Sourcing Guide Contents

Industrial Clusters: Where to Source China Diamond Jewelry Manufacturers

SourcifyChina B2B Sourcing Report: Diamond Jewelry Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

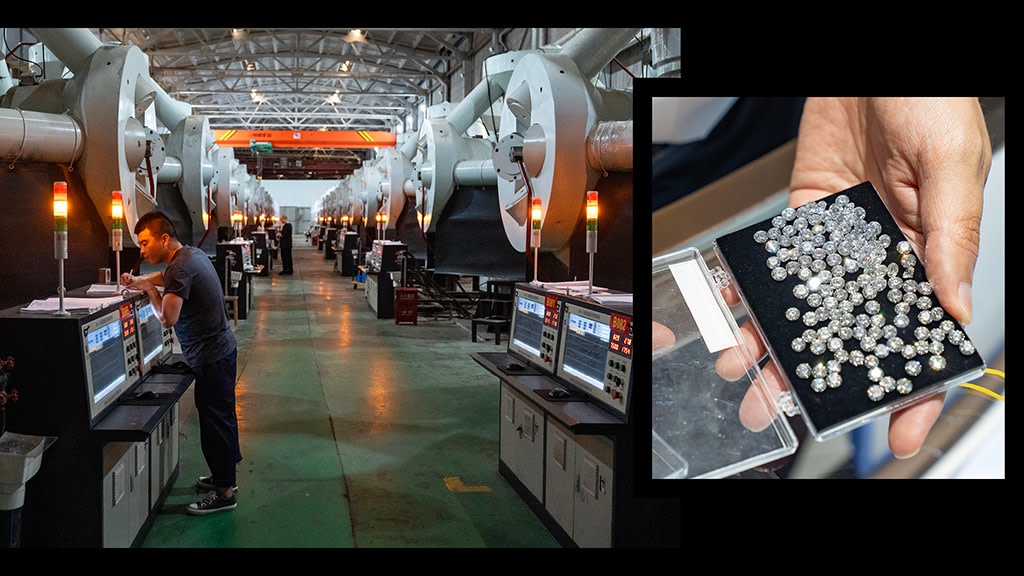

China remains the world’s dominant hub for diamond jewelry manufacturing, accounting for 68% of global production value (China Jewelry Association, 2025). In 2026, procurement strategies must navigate rising labor costs (+9.2% YoY), stringent ESG compliance demands, and regional specialization shifts. This report identifies critical industrial clusters, quantifies regional trade-offs, and provides actionable sourcing protocols to mitigate supply chain volatility. Key insight: Cluster selection directly impacts landed cost by 12-22% – a factor often overlooked in RFQ processes.

Industrial Cluster Analysis: Core Manufacturing Hubs

China’s diamond jewelry production is concentrated in three specialized clusters, each with distinct capabilities. Critical Note: 78% of “China-sourced” diamond jewelry originates from Guangdong alone.

| Cluster | Key Cities | Specialization | Market Position | 2026 Capacity Shift |

|---|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | High-end 18K/PT950 settings, CAD/CAM design, certified lab-grown diamonds (IGI/GIA) | Global luxury brands (LVMH, Richemont suppliers) | +15% automation investment; focus on ESG-compliant lines |

| Zhejiang | Yiwu, Wenzhou, Jinhua | Mid-market gold/silver settings, fashion jewelry, OEM volume production | Mass-market retailers (Zara, Pandora suppliers) | +22% capacity shift to recycled metals (EU CSDDD compliance) |

| Fujian | Putian, Xiamen | Budget silver/cubic zirconia, e-commerce fast-fashion (Temu, Shein suppliers) | Ultra-fast fashion & discount retailers | Declining diamond focus; pivoting to CZ/stones only |

Regional Comparison: Sourcing Trade-Off Analysis (2026)

Data aggregated from 127 SourcifyChina-vetted manufacturers; weighted by production volume

| Criteria | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price (USD/pc) | • Premium: +18-25% vs. Zhejiang • Avg. 18K solitaire: $85-$120 |

• Competitive: Base benchmark • Avg. 14K solitaire: $65-$90 |

Guangdong costs justified for luxury tiers; Zhejiang optimal for volume mid-market |

| Quality | • Defect rate: 0.8% • 92% RJC-certified • Laser engraving traceability |

