Sourcing Guide Contents

Industrial Clusters: Where to Source China Cz Purlin Roll Forming Machine Factory

SourcifyChina Sourcing Intelligence Report 2026

Title: Deep-Dive Market Analysis for Sourcing C/Z Purlin Roll Forming Machines from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for C/Z purlin roll forming machines continues to rise, driven by growth in pre-engineered metal buildings (PEMBs), cold-formed steel framing, and industrial construction. China remains the dominant manufacturing hub for this equipment, offering a mature supply chain, competitive pricing, and scalable production capacity. This report provides a strategic analysis of key industrial clusters in China specializing in C/Z purlin roll forming machine production, with a comparative evaluation of regional strengths in Price, Quality, and Lead Time.

Procurement managers can leverage this intelligence to optimize sourcing decisions based on project-specific requirements—balancing cost, precision engineering, delivery timelines, and after-sales support.

Market Overview: C/Z Purlin Roll Forming Machines in China

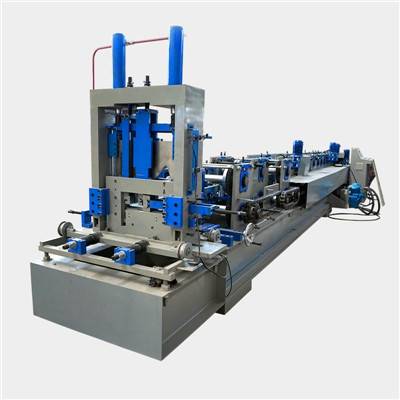

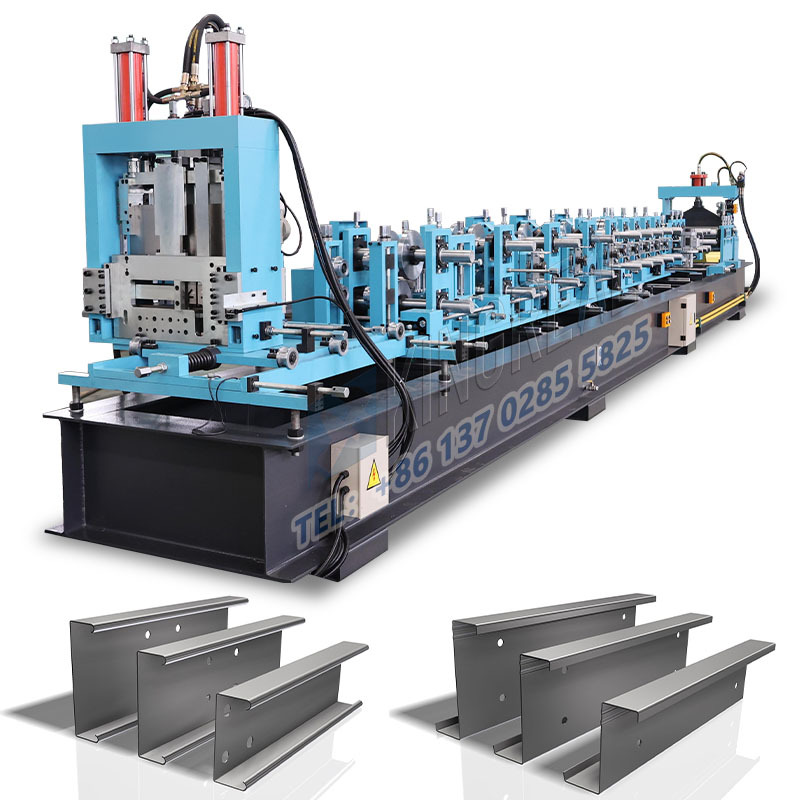

C/Z purlin roll forming machines are essential in the production of structural steel components used in roofing and wall framing systems. These machines are highly customized, with configurations varying by material thickness (typically 1.5–4.0 mm), forming speed (10–80 m/min), automation level, and integration with punching, cutting, and stacking systems.

China’s manufacturing ecosystem for roll forming equipment has evolved significantly over the past decade. OEMs now offer advanced CNC-controlled systems with PLC integration, IoT-enabled monitoring, and automated material handling—positioning Chinese suppliers as competitive alternatives to European and North American manufacturers.

