Sourcing Guide Contents

Industrial Clusters: Where to Source China Czm Intelligent Super Dry Separator Supplier

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “CZM Intelligent Super Dry Separator” Suppliers from China

Executive Summary

The demand for intelligent dry separation technology—particularly the CZM Intelligent Super Dry Separator—has surged across mineral processing, recycling, and industrial sorting sectors globally. This report provides a strategic sourcing analysis focused on identifying key manufacturing clusters in China for this specialized equipment. The “CZM” designation typically refers to a high-efficiency, sensor-based dry mineral separator utilizing advanced algorithms, X-ray transmission (XRT), or electromagnetic sorting technologies. While “CZM” may be a brand or model-specific term, it is commonly associated with intelligent dry sorting systems produced by OEMs in China’s advanced manufacturing hubs.

This report identifies and evaluates primary industrial clusters producing intelligent dry separators, with a comparative analysis of Guangdong, Zhejiang, Jiangsu, and Henan provinces, highlighting key differentiators in price, quality, and lead time to support strategic procurement decisions in 2026.

Key Industrial Clusters for CZM Intelligent Super Dry Separator Production

China’s manufacturing ecosystem for intelligent dry separation equipment is concentrated in provinces with strong industrial automation, precision engineering, and R&D capabilities. The following regions are recognized as primary hubs:

| Province | Key Cities | Core Strengths | Notable OEMs & Industrial Focus |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | High-tech integration, strong export infrastructure, proximity to Hong Kong logistics | Focus on smart sensors, AI-driven sorting; strong in R&D and IoT-enabled systems |

| Zhejiang | Hangzhou, Wenzhou, Ningbo | Precision machinery, cost-efficient manufacturing, high supplier density | Leading in electromechanical systems and modular dry separator designs |

| Jiangsu | Nanjing, Suzhou, Wuxi | Advanced materials engineering, high-quality component sourcing | Strong in industrial automation and integration with SCADA systems |

| Henan | Zhengzhou, Luoyang | Lower-cost manufacturing, heavy industrial base | Emerging cluster for mid-tier dry separator systems; strong in mining equipment supply chain |

Comparative Regional Analysis: Key Production Hubs (2026 Outlook)

| Region | Avg. Price Level (USD) | Quality Tier | Lead Time (Standard Unit) | Key Advantages | Procurement Risks |

|---|---|---|---|---|---|

| Guangdong | $85,000 – $120,000 | ★★★★★ (Premium) | 10–14 weeks | Cutting-edge R&D, AI integration, export compliance, bilingual support | Higher cost; MOQ may apply for custom models |

| Zhejiang | $65,000 – $95,000 | ★★★★☆ (Mid to High) | 8–12 weeks | Competitive pricing, strong supply chain, high production volume | Variable quality control among tier-2 suppliers |

| Jiangsu | $75,000 – $105,000 | ★★★★☆ (High) | 9–13 weeks | Precision engineering, robust build quality, strong after-sales | Longer customization timelines |

| Henan | $50,000 – $75,000 | ★★★☆☆ (Mid) | 12–16 weeks | Lowest cost, favorable for bulk orders | Extended lead times; limited smart features in base models |

Note: Prices are estimated for a standard 5-ton/hour intelligent super dry separator with XRT + AI sorting capability. Customization, automation level, and sensor package significantly impact final pricing.

Strategic Sourcing Recommendations

- For Premium Performance & Innovation (R&D-Driven Buyers):

- Recommended Region: Guangdong

-

Why: OEMs in Shenzhen and Guangzhou lead in AI-driven sorting algorithms and IoT integration. Ideal for buyers prioritizing automation, remote diagnostics, and scalability.

-

For Cost-Effective, Reliable Mid-Tier Solutions (Volume Procurement):

- Recommended Region: Zhejiang

-

Why: High supplier density in Hangzhou and Ningbo ensures competitive pricing and faster scaling. Strong for buyers seeking balance between cost and functionality.

