—such as verifying certifications, inspecting manufacturing processes, assessing delivery timelines, and comparing pricing structures—ensures long-term project success and cost efficiency. Building strong relationships with reputable suppliers enhances supply chain resilience and supports timely project execution. Ultimately, selecting the right cinder block supplier contributes significantly to construction quality, budget adherence, and overall project sustainability.