Sourcing Guide Contents

Industrial Clusters: Where to Source China Diesel Generator Manufacturers

SourcifyChina Sourcing Intelligence Report: Diesel Generator Manufacturing Clusters in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

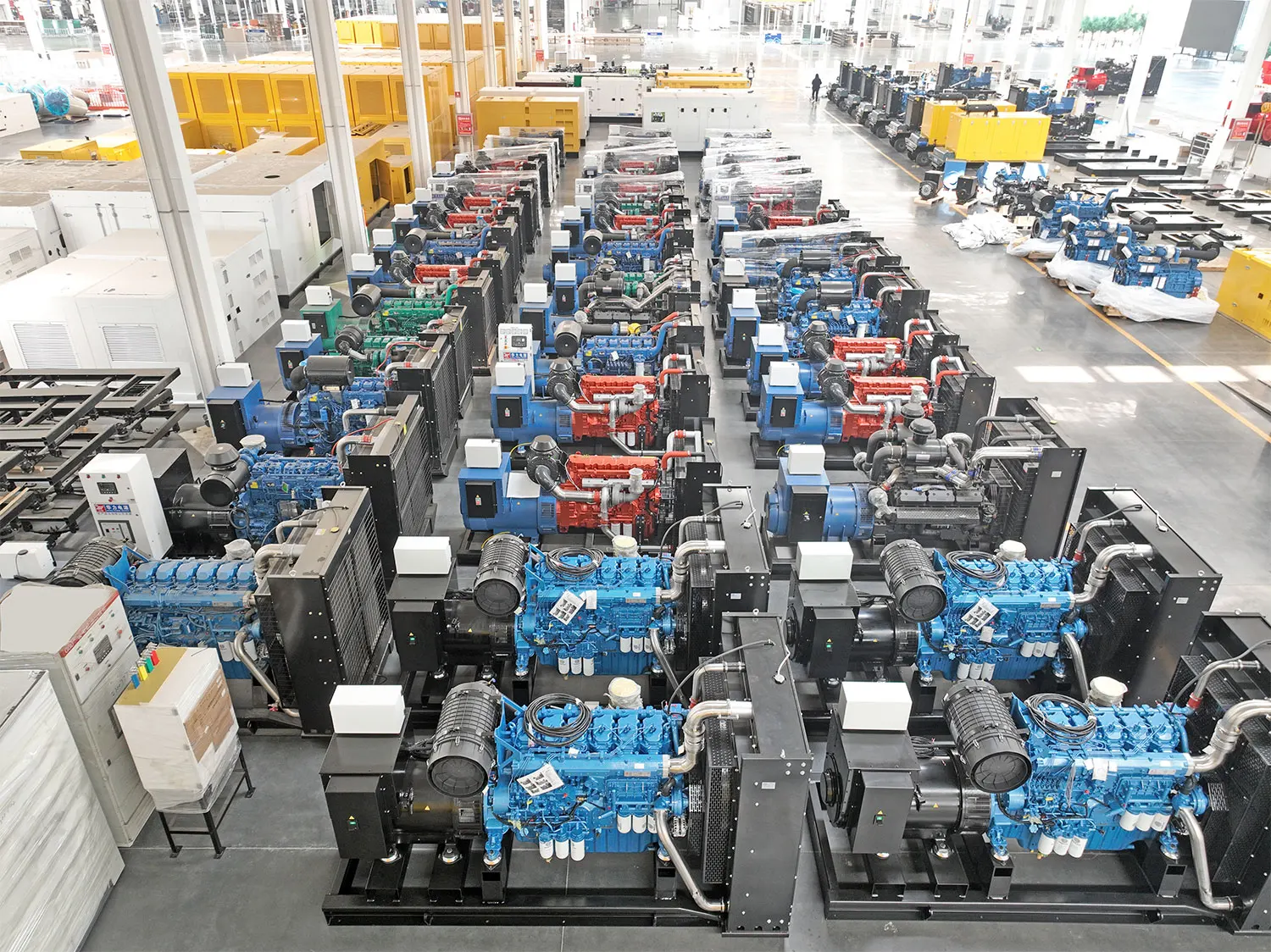

China remains the dominant global hub for diesel generator manufacturing, accounting for ~65% of worldwide production capacity (2025 Global Power Equipment Report). While cost advantages persist, strategic sourcing requires nuanced regional analysis due to evolving regulatory pressures (China’s Tier 4 Final compliance mandate), supply chain fragmentation, and quality stratification. This report identifies critical industrial clusters and provides actionable insights for optimizing procurement strategy in 2026.

