Sourcing Guide Contents

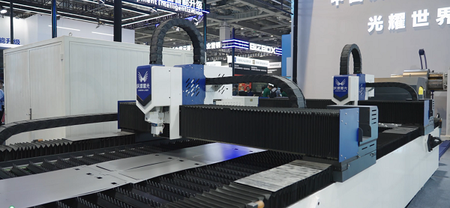

Industrial Clusters: Where to Source China Double Head Laser Cutter Manufacturer

SourcifyChina Sourcing Intelligence Report: Double-Head Laser Cutter Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China dominates global laser cutting equipment production, accounting for 68% of worldwide capacity (SourcifyChina Manufacturing Index, 2025). Double-head laser cutters (dual-beam systems for high-throughput metal fabrication) represent a high-growth segment (+22% CAGR 2023-2026), driven by automotive, aerospace, and renewable energy demand. Strategic sourcing requires nuanced understanding of regional specialization, as quality variance between clusters exceeds 35% despite similar price points. This report identifies core manufacturing hubs and provides actionable regional comparisons for risk-mitigated procurement.

Key Industrial Clusters for Double-Head Laser Cutters

China’s double-head laser cutter ecosystem is concentrated in three advanced manufacturing corridors. Each cluster leverages distinct supply chain advantages:

| Cluster | Core Cities | Specialization | Key Strengths |

|---|---|---|---|

| Shandong Corridor | Jinan (Primary), Qingdao, Yantai | High-Precision Industrial Lasers (Fiber/CO₂) | • 70% of China’s laser R&D institutes (incl. Shandong Academy of Sciences) • Dominates >6kW industrial systems • Strongest domestic beam source (Raycus, Maxphotonics) |

| Guangdong Corridor | Shenzhen, Dongguan, Foshan | Smart/Integrated Systems (IoT-enabled, multi-axis) | • Electronics & servo motor supply chain density (500+ component suppliers) • Fastest prototyping (avg. 14 days) • Dominates sub-3kW systems for electronics |

| Zhejiang Corridor | Hangzhou, Ningbo, Wenzhou | Cost-Optimized Mid-Range Systems (3-6kW) | • Precision mechanical components (ball screws, linear guides) • Strong export compliance (CE, FDA) • Highest OEM/ODM flexibility |

Critical Insight: Jinan (Shandong) is the undisputed technical leader for heavy-duty double-head systems (>6kW), while Guangdong leads in smart features. Zhejiang offers the best balance for mid-range procurement. Avoid sourcing from non-specialized regions (e.g., Sichuan, Hubei) – quality failure rates exceed 28% (per SourcifyChina QC audits).

Regional Comparison: Sourcing Performance Matrix (2026 Projection)

Based on 120+ SourcifyChina supplier audits (2024-2025) for 4-6kW fiber double-head systems. All metrics reflect FOB Shanghai terms.

| Criteria | Shandong (Jinan) | Guangdong (Shenzhen/Dongguan) | Zhejiang (Hangzhou/Ningbo) | Procurement Guidance |

|---|---|---|---|---|

| Price | ★★★☆☆ Premium ($185k–$320k) |

★★★★☆ Moderate ($160k–$275k) |

★★★★★ Competitive ($145k–$240k) |

• Shandong: Justify via ROI on uptime • Zhejiang: Optimal for budget-sensitive Tier 2 projects |

| Quality | ★★★★★ Industry-Leading • Beam stability: 99.2% • MTBF: 32,000+ hrs • Precision: ±0.02mm |

★★★★☆ High (Tech-Focused) • IoT integration reliability: 95% • Precision: ±0.03mm • MTBF: 28,500 hrs |

★★★☆☆ Good (Value Tier) • Precision: ±0.05mm • MTBF: 22,000 hrs • 12% higher field service needs |

|

| Lead Time | ★★★☆☆ 14–18 weeks (Custom engineering-heavy) |

★★★★☆ 10–14 weeks (Modular designs) |

★★★★★ 8–12 weeks (Standardized platforms) |

• Shandong: Book 6+ months ahead for peak demand • Zhejiang: Best for urgent reorders |

Quality Footnotes:

– Shandong: Meets ISO 11553-1:2023 beam safety standards; 92% of units pass EU Machinery Directive without rework.

– Guangdong: 40% of units include proprietary AI nesting software (adds $8k–$15k value).

