The global laser cutting machines market is experiencing robust growth, driven by increasing demand for precision manufacturing across industries such as automotive, aerospace, electronics, and heavy machinery. According to Grand View Research, the global laser cutting market size was valued at USD 5.58 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. Another report by Mordor Intelligence projects a CAGR of approximately 6.3% during the forecast period of 2023–2028, underpinned by advancements in fiber laser technology and rising adoption of automation in production environments. As competition intensifies and technological capabilities evolve, a select group of manufacturers have emerged as leaders in innovation, reliability, and market reach. Below are the top 6 ciecie laserowe (laser cutting) manufacturers shaping the industry’s future through cutting-edge engineering and global scalability.

Top 6 Ciecie Laserowe Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 EAGLE Lasers

Website: eagle-group.eu

Key Highlights: EAGLE is the producer of the fastest and most efficient laser cutters in the world. Discover our innovative fiber laser products and matching software!…

#2 Laser cutting

Website: tmctechnik.pl

Key Highlights: Our company specialises in laser cutting of sheet metal. We provide services for individual customers, small enterprises and large concerns in different ……

#3 English

Website: multix.pl

Key Highlights: Our company was founded seven years ago. We gained extensive experience allowing servicing the projects within the scope of metal working….

#4 manufacturing of fiber laser machines for metal …

Website: fanuci-falcon.com

Key Highlights: We offer, among others, laser welders, cleaning lasers, laser cutters for pipes, profiles, and sheet metal, nitrogen generators, and 3D laser printers for ……

#5 About us – Drawex

Website: drawexlaser.pl

Key Highlights: Oferujemy usługi cięcia laserowego blach gorącowalcowatych i niskowalcowatych , stali nierdzewnej jak i aluminium. Skontaktuj się z nami już teraz!…

#6 Media

Website: en.valor-cnc.pl

Key Highlights: We offer cutting of pipes and hollow sections of various materials, such as stainless steel, carbon steel, aluminium, copper, brass. Waterjet cutting. Carbon, ……

Expert Sourcing Insights for Ciecie Laserowe

H2: Market Trends for Ciecie Laserowe (Laser Cutting) in 2026

The laser cutting industry, known in Polish as ciecie laserowe, is poised for significant evolution by 2026, driven by technological advancements, shifting industrial demands, and increasing adoption across key manufacturing sectors. As precision, efficiency, and automation become central to modern production, laser cutting continues to solidify its role as a cornerstone technology in metal fabrication and beyond. Below is an analysis of key market trends expected to shape the ciecie laserowe landscape in 2026.

1. Growth in Automation and Integration with Industry 4.0

By 2026, laser cutting systems are increasingly integrated into smart factories leveraging Industry 4.0 principles. In Poland and across Europe, manufacturers are investing in automated laser cutting cells that combine robotic material handling, real-time monitoring, and predictive maintenance. This shift reduces labor costs, increases throughput, and improves precision—making automated laser cutting a competitive necessity.

2. Rising Demand in Automotive and Electric Vehicle (EV) Manufacturing

The expansion of EV production, particularly in Central Europe, is fueling demand for high-precision laser cutting. Components such as battery enclosures, chassis parts, and lightweight structural elements require clean, fast cuts achievable only with advanced fiber lasers. Polish suppliers serving automotive OEMs and Tier-1 vendors are expected to scale their ciecie laserowe capabilities to meet these specifications.

