The global laser engraving market is experiencing robust expansion, driven by rising demand across industries such as electronics, automotive, aerospace, and personalized manufacturing. According to a recent report by Mordor Intelligence, the global laser marking and engraving market was valued at approximately USD 2.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 7.5% from 2024 to 2029. China plays a pivotal role in this growth, emerging as both a manufacturing powerhouse and a leading exporter of laser engraving systems. With increasing adoption of fiber and CO2 laser technologies and strong government support for industrial automation, Chinese manufacturers now account for a significant share of global laser equipment production. Backed by technological advancements, competitive pricing, and scalable production capabilities, China-based firms are shaping the future of precision manufacturing. This list highlights the top 10 Chinese laser engraver manufacturers leading innovation and market penetration in this dynamic landscape.

Top 10 Chinese Laser Engraver Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Focus on laser

Founded: 1996

Website: hanslaser.net

Key Highlights: Han’s Laser Technology Industry Group Co., Ltd, a public company which was established in 1996, has now became the flagship of Chinese national laser industry ……

#2 Demark (Wuhan) Technology Co., Ltd.

Website: demarkchina.cn

Key Highlights: Demark (Wuhan) Technology Co.,ltd has focused on laser technology for over 20 years in China, including laser marking, laser engraving, laser welding and laser ……

#3 JPT Laser

Website: en.jptoe.com

Key Highlights: Find the Product For You As a leading laser manufacturer in China, JPT offers a full range of lasers, including MOPA laser, CW laser, DPSS laser, and diode ……

#4 DXTECH Official

Website: dxtech.com

Key Highlights: DXTECH, as the advanced CNC laser machine manufacturer, mainly manufactures and supplies the laser cutting machines, laser welding machines, laser engraving ……

#5 Wuhan Raycus Fiber Laser Technologies Co., Ltd.

Website: en.raycuslaser.com

Key Highlights: (hereinafter referred to as “Wuhan Raycus”) is the first Chinese enterprise engaged in the research, development and scale production of high-power fiber lasers ……

#6 20 Years Experience Laser Cutting Machine Chinese Manufacturer

Website: jqlaser.com

Key Highlights: Protube. Learning from experience, simplifying your production. ; The elegance of metal. Tube laser cutting machines give shape to your design….