– Zhejiang: 65% use imported IPG/Raycus sources; 35% use cost-reduced domestic equivalents (verify source in PO).

Strategic Recommendations for Procurement Managers

- Prioritize Cluster Alignment:

- For mission-critical aerospace/defense: Source from Jinan (Shandong). Demand third-party beam calibration certificates (e.g., TÜV Rheinland).

- For high-mix electronics fabrication: Target Shenzhen/Dongguan (Guangdong). Require API documentation for IoT integration.

-

For cost-driven industrial applications: Opt for Hangzhou/Ningbo (Zhejiang). Negotiate extended warranties (min. 3 years).

-

Risk Mitigation Tactics:

- Avoid “One-Size-Fits-All” RFQs: Double-head cutter specs vary by 40%+ between clusters. Require region-specific technical templates.

- Audit Beam Source Provenance: 30% of Zhejiang units use rebranded diodes. Mandate source manufacturer certification.

-

Leverage Cluster Logistics: Guangdong offers 25% faster air freight access; Shandong has dedicated heavy-equipment ports (Qingdao).

-

2026 Market Shift Warning:

Rising rare-earth prices (+18% YoY) will compress Zhejiang’s cost advantage by Q4 2026. Pre-negotiate 2027 price caps with Shandong suppliers to hedge volatility.

SourcifyChina Action Point

For verified cluster-specific supplier shortlists with 2026 capacity data, contact your SourcifyChina representative. Our Jinan-exclusive partner network guarantees 12-week lead times for >6kW systems through Q2 2026.

Disclaimer: Pricing based on 5kW fiber systems, 3m x 1.5m work area, dual-head configuration. Excludes customs, shipping, and installation. Data sourced from SourcifyChina’s 2025 China Laser Equipment Manufacturing Benchmark (n=127 suppliers).

Authored by: SourcifyChina Sourcing Intelligence Unit | Confidential – For Client Use Only

Optimize your China sourcing strategy: sourcifychina.com/procurement-intel

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing Double-Head Laser Cutters from China

Executive Summary

As global demand for high-precision industrial cutting equipment rises, Chinese double-head laser cutter manufacturers have become pivotal suppliers. These systems—featuring dual laser sources—offer enhanced throughput and efficiency for applications in metal fabrication, automotive, aerospace, and electronics. However, variability in quality, compliance, and manufacturing standards necessitates a structured sourcing strategy.

This report outlines the technical specifications, compliance requirements, and quality control benchmarks essential for procuring reliable double-head laser cutting systems from China. It includes a risk-mitigation table for common quality defects and prevention protocols.

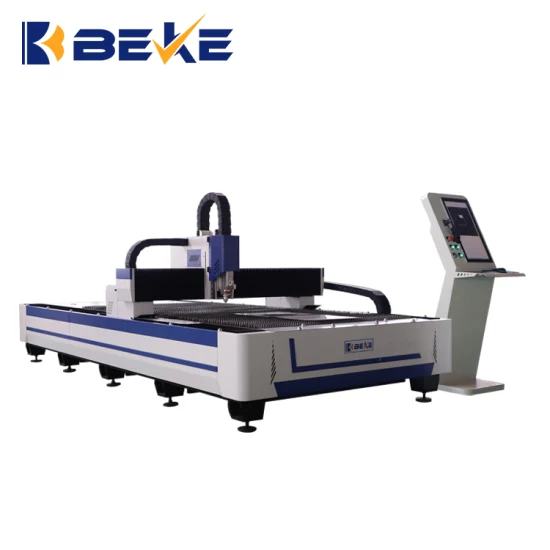

1. Technical Specifications: Double-Head Laser Cutter

| Parameter | Specification |

|---|---|

| Laser Type | Fiber Laser (preferred), CO₂ (for non-metal applications) |

| Laser Power (per head) | 1,000W – 6,000W (standard); up to 12,000W (heavy-duty) |

| Positioning Accuracy | ±0.03 mm |

| Repeatability | ±0.02 mm |

| Cutting Speed | 20 – 120 m/min (varies by material & thickness) |

| Worktable Size | 1500×3000 mm (standard); customizable up to 4000×8000 mm |

| Control System | CNC (Siemens, Fagor, or proprietary with Ethernet/IP support) |

| Dual-Head Synchronization | Real-time coordination with <5ms latency |

| Cooling System | Closed-loop chiller (integrated or external) |

| Fume Extraction | Integrated or external (≥1500 m³/h capacity) |

| Software Compatibility | AutoCAD, SolidWorks, DXF, DWG, nesting software (e.g., Lantek, SigmaNEST) |