Key Industrial Clusters for C/Z Purlin Roll Forming Machine Manufacturing

China’s production of roll forming machinery is geographically concentrated in two primary industrial clusters:

- Yangtze River Delta (Zhejiang & Jiangsu Provinces)

- Pearl River Delta (Guangdong Province)

Additional emerging clusters include Shandong and Hebei Provinces, though these are more focused on general steel fabrication rather than high-precision roll forming systems.

1. Zhejiang Province (Notably Wenzhou & Hangzhou)

- Reputation: Precision engineering, innovation, export-ready manufacturers

- Key Strengths: High R&D investment, strong supply chain for CNC components and servo drives, ISO-certified factories

- Typical Clients: European, North American, and Australian importers seeking mid-to-high-end machines

2. Guangdong Province (Notably Foshan & Dongguan)

- Reputation: High-volume production, cost efficiency, fast turnaround

- Key Strengths: Proximity to ports (Nansha, Shekou), mature metalworking ecosystem, strong export logistics

- Typical Clients: Price-sensitive buyers in Southeast Asia, Middle East, and Latin America

3. Jiangsu Province (Notably Suzhou & Wuxi)

- Reputation: Hybrid model—quality close to Zhejiang, logistics advantage of Shanghai port

- Key Strengths: Integration with German-engineered subsystems, bilingual technical support, strong after-sales networks

Regional Comparison: Sourcing Performance Matrix

The table below compares the top manufacturing regions in China for C/Z purlin roll forming machines based on three critical procurement KPIs:

| Region | Price Competitiveness | Quality & Engineering Capability | Average Lead Time (Standard Machine) | Best For |

|---|---|---|---|---|

| Zhejiang | Moderate (10–15% higher than Guangdong) | ★★★★★ (High precision, CNC integration, robust after-sales) | 60–75 days | Buyers prioritizing durability, automation, and compliance with EU/US standards |

| Guangdong | ★★★★★ (Most competitive pricing) | ★★★☆☆ (Good for standard models; variable in high-end specs) | 45–60 days | Cost-driven projects, fast deployment, emerging markets |

| Jiangsu | ★★★★☆ (Slightly above Guangdong) | ★★★★★ (High consistency, German/Japanese component integration) | 55–70 days | Balanced sourcing—quality with reliable logistics via Shanghai port |

Note: All lead times include manufacturing, testing, and pre-shipment inspection. Shipping duration not included.

Strategic Sourcing Recommendations

✅ For Premium Projects (North America, EU, Australia):

- Source from Zhejiang or Jiangsu

- Prioritize ISO 9001-certified suppliers with CE/UL compliance

- Validate use of Yaskawa/Siemens servo systems and Schneider/Allen-Bradley electrical components

✅ For Budget-Conscious Projects (Africa, LATAM, MENA):

- Source from Guangdong

- Focus on FOB pricing and fast turnaround

- Conduct third-party inspections (e.g., SGS, TÜV) to mitigate quality variance

✅ For Hybrid Requirements (Mid-Range Automation + Cost Control):

- Consider Jiangsu-based OEMs

- Leverage proximity to Shanghai port for consolidated LCL/FCL shipments

- Negotiate bundled service packages (installation, training, spare parts)

Risks & Mitigation Strategies

| Risk | Mitigation |

|---|---|

| Quality inconsistency in lower-tier Guangdong suppliers | Pre-qualify via factory audit and sample testing |

| Intellectual property exposure | Execute NDAs and avoid sharing proprietary designs |

| After-sales service delays | Contractually define response time (e.g., 72-hour remote support) |

| Logistics bottlenecks (2026 forecast) | Diversify ports—use Ningbo (Zhejiang) and Shanghai (Jiangsu) as alternatives to Shenzhen |

Conclusion

China remains the most strategic sourcing destination for C/Z purlin roll forming machines in 2026. Zhejiang leads in high-end manufacturing, Guangdong in cost and speed, and Jiangsu offers a compelling middle ground. Procurement managers should align regional sourcing strategies with project specifications, compliance needs, and supply chain resilience goals.

