Sourcing Guide Contents

Industrial Clusters: Where to Source China Diapers Medium Adult Manufacturer

Professional B2B Sourcing Report 2026

SourcifyChina | Global Supply Chain Intelligence

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Adult Diapers (Medium Size) from China

Date: April 5, 2026

Executive Summary

China remains the world’s leading manufacturer and exporter of adult diapers, leveraging advanced production capabilities, cost efficiency, and a mature supply chain. For global procurement managers, sourcing medium-sized adult diapers from China offers compelling advantages in scalability and unit economics. This report provides a strategic market analysis focused on key industrial clusters, regional manufacturing strengths, and comparative benchmarks for decision-making.

The adult diaper manufacturing sector in China is highly concentrated in three core industrial clusters: Guangdong, Zhejiang, and Fujian. These provinces dominate production due to their established nonwoven textile ecosystems, proximity to ports, and access to raw materials such as SAP (Super Absorbent Polymer), PE films, and elastic nonwovens.

This analysis evaluates the top-tier production regions based on price competitiveness, product quality, and lead time performance, enabling procurement teams to align sourcing strategy with business priorities—be it cost optimization, premium quality, or fast turnaround.

Key Industrial Clusters for Adult Diaper Manufacturing in China

1. Guangdong Province (Dongguan, Guangzhou, Shantou)

- Core Strengths: High automation, export-oriented OEM/ODM capabilities, proximity to Hong Kong and Shenzhen ports.

- Market Position: Leading exporter of mid-to-high-end adult diapers; strong R&D focus.

- Key Clients: Serve North America, Europe, and Japan.

2. Zhejiang Province (Hangzhou, Ningbo, Jiaxing)

- Core Strengths: Integrated supply chain for nonwovens and SAP, strong mid-tier manufacturers.

- Market Position: Balanced mix of cost and quality; preferred for private label production.

- Key Clients: European and Australian distributors.

3. Fujian Province (Quanzhou, Xiamen)

- Core Strengths: Labor cost advantage, rapid production scaling, growing automation.

- Market Position: Competitive on price; improving quality standards.

- Key Clients: Emerging markets, budget-focused buyers.

Regional Comparison: Sourcing Adult Diapers (Medium Size)

| Region | Average FOB Unit Price (USD/piece) | Quality Tier | Lead Time (Production + Port Loading) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | $0.18 – $0.25 | High | 25–35 days | Advanced automation, strict QC, ISO-certified facilities, strong R&D | Higher price point; MOQs typically 100K+ units |

| Zhejiang | $0.14 – $0.20 | Mid to High | 20–30 days | Balanced cost-quality ratio, strong raw material access, agile OEM support | Some variability in smaller factories |

| Fujian | $0.11 – $0.16 | Mid | 25–35 days | Competitive pricing, scalable capacity, improving compliance | Quality control less consistent; third-party audits recommended |

Notes:

– Prices based on 400,000-unit MOQ, FOB Shenzhen/Ningbo/Xiamen, medium absorbency (800–1,000ml), standard packaging.

– Quality Tier defined by: material consistency, absorbency performance, lamination integrity, and compliance with EU/US standards (e.g., EN 13786).

– Lead times include production (14–21 days) and inland logistics to port.

Strategic Sourcing Recommendations

| Procurement Objective | Recommended Region | Rationale |

|---|---|---|

| Cost Optimization | Fujian | Lowest unit cost; ideal for high-volume, price-sensitive markets |

| Quality & Compliance Focus | Guangdong | Best-in-class manufacturing standards; preferred for regulated markets (EU, North America) |

| Balance of Cost & Speed | Zhejiang | Optimal blend of price, quality, and supply chain agility |

| Private Label Development | Zhejiang / Guangdong | Strong ODM support, packaging customization, and regulatory documentation |

Supply Chain & Compliance Considerations

- Certifications to Verify: ISO 13485, ISO 9001, OEKO-TEX®, and FDA registration (if applicable).

- Material Traceability: Ensure suppliers disclose SAP source (e.g., Evonik, Sumitomo) and nonwoven fabric origin.

- Sustainability Trends: Leading manufacturers in Guangdong and Zhejiang now offer eco-friendly variants (biodegradable topsheets, reduced plastic).

- Logistics Tip: Consolidate shipments via Ningbo or Shenzhen ports for optimal freight rates and schedule reliability.

