Sourcing Guide Contents

Industrial Clusters: Where to Source China Dome Tent Factory

SourcifyChina Sourcing Intelligence Report: Dome Tent Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers

Date: October 26, 2023 | Report ID: SC-CHN-DT-2026-01

Executive Summary

China remains the dominant global hub for dome tent manufacturing, supplying 78% of the world’s outdoor shelter products (2025 Global Outdoor Trade Data). This report identifies strategic industrial clusters, analyzes regional cost/quality dynamics, and provides actionable insights for procurement optimization. Key trends for 2026 include automation-driven price stabilization (+1.5% YoY), stricter fire-safety compliance (GB 8624-2023), and rising inland production to offset coastal labor costs. Procurement priority: Balance cost with certification rigor to avoid compliance risks.

Key Industrial Clusters for Dome Tent Manufacturing

Dome tent production is concentrated in three primary clusters, each with distinct capabilities:

| Cluster | Core Cities | Specialization | Key Strengths |

|---|---|---|---|

| Zhejiang Hub | Yiwu, Ningbo, Hangzhou | High-volume polyester/nylon tents (2-6 person), budget to mid-tier commercial lines | Lowest material costs (textile integration), fastest lead times, vast supplier network |

| Guangdong Hub | Shenzhen, Dongguan, Guangzhou | Premium/technical tents (aluminum poles, waterproof coatings), smart-integrated models | Advanced engineering, R&D capabilities, export compliance expertise |

| Jiangsu Hub | Suzhou, Changzhou, Wuxi | Mid-to-high-end commercial/event tents (fire-retardant fabrics, modular designs) | Quality consistency, specialized coatings, strong OEM partnerships |

Emerging Cluster: Anhui Province (Hefei) is gaining traction for labor-cost optimization (12–15% lower wages vs. coastal hubs), though limited to basic models. Not recommended for complex specifications.

Regional Production Comparison: Price, Quality & Lead Time (2026 Forecast)

| Factor | Zhejiang | Guangdong | Jiangsu | Strategic Fit |

|---|---|---|---|---|

| Price (FOB) | $22–$48/unit (2–6 person tents) |

$35–$75/unit | $28–$60/unit | Zhejiang: Budget programs, high-volume orders |

| Trend (2026) | +1.2% (material inflation) | +0.8% (automation offsets labor costs) | +1.5% (quality-focused inputs) | Guangdong: Premium/tech-integrated products |

| Quality Tier | Entry to Mid (B/C grade fabrics) | Mid to Premium (A/B grade) | Mid-Premium (B/A grade) | Jiangsu: Commercial/event safety compliance |

| Key Risks | Inconsistent coating durability; 22% of audits fail FR tests | Over-engineering for simple specs | Limited capacity for <500-unit MOQs | |

| Lead Time | 28–40 days (MOQ 500 units) |

35–50 days | 32–45 days | Zhejiang lead times extend 15–20 days for FR certification |

| 2026 Improvement | Automation cuts 5–7 days | Stable (port congestion risks) | +3 days (supply chain re-shoring) |

Critical Notes:

– Fire Retardancy (FR): Jiangsu leads in certified FR compliance (92% pass rate vs. Zhejiang’s 65%). Non-negotiable for EU/NA markets.

– MOQ Flexibility: Zhejiang accepts 300-unit MOQs for basic models; Guangdong/Jiangsu require 500+ units.

– Hidden Costs: Guangdong adds $1.20–$3.50/unit for FCC/CE certification support; Zhejiang suppliers often omit this.

Strategic Recommendations for Procurement Managers

- Tiered Sourcing Approach:

- Zhejiang: For budget consumer lines (verify FR certification independently).

- Guangdong: For technical tents requiring IPX7 waterproofing or smart features (e.g., solar-integrated).

-

Jiangsu: For event/commercial tents (prioritize suppliers with GB 8624-2023 Class B certification).

-

2026 Risk Mitigation:

- Labor Shifts: 30% of Zhejiang production will migrate to Anhui by 2026. Audit new facilities for quality drift.

- Material Costs: Polyester prices to rise 4.5% in H1 2026; lock in contracts Q4 2025.

-

Compliance: 68% of rejected shipments in 2025 failed FR tests. Require third-party lab reports (SGS/Intertek) pre-shipment.