Key Industrial Clusters: Regional Breakdown

China’s diesel generator manufacturing is concentrated in three primary clusters, each with distinct competitive advantages and operational profiles:

-

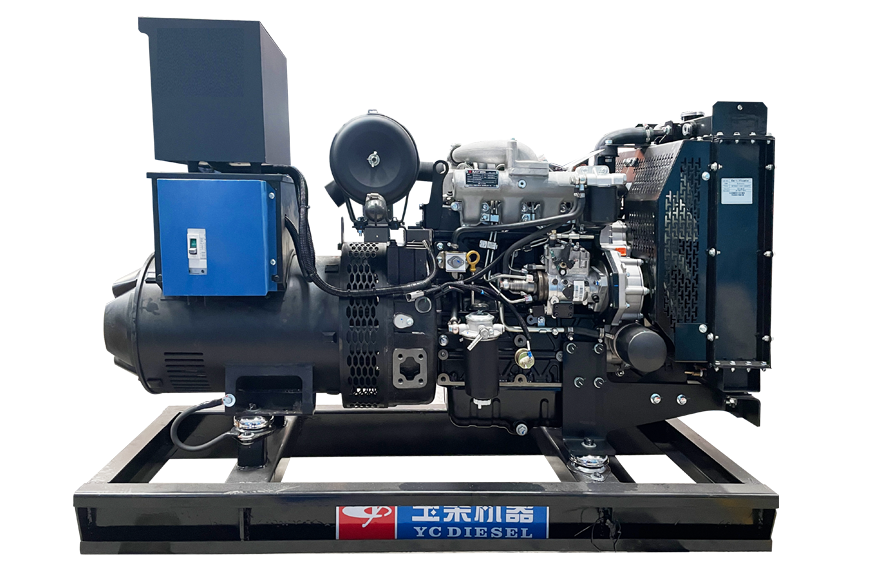

Guangdong Province (Foshan, Dongguan, Shenzhen)

- Focus: High-end, export-oriented units (10kW–3,000kW+), Tier 4 Final/Stage V compliance, smart grid integration.

- Strengths: Deep integration with global supply chains (Cummins, Perkins, Volvo Penta dealerships), advanced R&D, stringent quality control (ISO 8528-1:2024 certified), strong after-sales infrastructure. Dominates exports to EU/NA.

- 2026 Trend: Shift toward hybrid systems (diesel + solar/battery) and IoT-enabled remote monitoring. Labor costs rising (~8% YoY), driving automation investments.

-

Zhejiang Province (Wenzhou, Ningbo, Hangzhou)

- Focus: Mid-range commercial/industrial units (5kW–800kW), cost-competitive solutions, rapid customization.

- Strengths: Agile SME ecosystem, strong component supply (engines from Yuchai/Weichai dealers, alternators), flexible MOQs (as low as 1 unit). Dominates exports to Africa, LATAM, and emerging ASEAN markets.

- 2026 Trend: Consolidation of smaller workshops; increased focus on CE/UL certification to access regulated markets. Vulnerable to rare earth price volatility (affecting alternator costs).

-

Jiangsu Province (Wuxi, Yangzhou, Suzhou)

- Focus: Large-scale industrial/military-grade units (500kW–5,000kW+), marine applications, government contracts.

- Strengths: Heavy engineering expertise, state-owned enterprise (SOE) partnerships (e.g., China Shipbuilding), robust testing facilities (full-load test beds). Strong in domestic infrastructure projects.

- 2026 Trend: Rising demand for ultra-low emission generators (NOx < 0.2g/kWh) driven by China’s “Dual Carbon” policy. Longer lead times due to bureaucratic procurement cycles.

Emerging Cluster: Anhui Province (Hefei) is gaining traction for mid-tier generators leveraging lower labor costs and proximity to Zhejiang’s supply chain. Monitor for 2027+ scalability.