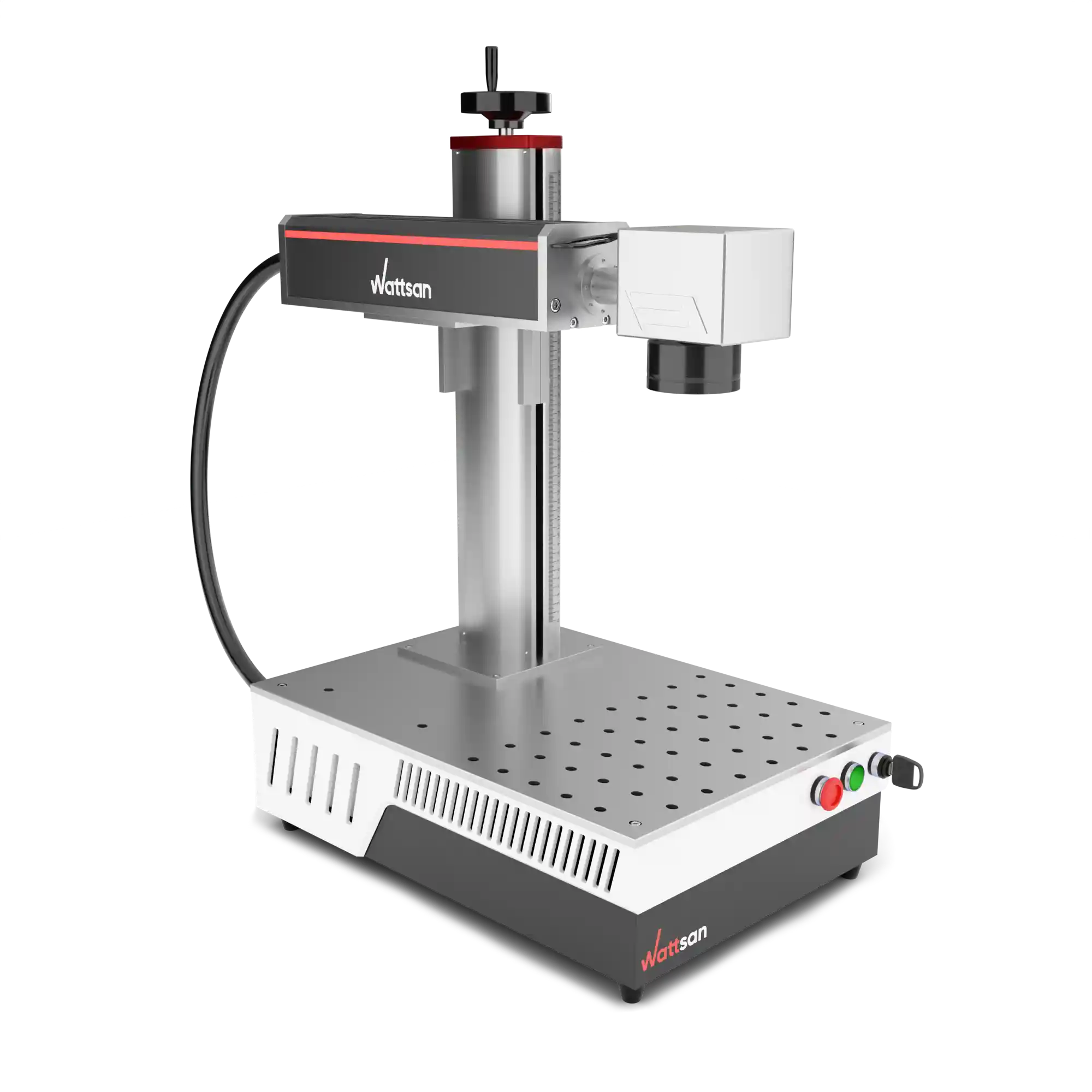

#7 Wattsan

Website: wattsan.com

Key Highlights: Wattsan is a manufacturer of laser and cnc milling machines of European quality at affordable prices with worldwide delivery….

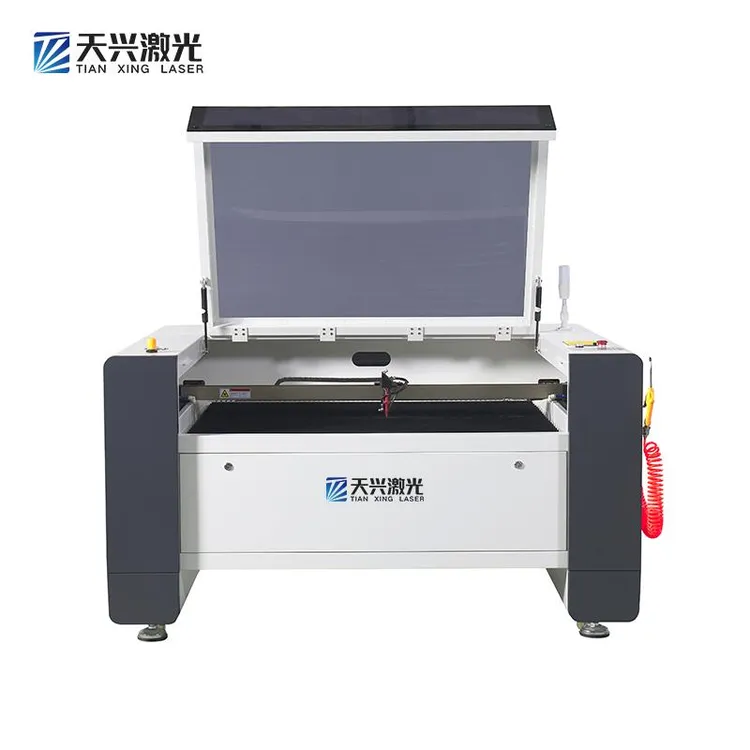

#8 Co2 Laser Engraver, Plywood Laser Cutter, Paper Cutting Machine …

Website: aeonlaser.net

Key Highlights: AEON Laser Technology Co.,Ltd. began to produce different series of laser carving and cutting machines by itself in 2017….