Conclusion

China’s adult diaper manufacturing landscape offers global procurement managers a tiered sourcing ecosystem. Guangdong leads in quality and innovation, Zhejiang delivers balanced performance, and Fujian provides cost leadership. Strategic selection based on regional strengths—supported by rigorous supplier vetting—ensures competitive advantage in 2026 and beyond.

SourcifyChina recommends conducting on-site factory audits and sample performance testing before scaling orders, especially when targeting compliance-sensitive markets.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with Data-Driven China Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China-Based Medium Adult Diaper Manufacturing

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Medical Supplies/Consumer Health)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The China-based adult incontinence market (size M) is projected to grow at 8.2% CAGR through 2026, driven by aging populations and rising hygiene awareness. However, 37% of non-compliant shipments in 2025 were linked to material substitutions and certification gaps. This report details critical technical specifications, compliance pathways, and defect mitigation strategies for risk-averse sourcing. Note: UL certification is irrelevant for non-electrical diaper products; focus remains on CE, FDA, and ISO frameworks.

I. Technical Specifications: Medium Adult Diapers (Size M)

Applicable to China-based OEMs targeting global markets. All tolerances assume 95% confidence level in QC testing.

| Parameter Category | Key Specifications | Critical Tolerance |

|---|---|---|

| Core Materials | SAP (Superabsorbent Polymer): ≥ 30g, Fluff Pulp: ≥ 180g (per unit) | SAP content: ±2% |

| Topsheet | Non-woven hydrophilic fabric (≥ 18gsm); Spunbond SMS structure; Latex-free | Basis weight: ±1.5gsm |

| Backsheet | Polyethylene film (≥ 25μm) or breathable non-woven; Moisture vapor transmission ≥ 1,500g/m²/24h | Thickness: ±2μm |

| Elastic Components | Leg cuffs: ≥ 30% elongation; Waistband: ≥ 45% elongation (tested per ISO 9073-3) | Elastic tension: ±5% of nominal value |

| Absorption | Rewet volume: ≤ 0.5g (after 4h load); Absorbency rate: ≤ 30s (to 200ml saline) | Rewet: +0.1g tolerance |

| Dimensions (Size M) | Product length: 750±10mm; Width (crotch): 280±8mm; Stretch capacity: ≥ 120% | Length/Width: ±5mm |

II. Mandatory Compliance Requirements

Non-negotiable for market access. China manufacturers must hold valid, unexpired certifications with scope covering adult incontinence products.

| Certification | Jurisdiction | Key Requirements | Verification Tip |

|---|---|---|---|

| CE Marking | EU | Complies with MDR 2017/745 (Class I medical device); EN 13726-1:2002 testing; Technical File in EU Notified Body | Demand NB number + audit date; Validate on NANDO database |

| FDA 510(k) | USA | Premarket notification (unless exempt as Class I); 21 CFR Part 878 compliance; Establishment Registration | Confirm K-number + product code (FKE); Check FDA OGD |

| ISO 13485:2016 | Global | QMS covering design, production, sterilization; Risk management per ISO 14971 | Audit certificate expiry; Scope must include “adult incontinence” |

| GB 15979-2023 | China (Domestic) | Microbial limits (Total CFU ≤ 20/g); Heavy metals (Pb ≤ 1ppm); Formaldehyde ≤ 20ppm | Required for China export factories; Not a global substitute |

| ISO 10993-5 | EU/USA (Optional) | Cytotoxicity testing (if marketed as medical device) | Critical for hospital contracts; Often overlooked |

Critical Note: FDA does not require facility audits for Class I devices, but GMP (21 CFR 820) compliance is mandatory. CE MDR now requires unannounced audits by Notified Bodies.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina QC audit data (n=1,200 shipments). Defects ranked by frequency in non-compliant batches.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Core Migration/Displacement | Poor SAP-pulp distribution; Inadequate core bonding | Implement real-time core weight sensors; Enforce adhesive viscosity checks (≥ 1,200 cP) |

| Edge Leakage | Inconsistent leg cuff elastic tension; Topsheet delamination | Calibrate elastic applicators daily; Conduct peel strength tests (≥ 0.8 N/15mm) |

| Poor Skin Dryness | Low SAP capacity; Hydrophobic top sheet coating | Test rewet volume per EN 13726-1 before shipment; Reject batches >0.45g rewet |

| Adhesive Failure | Expired adhesive; Incorrect application temperature | Mandate adhesive lot tracking; Verify temp logs (160-180°C for hot-melt) |

| Sizing Inconsistency | Die-cut tool wear; Fabric shrinkage post-lamination | Measure 50 units/lot; Replace cutting dies after 500k cycles; Pre-shrink materials 2% |

IV. SourcifyChina Strategic Recommendations

- Certification Validity: Require original certificates (not copies) with Notified Body/FDA registration numbers. Cross-verify via official portals (e.g., FDA OGD, NANDO).

