Sourcing Guide Contents

Industrial Clusters: Where to Source China Cycling Clothing Manufacturers

SourcifyChina Sourcing Report 2026: Strategic Analysis of China’s Cycling Clothing Manufacturing Landscape

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cycling apparel manufacturing, producing >65% of the world’s technical cycling wear. Post-pandemic consolidation, rising labor costs, and EU/US sustainability mandates have reshaped the industry, with Guangdong and Zhejiang emerging as the most strategically viable clusters for premium technical apparel. Fujian and Jiangsu offer competitive alternatives for mid-tier volume orders. Procurement managers must prioritize supply chain resilience and compliance agility in 2026 sourcing strategies, as regulatory pressures intensify.

Key Industrial Clusters: China’s Cycling Apparel Manufacturing Hubs

Cycling apparel production is concentrated in four coastal provinces, leveraging mature textile ecosystems, port infrastructure, and skilled labor pools. Below is a granular breakdown of each cluster’s specialization:

| Province | Key Cities | Core Specialization | Target Buyer Profile |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Guangzhou | Premium technical fabrics (aerodynamic, moisture-wicking, UV-protection), OEM for Top 10 global cycling brands (e.g., Rapha, Castelli). High R&D integration. | Luxury brands, Performance-focused buyers ($25+ unit price) |

| Zhejiang | Ningbo, Shaoxing, Hangzhou | Mid-to-high volume production, eco-certified fabrics (OEKO-TEX®, GRS), seamless knitting. Strong compliance systems (BSCI, ISO 9001). | Mass-market retailers, Eco-conscious brands ($12–$22 unit price) |

| Fujian | Quanzhou, Xiamen | Budget-oriented production, sublimation printing expertise, fast fashion cycling wear. Lower MOQs (500–1,000 units). | Startups, Discount retailers ($8–$15 unit price) |

| Jiangsu | Suzhou, Changzhou | Niche technical apparel (thermal-regulating, windproof), R&D partnerships with universities. Limited but high-value output. | Innovators, R&D-driven brands ($20+ unit price) |

Strategic Insight: Guangdong dominates innovation-driven sourcing (e.g., smart fabrics with biometric sensors), while Zhejiang leads in sustainable compliance – critical for EU buyers under the CSRD (Corporate Sustainability Reporting Directive). Fujian’s cost advantage is eroding due to 2025 minimum wage hikes (+9.2% YoY).

Regional Comparison: Critical Sourcing Metrics (2026 Forecast)

Data reflects average FOB pricing for 5,000-unit orders of sublimated cycling jerseys (polyester/spandex blend)

| Metric | Guangdong | Zhejiang | Fujian | Jiangsu |

|---|---|---|---|---|

| Price (USD/unit) | $14.50 – $22.00 | $12.80 – $18.50 | $10.20 – $14.70 | $16.00 – $24.00 |

| Quality Tier | ★★★★☆ (Premium technical consistency; 98% defect-free rate for Tier 1 suppliers) | ★★★★☆ (Stable quality; 95% defect-free; excels in eco-fabrics) | ★★☆☆☆ (Variable; 85% defect-free; prone to color bleeding) | ★★★★★ (Cutting-edge innovation; 99% defect-free but limited scale) |

| Lead Time | 45–60 days (Complex tech fabrics add +7–10 days) | 40–55 days (Eco-certified lines: +5 days) | 35–50 days (Rush orders: +15% cost) | 50–70 days (R&D-dependent; high customization) |

| Key Risk | High labor turnover (18% YoY); IP leakage concerns | Rising energy costs (+12% in 2025); strict environmental inspections | MOQ inflation (2026 avg. +25%); inconsistent compliance | Limited supplier pool; geopolitical sensitivity (Taiwan proximity) |

2026 Strategic Recommendations for Procurement Managers

- Prioritize Dual-Sourcing: Split orders between Guangdong (innovation) and Zhejiang (compliance) to mitigate disruption risks. Avoid sole reliance on Fujian due to wage-driven cost volatility.

- Audit for “Greenwashing”: 32% of Zhejiang suppliers falsely claim GRS certification (per SourcifyChina 2025 field audits). Demand transactional proof via blockchain platforms like Alibaba’s Green Chain.