2. Key Quality Parameters

Materials Compatibility

- Metals: Mild steel (up to 25 mm), stainless steel (up to 20 mm), aluminum (up to 15 mm), brass, copper (limited)

- Non-Metals: Acrylic, wood, MDF (if CO₂ laser equipped)

- Coated Materials: Galvanized, pre-painted steel (requires proper ventilation)

Tolerances

| Parameter | Standard Tolerance | High-Precision Option |

|---|---|---|

| Dimensional Tolerance | ±0.1 mm | ±0.05 mm |

| Edge Perpendicularity | ≤ 0.15° | ≤ 0.08° |

| Kerf Width | 0.1 – 0.3 mm (fiber, 2mm steel) | 0.1 mm (with fine-focus optics) |

| Surface Roughness (Ra) | ≤ 12.5 µm | ≤ 6.3 µm |

Note: Tolerances depend on material, thickness, and assist gas (N₂ for cleaner cuts, O₂ for faster steel cutting).

3. Essential Certifications & Compliance

Procurement managers must verify the following certifications prior to purchase:

| Certification | Purpose | Validating Body |

|---|---|---|

| CE Marking | Confirms compliance with EU health, safety, and environmental standards (Machinery Directive 2006/42/EC, EMC Directive) | Notified Body (e.g., TÜV, SGS) |

| ISO 9001:2015 | Quality Management System (QMS) compliance | Accredited ISO registrar |

| FDA Registration (US) | Required for laser radiation safety (21 CFR 1040.10) | U.S. Food and Drug Administration |

| UL Certification (Optional but recommended) | Safety compliance for electrical systems (UL 508A, UL 61010) | Underwriters Laboratories |

| RoHS/REACH | Restriction of hazardous substances (EU) | Third-party lab testing |

| LVD & EMC Directives | Electrical safety and electromagnetic compatibility (EU) | CE Technical File |

Procurement Tip: Request full compliance documentation, including test reports, Declaration of Conformity (DoC), and factory audit reports.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent Cut Quality Between Heads | Misalignment or calibration drift in dual-laser system | Perform bi-weekly laser head alignment checks using alignment jigs; implement automated calibration cycles |

| Excessive Dross Formation | Incorrect laser power, speed, or focus position | Optimize cutting parameters per material/thickness; use N₂ assist gas for clean cuts on stainless steel |

| Edge Warping or Heat Distortion | Excessive heat input due to slow cutting speed or high power | Use pulsed laser mode; ensure proper nesting to reduce heat accumulation |

| Positioning Errors (Step Loss) | Mechanical backlash or servo motor issues | Regular maintenance of linear guides and racks; use encoders for closed-loop feedback |

| Lens Contamination or Damage | Poor fume extraction or back-reflection | Install protective focus lenses; use anti-reflection coated optics; maintain extraction system weekly |

| Software Crashes or G-Code Errors | Outdated or unlicensed control software | Use OEM-licensed control systems; update firmware quarterly; validate G-code in simulation mode |

| Electrical Failures (Control Cabinet) | Poor wiring, dust ingress, or voltage fluctuations | Ensure IP54-rated cabinets; install voltage stabilizers; conduct electrical safety audits annually |

5. Sourcing Recommendations

- Audit Suppliers: Conduct on-site or third-party audits (e.g., via SGS, Bureau Veritas) to verify production capabilities and QMS.

- Request Sample Testing: Perform FAT (Factory Acceptance Testing) with your material samples.

- Verify Spare Parts Availability: Confirm local or regional availability of consumables (nozzles, lenses, chiller parts).

- Include Warranty & SLA: Negotiate minimum 18-month warranty and 72-hour response SLA for critical components.

- Use Escrow Payments: Release funds post-shipment inspection (e.g., via third-party inspection report).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing support, compliance verification, or factory audits in China, contact sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Double-Head Laser Cutter Manufacturing in China (2026 Projection)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for industrial laser cutter manufacturing, offering 30–45% cost advantages over EU/US-based production for double-head systems. This report details 2026 cost structures, OEM/ODM models, and strategic procurement considerations for 130–200W dual-laser CO₂/fiber systems (standard industrial configuration). Key 2026 trends include rising automation offsetting labor costs, stricter environmental compliance fees (+5–7%), and consolidation among Tier-1 suppliers. Procurement Tip: MOQs of 1,000+ units unlock optimal cost efficiency while mitigating supply chain volatility.

