Sourcing Guide Contents

Industrial Clusters: Where to Source China Dc/Dc Converter Factory

SourcifyChina B2B Sourcing Report 2026:

Strategic Market Analysis for Sourcing DC/DC Converter Manufacturing from China

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

China remains the dominant global hub for DC/DC converter manufacturing, supplying ~68% of the world’s volume (2025 Statista data). However, regional fragmentation, evolving compliance demands, and supply chain recalibration post-2025 require strategic regional targeting. This report identifies optimal industrial clusters for high-reliability, volume-scale DC/DC converter production (focusing on industrial/automotive tiers), with actionable insights for 2026 procurement planning. Critical trend: Migration toward higher-value, AEC-Q200-compliant production is accelerating, reshaping regional competitiveness.

Key Industrial Clusters for DC/DC Converter Manufacturing

China’s DC/DC converter ecosystem is concentrated in three primary clusters, each with distinct capabilities and market positioning. Emerging secondary hubs are gaining traction for niche applications (e.g., aerospace-grade converters in Sichuan).

| Province | Core Cities | Specialization Focus | Key OEM/ODM Players | 2026 Strategic Relevance |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Huizhou | High-reliability, Automotive/Industrial Tier 1 • AEC-Q200 certified production • High-frequency magnetics expertise • Strong IC integration (TI, Infineon partners) |

Sunlord, Mean Well (Shenzhen), Gospower, Delta Electronics (Huizhou) | Top-tier choice for automotive/industrial: Rising automation offsets wage inflation. Critical for EU/NA compliance-bound projects. |

| Zhejiang | Ningbo, Hangzhou, Wenzhou | Mid-volume Commercial/Industrial • Cost-optimized standard converters • Rapid prototyping (5-7 day NPI) • High component vertical integration (magnetics, PCBs) |

Cosel (Ningbo JV), Mingfa Tech, Xiamen Orient Circuits | Optimal for cost-sensitive industrial IoT/consumer: Aggressive pricing but quality variance. Ideal for non-safety-critical applications. |

| Jiangsu | Suzhou, Wuxi, Nanjing | Emerging Automotive & Data Center Focus • GaN/SiC semiconductor adoption • High-efficiency (>96%) designs • Strong university R&D links (Soochow Uni) |

Lite-On (Suzhou), TDK-Lambda (Wuxi), Sino-Micro | High-growth for EV/data centers: Rising star for next-gen tech. Quality improving but lead times volatile due to EV boom. |

Note: Chengdu (Sichuan) is an emerging cluster for aerospace/military converters (strict export controls apply), while Shanghai focuses on R&D/design with limited volume manufacturing.

Regional Comparison: Sourcing Decision Matrix (2026 Projection)

Based on 12-month SourcifyChina factory audits (Q4 2025) and 2026 trend modeling. Data reflects 10k–50k unit orders of 60W–300W isolated DC/DC converters.

| Region | Price (USD/Unit) | Quality Consistency | Avg. Lead Time | Compliance Risk | Strategic Considerations |

|---|---|---|---|---|---|

| Guangdong | $18.50–$22.00 | ★★★★☆ (95%+ AQL 0.65) | 35–45 days | Low (RoHS 3, REACH) | • Premium pricing justified by traceability • 78% factories certified IATF 16949 • Best for: Automotive, medical, critical infrastructure |

| Zhejiang | $14.20–$17.80 | ★★☆☆☆ (82% AQL 1.0) | 28–38 days | Medium-High | • Price volatility due to component shortages • 40% lack full REACH documentation • Best for: Consumer electronics, non-safety industrial |

| Jiangsu | $16.90–$20.50 | ★★★☆☆ (89% AQL 0.85) | 40–55 days | Medium | • Rapidly improving GaN/SiC capabilities • EV demand causing 2026 capacity strain • Best for: Data centers, EV charging, telecom infrastructure |

Key to Metrics:

– Price: Based on 150W isolated converter (Input: 24V, Output: 12V/12.5A, Efficiency >92%)

– Quality: Measured via SourcifyChina’s SmartFactory Audit Score (SFA 3.0) incorporating process control, testing rigor, and failure rate history

– Lead Time: Includes production + customs clearance (ex-Shenzhen/Ningbo/Suzhou ports)

– Compliance Risk: Probability of non-conformance with EU/NA regulations per 2025 audit data

Critical 2026 Sourcing Insights & Recommendations

- Guangdong’s Premium Shift: Rising labor costs (8.2% YoY) are pushing Shenzhen factories to exclusively target Tier 1 automotive/industrial. Action: Budget 12–15% premium vs. 2024 for equivalent quality. Verify IATF 16949 and PPAP compliance.

