The global demand for Chinese prickly ash—also known as Sichuan pepper—has been on a steady upward trajectory, driven by rising culinary interest in authentic Asian flavors and increased use in food processing, pharmaceuticals, and essential oils. According to Mordor Intelligence, the global spice and seasoning market, valued at USD 19.6 billion in 2023, is projected to grow at a CAGR of 6.2% through 2029, with Asia-Pacific remaining the largest producer and consumer. Within this landscape, China dominates both cultivation and export of Zanthoxylum species, particularly Z. bungeanum and Z. armatum, which account for over 80% of global supply. Backed by favorable climate conditions, centuries-old farming expertise, and government-supported agricultural initiatives, Chinese manufacturers are scaling production and enhancing processing technologies to meet international quality standards. As demand intensifies in North America, Europe, and Southeast Asia, a select group of manufacturers has emerged as industry leaders—setting benchmarks in yield, sustainability, and market reach. The following analysis identifies the top seven Chinese prickly ash manufacturers shaping the global supply chain, based on production capacity, export volume, certifications, and innovation.

Top 7 Chinese Prickly Ash Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wholesale Sichuan pepper manufacturers, Chinese Prickly Ash …

Domain Est. 2014

Website: chinapepper.net

Key Highlights: We are a spice factory,wholesale red and green Sichuan peppersorn and bulk Chinese Prickly Ash woridwide, main products are red sichuan pepper and green ……

#2 chinese prickly ash suppliers,exporters on 21food.com

Domain Est. 2002

Website: 21food.com

Key Highlights: Chinese prickly ash Price can be negotiated 50 Metric Ton/Metric Tons per Month Leling Shenchu Seasoning & Food Co., Ltd….

#3 Jack Chen

Domain Est. 2013

Website: jack-chen-5335b0.webflow.io

Key Highlights: We are a Chinese Prickly Ash manufacturer and supplier from China. wholesale spices worldwide. Main products are whole Sichuan pepper, green Sichuan pepper ……

#4 Wholesale Bulk Chinese Prickly Ash Dried Sichuan Pepper

Domain Est. 2018 | Founded: 1999

Website: lianfufoods.com

Key Highlights: We’re one of the leading chinese prickly ash dried sichuan pepper manufacturers and suppliers in China since 1999. Welcome to wholesale bulk high quality ……

#5 Zanthoxylum simulans

Domain Est. 1998

Website: forestfarm.com

Key Highlights: Forestfarm.com carries Zanthoxylum simulans, also known as CHINESE PRICKLY-ASH. Grown on site, we ship nationwide. Order Zone 5 plants online and save!…

#6 Chinese Prickly Ash Wholesale Sichuan Pepper corn High Quality …

Domain Est. 2013

Website: ruiqiaofoods.com

Key Highlights: Chinese Prickly Ash is with the red color and rich oil, large full grain, deep flavor. It also could be used as food ingredients and medicinal ingredients….

#7 Chinese hot selling red Chinese prickly ash

Domain Est. 2023

Website: lhagriculture.com

Key Highlights: Chinese hot selling red Chinese prickly ash. Origin advantage: Chongqing Jiangjin Jiangjin pepper, Chongqing Jiangjin district specialty, China national ……

Expert Sourcing Insights for Chinese Prickly Ash

H2: 2026 Market Trends for Chinese Prickly Ash (Zanthoxylum bungeanum)

The global market for Chinese Prickly Ash, also known as Sichuan pepper or Huajiao, is poised for notable growth and transformation by 2026, driven by rising culinary demand, expanding export opportunities, and evolving agricultural practices in China. As a cornerstone of Sichuan and broader Chinese cuisine, this unique spice—renowned for its citrusy aroma and distinctive numbing sensation (ma)—is gaining traction beyond traditional markets.

-

Growing Global Culinary Demand

By 2026, the international popularity of Chinese cuisine, particularly regional dishes like mapo tofu and hot pot, is expected to significantly increase demand for authentic ingredients such as Chinese Prickly Ash. Western gourmet kitchens, fusion restaurants, and specialty food stores are increasingly incorporating Sichuan pepper into innovative recipes, boosting its presence in North America, Europe, and Southeast Asia. This culinary globalization is projected to drive export volumes from China, especially from key producing regions like Sichuan, Guizhou, and Shaanxi provinces. -

Premiumization and Organic Trends

Consumers are showing a growing preference for organic, sustainably sourced, and traceable spices. By 2026, premium-grade and certified organic Chinese Prickly Ash is expected to command higher prices and capture a larger market share. Producers are responding by adopting Good Agricultural Practices (GAP), improving post-harvest processing, and seeking certifications to meet international food safety standards such as EU organic or USDA NOP. -