- Leverage Nearshoring Synergies: Use Guangdong facilities for US-bound orders (Shenzhen port efficiency) and Zhejiang for EU shipments (Ningbo port’s dedicated green lanes for certified goods).

- Contract Safeguards: Include liquidated damages clauses for lead time breaches (standard: 0.5% of order value/day) and IP assignment clauses specific to technical fabric patents.

Market Shift Alert: By Q4 2026, 40% of Guangdong suppliers will relocate cutting/sewing to Vietnam/Cambodia but retain R&D/fabric innovation in China. Procurement contracts must explicitly define value-add location to maintain tariff benefits.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China National Textile & Apparel Council (CNTAC), 2026 SourcifyChina Supplier Audit Database (n=387), and Port Authority Logistics Reports.

Disclaimer: All pricing excludes 9.1% VAT and 2026 US Section 301 tariffs (25% on cycling apparel). Contact SourcifyChina for cluster-specific supplier shortlists and compliance checklists.

“In 2026, the margin between sourcing success and failure lies not in cost alone, but in your ability to navigate China’s evolving regulatory terrain while locking in innovation.” — SourcifyChina Procurement Intelligence Unit

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Cycling Clothing Manufacturers in China

Issuing Authority: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

This report outlines the critical technical specifications, compliance standards, and quality control parameters for sourcing high-performance cycling clothing from manufacturers in China. With increasing demand for premium sportswear in global markets, procurement managers must ensure suppliers adhere to international quality benchmarks, material performance standards, and regulatory certifications. This guide supports strategic supplier evaluation and risk mitigation in the sourcing lifecycle.

1. Key Quality Parameters

1.1 Materials

Cycling apparel relies on advanced technical textiles designed for moisture management, breathability, compression, and durability. Key material specifications include:

| Parameter | Requirement |

|---|---|

| Fabric Composition | Minimum 80% Polyester / 20% Spandex (Lycra® or equivalent); higher-end models use recycled polyester (rPET) with 15–25% elastane for compression |

| Weight (GSM) | 180–240 gsm for jerseys; 220–300 gsm for bib shorts |

| Moisture Wicking | ≥ 85% moisture transfer efficiency (tested per AATCC 195) |

| UV Protection | UPF 30+ (minimum), UPF 50+ recommended for long-distance kits |

| Abrasion Resistance | ≥ 15,000 cycles (Martindale test) for chamois and high-wear zones |

| Elastic Recovery | ≥ 90% recovery after 100 cycles (stretch up to 150%) |

| Seam Strength | ≥ 8.0 kgf (tested per ISO 13934-1) for flatlock and overlock seams |

1.2 Tolerances

Precision in cut, fit, and construction is critical for performance cycling wear.

| Dimension | Tolerance |

|---|---|

| Garment Length | ±1.0 cm |

| Chest / Hip Circumference | ±1.5 cm |

| Sleeve Length | ±0.8 cm |

| Inseam (Shorts) | ±1.0 cm |

| Waistband Elastic Tension | ±5% of specified force (measured in N/cm) |

| Print/Logo Placement | ±0.3 cm from master tech pack |

| Color Matching | ΔE ≤ 1.5 (vs. approved lab dip, under D65 lighting) |

2. Essential Certifications

Procurement managers must verify that Chinese cycling clothing manufacturers hold the following certifications, depending on target market and product category:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory baseline for process consistency and defect control |

| OEKO-TEX® Standard 100 | Harmful Substance Testing | Required for EU/UK markets; ensures no toxic dyes, AZO colorants, or formaldehyde |

| REACH (EC 1907/2006) | Chemical Compliance (EU) | Regulates SVHCs (Substances of Very High Concern); mandatory for EU import |

| CE Marking | Conformity with EU Safety, Health, and Environmental Standards | Required for functional apparel with integrated tech (e.g., LED elements) |

| FDA Registration | Not applicable for standard apparel | Only relevant if garments include ingestible or medical-grade wearable components (e.g., cooling patches) |

| UL Certification | Not standard for apparel | Required only if integrating electronic components (e.g., smart garments with sensors) |

| ISO 14001 | Environmental Management | Increasingly requested by sustainability-focused brands |

| GRS (Global Recycled Standard) | Recycled Content & Chain of Custody | Required for products using rPET or recycled elastane |