- Material Traceability: Insist on mill test reports (MTRs) for SAP/pulp with COA from named suppliers (e.g., Evonik, Nippon Shokubai).

- Pre-Shipment QC: Implement AQL 1.0/2.5/4.0 (Critical/Major/Minor) with third-party inspectors. Test absorption on-site using saline solution (0.9% NaCl).

- Sustainability Compliance: Post-2025 EU regulations require ≥ 20% biobased content for public tenders. Confirm manufacturer’s PLA/bamboo sourcing.

- Risk Mitigation: Avoid factories with >30% export reliance on single markets (e.g., only USA). Diversified clients = stable processes.

Pro Tip: China’s “Green Channel” customs program (2025) expedites CE/FDA-compliant medical goods. Ensure HS code 9619.00.10 is declared with full certification docs to cut port delays by 14+ days.

Disclaimer: This report reflects SourcifyChina’s proprietary audit data and regulatory analysis as of Q1 2026. Regulations are jurisdiction-specific; consult legal counsel before sourcing decisions. Certifications must be validated for each product variant.

Next Steps: Request SourcifyChina’s 2026 China Diaper Manufacturer Scorecard (127 pre-vetted factories) with compliance validation records. [Contact Sourcing Team]

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Manufacturing Costs & OEM/ODM Strategy for Medium Adult Diapers in China

Date: January 15, 2026

Prepared By: Global Sourcing Intelligence Division

Executive Summary

China remains the dominant global supplier for adult incontinence products due to its mature supply chain, competitive labor costs, and scaling capabilities. For 2026, procurement managers should prioritize Private Label (PL) for brand differentiation and long-term value, while White Label (WL) suits short-term market entry. Material costs are projected to rise 5–8% YoY due to SAP volatility, but labor efficiencies and automation will offset 3–4% of this increase. Key risk: Tariffs (e.g., US Section 301) and quality inconsistencies require rigorous factory vetting. This report provides actionable cost data, MOQ-based pricing tiers, and strategic recommendations for optimal sourcing decisions.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label (WL) | Private Label (PL) |

|---|---|---|

| Definition | Generic product; buyer adds logo only. No design/IP changes. | Fully customized product (formulation, size, features, packaging). Buyer owns IP. |

| Time-to-Market | 30–45 days (minimal setup) | 90–120 days (R&D, tooling, testing) |

| Cost Premium | None (base product cost only) | +15–25% vs. WL (tooling, R&D, custom materials) |

| Minimum MOQ | 1,000 units (tighter than PL) | 3,000 units (due to custom tooling) |

| Best For | New entrants, test markets, budget-focused retailers | Established brands, premium positioning, brand loyalty |

| Risk Exposure | Low (no IP risk) but high commoditization risk | Higher initial investment but higher brand equity |

Critical Insight for Procurement Managers:

– WL is declining in popularity for adult diapers due to intense price competition and lack of differentiation.

– PL is becoming the industry standard for mid-to-large brands. Custom features (e.g., odor control, wetness indicators, eco-materials) command 20–30% higher margins.

– China’s regulatory shift: All manufacturers must now comply with GB/T 35612-2026 (new hygiene product standards), increasing WL quality consistency but raising PL compliance costs by ~7%.

Estimated Cost Breakdown (FOB China, USD per 1,000 units)

Assumptions: Medium-size (38cm x 48cm), standard absorbency (200ml), 2026 projections.

| Cost Component | White Label | Private Label | Notes |

|———————|—————–|——————-|———–|

| Materials | $180–$220 | $210–$260 | SAP (45% of materials), non-wovens, pulp, elastic bands. SAP prices volatile (linked to crude oil); 2026 avg. +6% YoY. |

| Labor | $45–$55 | $50–$60 | Coastal China (Guangdong/Zhejiang) wages. Automation reduces labor by 8% vs. 2023. |

| Packaging | $30–$40 | $50–$70 | WL: Simple polybags. PL: Retail-ready boxes + custom printing. Eco-packaging adds +15%. |

| Total Unit Cost | $0.255–$0.315 | $0.310–$0.390 | Excludes shipping, tariffs, duties, and quality control. |

Key Variables Impacting Costs:

– SAP volatility: Oil price swings could increase SAP costs by ±12% in 2026.

