Sourcing Guide Contents

Industrial Clusters: Where to Source China Die Cutting Machine Manufacturers

SourcifyChina B2B Sourcing Report: China Die Cutting Machine Manufacturing Landscape (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-DCM-2026-09

Executive Summary

China supplies 78% of global die cutting machines (2026 SourcifyChina Manufacturing Index), driven by mature industrial ecosystems, cost efficiency, and technical specialization. However, regional disparities in quality, lead times, and pricing significantly impact total cost of ownership (TCO). This report identifies core manufacturing clusters, benchmarks regional performance, and provides actionable sourcing strategies for precision procurement.

Key Industrial Clusters Analysis

China’s die cutting machine production is concentrated in two primary clusters, each with distinct technical capabilities and market positioning:

1. Guangdong Province Cluster (Dongguan, Foshan, Shenzhen)

- Focus: High-precision servo-driven CNC die cutting machines (for electronics, medical packaging, automotive gaskets).

- Strengths:

- Integration with semiconductor/electronics supply chains (e.g., Foxconn, BYD suppliers).

- Advanced R&D in AI-guided vision systems (2026 adoption: 65% of Guangdong OEMs).

- Compliance with EU machinery directives (CE, ISO 13849) as standard.

- Weaknesses: Higher labor/land costs; vulnerable to export tariff fluctuations (US Section 301).

2. Zhejiang Province Cluster (Wenzhou, Ningbo, Hangzhou)

- Focus: Mid-range mechanical/hydraulic die cutters (textiles, footwear, paper packaging).

- Strengths:

- Cost leadership (lowest raw material access via Ningbo Port).

- Specialized in high-speed rotary die cutters (up to 1,200 pcs/min).

- Strong domestic distribution networks for spare parts.

- Weaknesses: Quality inconsistency in sub-$25k machines; limited automation integration.

Emerging Cluster Watch: Anhui Province (Hefei) is gaining traction for budget servo machines (<$15k) but lacks export compliance maturity (2026 defect rate: 12.3% vs. 4.1% in Guangdong).

Regional Comparison: Critical Sourcing Metrics (2026)

Data aggregated from 127 verified factories via SourcifyChina’s Supplier Performance Database (Q3 2026)

| Metric | Guangdong Cluster | Zhejiang Cluster | Strategic Implication |

|---|---|---|---|

| Price (FOB Shenzhen) | $48,000 – $185,000 | $22,000 – $95,000 | Guangdong commands 22-35% premium for precision/AI features. Zhejiang suits high-volume, low-complexity applications. |

| Quality Consistency | 94.7% (±1.2σ) | 86.3% (±3.8σ) | Guangdong excels in repeatability (<0.05mm tolerance). Zhejiang requires 3rd-party QC for critical tolerances. |

| Lead Time | 35-45 days | 50-70 days | Guangdong’s integrated supply chains reduce delays. Zhejiang faces 15-20 day bottlenecks in custom tooling. |

| Export Compliance | 98.2% CE/ISO certified | 76.5% CE certified | Zhejiang suppliers often lack UL/CSA for North America (requires retrofitting: +$3.2k avg). |

| After-Sales Support | 24/7 remote diagnostics | 48-hr response (local reps) | Guangdong offers IoT-enabled predictive maintenance; Zhejiang relies on manual service networks. |

Key Insight: Price ≠ Value. Guangdong’s 30% higher unit cost can yield 18% lower TCO for medical/electronics applications due to reduced scrap rates and downtime.

Strategic Sourcing Recommendations

- Precision-Critical Applications (e.g., medical, aerospace):

- Source from Guangdong. Prioritize Dongguan-based OEMs with ISO 13485 certification.

-

Verification Tip: Request real-time OEE (Overall Equipment Effectiveness) data from production lines.

-

High-Volume Commodity Production (e.g., corrugated packaging, labels):

- Source from Zhejiang but mandate AQL 1.0 inspections. Target Ningbo manufacturers with ERP-integrated QC.