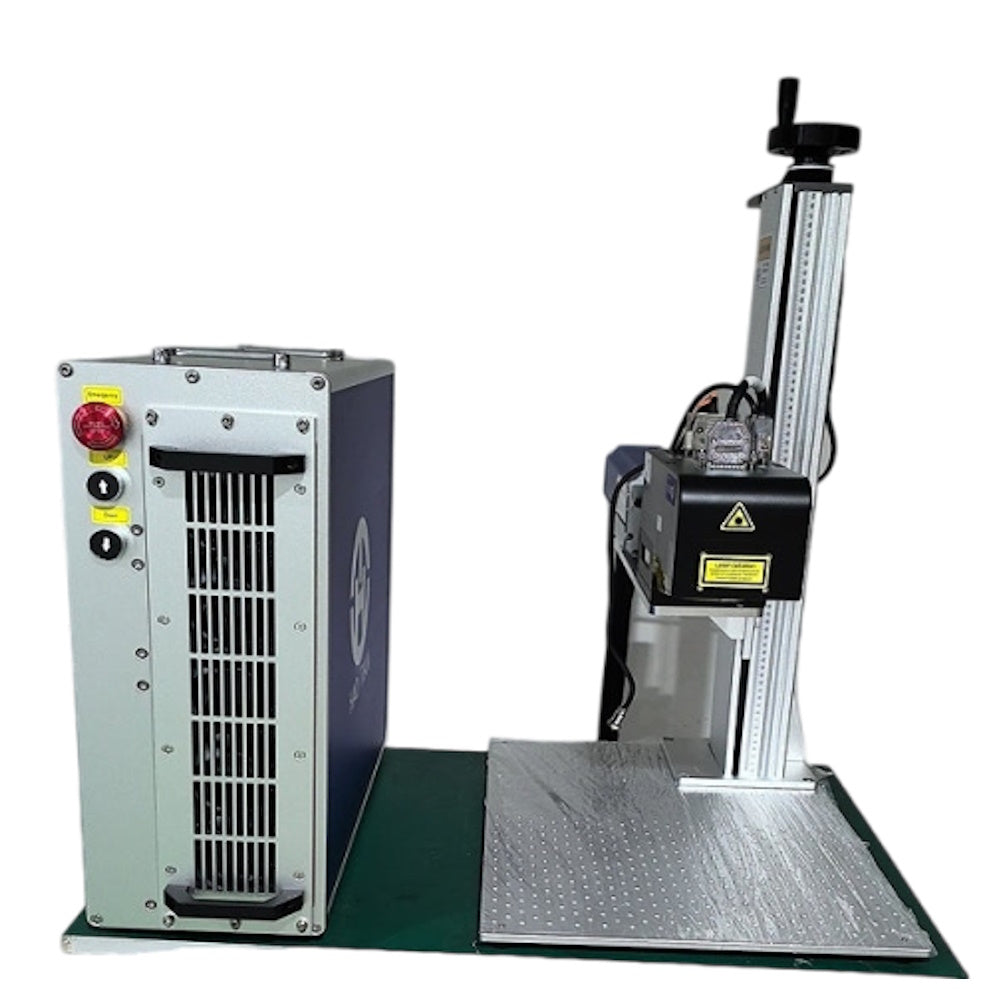

#9 HAOTIAN LASER

Website: haotianlaser.store

Key Highlights: Haotian Laser – Professional Laser Cutting Machines & Engravers. Get high-precision CO2 & fiber laser machines for wood, metal, acrylic, and leather….

#10 Laser Engraving Machine Manufacturers

Website: thunderlaser.com

Key Highlights: This article showcases the leading laser engraving machine manufacturers in China. The following ten laser engraving machine manufacturers offer cutting-edge ……

Expert Sourcing Insights for Chinese Laser Engraver

H2: Market Trends for Chinese Laser Engravers in 2026

By 2026, the Chinese laser engraver market is poised for significant transformation, driven by technological innovation, evolving global demand, policy support, and increasing competitiveness. As China continues to solidify its position as a global leader in manufacturing and high-tech industries, the domestic and export markets for laser engraving equipment are expected to expand across industrial, commercial, and consumer segments.

1. Technological Advancements and Product Innovation

Chinese manufacturers are heavily investing in R&D to enhance the precision, speed, and versatility of laser engraving systems. Fiber lasers, in particular, are gaining dominance due to their efficiency and durability in metal processing. By 2026, integration of AI-driven automation, IoT-enabled remote monitoring, and smart software interfaces will become standard in mid- to high-end models. Innovations such as multi-axis engraving, dynamic focus adjustment, and hybrid laser systems (e.g., CO2/fiber combos) will broaden application areas in electronics, automotive, and aerospace sectors.

2. Rising Global Demand and Export Growth

China remains the largest exporter of laser engraving machines worldwide. In 2026, emerging markets in Southeast Asia, Africa, Latin America, and Eastern Europe will drive export growth, particularly for cost-effective, compact desktop models used in small businesses and maker communities. The “Made in China 2025” initiative continues to enhance the reputation of Chinese laser equipment, enabling manufacturers to compete not only on price but also on quality and reliability.