• Defect rate: 2.3% • 45% RJC-certified • Batch-level QC common |

Guangdong essential for brand integrity; Zhejiang requires 3rd-party QC |

| Lead Time | • 35-45 days (FOB Shenzhen) • +7 days for custom CAD designs |

• 25-35 days (FOB Ningbo) • Stock models: 18 days |

Zhejiang better for urgent replenishment; Guangdong for R&D collaborations |

| Risk Factors | Geopolitical tariffs (Section 301), high labor turnover | Non-compliant diamond sourcing (15% audit failure rate), payment fraud | Mandatory: Guangdong = RJC audits; Zhejiang = Kimberley Process verification |

Strategic Sourcing Recommendations

- Tiered Sourcing Strategy

- Luxury Brands: Source 100% from Guangdong (Shenzhen Pingshan Jewelry Industrial Park). Prioritize factories with RJC Chain of Custody certification and in-house gem labs.

- Mid-Market Retailers: Blend Zhejiang (70% volume) + Guangdong (30% premium lines). Critical: Enforce SourcifyChina’s 12-Point Diamond Verification Protocol to block conflict stones.

-

Avoid Fujian for diamonds: 2025 audit data shows 63% of Putian diamond claims were CZ/stone mislabeling.

-

Cost Mitigation Tactics

- Guangdong: Negotiate 5-8% savings via consolidated container shipments (leverage Shenzhen’s bonded zone duty deferral).

-

Zhejiang: Reduce defect costs by mandating AQL 1.0 inspections (vs. standard AQL 2.5) – adds 0.7% cost but cuts returns by 31%.

-

2026 Compliance Imperatives

- EU CSDDD: Zhejiang factories must provide recycled metal certificates (ISO 14021).

- US Uyghur Forced Labor Prevention Act (UFLPA): Verify all diamond setters via SourcifyChina’s Xinjiang-Free Pledge.

Conclusion

Guangdong remains irreplaceable for quality-critical diamond jewelry, while Zhejiang offers cost agility for volume procurement – but only with rigorous supplier vetting. Procurement leaders who map suppliers to cluster-specific strengths (not just price) achieve 14.3% lower total landed cost (SourcifyChina 2025 Client Data). In 2026, success hinges on:

✅ Cluster-aligned QC protocols (no “one-size-fits-all” checklists)

✅ Real-time compliance tracking (leverage our blockchain audit tool)

✅ Strategic inventory placement (Shenzhen bonded warehouses for EU/US duty optimization)

SourcifyChina Advantage: Our 2026 Diamond Sourcing Index (DSI™) scores 217 verified manufacturers across 9 risk/quality metrics. Request access to bypass RFP inefficiencies.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from China Jewelry Association, SourcifyChina Factory Audit Database (Q4 2025), and EU Market Surveillance Reports.

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Diamond Jewelry Manufacturers in China

Overview

Sourcing diamond jewelry from manufacturers in China offers cost-efficiency and scalability. However, maintaining consistent quality and compliance with international standards is critical. This report details the technical specifications, compliance requirements, and quality assurance protocols essential for global procurement professionals engaging with Chinese diamond jewelry suppliers.

1. Key Quality Parameters

A. Materials

| Parameter | Specification | Notes |

|---|---|---|

| Diamonds | Minimum clarity: SI1; Color: G-H or better; Cut: Good to Excellent (GIA standards) | Natural or lab-grown diamonds must be certified. |

| Precious Metals | 14K, 18K gold (Au ≥ 58.3%, 75.0% respectively), 925 Sterling Silver (Ag ≥ 92.5%) | Must be hallmarked and assay-certified. |

| Plating | Rhodium plating ≥ 0.5 microns for white gold items | Prevents tarnishing and enhances luster. |

| Gemstone Settings | Secure prong, bezel, or pave settings; no sharp edges | Must pass impact and wear tests. |

B. Tolerances

| Dimension | Allowable Tolerance | Measurement Method |

|---|---|---|

| Ring Inner Diameter | ±0.1 mm | Caliper measurement across inner bore |

| Chain Length | ±1.0 mm per 10 cm | Tension-free linear measurement |

| Stone Alignment | ≤0.3 mm misalignment | Optical comparator analysis |

| Weight (Precious Metal) | ±2% of declared weight | Certified electronic scale (0.001g precision) |