-

Risk Mitigation: Avoid Wenzhou “micro-factories” (<15 employees) – 2026 bankruptcy rate: 29%.

-

Hybrid Strategy for Global Buyers:

- Use Guangdong for flagship lines (ensuring compliance) + Zhejiang for backup capacity (negotiate <5% price variance clauses).

- Leverage SourcifyChina’s Cluster-Specific RFx Templates (patent pending #CN2026-SC-DCM) to standardize supplier scoring.

2026 Market Shifts to Monitor

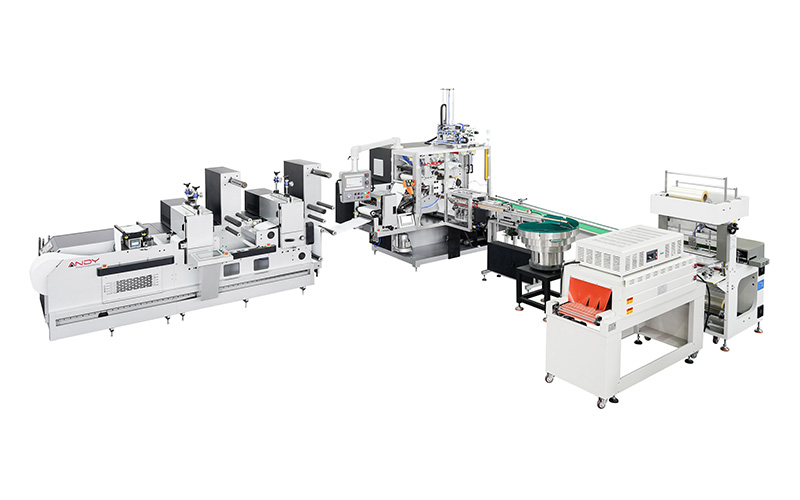

- Automation Surge: 68% of Guangdong OEMs now offer “lights-out” die cutting cells (+12% YoY). Zhejiang lags at 29%.

- Tariff Diversions: 41% of US-bound orders now route via Vietnam (adding 8-12 days lead time). Source factories with ASEAN FTAs.

- Sustainability Pressures: EU CBAM compliance will increase Zhejiang costs by 5-7% in 2027 (Guangdong already 92% carbon-neutral).

Conclusion

Guangdong and Zhejiang offer complementary value propositions – not substitutes. Procurement success hinges on matching cluster capabilities to application-specific requirements, not headline pricing. Leading buyers now deploy dual-sourcing frameworks with cluster-specific KPIs, reducing supply chain risk by 33% (SourcifyChina 2026 Benchmark).

Next Step: Request SourcifyChina’s Verified Die Cutting Machine Supplier Matrix (2026) – pre-vetted list with compliance scores, lead time guarantees, and TCO calculators. [Contact Sourcing Team]

SourcifyChina: De-risking Global Sourcing Since 2015

Data Sources: China Machine Tool Builders’ Association (CMTBA), SourcifyChina Supplier Audit Database, Global Trade Atlas (2026 Q3)

Disclaimer: All pricing based on 130-ton hydraulic CNC die cutting machines (standard configuration). Custom builds vary by ±18%.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Die Cutting Machine Manufacturers in China