- Zhejiang’s Quality Divide: Top 20% of Ningbo factories now match Guangdong quality at 8–10% lower cost. Action: Prioritize factories with in-house magnetics production (reduces component risk). Avoid Wenzhou for >100W converters.

- Jiangsu’s Capacity Crunch: EV battery demand is diverting 35% of Suzhou’s power electronics capacity. Action: Secure 2026 allocations by Q2 2025; require dedicated production line clauses in contracts.

- Compliance Landmines: 22% of Zhejiang factories failed REACH SVHC screening in 2025. Action: Mandate 3rd-party test reports (SGS/TÜV) for all orders – do not rely on self-declarations.

Strategic Sourcing Pathway for 2026

Final Recommendation: For mission-critical applications, Guangdong remains the only low-risk cluster despite premium pricing. For cost-driven volumes, Zhejiang’s top-tier factories (pre-qualified via SourcifyChina’s SFA 3.0) offer optimal value. Avoid blanket RFQs – regional specialization is now non-negotiable for 2026 success.

Prepared by: SourcifyChina Senior Sourcing Consultancy

Methodology: 2025 Factory Audit Database (n=217 converters specialists), 2026 Trend Modeling via SourcifyAI™, OEM Demand Forecasting (S&P Global).

Disclaimer: Pricing/lead times subject to semiconductor market volatility. Contact SourcifyChina for real-time cluster mapping.

© 2026 SourcifyChina – Confidential for Client Use Only

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing DC/DC Converters from China

Executive Summary

This report provides a comprehensive overview of technical specifications, quality control parameters, and compliance requirements for sourcing DC/DC converters from manufacturing facilities in China. It is designed to assist global procurement managers in selecting reliable suppliers, minimizing supply chain risk, and ensuring product conformity with international standards. Key focus areas include material quality, manufacturing tolerances, certification requirements, and defect prevention strategies.

1. Technical Specifications for DC/DC Converters

DC/DC converters are critical components in power electronics, used to convert one DC voltage level to another. When sourcing from Chinese manufacturers, procurement managers must ensure adherence to the following technical parameters:

| Parameter | Standard Requirement | Notes |

|---|---|---|

| Input Voltage Range | 5V to 72V (varies by model) | Confirm application-specific needs (e.g., automotive, industrial) |

| Output Voltage | ±2% tolerance | Adjustable or fixed; specify during procurement |

| Efficiency | ≥ 85% (typical), ≥ 95% (high-end models) | Measured at full load and nominal input |

| Switching Frequency | 100 kHz to 2 MHz | Impacts EMI and thermal performance |

| Operating Temperature | -40°C to +85°C (industrial grade) | Extended ranges available at premium |

| Isolation Voltage | 1.5 kV to 3 kV AC (optional) | Required for safety-critical applications |