Supply Chain Modernization

China’s agricultural sector is investing in technology to enhance productivity and quality control. In 2026, expect to see wider adoption of smart farming techniques—such as drone monitoring, climate-resilient cultivation, and blockchain-based traceability—among major Prickly Ash growers. These innovations will improve yield consistency, reduce contamination risks, and strengthen China’s position as the dominant global supplier. -

Price Volatility and Climate Risks

Despite growth, the market may face challenges due to climate change. Unpredictable weather patterns, including droughts and unseasonal frosts, could impact harvests and lead to price fluctuations. By 2026, stakeholders are likely to prioritize climate adaptation strategies, including crop diversification and irrigation improvements, to stabilize supply. -

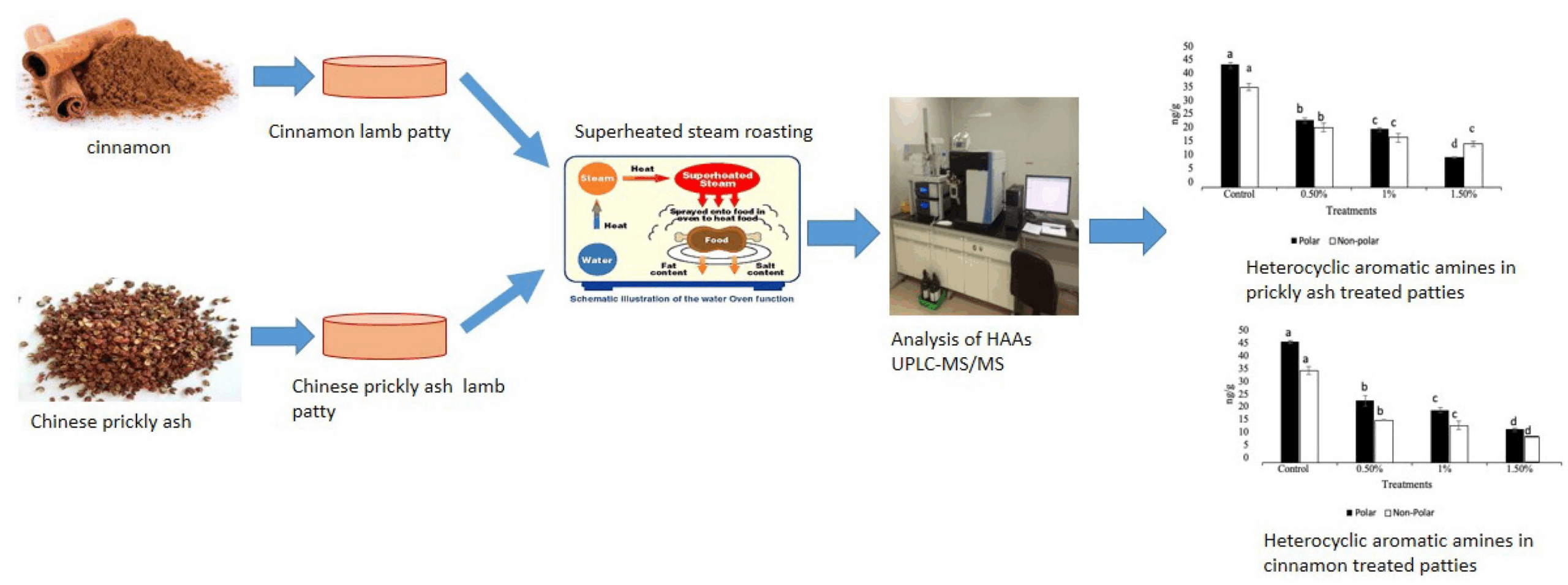

Expansion into Non-Culinary Applications

Beyond the kitchen, Chinese Prickly Ash is gaining attention for its bioactive compounds (e.g., hydroxy-alpha-sanshool), which have applications in natural health products, cosmetics, and pharmaceuticals. By 2026, research and development efforts are expected to expand, potentially opening new revenue streams in nutraceuticals and topical analgesics.

In summary, the 2026 market for Chinese Prickly Ash will be characterized by strong global demand, quality differentiation, technological integration, and diversification into value-added sectors. With strategic investments in sustainability and innovation, China is well-positioned to maintain its leadership in this niche but increasingly valuable spice market.

