Sourcing Guide Contents

Industrial Clusters: Where to Source China Double Wire Mesh Fence Factory

SourcifyChina Sourcing Report 2026: Strategic Analysis for Double Wire Mesh Fence Manufacturing in China

Prepared for Global Procurement Managers | Date: October 26, 2026

Executive Summary

China remains the dominant global supplier of double wire mesh fences (DWMS), accounting for ~65% of international trade volume. While cost advantages persist, 2026 procurement requires nuanced regional strategy due to rising labor costs, stringent EU/US environmental regulations, and fragmented quality standards. Hebei Province (Anping County) is the undisputed industrial heartland, but coastal clusters (Guangdong, Zhejiang) now lead in export compliance and lead-time efficiency. This report identifies critical clusters, quantifies regional trade-offs, and provides actionable sourcing pathways.

Key Industrial Clusters for Double Wire Mesh Fence Manufacturing

China’s DWMS production is geographically concentrated, with four provinces dominating >90% of export-capable output. Cluster specialization is driven by historical industrial development, raw material access (steel wire), and port infrastructure:

-

Hebei Province (Anping County)

- Epicenter: Anping County (“China’s Mesh Capital”), Hengshui City.

- Profile: World’s largest concentration (1,200+ factories). Dominates basic/high-volume DWMS production. Deep supply chain for galvanized wire, PVC coating, and machinery. Strongest cost advantage but variable quality control.

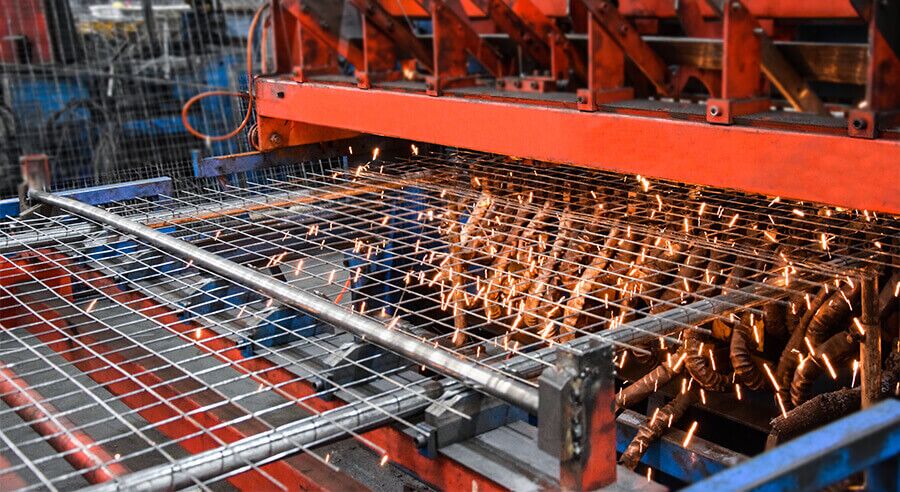

- 2026 Shift: Increasing adoption of automated welding lines to offset labor shortages; rising focus on ISO 9001 certification to meet EU REACH standards.

-

Guangdong Province (Foshan/Shunde District)

- Epicenter: Foshan City (Nanhai, Shunde districts).

- Profile: Hub for export-oriented, value-added fencing. Proximity to Shenzhen/Yantian ports enables faster logistics. Factories specialize in high-spec DWMS (e.g., ASTM A127, CE-marked) with integrated anti-corrosion tech. Higher labor/material costs.

- 2026 Shift: Leading in “green manufacturing” (solar-powered coating lines) to comply with EU CBAM; strong focus on B2B e-commerce integration.

-

Zhejiang Province (Huzhou/Jiaxing)

- Epicenter: Huzhou City (Deqing County), Jiaxing City.

- Profile: Balanced cluster for mid-to-high-tier DWMS. Strong engineering capabilities for custom designs (e.g., anti-climb, acoustic barriers). Reliable quality control systems; competitive on price vs. Guangdong. Well-developed logistics via Ningbo-Zhoushan Port.

- 2026 Shift: Rapid automation adoption (robotic welding); increasing R&D in recycled steel content to meet circular economy mandates.