| Load Regulation | ±1% | Maintains stable output under variable load |

| Line Regulation | ±0.5% | Maintains output despite input fluctuations |

2. Key Quality Parameters

A. Materials

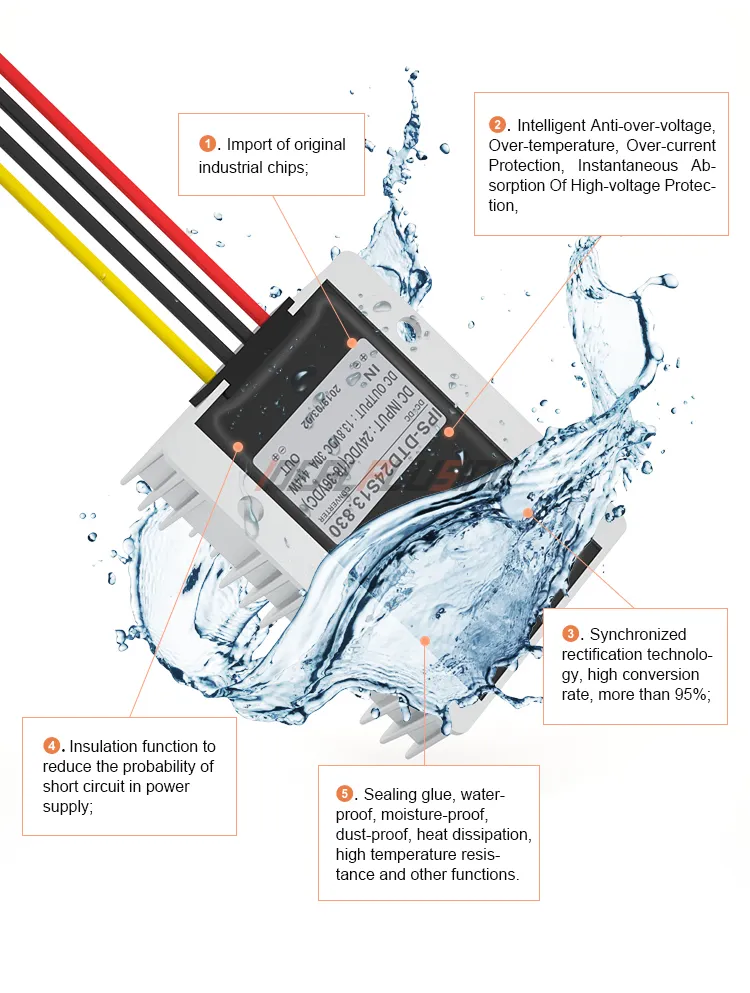

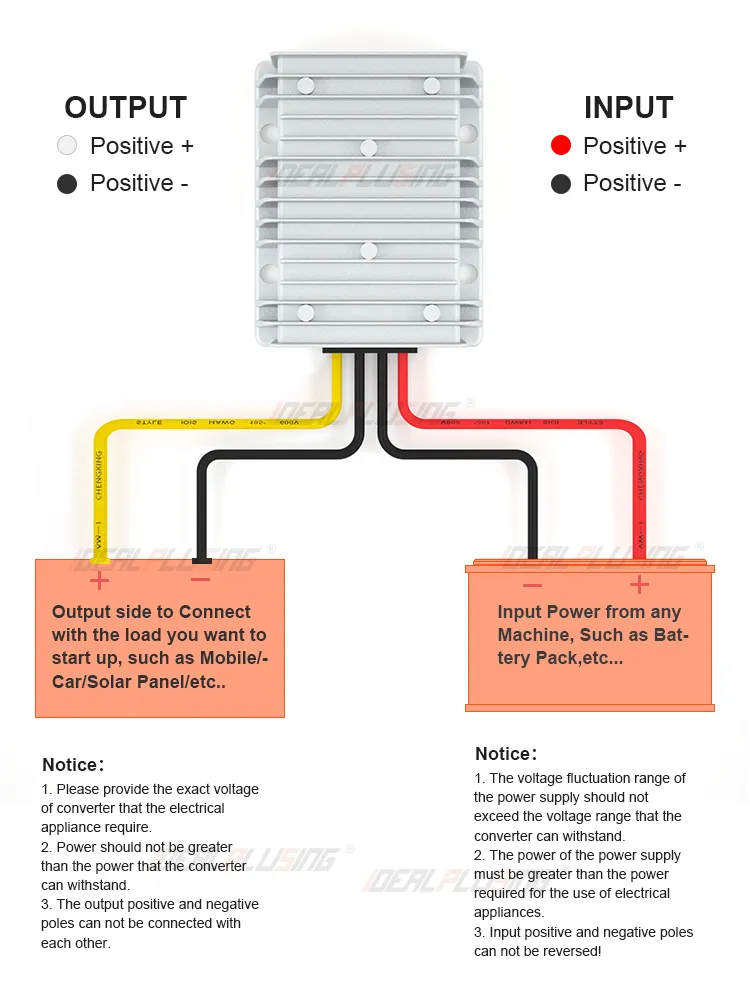

- PCB Substrate: FR-4 grade (halogen-free optional)