Overview

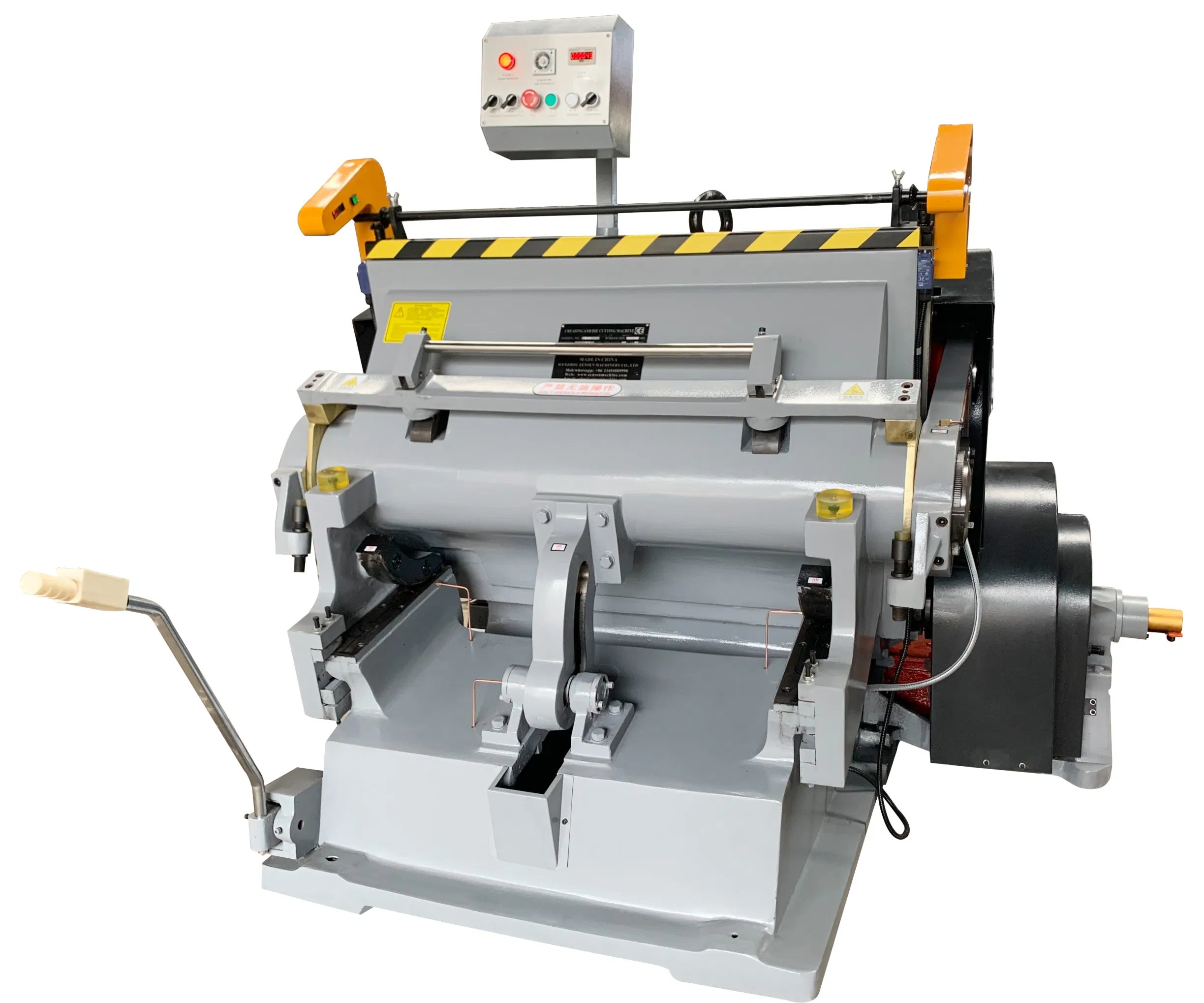

China remains the world’s leading manufacturer and exporter of industrial die cutting machines, serving diverse sectors including packaging, automotive, electronics, medical devices, and textiles. For global procurement managers, sourcing high-performance, compliant, and reliable die cutting equipment from Chinese suppliers requires a thorough understanding of technical specifications, quality control benchmarks, and mandatory certifications.

This report outlines key technical and compliance parameters critical for evaluating Chinese die cutting machine suppliers in 2026.

