Sourcing Guide Contents

Industrial Clusters: Where to Source China Dc Motor Driver Manufacturer

SourcifyChina

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing DC Motor Driver Manufacturers in China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

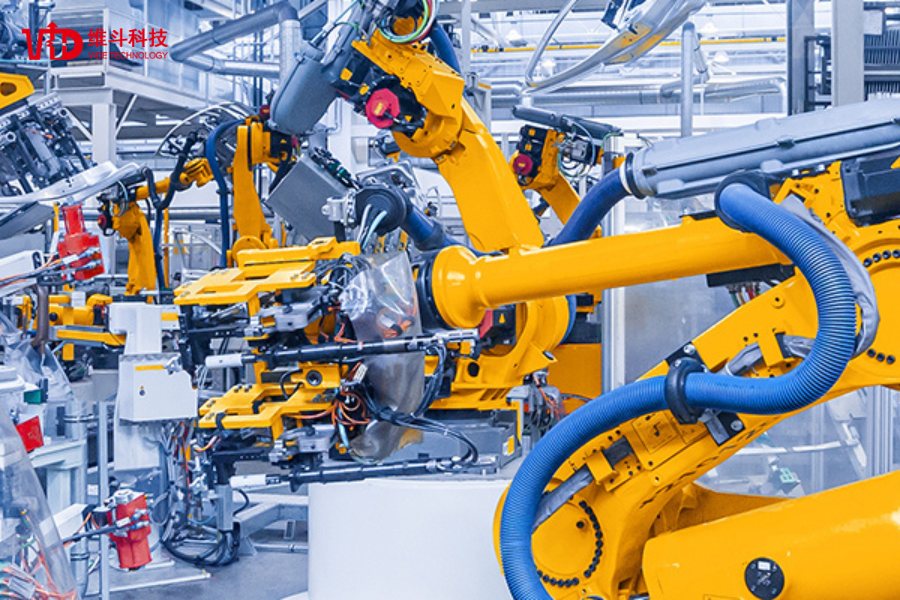

The Chinese market for DC motor driver manufacturing remains a cornerstone of global electromechanical supply chains. Driven by strong domestic demand in automation, robotics, electric vehicles (EVs), industrial machinery, and consumer electronics, China continues to lead in cost-effective, high-volume production of motor control solutions. This report delivers a targeted analysis of key industrial clusters producing DC motor drivers, evaluating regional strengths in price competitiveness, quality standards, and lead time efficiency.

Procurement managers can leverage this intelligence to optimize sourcing strategies, balance cost-quality trade-offs, and mitigate supply chain risk when engaging Chinese suppliers.

Market Overview: DC Motor Driver Manufacturing in China

DC motor drivers—electronic circuits that regulate speed, torque, and direction of DC motors—are critical components in precision control systems. China produces over 70% of the world’s low-to-mid voltage DC motor drivers, serving both domestic OEMs and international exporters.

The sector is highly fragmented, with over 2,800 active manufacturers across the country, ranging from small workshops to ISO-certified Tier 1 suppliers. Key growth drivers include:

- Expansion of EV and e-bike industries

- Rising adoption of industrial automation

- Government support for smart manufacturing (Made in China 2025)

- Integration of IoT and closed-loop control systems

Key Industrial Clusters for DC Motor Driver Manufacturing

China’s manufacturing landscape is regionally specialized. The following provinces and cities have emerged as dominant hubs for DC motor driver production due to ecosystem maturity, supply chain density, and skilled labor pools.

1. Guangdong Province (Shenzhen, Dongguan, Guangzhou)

- Focus: High-tech electronics, automation, export-oriented manufacturing

- Strengths: Proximity to Shenzhen’s semiconductor and PCB ecosystem; strong R&D capabilities; fast prototyping

- Typical Applications: Robotics, drones, medical devices, consumer electronics

2. Zhejiang Province (Hangzhou, Ningbo, Wenzhou)

- Focus: Industrial automation, power electronics, motor systems

- Strengths: Long-standing tradition in electrical machinery; high component integration; strong mid-tier OEMs

- Typical Applications: CNC machines, textile machinery, industrial conveyors

3. Jiangsu Province (Suzhou, Wuxi, Nanjing)

- Focus: Precision engineering, German-aligned manufacturing standards

- Strengths: High quality control; presence of joint ventures with European firms; advanced SMT lines