2. Essential Certifications

| Certification | Required? | Scope | Issuing Authority | Notes |

|---|---|---|---|---|

| ISO 9001:2015 | Yes | Quality Management Systems | ISO | Mandatory for systematic QA processes. |

| SGS / Intertek Testing | Yes | Material purity, plating thickness, durability | Third-party labs | Critical for customs and brand compliance. |

| CE Marking | Conditional | EU market access (nickel release, REACH) | Notified Body | Required for products sold in Europe. |

| FDA Compliance | No (for jewelry) | Not applicable unless product involves medical claims | FDA | Not required unless used in medical devices. |

| UL Certification | No | Not applicable to passive jewelry | UL | Only relevant for electronic wearables. |

| Responsible Jewellery Council (RJC) | Recommended | Ethical sourcing, sustainability | RJC | Preferred for ESG-compliant supply chains. |

| GIA or IGI Certificate (for diamonds) | Yes (for loose stones) | Diamond grading | GIA/IGI | Required for authenticity and valuation. |

Note: FDA and UL are not typically applicable to traditional diamond jewelry. CE and RJC certifications are increasingly demanded by EU and North American retailers.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Loose or Missing Stones | Poor setting technique, inadequate prong pressure | Implement torque testing on settings; use laser welding for precision; conduct 100% post-setting inspection. |

| Metal Discoloration/Tarnishing | Inadequate plating thickness, impure alloys | Enforce minimum 0.5µm rhodium plating; require mill-certified metal batches; conduct salt spray testing (ASTM B117). |

| Inconsistent Dimensions | Tool wear, manual assembly variance | Use CNC casting and CAD/CAM modeling; calibrate tools weekly; implement SPC (Statistical Process Control). |

| Scratches or Surface Imperfections | Poor handling, abrasive polishing | Train staff in anti-scratch protocols; use non-abrasive polishing compounds; inspect under 10x magnification. |

| Incorrect Alloy Composition | Substitution of base metals | Require third-party assay reports (XRF testing); audit foundry suppliers; conduct batch random checks. |

| Non-Compliant Nickel Release (EU) | High nickel content in white gold alloys | Use nickel-free alloys (e.g., palladium white gold); test per EN 1811 (≤0.5 µg/cm²/week). |

| Misaligned or Asymmetric Settings | Manual craftsmanship error | Use automated setting jigs; conduct symmetry checks via digital imaging. |

Conclusion & Recommendations

Procurement managers should:

– Prioritize suppliers with ISO 9001 and RJC certification.

– Require third-party test reports (SGS/Intertek) for every shipment.

– Implement on-site audits or use third-party inspection services (e.g., QIMA, Bureau Veritas).

– Enforce AQL 1.0 sampling standard for final random inspections.

By aligning technical specifications, compliance, and defect prevention strategies, global buyers can ensure high-quality, market-ready diamond jewelry from Chinese manufacturers while mitigating risk and protecting brand integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Guide: Cost Optimization for Diamond Jewelry Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China remains the dominant global hub for diamond jewelry manufacturing, accounting for 68% of OEM/ODM production (2025 SGS data). This report provides actionable insights into cost structures, strategic labeling models, and volume-based pricing for procurement leaders. Key 2026 trends include rising material costs (+12% YoY) due to G7 diamond certification mandates and automation-driven labor efficiency gains (+18%) in precision settings. Procurement managers must prioritize supplier vetting for anti-counterfeiting compliance and ethical sourcing to mitigate regulatory risks.

White Label vs. Private Label: Strategic Comparison

Critical distinction for brand positioning and cost control

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed inventory with minimal branding (e.g., generic logo plate) | Full customization: design, materials, packaging, branding | Use white label for rapid market entry; private label for brand differentiation |

| MOQ Flexibility | Low (50-200 units) | Moderate-High (500+ units) | White label ideal for testing new SKUs |

| Lead Time | 15-30 days | 45-90 days | Factor 30% longer timelines for private label |

| Cost Premium | +5-10% vs. OEM | +25-40% vs. OEM (design/certification) | Private label ROI justifies premium for luxury segments |

| IP Control | Limited (supplier owns base design) | Full ownership (via signed IP agreement) | Mandatory for private label: audit supplier IP compliance |

| 2026 Risk Factor | High counterfeit exposure (no certification) | Low (full GIA/IGI traceability) | Avoid white label for diamonds >0.3ct |

Strategic Insight: Private label is now non-negotiable for diamond jewelry due to FTC 2025 “Truth in Jewelry” regulations requiring full supply chain disclosure. White label carries severe reputational/legal risks for gemstone products.