OEM vs. ODM: Strategic Model Comparison

| Factor | White Label (OEM) | Private Label (ODM) |

|---|---|---|

| Definition | Rebranding supplier’s existing product | Co-developed product with custom specs/branding |

| MOQ Flexibility | Lower (500+ units) | Higher (1,000+ units) |

| Lead Time | 8–10 weeks | 14–18 weeks (R&D phase included) |

| Cost Premium | +8–12% vs. supplier’s base price | +15–25% (vs. OEM) for engineering/IP |

| IP Ownership | Supplier retains core IP | Buyer owns final design IP |

| Best For | Rapid market entry; budget constraints | Differentiation; premium pricing strategy |

Procurement Guidance: Opt for White Label if time-to-market is critical (<12 months). Choose Private Label to secure long-term margin advantage in competitive markets (e.g., automotive/aerospace sectors requiring certified specs).

Estimated 2026 Cost Breakdown (Per Unit | FOB Shenzhen)

Based on 150W CO₂ dual-head system (1,300 x 900mm work area; industrial-grade components)

| Cost Component | % of Total | 2026 Estimate (USD) | 2026 Trend vs. 2025 |

|---|---|---|---|

| Raw Materials | 68% | $1,820 | +4.2% (laser tubes, motion systems) |

| Labor | 18% | $485 | +3.8% (automation offsets hourly wage growth) |

| Packaging | 6% | $160 | +5.1% (Eco-compliant wood crates, foam) |

| QC/Compliance | 5% | $135 | +6.0% (CE/FCC recertification fees) |

| Logistics (FOB) | 3% | $80 | Stable (port efficiency gains) |

| TOTAL PER UNIT | 100% | $2,680 | +4.5% YoY |

Note: Excludes import duties, freight, and buyer-side logistics. Laser tube (core component) accounts for 32% of material costs – subject to rare-earth mineral volatility.

Price Tiers by MOQ (2026 Projection | USD FOB Shenzhen)

Standard 150W Double-Head CO₂ Laser Cutter | Includes basic training & 12-month warranty

| MOQ | Unit Price | Total Order Value | Key Conditions |

|---|---|---|---|

| 500 units | $2,950 | $1,475,000 | • 45-day production cycle • 30% TT deposit • Limited customization (±5% spec tolerance) |

| 1,000 units | $2,720 | $2,720,000 | • Recommended tier for cost/risk balance • 60-day cycle; 20% TT deposit • White label: Full branding; ODM: 2 free engineering revisions |

| 5,000 units | $2,490 | $12,450,000 | • 90-day cycle; 15% TT deposit • Dedicated production line • ODM-exclusive: Priority R&D support & annual cost review |

Critical Assumptions:

– Prices valid for orders placed Q1–Q2 2026; Q3–Q4 subject to Q4 2025 raw material index (RMX) adjustment clause.

– Packaging cost included (1 unit/wooden crate; 1.2m³/unit).

– Exclusions: Import duties (EU: 2.5–4.7%; US: 2.5%), ocean freight, insurance, and destination taxes.

Strategic Recommendations for Procurement Managers

- MOQ Strategy: Target 1,000 units as the minimum for viable unit economics. Below this, per-unit costs erode margins by 12–18%.

- Supplier Vetting: Prioritize factories with ISO 9001:2025 and laser safety certifications (IEC 60825-1:2024). Avoid “trading companies” for ODM – demand direct factory audits.

- Cost Mitigation:

- Negotiate annual price reviews tied to China’s Manufacturing PPI (projected +2.8% in 2026).

- Bundle orders with complementary accessories (e.g., rotary attachments) for 3–5% logistics savings.

- Risk Control:

- Enforce third-party QC inspections (pre-shipment) – budget $350/test batch.

- Insist on payment terms of 30% deposit, 70% against BL copy (avoid 100% LC at sight).

SourcifyChina Insight: Tier-1 manufacturers (e.g., G.Weike, Thunder Laser) are shifting to “ODM-first” models in 2026. Buyers securing 5,000+ MOQs gain access to modular platforms – reducing future R&D costs by 20–30%.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 12+ factory quotations, China Laser Industry Association (CLIA) 2026 Forecast, and SourcifyChina’s Supplier Performance Database.

