The global CI (cast iron) pipe fittings market is experiencing steady growth, driven by rising infrastructure development, urbanization, and demand for durable water supply and sewage systems. According to Grand View Research, the global ductile iron pipes and fittings market—closely aligned with cast iron products—was valued at USD 39.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of approximately 5.9% for the global iron pipes and fittings market over the forecast period (2023–2028), underpinned by increasing investments in municipal water projects and industrial applications. As demand surges, a select group of manufacturers has emerged as leaders in quality, innovation, and global reach. Below, we present the top 8 CI pipe fittings manufacturers shaping the industry’s future through advanced production capabilities and sustainable engineering solutions.

Top 8 Ci Pipe Fittings Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Tyler Pipe

Domain Est. 1997

Website: tylerpipe.com

Key Highlights: We are a manufacturer of cast iron soil pipe & fittings for DWV plumbing systems. Our products are sustainable and environmentally safe that are made from more ……

#2 Cast Iron Soil Pipe Institute

Domain Est. 1997

Website: cispi.org

Key Highlights: The Cast Iron Soil Pipe Institute (CISPI) was organized in 1949 by the leading American manufacturers of cast iron soil pipe and fittings….

#3 AMERICAN Ductile Iron Pipe

Domain Est. 2008

Website: american-usa.com

Key Highlights: AMERICAN Ductile Iron Pipe, a division of AMERICAN Cast Iron Pipe Company, is a manufacturer of ductile iron pipe and fittings for the waterworks industry….

#4 Pipe Fittings

Domain Est. 2020

Website: asc-es.com

Key Highlights: Anvil’s Beck Brand is the nation’s top manufacturer of high quality steel pipe nipples and steel couplings. Beck pipe nipples and couplings are ……

#5 U.S. Pipe

Domain Est. 1995

Website: uspipe.com

Key Highlights: US Pipe, a Quikrete company, offers a complete range of Ductile Iron Pipe, Restrained Joint Pipe, Fabrication, Gaskets, and Fittings….

#6 AB&I Foundry

Domain Est. 1996

Website: abifoundry.com

Key Highlights: AB&I produces quality cast iron soil pipe and fittings for Drain, Waste and Vent (DWV) plumbing systems. AB&I steadfastly adheres to ethical standards of ……

#7 Cast Iron Pipe & Fittings

Domain Est. 1997

Website: charlottepipe.com

Key Highlights: We produce a full line of service and extra-heavy cast iron soil pipe and fittings from 2 to 15 inches and double-hub pipe from 2 to 6 inches….

#8 Star Pipe Products

Domain Est. 1998

Website: starpipeproducts.com

Key Highlights: Star Pipe Products has manufactured ductile iron pipe fittings, joint restraints, and castings for the waterworks industry for over 40 years….

Expert Sourcing Insights for Ci Pipe Fittings

2026 Market Trends for CI Pipe Fittings

Cast iron (CI) pipe fittings have long been a staple in plumbing, drainage, and industrial systems due to their durability, corrosion resistance, and acoustic insulation properties. As we approach 2026, the market for CI pipe fittings is undergoing significant transformation driven by technological advancements, regulatory changes, and shifting infrastructure demands. This analysis explores the key trends expected to shape the CI pipe fittings market in 2026.

Growing Infrastructure Investment

One of the primary drivers for the CI pipe fittings market in 2026 is the global surge in infrastructure development. Governments in North America, Europe, and Asia-Pacific are allocating substantial funds to modernize aging water and wastewater systems. In the United States, the continued rollout of the Infrastructure Investment and Jobs Act is expected to boost municipal spending on durable piping solutions, including cast iron. Similarly, urbanization in India and Southeast Asia is fueling demand for reliable drainage and sewage networks, where CI fittings remain preferred for high-rise buildings and underground systems.

Sustainability and Longevity Focus

Environmental regulations and sustainability goals are increasingly influencing material choices in construction. CI pipe fittings are gaining favor due to their long service life—often exceeding 100 years—and recyclability. As green building certifications like LEED and BREEAM gain prominence, specifiers are more likely to select materials with low lifecycle environmental impact. The high recycled content of modern ductile iron (an evolution of traditional CI) fittings further strengthens their position in eco-conscious projects.

Shift Toward Ductile Iron

While traditional gray cast iron is still used, the market is steadily transitioning toward ductile iron (DI) pipe fittings, a more resilient variant with enhanced tensile strength and flexibility. By 2026, ductile iron is expected to dominate the CI segment due to its superior performance in seismic zones and high-pressure applications. Manufacturers are investing in upgraded production technologies to meet this demand, and standards such as ISO 2531 and AWWA C110 are being updated to reflect the growing preference for ductile iron.

Impact of Smart Water Management

The integration of smart water management systems is influencing pipeline component selection. While CI fittings themselves are not “smart,” their compatibility with monitoring sensors and leak-detection systems makes them viable in intelligent water networks. Utilities upgrading to smart infrastructure are retaining CI in critical junctions and vertical stacks where reliability is paramount, ensuring continued relevance in hybrid systems.