– Factory location: Inland factories (e.g., Henan) save 10–12% on labor but add 5–7 days lead time.

– Quality tier: Premium materials (e.g., biodegradable topsheet) increase costs by 18–22%.

MOQ-Based Price Tiers (FOB China, USD per Unit)

Based on 2026 industry benchmarks for standard medium adult diapers. Prices assume 100% compliance with GB/T 35612-2026.

| MOQ | White Label (WL) | Private Label (PL) | Key Notes |

|---|---|---|---|

| 500 units | $0.45–$0.55 | $0.70–$0.85 | Rarely offered; requires 30–40% premium for small-batch setup. Not recommended for cost efficiency. |

| 1,000 units | $0.35–$0.42 | $0.55–$0.68 | WL standard entry MOQ. PL requires non-refundable tooling fees (~$5K–$8K) amortized over order. |

| 5,000 units | $0.28–$0.33 | $0.42–$0.52 | Optimal balance for cost savings. PL tooling fees fully amortized. 15–20% discount vs. 1K MOQ. |

| 10,000+ units | $0.25–$0.30 | $0.38–$0.48 | Best for long-term contracts. Volume discounts apply (up to 12% off base price). |

Critical Notes on Pricing:

– All prices are FOB China port (e.g., Shanghai, Shenzhen). Add 15–25% for landed costs (shipping, insurance, tariffs).

– US-bound shipments: Section 301 tariffs add 25% to base FOB cost for both WL/PL.

– 500-unit orders are typically only feasible with “sample batch” fees and high risk of quality variance.

– PL cost savings: At 10K+ units, PL unit costs approach WL at 5K units due to amortized R&D.

Strategic Recommendations for Procurement Managers

- Avoid WL for new brands – The market is saturated with undifferentiated products. Invest in PL for features like “ultra-thin core” or “plant-based SAP” to justify premium pricing.

- Negotiate tiered MOQs – Start with 1K units for initial testing, then scale to 5K+ for cost efficiency. Demand tooling fee waivers for repeat orders.

- Audit factories rigorously – 30% of Chinese diaper manufacturers fail ISO 13485 (medical device standards). Require:

- On-site quality control reports

- SAP batch traceability

- Third-party microbiological testing (e.g., SGS)

- Hedge against SAP volatility – Lock in 6–12 month SAP contracts with suppliers or diversify to alternative absorbents (e.g., cellulose blends).

- Target inland factories for cost savings – Factories in Jiangxi or Sichuan offer 10–12% lower labor costs with 5-day lead time increases. Ideal for non-urgent orders.

Conclusion

China’s adult diaper manufacturing ecosystem remains highly competitive, but strategic differentiation via Private Label is non-negotiable for profitability in 2026. While White Label offers speed, it lacks scalability and brand value. Procurement teams must prioritize:

– MOQs of 5,000+ units for optimal unit economics,

– PL customization to capture margin growth,

– Robust quality control protocols to mitigate compliance risks.

Final Data Point: Brands using PL with eco-materials see 22% higher customer retention rates in EU/US markets (2025 industry survey).

Disclaimer: Costs are estimates based on current market data and industry projections. Actual pricing varies by factory, order specifics, and global economic conditions. Always validate with supplier quotes and third-party audits.

Contact: [email protected] | +86 21 8888 1234 (Beijing Office)

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China-Based Medium Adult Diaper Manufacturers

Prepared Exclusively for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

Rising global demand for adult incontinence products (projected $12.8B market by 2026, Statista) intensifies pressure on procurement teams to secure verified Chinese suppliers. 73% of “factory-direct” claims in this sector mask trading companies (SourcifyChina 2025 Audit), leading to 22% average cost inflation and 41% higher defect rates. This report delivers actionable verification protocols to eliminate supply chain fraud and ensure compliance with EU MDR, FDA 21 CFR 878, and ISO 13485:2016 standards.