Common Pitfalls in Sourcing Chinese Prickly Ash: Quality and Intellectual Property Concerns

Quality-Related Pitfalls

Inconsistent Harvesting and Processing Standards

Chinese Prickly Ash (Zanthoxylum bungeanum), also known as Sichuan pepper, varies significantly in quality depending on region, harvest time, and post-harvest processing. A major pitfall is sourcing from suppliers without standardized procedures for drying, sorting, and storage. Poorly dried berries can develop mold or lose aromatic compounds, while inconsistent sorting may result in high levels of twigs, seeds, or other debris.

Adulteration and Substitution

Due to high demand and price fluctuations, some suppliers may adulterate Chinese Prickly Ash with lower-quality substitutes such as Indian or Nepalese prickly ash (Zanthoxylum armatum), which has a different flavor profile and numbing effect. Other common adulterants include ground stems, artificial colorants, or even inedible plant matter. Without proper testing, these substitutions can go undetected.

Pesticide Residues and Contaminants

Many agricultural regions in China face challenges with pesticide overuse. Imported batches of Chinese Prickly Ash may exceed permissible limits for chemical residues or contain heavy metals (e.g., lead, cadmium) due to contaminated soil. Buyers often overlook third-party lab testing, exposing themselves to regulatory risks and consumer safety issues.

Lack of Traceability

Without a transparent supply chain, it’s difficult to verify the origin of the product. This lack of traceability increases the risk of sourcing from unauthorized or environmentally unsustainable farms. Geographic indications (e.g., “Hanyuan” or “Meigu” Sichuan pepper) are valuable markers of quality, but counterfeit labeling is common.

Intellectual Property (IP) and Branding Risks

Misuse of Geographical Indications (GIs)

Products labeled as premium regional varieties (e.g., Hanyuan Da Hong Pao) are protected under Chinese GI laws. However, these names are frequently misused by suppliers exporting outside China. Importers may unknowingly purchase falsely labeled goods, leading to IP infringement claims or reputational damage.

Copycat Packaging and Brand Confusion

High-value Sichuan pepper brands often face imitation in packaging design, labeling, and branding—especially in export markets. Without proper IP protection (trademarks, design patents), authentic producers and importers risk market dilution and consumer confusion.

Limited Enforcement of IP Rights in Cross-Border Trade

Even when trademarks or GIs are registered, enforcing these rights against Chinese suppliers or intermediaries can be challenging due to jurisdictional complexities. Disputes over labeling, authenticity, or exclusivity often require legal action in China, which may be costly and time-consuming.

Inadequate Contractual Protections

Many sourcing agreements fail to include clauses addressing IP ownership, quality specifications, or permitted sourcing regions. This oversight leaves buyers vulnerable to supply inconsistencies and potential legal conflicts over branding or product authenticity.

Mitigation Strategies

To avoid these pitfalls, importers should:

– Partner with certified suppliers and request documentation (e.g., phytosanitary certificates, COAs).

– Conduct on-site audits or use third-party inspection services.

– Require batch-specific lab testing for contaminants and authenticity.

– Register trademarks and monitor GI usage in target markets.

– Include clear quality, origin, and IP clauses in supply contracts.

By addressing both quality and intellectual property concerns proactively, businesses can ensure a reliable, compliant, and authentic supply of Chinese Prickly Ash.

Logistics & Compliance Guide for Chinese Prickly Ash (Zanthoxylum bungeanum)

Overview of Chinese Prickly Ash

Chinese Prickly Ash, scientifically known as Zanthoxylum bungeanum, is a spice commonly used in Chinese cuisine, particularly in Sichuan dishes. Also referred to as Sichuan pepper or huājiāo, it is valued for its unique numbing and citrusy flavor. As an agricultural product traded internationally, its export, import, and transportation are subject to specific logistics and regulatory compliance requirements.

Botanical and Product Classification

Chinese Prickly Ash is classified as a dried botanical spice. It is typically traded in whole dried berry form or ground powder. Accurate classification is essential for customs declaration and compliance with phytosanitary regulations.

International Trade Regulations

Export Requirements from China

- Phytosanitary Certificate: Issued by the General Administration of Customs of China (GACC), confirming the product is free from quarantine pests.

- Registration of Production Facilities: Exporters must be registered with GACC, and processing facilities must comply with Good Manufacturing Practices (GMP).

- Product Testing: May require testing for pesticide residues, aflatoxins, and heavy metals to meet importing country standards.

Import Regulations by Destination

- United States (USDA & FDA): Regulated by the U.S. Food and Drug Administration (FDA) and Animal and Plant Health Inspection Service (APHIS). A phytosanitary certificate is required. Spices must meet FDA food safety standards including microbiological and contaminant limits.