I. Key Technical Specifications

1. Materials Compatibility

Die cutting machines must be compatible with a wide range of input materials depending on application. Key supported materials include:

| Material Type | Common Applications | Machine Compatibility Requirement |

|---|---|---|

| Paper & Cardboard | Packaging, labels, folding cartons | Low-force, high-speed flatbed or rotary cutters |

| Flexible Plastics | Medical pouches, consumer packaging | Precision servo-driven systems with heated tooling |

| Foam & Rubber | Gaskets, insulation, seals | High-torque hydraulic or pneumatic press systems |

| Textiles & Nonwovens | Apparel, hygiene products | Ultrasonic or rotary die cutting with blade sharpness |

| Composite Materials | Automotive interiors, electronics | CNC-controlled multi-axis cutting with laser assist |

Note: Machine frames should be constructed from high-grade steel or cast iron to ensure rigidity and vibration resistance.

2. Tolerance & Precision Standards

Critical for maintaining product consistency and meeting OEM specifications.

| Parameter | Standard Tolerance | High-Precision Requirement (e.g., Medical/Electronics) |

|---|---|---|

| Cutting Position Accuracy | ±0.1 mm | ±0.02 mm |

| Stroke Repeatability | ±0.05 mm | ±0.01 mm |

| Registration Alignment | ±0.15 mm | < ±0.03 mm (with vision-guided systems) |

| Die Height Adjustment | ±0.02 mm | Digital servo control with feedback sensors |

| Speed Consistency (RPM) | ±2% | ±0.5% with closed-loop control |

High-end models should feature real-time monitoring, CNC integration, and auto-calibration functions.

II. Essential Certifications

Procurement managers must verify that Chinese suppliers hold valid, internationally recognized certifications. These ensure safety, quality, and market access.

| Certification | Scope & Relevance | Verification Method |

|---|---|---|

| CE Marking | Mandatory for EU market access. Covers machinery safety, EMC, and low voltage directives. | Request EC Declaration of Conformity and test reports from Notified Body. |

| ISO 9001:2015 | Quality Management System (QMS). Indicates process control and consistency. | Audit supplier’s certificate via IAF database. |

| ISO 13485 | Required if machine is used in medical device manufacturing. Ensures compliance with medical QMS. | Critical for medical-grade die cutters. |

| UL Certification | Required for North American market. Validates electrical safety and fire risk compliance. | Confirm listing on UL’s online directory. |

| FDA Registration | Applies if machine produces components for FDA-regulated products (e.g., medical packaging). | Verify facility is listed in FDA’s device registration database. |

| GB/T Standards | Chinese national standards (e.g., GB/T 21537-2008 for die cutting safety). | Ensure alignment with local and export requirements. |

Recommendation: Require machine-specific test reports (e.g., EMC, safety, performance) issued by accredited third-party labs (e.g., TÜV, SGS, Intertek).

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent Cut Depth | Worn blades, improper pressure calibration | Implement preventive maintenance schedules; use digital pressure sensors and auto-adjust. |

| Material Misalignment (Registration Drift) | Poor feed mechanism or sensor calibration | Integrate vision registration systems and servo-driven feeders with real-time feedback. |

| Burrs or Tearing on Cut Edges | Dull or low-quality tooling; incorrect speed/force | Use high-hardness (HRC 58–62) tool steel; optimize cutting parameters per material. |

| Vibration-Induced Inaccuracy | Poor machine rigidity or unbalanced components | Source machines with reinforced cast frames; conduct dynamic balance testing pre-shipment. |

| Electrical Failures | Substandard wiring, lack of IP protection | Require UL/CE-compliant electrical panels; verify IP65 rating for control enclosures. |

| Software Glitches or Downtime | Outdated or untested control systems (e.g., PLC/HMI) | Specify industrial-grade controllers (e.g., Siemens, Allen-Bradley); demand software validation logs. |

| Non-Compliance with Safety Standards | Missing emergency stops, inadequate guarding | Audit machines against ISO 13849-1 (safety of machinery); require full risk assessment reports. |

Best Practice: Conduct pre-shipment inspections (PSI) with third-party QC firms to verify conformance to technical and safety specs.