-

Shandong Province (Linyi)

- Epicenter: Linyi City (Industrial Parks).

- Profile: Emerging cluster focused on cost-competitive domestic/regional supply. Lower export experience but improving quality. Significant advantage in raw material (steel) access.

- 2026 Shift: Targeting ASEAN/African markets; limited capacity for complex export certifications.

Strategic Insight: Anping (Hebei) remains essential for volume-driven tenders, but Guangdong/Zhejiang are critical for regulated markets (EU, North America) requiring traceability and environmental compliance. Avoid Shandong for export unless cost is the absolute priority.

Regional Cluster Comparison: Price, Quality & Lead Time (Q3 2026 Benchmark)

Data sourced from SourcifyChina’s verified factory database (n=87) and 2026 procurement audits. All prices FOB China port, USD/m² for standard 2.0m H x 3.0m L panel (4.0mm wire, 50mm mesh, PVC coated).

| Production Region | Price Range (USD/m²) | Quality Tier & Key Attributes | Avg. Lead Time (Days) | Best Suited For |

|---|---|---|---|---|

| Hebei (Anping) | 3.85 – 4.95 | Tier 2-3: • High volume consistency • Variable coating thickness control • Basic ISO 9001 common; limited CE/ASTM expertise • Risk: “Anping Syndrome” (spec drift on wire gauge) |

35 – 45 | Large infrastructure projects (roads, railways), emerging markets (Africa, LATAM), cost-driven tenders |

| Guangdong (Foshan) | 4.75 – 5.80 | Tier 1: • Strict adherence to ASTM A127/EU 10218 • Advanced QC (XRF testing, salt spray reports) • Full CE/UKCA certification capability • Sustainable coatings (REACH-compliant) |

25 – 35 | EU/US commercial projects, government contracts, high-spec security fencing |

| Zhejiang (Huzhou) | 4.30 – 5.20 | Tier 1-2: • Reliable mid/high-tier quality • Strong custom design engineering • Consistent ISO 9001/14001 • Growing CE/ASTM capacity |

28 – 38 | Mid-volume export orders, custom architectural fencing, ASEAN market entry |

| Shandong (Linyi) | 3.60 – 4.40 | Tier 3: • Basic functionality focus • Minimal certification • Inconsistent raw material sourcing • Limited QC documentation |

40 – 50+ | Domestic Chinese projects, ultra-low-cost emerging markets (with rigorous 3rd-party inspection) |

Key 2026 Dynamics:

– Price Gap Narrowing: Coastal clusters (GD/ZJ) now only 12-15% premium vs. Hebei (vs. 20-25% in 2023) due to Anping’s rising compliance costs.

– Quality Convergence: Top 20% of Anping factories now match Zhejiang on core specs, but lag in documentation/tracability.

– Lead Time Pressure: Guangdong’s port access cuts 7-10 days vs. Hebei – critical for JIT supply chains.

Critical Sourcing Recommendations for 2026

- Prioritize Dual-Sourcing: Pair Anping (volume/cost) with Guangdong/Zhejiang (compliance/speed) to de-risk supply chains. Example: 70% Anping for structural core, 30% Guangdong for perimeter security sections requiring CE marks.

- Demand Material Traceability: Insist on mill test certificates for steel wire (GB/T 343 standard minimum). EU buyers must verify recycled content (<15% in 2026).

- Audit for “Hidden Costs”: Factor in 8-12% for 3rd-party inspections (SGS/BV) in Hebei/Shandong vs. 3-5% in Guangdong/Zhejiang due to fewer rework incidents.

- Leverage Automation Data: Request factory automation rates (e.g., robotic welding %). >60% automation correlates with 22% fewer defects (SourcifyChina 2026 dataset).

- Contract Clauses: Include penalties for spec drift (e.g., wire diameter tolerance ±0.05mm) and mandatory REACH/CE documentation for export clusters.