Regional Market Dynamics

Asia-Pacific is projected to be the fastest-growing market for CI pipe fittings by 2026, driven by rapid urbanization and industrialization in China, India, and Indonesia. Europe maintains steady demand due to replacement cycles in aging cities, while North America sees growth from both new construction and water main rehabilitation projects. In contrast, some emerging markets are exploring alternatives like PVC and HDPE for cost reasons, but CI remains dominant in commercial and high-rise applications.

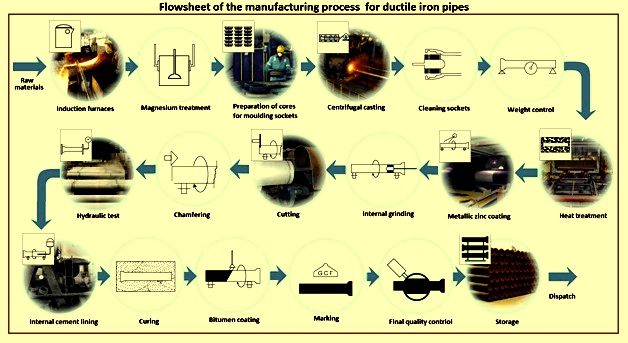

Supply Chain and Raw Material Challenges

Volatility in iron ore prices and energy costs may impact CI pipe fitting production margins in 2026. Manufacturers are responding by optimizing foundry operations, adopting energy-efficient induction furnaces, and exploring localized sourcing to reduce dependency on global supply chains disrupted by geopolitical factors. Recycling scrap iron remains a key strategy to stabilize input costs and support sustainability goals.

Competitive Landscape and Innovation

Market consolidation is expected among CI pipe fitting manufacturers, with larger players acquiring smaller foundries to expand geographic reach and product lines. Innovation is focused on improving jointing technologies (e.g., push-on and mechanical joints), enhancing internal linings for corrosion resistance, and developing lightweight designs without compromising strength. Digital tools such as BIM (Building Information Modeling) are also being leveraged to streamline specification and installation processes.

Conclusion

By 2026, the CI pipe fittings market will be shaped by infrastructure renewal, sustainability imperatives, and the ongoing shift to ductile iron. While facing competition from plastic alternatives, CI fittings will maintain a strong foothold in applications demanding durability, fire resistance, and noise control. Stakeholders who invest in innovation, sustainability, and regional market intelligence will be best positioned to capitalize on emerging opportunities in this resilient sector.

Common Pitfalls Sourcing CI Pipe Fittings (Quality, IP)

Sourcing cast iron (CI) pipe fittings requires careful attention to both quality and intellectual property (IP) considerations. Failure to address these aspects can lead to project delays, safety hazards, legal issues, and financial losses. Below are common pitfalls to avoid:

Poor Material Quality and Non-Compliance

One of the most frequent issues when sourcing CI pipe fittings is receiving substandard materials. Suppliers—especially from regions with lax manufacturing oversight—may use inferior-grade cast iron, improper alloy mixtures, or recycled materials that compromise structural integrity. These fittings often fail to meet international standards such as ISO 2531, EN 545, or ASTM A74, leading to leaks, bursts, or early system failure.

Red Flags:

– Lack of material test certificates (MTCs)

– Inconsistent wall thickness or surface finish

– No third-party inspection reports

Always request certified test reports and consider independent quality inspections before shipment.

Counterfeit or Misrepresented Products

Counterfeiting is a growing concern in the pipeline industry. Some suppliers may falsely label ductile iron (DI) as CI or rebrand lower-grade fittings with forged certifications. Additionally, counterfeit products may carry fake markings of reputable manufacturers, misleading buyers about origin and compliance.

Prevention Tips:

– Verify manufacturer authenticity through official channels

– Conduct factory audits or use third-party inspection services

– Use traceable batch numbers and QR codes where available

Inadequate Intellectual Property Due Diligence

When sourcing CI pipe fittings—especially proprietary designs or patented technologies—ignoring IP rights can result in legal liability. Using fittings that incorporate patented designs (e.g., specialized joint systems, sealing mechanisms) without proper licensing may expose the buyer to infringement claims, particularly in regulated markets like the EU or North America.

Key Risks:

– Importing fittings that infringe on design or utility patents

– Unlicensed use of branded engineering solutions

– Liability passed from supplier to buyer in case of litigation

Ensure suppliers provide IP indemnity clauses in contracts and conduct patent landscape reviews for critical components.

Lack of Traceability and Documentation

Poor traceability makes it difficult to verify the origin, manufacturing date, heat number, and quality control processes of CI fittings. Without proper documentation, compliance audits, warranty claims, or incident investigations become nearly impossible.

