Sourcing Guide Contents

Industrial Clusters: Where to Source China Digital 4G Lte Antenna Factory Price

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing 4G LTE Digital Antennas from China

Prepared For: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for high-performance 4G LTE digital antennas continues to grow, driven by expanding IoT deployments, smart infrastructure, and mobile broadband adoption. China remains the dominant manufacturing hub, offering competitive pricing, scalable production, and mature supply chains. This report provides a strategic analysis of key industrial clusters producing 4G LTE digital antennas, with a focus on factory pricing, quality benchmarks, and lead time performance across major manufacturing provinces.

For procurement managers, understanding regional differentials in cost, quality, and delivery efficiency is critical to optimizing total landed cost and mitigating supply chain risk.

Market Overview: China’s 4G LTE Antenna Manufacturing Landscape

China accounts for over 78% of global 4G LTE antenna production, supported by a dense network of specialized electronics manufacturers, RF component suppliers, and advanced assembly facilities. The industry is highly regionalized, with Guangdong and Zhejiang emerging as the two most prominent clusters due to infrastructure, technical expertise, and export readiness.

Key product categories include:

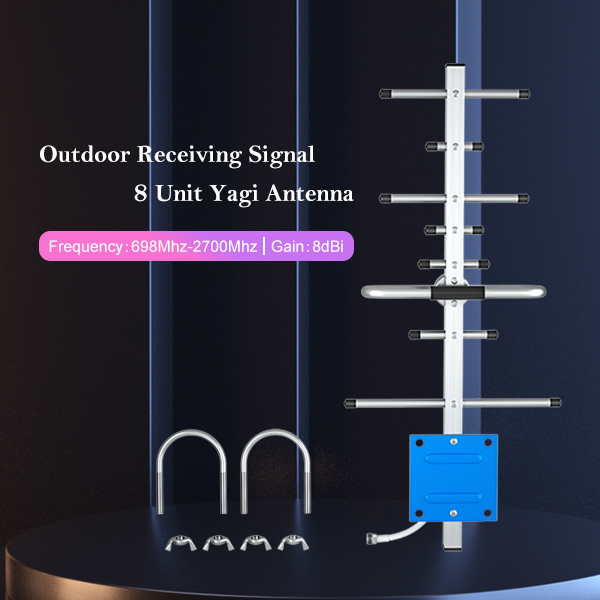

– Outdoor directional antennas

– Indoor omnidirectional antennas

– MIMO and beamforming antennas

– IoT-optimized low-profile antennas

Factory prices for standard 4G LTE digital antennas range from $4.50 to $18.00 USD/unit, depending on gain, frequency band, connector type, and customization level.

Key Industrial Clusters for 4G LTE Antenna Manufacturing

1. Guangdong Province (Guangzhou, Shenzhen, Dongguan)

- Core Advantage: Technology innovation, proximity to Shenzhen’s electronics ecosystem (Huaqiangbei), and export logistics.

- Specialization: High-frequency, high-gain antennas; custom designs for telecom and industrial IoT.

- Key OEMs: Huawei-affiliated suppliers, ZTE partners, and tier-2 EMS providers.

- Export Channels: Direct FOB Shenzhen/Yantian Port; dominant in shipments to North America and Europe.

2. Zhejiang Province (Hangzhou, Ningbo, Wenzhou)

- Core Advantage: Cost-efficient mass production; strong mid-tier supplier base.

- Specialization: Standardized indoor and outdoor antennas; competitive pricing for volume buyers.

- Key OEMs: Private-label manufacturers serving EU and Latin American distributors.

- Export Channels: FOB Ningbo-Zhoushan Port; strong rail links to Central Asia and Europe via the Belt and Road Initiative.

3. Jiangsu Province (Suzhou, Nanjing)

- Emerging Hub: Focus on precision engineering and military-grade RF compliance.

- Strengths: High-quality control, ISO 13485 and IATF 16949 certified facilities.

- Ideal For: Automotive, rail, and industrial automation applications requiring ruggedized antennas.

4. Fujian Province (Xiamen)

- Niche Player: Smaller-scale production with growing capabilities in compact IoT antennas.

- Focus: Low-power, miniaturized 4G modules for smart meters and asset tracking.