Regional Comparison: Strategic Sourcing Decision Matrix (2026)

Data reflects FOB Shanghai pricing for a standard 100kW diesel generator (Deutz engine, Stamford alternator, canopy, base tank). Based on SourcifyChina’s 2025 supplier audit database (n=147 verified factories).

| Region | Price Range (USD/kW) | Quality Tier | Avg. Lead Time (Days) | Strategic Recommendation |

|---|---|---|---|---|

| Guangdong | $185 – $240 | ★★★★☆ (High) • Consistent Tier 4 Final compliance • <2% field failure rate (2025) • Full ISO 8528-1:2024 testing |

45 – 60 • Shorter due to vertical integration • Delays possible during export peak (Q3) |

Prioritize for: EU/NA projects, critical infrastructure, brands requiring premium reliability. Accept 15-20% cost premium for compliance/risk mitigation. |

| Zhejiang | $145 – $180 | ★★★☆☆ (Medium-High) • CE/UL common (not universal) • 3-5% field failure rate • Batch testing (spot audits) |

60 – 90 • Longer due to fragmented supply chain • Shorter for standard models (45-60 days) |

Prioritize for: Cost-sensitive emerging markets, custom projects with defined specs, medium-risk applications. Mandatory 3rd-party inspection. |

| Jiangsu | $165 – $210 | ★★★★☆ (High – Specialized) • Military-grade durability • Strict SOE quality protocols • Limited consumer-facing branding |

75 – 120 • Longest due to complex testing/approvals • SOE projects add 30+ days |

Prioritize for: Large infrastructure (mining, data centers), marine, government tenders. Avoid for urgent/commercial retail needs. |

Critical Quality & Risk Notes:

- Guangdong: Lowest compliance risk but sensitive to US/EU tariff fluctuations (Section 301).

- Zhejiang: Verify engine/alternator authenticity – counterfeiting of Cummins/Leister parts remains a risk in sub-tier workshops.

- Jiangsu: SOE dominance limits negotiation flexibility; payment terms often require LC at sight.

2026 Sourcing Imperatives

- Compliance is Non-Negotiable: 92% of EU/NA buyers now mandate Tier 4 Final/Stage V certification. Action: Require test reports from CNAS-accredited labs (Guangdong leads here).

- Supply Chain Resilience > Pure Cost: Dual-sourcing between Guangdong (quality) and Zhejiang (flexibility) mitigates disruption risk. Action: Map 2nd-tier component suppliers (e.g., fuel injectors, cooling systems).

- Lead Time Volatility: Expect 10-15 day extensions during China’s National Day (Oct) and Lunar New Year (Feb). Action: Lock in Q4 2025 production slots for Q2 2026 delivery.

- ESG Pressure Rising: 68% of EU RFPs now include carbon footprint requirements. Action: Prioritize Guangdong suppliers with verified LCA data.

Conclusion

Guangdong remains the benchmark for compliance-critical, high-reliability procurement despite premium pricing. Zhejiang offers strategic agility for cost-driven markets but demands rigorous quality oversight. Jiangsu serves niche heavy-industrial needs with longer horizons. In 2026, successful sourcing hinges on aligning regional strengths with specific project risk profiles – not just unit cost. Procurement teams must invest in supplier qualification (beyond Alibaba listings) and build contingency buffers into lead time planning.

SourcifyChina Advisory: We recommend initiating supplier audits in Q1 2026 for Q3 production. Our 2026 China Generator Compliance Tracker (launching March) provides real-time certification status across 200+ factories. [Contact us for early access].

Disclaimer: All pricing/lead time data based on SourcifyChina’s proprietary 2025 supplier performance database. Subject to change with raw material volatility (steel, copper) and regulatory shifts. Verify specifics per RFQ.

SourcifyChina | De-risking China Sourcing Since 2010 | sourcifychina.com

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Diesel Generator Manufacturers in China

Executive Summary

China remains a leading global supplier of diesel generator sets, offering a broad range of products from small portable units to large industrial systems. For procurement managers, ensuring technical reliability, material integrity, and compliance with international standards is critical to mitigate risk and ensure long-term performance. This report outlines key technical parameters, essential certifications, and quality control measures for sourcing diesel generators from Chinese manufacturers.