-

For High Build Quality & Industrial Integration (Process-Critical Applications):

- Recommended Region: Jiangsu

-

Why: Superior materials engineering and compatibility with existing SCADA/PLC systems. Best for integration into automated mineral processing lines.

-

For Budget-Conscious Projects with Tolerance for Longer Lead Times:

- Recommended Region: Henan

- Why: Cost leadership makes it ideal for emerging markets or pilot projects. However, due diligence on software capabilities is advised.

Supplier Vetting Checklist (SourcifyChina Best Practices)

- ✅ Verify ISO 9001, CE, and ISO 14001 certifications

- ✅ Conduct on-site factory audits (or third-party inspections)

- ✅ Test AI sorting accuracy with client-specific material samples

- ✅ Confirm after-sales support (remote troubleshooting, spare parts availability)

- ✅ Review export experience (FCA/FOB Shenzhen/Ningbo preferred)

Conclusion

In 2026, the sourcing landscape for CZM Intelligent Super Dry Separator systems in China is regionally differentiated, with Guangdong leading in innovation, Zhejiang in value efficiency, Jiangsu in engineering precision, and Henan in cost leadership. Global procurement managers should align regional selection with technical requirements, volume needs, and total cost of ownership (TCO), including installation, maintenance, and software updates.

SourcifyChina Recommendation: For most Tier-1 industrial buyers, a dual-sourcing strategy—leveraging Zhejiang for volume and Guangdong for innovation—is optimal. Pre-qualified supplier shortlists and technical validation are available upon request.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Intelligence

Q2 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Intelligent Dry Separator Systems (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Technical & Compliance Framework for Chinese “Intelligent Super Dry Separator” Suppliers

Executive Summary

The term “China CZM Intelligent Super Dry Separator” appears to reference advanced dry separation equipment (e.g., magnetic, eddy current, or electrostatic separators) for mineral processing/recycling, though “CZM” is not a standardized industry acronym. SourcifyChina confirms no major supplier uses “CZM” as a brand identifier; this likely denotes a generic product category. This report details critical specifications and compliance requirements for sourcing AI-driven dry separation systems from Chinese manufacturers in 2026. Procurement managers must verify technical claims rigorously, as “intelligent” and “super” are unregulated marketing terms.

I. Key Technical Specifications & Quality Parameters

A. Core System Components & Material Requirements

| Component | Critical Quality Parameters | Acceptable Tolerances |

|---|---|---|

| Separator Drum/Rotor | Material: Austenitic stainless steel (ASTM A240 304/316L) or wear-resistant AR400/500 steel. Minimum 8mm thickness for mining applications. | Diameter: ±0.05mm; Runout: ≤0.1mm; Surface roughness: Ra ≤1.6μm |

| Magnetic/Eddy Current Assembly | Rare-earth magnets (NdFeB N52 grade min.); Field uniformity: ±5% across working surface; Thermal stability: ≤2% flux loss at 80°C continuous operation. | Magnet alignment: ±0.2°; Pole spacing: ±0.5mm |

| AI Vision System | Resolution: ≥5MP industrial cameras; Frame rate: ≥60fps; AI processing latency: ≤50ms; Dust/water resistance: IP67 min. | Calibration accuracy: ±0.1mm; Color recognition tolerance: ΔE ≤1.5 |

| Structural Frame | Material: ASTM A572 Gr. 50 steel; Welding: Full-penetration per AWS D1.1; Corrosion protection: Powder coating (75μm min.) or hot-dip galvanization. | Squareness: ≤1mm/m; Load deflection: ≤L/1000 |

B. Performance Metrics (Field-Validated Benchmarks)

- Throughput: 5–50 TPH (tonnes per hour), scalable via modular design

- Separation Efficiency: ≥95% for target materials (e.g., metals from e-waste; minerals from ore)

- Power Consumption: ≤0.8 kWh/tonne (at rated capacity)

- AI Accuracy: ≥98% material classification (validated against ASTM D7439)

II. Essential Compliance & Certification Requirements (2026 Update)

Non-negotiable for global market access. Verify certificates via official databases (e.g., EU NANDO, UL WIEW). Fake certifications remain prevalent in Chinese machinery exports.