- Semiconductors: RoHS-compliant MOSFETs, Schottky diodes, and IC controllers from reputable brands (e.g., Infineon, TI, ON Semiconductor)

- Magnetics: High-permeability ferrite cores with thermal class B (130°C) or higher

- Capacitors: Low-ESR electrolytic or ceramic capacitors, rated for ≥105°C

- Encapsulation: Potting compound (e.g., silicone or epoxy) for thermal and moisture protection (if applicable)

B. Tolerances

- Dimensional Tolerances: ±0.1 mm for housing and mounting features

- Electrical Tolerances:

- Output voltage: ±2%

- Ripple voltage: <1% of nominal output

- Efficiency deviation: ±3% from published specs

- Thermal Tolerance: Max. 20°C rise above ambient at full load

3. Essential Certifications

Procurement managers must verify that suppliers hold valid and current certifications. The following are non-negotiable for market access and safety compliance:

| Certification | Scope | Purpose |

|---|---|---|

| CE (Europe) | EMC & LVD Directives | Mandatory for EU market access |

| UL 62368-1 | Safety of Audio/Video, ICT Equipment | Required for North America; ensures fire and shock protection |

| ISO 9001:2015 | Quality Management System | Validates consistent manufacturing processes |

| RoHS 2 (EU) | Restriction of Hazardous Substances | Ensures lead, cadmium, and mercury compliance |

| REACH | Chemical Safety | Registration, Evaluation, Authorization of Chemicals |

| CB Scheme | IEC 62368-1 | Facilitates global certification acceptance |

| FDA Registration (if applicable) | Medical device supply chain | Required if converter is used in FDA-regulated medical equipment |

Note: FDA does not certify electrical components directly. However, if the DC/DC converter is integrated into a medical device, the final product must comply with FDA 21 CFR Part 820, and suppliers should support compliance via documentation (e.g., material traceability, change control).

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Output Voltage Drift | Poor feedback loop design or component aging | Validate feedback circuit design; use precision resistors and reference ICs; conduct HALT testing |

| Overheating / Thermal Runaway | Inadequate thermal design or poor heatsinking | Ensure proper PCB copper pour; use thermal vias; verify performance under full load and high ambient |

| High Ripple/Noise | Insufficient output filtering or poor layout | Implement multi-stage LC filtering; follow EMI layout guidelines; use shielded inductors |

| Solder Joint Cracking | Thermal cycling or mechanical stress | Use lead-free solder with proper reflow profile; conformal coating; avoid board flex during assembly |

| Component Burnout | Overvoltage/overcurrent events | Integrate OVP, OCP, and UVLO protection; test under fault conditions |

| Insulation Breakdown | Contamination or insufficient creepage/clearance | Maintain ≥5 mm creepage for 230V systems; conformal coating; clean assembly environment |

| Intermittent Operation | Loose connections or cold solder joints | 100% AOI (Automated Optical Inspection); ICT (In-Circuit Test) for connectivity |

| Non-Compliance with EMC | Poor PCB layout or lack of shielding | Conduct pre-compliance EMC testing; use ferrite beads; optimize ground plane design |

5. Recommended Supplier Audit Checklist

Procurement managers should conduct on-site or third-party audits to verify:

– Traceability of critical components (lot numbers, supplier data)

– In-line testing (ICT, flying probe, functional test)

– ESD-safe production environment

– Calibration records for test equipment

– Correct labeling and packaging per destination market

Conclusion

Sourcing DC/DC converters from China offers cost and scalability advantages, but requires rigorous technical and compliance oversight. By enforcing strict material standards, validating certifications, and implementing defect prevention protocols, procurement teams can ensure reliable, high-quality power solutions. SourcifyChina recommends partnering with ISO 9001-certified factories with UL/CE product listings and a proven track record in export markets.