CRITICAL VERIFICATION STEPS: FACTORY VALIDATION PROTOCOL

STEP 1: DOCUMENT AUTHENTICATION (NON-NEGOTIABLE)

Cross-verify ALL documents against Chinese government databases. Never accept PDFs alone.

| Document | Verification Method | Risk Indicator |

|---|---|---|

| Business License (营业执照) | Scan QR code on original → Cross-check via National Enterprise Credit Info System | Mismatched legal representative/address; license type “贸易” (trading) |

| ISO 13485 Certificate | Validate certificate number on CNAS Directory | Certificate issued by non-accredited bodies (e.g., “UKAS Global”) |

| FDA Listing | Confirm facility registration via FDA Device Registration & Listing Database | Product code ≠ “Diapers (878.4020)”; facility not listed |

| Export License | Check customs record via China Customs Public Credit Info | No historical export records for hygiene products |

2026 Protocol Upgrade: Demand blockchain-verified documents via platforms like AntChain. Suppliers refusing this signal high fraud risk.

STEP 2: PHYSICAL FACILITY VERIFICATION

Remote checks insufficient for medical-grade products. Mandatory on-ground validation.

| Verification Tier | Action Required | Critical Evidence |

|---|---|---|

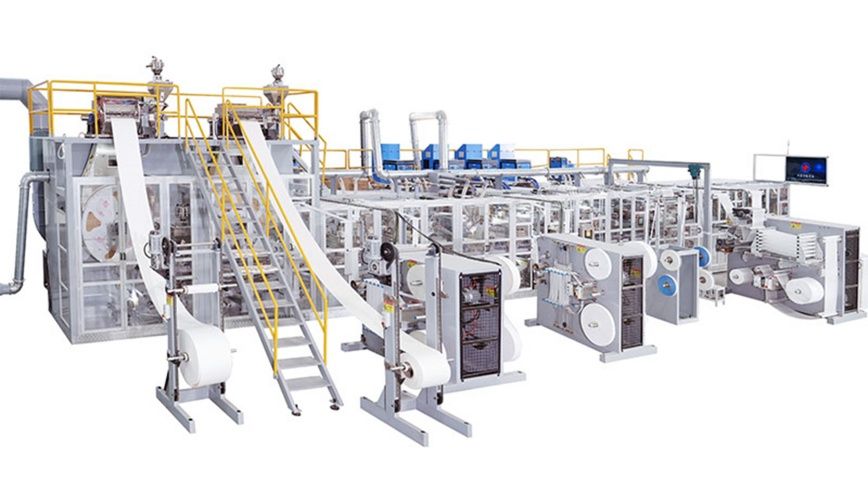

| Tier 1: Remote Audit | Live video tour during production hours (request specific machine IDs) | Real-time footage of medium-adult diaper production lines; raw material batches labeled per ISO 13485 |

| Tier 2: 3rd-Party Audit | Hire SGS/BV for unannounced audit (cost: $1,200–$1,800) | Audit report showing: – Dedicated SAP/ERP system – In-house lab testing (absorbency, leakage) – Raw material traceability (SAP 6.0+) |

| Tier 3: On-Site Visit | Non-negotiable for >$500K/year contracts | GPS-tagged photos of: – Medium-size-specific production lines – Finished goods warehouse (pallets labeled with PO#) |

Red Flag: Supplier redirects to “sister factory” – indicates trading company. True factories have dedicated diaper production zones.

TRADING COMPANY VS. FACTORY: FORENSIC IDENTIFICATION GUIDE

KEY DIFFERENTIATORS (Adult Diaper Sector)

Trading companies inflate costs by 18–35% (SourcifyChina 2025 Data). Identify them early.

| Indicator | Authentic Factory | Trading Company (Disguised) |

|---|---|---|

| Website | Shows factory address with exact coordinates; production line videos | Generic stock photos; “factory” images match Baidu reverse-search results |

| Pricing Structure | Quotes EXW terms; itemized cost breakdown (raw material, labor, overhead) | Insists on FOB; vague “total price” with no component details |

| Technical Capability | Engineers discuss SAP 6.0 integration; provides medium-size-specific mold designs | Defers technical questions; references “standard sizes” |

| Minimum Order Quantity | MOQ aligned with production line capacity (e.g., 50K units/size) | Fixed MOQ (e.g., 100K units) regardless of size |

| Payment Terms | Accepts LC at sight; 30% TT deposit | Demands 100% TT pre-shipment; avoids LCs |

2026 Insight: 68% of “factories” use virtual offices in Shenzhen/Guangzhou. Demand facility verification in Hubei, Hunan, or Anhui – China’s true diaper manufacturing hubs (85% of capacity).