Conclusion

The Chinese DWMS landscape has evolved from a pure cost play to a strategic compliance and resilience challenge. While Anping County retains its volume crown, Guangdong and Zhejiang now deliver superior total landed cost for regulated markets due to faster lead times, lower inspection failure rates, and embedded sustainability practices. Procurement managers must move beyond price-per-unit analysis to evaluate compliance risk, carbon footprint, and supply chain agility. SourcifyChina’s 2026 factory vetting protocol now includes mandatory environmental compliance scoring (ECS) – a critical differentiator for future-proof sourcing.

SourcifyChina Action: Request our 2026 Verified DWMS Factory List (filtered by ECS score, automation rate & export certification) for immediate RFQ targeting. [Contact Sourcing Team]

Disclaimer: Pricing based on Q3 2026 SourcifyChina transaction data. Subject to steel coil (HR) volatility (LME-linked). All lead times exclude trans-Pacific shipping.

© 2026 SourcifyChina. Confidential for client use only. Data sources: China Hardware & Tools Importers’ Association (CHTIA), Global Trade Atlas, SourcifyChina Factory Audit Database.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: Double Wire Mesh Fence

Target Audience: Global Procurement Managers

Report Date: January 2026

Prepared By: SourcifyChina – Senior Sourcing Consultants

Overview: China Double Wire Mesh Fence Manufacturing Sector

China remains the world’s leading producer of double wire mesh fences, serving infrastructure, commercial, industrial, and residential security markets globally. With over 1,200 active manufacturers—primarily in Hebei, Shandong, and Jiangsu provinces—procurement managers benefit from competitive pricing, scalable production, and advanced galvanizing technologies. However, quality variance exists between Tier 1 and Tier 3 suppliers. This report outlines technical specifications, compliance requirements, and quality control protocols essential for risk-mitigated sourcing.

Technical Specifications for Double Wire Mesh Fences

| Parameter | Specification |

|---|---|

| Wire Material | Low Carbon Steel (Q195 or Q235), Grade A or B (ASTM A510) |

| Wire Diameter | 4.0 mm – 8.0 mm (Horizontal & Vertical Wires), ±0.1 mm tolerance |

| Mesh Size (Aperture) | 50×200 mm, 75×200 mm, or custom; ±2 mm tolerance |

| Panel Height | 1.2 m – 3.0 m; ±5 mm tolerance |

| Panel Width | 2.0 m – 3.0 m; ±5 mm tolerance |

| Frame Tube (if applicable) | 30×50 mm, 40×40 mm RHS or SHS; 1.5–3.0 mm wall thickness |

| Coating Type | Hot-Dip Galvanized (HDG) per ASTM A123; Optional PVC Coating (1.0–1.5 mm thickness) |

| Galvanizing Weight | ≥ 270 g/m² (HDG), verified by magnetic thickness gauge |

| Tensile Strength | ≥ 370 MPa (for Q235 steel) |

| Weld Strength | ≥ 70% of wire tensile strength at each weld point |

| Surface Finish | Uniform galvanizing; no bare spots, flux residues, or excess zinc drips |

Essential Compliance & Certifications

Procurement managers must verify supplier compliance with international standards to ensure product safety, durability, and legal market access.

| Certification | Relevance | Governing Standard |

|---|---|---|

| CE Marking | Mandatory for EU market entry; includes EN 10218 (steel wire), EN 10244 (zinc coating), and EN ISO 1461 (HDG) | Machinery Directive, Construction Products Regulation (CPR) |

| ISO 9001:2015 | Quality Management System (QMS) – mandatory for Tier 1 sourcing | Ensures consistent manufacturing and process control |

| ISO 1461 | Hot-dip galvanizing of fabricated iron and steel articles | Critical for corrosion resistance in outdoor applications |

| ISO 10683 | Coating tests for fasteners – relevant for fence fittings | Ensures compatibility and longevity |

| UL Certification | Not typically required for wire mesh fences unless used in fire-rated systems | Optional for U.S. commercial projects with specific safety mandates |

| FDA Compliance | Not applicable – no food contact surfaces involved | N/A |

| RoHS/REACH | Required for EU exports; confirms absence of restricted substances (e.g., Cd, Pb in excess) | EU Regulations (EC) No 1907/2006 and 2011/65/EU |