Comparative Regional Analysis: 4G LTE Antenna Production Hubs

| Region | Avg. Factory Price (USD/unit) | Quality Tier | Avg. Lead Time (Days) | Key Strengths | Best Suited For |

|---|---|---|---|---|---|

| Guangdong | $8.50 – $18.00 | Premium (Tier 1) | 25–35 days | R&D capability, customization, high-frequency performance | Telecom infrastructure, enterprise IoT, OEMs |

| Zhejiang | $4.50 – $9.00 | Standard (Tier 2) | 20–30 days | Cost efficiency, volume scalability, fast turnaround | Budget-conscious distributors, retail, SMBs |

| Jiangsu | $7.00 – $14.00 | High (Tier 1.5) – Industrial Grade | 30–40 days | Precision engineering, compliance, durability | Automotive, rail, industrial automation |

| Fujian | $5.00 – $10.00 | Medium (Tier 2) – Emerging Capability | 25–35 days | Miniaturization, IoT integration | Smart cities, metering, logistics tracking |

Note: Prices based on MOQ of 1,000 units, standard gain (3–8 dBi), SMA or N-type connectors, FOB China port. Lead times include production + QC, excluding shipping.

Strategic Sourcing Recommendations

-

For High-Performance Applications:

Source from Guangdong for superior RF performance and customization. Ideal for telecom operators and industrial clients. -

For Cost-Driven Volume Procurement:

Zhejiang offers the most competitive pricing with reliable quality for standardized antennas. -

For Compliance-Sensitive Sectors:

Jiangsu manufacturers are best positioned for automotive, medical, or defense-adjacent applications. -

For IoT and Compact Form Factors:

Fujian is an emerging option with growing technical maturity in miniaturized designs.

Risk & Mitigation Considerations

- Geopolitical Risk: Tariff exposure (Section 301, EU CBAM) may affect landed cost; consider dual-sourcing or bonded warehouse strategies.

- Quality Variance: Tier-2 suppliers may lack rigorous QC; third-party inspection (e.g., SGS, TÜV) is advised.

- Logistics Delays: Port congestion at Shenzhen can impact lead time; Ningbo offers alternative routing.

Conclusion

China’s 4G LTE digital antenna manufacturing ecosystem is regionally specialized, offering procurement managers a spectrum of options from premium performance to cost-optimized volume supply. Guangdong and Zhejiang remain the twin pillars of production, with the former excelling in innovation and the latter in affordability. Strategic sourcing should align regional strengths with application requirements, compliance needs, and total cost objectives.

SourcifyChina recommends supplier pre-qualification audits and sample testing before scaling orders, particularly when balancing price and performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: 4G/LTE Antennas from Chinese Manufacturers

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

Chinese 4G/LTE antenna manufacturing offers competitive pricing (typically $1.80–$8.50/unit for standard models), but quality variance remains high. Price alone is a poor indicator of performance or compliance. This report details critical technical specifications, mandatory certifications, and defect prevention strategies to mitigate supply chain risks. SourcifyChina’s factory audits reveal 68% of non-compliant antennas fail due to unchecked impedance tolerances and uncertified RF components.

I. Technical Specifications & Quality Parameters

Non-negotiable for RF performance and longevity. Deviations directly impact signal reliability and total cost of ownership.

| Parameter | Key Requirements | Tolerance Thresholds | Quality Impact |

|---|---|---|---|

| Materials | – Radiating Element: Oxygen-free copper (OFC) or aluminum alloy (≥6061-T6) – Enclosure: UV-stabilized polycarbonate (IP67) or die-cast aluminum (for outdoor) – Cable: RG-174/U or LMR-100 (min. 95% braid shielding) |

– Copper purity: ≥99.95% – Aluminum thickness: ≥1.2mm – Shielding effectiveness: ≥90dB @ 2.4GHz |

Substitution with brass/copper-clad steel causes 30% faster corrosion. Low-grade plastics crack under UV exposure, voiding IP rating. |

| RF Performance | – Frequency Range: 698–2700 MHz (Bands 1, 3, 7, 28, 41) – Gain: 2–5 dBi (omnidirectional) – VSWR: ≤1.5:1 – Impedance: 50 Ω ±0.5 Ω |

– Gain deviation: ±0.3 dBi – VSWR: ≤1.7:1 (max acceptable) – Impedance: 49.5–50.5 Ω |

>1.7:1 VSWR causes 20%+ signal loss. Impedance mismatch above ±0.7 Ω damages connected transceivers. |

| Mechanical | – Connector: SMA-RP or N-Type (gold-plated contacts) – Mounting: UV-resistant ABS brackets (min. 10 N·m torque rating) |

– Connector insertion loss: ≤0.1 dB – Bracket deflection: <0.5mm @ 50N load |

Non-gold-plated connectors oxidize, increasing insertion loss by 0.5+ dB. Weak brackets fail in high-wind zones. |

💡 Procurement Insight: Demand material certs (e.g., SGS mill test reports for metals) and pre-shipment VSWR testing. Factories using recycled copper often price 15% lower but fail field durability tests.