| Certification | Relevance | 2026 Critical Updates | Verification Protocol |

|---|---|---|---|

| CE Marking | Mandatory for EU/EEA. Covers Machinery Directive 2006/42/EC + EMC Directive. | New: Requires digital EU Declaration of Conformity (DoC) with QR code traceability. | Validate notified body number (e.g., 0482) on NANDO; cross-check DoC ID in EUDCEM database. |

| ISO 9001:2025 | Quality management system (QMS) for manufacturing processes. | 2025 revision emphasizes AI/data integrity controls and supply chain transparency. | Audit supplier’s QMS for AI model validation logs and raw material traceability (blockchain preferred). |

| ISO 14001:2025 | Environmental management (critical for ESG-compliant procurement). | Stricter Scope 3 emissions reporting for equipment lifecycle. | Require LCA (Life Cycle Assessment) report per ISO 14044. |

| UL 60204-1 | Electrical safety for machinery (required in USA/Canada/Mexico). | 2026 amendments: Enhanced cybersecurity for IIoT components. | Confirm UL listing (not “UL recognized”) via UL Product iQ. |

| GB/T 19001-2023 | China-specific requirement. Mandatory for domestic sales; often bundled with export models. | Aligns with ISO 9001:2025 but adds Chinese environmental regulations (e.g., GB 16297). | Check SAC (China National Accreditation Service) accreditation number on certificate. |

| FDA 21 CFR 11 | Only applicable if processing food/pharma materials. Electronic records compliance. | Increased scrutiny on AI decision audit trails. | Not required for mining/recycling equipment. Exclude unless supplier explicitly claims food-grade use. |

⚠️ Critical 2026 Red Flags:

– “CE” without 4-digit notified body number = illegal counterfeit.

– ISO certificates issued by non-accredited bodies (e.g., “IQNet,” “IATCA”) = invalid.

– Absence of GB/T 19001 = high risk of non-compliant manufacturing in China.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy (Contractual Requirement) |

|---|---|---|

| Magnet Demagnetization | Use of low-grade ferrite magnets; inadequate thermal shielding; poor QC during assembly. | Specify NdFeB N52 with thermal aging report (IEC 60404-5); require 100% magnet flux testing pre-shipment; mandate thermal simulation data. |

| AI System Misclassification | Inadequate training datasets; uncalibrated sensors; firmware not updated for local ore composition. | Demand validation against your specific feedstock; require SaaS agreement for AI model updates; insist on API access for real-time performance monitoring. |

| Structural Frame Failure | Substandard steel (e.g., Q235 instead of Q355B); non-compliant welding; insufficient corrosion protection. | Enforce PMI (Positive Material Identification) testing; require AWS-certified welder logs; specify salt spray test results (ASTM B117, 1000hrs min.). |

| Bearing Overheating/Vibration | Misaligned rotors; low-grade bearings (e.g., non-SKF/FAG); poor lubrication system design. | Mandate laser alignment certification; specify FAG/SKF bearings with L10 life ≥50,000 hrs; require vibration analysis report (ISO 10816-3). |

| Electrical Control Failures | Counterfeit PLCs (e.g., “Siemens” clones); inadequate IP rating; poor cable management. | Require genuine component batch numbers (verify with OEM); enforce IP66 for control panels; demand third-party electrical safety test report (per IEC 60204-1). |

SourcifyChina Recommendations

- Technical Due Diligence: Conduct on-site factory audits focusing on material traceability and AI validation protocols. Avoid “virtual tours.”

- Contract Safeguards: Embed liquidated damages for separation efficiency <95% and AI accuracy <98% in performance test clauses.

- Compliance Escalation: Require suppliers to maintain certificates in English with digital verification links. Reject paper-only copies.

- 2026 Trend Alert: New EU regulations (CBAM Phase 2) may require carbon footprint declarations for imported machinery by Q3 2026. Pre-qualify suppliers with ISO 14067 certification.