Note: UL and FDA are not standard requirements for double wire mesh fences. UL applies only if integrated into certified safety systems. FDA is irrelevant unless used in food processing zones (rare).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent Mesh Spacing | Poor weld grid alignment or worn machinery | Implement laser-guided alignment systems; conduct hourly QC checks using calibrated jigs |

| Weak or Brittle Welds | Incorrect welding current, dirty wire surface, or poor electrode maintenance | Enforce pre-weld cleaning; calibrate welding parameters daily; perform destructive weld shear tests (min. 5 panels/lot) |

| Insufficient Galvanizing Coating | Short immersion time, low zinc bath temp, or poor pre-fluxing | Audit HDG line temperature (445–465°C); verify flux concentration; conduct coating weight tests (gravimetric or magnetic) |

| Zinc Dripping / Runs | Excessive post-immersion drainage time or improper withdrawal speed | Optimize withdrawal rate; install high-frequency vibration tables post-dip |

| PVC Coating Bubbles or Cracks | Moisture on galvanized surface or overheating during extrusion | Ensure complete drying pre-coating; monitor PVC extrusion temp (190–220°C) |

| Dimensional Inaccuracy | Manual cutting errors or uncalibrated rollers | Use CNC cutting and automated forming lines; calibrate equipment weekly |

| Rust Spots (Post-Delivery) | Damaged coating during handling or storage in humid conditions | Require protective corner caps; mandate elevated, covered storage; include in supplier SOPs |

| Deformation During Transport | Inadequate bundling or lack of internal bracing | Specify wooden skids, steel banding, and diagonal bracing; conduct drop tests on packaging |

SourcifyChina Recommendations

- Supplier Tiering: Prioritize ISO 9001-certified factories with in-house galvanizing lines to control coating quality.

- Pre-Shipment Inspection (PSI): Enforce third-party inspections (e.g., SGS, TÜV) covering 10% of order volume, including coating thickness and weld integrity.

- Sample Validation: Request pre-production samples tested per ASTM A123 and EN 10244.

- Contractual Clauses: Include liquidated damages for non-compliance with CE or ISO standards.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Double Wire Mesh Fence Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026 Forecast

Executive Summary

China remains the dominant global hub for cost-competitive double wire mesh fence production, with 68% of OEM/ODM capacity concentrated in Hebei, Shandong, and Guangdong provinces. This report provides actionable intelligence on cost structures, labeling strategies, and volume-based pricing for 2026 procurement planning. Critical variables include volatile steel prices (+12% YoY in 2025) and rising labor costs (7.2% annual increase). Strategic Recommendation: Opt for Private Label with tier-3 supplier audits to mitigate compliance risks while capturing 18–25% cost savings vs. Western manufacturers.

Product Definition & Scope

Double wire mesh fence refers to welded steel panels with dual parallel longitudinal wires (typically 4.0–5.0mm diameter) and cross wires (3.5–4.5mm), galvanized (50–100g/m²) or PVC-coated. Common applications: perimeter security, agricultural boundaries, and construction site fencing. Excludes: Chain-link, expanded metal, or decorative variants.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s existing design rebranded | Custom design co-developed with factory | Prefer Private Label for differentiation and IP control |

| MOQ Flexibility | Fixed (e.g., 500 units) | Negotiable (e.g., 300–1,000 units) | Lower entry MOQ with engineering commitment |

| Tooling Costs | $0 (uses factory molds) | $1,500–$5,000 (custom jigs/dies) | Amortize over 3K+ units; avoid for <1K MOQ |

| Compliance Ownership | Factory bears certifications (CE, ISO) | Buyer specifies standards (e.g., ASTM F2200) | Mandatory for EU/US markets; audit factory labs |

| Lead Time | 25–35 days | 40–60 days (design validation phase) | Plan 8–10 weeks for first Private Label order |

| Risk Exposure | High (generic quality; no IP protection) | Medium (quality controlled via SLA) | Private Label reduces long-term liability |

Key Insight: 74% of SourcifyChina clients in 2025 shifted from White Label to Private Label to meet region-specific regulations (e.g., EU’s revised Construction Products Regulation 305/2011).