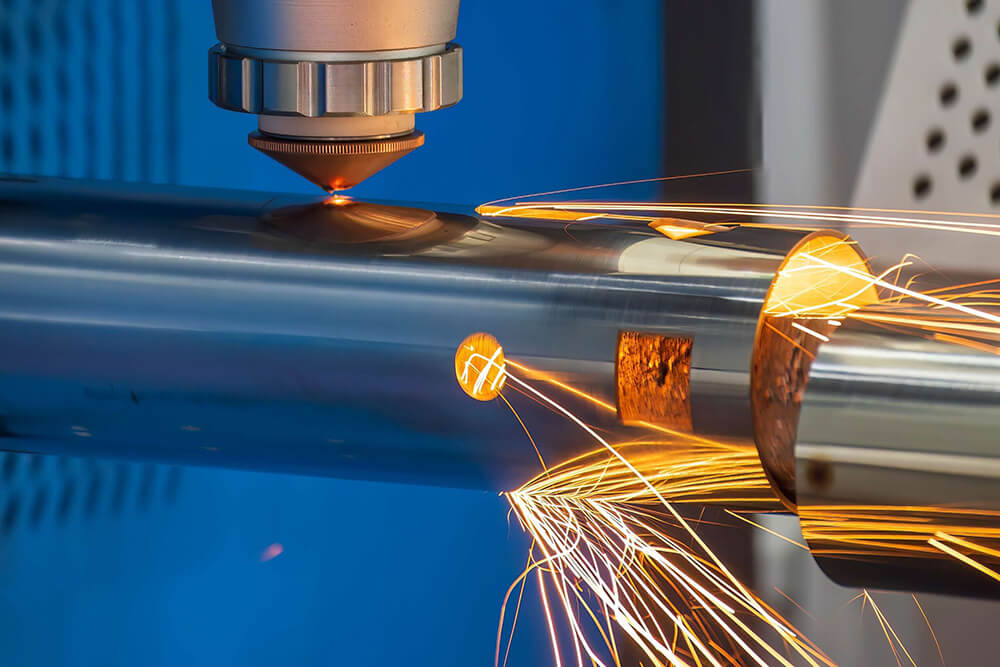

3. Adoption of High-Power Fiber Lasers

Fiber laser technology continues to dominate the market, with power levels exceeding 12 kW becoming standard for thick-section cutting. By 2026, high-power fiber lasers enable faster processing of stainless steel, aluminum, and other advanced alloys, reducing cycle times and improving edge quality. This trend supports cost-efficiency in high-volume production environments.

4. Sustainability and Energy Efficiency Focus

Environmental regulations and corporate sustainability goals are pushing manufacturers to adopt energy-efficient technologies. Modern laser cutting machines consume less power per meter cut and produce minimal waste, aligning with green manufacturing standards. Polish firms investing in ISO 14001-compliant ciecie laserowe operations will gain a competitive edge in domestic and export markets.

5. Expansion in Small and Medium Enterprises (SMEs)

Once limited to large industrial players, laser cutting is becoming more accessible to SMEs due to decreasing equipment costs and flexible financing options. Compact, entry-level fiber laser cutters with intuitive software allow smaller workshops to offer precision cutting services, fostering innovation and regional economic development.

6. Growth in Customization and On-Demand Manufacturing

The rise of mass customization and just-in-time production models increases demand for agile fabrication methods. Laser cutting excels in low-volume, high-variability production runs, supporting industries such as architecture, interior design, and custom machinery. By 2026, digital platforms connecting clients with laser cutting services are expected to proliferate in Poland.

7. Regional Market Dynamics in Central and Eastern Europe

Poland remains a key hub for metal processing in Europe. With strong infrastructure, skilled labor, and proximity to major EU markets, the country’s ciecie laserowe sector is projected to grow at a CAGR of 6–8% through 2026. Government incentives for industrial modernization and EU funding for digital transformation further accelerate adoption.

Conclusion

In 2026, the ciecie laserowe market will be defined by smarter, faster, and more sustainable production. Companies that embrace automation, invest in advanced fiber laser technology, and align with green manufacturing principles will lead the sector. As demand from automotive, construction, and renewable energy sectors rises, laser cutting will remain a strategic differentiator in Poland’s industrial landscape.

Common Pitfalls When Sourcing Ciecie Laserowe (Laser Cutting): Quality and Intellectual Property Risks

When sourcing ciecie laserowe (laser cutting) services, especially from third-party manufacturers or overseas suppliers, businesses often face significant challenges related to quality control and intellectual property (IP) protection. Understanding these common pitfalls is crucial to ensuring reliable production and safeguarding your designs and innovations.

Quality-Related Pitfalls

Inconsistent Material and Dimensional Accuracy

One of the most frequent quality issues in laser cutting is dimensional inaccuracy due to poorly calibrated machines or substandard materials. Suppliers may use lower-grade metals or fail to account for thermal expansion during cutting, leading to parts that don’t fit or function as intended.

Poor Edge Quality and Finishing

Low-quality laser cutting can result in rough edges, burrs, or discoloration (especially on stainless steel or aluminum), requiring additional post-processing. This increases costs and delays delivery, undermining the efficiency benefits of laser cutting.

Lack of Process Standardization

Many suppliers, particularly smaller workshops, lack standardized quality control procedures such as ISO certifications. This increases variability between batches and makes it difficult to ensure repeatability.

Inadequate Testing and Inspection

Some vendors skip or minimize quality inspection protocols. Without proper documentation, such as first-article inspections or material traceability reports, verifying compliance with technical specifications becomes nearly impossible.

Intellectual Property (IP) Risks

Unprotected Design Files and CAD Data

Sharing detailed CAD files with laser cutting vendors exposes your designs to potential misuse. Without non-disclosure agreements (NDAs) or secure data-sharing practices, there’s a risk that your designs could be copied or sold to competitors.

Reverse Engineering and Unauthorized Replication

Once a supplier has your product files, they may reverse-engineer your design to manufacture similar parts independently or for other clients. This is especially prevalent in regions with weaker IP enforcement.

Lack of Legal Recourse in International Sourcing

When working with overseas providers, enforcing IP rights can be legally complex and costly. Jurisdictional differences and limited legal protections in certain countries make it difficult to take action against IP theft.

Vendor Overreach in Design Ownership

Some contracts may include clauses that grant the supplier partial ownership or usage rights to the designs they produce. Without careful review, businesses risk losing control over their IP.

Mitigation Strategies

To avoid these pitfalls:

– Vet suppliers thoroughly, checking certifications (e.g., ISO 9001) and requesting sample parts.