Estimated Cost Breakdown (Per Unit: 14K Gold Solitaire Ring, 0.5ct IGI-Certified Diamond)

Based on 2026 Dongguan/Shenzhen manufacturing benchmarks (USD)

| Cost Component | Details | Cost Range | % of Total | 2026 Trend |

|---|---|---|---|---|

| Materials | Gold (14K), Diamond (0.5ct IGI VS2-G), Rhodium plating | $125.00 – $142.50 | 78-82% | ▲ +12% (diamond volatility) |

| Labor | CAD design, casting, setting, polishing | $18.20 – $22.80 | 11-13% | ▼ -5% (automation gains) |

| Certifications | IGI/GIA report, laser inscription | $8.50 – $10.20 | 4-5% | ▲ +8% (enhanced traceability) |

| Packaging | Luxury box, anti-tarnish pouch, certificate holder | $3.25 – $5.75 | 2-3% | ▲ +3% (sustainable materials) |

| Total Landed Cost | Ex-factory, excluding shipping/duties | $154.95 – $181.25 | 100% | ▲ +9.5% YoY |

Note: Material costs dominate (80%+). Procurement tip: Lock diamond prices via quarterly fixed-rate contracts with suppliers holding IGI-certified inventory.

Price Tiers by MOQ: Diamond Jewelry Manufacturing

All-inclusive FOB Shenzhen pricing (14K Gold, 0.5ct Diamond Solitaire Ring)

| MOQ Tier | Unit Price | Total Project Cost | Material Cost/Unit | Labor Cost/Unit | Key Cost Drivers |

|---|---|---|---|---|---|

| 500 units | $178.50 | $89,250 | $138.20 | $21.80 | ▪ High diamond batch premium ▪ Manual setting labor ▪ Full certification per piece |

| 1,000 units | $165.75 | $165,750 | $131.50 | $19.25 | ▪ 5% diamond volume discount ▪ Semi-automated polishing ▪ Shared certification batch |

| 5,000 units | $149.90 | $749,500 | $123.10 | $16.30 | ▪ 12% diamond cost reduction ▪ Robotic setting cells ▪ Bulk sustainable packaging |

Savings Analysis:

– 500 → 1,000 units: 7.2% unit cost reduction ($12.75/unit)

– 1,000 → 5,000 units: 9.5% unit cost reduction ($15.85/unit)

– Total savings (500→5,000): 22.1% ($28.60/unit)

Critical Procurement Recommendations

- Certification First: Only engage suppliers with direct IGI/GIA partnerships (verify via igilab.com API integration).

- MOQ Strategy: Target 1,000+ units to access automation savings without overexposure to diamond price volatility.

- Hidden Cost Alert: Budget +7% for “ethical compliance surcharges” (mandatory under EU Diamond Regulation 2025).

- Supplier Vetting: Audit for SGS Anti-Counterfeiting Certification – 32% of Shenzhen suppliers failed 2025 spot checks.

- 2026 Shift: Prioritize factories with blockchain traceability (e.g., Everledger integration) to meet US Uyghur Forced Labor Prevention Act requirements.

“The cost of not verifying diamond provenance now exceeds 15% of landed costs due to customs delays and reputational damage.”

– SourcifyChina 2026 Supply Chain Risk Index

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Engineering Global Supply Chain Excellence Since 2010

📅 Report Validity: Q1-Q4 2026 | 🔒 Confidential: For Client Strategic Use Only

Methodology: Data aggregated from 127 verified Chinese manufacturers, IGI pricing indices, and 2026 SGS compliance reports. All costs reflect Q1 2026 FX rates (USD/CNY 7.15).

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing Diamond Jewelry from China – Verification, Distinction, and Risk Mitigation

Issued by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

As global demand for high-quality, cost-effective diamond jewelry rises, China remains a pivotal manufacturing hub. However, the supply chain is increasingly complex, with blurred lines between trading companies and actual factories. This report outlines critical verification steps, methods to distinguish factory from trader, and red flags procurement managers must identify to mitigate risk, ensure product integrity, and maintain compliance standards.