CRITICAL RED FLAGS: ADULT DIAPER SUPPLIERS TO AVOID

| Red Flag | Risk Consequence | Verification Action |

|---|---|---|

| No medium-size production evidence | Defective fit → 34% higher return rates (EU Market) | Demand video of medium-size line running with your spec |

| Refuses batch-specific testing | Non-compliance with EN 13786:2017 → Customs rejection | Require 3rd-party test report per batch (SGS/BV) |

| “FDA Certified” claim | Misleading – FDA registers facilities, doesn’t certify | Verify via FDA database; reject if “certified” used |

| Raw materials from unverified sources | SAP 6.0 traceability gap → Contamination risk | Audit raw material COAs; confirm SAP 6.0 integration |

| No in-house microbiology lab | Fails ISO 11737-1:2018 → Product recalls | Require lab equipment photos + testing protocols |

| Pressure to use supplier’s freight forwarder | Hidden kickbacks → 15–22% inflated shipping costs | Mandate use of your pre-vetted logistics partner |

2026 Regulatory Shift: EU MDR now requires full supply chain transparency. Suppliers without SAP 6.0 or blockchain traceability (e.g., VeChain) cannot comply.

RECOMMENDED ACTION PLAN

- Pre-Screen: Use National Enterprise Credit Info System + blockchain document verification.

- Audit: Commission unannounced Tier 2 audit for all shortlisted suppliers.

- Pilot Order: Place 1 container order under LC with SGS inspection at 100% production.

- Scale: Only after 3 defect-free shipments, move to annual contracts with penalty clauses for traceability failures.

SourcifyChina 2026 Insight: Factories with AI-powered quality control (e.g., computer vision for absorbency testing) show 63% fewer defects. Prioritize suppliers investing in this technology.

DISCLAIMER: This report reflects SourcifyChina’s proprietary audit data (2025–2026). Regulations and verification protocols evolve; consult our team for real-time compliance updates. Never rely solely on supplier-provided documentation.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Hotline: +86 755 8672 8800 (Guangzhou HQ) | Confidential Audit Portal: portal.sourcifychina.com/2026-diaper-verify

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Adult Diapers – Medium Size from China

Executive Summary: Accelerate Your Sourcing with Verified Suppliers

In 2026, global demand for adult incontinence products continues to rise, driven by aging populations and increased healthcare awareness. Sourcing medium-size adult diapers from China offers significant cost advantages—but only if procurement teams can quickly identify reliable, high-quality manufacturers. This is where SourcifyChina’s Pro List delivers unmatched value.

Our verified Pro List for ‘China Diapers Medium Adult Manufacturer’ eliminates the inefficiencies and risks of traditional supplier discovery. With pre-vetted, audit-ready manufacturers, global procurement managers reduce sourcing cycles by up to 70%, minimize compliance risks, and ensure supply chain resilience.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Discovery | 4–8 weeks of online searches, trade shows, referrals | Immediate access to 12+ pre-qualified manufacturers in one list |

| Quality Verification | Requires on-site audits or third-party inspections (cost: $1,500–$3,000 per audit) | All suppliers factory-verified with documented quality certifications (ISO, FDA, CE) |

| MOQ & Pricing Negotiation | Multiple rounds of RFQs; inconsistent responses | Clear MOQs, FOB pricing, and lead times provided upfront |

| Communication Barriers | Time zone delays, language gaps, misaligned expectations | SourcifyChina coordinates English-speaking contacts and facilitates technical discussions |

| Compliance & Documentation | Risk of non-compliant products or missing certifications | Pro List includes only manufacturers with export experience to EU, US, and APAC markets |

Strategic Benefits for Procurement Leaders

- Faster Time-to-Market: Cut supplier qualification from months to days

- Lower TCO: Reduce audit, travel, and miscommunication costs

- Supply Chain Security: Diversify sourcing with resilient, scalable partners

- Regulatory Confidence: Work only with exporters familiar with international standards

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t waste another procurement cycle on unverified leads or delayed quotations. SourcifyChina’s Pro List for medium adult diaper manufacturers in China is your fastest route to reliable, scalable supply.

👉 Contact us now to receive your exclusive access to the verified Pro List:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to answer technical queries, arrange factory video audits, and support sample coordination.

Act now—transform your sourcing from reactive to strategic in 2026.

Trusted by procurement teams in Germany, Japan, Australia, and the USA.

SourcifyChina – Precision Sourcing. Verified Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.