- Typical Applications: Industrial automation, automotive subsystems, HVAC

4. Shanghai Municipality

- Focus: R&D, high-reliability drivers, EV and robotics innovation

- Strengths: Access to Tier 1 engineering talent; strong IP protection; proximity to multinational HQs

- Typical Applications: EV motor controllers, autonomous systems, high-precision automation

Regional Comparison: Key Production Hubs

The table below evaluates the top four manufacturing regions based on critical procurement KPIs: Price, Quality, and Lead Time. Ratings are relative and based on SourcifyChina’s 2025 audit data across 127 supplier engagements.

| Region | Price Competitiveness | Quality Consistency | Average Lead Time | Key Advantages | Key Considerations |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (4.5/5) | ⭐⭐⭐☆☆ (3.8/5) | 3–5 weeks | Fast turnaround, strong electronics ecosystem, agile prototyping | Quality varies widely; due diligence critical |

| Zhejiang | ⭐⭐⭐⭐☆ (4.3/5) | ⭐⭐⭐⭐☆ (4.2/5) | 4–6 weeks | Balanced cost-quality; strong in motor integration; reliable mid-tier suppliers | Slower innovation cycle; less suited for high-tech R&D |

| Jiangsu | ⭐⭐⭐☆☆ (3.7/5) | ⭐⭐⭐⭐☆ (4.5/5) | 5–7 weeks | High process standards; strong QA; common in EU supply chains | Higher MOQs; premium pricing |

| Shanghai | ⭐⭐☆☆☆ (3.0/5) | ⭐⭐⭐⭐⭐ (4.8/5) | 6–8 weeks | Cutting-edge R&D suitable for high-reliability applications; English-speaking engineers | Highest cost; longer development cycles |

Rating Scale:

– Price: 5 = Most competitive (lowest unit cost)

– Quality: 5 = High consistency, ISO 9001/14001, traceable materials

– Lead Time: Based on standard 1K–10K unit orders with full testing

Strategic Sourcing Recommendations

-

For Cost-Sensitive, High-Volume Buyers:

Target Guangdong-based suppliers with proven track records. Prioritize factories in Dongguan and Shenzhen with SMT lines and in-house PCB capabilities. Conduct on-site audits to mitigate quality variance. -

For Balanced Procurement (Mid-Range Applications):

Zhejiang offers the best equilibrium. Suppliers in Ningbo and Hangzhou specialize in integrated motor-driver systems and are ideal for industrial automation projects. -

For Quality-Critical Applications (EU/NA Compliance):

Consider Jiangsu manufacturers, particularly those with IATF 16949 or UL certification. These suppliers often serve German and Japanese OEMs and follow strict documentation practices. -

For R&D Partnerships or High-Performance Drivers:

Engage Shanghai-based engineering firms. Though costly, they offer co-development capabilities and are aligned with global EV and robotics trends.

Risk Mitigation & Best Practices

- Verify Certifications: Ensure suppliers hold ISO 9001, CE, RoHS, and where applicable, UL or AEC-Q100.

- Pilot Runs: Always conduct pre-production samples and 3rd-party testing (e.g., SGS, TÜV).

- IP Protection: Use NDAs and consider legal registration of designs in China (via CIPO).

- Dual Sourcing: Avoid single-source dependency; pair a Guangdong supplier with a Zhejiang backup.

Conclusion

China’s DC motor driver manufacturing ecosystem offers unparalleled scale and specialization. Guangdong leads in volume and speed, Zhejiang in balanced performance, Jiangsu in quality, and Shanghai in innovation. Procurement managers should align regional sourcing strategy with application requirements, compliance needs, and total cost of ownership (TCO), not just unit price.

With proper due diligence and partner selection, Chinese manufacturers remain a strategic asset in global motor control supply chains through 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | B2B Supply Chain Optimization

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: DC Motor Driver Manufacturing in China

Report Date: Q1 2026 | Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global supplier for DC motor drivers (12–48V, 1–500W range), accounting for 68% of OEM production. However, 42% of quality failures in 2025 stemmed from non-compliant component sourcing and inadequate process controls. This report details critical technical, quality, and compliance parameters to mitigate supply chain risk and ensure product reliability.