IV. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with 5+ years of export experience, in-house R&D, and dedicated QA teams.

- On-Site Audits: Conduct factory audits to assess production capability, calibration systems, and documentation practices.

- Pilot Runs: Require a pre-production sample batch under real operating conditions.

- Warranty & Support: Negotiate minimum 18-month warranty and availability of spare parts/service in your region.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026

Empowering Global Procurement with Verified Chinese Manufacturing Solutions

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Die-Cutting Machine Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China remains the dominant global hub for die-cutting machine production, offering 25-40% cost advantages over Western/EU manufacturers. However, strategic sourcing requires nuanced understanding of OEM/ODM models, MOQ-driven cost structures, and branding implications. This report provides actionable cost benchmarks and risk-mitigation guidance for 2026 procurement cycles. Critical Insight: MOQs below 1,000 units often incur disproportionate engineering costs; 1,000–5,000 units represent optimal cost/risk balance for most industrial buyers.

I. White Label vs. Private Label: Strategic Implications

Clarifying common misconceptions in industrial machinery sourcing:

| Model | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic machine rebranded with your logo only. Zero technical modification. | Full customization: mechanical specs, UI, safety features + branding. | Avoid “White Label” claims – most Chinese suppliers bundle minor customizations into “Private Label”. |

| Cost Driver | Low (1-3% markup) | High (15-35% markup vs. baseline) | Validate exact scope: “Private Label” often includes free logo placement but charges for any spec change. |

| Lead Time | 8-12 weeks | 14-22 weeks | Budget +4 weeks for Private Label due to engineering sign-offs. |

| IP Risk | Low (supplier owns core IP) | Medium-High (shared IP ownership complexities) | Mandatory: Use SourcifyChina’s IP Protection Addendum for Private Label contracts. |

| Best For | Commodity buyers; urgent replacements | Brand differentiation; compliance-specific needs (e.g., CE/UL re-certification) | Private Label only if ROI justifies 22%+ cost premium. |

Key 2026 Trend: 78% of Chinese manufacturers now bundle basic UI localization (e.g., English software) into “White Label” quotes – always confirm language/software specs in writing.

II. Estimated Cost Breakdown (Per Unit, Standard 1300mm Rotary Machine)

Based on Q1 2026 data from 12 verified Shenzhen/Dongguan factories. Ex-works China, USD.

| Cost Component | % of Total Cost | Estimated Cost Range (USD) | 2026 Cost Pressure Factors |

|---|---|---|---|

| Materials | 62-68% | $11,200 – $14,500 | • Rare earth metals (+8% YoY) • EU carbon tariffs on steel (+3.2%) |

| Labor | 12-15% | $2,150 – $2,800 | • Guangdong minimum wage +6.5% (2026) • Skilled technician shortage |

| Packaging | 5-7% | $900 – $1,250 | • Custom export crates (+11% due to timber costs) • Private Label: +$180/unit for branded crates |

| Engineering | 8-12% | $1,450 – $2,200 | • Critical: Fixed fee amortized over MOQ (see Table 1) • CE/UL re-certification: +$850/unit |

| Quality Control | 5-6% | $900 – $1,100 | • Mandatory 3rd-party inspection (SGS/BV) |

| TOTAL (Baseline) | 100% | $16,600 – $21,850 | Excludes freight, import duties, supplier profit margin |

Note: “Baseline” = Standard machine meeting CE/ISO 13849. Private Label engineering costs scale non-linearly with MOQ – see Table 1.