3. Expansion into Niche and High-Value Applications

Beyond traditional uses in signage and personalization, Chinese laser engravers are increasingly penetrating high-value niches such as medical device manufacturing, precision electronics, and renewable energy components (e.g., solar panel marking). The ability to micro-engrave on complex materials like ceramics, composites, and flexible circuits will open new revenue streams for advanced Chinese systems.

4. Domestic Market Maturation and Industrial Adoption

Within China, industries such as automotive, consumer electronics, and smart manufacturing are adopting laser engraving for product traceability (e.g., QR codes, serial numbers) and branding. Government incentives promoting smart factories and Industry 4.0 adoption will accelerate the integration of laser systems into automated production lines, boosting domestic demand.

5. Competitive Landscape and Price Pressure

The market remains highly competitive, with hundreds of manufacturers ranging from giants like Han’s Laser and HSG Laser to agile SMEs. While innovation drives premium product lines, intense competition will sustain price pressures, especially in the entry-level segment. Consolidation is expected as smaller players struggle with R&D costs and quality compliance, leading to increased market concentration.

6. Regulatory and Environmental Factors

Stricter environmental regulations in China and abroad are pushing manufacturers toward energy-efficient, low-emission laser systems. Compliance with international safety standards (e.g., CE, FDA) will be critical for export success. Additionally, export controls on dual-use technologies may impact high-power laser equipment shipments to certain regions.

7. E-Commerce and Direct-to-Consumer Channels

Online platforms like Alibaba, JD.com, and Amazon continue to play a pivotal role in distributing Chinese laser engravers globally. By 2026, direct-to-consumer marketing, bundled software subscriptions, and value-added services (e.g., training, maintenance) will differentiate brands in the crowded e-commerce space.

Conclusion

In 2026, the Chinese laser engraver market will be characterized by technological sophistication, global reach, and diversification into high-growth sectors. While challenges such as overcapacity and geopolitical trade tensions persist, strategic innovation and policy alignment will enable Chinese manufacturers to maintain leadership in both volume and value segments of the global laser engraving industry.

Common Pitfalls When Sourcing Chinese Laser Engravers: Quality and Intellectual Property Risks

Poor Build Quality and Component Reliability

Many Chinese laser engravers, especially lower-cost models, suffer from inconsistent build quality. Components such as laser tubes, mirrors, lenses, and stepper motors may be substandard or poorly calibrated, leading to reduced precision, frequent breakdowns, and shortened machine lifespan. Buyers often encounter misaligned parts, weak structural frames, or inadequate cooling systems—issues that compromise performance and safety.

Inaccurate Power Ratings and Misleading Specifications

A frequent issue is the exaggeration of laser power (e.g., advertising a “50W” laser that performs like a 30W). This misleading specification can result in underperformance, especially when engraving or cutting denser materials. Additionally, advertised engraving speeds and accuracy may not reflect real-world performance due to poor motion control or software limitations.

Lack of Quality Control and Inconsistent Units

Mass-produced laser engravers from some Chinese suppliers lack rigorous quality control, meaning two units from the same batch can perform differently. Buyers may receive machines with assembly defects, electrical issues, or software bugs not caught during manufacturing, increasing the risk of post-purchase failures.

Shortened Laser Tube and Optical Component Lifespan

Chinese CO2 or diode laser tubes often have significantly shorter operational lifespans compared to premium brands. Poor-quality optics degrade quickly when exposed to heat and debris, requiring frequent replacements. This increases long-term costs and downtime, undermining the initial cost advantage.

Inadequate or Non-Compliant Safety Features

Some imported laser engravers lack essential safety certifications (e.g., CE, FDA, or IEC standards) or include only minimal safety mechanisms. Units may be missing emergency stops, proper enclosures, interlocks, or fail-safe ventilation—posing serious fire and health risks, particularly in commercial environments.

Intellectual Property Infringement Risks

Many Chinese laser engravers clone designs, firmware, or software from established Western or Korean brands without authorization. Sourcing such equipment exposes buyers to legal liability, especially in markets with strict IP enforcement. Using counterfeit control boards (e.g., fake Ruida or Trocen) can also void warranties and create compatibility or support issues.

Limited Technical Support and Spare Parts Availability

After-sales support from some Chinese suppliers is often slow or non-existent. Spare parts may be difficult to obtain, and technical documentation may be incomplete or poorly translated. This complicates troubleshooting and maintenance, particularly for users without technical expertise.