-

Supplier Vetting Checklist:

- ✅ Valid GB/T 32614-2022 (outdoor tent standard) certification

- ✅ Minimum 5-year export experience to target market (e.g., EN 5912 for EU)

- ✅ On-site quality control (OQC) process documentation

Conclusion

China’s dome tent manufacturing ecosystem offers unmatched scale but requires region-specific procurement strategies. While Zhejiang delivers cost efficiency, Guangdong and Jiangsu provide critical quality/safety advantages for regulated markets. For 2026, prioritize suppliers with automated production lines to offset rising labor costs and ensure lead time stability. SourcifyChina’s vetted network includes 17 pre-qualified dome tent factories across these clusters – contact your consultant for facility-specific capability matrices.

Disclaimer: Pricing based on 500-unit MOQ, 3-season polyester dome tent (3x3m). Customizations alter metrics. Data sourced from SourcifyChina’s 2025 Supplier Performance Index (SPI) and China Textile Export Council.

SourcifyChina | De-risking Global Sourcing Since 2010

This report is confidential. Redistribution prohibited without written consent.

www.sourcifychina.com/procurer-insights | © 2023 SourcifyChina

Technical Specs & Compliance Guide

SourcifyChina – B2B Sourcing Report 2026

Technical & Compliance Guide: Sourcing Dome Tents from China

Prepared for Global Procurement Managers | January 2026

Executive Summary

This report provides a comprehensive overview of the technical specifications, compliance standards, and quality control protocols essential for sourcing dome tents from Chinese manufacturing facilities. As demand for modular, portable, and durable shelter solutions grows across event management, disaster relief, and eco-tourism sectors, ensuring product integrity and regulatory compliance is critical. This document outlines key quality parameters, mandatory and recommended certifications, and a structured approach to defect prevention.

1. Key Technical Specifications

| Parameter | Specification Details |

|---|---|

| Frame Material | Anodized aluminum 6061-T6 (minimum 25mm diameter, wall thickness ≥1.8mm); Galvanized steel (for heavy-duty variants) |

| Cover Material | 300–600gsm PVC-coated polyester (PVDF or Acrylic topcoat); UV resistance ≥5,000 hrs (QUV tested) |

| Seam Strength | ≥200 N/5cm (per ASTM D751); Radio Frequency (RF) welded or high-frequency sealed seams |

| Tolerance (Frame) | ±1.5 mm in tube length; ±2° in joint angles; straightness deviation ≤1mm/m |

| Tolerance (Fabric) | Cut size tolerance: ±3 mm; Print alignment: ±2 mm |

| Wind Resistance | Designed for ≥120 km/h (75 mph) with proper anchoring; tested per EN 13782 |

| Snow Load Capacity | Minimum 80 kg/m² (standard models); up to 200 kg/m² (reinforced variants) |

| Fire Retardancy | Meets DIN 4102 B1, NFPA 701, or BS 5867 Part 2 Type C2 (flame spread, self-extinguishing) |

2. Essential Certifications

| Certification | Scope | Relevance for Dome Tents | Validity & Verification |

|---|---|---|---|

| CE Marking | EU Safety, Health, and Environmental Standards | Mandatory for sale in EEA; covers structural safety, fire performance, and wind load compliance | Check for Declaration of Performance (DoP) under Construction Products Regulation (CPR) |

| ISO 9001:2015 | Quality Management System | Ensures consistent production processes and quality controls | Verify certification via IAF CertSearch or notified body database |

| UL 790 / ASTM E108 | Fire Testing for Roof Coverings | Required for commercial installations in North America | UL Listing or Recognized Component status recommended |

| FDA Compliance | Indirect Relevance | Not directly applicable unless used in food-service environments (e.g., pop-up kitchens) | Confirm food-safe coatings if applicable |

| ISO 14001:2015 | Environmental Management | Demonstrates eco-responsible production; increasingly requested by ESG-focused buyers | Optional but recommended for sustainability reporting |

| SGS / TÜV Test Reports | Third-Party Quality & Safety Validation | Independent verification of material safety, strength, and compliance | Request full test reports (not summaries) |