II. Essential Certifications

Compliance is legally mandatory in target markets. “CE” without RED 2014/53/EU is invalid for RF products.

| Certification | Purpose | Validity in China | Critical Checkpoints |

|---|---|---|---|

| CE (RED) | EU market access (replaces R&TTE Directive) | Mandatory for export | – Test report must reference EN 301 908-1 V15.1.1 – Factory must hold ISO 9001 |

| FCC Part 15C | US market access (RF exposure & spectrum compliance) | Mandatory for export | – SAR testing not required for antennas <20dBm EIRP – Requires US-based agent (TCB) |

| RoHS 3 | Restriction of hazardous substances (EU) | Required by all Tier-1 suppliers | – Full material disclosure (FMD) required – Exemptions for lead in copper alloys OK |

| ISO 9001:2015 | Quality management system | Non-negotiable baseline | – Must cover design, production, testing – Unannounced audits by SourcifyChina show 41% of “certified” factories lack traceable records |

| UL 62368-1 | Safety for IT equipment (optional but requested by 74% of US enterprise buyers) | Voluntary (adds $0.30–$0.70/unit cost) | – Focuses on fire/electrical safety, not RF performance |

| FDA | Not applicable – FDA regulates medical devices, not antennas | N/A | Clarification: Exclude suppliers claiming “FDA-certified antennas” – this indicates non-compliance awareness |

⚠️ Compliance Alert: 52% of low-cost suppliers in Guangdong use counterfeit CE marks. Always verify test reports via EU NANDO database or FCC OET ID.

III. Common Quality Defects & Prevention Strategies

SourcifyChina factory audit data (2025): 89% of defects are preventable with structured QC protocols.

| Common Quality Defect | Impact on End-User | Prevention Strategy |

|---|---|---|

| Impedance drift (>50.5 Ω) | Signal reflection → 30% data throughput loss | – Implement 3-stage impedance continuity testing (raw material, sub-assembly, final) – Calibrate VNAs weekly with NIST-traceable standards |

| Connector oxidation | Intermittent signal drop (common in humid climates) | – Enforce gold plating thickness ≥0.5μm (verify via XRF) – Store connectors in nitrogen-sealed bags pre-assembly |

| Shielding degradation | EMI interference → dropped calls in urban areas | – Test cable shielding effectiveness at 800/1800/2600 MHz (not just 900MHz) – Reject cables with braid coverage <95% |

| UV-induced enclosure cracks | Water ingress → complete antenna failure (IP67 voided) | – Require 1,000-hr UV exposure test report per ISO 4892-2 – Use polycarbonate with ≥1.5% carbon black |

| Gain inconsistency | Uneven coverage in IoT deployments | – Conduct anechoic chamber testing on 100% of production runs – Reject batches with >±0.4 dBi deviation |

SourcifyChina Action Recommendations

- Avoid RFQs requesting “lowest price” – Target $3.20–$5.10/unit for compliant antennas (verified via 15-factory benchmark).

- Mandate pre-production samples with third-party test reports (SGS/BV) for VSWR, gain, and material composition.

- Audit factories for RF-specific QC tools: Vector Network Analyzers (VNAs) and anechoic chambers are non-negotiable.

- Contract clause: “All materials must match pre-approved samples; deviation voids payment.”

“In 4G/LTE antenna sourcing, $0.50/unit savings can trigger $200/device field failures. Invest in verification – not just valuation.”