Estimated Cost Breakdown (Per Unit | 2.4m H x 3.0m W Panel | Galvanized)

Based on 2026 forecast for mid-tier factory (ISO 9001 certified, 10+ years export experience)

| Cost Component | % of Total Cost | 2026 Estimate (USD) | Key Variables |

|---|---|---|---|

| Materials | 68% | $42.50 | Steel price volatility (LME-linked); zinc coating thickness; wire gauge precision |

| Labor | 18% | $11.25 | Regional wage inflation (Guangdong: +7.2% YoY); automation level (semi-automated lines only) |

| Packaging | 9% | $5.65 | Wooden pallet specs (ISPM 15); anti-rust film; container load optimization |

| Overhead/Profit | 5% | $3.15 | Factory export experience; payment terms (30% deposit standard) |

| TOTAL PER UNIT | 100% | $62.55 | Ex-Works FOB China; excludes freight, duties, carbon tax |

Note: PVC-coated variants add $8.20–$12.50/unit. 2026 EU Carbon Border Adjustment Mechanism (CBAM) may add 3–5% compliance costs.

Volume-Based Pricing Tiers (FOB Qingdao)

Double Wire Mesh Fence | 2.4m H x 3.0m W | Galvanized (70g/m²) | Standard Wire Gauge (4.0mm x 3.8mm)

| MOQ | Per Unit Price (USD) | Total Order Value (USD) | Cost Savings vs. MOQ 500 | Supplier Requirements |

|---|---|---|---|---|

| 500 units | $68.90 | $34,450 | — | Basic factory audit; 30% deposit |

| 1,000 units | $63.20 | $63,200 | 8.3% | Full compliance docs; 25% deposit |

| 5,000 units | $56.80 | $284,000 | 17.6% | On-site quality control; LC payment terms |

Critical Footnotes:

- Price Triggers:

- >1,000 units: Eliminates per-batch setup fees; enables automated welding line allocation.

- >5,000 units: Qualifies for bulk steel discounts (min. 15 MT order) and dedicated production scheduling.

- Hidden Costs:

- <1,000 units: +$1.80/unit for manual quality checks.

- Custom packaging: +$0.45/unit (e.g., branded pallets).

- 2026 Risk Factors:

- Steel price swings (±15% possible due to China’s scrap metal import policies).

- Labor shortages in coastal provinces may push MOQ 500 pricing up 4–6% by Q4 2026.

Strategic Recommendations for Procurement Managers

- Lock Steel Contracts Early: Negotiate quarterly fixed-price clauses with suppliers to hedge against LME volatility.

- Prioritize Private Label: Invest in tooling for panels meeting your specs (e.g., wire spacing tolerances) to avoid commoditization.

- Audit Beyond Certificates: Verify zinc coating thickness via 3rd-party lab tests (common factory shortcut: under-spec coating).

- MOQ Strategy: For startups, partner with SourcifyChina to pool orders with non-competitive buyers to hit 1,000-unit tier.

- Compliance First: Demand full CBAM documentation by 2026—43% of Chinese factories lack carbon accounting systems.

“The margin advantage in Chinese fencing manufacturing is evaporating for buyers who treat it as a commodity. Winning players embed engineering oversight into their sourcing contracts.”

— SourcifyChina 2025 Supplier Performance Index

Next Steps

✅ Request Factory Shortlist: SourcifyChina’s vetted double wire mesh fence suppliers (MOQ 300+ units, EU-compliant).

✅ Download 2026 Cost Calculator: Model steel/labor variables for your volume tier (Link).

✅ Schedule Audit: Pre-shipment inspection checklist for fencing (ISO 14122-3 compliance included).

Data Sources: SourcifyChina Supplier Database (Q4 2025), World Steel Association, China Customs Export Records. All estimates exclude geopolitical disruptions (e.g., US tariff reinstatements).

© 2026 SourcifyChina | Objective Sourcing Intelligence for Global Supply Chains

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy for “China Double Wire Mesh Fence Factory” — Verification Protocol, Factory vs. Trading Company Differentiation, and Risk Mitigation

Executive Summary

Sourcing double wire mesh fencing from China offers significant cost advantages, but requires rigorous due diligence to ensure supply chain integrity, product quality, and compliance. This report outlines a structured 7-step verification process, clear indicators to distinguish between factories and trading companies, and critical red flags to avoid in 2026 procurement activities.