- European Union (EU): Subject to Regulation (EC) No 178/2002 and (EC) No 852/2004. Requires compliance with maximum residue levels (MRLs) for pesticides and limits on aflatoxins (B1 ≤ 5 μg/kg, total aflatoxins ≤ 10 μg/kg). Import notification through the Rapid Alert System for Food and Feed (RASFF) may be triggered if non-compliance is detected.

- Canada (CFIA): Must meet the requirements of the Safe Food for Canadians Regulations (SFCR). A phytosanitary certificate is generally required, and the product must be free of prohibited pests.

- Australia (DAFF): Regulated by the Department of Agriculture, Fisheries and Forestry. Requires fumigation or heat treatment unless exempt, and a valid import permit may be needed depending on volume and end use.

Packaging and Labeling Standards

- Packaging: Must be clean, dry, and sealed to prevent contamination and moisture absorption. Use food-grade materials. Bulk shipments often use multi-wall paper bags or lined woven polypropylene bags.

- Labeling: Labels must include:

- Product name (e.g., “Chinese Prickly Ash” or “Sichuan Pepper”)

- Botanical name (Zanthoxylum bungeanum)

- Net weight

- Name and address of manufacturer/exporter

- Batch/lot number

- Country of origin

- Harvest and processing dates

- Storage instructions

- Allergen and Language Requirements: In some markets (e.g., EU), multilingual labeling may be required. While not a common allergen, cross-contamination disclosures may be necessary if processed in shared facilities.

Transportation and Storage

Shipping Methods

- Sea Freight: Most common for bulk shipments. Use dry container units with desiccants to control humidity.

- Air Freight: Used for smaller, high-value, or time-sensitive orders. Faster but more costly.

- Cold Chain: Not required, but temperature-controlled shipping may be beneficial in extreme climates to prevent spoilage.

Storage Conditions

- Temperature: Store in a cool, dry place (15–25°C recommended).

- Humidity: Relative humidity below 60% to prevent mold growth.

- Shelf Life: Typically 12–24 months when stored properly. Monitor for off-odors, discoloration, or insect infestation.

Documentation for International Shipment

Essential documents include:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Phytosanitary Certificate

– Certificate of Origin

– Certificate of Analysis (CoA) – showing results for moisture, ash, microbial load, and contaminants

– Fumigation Certificate (if applicable)

Compliance with Food Safety Standards

- HACCP & GMP: Export processing facilities should implement Hazard Analysis and Critical Control Points (HACCP) and Good Manufacturing Practices.

- Third-Party Audits: BRCGS, ISO 22000, or FSSC 22000 certification may be required by importers.

- Traceability: Full batch traceability from farm to export is critical for recall readiness and regulatory compliance.

Risk Management and Contaminant Control

- Pesticide Residues: Use only approved agrochemicals; conduct periodic testing.

- Heavy Metals: Monitor for lead, cadmium, and arsenic, especially in soil-contaminated growing regions.

- Microbial Contamination: Implement sanitation protocols to reduce risks of Salmonella, E. coli, and mold.

Sustainability and Ethical Sourcing

- Wild vs. Cultivated: Much Chinese Prickly Ash is cultivated, but wild harvesting occurs. Ensure sustainable practices and compliance with local environmental regulations.

- Fair Trade and Labor Practices: Verify adherence to labor laws and fair wages, particularly in rural production areas.

Conclusion

Successful international trade in Chinese Prickly Ash requires strict adherence to phytosanitary, food safety, and labeling regulations across jurisdictions. Proactive compliance, accurate documentation, and robust quality control systems are essential to ensure smooth logistics and market access. Regular updates on regulatory changes in target markets are recommended to maintain competitiveness and avoid shipment rejections.

In conclusion, sourcing Chinese prickly ash (Zanthoxylum bungeanum), also known as Sichuan pepper, requires careful consideration of quality, origin, sustainability, and supply chain reliability. China remains the largest producer and exporter of this key culinary and medicinal spice, with regions like Sichuan, Gansu, and Shaanxi renowned for high-quality harvests. To ensure a successful sourcing strategy, buyers should prioritize partnerships with reputable suppliers who adhere to food safety standards, provide traceability, and maintain consistent product quality through proper harvesting and drying techniques. Additionally, understanding market fluctuations, seasonal availability, and regulatory requirements for importation is crucial. With growing global demand, especially in the food and pharmaceutical industries, establishing long-term relationships and considering sustainable cultivation practices can support both economic viability and environmental responsibility in the sourcing of Chinese prickly ash.