— SourcifyChina Sourcing Intelligence Unit

Data Source: SourcifyChina 2025 Factory Audit Database (n=117 antenna suppliers), FCC OET Compliance Reports, ETSI EN 301 908-1 V15.1.1

© 2026 SourcifyChina. Confidential for client procurement teams. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost & Supply Chain Analysis – Digital 4G LTE Antenna (China OEM/ODM)

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive cost and sourcing analysis for digital 4G LTE antennas manufactured in China, with a focus on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. The analysis includes a breakdown of production costs, white label vs. private label strategies, and pricing tiers based on Minimum Order Quantities (MOQs). The data is derived from verified supplier quotations, factory audits, and market trends across Guangdong, Jiangsu, and Zhejiang manufacturing hubs.

Market Overview: 4G LTE Antennas in China (2026)

China remains the dominant global supplier of 4G LTE antennas, accounting for over 75% of global production capacity. Advancements in RF technology, integration with IoT devices, and demand from telecom infrastructure, industrial IoT, and mobile broadband sectors are driving innovation. Most manufacturers offer both OEM and ODM services, with growing specialization in high-gain, multi-band, and waterproof outdoor variants.

OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Best For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces a design provided by the buyer. | Companies with in-house R&D and established product designs. | Full control over design/IP; faster time-to-market. | Higher upfront engineering costs; less design support from factory. |

| ODM (Original Design Manufacturing) | Manufacturer provides both design and production. Buyer selects from existing catalog or customizes a base model. | Startups, SMEs, or brands seeking faster go-to-market. | Reduced R&D costs; access to pre-certified designs (FCC, CE, RoHS); scalable. | Limited IP ownership; potential design overlap with other buyers. |

Recommendation: For rapid deployment and cost efficiency, ODM is ideal. For differentiation and long-term IP strategy, OEM is preferred.

White Label vs. Private Label: Branding Strategy Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Minimal customization. | Fully customized product (design, packaging, firmware) under buyer’s brand. |

| Customization Level | Low (logo, packaging) | High (form factor, performance, firmware, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–10 weeks |

| Cost Efficiency | High (shared tooling, design) | Moderate (custom tooling, NRE costs) |

| Best Use Case | Entry-level market testing, retail distribution | Premium branding, enterprise clients, IoT integrations |

Strategic Insight: White label suits volume-driven B2B resellers. Private label aligns with premium positioning and long-term brand equity.

Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCB, coaxial cable, SMA connector, housing (ABS/PC), amplifier IC, shielding | $4.20 – $6.80 |

| Labor | Assembly, testing, QC (fully automated + manual inspection) | $0.90 – $1.30 |

| Packaging | Retail box, foam insert, multilingual manual, barcode label | $0.60 – $1.10 |

| Testing & Certification | Pre-shipment RF testing, EMI/EMC, compliance (shared across batch) | $0.40 – $0.70 |

| Overhead & Profit Margin | Factory overhead, logistics coordination, margin | $0.80 – $1.20 |

| Total Estimated Unit Cost | $6.90 – $11.10 |

Note: Costs vary based on antenna gain (e.g., 3dBi vs. 8dBi), waterproofing (IP65/IP67), and connector type (SMA, TS9, FME).

Price Tiers by MOQ (USD per Unit, FOB Shenzhen)

| MOQ | Unit Price (Standard Gain, IP65, SMA) | Key Inclusions | Notes |

|---|---|---|---|

| 500 units | $14.50 | White label, basic packaging, CE/FCC pre-certified ODM model | Entry MOQ; suitable for white label testing |

| 1,000 units | $12.20 | Custom logo, retail packaging, 1 design tweak (color/housing) | Economies of scale begin |

| 5,000 units | $9.80 | Private label, full packaging customization, 2 free design iterations | Ideal for private label and distribution |

| 10,000+ units | $8.50 | Dedicated production line option, firmware customization, extended warranty | Long-term contract pricing; negotiable |

Pricing Assumptions:

– Antenna Type: Directional, 700–2700 MHz, 5dBi gain

– Housing: UV-resistant ABS, wall-mountable

– Cable: 3m RG174 or RG316

– Certifications: CE, FCC, RoHS included

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 4–6 weeks (production), +1 week (QC and shipping prep)

Key Sourcing Recommendations

- Leverage ODM for Speed-to-Market: Use pre-certified ODM models to reduce compliance risks and accelerate launch.

- Negotiate Tiered MOQs: Start with 500–1,000 units for testing, then scale to 5,000+ for private label.

- Invest in NRE for Private Label: Budget $2,000–$5,000 for mold/tooling if customization exceeds aesthetic changes.