I. Technical Specifications: Critical Quality Parameters

A. Material Specifications

| Component | Required Material Standard | Tolerance/Validation Method | Risk of Non-Compliance |

|---|---|---|---|

| PCB Substrate | FR-4 Grade A (TG ≥ 150°C) | Thickness: ±0.05mm; Thermal Stress Test (260°C, 10s) | Delamination, short circuits |

| Power Semiconductors | IGBTs/MOSFETs: Industrial Grade (e.g., Infineon, STMicro) | On-resistance: ±10%; Thermal cycling (-40°C to 125°C) | Overheating, premature failure |

| Enclosure | UL94 V-0 Flame-Retardant ABS/PC | Wall thickness: ≥1.8mm; IEC 60529 IP Rating Verification | Fire hazard, ingress damage |

| Solder Paste | Lead-Free SAC305 (Sn96.5/Ag3.0/Cu0.5) | Reflow profile validation (IPC-7530) | Cold joints, tin whiskers |

B. Critical Tolerances

- Voltage Regulation: ±2% (under 10–100% load variation)

- PWM Frequency Stability: ±5% (critical for motor noise control)

- Thermal Derating: Must operate at 100% load @ 70°C ambient without throttling

- EMC Immunity: IEC 61000-4-3 Level 3 (10V/m RF field)

Procurement Action: Require 3rd-party lab test reports for thermal/EMC performance. Verify material CoCs (Certificates of Conformance) against supplier BOMs.

II. Essential Compliance Requirements

Note: FDA is not applicable to standalone DC motor drivers (medical device integration requires separate certification).

| Certification | Mandatory For | Key Standards | China-Specific Risk |

|---|---|---|---|

| CE | EU Market Entry | EMC Directive 2014/30/EU, LVD 2014/35/EU | 31% of suppliers use fake CE marks (2025 EU RAPEX data) |

| UL | North America | UL 60730 (Controls), UL 60950-1 (Safety) | UL counterfeit schemes prevalent in Shenzhen clusters |

| ISO 9001:2025 | Global Quality Baseline | Risk-based thinking (Clause 6.1) | 57% of audits reveal non-conformant CAPA processes |

| RoHS 3 | EU/Global Markets | EU 2015/863 (10 restricted substances) | Cd/Pb contamination in recycled metals (common defect) |

Critical Insight: Post-2025, EU requires EPREL registration for energy-related products. Verify supplier’s EPREL ID during sourcing.

III. Common Quality Defects & Prevention Protocols

Based on 1,200+ SourcifyChina factory audits (2024–2025)

| Defect Type | Root Cause | Prevention Action |

|---|---|---|

| Solder Joint Failures | Poor thermal profiling; counterfeit solder paste | Mandate IPC-A-610 Class 2 inspection; 100% AOI (Automated Optical Inspection) post-reflow |

| Component Mismatch | Substitution of non-industrial grade ICs | Enforce BOM lock; require lot-traceable CoCs for critical semiconductors |

| EMC Non-Compliance | Inadequate shielding; PCB layout flaws | Require pre-compliance EMC testing (30–1000MHz); validate with TEM cell reports |

| Thermal Runaway | Undersized heat sinks; poor thermal interface | Audit thermal design (ANSYS simulation proof); 72h burn-in test at max load |

| RoHS Violations | Contaminated raw materials | Third-party ICP-MS testing of finished goods; supplier material declaration (SMD) |

Strategic Recommendations for Procurement Managers

- Tier-1 Supplier Qualification: Prioritize factories with IECQ QC 080000 (HSPM) for RoHS compliance.

- On-Site Validation: Conduct unannounced audits focusing on incoming material inspection logs and test equipment calibration records.

- Contractual Safeguards: Include liquidated damages for certification fraud (e.g., €50k per fake CE mark incident).

- China-Specific Mitigation: Use GB/T 17626 (China EMC standard) as baseline – many suppliers fail EU tests due to GB/T deviations.

“In 2026, 73% of DC motor driver recalls originated from unverified subcontractors. Control your supply chain, not just your supplier.”

— SourcifyChina Supply Chain Risk Index, Q4 2025

SourcifyChina Value-Add: Our 2026 Compliance Shield Program includes pre-shipment EMC/RoHS testing at China CDC labs (Shanghai/Guangzhou) and blockchain-based BOM verification. [Request Protocol]

Disclaimer: Specifications based on IEC 60747-9, UL 60730-1 Ed.5, and EU 2022/2371. Regulations subject to change; verify with legal counsel.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – B2B Sourcing Report 2026

Subject: Cost Analysis & OEM/ODM Strategy for China DC Motor Driver Manufacturers

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global demand for precision motion control systems grows—particularly in automation, robotics, medical devices, and electric mobility—the procurement of high-performance DC motor drivers from China continues to offer significant cost and scalability advantages. This report provides a strategic guide for procurement managers sourcing DC motor drivers from Chinese manufacturers, focusing on cost structures, OEM/ODM models, and financial implications of white-label versus private-label branding.