Hidden Costs from Customs, Repairs, and Downtime

While the initial purchase price may be low, hidden costs can accumulate quickly—import duties, shipping damage, repair expenses, and productivity losses due to machine failure. Poor quality may result in higher total cost of ownership compared to investing in a reliable branded machine upfront.

Firmware and Software Limitations

Cloned or modified firmware may lack updates, contain bugs, or restrict compatibility with industry-standard design software. Some machines use proprietary software that limits functionality or requires workarounds, reducing workflow efficiency and integration potential.

Environmental and Regulatory Non-Compliance

Imported laser engravers may not meet local emissions, electrical, or laser safety regulations. Non-compliant units can be seized at customs or banned from operation, leading to financial loss and operational delays. Ensuring compliance requires due diligence that many buyers overlook.

Logistics & Compliance Guide for Chinese Laser Engraver

Product Classification and HS Code

Identify the correct Harmonized System (HS) code for your laser engraver, typically under Chapter 84 (Nuclear reactors, boilers, machinery). Common classifications include 8456.11 (machines for laser working of metals) or 8456.19 (other laser processing machines). Accurate classification ensures correct duty rates and regulatory compliance.

Import Regulations and Permits

Check destination country requirements for importing laser equipment. Many countries regulate Class 3B and Class 4 lasers due to safety concerns. You may need an import permit, safety certification (e.g., FDA registration in the U.S., CE marking in the EU), or a laser product report.

Safety and Technical Standards

Ensure the laser engraver complies with international safety standards such as:

– IEC 60825-1 (laser product safety)

– CE Marking (for EU markets, covering EMC, LVD, and Machinery Directive)

– FCC Certification (for electromagnetic compatibility in the U.S.)

– RoHS Compliance (restriction of hazardous substances)

Documentation such as user manuals, safety labels, and technical files must be provided in the local language.

Shipping and Packaging Requirements

Use sturdy, shock-resistant packaging with internal cushioning to protect delicate optical components. Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”). Include all required shipping documents: commercial invoice, packing list, bill of lading/air waybill, and certificate of origin.

Customs Documentation

Prepare accurate and complete customs documentation, including:

– Commercial invoice (with full product description, value, HS code, and country of origin)

– Packing list

– Bill of Lading or Air Waybill

– Certificate of Origin (often required for preferential tariff treatment)

– Compliance certificates (CE, FCC, RoHS, etc.)

Duty and Tax Calculation

Calculate applicable import duties, VAT, and other local taxes based on the landed cost (product value + shipping + insurance). Use the correct HS code and check for free trade agreements that may reduce tariffs. Some countries impose anti-dumping duties on Chinese machinery.

Restricted or Prohibited Components

Verify that the laser engraver does not contain restricted materials or dual-use components subject to export controls (e.g., under China’s Export Control Law or international regimes like the Wassenaar Arrangement). High-power lasers may require export licenses from Chinese authorities.

After-Sales Compliance and Support

Provide local-language user manuals, warranty information, and technical support contact details. Maintain records for product traceability and compliance audits. Be prepared to address recalls or safety notices in accordance with local consumer protection laws.

Environmental and Disposal Regulations

Inform customers of proper end-of-life disposal procedures. Comply with WEEE (Waste Electrical and Electronic Equipment) directives in regions like the EU, which require producers to manage recycling and disposal of electronic equipment.

Recommended Actions

- Confirm HS code with a licensed customs broker.

- Obtain all required safety certifications before shipping.

- Partner with a freight forwarder experienced in machinery imports.

- Retain documentation for at least 5–7 years for audit purposes.

- Monitor regulatory updates in target markets regularly.

In conclusion, sourcing a Chinese laser engraver can offer significant advantages in terms of cost-effectiveness, wide product variety, and access to advanced technology. With China being a global hub for manufacturing and innovation, buyers can find machines that meet diverse requirements—from entry-level models for small businesses to high-powered industrial systems. However, success in sourcing depends on careful supplier evaluation, clear communication, verification of product quality, and understanding of logistics, warranties, and after-sales support. By conducting due diligence, leveraging platforms like Alibaba or attending trade shows, and considering factors such as certifications (e.g., CE, FDA), technical specifications, and customer reviews, businesses can mitigate risks and establish reliable supply chains. Ultimately, when approached strategically, sourcing laser engravers from China can be a smart and profitable decision for companies looking to enhance their production capabilities efficiently.