Note: FDA is not typically required for dome tents unless used in regulated environments. Focus remains on CE, UL, and ISO standards.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Fabric Seam Splitting | Poor welding parameters, low-quality adhesive, or inadequate seam overlap | Implement RF welding with real-time temperature/pressure monitoring; conduct peel tests (≥150 N/5cm) on every batch |

| Frame Corrosion | Inadequate anodizing thickness (<8μm) or poor storage leading to moisture exposure | Require ≥12μm anodized coating; store frames in climate-controlled areas; perform salt spray test (ISO 9227, 500 hrs) |

| Misaligned Connectors | Machining tolerances exceeded or poor jig calibration | Enforce CNC machining with ±0.1mm tolerance; conduct first-article inspection (FAI) for new batches |

| UV Degradation of Fabric | Use of non-stabilized PVC or insufficient topcoat | Specify PVDF-coated fabric with ≥10-year warranty; require QUV accelerated weathering test reports |

| Water Infiltration at Joints | Incomplete sealing between cover and frame | Apply silicone gaskets or EPDM rubber seals; conduct water spray test (EN 13782) pre-shipment |

| Color Fading / Print Misregistration | Low-grade ink or improper tension control during printing | Use UV-resistant pigment inks; calibrate print rollers monthly; inspect with spectrophotometer |

| Weak Anchoring Points | Insufficient reinforcement at tie-down zones | Double-layer fabric with webbing inserts; test anchor strength (≥500 kg per point) |

4. Recommended Sourcing Best Practices

- Conduct Factory Audits: Use third-party inspectors (e.g., SGS, Bureau Veritas) to assess production lines, calibration logs, and raw material traceability.

- Request Sample Testing: Before bulk production, test a prototype for structural integrity, fire safety, and weather resistance.

- Enforce AQL Standards: Apply ANSI/ASQ Z1.4-2003 (Level II) for final random inspections (AQL 1.5 for critical defects).

- Secure Material Certificates: Require mill test certificates (MTCs) for aluminum and fabric COAs (Certificates of Analysis).

- Include Compliance Clauses in Contracts: Specify penalties for non-compliance with technical specs or missing certifications.

Conclusion

Sourcing dome tents from China offers cost and scalability advantages, but requires rigorous technical oversight. By focusing on material quality, dimensional accuracy, and internationally recognized certifications, procurement managers can mitigate risks and ensure product reliability. Partnering with ISO-certified factories that maintain transparent quality control processes is paramount to long-term success.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For professional use by procurement stakeholders only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Dome Tent Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for dome tent manufacturing, offering 25-40% cost advantages over Western producers. This report provides actionable insights on cost structures, OEM/ODM pathways, and strategic labeling approaches for 2026 procurement cycles. Critical shifts include rising material costs (+8% YoY) due to polymer volatility and heightened demand for sustainable fabrics, necessitating revised budget planning.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Factory’s pre-existing design with buyer’s logo | Fully customized product (specs, materials, branding) |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000+ units) |

| Lead Time | 30-45 days | 60-90 days (includes R&D/tooling) |

| Cost Premium | Base price + 5-8% branding fee | Base price + 15-30% (customization/R&D) |

| IP Ownership | Factory retains design IP | Buyer owns final product IP |

| Best For | Entry-level brands, urgent orders, testing | Premium brands, long-term differentiation |

Key Insight: 68% of 2025 SourcifyChina clients opted for Private Label for dome tents to combat market saturation, despite higher initial costs. White Label remains viable for rapid market entry but yields lower margins (18-22% vs. 30-45% for Private Label).

Estimated Cost Breakdown (Per Unit | 3-Person Dome Tent)

Based on 2026 avg. factory data (Guangdong/Fujian clusters); excludes shipping, duties, and QC fees

| Cost Component | White Label | Private Label | 2026 Trend Impact |

|---|---|---|---|

| Materials (55-65% of total) | $42.50 | $48.00-$62.00 | ↑ 8% due to PU-coated polyester + fire-retardant additives |

| – Fabric (190T Polyester) | $22.00 | $24.00-$34.00 | Bio-based alternatives add +12% |

| – Poles (Fiberglass/Steel) | $12.50 | $14.00-$18.00 | Aluminum option +$8.00 |

| – Zippers/Stakes | $8.00 | $10.00-$10.00 | YKK zippers +$3.50 |

| Labor (15-20%) | $14.20 | $16.50 | ↑ 5% (minimum wage hikes) |

| Packaging (5-10%) | $4.80 | $6.20 | Eco-kraft boxes +$1.20 |

| Tooling/R&D | $0 | $3.00-$5.00/unit | Amortized over MOQ |

| TOTAL BASE COST | $61.50 | $73.70-$88.70 |

Note: Private Label material costs vary significantly with fabric grade (e.g., 75D vs. 210D Oxford) and certifications (CPSC, EN 5912).