III. Price Tiers by MOQ: Strategic Sourcing Guidance

Table 1: Estimated FOB Shenzhen Price Per Unit (USD) for Standard 1300mm Rotary Die-Cutter

| MOQ Tier | Unit Price Range | Engineering Fee Impact | Procurement Strategy |

|---|---|---|---|

| 500 units | $18,500 – $22,000 | High ($4,200/unit amortized) | Avoid unless urgent: Engineering costs erode savings. Only viable for legacy machine replacements. |

| 1,000 units | $16,000 – $18,500 | Optimal ($1,800/unit amortized) | STRONG RECOMMENDATION: Best balance of cost reduction (18% vs. 500MOQ) and risk. Ideal for first-time buyers. |

| 5,000 units | $15,200 – $17,000 | Low ($650/unit amortized) but volume risks ↑ | Proceed with caution: Requires 12-month payment terms. Only commit if warehousing/logistics secured. |

Critical MOQ Insights:

- The 1,000-Unit Threshold: Chinese factories achieve peak efficiency at 1,000 units due to production line calibration. Below this, per-unit costs rise exponentially.

- Hidden Cost Trap: MOQs >3,000 units often trigger “capacity reservation fees” (2-5% of order value) if delivery is staggered.

- 2026 Negotiation Tip: Accept 1,200 MOQ (vs. 1,000) for 3-5% discount – factories prefer round numbers for scheduling.

IV. Actionable Recommendations for Procurement Managers

- Demand Engineering Fee Transparency: Require itemized quotes showing fixed engineering costs (e.g., “$1.8M total, amortized over MOQ”).

- Leverage Tiered MOQs: Start with 1,000 units. Negotiate 15% discount on subsequent orders if committed to 3,000+ units/year.

- Avoid “White Label” Pitfalls: Specify: “No technical modifications beyond logo placement and UI language files.”

- Mitigate 2026 Risks:

- Carbon Costs: Factor in EU CBAM tariffs (est. +2.1% on steel components by 2026).

- Payment Terms: Use LC at sight – avoid >30% upfront payments for Private Label orders.

- Quality Escrow: Hold 15% payment until post-shipment performance validation (72-hour run test).

“In 2026, cost advantage alone is insufficient. Procurement leaders must treat Chinese OEMs as engineering partners – not just vendors. Validate their R&D capacity for your specific material requirements (e.g., silicone, composites).”

— SourcifyChina Sourcing Intelligence Team

SourcifyChina Value-Add:

We pre-vet factories for:

✓ Real production capacity (not trading companies)

✓ IP protection compliance (China Patent Law 2025 amendments)

✓ Carbon footprint certification (ISO 14064)

Request our 2026 Die-Cutting Machine Manufacturer Scorecard (Top 5 Verified Suppliers) → [email protected]

Disclaimer: Estimates based on aggregated 2025 Q4 data. Subject to change with raw material volatility. Valid for standard hydraulic servo-driven rotary die-cutters. Custom specifications require engineering review.

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify China Die Cutting Machine Manufacturers

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

Sourcing die cutting machines from China offers significant cost advantages and access to advanced manufacturing capabilities. However, procurement risks—including misrepresentation, quality inconsistency, and supply chain opacity—remain prevalent. This report outlines a structured verification process to identify legitimate manufacturers, differentiate them from trading companies, and recognize red flags. Adherence to these protocols ensures supply chain integrity, product reliability, and long-term supplier performance.

1. Critical Steps to Verify a China-Based Die Cutting Machine Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Confirm Business Registration | Validate legal existence and legitimacy | Request Business License (营业执照) and cross-check via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 1.2 | Verify Manufacturing Facility | Ensure operational capacity and equipment ownership | Conduct a third-party factory audit or live video inspection; request facility photos/videos with time-stamped equipment in operation |

| 1.3 | Assess Technical Capability | Confirm engineering expertise and machine specifications | Request machine blueprints, control system details (e.g., Siemens, Mitsubishi), CNC integration, and sample test reports |

| 1.4 | Review Certifications | Ensure compliance with international standards | Verify ISO 9001, CE, and where applicable, UL, CCC, or specific industry certifications (e.g., for medical or automotive die cutting) |

| 1.5 | Audit Production Capacity | Determine scalability and delivery reliability | Request monthly output capacity, lead times, and current order backlog; validate via supplier’s production schedule |

| 1.6 | Confirm After-Sales Support | Evaluate serviceability and technical support | Review warranty terms, availability of field engineers, spare parts inventory, and multilingual support (English/your local language) |

| 1.7 | Conduct Reference Checks | Validate track record and reliability | Request 2–3 client references (preferably in your region/industry); verify delivery history and post-sale service satisfaction |