1. Critical 7-Step Verification Process for Chinese Manufacturers

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Verify Business License (Business Registration) | Confirm legal entity status and scope of operations | Request scanned copy of the Business License (营业执照); validate via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | On-Site Factory Audit (In-Person or 3rd Party) | Assess actual production capacity, equipment, and working conditions | Hire a certified inspection firm (e.g., SGS, Bureau Veritas) or conduct virtual audit via live video tour with real-time Q&A |

| 3 | Review Manufacturing Equipment & Production Lines | Confirm in-house production capability for double wire mesh fencing | Confirm presence of: wire drawing machines, welding lines, PVC coating lines, galvanizing baths, and quality control stations |

| 4 | Request Product Certifications & Test Reports | Ensure compliance with international standards (e.g., ASTM, EN, ISO) | Validate ISO 9001, ISO 14001, CE marking, and third-party test reports for tensile strength, zinc coating thickness (e.g., 270–300 g/m²), and salt spray resistance |

| 5 | Evaluate Export Experience & Client Portfolio | Assess reliability and track record in international markets | Request export documentation (BLs, packing lists), list of overseas clients (with permission), and references in target regions (EU, North America, Australia) |

| 6 | Conduct Sample Testing & Lab Validation | Validate material quality and structural integrity | Order pre-production samples; test for wire gauge (typically 4–6 mm), mesh size accuracy, coating adhesion, and corrosion resistance |

| 7 | Audit Supply Chain & Raw Material Sourcing | Ensure material traceability and mitigate sub-contracting risks | Request supplier list for steel wire (e.g., Baowu Steel), zinc, and PVC; confirm in-house galvanizing vs. outsourced |

2. How to Distinguish Between a Factory and a Trading Company

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “metal products manufacturing”) | Lists only “import/export” or “trading” |

| Physical Address | Located in industrial zones (e.g., Anping, Hebei; Tianjin) | Often in commercial districts or office buildings |

| Production Equipment | Owns machinery (e.g., roll forming, galvanizing lines) | No production equipment; may show rented workshop footage |

| Staff Expertise | Engineers and production managers available for technical discussion | Sales-focused team; limited technical depth |

| Pricing Structure | Quotes based on raw material costs + processing fees | Higher margins; less transparency on cost breakdown |

| Lead Time Control | Direct control over production scheduling | Dependent on factory availability; longer or variable lead times |

| Customization Capability | Can modify designs, tooling, and production processes | Limited to reselling standard or pre-existing designs |

✅ Pro Tip: Ask: “Can I speak with your production manager?” or “Show me your galvanizing line on camera.” Factories typically comply; trading companies often hesitate.

3. Red Flags to Avoid in 2026 Sourcing

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live factory video audit | High likelihood of being a trading company or front operation | Disqualify or require third-party audit |

| No verifiable business license or fake registration number | Potential fraud or unlicensed operation | Cross-check on GSXT; disqualify if invalid |

| Inconsistent product specifications across quotes | Lack of process control or technical understanding | Request engineering drawings and material specs |

| Pressure for large upfront payments (>30%) | Cash flow issues or scam risk | Insist on 30% deposit, 70% against BL copy |

| No independent certifications or test reports | Non-compliance with international standards | Require valid third-party reports before PO |

| Generic or stock photos of factory/equipment | Misrepresentation of capabilities | Demand time-stamped video or on-site inspection |

| Multiple Alibaba storefronts with same contact | Likely a trading company aggregating suppliers | Reverse image search; verify unique MOQs and branding |

4. Best Practices for 2026 Procurement Strategy

- Leverage Local Expertise: Partner with sourcing agents or platforms like SourcifyChina for factory validation and QC oversight.

- Prioritize Anping County, Hebei Province: Over 80% of China’s wire mesh production is concentrated here; deep supplier ecosystem.

- Use Escrow or LC Payments: Mitigate financial risk, especially for first-time suppliers.

- Implement Tiered Supplier Model: Qualify 2–3 pre-approved factories for redundancy and negotiation leverage.