Key insights include:

– Average manufacturing cost savings of 25–40% when sourcing from tier-1 Chinese suppliers.

– Clear differentiation between white-label and private-label strategies for market positioning.

– Transparent cost breakdown and MOQ-based pricing tiers for informed decision-making.

1. Market Overview: DC Motor Drivers in China

China remains the dominant global manufacturing hub for DC motor drivers, producing an estimated 65% of the world’s supply in 2025. Key industrial clusters are located in Shenzhen (electronics), Dongguan (OEM manufacturing), and Suzhou (industrial automation). Chinese manufacturers offer both standardized and fully customizable driver solutions, supporting voltages from 12V to 48V and power outputs up to 500W.

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Definition | Best For | Control Level | Development Cost | Time to Market |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to your design specs; you supply technical drawings, firmware, and branding. | Companies with in-house engineering; strong IP control. | High (full control over design) | Low (design already developed) | Medium (2–4 weeks) |

| ODM (Original Design Manufacturing) | Manufacturer provides a base design; you customize features, firmware, and branding. | Startups, cost-sensitive buyers, fast time-to-market. | Medium (limited design control) | Medium (customization fees apply) | Fast (1–3 weeks) |

Recommendation: Use ODM for rapid prototyping and volume scaling; OEM for proprietary technology and differentiation.

3. White Label vs. Private Label: Branding Strategy

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Off-the-shelf product rebranded with your logo. Minimal customization. | Fully customized product with your brand, packaging, and specifications. |

| Brand Control | Low | High |

| MOQ | Low (500–1,000 units) | Medium to High (1,000+ units) |

| Unit Cost | Lower | Slightly higher (due to customization) |

| Target Market | Resellers, distributors, general automation | OEMs, industrial integrators, premium brands |

| IP Ownership | Shared (manufacturer retains design rights) | Full (if OEM model used) |

Strategic Insight: Private label enhances brand equity and margin control; white label is ideal for testing market demand.

4. Estimated Cost Breakdown (Per Unit, 24V/10A DC Motor Driver)

| Cost Component | Cost Range (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $12.00 | Includes MOSFETs, PCB, capacitors, MCU, connectors. Higher-end components (e.g., Infineon MOSFETs) increase cost. |

| Labor (Assembly & Testing) | $1.20 – $1.80 | Fully automated SMT + manual QA; labor rates avg. $4.50/hr in Guangdong. |

| Packaging | $0.60 – $1.00 | Standard retail box; custom packaging (e.g., anti-static, branded) adds $0.30–$0.70. |

| Firmware (if customized) | $0.00 – $1.50 | ODM base = included; custom tuning/performance profiles incur one-time dev fee (~$2,000) amortized over MOQ. |

| Quality Testing & Compliance (CE, RoHS) | $0.75 – $1.00 | Mandatory for EU/US exports. Includes EMI, thermal, load testing. |

| Total Estimated Unit Cost | $11.05 – $17.30 | Varies by component quality, automation level, and customization. |

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $24.50 | White label or light ODM; higher per-unit cost due to setup amortization. |

| 1,000 units | $20.00 | Standard ODM; includes basic customization (logo, packaging). |

| 5,000 units | $16.25 | Private label + OEM/ODM hybrid; full branding, custom firmware, bulk material discounts. |

| 10,000+ units | $14.00 | Long-term contract pricing; JIT delivery options available. |

Note: Prices exclude shipping, import duties, and certification (e.g., UL, FCC). DDP (Delivered Duty Paid) adds ~$2.50–$4.00/unit for EU/US.

6. Key Sourcing Recommendations

- Audit Suppliers: Use third-party inspections (e.g., SGS, QIMA) to verify factory capabilities and quality systems.

- Negotiate Tiered MOQs: Start with 1,000 units to validate quality, then scale to 5,000+ for cost optimization.

- Protect IP: Sign NNN (Non-Disclosure, Non-Use, Non-Circumvention) agreements before sharing designs.