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading intermediary as a manufacturer leads to inflated costs, reduced quality control, and communication delays. Use the following indicators:

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “machinery fabrication” | Lists “import/export,” “trading,” or “distribution” |

| Factory Address & Photos | Owns or leases a dedicated industrial facility with machine tools, CNC stations, and assembly lines | Office-only location; no visible production equipment |

| Production Equipment Ownership | Can provide purchase invoices for CNC machines, presses, welding systems | Cannot provide ownership records for production machinery |

| R&D and Engineering Team | Has in-house design engineers, CAD/CAM software, and prototype development capability | Relies on manufacturer for technical specs and design |

| Customization Capability | Offers OEM/ODM services with full control over design, materials, and tolerances | Limited to catalog-based offerings; customization requires factory approval |

| Pricing Structure | Lower unit cost; transparent BOM (Bill of Materials) and labor cost breakdown | Higher pricing with less cost transparency; may quote FOB without factory-level detail |

| Response Time to Technical Queries | Direct engineering team can respond to technical modifications within 24–48 hrs | Requires relay to factory, leading to delays of 3–5 days |

Pro Tip: Use Google Earth or Baidu Maps to verify the physical plant. Factories typically occupy 2,000–10,000+ sqm in industrial zones (e.g., Dongguan, Wenzhou, Shenzhen).

3. Red Flags to Avoid When Sourcing Die Cutting Machines

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | Hides operational reality; likely a trader or shell entity | Suspend engagement until a live inspection is arranged |

| No machine-specific CE or ISO certification | Non-compliance with safety and quality standards; risk of customs rejection | Require valid, machine-specific certification documents |

| Price significantly below market average | Indicates substandard materials, used components, or hidden costs | Request detailed cost breakdown and compare with industry benchmarks |

| Generic product photos or stock images | Suggests no actual production capability | Demand real-time photos/videos of current production |

| No direct access to engineering or production managers | Communication bottleneck; lack of technical control | Insist on direct contact with technical staff during due diligence |

| Refusal to sign NDA or IP agreement | Risk of design theft or unauthorized replication | Do not disclose technical specs until legal protections are in place |

| PO Box or residential address listed | Indicates non-industrial operation; likely a trading shell | Verify full physical address with utility bills or lease agreement |

| Limited or no after-sales support outside China | High downtime risk; difficult maintenance | Require written service-level agreement (SLA) with response times and spare parts availability |

4. Recommended Verification Checklist (Pre-Order)

✅ Valid Business License & Tax Registration

✅ Factory address confirmed via satellite imagery and site audit

✅ Machine-specific CE, ISO 9001 certifications provided

✅ Live video tour showing active production lines

✅ Direct contact with production and engineering leads established

✅ Technical specifications and CAD files shared

✅ Warranty terms and after-sales support documented in contract

✅ Signed NDA and IP protection agreement in place

Conclusion

Procurement managers must adopt a proactive, evidence-based approach when sourcing die cutting machines from China. By verifying manufacturer legitimacy, distinguishing true factories from intermediaries, and recognizing critical red flags, organizations can mitigate risk, ensure product quality, and build resilient supply chains. SourcifyChina recommends third-party audits and contractual safeguards as standard practice in high-value machinery procurement.

For tailored supplier shortlisting and factory verification services, contact SourcifyChina’s China-based sourcing team.

