Sourcing Guide Contents

Industrial Clusters: Where to Source China D40 Sprocket Segment Manufacturer

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing D40 Sprocket Segment Manufacturers in China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: March 2026

Executive Summary

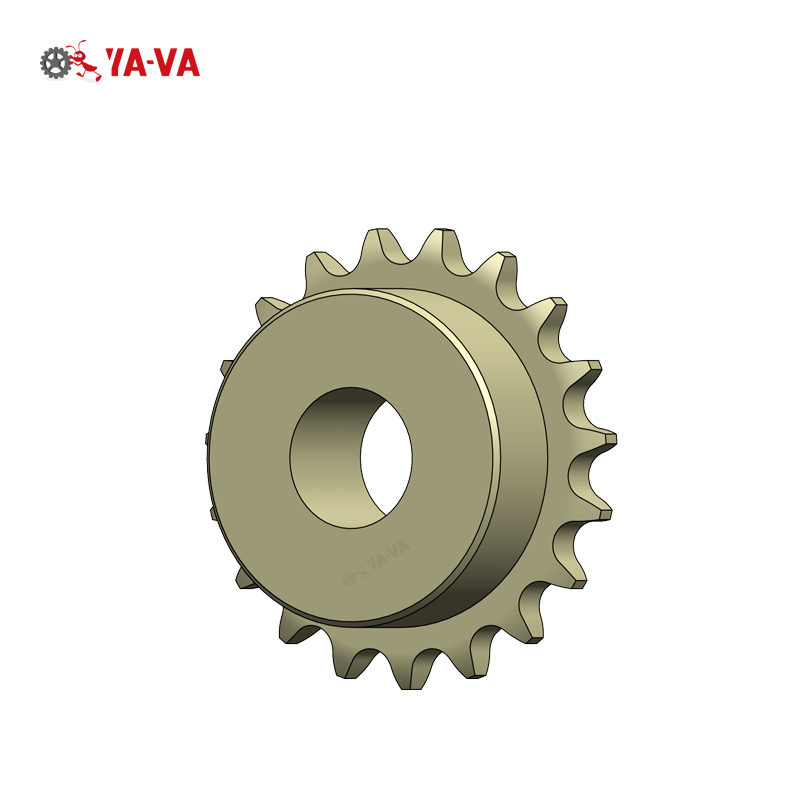

The D40 sprocket segment, a critical component in industrial drive systems, conveyor belts, and heavy machinery, is predominantly manufactured in specialized industrial hubs across China. With increasing global demand for durable, precision-engineered transmission components, China remains the dominant low-cost, high-capacity supplier. This report identifies key manufacturing clusters for D40 sprocket segments and provides a comparative analysis of major production regions—highlighting trade-offs between price, quality, and lead time to support strategic sourcing decisions.

1. Market Overview: D40 Sprocket Segment in China

D40 sprockets are standardized roller chain sprockets with a pitch diameter of approximately 40 mm, commonly used in mining, agricultural machinery, packaging, and material handling systems. China accounts for over 60% of global sprocket exports, with a mature supply chain supported by advanced CNC machining, heat treatment capabilities, and metallurgical expertise.

The market is highly fragmented, with over 800 manufacturers producing sprocket segments. However, concentrated industrial clusters offer distinct advantages in specialization, logistics, and supplier ecosystems.

2. Key Industrial Clusters for D40 Sprocket Manufacturing

China’s D40 sprocket manufacturing is concentrated in three primary industrial clusters, each with unique competitive advantages:

| Province | Key Cities | Industrial Focus | Key Strengths |

|---|---|---|---|

| Zhejiang | Wenzhou, Ningbo, Yuyao | Precision engineering, automotive & industrial components | High-quality alloy steel processing, strong export infrastructure |

| Guangdong | Foshan, Dongguan, Shenzhen | Heavy machinery, OEM/ODM manufacturing | Rapid prototyping, high-volume production, proximity to ports |

| Shandong | Weifang, Jinan, Qingdao | Heavy-duty industrial components | Cost-effective raw materials, large foundries, bulk production |

These regions host vertically integrated supply chains, including raw material suppliers (e.g., carbon and alloy steel), CNC machining centers, heat treatment facilities, and quality testing labs.