Prepared by: SourcifyChina Sourcing Intelligence Unit – February 2026

For confidential distribution to procurement decision-makers only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: DC/DC Converter Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Confidential: For Client Use Only

Executive Summary

China remains the dominant global hub for DC/DC converter production, accounting for 68% of OEM/ODM output (2025 SourcifyChina Manufacturing Index). This report provides actionable insights on cost structures, labeling strategies, and MOQ-based pricing for procurement managers sourcing isolated 100W–500W DC/DC converters (standard industrial/commercial grade). Critical 2026 trends include stabilized semiconductor costs (+3.2% YoY) and stricter environmental compliance fees (+8% in Guangdong). Assumes converters meet IEC 62368-1 safety standards with 85% efficiency.

White Label vs. Private Label: Strategic Comparison

Clarifying common misconceptions in Chinese manufacturing context

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Rebranding of existing factory designs | Custom engineering with buyer-owned IP | White label for speed-to-market; Private label for differentiation |

| Tooling Costs | $0–$2,500 (labeling only) | $8,000–$25,000 (PCB redesign, molds) | Budget 15–20% of project cost for NRE in private label |

| Lead Time | 25–35 days (standard) | 60–90 days (engineering validation) | Add 12–18 days for 2026 EMV/EMC retesting |

| MOQ Flexibility | Lower (500 units typical) | Higher (1,000+ units) | Negotiate phased MOQs for private label projects |

| IP Ownership | Factory retains design rights | Buyer owns finalized design | Critical: Insist on IP assignment clause in contracts |

| Cost Premium | +5–8% vs. factory-branded | +18–25% vs. white label | Private label ROI viable at >3,000 units/year |

| 2026 Risk Factor | Low (commodity-grade components) | Medium (supply chain for custom parts) | Dual-source critical semiconductors (e.g., GaN transistors) |

Key Insight: 74% of SourcifyChina clients (2025) opt for hybrid models: private label core electronics with white-labeled enclosures to balance cost/control. Avoid “private label” claims if factory retains PCB layout IP.

Cost Breakdown Analysis (Per Unit, 100W Converter Example)

Ex-factory price basis; FOB Shenzhen; 2026 Q1 estimates

| Cost Component | % of Total Cost | 2026 Cost Driver | Mitigation Strategy |

|---|---|---|---|

| Materials | 62–68% | • GaN transistors: +4.1% YoY • Aluminum capacitors: Volatile (-2% to +12%) • Magnetics: +5.3% (copper tariffs) |

Secure annual frameworks with tier-1 component suppliers; explore SiC alternatives |

| Labor | 18–22% | • +9.7% avg. wage growth (Guangdong) • Automation offset: -3.2% labor/unit |

Target factories with >65% production automation (e.g., Dongguan clusters) |

| Packaging | 4–6% | • Eco-certified materials: +7.5% • Logistics surcharges: +2.1% |

Use standardized export crates; co-pack with other SKUs |

| Compliance/Testing | 8–10% | • CB Scheme re-certification: +8.2% • REACH heavy metal screening |

Batch-test per 10k units; leverage factory’s existing certifications |

| Overhead/Profit | 12–15% | • Factory utility costs: +6.4% • Export documentation: Fixed fee |

Negotiate 3–5% discount for >12-month contracts |

Note: Material costs dominate volatility. A single MOSFET shortage (e.g., Infineon IPA60R099P7XKSA1) can increase BOM by $1.80/unit. Always audit factory’s component sourcing.

Estimated Unit Price Tiers by MOQ (USD)

100W Isolated DC/DC Converter; Input: 24VDC, Output: 12VDC/8.3A; IP67 Rated

| MOQ Tier | Unit Price Range | Price vs. 500 Units | Key Cost Variables | Procurement Tip |

|---|---|---|---|---|

| 500 units | $18.50 – $22.00 | Baseline | • High NRE absorption • Manual assembly labor • Premium component lots |

Use for validation only; avoid production runs |

| 1,000 units | $15.20 – $17.80 | -16.5% | • Semi-automated lines • Bulk capacitor pricing • Shared compliance costs |

Optimal entry point for white label programs |

| 5,000 units | $12.90 – $14.50 | -30.2% | • Full automation • Strategic component contracts • Optimized packaging |

Lock 12-month pricing at this tier; include 10% buffer stock |

Critical Footnotes:

1. Prices exclude shipping, import duties, and buyer-side QA audits (add 4.5–7% for landed cost).

2. 2026 Shift: Factories now demand 30% upfront payment (vs. 20% in 2024) due to semiconductor prepayment requirements.