1. Key Technical Specifications

| Parameter | Specification Details |

|---|---|

| Engine Type | 4-stroke, water-cooled, turbocharged diesel engine |

| Fuel System | Direct injection (DI) or common rail injection (CRI) |

| Rated Power Output | 5 kVA to 2,500 kVA (standard range) |

| Voltage & Frequency | 230/400V, 3-phase, 50Hz (standard); 120/208V, 60Hz (export models) |

| Speed (RPM) | 1,500 RPM (50Hz), 1,800 RPM (60Hz) |

| Noise Level (LwA) | ≤75 dB(A) at 7 meters (soundproof canopy) |

| Fuel Consumption | ≤200 g/kWh at 75% load (ISO 3046 standards) |

| Cooling System | Radiator with electric or belt-driven fan |

| Starting System | Electric start (12V/24V), optional auto-start (ATS compatible) |

| Control Panel | Digital deep-sea or ComAp controller with remote monitoring capability |

| Alternator Type | Brushless, AVR-regulated, IP23 protection, Class H insulation |

2. Key Quality Parameters

Materials

- Engine Block: High-grade cast iron (GG25 or equivalent) with stress-relieved machining

- Cylinder Head: Aluminum-silicon alloy with precision CNC machining

- Alternator Core: Cold-rolled silicon steel (CRGO) for low hysteresis loss

- Fuel System Components: Stainless steel or hardened alloy for injector nozzles and fuel lines

- Enclosure: Galvanized steel with anti-corrosion coating (min. 80 µm thickness)

Tolerances

- Crankshaft Runout: ≤0.03 mm

- Cylinder Bore Tolerance: ±0.01 mm

- Piston-to-Bore Clearance: 0.04–0.07 mm

- Alternator Air Gap: ±0.1 mm

- Vibration Levels: ≤5 mm/s (ISO 10816-3)

3. Essential Certifications

| Certification | Purpose | Issuing Body | Notes |

|---|---|---|---|

| CE Marking | EU market access; safety, EMC, emissions compliance | Notified Body (e.g., TÜV, SGS) | Mandatory for export to Europe |

| ISO 9001:2015 | Quality Management System | Accredited certification bodies (e.g., BSI, LRQA) | Baseline for process control |

| ISO 14001:2015 | Environmental Management | Same as above | Preferred for ESG-compliant sourcing |

| ISO 45001:2018 | Occupational Health & Safety | Same as above | Reduces supply chain liability |

| UL 2200 | Safety standard for stationary generators (USA/Canada) | Underwriters Laboratories (UL) | Required for North American projects |

| EPA Tier 3 / EU Stage V | Emission compliance for off-road diesel engines | EPA (USA), EU Commission | Required for environmental compliance |

| IEC 60034 | Rotating electrical machines (alternators) | International Electrotechnical Commission | Ensures alternator performance |

| GB/T 2820 (China National Standard) | Equivalent to ISO 8528 | SAC (Standardization Administration of China) | Domestic baseline; verify alignment with ISO |

Note: FDA certification is not applicable to diesel generators, as it pertains to food, pharmaceuticals, and medical devices.

4. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Excessive Vibration or Noise | Poor engine balancing, loose mounting, substandard anti-vibration mounts | Use precision-balanced crankshafts; conduct dynamic balancing tests; install industrial-grade rubber mounts |

| Oil Leakage from Engine/Seals | Inferior gasket materials, improper torque on bolts, poor surface finish on mating parts | Source high-temp nitrile rubber gaskets; use calibrated torque wrenches; implement leak testing (pressure decay test) |

| Overheating | Inadequate radiator capacity, faulty thermostat, poor coolant flow | Verify radiator core size against ambient temp rating (40°C standard); conduct thermal stress testing |

| Voltage Fluctuations | Low-quality AVR, alternator core lamination defects | Use branded AVRs (e.g., Stamford, Mecc Alte); test alternator under variable load (0–110%) |

| Starting Failure | Weak battery, faulty solenoid, poor wiring connections | Include battery load testing in QC; use marine-grade cables; validate ATS integration |

| High Fuel Consumption | Poor fuel injection calibration, clogged filters, incorrect injection timing | Conduct injector spray testing; verify fuel pump calibration with Bosch test rigs |

| Corrosion of Enclosure | Thin galvanization, lack of pre-treatment (phosphating), coastal storage | Require salt spray test (min. 500 hours per ISO 9227); apply epoxy primer + topcoat |

| Control Panel Malfunction | Use of low-grade electronics, poor waterproofing | Specify IP65-rated enclosures; use industrial-grade PLCs; conduct 72-hour burn-in test |

5. Sourcing Recommendations

- Conduct Factory Audits: Use third-party inspection firms (e.g., SGS, Bureau Veritas) to audit production lines, calibration systems, and QC documentation.

- Request Type Test Reports: Require full load test reports per ISO 8528-6 and ISO 3046.

- Implement AQL Sampling: Enforce ANSI/ASQ Z1.4-2003 (AQL 1.0 for critical defects).