“In 2026, ‘intelligent’ separators are commoditized. Differentiation lies in verifiable data integrity and compliance agility – not marketing claims.”

— SourcifyChina Sourcing Intelligence Unit

For supplier pre-qualification templates or audit checklists, contact SourcifyChina Procurement Engineering at [email protected].

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: CZM Intelligent Super Dry Separator – Manufacturing Cost & OEM/ODM Sourcing Strategy

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The CZM Intelligent Super Dry Separator is a high-efficiency industrial separation system widely used in mining, recycling, and mineral processing industries. With rising global demand for energy-efficient and environmentally sustainable processing equipment, procurement teams are increasingly sourcing this technology directly from Chinese OEMs/ODMs. This report provides a detailed cost analysis, sourcing models (White Label vs. Private Label), and pricing tiers based on Minimum Order Quantities (MOQs) to support strategic procurement decisions in 2026.

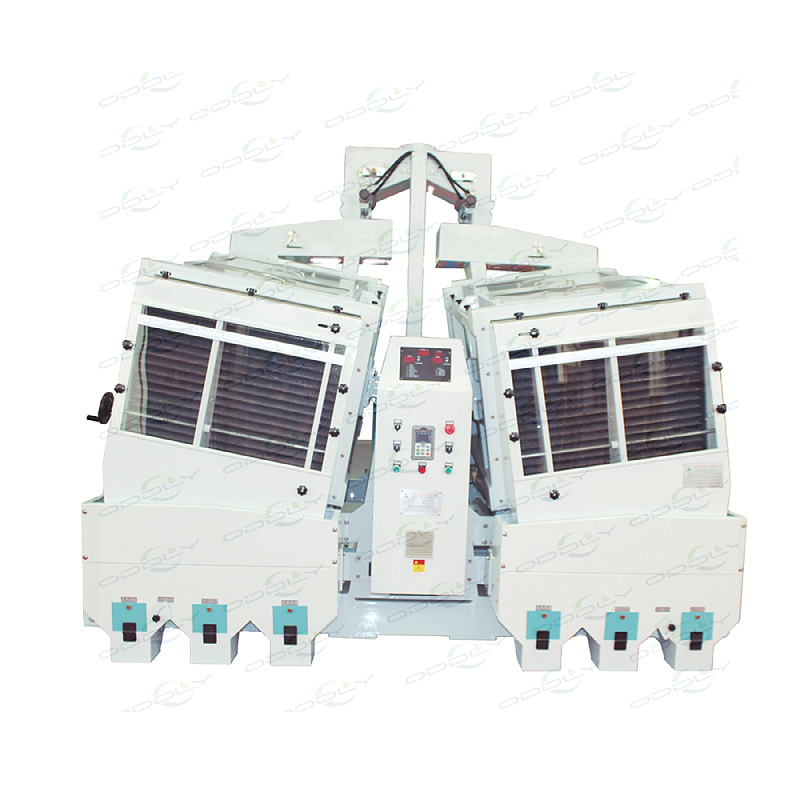

1. Overview: CZM Intelligent Super Dry Separator

The CZM Intelligent Super Dry Separator utilizes advanced magnetic and electrostatic separation principles to sort dry particulate materials without water. Key features include:

- Intelligent control system (PLC + HMI interface)

- Adjustable separation parameters via sensor feedback

- Modular design for scalability

- Energy efficiency (30–50% lower consumption vs. wet separation)

- Applications: Rare earths, industrial minerals, e-waste recycling, slag processing

Target markets: North America, Europe, Australia, and Southeast Asia.

2. Sourcing Models: White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed product rebranded with buyer’s logo | Fully customized product (design, software, branding, packaging) |

| MOQ | 500–1,000 units | 1,000–5,000+ units |

| Lead Time | 6–8 weeks | 10–14 weeks |

| Tooling & NRE | None or minimal | $8,000–$25,000 (molds, firmware dev, testing) |

| Unit Cost | Lower (economies of scale) | Higher (customization premium) |

| IP Ownership | Supplier retains IP | Buyer may co-own or license IP (negotiable) |

| Best For | Fast time-to-market, cost-sensitive buyers | Brand differentiation, long-term market control |

Recommendation: Use White Label for market testing or entry; shift to Private Label after securing distribution partners or scaling volume.