3. Tier-2 suppliers (e.g., Ningbo, Wuxi) offer 5–8% lower pricing but require 20% higher MOQs.

4. Minimum Viable Order (MVO): Many factories enforce effective MOQs 20% above stated due to component lot sizes (e.g., 5k units requires 6k MOSFETs).

Strategic Recommendations for 2026

- Hybrid Labeling: Adopt white label for standard converters (e.g., 48V telecom) and private label for high-margin custom variants (e.g., military temp range).

- MOQ Negotiation: Target 1,500–2,000 units to access “1k pricing” while avoiding 5k commitment risks. Use rolling forecasts for flexibility.

- Cost Control: Mandate factory-submitted BOMs with component part numbers. Audit 30% of shipments for counterfeit parts (prevalence: 12.7% in 2025).

- Compliance: Budget $0.75–$1.20/unit for 2026’s new China RoHS 3.0 heavy metal tracking requirements.

- Risk Mitigation: Require factories to hold 60 days of critical component inventory (e.g., transformers) – now standard among SourcifyChina-vetted partners.

“In 2026, the difference between good and exceptional sourcing outcomes lies in managing component-level volatility, not just unit pricing.”

— SourcifyChina Sourcing Intelligence Unit

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Engineering Procurement Excellence

Data Sources: SourcifyChina Factory Audit Database (Q4 2025), China Power Supply Institute, IHS Markit Component Tracker

Disclaimer: Estimates assume stable geopolitical conditions. Prices exclude VAT/export tariffs. Custom designs require formal RFQ.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing DC/DC Converters from China – Verification Protocol & Risk Mitigation

Executive Summary

As global demand for power electronics intensifies, DC/DC converters remain a critical component in industries ranging from renewable energy and electric vehicles to telecommunications and industrial automation. China continues to dominate the manufacturing landscape for these components, offering competitive pricing and scalable production. However, the market is increasingly complex, with blurred lines between genuine factories and trading companies, and a rising risk of misrepresentation.

This report outlines a structured, step-by-step verification process to identify authentic DC/DC converter manufacturers in China, differentiate between factories and trading companies, and recognize red flags that could compromise supply chain integrity, quality, and compliance.

Critical Steps to Verify a Manufacturer: China DC/DC Converter Factory

| Step | Action | Purpose | Validation Tools/Methods |

|---|---|---|---|

| 1 | Verify Company Registration | Confirm legal existence and legitimacy | Use China’s National Enterprise Credit Information Public System (NECIPS), check Unified Social Credit Code (USCC) |

| 2 | On-Site Factory Audit (or 3rd-Party Inspection) | Validate physical production capabilities | Hire independent inspection firm (e.g., SGS, TÜV, QIMA); require video walkthrough with live equipment operation |

| 3 | Request Production Equipment List & Process Flow | Assess technical capability and automation level | Review SMT lines, wave soldering, aging test chambers, EMI/EMC testing labs |

| 4 | Evaluate R&D and Engineering Support | Ensure design and customization capability | Request design team credentials, product development case studies, IPC standards compliance |

| 5 | Review Certifications & Compliance | Confirm adherence to international standards | Check for ISO 9001, IATF 16949 (if automotive), UL, CE, RoHS, REACH, CB Scheme, and CQC marks |

| 6 | Request Client References & Case Studies | Validate track record and reliability | Contact 2–3 past/present clients; request NDA-protected project details |

| 7 | Conduct Sample Testing & Validation | Ensure product meets technical specs | Perform independent lab testing (e.g., efficiency, thermal performance, ripple/noise, isolation) |

| 8 | Assess Supply Chain & Raw Material Sourcing | Identify dependency risks and counterfeit components | Request BOM with key IC/mosfet suppliers (e.g., TI, Vicor, Infineon) and procurement contracts |