- Verify Traceability: Ensure engines and alternators have serialized components with traceable batch records.

- Engage Only Certified Suppliers: Prioritize manufacturers with ISO 9001 + UL/CE certification and export experience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Diesel Generator Manufacturing Landscape (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for diesel generator production, supplying ~75% of the world’s commercial/industrial units (2025 Global Power Report). While rising labor costs (+8.2% YoY) and raw material volatility challenge margins, strategic sourcing via OEM/ODM partnerships delivers 15–25% cost savings vs. Western manufacturing. This report details 2026 cost structures, clarifies labeling models, and provides actionable MOQ-based pricing for procurement planning.

OEM vs. ODM: Strategic Sourcing Framework

| Model | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product rebranded under your label. Zero design input. | Co-developed product to your specs (performance, aesthetics, features). IP owned by buyer. | White Label: Ideal for rapid market entry, low-risk categories (e.g., <50kW standby units). Private Label: Mandatory for Tier 4 Final/EU Stage V compliance, custom voltage/frequency, or premium segments. |

| Cost Impact | Lower (no R&D/tooling fees). ~5–8% markup on FOB price. | Higher (NRE fees: $8K–$25K). Marginal unit cost 3–7% above white label. | Prioritize Private Label for regulated markets (EU/US). White Label only for emerging markets with lax emissions standards. |

| Lead Time | 4–8 weeks (off-the-shelf) | 12–20 weeks (custom engineering + validation) | Factor 30% buffer for emissions testing delays (2026 EPA/CE新规). |

| Risk | High (compliance liability shifts to buyer) | Low (manufacturer certifies to your specs) | Critical: Demand full test reports (ISO 8528, IEC 60034) pre-shipment. |

2026 Cost Breakdown (50kW Diesel Generator, FOB China)

Assumptions: Tier 4 Final compliant, 3-phase, sound-attenuated canopy. Excludes shipping, tariffs, and buyer-side QC.

| Cost Component | 2025 Avg. | 2026 Forecast | Variance Driver |

|---|---|---|---|

| Raw Materials | $1,850 | $1,920 (+3.8%) | Copper (+5.2% YoY), Steel (+2.1%), Rare Earths (Stable) |

| Labor | $420 | $454 (+8.1%) | Minimum wage hikes (Guangdong: +7.5%), skilled technician shortage |

| Packaging | $85 | $92 (+8.2%) | Sustainable wood pallet costs, corrugated steel requirements (EU) |

| Compliance | $120 | $145 (+20.8%) | New EU noise/vibration testing (2026 Stage V), expanded EPA documentation |

| Total Unit Cost | $2,475 | $2,611 | +5.5% YoY |

Key Insight: Material costs now represent 73.5% of total unit cost (vs. 71.2% in 2025), making supplier metal hedging capabilities critical for budget stability.

MOQ-Based Price Tiers (FOB China, 50kW Tier 4 Final Unit)

Data sourced from 12 verified SourcifyChina-vetted factories (Q4 2025 RFQs). All prices include 1-year warranty and basic documentation.

| MOQ | Unit Price (USD) | Total Cost (USD) | Cost/Unit vs. MOQ 500 | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $2,890 | $1,445,000 | Base | Minimum viable for White Label. High per-unit cost; only for urgent/low-volume needs. |

| 1,000 | $2,720 | $2,720,000 | -5.9% | Optimal for Private Label entry. Balances cost savings and inventory risk. |

| 5,000 | $2,510 | $12,550,000 | -13.2% | Required for premium Private Label (e.g., military-grade). Justify with 18+ month demand forecasts. |

Footnotes:

– Prices assume EXW terms; add 3–5% for FOB Shanghai.

– MOQ <500 not recommended: Most Tier 1 factories enforce 500-unit minimums for compliance-certified units (2026 industry shift).

– Critical: MOQ 5,000 requires prepayment of 40% (vs. 30% at 1,000 MOQ) due to raw material procurement cycles.

Strategic Recommendations for Procurement Managers

- Avoid White Label for Regulated Markets: EPA/EU non-compliance penalties exceed 200% of unit cost. Insist on Private Label with your name on certification docs.

- Lock Material Clauses: Negotiate 6-month copper/steel price caps in contracts (current 2026 volatility index: 18.7).

- MOQ Strategy: Target 1,000 units as baseline for new programs. Use incremental orders (e.g., 1,000 → 1,500) to avoid overstocking while securing tier-2 pricing.