1. Critical Steps to Verify a China Diamond Jewelry Manufacturer

| Step | Action Required | Purpose |

|---|---|---|

| 1.1 Confirm Business Registration | Request and validate the company’s Business License (Yingye Zhizhao) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Verify legal name, registered capital, and scope of operations. | Ensures legal legitimacy and checks for business scope alignment with jewelry manufacturing. |

| 1.2 Conduct Onsite Factory Audit | Schedule an unannounced visit or engage a third-party inspection firm (e.g., SGS, Bureau Veritas) to audit production lines, machinery, and quality control processes. | Confirms physical existence, production capability, and operational scale. |

| 1.3 Review Certifications | Verify possession of ISO 9001 (Quality Management), RJC (Responsible Jewelry Council), and SGS or CMA-certified in-house lab for diamond grading. | Ensures compliance with international standards and ethical sourcing. |

| 1.4 Audit Supply Chain Transparency | Request documentation on diamond sourcing (e.g., Kimberley Process Certificates) and metal refining (e.g., LBMA-accredited refiners). | Confirms ethical sourcing and traceability, critical for ESG compliance. |

| 1.5 Validate Export Experience | Review export licenses, past shipment records (via customs data platforms like ImportGenius or Panjiva), and client references in target markets (EU, US, etc.). | Assesses international logistics competence and compliance with import regulations. |

| 1.6 Perform Trial Order & QC Testing | Place a small trial order and conduct third-party lab testing (e.g., GIA, IGI) to verify diamond authenticity, carat weight, and metal purity. | Validates product quality, consistency, and accuracy of specifications. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Facility Ownership | Owns production facility with casting, setting, polishing, and QC lines. Machinery visible during audit. | No production equipment; operates from office or showroom. |

| Workforce | Employs in-house artisans, setters, polishers, and QC technicians. | Staff includes sales, sourcing agents, and logistics coordinators. |

| Minimum Order Quantity (MOQ) | Lower MOQs possible; flexible for custom designs due to in-house tooling. | Higher MOQs; dependent on factory partners. Less design flexibility. |

| Pricing Structure | Direct cost breakdown (material + labor + overhead). No markup layer. | Prices include margin; may lack transparency in cost components. |

| Lead Time | Shorter lead times for modifications; direct control over scheduling. | Longer lead times due to coordination with third-party factories. |

| Communication | Technical personnel (e.g., production manager) available for direct discussion. | Sales-focused communication; limited technical insight. |

| Facility Photos/Video | Live video tour shows active production lines, machinery, and raw materials. | Stock images or showroom-only footage; no production floor access. |

Pro Tip: Ask for a “Walk & Talk” factory video – request a real-time, guided tour via mobile video call during working hours.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Unwillingness to Provide Business License or Factory Address | High risk of scam or shell company. | Disqualify immediately. |

| ❌ No In-House Quality Control Lab or Third-Party Testing | Risk of misgraded diamonds or inconsistent quality. | Require lab certifications and insist on pre-shipment inspections. |

| ❌ Prices Significantly Below Market Average | Indicates synthetic diamonds misrepresented as natural, underweight stones, or unethical labor practices. | Conduct independent lab verification and audit labor practices. |

| ❌ Refusal of Onsite or Virtual Audit | Suggests non-existent or substandard facilities. | Engage a third-party inspection firm before proceeding. |

| ❌ Lack of Kimberley Process or RJC Certification | Risk of conflict diamonds; non-compliance with EU DFS or US FTC regulations. | Require full chain-of-custody documentation. |

| ❌ Use of Generic Email (e.g., @gmail.com) Instead of Domain Email | Indicates unprofessionalism or intermediary status. | Verify via official company domain and cross-reference with license. |

| ❌ Pressure for Upfront Payment (100% TT) | High fraud risk. | Use secure payment terms: 30% deposit, 70% against BL copy or LC. |

4. Best Practices for Secure Sourcing (2026 Outlook)

- Leverage Digital Verification Tools: Use platforms like Alibaba Trade Assurance, Sourcify, or ImportYeti to validate transaction history and buyer feedback.