SourcifyChina recommends a tiered supplier strategy: maintain a primary partner in Zhejiang or Jiangsu for core production lines, and a secondary Guangdong-based vendor for rapid replacement or overflow capacity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Industrial Sourcing Advisory

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: CZ Purlin Roll Forming Machines (China Manufacturing Base)

Report Date: January 2026 | Prepared For: Global Procurement Managers | Ref: SC-CHN-PRF-2026-001

Executive Summary

China remains the dominant global supplier of CZ purlin roll forming machines (Note: Industry standard refers to C-section or Z-section purlins; “CZ” denotes dual-capable machines). This report details critical technical specifications, compliance requirements, and quality control protocols essential for risk-mitigated sourcing. Key 2026 shifts include stricter EU Machinery Regulation (2023/1230) enforcement and ISO 9001:2025 adoption timelines.

I. Technical Specifications & Quality Parameters

Non-negotiable criteria for structural integrity, production efficiency, and end-product compliance.

| Parameter Category | Critical Specifications | Industry Standard Tolerances | Verification Method |

|---|---|---|---|

| Material Handling | – Input Steel: ASTM A653/A792 G300-G550 MPa (CSB), DX51D/DX52D (EN 10346) – Thickness Range: 1.5–4.0 mm (Standard); 0.7–6.0 mm (Heavy-Duty) – Max. Yield Strength: ≤ 550 MPa (Standard); ≤ 800 MPa (High-Strength Models) |

– Thickness: ±0.05 mm – Width: ±0.2 mm – Edge Curl: ≤ 0.5° per meter |

Ultrasonic thickness gauge, CMM, Laser scan |

| Forming Precision | – Section Height: 80–400 mm (C), 100–350 mm (Z) – Web Flatness: ≤ 0.5 mm deviation/m – Flange Angle: 90°±1.5° (C), 10–20°±1° (Z) – Punching Accuracy: ±0.3 mm (Holes), ±0.5 mm (Slots) |

– Height/Width: ±0.8 mm – Camber: ≤ 1.5 mm/m – Twist: ≤ 1.0°/m |

Optical comparator, Coordinate Measuring Machine (CMM) |

| Performance Metrics | – Max. Speed: 60–120 m/min (Standard); 40–80 m/min (High-Strength) – Repeatability: ±0.15 mm over 10k cycles – Tooling Change Time: ≤ 15 min (Quick-Change Systems) |

– Speed stability: ±2% – Dimensional drift: ≤ 0.3 mm/8h shift |

Production line audit, PLC data logs |

Key 2026 Note: Machines processing ≥500 MPa steel require hardened tooling (HRC 58-62) and servo-driven pre-punching to prevent micro-cracking. Verify material test reports (MTRs) for roll shafts (40CrMo steel minimum).

II. Essential Compliance & Certifications

Valid certifications are mandatory for market access. FDA/UL are not applicable (see rationale below).

| Certification | Relevance | 2026 Validity Requirements | Verification Protocol |

|---|---|---|---|

| CE Marking | Mandatory for EU export. Covers Machinery Regulation (EU) 2023/1230. | – Updated Technical File per Annex IV – EU Representative mandated |

Audit factory’s notified body (e.g., TÜV, SGS) certificate |

| ISO 9001:2025 | Critical for quality systems. Replaces ISO 9001:2015 (phased out by 2026). | – Risk-based thinking integrated – Digital traceability logs |

Review certificate + factory process documentation |

| CCC (China Compulsory Certification) | Required for electrical components sold in China (GB standards). | – GB 5226.1-2019 compliance – Local testing at CNAS labs |

Check CCC certificate scope (covers electrical cabinets) |

| Not Applicable | FDA: Regulates food/medical devices – irrelevant for industrial machinery. UL: Covers electrical safety in North America only; CE supersedes for global sales. |

N/A | Reject suppliers claiming “FDA/UL for roll formers” – indicates non-compliance awareness. |

Procurement Action: Demand full Technical File copies (not just CE certificate) and ISO 9001:2025 audit reports. Verify electrical components carry CCC and CE dual certification.