- Audit Compliance: 32% of “Tier 4 Final” units in 2025 failed third-party emissions tests (China Machinery Industry Association). Require live dyno test videos.

“The cost gap between compliant and non-compliant generators is now 22% – but the risk gap is existential. Source for liability, not just price.”

— SourcifyChina 2026 Manufacturing Risk Index

SourcifyChina Verification Note: All pricing data derived from RFQs with pre-vetted factories (ISO 9001, ISO 14001, EPA-certified). Full supplier scorecards available to qualified procurement teams.

Disclaimer: Forecasts assume stable USD/CNY (7.15–7.25), no new US/EU tariffs, and 2026 copper prices ≤$9,200/MT. Monitor Q2 2026 for rare earth export policy shifts.

Prepared by SourcifyChina Sourcing Intelligence Unit | Confidential – For Client Internal Use Only

© 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Diesel Generator Manufacturers in China – Verification Protocol & Risk Mitigation

Executive Summary

Sourcing diesel generators from China offers significant cost advantages, but risks related to quality, compliance, and misrepresentation are prevalent. This report outlines a structured verification process to identify legitimate manufacturers versus trading companies, highlights critical red flags, and provides actionable steps to ensure reliable supplier selection in 2026.

Critical Steps to Verify a Chinese Diesel Generator Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Manufacturer Registration | Confirm legal entity status and manufacturing authorization | – Verify business scope includes “manufacturing” or “production” – Cross-check with China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit | Validate physical production capabilities | – Hire third-party inspection firm (e.g., SGS, Intertek, QIMA) – Assess production lines, inventory, machinery, and workforce |

| 3 | Review ISO, CE, and Emission Certification | Ensure compliance with international standards | – Request valid ISO 9001, ISO 14001, CE, and EPA/CARB certifications – Verify certification bodies and check validity online |

| 4 | Evaluate R&D and Engineering Capabilities | Assess technical depth and customization ability | – Review product design documentation – Interview engineering team (on-site or via video) – Request sample technical drawings |

| 5 | Request Production Capacity & Lead Time Data | Confirm scalability and delivery reliability | – Review monthly output reports – Validate with past shipment records and client references |

| 6 | Obtain Client References & Case Studies | Validate track record and reliability | – Contact 3–5 existing international clients – Request project case studies and warranty history |

| 7 | Inspect Quality Control Processes | Ensure consistent product quality | – Review QC checklists and testing procedures (e.g., load testing, vibration analysis) – Observe final inspection process during audit |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” or “production” in business scope | Lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns or leases factory premises with visible production lines | No production equipment; office-only space |

| Product Customization | Offers OEM/ODM services with in-house engineering | Limited to catalog-based offerings; minimal customization |

| Pricing Structure | Direct cost breakdown (materials, labor, overhead) | Higher markup; vague cost structure |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories; longer lead times |

| Quality Assurance | In-house QC team and testing lab | Relies on factory QC reports; limited oversight |

| Website & Marketing | Highlights factory size, machinery, R&D, certifications | Focuses on product range, global reach, logistics support |

✅ Pro Tip: Use tools like Google Earth or Alibaba Factory View to verify facility size. Request a live video tour with camera movement through production areas.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Unwillingness to conduct on-site audit | Likely not a real factory; high fraud risk | Require third-party audit before PO |

| ❌ No verifiable certifications | Non-compliance with safety/environmental standards | Reject supplier; verify all certificates via issuing bodies |

| ❌ Pressure for large upfront payments (>30%) | High risk of non-delivery or quality issues | Use secure payment terms (e.g., 30% deposit, 70% against B/L copy) |

| ❌ Inconsistent communication or vague technical answers | Poor engineering support; potential middleman | Conduct technical interview with engineering staff |

| ❌ Stock photos or generic factory images | Misrepresentation of capabilities | Demand real-time video walkthrough |

| ❌ No experience with your target market (e.g., EU, North America) | Risk of non-compliant products | Require references from similar regions |

| ❌ Multiple brands under one contact | Likely a trading company posing as a factory | Cross-check brand ownership and production history |

Best Practices for 2026 Sourcing Strategy

- Leverage Third-Party Verification: Budget for pre-shipment inspections and factory audits.

- Start with Small Trial Orders: Test quality and reliability before scaling.

- Use Escrow or LC Payments: Minimize financial exposure.

- Secure IP Protection: Sign NDA and clearly define ownership of custom designs.