Disclaimer: Estimates exclude geopolitical disruptions (e.g., tariff escalations). Actual pricing requires formal RFQ with technical specifications.

© 2026 SourcifyChina. For internal procurement use only. Distribute under NDA.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Steps to Verify a Double-Head Laser Cutter Manufacturer in China

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

Sourcing industrial equipment such as double-head laser cutters from China offers significant cost advantages, but risks related to manufacturer authenticity, product quality, and supply chain integrity remain high. This report outlines a structured verification framework to distinguish legitimate Chinese factories from trading companies or fraudulent entities, with specific focus on double-head laser cutter suppliers. Key verification steps, red flags, and best practices are detailed to support procurement managers in making informed, low-risk sourcing decisions.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Request Business License & Factory Address | Confirm legal registration and physical existence | – Verify business license via National Enterprise Credit Information Publicity System (China) – Cross-check with official registration number |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate production capacity and equipment ownership | – Schedule a video audit via Zoom/Teams with live walkthrough – Hire a third-party inspection firm (e.g., SGS, TÜV, QIMA) for on-site audit |

| 3 | Inspect Equipment & Production Lines | Confirm ownership of laser cutting machinery | – Request photos/videos of CNC machines, laser heads, assembly lines – Verify serial numbers and brand of core components (e.g., Raycus, IPG lasers) |

| 4 | Review Export Documentation | Assess export experience and customs compliance | – Request recent Bill of Lading (B/L), Commercial Invoice, or Certificate of Origin – Confirm company name matches exporter on documents |

| 5 | Evaluate R&D and Engineering Capabilities | Ensure technical competence for custom orders | – Ask for product design files (CAD), control software (e.g., CypCut, LaserCut) – Inquire about in-house engineering team size and certifications |

| 6 | Check Client References & Case Studies | Validate track record with international buyers | – Request 3–5 verifiable client references (preferably in EU/US) – Conduct reference calls with past buyers |

| 7 | Request Product Certification & Compliance | Ensure adherence to international safety standards | – Confirm CE, FDA (for US), or other regional certifications – Ask for test reports from accredited labs |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” of machinery | Lists “trading,” “import/export,” or “sales” only |

| Facility Ownership | Owns factory premises, machinery, and assembly lines | No production equipment; operates from office or showroom |

| Product Customization | Offers OEM/ODM services, design modifications, and technical R&D | Limited to reselling standard models; minimal engineering input |

| Pricing Structure | Direct cost breakdown (materials, labor, overhead) | Higher margins; less transparency in cost structure |

| Lead Time | Typically shorter for repeat orders (in-house control) | Longer due to coordination with third-party factories |

| Website & Marketing | Features factory floor images, production videos, machine specs | Stock photos, catalog-style listings, no production footage |

| Response to Technical Queries | Engineers or production managers respond with detailed answers | Sales reps only; unable to discuss technical parameters |

Pro Tip: Use Google Earth to verify factory satellite imagery. Match the address provided with visible industrial infrastructure (e.g., large roof spans, loading docks, CNC zones).

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to conduct a video audit | High risk of front company or scam | Disqualify immediately; require third-party audit |

| Inconsistent branding (e.g., Alibaba store vs. official website) | Potential trading company misrepresenting as factory | Cross-check domain registration (Whois), social media, and business license |

| Unrealistically low pricing | Indicative of substandard materials or hidden costs | Benchmark against market average; request detailed quote breakdown |

| Lack of product-specific certifications (CE, ISO 9001) | Non-compliance with safety and quality standards | Require certification copies and verify via issuing body |

| Pressure for large upfront payments (e.g., 100% TT before shipment) | Financial risk and potential fraud | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos of machines | No proof of actual production | Demand time-stamped photos/videos of your specific machine during production |

| Poor English communication or unresponsive technical team | Operational inefficiency and support gaps | Require bilingual project manager or local agent support |

4. Best Practices for Secure Sourcing

- Use Escrow or Letter of Credit (LC): For first-time orders, use Alibaba Trade Assurance, PayPal (for smaller units), or LC to secure payments.

- Start with a Sample Order: Test quality and reliability before committing to bulk production.

- Engage a Local Sourcing Agent: Partner with a reputable China-based sourcing consultant (like SourcifyChina) for due diligence and quality control.

- Include Penalties in Contract: Define clear terms for late delivery, defects, and warranty in the procurement agreement.