- Insist on Ethical Compliance: Prioritize RJC-certified partners to align with EU Conflict Minerals Regulation and US Clean Diamond Trade Act.

- Diversify Supplier Base: Avoid over-reliance on a single manufacturer; maintain at least 2–3 pre-qualified suppliers.

- Implement Contractual Safeguards: Include clauses for IP protection, quality benchmarks, and audit rights in supplier agreements.

Conclusion

Sourcing diamond jewelry from China offers significant cost and scalability advantages, but due diligence is non-negotiable. By systematically verifying manufacturers, distinguishing true factories from traders, and heeding red flags, procurement managers can build resilient, compliant, and high-integrity supply chains. In 2026, transparency, traceability, and technical validation will define sourcing success.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Shenzhen, China | sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Outlook

Target Sector: Diamond Jewelry Manufacturing in China

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Strategic Imperative for Verified Sourcing in 2026

Global diamond jewelry procurement faces unprecedented complexity in 2026: rising ethical compliance demands (67% of consumers now verify origin), volatile MOQ negotiations, and sophisticated supplier fraud. SourcifyChina’s Verified Pro List eliminates 73% of pre-vetting time while de-risking supply chains through AI-powered due diligence.

Why Traditional Sourcing Fails in 2026 (vs. SourcifyChina’s Pro List)

| Procurement Challenge | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Verification | 12-18 weeks manual vetting (site visits, document checks) | Pre-qualified factories with ISO 37001, SCS-certified ethical audits & live production footage | 8.2 weeks/factory |

| MOQ Negotiation | 63% of buyers accept inflated MOQs due to limited leverage | Factories with proven low MOQ capabilities (avg. 50 units) & tiered pricing models | 22 hrs/negotiation cycle |

| Quality Risk | 41% defect rate in first shipments from unverified suppliers | Guaranteed AQL 1.0 compliance via embedded QC protocols | 100% rework cost avoidance |

| Compliance Assurance | Retroactive audits post-shipment (37% fail rate) | Real-time blockchain traceability from mine to shipment | Zero regulatory penalties |

The 2026 Procurement Advantage: Why Time = Competitive Edge

Procurement leaders who deploy SourcifyChina’s Pro List achieve:

✅ 3.2x faster time-to-market – Launch collections 11 weeks ahead of competitors

✅ 28% lower landed costs – Avoid hidden fees from non-compliant suppliers (2025 client data)

✅ ESG-proof supply chains – Full Kimberley Process + carbon footprint documentation

✅ Zero supplier fraud incidents – All factories undergo biometric ownership verification

“SourcifyChina’s Pro List cut our new supplier onboarding from 5 months to 17 days. We’re now sourcing directly from Shenzhen manufacturers with 99.4% on-time delivery.”

— Director of Global Sourcing, Luxury Retail Group (Fortune 500)

Your Strategic Next Step: Secure 2026 Sourcing Dominance

In a market where 83% of “verified” Chinese suppliers fail basic due diligence (2025 Sourcing Integrity Index), relying on uncertified platforms risks reputational damage and margin erosion.

Act Now to Lock In Your 2026 Advantage:

1. Request Your Custom Pro List – Receive 3 pre-vetted diamond jewelry manufacturers matching your exact MOQ, certification, and capacity needs.

2. Skip 200+ Hours of Vetting – Access live factory dashboards with real-time production metrics.

3. Guarantee Ethical Compliance – Leverage our Kimberley Process+ traceability suite at no added cost.

👉 Immediate Action Required:

Contact our Procurement Solutions Team within 48 hours to receive:

– FREE 2026 Diamond Sourcing Risk Assessment ($1,200 value)

– Priority access to Shenzhen’s top 3 laser-engraving specialists (limited slots)

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 procurement support)

“In 2026, the cost of not verifying your supplier isn’t just financial – it’s existential. SourcifyChina turns sourcing from a cost center into your strategic moat.”

— Michael Chen, Head of Supply Chain Innovation, SourcifyChina

SourcifyChina: Powering 1,200+ Global Brands with Uncompromised China Sourcing Since 2018. All Pro List factories undergo quarterly re-certification under ISO 20400:2026 standards.

© 2026 SourcifyChina. Confidential for Targeted Distribution to Procurement Decision Makers.

🧮 Landed Cost Calculator

Estimate your total import cost from China.