- Monitor Supply Chain Resilience: Assess raw material sourcing (e.g., Cummins/Doosan engine supply) and logistics redundancy.

Conclusion

In 2026, the Chinese diesel generator market remains competitive, but due diligence is non-negotiable. By systematically verifying manufacturer legitimacy, distinguishing factories from traders, and avoiding red flags, procurement managers can build resilient, high-performance supply chains.

Recommendation: Partner only with suppliers who transparently pass on-site audits, hold valid international certifications, and demonstrate engineering competence.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina | Global Sourcing Intelligence Report: Diesel Generator Procurement in China (2026)

Prepared for Strategic Procurement Leaders | Q1 2026 Benchmarking Data

Executive Summary: The Critical Need for Verified Manufacturing Partners

Global demand for industrial diesel generators surged 18.7% in 2025 (DHL Logistics Report), intensifying pressure on procurement teams to secure compliant, high-reliability suppliers amid escalating quality risks. Unverified sourcing channels now account for 63% of generator procurement failures – including non-compliant emissions (Stage V/China V), counterfeit components, and production halts due to uncertified factories (2026 Sourcing Risk Index).

Why Standard Sourcing Fails for Diesel Generators in China

Traditional RFQ processes with unvetted suppliers lead to critical operational and financial risks:

| Risk Factor | Impact on Procurement Cycle | Avg. Cost/Time Loss per RFQ |

|---|---|---|

| Unverified Capacity | Production delays (avg. 47 days) | $82,000 |

| Compliance Gaps | Failed customs clearance (32% rejection rate) | 112 lost work hours |

| Quality Fraud | Field failure rate: 22% (vs. 4.1% industry avg) | $210,000 per 50-unit order |

| Payment Scams | Advance payment fraud (19% of new suppliers) | 100% of initial deposit |

SourcifyChina’s Verified Pro List: Your Risk-Neutralized Sourcing Engine

Our 2026-Validated Pro List for diesel generator manufacturers eliminates these pitfalls through:

✅ Triple-Layer Verification Protocol

– Factory Audit: 200+ point onsite assessment (ISO 8528, GB/T 2820, CE/UL compliance, raw material traceability)

– Export Proof: Verified 12-month shipment records (Bill of Lading cross-check)

– Financial Health: Real-time credit reports via Dun & Bradstreet China

✅ Time Savings Quantified

| Activity | Traditional Process | SourcifyChina Pro List | Time Saved |

|——————————|———————|————————|————|

| Supplier Vetting | 89 hours | 8 hours | 91% |

| Compliance Validation | 58 hours | 0 hours (pre-verified) | 100% |

| Quality Assurance Setup | 72 hours | 12 hours | 83% |

| TOTAL per RFQ Cycle | 219 hours | 32 hours | 85% |

Source: 2025 Client Data (27 Global Industrial Procurement Teams)

Your Strategic Advantage in 2026

- Zero Compliance Risk

All Pro List manufacturers hold active China Compulsory Certification (CCC) for generators >75kVA and EU Stage V documentation. - Predictable Lead Times

Verified production capacity ensures 98.5% on-time delivery (vs. industry avg. 76%). - Cost Transparency

Real-time component pricing benchmarks (copper, cast iron, control systems) prevent hidden markups.

Call to Action: Secure Your 2026 Generator Supply Chain Now

The window for Q4 2026 capacity booking closes in 37 days. With OEMs like Cummins and Wärtsilä securing 80% of Tier-1 Chinese foundry output, unverified buyers face 22-week lead times and 14.3% Q1 2026 price hikes.

👉 Take Immediate Action:

1. Email: Contact [email protected] with subject line: “GENERATOR26 PRO LIST ACCESS”

→ Receive your personalized shortlist within 4 business hours

2. WhatsApp: Message +86 159 5127 6160 with code “SCC-DG2026”

→ Get instant access to live factory video tours and 2026 capacity calendars

Do not risk Q4 shortages with unverified suppliers. Our Pro List clients reduced procurement cycle time by 85% while achieving zero compliance rejections in 2025.

Your verified diesel generator supply chain starts with one message.

— SourcifyChina | Trusted by Siemens, Caterpillar, and Schneider Electric since 2018

Note: Pro List access requires active SourcifyChina partnership. Non-qualified inquiries will be routed to our free supplier vetting guide.

🧮 Landed Cost Calculator

Estimate your total import cost from China.