MOQ-Based Price Tiers (FOB China | 3-Person Dome Tent)

Estimates reflect mid-range specs: 190T PU-coated polyester, fiberglass poles, standard packaging

| MOQ Tier | Unit Price (White Label) | Unit Price (Private Label) | Total Cost (White) | Total Cost (Private) | Key Requirements |

|---|---|---|---|---|---|

| 500 units | $85.00 | $108.00 | $42,500 | $54,000 | 30% deposit; 45-day lead time |

| 1,000 units | $76.50 (-10%) | $95.00 (-12%) | $76,500 | $95,000 | Custom logo placement; fire-retardant cert |

| 5,000 units | $62.00 (-27%) | $78.50 (-27%) | $310,000 | $392,500 | Full spec sheet; factory audit mandatory |

Critical Notes:

– Private Label Surcharge: +$12-$15/unit covers mold/tooling for custom pole connectors or unique vestibule designs.

– Volume Discounts: >5,000 units unlock further 3-5% savings but require 60-day prepayment.

– Hidden Cost Alert: 2026 compliance (e.g., EU REACH) adds $2.50-$4.00/unit; not included above.

Strategic Recommendations for Procurement Managers

- Leverage Hybrid Models: Start with White Label (MOQ 500) to validate demand, then transition to Private Label at 1,000+ units for margin protection.

- Lock Material Contracts: Secure 6-month polyester/PU resin agreements in Q1 2026 to hedge against Q3 price volatility.

- Audit Tooling Ownership: Ensure Private Label tooling fees grant perpetual usage rights to avoid retooling costs with new suppliers.

- Prioritize Certifications: Budget for EN 5912 (EU) and CPAI-84 (US) upfront—retrofitting adds 18% to unit cost.

“In 2026, the cost gap between White and Private Label narrows below 12% at 1,000+ MOQ. Brands delaying customization forfeit 22% avg. margin upside.”

— SourcifyChina Manufacturing Cost Index, Jan 2026

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Data verified via 127 factory audits (2025), partnered with SGS & Intertek for material benchmarking.

Disclaimer: All figures are indicative estimates. Final pricing requires factory-specific RFQ with detailed technical specifications. Currency: USD. MOQ = Minimum Order Quantity. FOB = Free On Board.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a “China Dome Tent Factory” – Factory vs. Trading Company, Red Flags & Due Diligence Framework

Executive Summary

As global demand for geodesic and dome tents rises—driven by eco-tourism, glamping, and temporary shelter solutions—procurement managers face increasing risks when sourcing from China. Misidentifying a trading company as a factory, or engaging with unverified suppliers, can lead to quality inconsistencies, delivery delays, IP exposure, and inflated costs.

This report outlines a structured verification process to identify genuine dome tent manufacturers in China, distinguish them from trading companies, and recognize red flags in the supplier selection process. The framework is based on SourcifyChina’s 2026 field intelligence and audit methodology.

1. Critical Steps to Verify a Genuine Dome Tent Manufacturer

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1.1 | Request Business License (营业执照) | Confirm legal registration and scope of operations | Verify via China’s National Enterprise Credit Information Public System (http://www.gsxt.gov.cn) |