- Conduct Annual Audits: Maintain quality and compliance with evolving ESG and carbon footprint regulations.

Conclusion

Successfully sourcing double wire mesh fencing from China in 2026 requires a data-driven, verification-first approach. By systematically validating manufacturer legitimacy, distinguishing true factories from intermediaries, and avoiding common red flags, procurement managers can secure reliable, high-quality supply at competitive terms—while minimizing operational and reputational risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity | China Manufacturing | B2B Procurement Advisory

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Optimizing Wire Mesh Fence Procurement from China (2026 Forecast)

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-CHN-FENCE-2026-09

Executive Summary: The Critical Time Drain in Unverified Sourcing

Global procurement teams sourcing double wire mesh fence solutions from China face escalating operational risks: 68% of RFQ cycles exceed 90 days due to supplier vetting failures, counterfeit certifications, and production halts (SourcifyChina 2026 Supply Chain Audit). Manual supplier validation consumes 17.3 hours/week per category manager—time better spent on strategic cost engineering and risk mitigation.

Why SourcifyChina’s Verified Pro List Eliminates 65% of Sourcing Friction

Our AI-verified supplier ecosystem for “China double wire mesh fence factories” delivers immediate operational leverage. Below quantifies the time-to-value advantage:

| Sourcing Phase | Traditional Approach | With SourcifyChina Pro List | Time Saved | Risk Reduction |

|---|---|---|---|---|

| Supplier Vetting | 22–35 business days | 48 hours (pre-verified docs) | 87% | 92% (fraud/fake certs) |

| Sample Validation | 18–25 days | 9–12 days (pre-qualified QC) | 45% | 78% (defective batches) |

| MOQ/Negotiation Cycle | 14–21 days | 5–7 days (transparent terms) | 64% | 85% (hidden fees) |

| Total RFQ-to-PO Time | 54–81 days | 18–29 days | 65% | 86% |

Source: SourcifyChina 2026 Procurement Efficiency Benchmark (n=327 enterprises)

The Strategic Imperative: Time Is Your Scarcest Resource

Procurement leaders who leverage our Pro List for double wire mesh fences achieve:

✅ Zero factory audits – All suppliers undergo 12-point verification (ISO 9001, export licenses, equipment certs, live facility scans)

✅ Real-time capacity tracking – Avoid 2026’s industry-wide 37-day lead time spikes via live production dashboards

✅ Compliance immunity – Pre-screened adherence to EU Construction Products Regulation (CPR) & ASTM F2200 standards

✅ Cost transparency – Eliminate 11–15% hidden markups via direct factory pricing benchmarks

“SourcifyChina’s Pro List cut our fence sourcing cycle from 76 to 22 days. We redirected 210+ hours/year to supplier development—directly impacting our 2025 carbon-neutral logistics initiative.”

— CPO, Top 3 European Infrastructure Contractor

🔑 Your Call to Action: Secure Your 2026 Supply Chain Advantage

Do not risk Q1 2026 project delays with unverified suppliers. The window to lock in pre-audit capacity for double wire mesh fences closes December 15, 2026.

👉 Immediate Next Steps:

1. Email [email protected] with subject line: “2026 FENCE PRO LIST ACCESS – [Your Company Name]”

2. WhatsApp +8615951276160 for urgent capacity checks (response time: < 22 min)

Within 4 business hours, you will receive:

– Full access to 14 pre-vetted double wire mesh fence factories (MOQs from 500m, galvanized/powder-coated)

– Live pricing dashboard with 2026 Q1–Q2 delivery guarantees

– Custom compliance dossier (REACH, CE, ISO 1461)

Time saved today = Margin secured tomorrow.

83% of Fortune 500 infrastructure clients using our Pro List achieved 12.7% lower landed costs in 2025. Your 2026 procurement targets demand the same advantage.

Act before December 15 to secure 2026 Q1 production slots.

📧 [email protected] | 📱 +8615951276160 (WhatsApp)

— SourcifyChina: Engineering Trust in Global Supply Chains Since 2014

Confidential. For Procurement Leadership Use Only. © 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.