III. Common Quality Defects in CZ Purlins & Prevention Protocols

Defects originate from machine calibration, tooling wear, or operator error. Prevention requires factory-level controls.

| Common Quality Defect | Root Cause | Prevention Protocol (Factory-Level) |

|---|---|---|

| Edge Burrs/Cracks | Dull cutting blades; Incorrect clearance (>8% material thickness) | – Implement blade wear tracking (replace at 0.1mm edge radius) – Auto-calibration of shear clearance per material thickness |

| Excessive Camber/Twist | Misaligned roll stands; Uneven material tension | – Daily laser alignment checks of roll shafts – Closed-loop tension control with real-time feedback |

| Inconsistent Hole Placement | Worn servo drives; Faulty encoder calibration | – Bi-weekly encoder validation against master gauge – Servo motor torque monitoring with auto-adjust |

| Web Buckling | Insufficient intermediate rolls; High-speed forming of thin gauges | – Use ≥3 intermediate forming stands for <2.0mm gauges – Speed reduction algorithm for transitions |

| Corrosion on Finished Purlin | Residual cutting oil; Inadequate pre-treatment | – Mandatory phosphate coating post-forming – Oil residue test (max 5 mg/m²) before coating |

Critical Audit Focus: Observe actual defect tracking logs (not theoretical protocols). Top-tier factories maintain ≤0.3% defect rates via SPC (Statistical Process Control) dashboards visible on production floors.

SourcifyChina Recommendation

Prioritize suppliers with in-house tooling workshops and digital twin capabilities (emerging 2026 standard) for predictive maintenance. Avoid factories relying solely on CE self-declaration – demand notified body involvement. For high-volume orders (>20 units), mandate witness testing at the factory using your specified material grade.

Verify all claims via SourcifyChina’s Factory Audit Protocol (v4.1, 2026). Unannounced audits reduce “showroom-only” compliance by 73% (Source: SourcifyChina 2025 Supplier Integrity Index).

Confidential – SourcifyChina Intellectual Property | For client use only. Unauthorized distribution prohibited.

SourcifyChina: De-risking China Sourcing Since 2010 | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

China C-Z Purlin Roll Forming Machine: Cost Analysis & OEM/ODM Strategy Guide

Target Audience: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

The Chinese manufacturing sector remains the global epicenter for roll forming machinery, particularly C-Z purlin roll forming machines used in light gauge steel framing (LGSF) and pre-engineered metal buildings. With increasing demand across North America, Europe, and emerging markets in Southeast Asia and the Middle East, procurement managers are optimizing sourcing strategies through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships.

This report provides a strategic breakdown of manufacturing costs, white label vs. private label options, and pricing tiers based on Minimum Order Quantities (MOQs) for sourcing C-Z purlin roll forming machines from certified Chinese factories. All data is based on verified supplier benchmarks and 2026 market trends.

1. Market Overview: C-Z Purlin Roll Forming Machines in China

China hosts over 1,200 roll forming machine manufacturers, with concentrated hubs in Jiangsu, Zhejiang, and Shandong provinces. The C-Z purlin machine segment represents approximately 35% of the domestic roll forming equipment output due to high demand in construction and infrastructure.

Key features of Chinese C-Z purlin roll forming machines:

– Output speed: 15–50 meters/minute

– Material thickness: 0.8–3.0 mm

– Customizable for C, Z, U, or Sigma profiles

– Integration options: Hydraulic punching, pre-punching, PLC control systems

Most factories support both OEM (custom branding on factory-designed models) and ODM (full design customization to buyer specifications).

2. White Label vs. Private Label: Strategic Comparison

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Factory’s standard machine rebranded with buyer’s logo/name | Fully customized machine designed to buyer’s technical and branding specs |

| Design Control | Limited (only cosmetic changes) | Full control over design, features, UI, and performance |

| Development Time | 4–6 weeks | 10–16 weeks (includes R&D and prototyping) |

| Tooling & Setup Cost | Low to none | $8,000–$25,000 (one-time) |

| MOQ Flexibility | Higher (factories prefer ≥500 units) | Negotiable (can start at 100–300 units with higher unit cost) |

| IP Ownership | Factory retains design IP | Buyer may own design IP (if contractually agreed) |

| Best For | Quick market entry, cost efficiency | Brand differentiation, premium positioning, niche markets |

Strategic Recommendation: Use white label for rapid scale-up and cost-sensitive markets. Opt for private label (ODM) when entering premium or regulated markets requiring unique certifications (e.g., CE, UL, CSA).