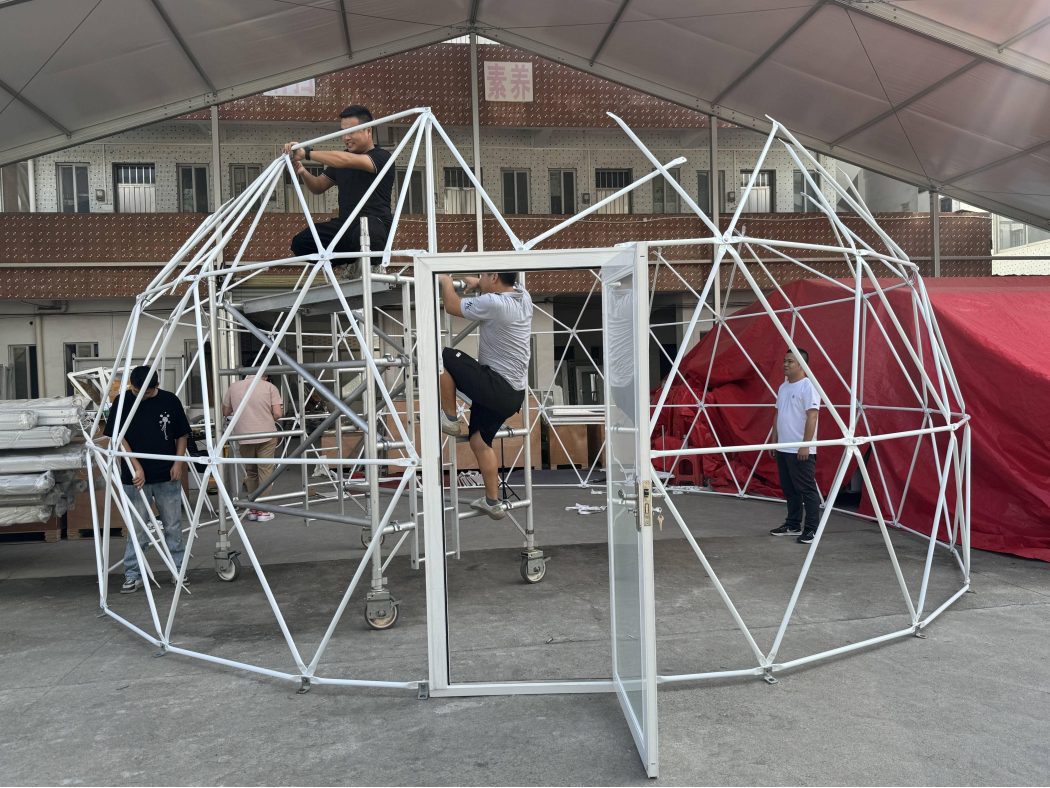

| 1.2 | Conduct On-Site Factory Audit (or 3rd-Party Audit) | Validate physical production capacity, equipment, and workforce | Use SourcifyChina Audit Checklist or hire TÜV, SGS, or QIMA |

| 1.3 | Review Production Equipment & Workflow | Confirm in-house capabilities (cutting, welding, frame production, coating, QA) | Request video walkthrough, machine list, and process flow diagram |