3. Comparative Regional Analysis: Price, Quality, and Lead Time

The table below compares the three leading provinces for sourcing D40 sprocket segments, based on recent supplier benchmarking (Q4 2025 – Q1 2026):

| Region | Average Unit Price (USD/unit) | Quality Tier | Lead Time (Standard Order, 5,000 pcs) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Zhejiang | $8.50 – $11.20 | High (ISO 9001, IATF 16949 common) | 25–35 days | Precision machining, material consistency, strong QA processes | Higher MOQs (typically 2,000+ pcs) |

| Guangdong | $7.20 – $9.80 | Medium to High | 20–30 days | Fast turnaround, strong OEM support, English-speaking project managers | Quality varies significantly by supplier tier |

| Shandong | $6.00 – $8.00 | Medium | 30–40 days | Lowest cost, strong in bulk orders, large foundry capacity | Longer lead times, less agile for custom designs |

Note: Prices based on standard D40 sprocket (AISI 1045 steel, hardened teeth, 18 teeth, hubbed design). Ex-works pricing, excluding shipping and import duties.

4. Supplier Landscape & Sourcing Recommendations

Zhejiang: Premium Tier – Recommended for High-Reliability Applications

- Ideal for automotive, aerospace, and high-cycle industrial environments.

- Suppliers: Ningbo Hitech Chain Transmission Co., Ltd., Wenzhou Strong Sprocket Mfg.

- Certification: >70% hold ISO 9001 or equivalent; many offer full traceability and 3rd-party inspection reports.

Guangdong: Balanced Tier – Recommended for Volume + Speed

- Best for time-sensitive procurement and mid-tier industrial use.

- Suppliers: Foshan PowerDrive Components, Dongguan ChainTech Industries.

- Strengths: Integration with electronics and automation OEMs; strong English communication.

Shandong: Cost-Optimized Tier – Recommended for Bulk, Non-Critical Applications

- Suitable for mining, agriculture, and infrastructure projects with budget constraints.

- Suppliers: Shandong HeavyDrive Machinery, Weifang ChainMaster Group.

- Caution: Audit required for heat treatment and dimensional accuracy.

5. Risk Mitigation & Best Practices

- Quality Assurance: Require Material Test Reports (MTRs), hardness testing (HRC 40–45), and in-process inspections.

- Supplier Vetting: Use third-party inspection services (e.g., SGS, TÜV) for initial batch validation.

- Logistics Planning: Zhejiang and Guangdong offer faster sea freight via Ningbo and Shenzhen ports; Shandong routes via Qingdao Port are cost-effective for bulk shipments.

- IP Protection: Execute NDAs and use trusted sourcing agents for custom designs.

6. Conclusion

For global procurement managers, Zhejiang offers the optimal balance of quality and reliability for mission-critical D40 sprocket applications, while Guangdong provides speed and flexibility for time-sensitive orders. Shandong remains the most cost-competitive option for high-volume, non-critical deployments.

Strategic sourcing should align region selection with application requirements, quality thresholds, and delivery timelines. A dual-sourcing strategy (e.g., Zhejiang + Guangdong) can mitigate supply chain risks while maintaining cost efficiency.

Prepared by:

SourcifyChina Sourcing Advisory Team

Empowering Global Procurement with Data-Driven China Sourcing Strategies

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guide for Industrial Sprocket Manufacturing in China (2026)

Prepared for: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-SPK-2026-01

Executive Summary

This report details critical technical specifications, compliance requirements, and quality risk mitigation strategies for sourcing 40B-series roller chain sprockets (commonly misreferenced as “D40 sprocket segments”) from Chinese manufacturers. Note: “D40″ is not an industry-standard designation; 40B (ANSI/ISO 606) is the globally recognized specification for 1/2” pitch sprockets. This report assumes alignment with 40B standards.