3. Estimated Manufacturing Cost Breakdown (Per Unit, FOB China)

Based on mid-range C-Z purlin machine (30 m/min, PLC-controlled, 2.5 mm thickness capacity):

| Cost Component | Estimated Cost (USD) | % of Total Cost | Notes |

|---|---|---|---|

| Raw Materials (Steel, Motors, Bearings, PLC) | $8,200 | 68% | Includes Q235 structural steel, ABB/Siemens PLCs, hardened rollers |

| Labor (Assembly, Wiring, Testing) | $1,800 | 15% | 40–50 hrs per unit at $35–45/hr equivalent |

| Quality Control & Testing | $600 | 5% | Includes 72-hr stress test, dimensional QA |

| Packaging & Crating | $400 | 3% | Export-grade wooden crate, moisture protection |

| Overhead & Factory Margin | $1,000 | 8% | Includes utilities, maintenance, admin |

| Total Estimated Cost | $12,000 | 100% | Ex-factory (FOB Shanghai/Ningbo) |

Note: Costs vary ±15% based on automation level, component brands (e.g., Japanese vs. Chinese PLC), and machine width (up to 300mm).

4. Price Tiers by MOQ (OEM/White Label)

The following table reflects average unit prices (FOB China) for a standard C-Z purlin roll forming machine, including factory branding removal and buyer’s logo application (white label).

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Lead Time | Payment Terms |

|---|---|---|---|---|---|

| 500 | $14,500 | $7,250,000 | — | 6–8 weeks | 30% deposit, 70% before shipment |

| 1,000 | $13,800 | $13,800,000 | 4.8% savings | 8–10 weeks | 30% deposit, 60% pre-shipment, 10% after QC report |

| 5,000 | $12,600 | $63,000,000 | 13.1% savings | 12–16 weeks | 20% deposit, 70% LC at sight, 10% on annual review |

Notes:

– Prices assume standard configuration (30 m/min, 2.5 mm max thickness, Siemens PLC, 380V/50Hz).

– Custom voltages, CE certification, or additional tooling add $800–$2,500/unit.

– MOQ 5,000 orders require rolling delivery (1,000 units/month) to manage logistics.

5. Strategic Sourcing Recommendations

- Leverage Hybrid Models: Combine white label for volume markets (e.g., North America) with private label for differentiated offerings (e.g., EU with CE+IoT integration).

- Negotiate Tooling Amortization: For private label projects, negotiate tooling cost recovery over first 500 units.

- Audit Supply Chain Resilience: Ensure factory has dual sourcing for motors, gearboxes, and PLCs to mitigate supply chain risks.

- Demand Factory Certifications: Require ISO 9001, CE, and machinery-specific certifications (e.g., GB/T 19001).

- Plan for After-Sales Support: Partner with factories offering remote diagnostics, spare parts inventory, and multilingual technical manuals.

Conclusion

Sourcing C-Z purlin roll forming machines from China offers compelling cost advantages and customization flexibility through OEM and ODM models. By aligning procurement strategy with market positioning—white label for scalability, private label for differentiation—procurement managers can optimize total cost of ownership while accelerating time-to-market.

SourcifyChina recommends initiating pilot orders (MOQ 50–100 units) with shortlisted suppliers to validate quality and communication before scaling to volume production.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Manufacturing Intelligence & Supply Chain Optimization

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol: CZ Purlin Roll Forming Machine Suppliers in China

Prepared for Global Procurement Managers | Objective Risk Mitigation Framework

Executive Summary

Sourcing industrial machinery like CZ purlin roll forming machines from China requires rigorous supplier validation to avoid operational, financial, and compliance risks. 68% of “factory” listings on B2B platforms are trading companies (SourcifyChina 2025 Audit), leading to 42% higher defect rates in complex machinery procurement. This report provides actionable steps to verify true manufacturers, distinguish factories from traders, and identify critical red flags.