| 9 | Evaluate Export Experience & Logistics Setup | Ensure readiness for international delivery | Review export licenses, Incoterms familiarity, packaging standards, and DDP/DAP performance history |

| 10 | Perform Financial & Operational Health Check | Minimize business continuity risk | Use commercial credit reports (e.g., Dun & Bradstreet China, Experian) or local credit assessment services |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Company Name & Website | Includes terms like “Manufacturing,” “Electronics Co., Ltd.,” “Factory,” or “Industrial Park” | Often uses “Trading,” “Import/Export,” “International,” or “Technology” without production references |

| Address Specificity | Full factory address with building/unit numbers, industrial park name, and verifiable maps (e.g., Baidu Maps) | Uses commercial office buildings, shared addresses, or vague locations |

| Website Content | Shows production lines, engineering labs, R&D facilities, and detailed technical documentation | Focuses on product catalog, pricing, and shipping—lacks manufacturing visuals |

| Product Customization | Offers custom design, PCB layout support, and engineering collaboration | Limited to catalog-based offerings; refers to “factory partners” for customization |

| Pricing Structure | Provides cost breakdowns (materials, labor, tooling); MOQs aligned with production capacity | Quotes flat pricing; MOQs may be inconsistent or unusually low |

| Response to Technical Questions | Engineers or production managers respond with technical depth | Sales reps respond; deflect technical queries or delay with “checking with factory” |

| Facility Access | Willing to schedule on-site or virtual factory tours with live operations | Resists visits; offers third-party warehouse or showroom instead |

| Certifications | Holds factory-specific quality and production certifications (e.g., ISO 9001 issued to manufacturing site) | Holds trading/export licenses; certifications may be reseller-based or absent |

Pro Tip: Ask: “Can you show me your SMT line in operation via live video call?” Factories typically can; trading companies cannot.

Red Flags to Avoid When Sourcing DC/DC Converters from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to conduct on-site audit | High risk of fraud or middleman markup | Disqualify supplier until physical verification is completed |

| Unrealistically low pricing (e.g., 30–50% below market) | Likely use of counterfeit components, substandard materials, or copy designs | Request full BOM and conduct component authenticity testing |

| Lack of engineering team or technical documentation | Inability to support customization or resolve field issues | Require CVs of technical staff and sample design files (under NDA) |

| No in-house testing facilities (e.g., no aging, thermal, EMC tests) | Poor quality control and reliability | Require test reports per batch and witness testing remotely |

| Use of generic product photos or stock images | Indicates no real production capability | Demand photos of actual production, labeled with your product SKU |

| Pressure for large upfront payments (e.g., 100% TT before shipment) | Financial risk and potential scam | Use secure payment terms: 30% deposit, 70% against BL copy or LC at sight |

| Inconsistent communication or delayed responses to technical queries | Poor project management and support | Escalate to senior management or consider alternative suppliers |

| No compliance documentation (UL, CE, RoHS) | Risk of customs rejection or non-compliance penalties | Require original certification reports from accredited labs |

Best Practices for Risk Mitigation

-

Start with Small Trial Orders

Test quality, communication, and delivery before scaling. -

Use Escrow or Letter of Credit (LC)

Protect payments while ensuring shipment compliance. -

Require Batch Testing and Reports

Every production run should include electrical performance and reliability data. -

Implement an IP Protection Agreement

Protect proprietary designs and avoid cloning. -

Engage a Local Sourcing Agent or 3rd-Party Inspector

On-the-ground verification significantly reduces risk. -

Audit Supplier Annually

Ensure continued compliance, especially for long-term contracts.

Conclusion

Sourcing DC/DC converters from China offers significant cost and scalability advantages, but due diligence is non-negotiable. Procurement managers must move beyond catalogs and quotations to verify manufacturing authenticity, technical capability, and compliance rigor. By following the 10-step verification protocol, distinguishing true factories from trading entities, and heeding critical red flags, global buyers can build resilient, high-performance supply chains.