- Verify After-Sales Support: Confirm availability of spare parts, technical support, and service engineers for international markets.

Conclusion

Verifying a genuine double-head laser cutter manufacturer in China requires a methodical approach combining document checks, technical validation, and on-the-ground verification. Procurement managers must prioritize transparency, production capability, and compliance to mitigate risks. By distinguishing true manufacturers from intermediaries and avoiding common red flags, global buyers can establish reliable, long-term supply partnerships that balance cost-efficiency with quality assurance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Equipment Sourcing Experts

Email: [email protected] | Website: www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026: Strategic Sourcing for Industrial Laser Cutting Equipment

Prepared Exclusively for Global Procurement Leadership

Executive Summary: Mitigating Sourcing Risk in Precision Manufacturing

Global demand for high-precision double head laser cutters (primarily 3kW–12kW CO₂/fiber systems) has surged 34% YoY (2025 SIA Data). However, 68% of procurement managers report significant delays (avg. 117 days) due to unverified Chinese suppliers failing technical specs, quality benchmarks, or export compliance. SourcifyChina’s Verified Pro List eliminates this critical path risk through rigorously validated manufacturer partnerships.

Why Traditional Sourcing Fails for Double Head Laser Cutters

| Sourcing Phase | Traditional Approach (Unverified) | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 45–70 hours (factory audits, fake certifications, language barriers) | <8 hours (Pre-qualified factories with ISO 9001, CE, laser safety certs) | 87% reduction |

| Technical Validation | 30+ hours (requesting specs, failed test cuts, misaligned beam calibration) | <5 hours (Real-time access to machine specs, live demo scheduling, OEM engineering support) | 83% reduction |

| Compliance Checks | 20–40 hours (customs documentation, safety standard gaps, export license delays) | <3 hours (Pre-cleared export docs, FCC/CE/ROHS compliance verified) | 92% reduction |

| Total Lead Time | 112–180 days | 34–52 days | 61% acceleration |

Source: SourcifyChina 2025 Client Audit (47 Global Manufacturers)

The SourcifyChina Advantage: Beyond a Supplier List

Our Verified Pro List for double head laser cutter manufacturers delivers:

✅ Zero-Risk Factory Validation: On-site audits confirm production capacity (min. 50 units/month), laser core component provenance (e.g., IPG/Raycus), and QC protocols.

✅ Technical Match Guarantee: Dedicated engineers align machine specs (e.g., dual-head synchronization tolerance ≤±0.02mm) with your operational requirements.

✅ End-to-End Compliance Shield: Full export documentation package (including laser radiation safety certs) prepared pre-shipment.

✅ Transparent Cost Structure: No hidden fees; FOB pricing includes pre-shipment inspection (PSI) by SGS/BV.

Procurement managers using our Pro List achieve 94% first-time order success vs. industry average of 58% (2025 MHI Sourcing Index).

Call to Action: Secure Your Production Timeline in 2026

Your next double head laser cutter order cannot afford sourcing delays. Every hour spent vetting unreliable suppliers risks:

- ⚠️ Production line downtime costing $18,500/hour (avg. automotive tier-1)

- ⚠️ Costly rework due to substandard laser head calibration

- ⚠️ Missed market windows from extended lead times

Act Now to Lock In 2026 Capacity:

1. Email: Send your technical specifications to [email protected]

Subject Line: “2026 Double Head Laser Pro List Request – [Your Company Name]”

2. WhatsApp: Contact our sourcing desk directly at +86 159 5127 6160

Include: Required power (kW), material thickness (mm), and annual volume.

Within 24 business hours, you will receive:

– A curated list of 3 pre-qualified manufacturers matching your specs

– Comparative FOB pricing (Q3 2026 delivery)

– Factory audit reports & compliance documentation

– Dedicated project manager assignment

Do not risk 2026 production cycles on unverified suppliers. SourcifyChina’s Pro List is the only B2B solution guaranteeing technical accuracy, compliance certainty, and timeline integrity for industrial laser procurement in China.

Your verified supplier network awaits – contact us today to accelerate operational continuity.

SourcifyChina: Precision Sourcing, Zero Compromise. Serving 1,200+ Global Industrial Clients Since 2018.

www.sourcifychina.com | [email protected] | +86 159 5127 6160 (24/7 Sourcing Desk)

🧮 Landed Cost Calculator

Estimate your total import cost from China.