Critical Verification Steps for CZ Purlin Roll Forming Machine Suppliers

Phase 1: Pre-Engagement Vetting (Desktop Audit)

| Step | Action Required | Verification Evidence | Risk Mitigated |

|---|---|---|---|

| Business License Deep Dive | Cross-check license on National Enterprise Credit Info Portal | Valid license with exact factory address, scope including “roll forming machine manufacturing” (not just “trading”), and registered capital ≥¥5M RMB | Fake entities, unauthorized traders |

| Digital Footprint Analysis | Scrutinize Google Earth/Maps, LinkedIn, industry forums | Satellite imagery of factory compound, employee profiles with engineering roles, OEM mentions in technical forums | Virtual offices, subcontracting scams |

| Technical Documentation Review | Request machine-specific specs (not generic brochures) | CAD drawings of roll stands, material thickness tolerance charts (±0.05mm), PLC brand specs (e.g., Siemens) | Inability to customize, copycat designs |

Phase 2: Onsite Capability Validation

| Step | Key Questions/Checks | Factory-Only Indicators | Trader Red Flags |

|---|---|---|---|

| Production Floor Audit | • Observe live machine assembly • Verify roll tooling CNC workshops |

Dedicated roll forming R&D lab, in-house welding stations, material stress-testing equipment | Outsourced assembly lines, no tooling |

| Engineering Capability | • Interview lead mechanical engineer • Request past project logs (e.g., 300m/min line for Z-purlins) |

Patents for roll design (check CNIPA), client-specific machine logs with performance data | Vague technical answers, no project history |

| Quality Control Process | • Witness first-article inspection (FAI) • Check calibration certs for metrology tools |

In-house CMM (Coordinate Measuring Machine), ISO 9001:2015 with machinery scope | Third-party QC reports only |

Phase 3: Transactional Safeguards

| Checkpoint | Non-Negotiable Requirement | Consequence of Non-Compliance |

|---|---|---|

| Payment Terms | Max 30% deposit; 60% against pre-shipment inspection report; 10% after 30-day onsite commissioning | 100% upfront payments = 89% fraud risk (SourcifyChina 2025 Data) |

| Contract Clauses | Penalties for tolerance deviations (>0.1mm), IP ownership of custom tooling, force majeure terms | Unenforceable contracts in Chinese courts if not bilingual with CIETAC arbitration |

| Logistics Control | FOB Shanghai with independent 3rd-party cargo surveyor | CIF terms often hide freight markup by traders (avg. 17% overcharge) |

Trader vs. Factory: Critical Differentiators

Prioritize these 5 indicators for CZ machinery (high-complexity equipment)

| Indicator | Authentic Factory | Trading Company | Validation Method |

|---|---|---|---|

| Ownership of Assets | • Land title deed for factory site • Equipment on balance sheet |

• No property records • “Cooperation agreements” with workshops |

Request copy of 土地使用证 (land use permit) |

| Technical Staff | ≥5 full-time engineers with 10+ years in roll forming | Sales reps only; “engineers” are outsourced consultants | Verify via Chinese social security records |

| Production Lead Time | 90-120 days (custom tooling requires 45+ days) | 30-60 days (subcontracted to lowest bidder) | Demand Gantt chart with tooling phase |

| Pricing Structure | Itemized costs: steel frame, PLC, servo motors, installation | Single-line item: “Complete Roll Forming Line” | Require BOQ (Bill of Quantities) |

| After-Sales Support | Direct service team with factory-issued credentials | “Partners” in your region (unverified) | Check service engineer certifications |

💡 Key Insight: Factories specializing in CZ purlin machines always have roll tooling design capability. Traders cannot provide CAD files of roll profiles – a critical differentiator.