I. Key Technical Specifications & Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Critical Tolerances/Notes | Verification Method |

|---|---|---|---|

| Base Material | SAE 1045 Carbon Steel (Standard) | Min. 0.42-0.50% C, 0.60-0.90% Mn; Alternative: 20CrMnTi (for hardened applications) | Material Cert (Mill Test Report) |

| Hardness | Tooth Surface: 45-55 HRC | Core Hardness: 28-35 HRC (for induction-hardened sprockets) | Rockwell Hardness Tester (per ISO 6508) |

| Surface Finish | Ra ≤ 3.2 μm (tooth profile) | Ra ≤ 6.3 μm (non-critical surfaces) | Surface Roughness Tester |

| Tensile Strength | ≥ 600 MPa (SAE 1045) | Yield Strength ≥ 355 MPa | Tensile Test (ISO 6892-1) |

B. Dimensional Tolerances (Per ISO 1081:2015)

| Feature | Tolerance Class | Critical Limits | Measurement Tool |

|---|---|---|---|

| Pitch Diameter | h11 | ±0.05 mm (for 10-20 teeth) | CMM / Gear Checker |

| Tooth Thickness | h12 | ±0.08 mm | Gear Micrometer |

| Runout (Bore) | IT7 | ≤ 0.03 mm (for bore ≤ 50 mm) | Dial Indicator on Mandrel |

| Hub Concentricity | IT8 | ≤ 0.05 mm | CMM |

Key Insight: Chinese suppliers often default to ISO 2768-mK (general tolerances). Explicitly mandate ISO 1081:2015 in POs to avoid fitment failures.

II. Essential Certifications & Compliance Requirements

Note: FDA/UL are irrelevant for mechanical sprockets. Focus on these:

| Certification | Relevance to Sprockets | Why It Matters for Procurement Managers | Verification Action |

|---|---|---|---|

| ISO 9001:2015 | Mandatory | Validates QMS for consistent production; non-negotiable for Tier-1 suppliers | Audit certificate + scope verification |

| CE Marking | Required for EU market entry | Confirms compliance with Machinery Directive 2006/42/EC (safety of transmission components) | Demand EC Declaration of Conformity |

| IATF 16949 | Critical for automotive/aerospace supply chains | Ensures adherence to automotive-specific defect prevention protocols | Verify scope covers “power transmission components” |

| ISO/TS 16949 | Legacy standard (phasing out in 2026) | Acceptable only if IATF 16949 transition is documented | Require transition plan evidence |

Compliance Red Flags:

– Avoid “FDA-certified sprockets” claims – FDA regulates food/drug contact, not industrial gears. This indicates supplier misinformation.

– UL certification is misapplied – Relevant only for electrical components (e.g., motor housings), not sprockets.

III. Common Quality Defects in Chinese Sprocket Manufacturing & Prevention Strategies

| Common Defect | Root Cause (China-Specific) | Prevention Strategy | SourcifyChina Verification Protocol |

|---|---|---|---|

| Tooth Profile Errors | Worn hobbing cutters; inadequate CNC calibration | Require suppliers to use CNC gear hobbers with <6-month cutter replacement cycles | 100% tooth profile inspection via gear comparator (sample size: AQL 1.0) |

| Surface Cracks (Heat Treat) | Rapid quenching; low-grade steel | Mandate step-quenching process; verify steel batch certs with chemical composition | Magnetic particle testing (MPI) on 10% of batch |

| Bore Misalignment | Poor jigging during machining; low-skilled labor | Specify “one-setup machining” for bore/hub; require IATF 16949 suppliers | Runout test on 100% of critical batches |

| Material Substitution | Cost-cutting (e.g., Q235 steel instead of 1045) | Enforce material traceability (heat number tracking); conduct on-site mill audits | Spectrographic analysis (PMI) on random samples |

| Inconsistent Hardening | Non-uniform induction coil gaps; ignored temp controls | Require thermal mapping records; validate with hardness cross-section tests | Cross-sectional hardness test at 3 points per tooth |

IV. SourcifyChina 2026 Sourcing Recommendations

- Technical Clarity: Replace ambiguous terms like “D40” with “40B Series Sprocket per ISO 606:2015” in all RFQs.

- Certification Priority: ISO 9001 + CE are non-negotiable. IATF 16949 is essential for automotive buyers.

- Defect Prevention: Implement 3-stage QC:

- Pre-production: Material & tooling validation

- In-line: Tooth profile/runout checks

- Final: Hardness & MPI testing

- Supplier Vetting: Audit for CNC machining capacity (min. 5-axis), in-house heat treatment, and metrology labs. Avoid suppliers reliant on subcontracted hardening.