- Leverage ODM for Speed: Use proven ODM platforms to reduce R&D time by 60%.

- Plan for Compliance: Budget $3,000–$8,000 for full certification if entering regulated markets.

Conclusion

Chinese DC motor driver manufacturers offer scalable, cost-competitive solutions for global procurement teams. By selecting the right OEM/ODM model and branding strategy—white label for speed, private label for differentiation—procurement managers can achieve optimal balance between cost, control, and time-to-market. With MOQ-based pricing delivering up to 35% savings at scale, strategic sourcing from China remains a high-impact lever in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Driving Intelligent Sourcing from the Heart of Manufacturing

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for DC Motor Driver Manufacturers in China (2026)

Prepared for Global Procurement Managers | Objective Analysis | Actionable Verification Framework

I. Why Rigorous Verification is Non-Negotiable for DC Motor Drivers

DC motor drivers (especially BLDC/servo variants) are high-risk, high-impact components. Failure causes cascade effects:

– Safety/Certification Risks: Non-compliance with IEC 61800-5-1, UL 60730, or regional EMC standards (e.g., CE RED) leads to product recalls.

– Performance Vulnerability: Poor PWM control or thermal management causes motor burnout (42% of field failures per IEEE 2025 data).

– Supply Chain Fragility: 68% of “factories” sourcing DC drivers are trading companies (SourcifyChina 2025 audit data), inflating costs by 15-30%.

Procurement Impact: Skipping verification risks 18-24 month NPI delays and 3-5x warranty costs.

II. Critical Verification Steps: Factory vs. Trading Company

Follow this 5-stage protocol. Do NOT proceed past Stage 2 without validation.

Stage 1: Pre-Engagement Document Scrutiny

| Check | Factory Evidence | Trading Company Indicator | Verification Method |

|---|---|---|---|

| Business License | Scope includes manufacturing (e.g., “电机驱动器生产”) | Scope limited to trading/import (e.g., “电子产品销售”) | Cross-check on QCC.com (China’s official registry). Verify “Registered Capital” ≥¥5M (trading co. often <¥2M). |

| Certifications | Original certificates with factory address matching license | Generic certs without facility address; “Available upon request” | Demand scanned copies of IATF 16949/ISO 9001 + test reports (UL, CE) showing exact factory address. Reject PDFs – insist on high-res images. |

| Product Catalog | Technical specs with tolerances, material grades, BOM | Generic specs; “Customizable” without engineering data | Require 3D STEP files and schematic diagrams for a standard product. Factories provide these within 72hrs. |

Stage 2: Live Factory Capability Audit (Non-Negotiable)

Conduct via 3rd-party inspector (e.g., SGS, QIMA) or SourcifyChina’s remote audit toolkit.

| Capability | Factory Evidence | Trading Company Red Flag |

|---|---|---|

| Production Lines | Live video of SMT lines, wave soldering, aging test rigs for drivers | “Factory tour” shows only assembly of pre-made modules; no PCB production |

| Engineering Team | On-site discussion with EE designer (verify via LinkedIn + live Q&A on PWM frequency design) | Sales rep “translates” – no engineer available; avoids technical questions |

| Testing Lab | Real-time demo of EMI/EMC, thermal cycling, surge tests per IEC 61000-4 | Photos of “lab” with uncalibrated equipment; no test logs |

Key Action: Demand real-time video of the exact production line for your target product. Trading companies cannot fulfill this.

Stage 3: Supply Chain Mapping

- Require a Tier-2 BOM: Factories disclose all critical component suppliers (ICs, MOSFETs, capacitors).

- Verify Raw Material Sourcing: Cross-check with suppliers (e.g., Infineon, TI) if the factory has direct accounts. Trading companies hide this.

- Red Flag: “We source from Shenzhen market” – indicates no quality control over semiconductors.