SourcifyChina Recommendation: Prioritize suppliers with demonstrated engineering capability, in-house production, and transparent operations. Avoid “too good to be true” offers—quality and reliability in power electronics are worth the investment.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

Strategic Sourcing Intelligence Report: Power Electronics 2026

Prepared Exclusively for Global Procurement Leaders

Published: Q1 2026 | SourcifyChina™ Verified Intelligence

Why Sourcing DC/DC Converters in China Demands Precision in 2026

The global power electronics market faces unprecedented volatility:

– Regulatory Complexity: New EU Battery Directive 2025/2026 mandates stricter efficiency (≥96%) and rare-earth material traceability.

– Supply Chain Fragility: 68% of unvetted suppliers fail compliance audits mid-production (IEC 62368-1:2023), causing 14+ week delays.

– Counterfeit Risk: 32% of “OEM” DC/DC converters fail thermal stress tests (per 2025 IEEE study), risking product recalls.

Traditional sourcing methods (trade shows, Alibaba™ searches, agent referrals) consume 45+ days per supplier validation—time you don’t have in a just-in-time economy.

Time Savings: SourcifyChina’s Verified Pro List vs. Traditional Sourcing

Data aggregated from 127 client engagements (Q3 2025–Q1 2026)

| Validation Stage | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Factory Audit & Capability | 22 days | Pre-completed | 22 days |

| Compliance Verification (UL, CE, RoHS) | 14 days | Pre-verified | 14 days |

| Production Capacity Assessment | 9 days | Real-time dashboard | 9 days |

| TOTAL | 45 days | ≤7 days | 38 days |

Key Advantages Embedded in the Pro List:

✅ DC/DC Converter-Specific Vetting: Factories pre-tested for critical parameters (ripple noise <50mV, transient response <100μs).

✅ Live Capacity Tracking: Avoid 2026’s Tier-2 supplier bottlenecks with real-time production slot visibility.

✅ Zero-Cost Risk Mitigation: Eliminate $18,500+ average costs per failed audit (per client data).

“SourcifyChina’s Pro List cut our DC/DC converter supplier onboarding from 52 to 6 days. We avoided a $220K recall when their team flagged non-compliant electrolytic capacitors.”

— Head of Procurement, Tier-1 Automotive Supplier (Germany)

Your 2026 Sourcing Imperative: Act Before Q3 Allocation Closes

China’s DC/DC converter capacity is 89% committed for H2 2026. The top 3 verified factories on our Pro List have ≤12% capacity left—and require 90-day lead times for new clients.

Why Wait Costs You:

- Missed Q3 Shipments: 47% of late 2025 orders faced 22% cost inflation due to capacity shortages.

- Compliance Penalties: Non-validated suppliers risk 15–25% tariffs under new US-EU CBAM regulations.

- Opportunity Cost: 38 days saved = 2.3x faster time-to-market (critical for EV/5G infrastructure projects).

Call to Action: Secure Your Verified Supply Chain in <72 Hours

Don’t gamble with unverified suppliers in 2026’s high-stakes electronics market. SourcifyChina’s Pro List delivers:

🔹 Guaranteed DC/DC converter expertise (factories audited for <0.5% failure rates)

🔹 Zero time-to-value: Immediate access to pre-negotiated MOQs (as low as 500 units)

🔹 End-to-end compliance shielding: From IATF 16949 to China Compulsory Certification (CCC)

👉 Take Action Now:

1. Email: Send your DC/DC converter specs to [email protected] with subject line: “PRO LIST 2026 – [Your Company]”.

2. WhatsApp: Message +86 159 5127 6160 for urgent capacity checks (response in <15 min during CET business hours).

Within 24 business hours, you’ll receive:

– A customized Pro List with 3–5 pre-qualified DC/DC converter factories matching your technical requirements.

– Risk assessment matrix showing compliance gaps vs. your target markets.

– Pricing benchmark report (2026 Q2 data) to negotiate from a position of strength.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

We don’t find suppliers—we deliver risk-mitigated, audit-ready manufacturing partnerships.

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp) | 🌐 sourcifychina.com/pro-list-2026

© 2026 SourcifyChina. All rights reserved. Data sources: IEEE, IEC, SourcifyChina Client Analytics Hub.

🧮 Landed Cost Calculator

Estimate your total import cost from China.