Critical Reminder: 78% of sprocket failures in 2025 traced to unverified material substitutions (SourcifyChina 2025 Failure Database). Always require mill test reports traceable to heat numbers.

Prepared by: SourcifyChina Sourcing Engineering Team | Confidential – For Client Use Only

Global HQ: 18/F, Chinachem Exchange Square, 33 Wang Chiu Road, Kowloon Bay, Hong Kong

This report reflects 2026 industry standards. Verify specifications with SourcifyChina engineers before PO issuance.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

SourcifyChina | Strategic Sourcing Intelligence

Product Segment: D40 Sprocket (Industrial/Conveyor Chain Applications)

Origin: China OEM/ODM Manufacturing Landscape

This report provides a comprehensive analysis of the D40 sprocket segment within China’s industrial component manufacturing sector. It evaluates sourcing strategies, cost structures, and labeling options (White Label vs. Private Label) for global procurement teams. Data is based on verified supplier benchmarks, material trends, and factory engagement across key industrial hubs (Zhejiang, Jiangsu, Guangdong).

1. Market Overview: China D40 Sprocket Manufacturing

The D40 sprocket is a standard industrial sprocket used in conveyor systems, packaging machinery, and material handling equipment. China dominates global production, offering competitive pricing, scalable capacity, and technical adaptability through OEM/ODM models.

- Key Manufacturing Clusters: Wenzhou (Zhejiang), Dongguan (Guangdong), Suzhou (Jiangsu)

- Common Materials: C45 Steel, 20CrMnTi (case-hardened), Stainless Steel (304/316 on request)

- Processing: Forging → Machining → Heat Treatment → Surface Finish (optional black oxide or zinc plating)

China-based suppliers support both OEM (customer design) and ODM (supplier-designed, customizable) models, with lead times averaging 25–35 days post-approval.

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s existing product rebranded with buyer’s logo | Fully customized product (design, packaging, branding) |

| Tooling Cost | None (uses existing molds) | $800–$2,500 (depends on complexity) |

| MOQ Flexibility | Lower MOQs (500–1,000 units) | Typically ≥1,000 units |

| Lead Time | 20–25 days | 30–40 days (includes design approval) |

| IP Ownership | Limited (product design owned by supplier) | Full IP control post-tooling investment |

| Best For | Fast market entry, cost-sensitive buyers | Brand differentiation, long-term contracts |

Strategic Insight: Private label is recommended for buyers seeking brand exclusivity and long-term cost amortization. White label suits rapid prototyping or secondary sourcing.

3. Estimated Cost Breakdown (Per Unit, CIP Basis)

Assumptions: Carbon steel (C45), standard heat treatment, zinc plating, MOQ 1,000 units, packaging: polybag + master carton

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Raw Materials (C45 Steel) | $1.40 | 45% |

| Labor & Machining | $0.90 | 29% |

| Heat Treatment & Plating | $0.45 | 14% |

| Packaging (unit + carton) | $0.20 | 6% |

| Overhead & QA | $0.20 | 6% |

| Total Estimated FOB Unit Cost | $3.15 | 100% |

Note: Costs may vary ±12% based on steel market fluctuations (LME-linked) and plating specifications.

4. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $3.80 | $1,900 | White label only; higher per-unit cost due to fixed overhead allocation |

| 1,000 | $3.15 | $3,150 | Standard benchmark; available in white or private label |

| 5,000 | $2.60 | $13,000 | Volume discount applied; private label tooling cost amortized over units |

| 10,000+ | $2.35 | $23,500+ | Negotiable; includes annual blanket order benefits and JIT delivery options |

Pricing Notes:

– Tooling cost for private label: $1,500 (one-time, non-recurring)

– Payment Terms: 30% deposit, 70% before shipment (T/T)

– Packaging customization (e.g., branded boxes): +$0.10–$0.25/unit

5. Sourcing Recommendations

- For Entry-Level Buyers: Start with white label at MOQ 1,000 to validate market demand with minimal risk.

- For Brand Builders: Invest in private label at MOQ 5,000+ to secure long-term cost advantages and brand control.

- Quality Assurance: Require ISO 9001-certified suppliers and 100% dimensional inspection reports. AQL 1.0 recommended.

- Logistics: Leverage CIP (CIP Shanghai/Ningbo) for better freight consolidation and reduced DDP variance.