Best Practices:

– Require full traceability documentation with each shipment

– Insist on clear labeling (manufacturer, standard, size, batch)

– Maintain digital records of certifications and inspections

Choosing Suppliers Based on Price Alone

Opting for the lowest-cost supplier often leads to compromised quality and hidden costs. Cheap fittings may require frequent replacements, cause downtime, or fail under pressure, ultimately increasing total cost of ownership.

Recommendation:

– Balance cost with long-term reliability

– Evaluate total value, including warranty, support, and compliance

– Build relationships with pre-qualified, audited suppliers

By addressing these pitfalls proactively, procurement teams can ensure the safe, compliant, and cost-effective sourcing of CI pipe fittings.

Logistics & Compliance Guide for CI Pipe Fittings

This guide outlines key logistics and compliance considerations when transporting and handling Cast Iron (CI) pipe fittings to ensure safe, efficient, and regulatory-compliant operations.

Packaging and Handling Requirements

CI pipe fittings are heavy and brittle, requiring robust packaging to prevent damage during transit. Use wooden crates or pallets with secure strapping to immobilize fittings. Individual fittings should be separated with protective materials (e.g., cardboard, foam) to avoid chipping or cracking. Clearly label packages with weight, contents, and handling instructions (e.g., “Fragile,” “Do Not Stack,” “This Side Up”).

Transportation and Load Securing

Use flatbed or enclosed trucks with sufficient load-bearing capacity. Distribute weight evenly across the vehicle bed and secure loads with heavy-duty straps, chains, or load bars to prevent shifting. Avoid overloading to comply with road weight regulations. For international shipments, ensure compatibility with intermodal containers (e.g., 20’ or 40’ dry vans), accounting for the high density of cast iron.

Import/Export Documentation

Maintain accurate documentation for cross-border shipments, including:

– Commercial Invoice

– Packing List

– Bill of Lading (B/L) or Air Waybill (AWB)

– Certificate of Origin

– Material Test Reports (MTRs), if required

Check destination country requirements for additional certifications or declarations, especially for industrial components.

Regulatory Compliance

Ensure CI pipe fittings meet relevant international and regional standards, such as:

– ASTM A74, ASTM A888 (U.S. standards for cast iron fittings)

– EN 877 (European standard for cast iron pipes and fittings)

Verify compliance with local building and plumbing codes at the destination. Some regions may impose restrictions on materials used in potable water systems—confirm suitability for intended application.

Environmental and Safety Regulations

Handle CI pipe fittings in accordance with OSHA (or equivalent) safety standards to prevent worker injury. Use proper lifting equipment (e.g., forklifts, cranes) due to weight. Be aware of environmental regulations regarding metal manufacturing by-products or coatings (e.g., lead content restrictions under REACH or RoHS, if applicable). Though cast iron typically falls outside RoHS scope, verify if coatings or linings are subject to regulation.

Customs Clearance and Duties

Classify CI pipe fittings correctly under the Harmonized System (HS Code). Common classifications include:

– HS 7307.19: Other cast iron pipe fittings

Confirm the exact code with local customs authorities, as duties and regulations vary by country. Provide all necessary documentation to avoid delays. Consider using a licensed customs broker for complex international shipments.

Storage and Inventory Management

Store CI pipe fittings in dry, level areas to prevent corrosion and structural stress. Elevate pallets off the ground and cover if stored outdoors. Implement a first-in, first-out (FIFO) inventory system to minimize long-term exposure and ensure product integrity. Protect threaded or flanged ends with caps or covers.

Quality Assurance and Traceability

Maintain traceability through batch/lot numbers and certification documentation. Conduct pre-shipment inspections to verify compliance with purchase specifications. Retain records for audit and recall purposes, especially for projects requiring certified materials.

By adhering to this guide, stakeholders can ensure the safe, compliant, and efficient movement of CI pipe fittings across the supply chain.

Conclusion for Sourcing CI (Cast Iron) Pipe Fittings:

Sourcing cast iron (CI) pipe fittings requires a strategic approach that balances quality, cost, durability, and compliance with industry standards. CI fittings remain a reliable choice for plumbing, drainage, sewage, and industrial applications due to their high strength, corrosion resistance (especially in soil environments), and long service life. However, careful consideration must be given to supplier reliability, adherence to international standards (such as ISO, ASTM, or BS), and material specifications to ensure compatibility with existing systems.

Key factors in successful sourcing include verifying the mechanical properties and coating requirements of the fittings, evaluating supplier certifications and manufacturing processes, and conducting thorough quality inspections. Additionally, logistics, lead times, and total cost of ownership — including maintenance and longevity — should inform procurement decisions.

In summary, while CI pipe fittings are a traditional and robust solution, effective sourcing depends on due diligence, clear technical specifications, and strong supplier partnerships. When executed properly, sourcing CI fittings can provide a durable, cost-effective solution that ensures system integrity and long-term performance in critical infrastructure projects.