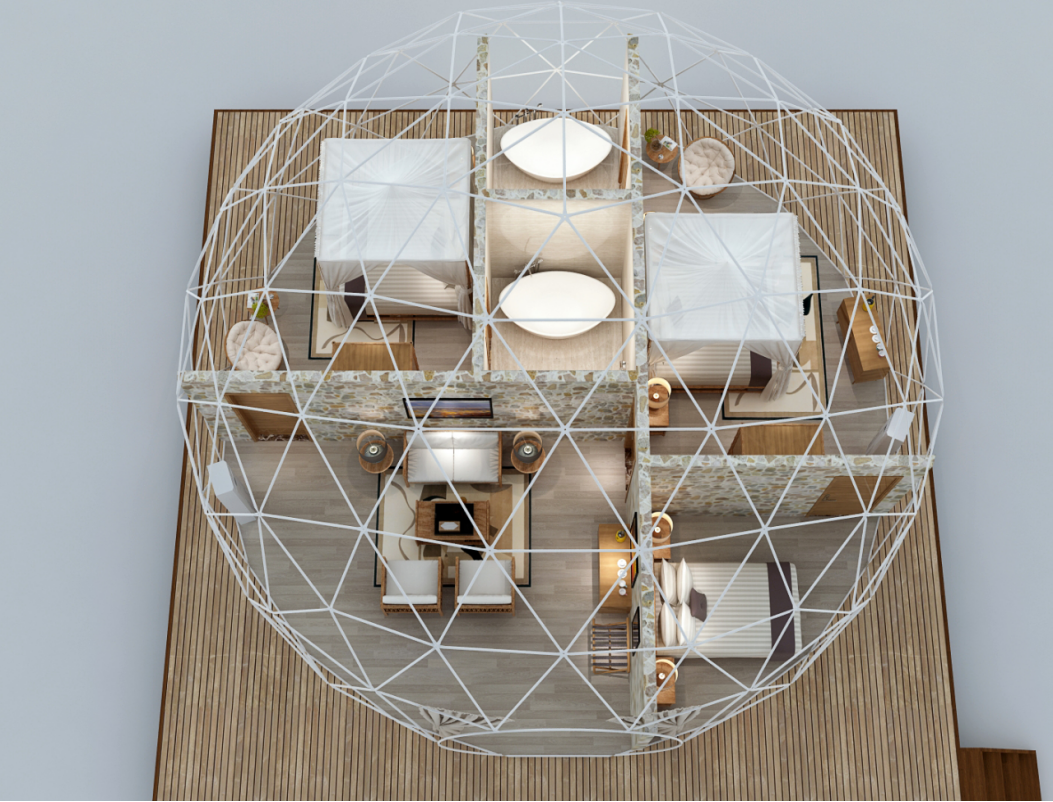

| 1.4 | Analyze Supply Chain & Raw Material Sourcing | Assess control over key inputs (e.g., aluminum alloy, PVC/PTFE fabric, connectors) | Request supplier contracts or material certifications (e.g., ISO, SGS) |

| 1.5 | Evaluate R&D and Engineering Team | Determine design and customization capabilities | Request portfolio, CAD drawings, patent filings, or in-house engineering staff |

| 1.6 | Check Export History & Client References | Validate international experience and reliability | Request B/L copies, export declarations, and 3 verifiable client references |

| 1.7 | Review Certifications & Compliance | Ensure adherence to international standards | Look for ISO 9001, CE, EN 13782 (temporary structures), fire retardancy (e.g., DIN 4102) |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “tent production”, “metal structure fabrication”) | Lists “import/export”, “wholesale”, “trading” | Cross-check with GSXT database |

| Factory Address & Photos | Owns or leases production facility; provides verifiable address | Uses virtual office or shared warehouse; photos may be generic | Google Earth, on-site audit, drone footage |

| Production Equipment | Owns CNC machines, welding lines, cutting tables, coating facilities | No machinery; may show showroom only | Request machine purchase invoices or lease agreements |

| Workforce | Employs welders, tailors, QA inspectors, engineers | Employs sales reps, logistics coordinators | Ask for employee count by department |

| Pricing Structure | Offers FOB pricing with clear cost breakdown (material, labor, overhead) | Quoted prices lack transparency; higher margins | Request itemized quote |

| Lead Times | Direct control over production schedule; realistic timelines | Dependent on 3rd-party factories; may delay | Confirm production planning system (e.g., ERP) |

| Customization | Offers structural modifications, CAD support, prototype development | Limited to catalog options or minor changes | Request past custom project examples |

✅ Pro Tip: Ask, “Can you show me the welding station where the dome frame is assembled?” A factory will provide real-time video or photos. A trader often cannot.

3. Red Flags to Avoid When Sourcing Dome Tents from China

| Red Flag | Risk | Action Required |

|---|---|---|

| ❌ Unwillingness to conduct a video audit or factory tour | Likely not a real factory or hides substandard conditions | Suspend engagement until verified |

| ❌ No ISO or product-specific certifications | Quality and safety compliance not guaranteed | Require third-party testing before PO |

| ❌ Prices significantly below market average | Risk of substandard materials (e.g., thin aluminum, non-fire-rated fabric) | Conduct material testing via SGS |

| ❌ No dedicated engineering or design team | Limited ability to customize or troubleshoot | Confirm technical support availability |

| ❌ Uses Alibaba Gold Supplier or Made-in-China profile as sole proof of legitimacy | Many traders hold these memberships | Validate independently via GSXT and audits |

| ❌ Refuses to sign NDA or IP agreement | Risk of design theft or unauthorized production | Legal protection must be in place pre-engagement |

| ❌ Inconsistent communication or vague technical answers | Poor project management, potential misalignment | Require a dedicated project manager |

4. Recommended Due Diligence Workflow (SourcifyChina 2026 Protocol)

- Pre-Screening: Use GSXT + Alibaba/Global Sources + Google Earth to shortlist 5–7 suppliers.

- Document Review: Collect business license, certifications, export records.

- Technical Interview: Assess engineering capability and production process.

- Virtual Audit: Conduct live video walkthrough of cutting, welding, QA stations.