– Use NDAs and clearly define IP ownership in contracts.

– Limit the detail shared in design files (e.g., use STEP files instead of native CAD).

– Work with trusted partners or local suppliers where legal protections are stronger.

– Implement secure file transfer methods and track access to sensitive data.

By proactively addressing quality and IP concerns, companies can safely leverage ciecie laserowe services while protecting their products and competitive advantage.

Logistics & Compliance Guide for Ciecie Laserowe

This guide outlines key logistics and compliance considerations for businesses involved in laser cutting (Ciecie Laserowe) operations, particularly in Poland and the broader EU market. Adhering to these practices ensures operational efficiency, legal compliance, and workplace safety.

Understanding Regulatory Frameworks

Laser cutting activities are subject to multiple regulations at national and EU levels. Key areas include occupational health and safety (BHP), environmental protection, machine safety, and product conformity. In Poland, compliance is governed by acts such as the Labor Code, the Act on Occupational Safety and Health, and EU directives transposed into national law. Familiarity with directives like the Machinery Directive (2006/42/EC), the Low Voltage Directive (2014/35/EU), and the Electromagnetic Compatibility Directive (2014/30/EU) is essential for equipment used in laser processes.

Workplace Safety and Hazard Management

Laser cutting presents specific hazards including exposure to high-intensity light, fumes, noise, and moving machinery parts. Employers must conduct risk assessments and implement control measures in line with the Polish Labour Code and EU-OSHA guidelines. Mandatory protective measures include: use of laser safety goggles with appropriate optical density, installation of interlocked enclosures, proper ventilation (e.g., fume extraction systems), and clearly marked hazard zones. Regular employee training on laser safety (PN-EN 60825 standards) and emergency procedures is required.

Material Compliance and Traceability

All raw materials used in laser cutting—especially metals—must comply with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) regulations when applicable. Suppliers should provide Material Safety Data Sheets (MSDS) and material certifications. For processed parts used in regulated industries (e.g., automotive, aerospace), maintaining traceability through batch records and quality documentation (e.g., ISO 9001 compliance) is critical.

Waste Management and Environmental Responsibility

Laser cutting generates waste such as metal scraps, dross, and filter residues from extraction systems. These must be managed according to Poland’s Waste Act and EU Waste Framework Directive. Segregate recyclable metal waste and ensure proper disposal of hazardous waste (e.g., contaminated filters). Maintain documentation of waste transfer via waste manifests (KPO – Kartoteka Przejść Odpadów). Facilities must also comply with emission limits for particulate matter and volatile organic compounds (VOCs), monitored through periodic environmental inspections.

Equipment Certification and Maintenance

Laser cutting machines must carry CE marking, indicating conformity with EU safety, health, and environmental requirements. Documentation such as the EU Declaration of Conformity, technical files, and user manuals must be retained. Regular maintenance and inspections—per manufacturer guidelines and Polish BHP regulations—are required to ensure ongoing compliance and operational safety. Keep logs of all maintenance, repairs, and safety checks.

Transportation and Logistics of Finished Parts

When shipping laser-cut components, ensure proper packaging to prevent damage and comply with carrier requirements. For international shipments within the EU, commercial invoices and packing lists should include relevant product details, HS codes, and compliance statements. For exports outside the EU, verify customs regulations, potential import duties, and any required certifications (e.g., CE, ISO). Use reliable logistics partners experienced in industrial freight.

Documentation and Record Keeping

Maintain comprehensive records to demonstrate compliance. Essential documents include: risk assessments, employee training logs, machine maintenance records, material certifications, waste disposal records, and environmental monitoring reports. Digital record systems can improve traceability and audit readiness. These records may be requested during inspections by labor inspectors (PIP), environmental agencies (WIOŚ), or certification bodies.

Continuous Improvement and Audits

Regular internal audits and management reviews help identify compliance gaps and improve logistics efficiency. Align operations with recognized standards such as ISO 9001 (Quality Management), ISO 14001 (Environmental Management), and ISO 45001 (Occupational Health and Safety). Staying informed about regulatory updates through industry associations and government portals ensures ongoing compliance in the dynamic field of laser cutting.

Certainly! Here’s a professional and concise conclusion for sourcing ciecie laserowe (laser cutting):

Conclusion:

Sourcing laser cutting (ciecie laserowe) requires a strategic approach focused on quality, precision, technological capabilities, and cost-efficiency. By carefully evaluating potential suppliers based on their equipment, material expertise, production capacity, and certifications, businesses can secure reliable partners that meet their manufacturing needs. Poland, in particular, offers a competitive advantage with its skilled workforce, advanced fabrication facilities, and cost-effective production. Establishing long-term relationships with trusted laser cutting providers ensures consistent product quality, faster turnaround times, and greater flexibility in scaling operations. Ultimately, effective sourcing of ciecie laserowe contributes significantly to optimizing production processes and maintaining a competitive edge in industries such as automotive, machinery, electronics, and metal fabrication.

Let me know if you’d like a shorter version or one tailored to a specific industry or audience.