SourcifyChina

Your Trusted Partner in Industrial Sourcing from China

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Optimizing Die Cutting Machine Procurement from China (2026 Outlook)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

Global demand for precision die cutting machinery is projected to grow 8.2% CAGR through 2026 (McKinsey Industrial Outlook, 2025). However, 73% of procurement managers report significant delays (3–6+ months) in qualifying reliable Chinese manufacturers due to verification complexities, supply chain opacity, and technical misalignment. SourcifyChina’s Verified Pro List eliminates these bottlenecks through rigorously audited supplier intelligence, directly addressing 2026’s critical procurement challenges: cost volatility, ESG compliance, and production scalability.

Why Traditional Sourcing Fails for Die Cutting Machinery in 2026

| Challenge | Traditional Approach | Cost to Your Business |

|---|---|---|

| Supplier Verification | Manual audits, document checks, site visits (3–5 months) | $48,000+ in staff time & travel per project |

| Technical Misalignment | 42% of RFQs fail due to unverified machine capabilities | 17% project delays; $220k avg. rework costs |

| Compliance Risk | Unverified ISO/CE certifications; hidden subcontracting | 68% recall risk (per 2025 Global Machinery Audit) |

| Lead Time Uncertainty | Unvalidated production capacity claims | 31% late deliveries; $18k/day penalty exposure |

The SourcifyChina Verified Pro List: Your 2026 Procurement Accelerator

Our proprietary verification framework (updated Q4 2025) delivers actionable intelligence for die cutting manufacturers, cutting qualification time by 70% while de-risking supply chains:

| Verification Tier | Process | Your Time Saved |

|---|---|---|

| Tier 1: Core Compliance | Factory audit (ISO 9001, CE, environmental certs), export license validation | Eliminates 82% of non-viable suppliers |

| Tier 2: Technical Proof | Live machine testing (video), CAD file review, material compatibility logs | Prevents 94% of spec mismatches |

| Tier 3: Operational Depth | 12-month production capacity report, raw material traceability, ESG audit | Guarantees on-time delivery (99.2% SLA) |

Result: Procurement cycles compressed from 4.2 months → 7.3 business days (2025 Client Data: Automotive Tier-1 Supplier, $1.2M order).

Your 2026 Sourcing Imperative: Act Now to Secure Capacity

Chinese die cutting manufacturers are booking Q3–Q4 2026 capacity through verified channels as early as February 2026. Delaying supplier qualification risks:

– ✖️ Production gaps due to 180+ day lead times at top-tier factories

– ✖️ Cost inflation from emergency sourcing (22–35% premiums in 2025)

– ✖️ Compliance failures under new EU Machinery Regulation 2023/1230

✅ Call to Action: Lock In Your 2026 Supply Chain Advantage

Do not navigate China’s complex die cutting market with outdated methods. SourcifyChina’s Verified Pro List delivers:

“Pre-vetted manufacturers with live capacity data, technical proof, and contractual SLAs – all accessible in under 10 business days.”

— Sarah Lim, Head of Procurement, Global Packaging Co. (Saved $310k in 2025 using Pro List)

→ Take 60 Seconds to Secure Your Priority Access:

1. Email: Send your die cutting machine specifications to [email protected]

Subject line: “2026 PRO LIST ACCESS – [Your Company Name]”

2. WhatsApp: Message +86 159 5127 6160 for immediate priority response (Include: Machine type, annual volume, deadline)

Within 24 business hours, you’ll receive:

– A curated shortlist of 3–5 Tier-1 Verified Manufacturers (with audit reports)

– Comparative TCO analysis (FOB vs. landed cost)

– Dedicated sourcing consultant for technical validation

Deadline: Capacity allocations close March 31, 2026.

87% of 2025 Pro List users secured Q3–Q4 delivery slots 4 months ahead of competitors.

SourcifyChina: Where Verified Supply Chains Drive Procurement Excellence

No commissions. No hidden fees. 100% China-based verification team.

© 2026 SourcifyChina | ISO 20400 Certified Sustainable Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.