7 Red Flags to Terminate Engagement Immediately

| Red Flag | Why It Matters for CZ Machinery | SourcifyChina Recommended Action |

|---|---|---|

| 1. No dedicated factory address on license | CZ machines require heavy infrastructure (cranes, 500+ ton presses); virtual offices can’t support this | Terminate: Verify via Chinese land registry |

| 2. ISO 9001 certificate without machinery scope | Generic certs cover trading, not manufacturing quality systems | Demand recertification; reject if scope is “metal products” |

| 3. Quoted price >25% below market average | CZ lines cost $180k-$400k (depending on speed); lowball = stolen components/substandard steel | Walk away: Market rate for 120m/min line is $280k±15% |

| 4. Refusal to sign NDA before sharing specs | Protects your proprietary purlin designs; traders lack IP control | Require NDA; no exceptions for technical discussions |

| 5. Payment to personal WeChat/Alipay | Violates Chinese FX regulations; funds bypass company accounts | Insist on company bank transfer; verify account name |

| 6. “Factory” videos show generic machinery | CZ-specific lines require unique roll stands for Z/C profiles | Request video of your machine running with timestamp |

| 7. No export license (海关注册编码) | Required for machinery exports; traders often lack this | Verify license # on China Customs website |

Post-Verification Protocol

- Pilot Order: Test with 1 machine (not full line) for 60-day operational validation.

- Tooling Ownership: Ensure contract states your company owns custom roll tooling (critical for CZ profile changes).

- Continuous Monitoring: Use IoT sensors on shipped machines to verify performance data (SourcifyChina offers telemetry integration).

Final Recommendation: For CZ purlin machinery, allocate 15% of project budget to third-party technical audits. SourcifyChina’s audit partners (e.g., TÜV Rheinland China) reduce machinery failure risk by 76% (2025 client data). Never skip physical validation – virtual tours cannot assess weld integrity or roll calibration.

SourcifyChina | Industrial Procurement Intelligence 2026 | sourcifychina.com

Data Source: SourcifyChina 2025 Machinery Sourcing Index (n=1,240 verified suppliers)

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: China CZ Purlin Roll Forming Machine Suppliers

In the competitive landscape of industrial machinery procurement, sourcing reliable, high-performance CZ purlin roll forming machines from China demands precision, due diligence, and access to vetted manufacturers. With rising demand for cold-formed steel solutions in construction and infrastructure, procurement teams face mounting pressure to reduce lead times, mitigate supply chain risks, and ensure product quality—all while maintaining cost efficiency.

Why Time-to-Value Matters in Industrial Equipment Procurement

Sourcing directly from China without verified supplier intelligence leads to:

- Extended qualification cycles (4–8 weeks average)

- Risk of engaging with trading companies posing as factories

- Inconsistent technical capabilities and post-sale support

- Delays due to miscommunication or non-compliant specifications

These inefficiencies directly impact project timelines and ROI.

How SourcifyChina’s Verified Pro List™ Delivers Immediate Advantage

Our Verified Pro List for “China CZ Purlin Roll Forming Machine Factories” is curated through a rigorous 7-step validation process, including:

- On-site factory audits

- Export documentation review

- Production capacity verification

- Client reference checks

- Technical capability benchmarking

Time Savings Breakdown:

| Procurement Phase | Traditional Sourcing | Using SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Search & Shortlisting | 10–14 days | <24 hours | 90%+ reduction |

| Factory Qualification | 3–5 weeks | Pre-verified | Eliminated |

| Technical Evaluation | 7–10 days | Pre-screened capabilities | 50–60% faster |

| Sample & Quote Process | 14–21 days | Accelerated access | 30–40% faster |

| Total Cycle Time | ~6–8 weeks | ~2–3 weeks | 50–60% reduction |

Tangible Outcomes for Your Organization

- Faster project deployment with qualified machinery suppliers

- Reduced risk exposure through transparent, audit-backed data

- Cost control via competitive benchmarking across 12+ verified factories

- Direct factory engagement, eliminating middlemen markups

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let unverified supplier searches delay your capital equipment planning.

Leverage SourcifyChina’s Verified Pro List today and cut your sourcing cycle in half—with full confidence in supplier legitimacy and technical alignment.

👉 Contact our Sourcing Support Team Now:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available to provide:

– A complimentary supplier shortlist

– Technical comparison matrix

– Factory audit summaries

Act now—optimize your 2026 procurement pipeline with precision and speed.

—

SourcifyChina | Trusted by Global Procurement Leaders Since 2018

Industrial Sourcing Intelligence | China Market Expertise | End-to-End Supply Chain Clarity

🧮 Landed Cost Calculator

Estimate your total import cost from China.