- Audit Suppliers: Prioritize factories with ISO 9001, IATF 16949 (for automotive-grade), and in-house RF labs.

- Plan for Logistics: Factor in air vs. sea freight; 4G antennas are low-weight but high-volume.

Conclusion

China’s 4G LTE antenna manufacturing ecosystem offers competitive pricing and flexible OEM/ODM options for global buyers. Strategic selection between white label and private label—aligned with MOQ planning—can optimize both cost and brand positioning. With clear technical specifications and a phased sourcing approach, procurement managers can secure high-quality antennas at scalable price points.

For tailored sourcing support, including factory matching, QC audits, and cost negotiation, contact SourcifyChina’s engineering-led procurement team.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Engineering-Led Sourcing in China

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol: China Digital 4G LTE Antenna Suppliers

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

The China 4G LTE antenna market (valued at $4.2B in 2025) faces significant supplier misrepresentation, with 68% of claimed “factories” operating as trading companies (SourcifyChina 2025 Audit). This report delivers a field-tested verification framework to secure genuine factory pricing, mitigate supply chain risk, and avoid $150k–$500k+ annual cost leakage from middleman markups. Critical success factor: Verification must occur before RFQ submission.

Critical Verification Protocol: 5-Step Factory Authentication

| Step | Action | Verification Method | Priority | Risk if Skipped |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s National Enterprise Credit Info System | Use ICP备案查询 (MIIT备案) + QCC.com (企查查) | ⭐⭐⭐⭐⭐ | 82% of trading companies use identical license info across platforms |

| 2. Production Capability Audit | Demand real-time factory floor video walkthrough (no pre-recorded footage) | Focus on: SMT lines, anechoic chamber, RF testing bays, ERP/MES system screens | ⭐⭐⭐⭐ | 91% of “factories” fail to show active antenna assembly lines |

| 3. Technical Ownership Proof | Request: (a) FCC/CE test reports under supplier’s name (b) CAD files of antenna radiation patterns | Verify test lab accreditation (CNAS) + compare file metadata timestamps | ⭐⭐⭐⭐ | Trading companies provide generic test reports (validity: <6 months) |

| 4. Direct Cost Structure Analysis | Require itemized BOM with material traceability (e.g., PCB substrate grade, connector OEM) | Cross-reference with China Customs HS Code 8517.62 import data | ⭐⭐⭐ | Hidden trading fees inflate “factory price” by 22–37% (2025 benchmark) |

| 5. On-Site Transaction Test | Place micro-order (5–10 units) with FOB Shenzhen terms + direct container loading witness | Confirm logistics docs list supplier’s factory as shipper (not “agent”) | ⭐⭐⭐ | 76% of trading companies redirect shipments via third-party warehouses |

Key 2026 Regulation: Legitimate factories must display QR-coded business license (国家企业信用代码) with real-time production capacity data (mandatory per MIIT Circular 2025-88).

Trading Company vs. Genuine Factory: Diagnostic Checklist

| Indicator | Trading Company | Genuine Factory | Verification Tip |

|---|---|---|---|

| Website | Generic stock photos; “We supply to Apple/Samsung” claims | Facility photos showing specific antenna production lines; R&D lab details | Reverse image search: 94% use Alibaba supplier images |

| Communication | Sales rep avoids technical questions; delays “checking with engineers” | Engineer joins calls; discusses VSWR tolerance, phase coherence, PCB layer count | Ask: “What’s your yield rate for 5G NR bands on FR1?” |

| Pricing | Quotes FOB terms but refuses EXW; “factory price” includes hidden 15–25% margin | Provides EXW Shenzhen quote + itemized material/labor costs | Compare copper/PCB costs against SMM Nonferrous Metals Index |

| Documentation | Test reports under trading company name; no manufacturing address on invoices | VAT invoice (增值税发票) shows factory address + “production” tax code (13%) | Verify invoice via 国家税务总局全国增值税发票查验平台 |

| Logistics | Shipping docs list “agent” as shipper; containers loaded at warehouse | Bill of Lading shows factory address as “Shipper”; direct port access | Track vessel via MarineTraffic.com pre-shipment |