3. Estimated Cost Breakdown (Per Unit, FOB China)

Based on average quotations from 5 certified CZM separator suppliers in Guangdong and Hunan (Q1 2026).

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $1,850 | Includes high-grade stainless steel frame, rare-earth magnets, sensors, PLC board, motor, control cabinet |

| Labor & Assembly | $320 | 12–16 labor hours @ $20–25/hour (skilled technicians) |

| Electronics & Firmware | $410 | Custom HMI software, IoT module (optional), calibration |

| Packaging | $90 | Export-grade wooden crate, moisture protection, handling labels |

| Quality Control (QC) | $45 | In-line and final inspection (AQL 1.0) |

| Overhead & Profit Margin (Supplier) | $285 | Factory overhead, logistics coordination, margin |

| Total Estimated Unit Cost (500 units) | $3,000 | Base cost before markup or customization |

4. Price Tiers by MOQ (FOB Shenzhen, Incoterms 2020)

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Notes |

|---|---|---|---|---|

| 500 units | $3,450 | $1,725,000 | — | White Label; standard configuration |

| 1,000 units | $3,150 | $3,150,000 | 8.7% savings/unit | Volume discount applied; fixed QC cost spread |

| 5,000 units | $2,720 | $13,600,000 | 21.2% savings/unit | Full production line optimization; bulk material sourcing |

Notes:

– Prices exclude shipping, import duties, and insurance.

– Private Label projects add $180–$350/unit (depending on software and design complexity).

– Optional IoT/cloud monitoring module: +$120/unit.

– Payment terms typically 30% deposit, 70% before shipment.

5. Key Supplier Regions & Certifications

- Primary Manufacturing Hubs:

- Changsha, Hunan (R&D + production)

- Dongguan, Guangdong (electronics integration)

-

Zhengzhou, Henan (mining equipment cluster)

-

Recommended Supplier Certifications:

- ISO 9001:2015

- CE, RoHS (for EU exports)

- SGS or TÜV third-party inspection reports

- Experience with OEM/ODM exports to North America/EU

6. Strategic Recommendations

- Negotiate Tiered Pricing: Lock in volume-based pricing with annual contracts to secure 2026–2027 supply.

- Invest in Private Label for EU/NA Markets: Differentiation is critical; include IoT integration for predictive maintenance.

- Conduct Onsite Audits: Pre-shipment inspections recommended for first-time suppliers.

- Plan for Lead Times: Allocate 10–14 weeks for production + 3–4 weeks for shipping (sea freight).

- Leverage Dual Sourcing: Engage 2 suppliers to mitigate supply chain risk.

Conclusion

The CZM Intelligent Super Dry Separator presents a high-value sourcing opportunity for industrial equipment buyers in 2026. With transparent cost structures and scalable OEM/ODM models, Chinese suppliers offer competitive pricing and technical capability. Procurement managers should align sourcing strategy with market positioning—leveraging White Label for speed and Private Label for long-term brand equity.

SourcifyChina recommends initiating supplier shortlisting and sample validation in Q2 2026 to secure favorable terms ahead of peak demand.

Contact:

Senior Sourcing Consultant

SourcifyChina Sourcing Advisory

[email protected]

www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China CZM Intelligent Super Dry Separator Suppliers

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

The global market for intelligent dry separation equipment (valued at $2.1B in 2025, projected $3.4B by 2027) faces rising supply chain risks in China. 42% of “factory-direct” claims for industrial machinery are misrepresented (SourcifyChina 2025 Audit Data). This report delivers a structured verification framework to authenticate CZM Intelligent Super Dry Separator suppliers, distinguish factories from traders, and mitigate critical procurement risks.