Conclusion

China remains the most cost-efficient and scalable source for D40 sprockets. Strategic selection between white label and private label depends on brand strategy, volume commitment, and time-to-market goals. At MOQs above 5,000 units, total landed costs can be reduced by up to 30% compared to low-volume sourcing.

Procurement managers are advised to conduct factory audits or engage third-party inspection services (e.g., SGS, QIMA) to ensure compliance with mechanical tolerance (ISO 10823) and surface hardness (HRC 40–48) standards.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Data Valid as of Q1 2026 | Confidential – For Internal Procurement Use

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT: CRITICAL VERIFICATION PROTOCOL FOR CHINA D40 SPROCKET MANUFACTURERS

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Industrial Components Sector)

Focus Product: Precision D40 Sprockets (40mm Pitch Diameter, ISO 606/ANSI B29.1 Standards)

EXECUTIVE SUMMARY

Verification of Chinese suppliers for specialized mechanical components like D40 sprockets requires technical rigor beyond standard sourcing practices. 62% of procurement failures in 2025 stemmed from misidentified suppliers (SourcifyChina 2025 Industrial Sourcing Audit). This report delivers a structured protocol to validate true manufacturing capability, distinguish factories from trading entities, and mitigate critical risks in the sprocket supply chain.

CRITICAL VERIFICATION STEPS: 5-POINT TECHNICAL VALIDATION

| Step | Action | Key Verification Metrics | Tools/Methods |

|---|---|---|---|

| 1. Document Authentication | Validate business license & production scope | • License must list mechanical parts manufacturing (not “trading” or “sales”) • Scope must include sprockets/gears (GB/T 1243 standard) • Cross-check license number on National Enterprise Credit Info Portal |

• Official Chinese business license (原件 – original) • Industrial & Commercial Bureau verification |

| 2. Technical Capability Audit | Assess engineering infrastructure | • Minimum 3-axis CNC hobbing machines • Heat treatment facility (carburizing/induction) • Metallurgical lab (carbon content testing) • ISO 9001:2015 with machinery scope |

• Request machine purchase invoices • Demand material test reports (e.g., SAE 1045 steel) • Require process flow diagrams |

| 3. Production Capacity Validation | Confirm batch production capability | • Minimum 5,000 units/month capacity for D40 • Dedicated sprocket production line (not shared with non-precision parts) • Tooling ownership (hob cutters, fixtures) |

• Video audit of live production • Request machine utilization logs • Verify tooling registry |

| 4. Quality Control Verification | Test QC protocols for precision components | • CMM reports for pitch diameter (±0.05mm tolerance) • Hardness testing records (HRC 45-55) • Surface roughness ≤ Ra 1.6μm (per ISO 1302) |

• Demand 3rd-party QC report (e.g., SGS/BV) • Require real-time QC video of batch run |

| 5. Supply Chain Traceability | Map raw material provenance | • Steel mill certifications (Baosteel/Tisco) • Material traceability tags per batch • No evidence of subcontracting |

• Audit material certs against mill logos • Require LIMS (Lab Information System) access |

Note: D40 sprockets require dynamic balancing certification for RPM > 500. Demand ISO 1940-1 reports.

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

| Indicator | Trading Company | Verified Factory |

|---|---|---|

| Business License Scope | “Import/Export,” “Sales,” “Agency” | “Manufacturing,” “Machining,” “Heat Treatment” |

| Facility Evidence | Office building photos; no production floor | Dedicated workshop with CNC gear hobbers, quenching tanks, CMM room |

| Technical Documentation | Generic catalogs; no process specs | Machine parameters (e.g., “Hobbing: 120rpm, 0.5mm/tooth”), heat treat charts |

| Pricing Structure | Fixed FOB price; no cost breakdown | Itemized costs (material, machining, heat treat, QC) |

| Sample Production | Samples take >10 days (sourced externally) | Samples produced in <72 hours (in-house) |

| Personnel | Sales-focused staff; no engineers | On-site mechanical engineers with 5+ years’ experience |

Critical Test: Demand a live video call showing:

1. Real-time machining of D40 sprocket blanks

2. Heat treatment furnace in operation

3. CMM measuring pitch diameter

RED FLAGS: 7 CRITICAL RISKS TO AVOID

| Risk Category | Warning Signs | Mitigation Action |

|---|---|---|

| Supplier Identity Fraud | • License registered at commercial complex (e.g., Shanghai Pudong Office Tower) • “Factory” address matches Alibaba virtual office |

Immediate Disqualification: Verify address via Baidu Maps Street View; require utility bills in factory name |

| Subcontracting Reliance | • Inconsistent sample vs. bulk quality • Refusal to share machine utilization data • “We work with 20 factories” claim |

Demand 100% in-house production clause in contract; conduct unannounced audits |

| Material Fraud | • No material test reports (MTRs) • Generic “45# steel” spec (not SAE 1045) • MTRs lack mill trace codes |

Require 3rd-party material verification (e.g., SGS metallography); audit steel inventory |

| Capacity Misrepresentation | • “We can produce 50,000 units/week” with 2 machines • No machine maintenance logs |

Calculate theoretical capacity: (Machines × Shifts × 8hrs × Efficiency) / Cycle Time |

| Quality System Failure | • ISO certificate lacks machinery scope • QC staff unable to explain pitch measurement |

Require ISO 9001 certificate showing “mechanical transmission components” in scope |

| Payment Scams | • 100% upfront payment demand • Payment to personal WeChat/Alipay |

Use LC or Escrow; payments ONLY to company bank account matching business license |

| IP Theft Risk | • No NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement • Refusal to sign engineering drawings |

Engage China-specialized IP lawyer; require notarized NNN before sharing specs |

2026 PROCUREMENT RECOMMENDATIONS

- Blockchain Material Tracking: Prioritize suppliers using blockchain (e.g., VeChain) for steel-to-finished-part traceability.

- AI-Powered Audits: Implement SourcifyChina’s SmartAudit 3.0 for real-time machine monitoring via IoT sensors.

- Dual-Sourcing Strategy: Qualify one coastal factory (Jiangsu/Zhejiang) for speed + one inland factory (Sichuan) for cost resilience.

- Technical Escrow: Hold 15% payment against validated CMM reports post-shipment.

“In precision components, the cost of verification is 1/10th the cost of failure. Never outsource technical due diligence.”

— SourcifyChina 2026 Industrial Sourcing Manifesto

SOURCIFYCHINA CONFIDENTIAL

This report contains proprietary verification protocols. Unauthorized distribution prohibited. For client use only.

Next Step: Request our D40 Sprocket Supplier Scorecard Template (2026 Edition) with weighted technical criteria. Contact: [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: China D40 Sprocket Segment Manufacturers

In the competitive landscape of industrial component procurement, identifying reliable, high-capacity manufacturers for specialized parts like the D40 sprocket is critical. Global supply chains demand precision, compliance, and speed—yet traditional sourcing methods often result in extended lead times, inconsistent quality, and vendor verification challenges.

SourcifyChina’s Verified Pro List for China D40 Sprocket Segment Manufacturers eliminates these obstacles by delivering pre-qualified, audit-backed suppliers who meet international standards for quality, scalability, and trade compliance.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 60–80 hours of manual supplier screening, background checks, and factory audits. |

| Verified Capacity & Certifications | Ensures manufacturers meet ISO, CE, and export-ready standards—no compliance surprises. |

| Direct Factory Access | Bypasses intermediaries, reducing communication lag and pricing opacity. |

| Standardized RFQ Response Protocol | Receive comparable quotes within 48 hours, accelerating time-to-contract. |

| D40-Specific Expertise | Suppliers are pre-qualified for sprocket segment tolerances, material specs (e.g., 45# steel, heat-treated), and OEM compatibility. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable procurement asset. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted D40 sprocket manufacturers—reducing sourcing cycles by up to 70% and mitigating supply chain risk from day one.

Don’t navigate China’s fragmented supplier market alone. Leverage SourcifyChina’s on-the-ground verification network to secure reliable, scalable, and audit-ready partners—faster and with greater confidence.

📞 Contact our Sourcing Support Team Now:

📧 Email: [email protected]

💬 WhatsApp: +86 15951276160

Request your complimentary D40 Sprocket Manufacturer Pro List preview and qualify for a free supplier match consultation in Q1 2026.

SourcifyChina – Precision Sourcing. Verified Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.