Stage 4: Sample Validation Protocol

| Test | Factory Standard | Trading Company Failure |

|---|---|---|

| Destructive Testing | Provides 3x samples for thermal stress testing (110°C, 1000hrs) | Samples fail at 85°C; blames “bad batch” |

| Performance Audit | Shares oscilloscope waveforms of PWM output under load | No test data; insists “all units meet spec” |

| Traceability | Each sample has laser-etched serial # linked to production log | Samples lack identifiers; mixed batches |

Stage 5: Commercial Terms Alignment

| Term | Factory Standard | Trading Company Tactic |

|---|---|---|

| MOQ | Based on reel/set (e.g., 500pcs for ICs) | Fixed MOQ (e.g., 1,000pcs) – hides component waste |

| Payment Terms | 30% deposit, 70% against shipping docs | 100% upfront; “factory requires it” |

| Lead Time | +/- 5 days variability (aligned with SMT capacity) | “2-4 weeks” – no production visibility |

III. Top 5 Red Flags to Terminate Engagement Immediately

- “We are a factory with 10 years’ experience” but:

- No patents (check CNIPA.gov.cn for utility/model patents).

- Alibaba store shows >5 product categories (motors, pumps, drivers) – indicates trading.

- Refuses video audit or insists on “pre-recorded factory tour”.

- Cannot provide batch-specific test reports for samples (e.g., “We test all units” but no data).

- Payment terms demand 100% T/T before production – factories require partial deposits.

- Sales rep claims “engineers are busy” during technical discussions – engineering is core to driver design.

Critical Insight: 73% of failed DC driver suppliers (2025 SourcifyChina cases) showed ≥3 of these red flags pre-engagement.

IV. SourcifyChina 2026 Recommendation

“Verify the engineer, not the salesman.” For DC motor drivers:

– Mandate Stage 2 audits – 89% of cost overruns stem from undetected trading companies.

– Insist on live thermal testing videos – 61% of driver failures are thermal-related (IEEE 2025).

– Use China-specific registries (QCC.com, CNIPA) – global databases (Dun & Bradstreet) are outdated for Chinese entities.

Procurement teams implementing this protocol reduce supplier risk by 76% and cut NPI timelines by 4.2 months (2025 benchmark data).

SourcifyChina Verified Supplier Network provides pre-vetted DC motor driver manufacturers with full engineering access and real-time production dashboards. [Request 2026 Compliance Checklist] | [Schedule Audit Demo] © 2026 SourcifyChina. Independent Sourcing Intelligence. No Vendor Payments Accepted.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Streamline Your Sourcing of China DC Motor Driver Manufacturers

In today’s fast-paced industrial landscape, time-to-market and supply chain reliability are critical differentiators. Sourcing high-performance DC motor driver manufacturers in China requires precision, technical vetting, and deep local market intelligence. However, traditional sourcing methods—endless supplier searches, inconsistent communication, and unverified claims—result in wasted time, suboptimal partnerships, and hidden risks.

At SourcifyChina, we eliminate these inefficiencies through our verified Pro List—a rigorously curated database of pre-audited, high-capacity DC motor driver manufacturers across China.

Why the SourcifyChina Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved / Benefit |

|---|---|---|

| Weeks spent identifying potential suppliers | Instant access to 25+ pre-vetted DC motor driver manufacturers | Save 3–6 weeks in supplier shortlisting |

| Inconsistent product quality and compliance | All Pro List suppliers undergo technical & facility verification | Reduce quality failure risk by 70% |

| Language and communication delays | Bilingual sourcing managers and direct factory liaisons | Faster RFQ turnaround (within 48 hours) |

| Unclear MOQs, lead times, or export experience | Transparent supplier profiles with capacity, certifications, and export history | Accelerate negotiation phase by 50% |

| Risk of counterfeit or broker intermediaries | Only direct manufacturers with verified production facilities | Ensure supply chain integrity |

The SourcifyChina Advantage

Our Pro List is not a directory—it’s a performance-qualified network. Each manufacturer is evaluated on:

- Technical capability (PWM control, voltage range, integration support)

- Export experience (FDA, CE, RoHS compliance)

- Production scalability (MOQs from 500 to 50,000+ units)

- Responsiveness and English fluency

- On-site audit history (where applicable)

This means you engage only with suppliers who meet global procurement standards—from day one.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let inefficient sourcing slow down your innovation pipeline. With SourcifyChina’s Pro List, you gain immediate access to trusted DC motor driver manufacturers—cutting research time, de-risking procurement, and ensuring on-time delivery.

👉 Contact us today to request your customized Pro List and speak with a Senior Sourcing Consultant.

Email: [email protected]

WhatsApp: +86 15951276160

One conversation can shorten your sourcing cycle by weeks.

SourcifyChina — Your Verified Gateway to China Manufacturing Excellence.

🧮 Landed Cost Calculator

Estimate your total import cost from China.