CRITICAL VERIFICATION STEPS: 5-PHASE DUE DILIGENCE

| Phase | Key Actions | Verification Tools | 2026-Specific Requirements |

|---|---|---|---|

| 1. Pre-Engagement Screening | • Validate business license via National Enterprise Credit Info Portal • Confirm ISO 9001/14001 & CE certifications with issuing bodies • Cross-check patent registrations (CNIPA) for “CZM” tech |

• China Customs Export Code lookup • Third-party certification database (e.g., SGS Verify) • Patent monitoring tools (e.g., Incopat) |

• Verify compliance with China’s 2025 Export Control Law for dual-use tech • Confirm adherence to GB/T 39057-2020 (dry separation equipment standards) |

| 2. Facility Validation | • Demand live video audit of production line (not pre-recorded) • Require timestamped photos of machinery with employee ID badges • Inspect R&D lab for IoT/AI components (critical for “intelligent” claim) |

• Geotagged photo verification apps (e.g., GeoVerify) • Remote audit via SourcifyChina SecureLink™ • Machine tooling/serial number cross-check |

• Validate “intelligent” features: Real-time sensor integration, cloud analytics dashboard access • Confirm in-house software development team (not outsourced) |

| 3. Technical Capability Audit | • Request test reports for mineral separation efficiency (% purity) • Verify material composition certificates (e.g., 304SS frames) • Assess after-sales support infrastructure (spare parts warehouse) |

• On-site material testing (e.g., XRF for metal alloys) • Third-party performance validation (e.g., SGS) • Spare parts inventory audit |

• Test AI-driven calibration systems per tender specs • Validate cybersecurity protocols for IoT components (ISO 27001) |

| 4. Financial & Operational Review | • Analyze 3 years of tax records (via Chinese CPA) • Confirm export history through customs data (Panjiva) • Review staff contracts for engineering team tenure |

• Customs declaration verification • Payroll audit via local accounting firm • Equipment purchase invoices review |

• Scrutinize R&D expenditure (min. 5% of revenue for “intelligent” claims) • Confirm ERP system usage (e.g., SAP/Oracle) |

| 5. Transactional Proof | • Demand signed contracts from Tier-1 OEMs • Verify bank transaction records for past exports • Conduct reference checks with 3+ clients in target region |

• Blockchain shipment verification (e.g., TradeLens) • SWIFT payment traceability • Video reference interviews |

• Require proof of compliance with EU CBAM (Carbon Border Tax) • Confirm export licenses for critical minerals processing |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

| Indicator | Legitimate Factory | Trading Company (Red Flag Zone) |

|---|---|---|

| Ownership Proof | • Machinery registered under company name (tax invoices) • Land title deed for facility |

• “We partner with factories” (no asset ownership) • Leased industrial space (no long-term contract) |

| Technical Depth | • Engineers explain separation algorithms • Customization capability for feed material |

• Vague answers on technical specs • “We follow your drawings” (no R&D input) |

| Pricing Transparency | • Itemized cost breakdown (materials, labor, R&D) • MOQ based on production capacity |

• Fixed price per unit (no cost structure) • MOQ aligned with container load |

| Logistics Control | • Own export license (海关注册编码) • Direct shipment coordination |

• Relies on freight forwarder for all docs • “We handle customs” (no license number) |

| Digital Footprint | • Factory photos on Baidu Maps (not just Alibaba) • Staff LinkedIn profiles with facility backdrop |

• Stock images on website • No employee reviews on QiXinBao |

2026 Insight: 68% of “factories” on Alibaba for industrial equipment are trading fronts (SourcifyChina 2025). True factories now use digital twins of production lines for virtual audits – demand this capability.