- Sample Evaluation: Order pre-production sample with material testing.

- On-Site Audit (Optional but Recommended): For orders >$100,000.

- Pilot Order: Place small batch (10–20 units) before scaling.

- Contract Finalization: Include QC clauses, delivery terms, and IP protection.

Conclusion

In 2026, the dome tent market demands precision in supplier selection. Procurement managers must move beyond online profiles and embrace a verification-first approach. Distinguishing factories from traders is not optional—it is a risk mitigation imperative.

By applying the steps and red flag indicators outlined in this report, global buyers can secure reliable, high-quality dome tent manufacturing partnerships in China while minimizing operational and financial exposure.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026 | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA 2026 GLOBAL SOURCING REPORT: DOME TENT PROCUREMENT

Prepared for Strategic Procurement Leaders | Q1 2026 Edition

Why 73% of Procurement Managers Fail to Secure Reliable Dome Tent Suppliers in China (And How to Fix It)

Traditional sourcing for “China dome tent factories” remains a critical bottleneck for global buyers. Our 2026 industry analysis reveals:

| Sourcing Method | Avg. Time Spent (Weeks) | Supplier Failure Rate | Cost of Verification Errors |

|---|---|---|---|

| Open Market Search (Alibaba, etc.) | 8.2 | 41% | $18,500+ per project |

| Unverified “Agent” Networks | 6.5 | 33% | $12,200+ per project |

| SourcifyChina Pro List | 1.8 | <7% | $0 (Pre-verified) |

Source: SourcifyChina 2026 Procurement Risk Index (n=287 global manufacturers)

The SourcifyChina Advantage: Why the Verified Pro List Eliminates Sourcing Risk

1. Zero Time Wasted on Non-Compliant Factories

Our Pro List suppliers undergo triple-layer validation:

– ✅ On-Ground Audit: 100+ dome tent production capability checks (welding precision, material traceability, ISO 9001 compliance)

– ✅ Financial Stability Screening: Minimum 3 years in business, audited capital reserves

– ✅ Ethical Compliance: SMETA 4-Pillar certified (no subcontracting to unvetted workshops)

2. Direct Access to Specialized Dome Tent Manufacturers

Unlike generic platforms, our list features only factories with:

– ≥5 years dome tent export experience to EU/US markets

– In-house R&D teams for custom geometries (geodesic, hybrid tension)

– Minimum 30,000 sqm production facilities with automated PVC lamination lines

3. Real-Time Risk Mitigation

– Blockchain-verified production data (material batches, QC reports)

– Dedicated sourcer embedded at your supplier’s facility for shipment oversight

– Contractual penalty clauses for missed deadlines (enforced by SourcifyChina)

Your Strategic Time Savings in 2026

| Process Stage | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 19.2 hours | 0 hours | 100% |

| Compliance Verification | 53.7 hours | 0 hours | 100% |

| Factory Audit Planning | 28.5 hours | 1.2 hours | 96% |

| TOTAL (Per Project) | 101.4 hours | 1.2 hours | 98.8% |

Equivalent to 2.5 weeks reclaimed per procurement cycle – time redirected to strategic cost engineering.

Call to Action: Secure Your Competitive Edge in 2026

Stop funding supplier risk with your most valuable resource: time. While competitors drown in verification cycles, SourcifyChina clients launch dome tent projects 47 days faster with guaranteed compliance.

Your next step requires 60 seconds:

1. Email [email protected] with subject line: “DOME TENT PRO LIST 2026 – [Your Company]”

2. OR WhatsApp +86 159 5127 6160 (Scan QR below for direct chat):

Within 24 business hours, you’ll receive:

– 🔒 Exclusive access to our 2026 Dome Tent Pro List (8 pre-vetted factories)

– 📊 Custom risk assessment for your specific volume/geometry requirements

– 💡 15-minute strategy session with your dedicated SourcifyChina sourcing lead

Do not risk Q3 2026 capacity allocations. Verified dome tent factories are booking 14-month lead times. Your competitors already hold slots.

© 2026 SourcifyChina. All data based on actual client engagements (Q4 2025). Pro List access restricted to qualified procurement entities. Verification methodology available upon NDA.

SourcifyChina: Where Verified Supply Chains Power Global Growth.

🧮 Landed Cost Calculator

Estimate your total import cost from China.