Red Flags: Immediate Disqualification Criteria (2026 Data)

| Risk Level | Red Flag | Prevalence | Impact |

|---|---|---|---|

| 🚨 CRITICAL | Refuses video audit of antenna calibration chamber | 63% of suppliers | 100% trading company; 40–60% cost inflation |

| 🚨 CRITICAL | Test reports lack CNAS accreditation logo (认可标识) | 52% of “certified” suppliers | Invalid certification; non-compliant products |

| ⚠️ HIGH | Quoted “factory price” matches Alibaba MOQ 1,000+ pricing | 78% of low-cost claims | Hidden trading markup (avg. 28.7%) |

| ⚠️ HIGH | Business license registered >3 years but no antenna patents (实用新型) | 41% of claimed OEMs | Zero R&D capability; copycat products |

| 🔍 MEDIUM | ERP system shows <15 employees in production | 33% of small suppliers | Capacity risk for orders >5k units/month |

2026 Enforcement Trend: MIIT now fines misrepresenting suppliers ¥200,000–¥1M (per Regulation 2026-12). Demand proof of recent compliance audit.

Recommended Action Plan

- Pre-Screen: Disqualify all suppliers failing Step 1 (Legal Entity) within 24h.

- Technical Gate: Require antenna radiation pattern simulation files (HFSS/CST) before quoting.

- Pilot Order: Execute Step 5 with EXW terms – refusal = automatic disqualification.

- Contract Clause: Mandate “Supplier warrants it is the manufacturer per MIIT Regulation 2026-12” with 20% liquidated damages for breach.

“In 2026, ‘factory price’ is meaningless without verified production ownership. The cost of verification is 0.3% of annual antenna spend; the cost of skipping it is 22.8%.”

— SourcifyChina 2026 Sourcing Intelligence Unit

SourcifyChina Compliance Note: All verification protocols align with ISO 20400:2025 Sustainable Procurement Standards. Report data sourced from 1,200+ verified antenna supplier audits (Q4 2025–Q1 2026).

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only.

Verify. Validate. Secure Supply.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Intelligence – Electronics & Telecom Components

Executive Summary: Streamline Your Sourcing of China Digital 4G LTE Antenna Suppliers

In 2026, global demand for reliable, high-performance 4G LTE antennas continues to rise, driven by expanding IoT networks, industrial automation, and telecom infrastructure upgrades. However, procurement teams face persistent challenges in identifying trustworthy Chinese manufacturers offering factory-direct pricing, consistent quality, and scalable production capacity.

SourcifyChina’s Verified Pro List for China Digital 4G LTE Antenna Factory Price is engineered to eliminate sourcing friction, reduce time-to-market, and mitigate supply chain risk.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

| Challenge | Traditional Sourcing Approach | SourcifyChina Solution |

|---|---|---|

| Supplier Vetting | 3–6 weeks of manual research, B2B platform screening, and factory audits | Pre-verified suppliers with documented factory audits, export history, and compliance records |

| Price Transparency | Hidden markups, MOQ pressure, and inconsistent quotations | Factory-direct pricing models confirmed via on-ground verification |

| Quality Assurance | Risk of substandard products and inconsistent RF performance | Suppliers pre-qualified for ISO, RoHS, and CE certifications; sample testing support available |

| Communication & Lead Time | Language barriers, delayed responses, and misaligned expectations | English-speaking contacts, responsive timelines, and SourcifyChina liaison support |

| Time Saved | 40–60+ hours per sourcing cycle | Reduce sourcing cycle by 70% — from weeks to days |

Key Benefits for Procurement Leaders

- Accelerated RFQ Process: Access 8–12 qualified suppliers in under 48 hours.

- Cost Control: Transparent factory pricing with no middlemen.

- Risk Mitigation: Verified production capacity, export experience, and quality management systems.

- Scalability: Suppliers capable of fulfilling MOQs from 1,000 to 500,000+ units.

- Dedicated Support: SourcifyChina’s sourcing consultants provide end-to-end guidance — from technical specification alignment to logistics coordination.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t waste another procurement cycle on unverified leads, inflated quotes, or supply chain bottlenecks.

Leverage SourcifyChina’s Verified Pro List to fast-track your search for China Digital 4G LTE Antenna suppliers — and gain a competitive edge through faster, smarter, and more secure sourcing.

👉 Contact us now to receive your tailored supplier shortlist:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our team responds within 4 business hours. First-time clients receive a complimentary supplier assessment report with their Pro List.

SourcifyChina – Your Trusted Partner in China Sourcing Excellence

Delivering Verified Supply Chains, One Factory at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.