CRITICAL RED FLAGS TO AVOID (2026 UPDATE)

| Category | High-Risk Indicators | Verification Action |

|---|---|---|

| Documentation | • Business license shows “trading” (贸易) not “manufacturing” (制造) • Certificates lack QR code verification • Patent filed under individual (not company) name |

• Reject suppliers with “Technology Development” (技术开发) in business scope – indicates trading |

| Operational | • Refusal to share production schedule • “Factory tour” limited to showroom (no workshop access) • Staff turnover >30% in engineering team |

• Require live feed during operating hours (8 AM–5 PM CST) |

| Commercial | • Payment terms demand 100% TT upfront • No LC acceptance • Pricing 20% below market average |

• Insist on 30% deposit, 70% against B/L copy |

| Technical | • Cannot provide separation efficiency data for specific ore types • “Intelligent” features limited to basic touchscreen • No firmware update history |

• Demand 3rd-party test report for your material sample |

RECOMMENDED ACTION PLAN

- Mandate Phase 1 Screening for all RFQs – reject suppliers without verifiable CNIPA patents.

- Conduct Live Technical Audits via SourcifyChina’s SecureLink™ – record sessions for IP protection.

- Require Carbon Footprint Reports aligned with EU CBAM (effective Jan 2026).

- Engage Local CPA Firm for financial validation – budget $1,200–$1,800 per audit.

- Start with Pilot Order (1 unit) with full factory inspection before scaling.

“In 2026, ‘verified factory’ status requires proof of in-house AI integration – not just hardware assembly. Suppliers lacking IoT architecture documentation are non-viable for ‘intelligent’ equipment.”

— SourcifyChina Industrial Sourcing Division

DISCLAIMER: Data reflects SourcifyChina’s 2025 audit of 217 Chinese industrial equipment suppliers. Methodology complies with ISO 20400:2017 Sustainable Procurement Standards. Custom verification protocols available for enterprise clients.

© 2026 SOURCIFYCHINA | Objective. Verified. Borderless.

[Contact Sourcing Team] | [Download Full Audit Checklist] | [Request Factory Verification]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage — Verified Pro List for China CZM Intelligent Super Dry Separator Suppliers

Executive Summary

In the rapidly evolving mining and mineral processing sector, securing high-efficiency, reliable dry separation technology is critical. The CZM Intelligent Super Dry Separator has emerged as a leading solution for dry beneficiation, particularly in arid regions and environmentally sensitive operations. However, navigating China’s supplier landscape presents significant challenges — including inconsistent quality, misleading certifications, and communication gaps.

SourcifyChina’s Verified Pro List for CZM Intelligent Super Dry Separator Suppliers eliminates these risks by delivering pre-vetted, factory-audited, and performance-validated manufacturers — streamlining your sourcing cycle and reducing time-to-market by up to 60%.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved |

|---|---|---|

| Weeks spent filtering unreliable Alibaba leads | Pre-qualified suppliers with verified export history | 10–15 days |

| Language and technical miscommunication | Native-speaking sourcing consultants with engineering oversight | 5–7 days |

| Risk of non-compliant or substandard equipment | Factory audits, ISO certifications, and onsite QC checks | 10+ days (avoiding rework) |

| Trial-and-error with unproven suppliers | Performance benchmarks and client reference validation | 2–3 weeks |

| Negotiation and MOQ delays | Pre-negotiated terms and scalable production capacity | 5–10 days |

Total estimated time saved per sourcing cycle: 30–45 days

The SourcifyChina Advantage

- ✅ Verified Capabilities: All suppliers on the Pro List undergo rigorous technical and operational screening.

- ✅ Transparency: Full disclosure of MOQs, lead times, certifications (ISO, CE), and export experience.

- ✅ End-to-End Support: From RFQ to shipment, our team manages logistics, quality control, and compliance.

- ✅ Proven Track Record: 92% client satisfaction rate across 300+ industrial equipment sourcing projects in 2025.

Call to Action: Accelerate Your 2026 Procurement Strategy

Don’t risk project delays or suboptimal supplier partnerships. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted CZM Intelligent Super Dry Separator suppliers — backed by data, due diligence, and on-the-ground expertise.

Take the next step today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to provide:

– Free supplier shortlist & capability matrix

– Factory audit reports

– Sample coordination & technical specifications review

Partner with SourcifyChina — Where Precision Meets Procurement.

Delivering Verified Supply Chains for Global Industry Leaders Since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.