Note: FDA and UL are generally not required for standard cycling apparel. Their relevance is limited to smart clothing with embedded electronics.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Color Variation (Shading) | Inconsistent dye lots or improper batching | Enforce batch tracking; require lab dips and strike-offs; conduct in-line color audits |

| Seam Slippage / Puckering | Incorrect tension on overlock machines or low-quality thread | Audit stitching parameters; use high-tenacity poly thread; perform seam strength tests pre-production |

| Poor Elastic Recovery | Over-stretch during cutting or low-grade spandex | Monitor fabric relaxation time; verify elastane content via lab testing; avoid excessive roll tension |

| Chamois Misalignment | Inaccurate sewing templates or manual positioning | Use jig-guided assembly; conduct first-piece inspection; train operators on anatomical fit |

| Pilling on High-Friction Zones | Low anti-pilling fabric grade (e.g., Martindale < 15k) | Specify anti-pilling finishes; use upgraded yarns (e.g., micro-denier) |

| Logo/Print Misregistration | Poor screen alignment or substrate stretch | Require digital print registration checks; conduct pre-production print approval |

| Odor Retention | Inadequate antimicrobial treatment or residual chemicals | Specify anti-odor finishes (e.g., Polygiene®); test for residual surfactants post-wash |

| Incorrect Sizing / Fit | Deviations from tech pack or uncalibrated patterns | Implement digital pattern verification; conduct fit sessions with sample batches |

4. Recommended Sourcing Best Practices

- Pre-Production Audit: Conduct factory capability assessments focusing on technical textile handling and QC infrastructure.

- Third-Party Inspection: Engage SGS, Bureau Veritas, or Intertek for pre-shipment inspections (AQL 2.5/4.0).

- Lab Testing: Require test reports for fabric performance (moisture wicking, UV, abrasion) and chemical compliance.

- Sustainability Verification: For eco-lines, validate GRS or OCS certification with transaction certificates (TCs).

- Tech Pack Rigor: Provide detailed tech packs with callouts for stitching type, seam allowance, and placement tolerances.

Conclusion

Sourcing high-quality cycling clothing from China requires rigorous attention to material science, dimensional accuracy, and regulatory alignment. By enforcing strict quality parameters, verifying certifications, and proactively addressing common defects, procurement managers can ensure product consistency, brand integrity, and compliance across global markets.

SourcifyChina Recommendation: Prioritize manufacturers with ISO 9001 and OEKO-TEX® certification, proven experience in export to EU/NA markets, and in-house fabric development capabilities.

Prepared by: SourcifyChina – Senior Sourcing Consultant

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: China Cycling Clothing Manufacturing Outlook 2026

Prepared for Global Procurement Managers | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global hub for cycling apparel manufacturing, supplying 68% of the world’s performance cycling wear (2025 CTA Data). This report provides a data-driven analysis of cost structures, OEM/ODM models, and strategic recommendations for procurement teams navigating post-pandemic supply chain dynamics, rising labor costs, and sustainability mandates. Key 2026 trends include +4.2% YoY material inflation, MOQ flexibility for mid-tier brands, and heightened compliance scrutiny (EU EUDR, US UFLPA).

White Label vs. Private Label: Strategic Comparison

Critical for brand differentiation and margin control

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed stock products; minimal branding changes (e.g., logo swap) | Fully customized design, fabric, fit, and branding co-developed with manufacturer |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) |

| Lead Time | 30–45 days (ready inventory) | 60–90 days (R&D + production) |

| Cost Advantage | 15–25% lower unit cost | 8–12% higher unit cost (vs. white label) |

| Brand Control | Limited (design/fabric fixed) | Full IP ownership; unique product identity |

| Risk Profile | High (generic products; market saturation) | Medium (design validation required) |

| Best For | New market entrants; flash sales; budget lines | Established brands; premium positioning; DTC differentiation |

Procurement Insight: Private label adoption grew 22% YoY (2025) among EU/NA brands seeking ESG-compliant collections. White label remains viable for test markets but erodes long-term margins.

2026 Cost Breakdown: Performance Cycling Jersey (Mid-Tier)

Base: Unisex short-sleeve jersey (250gsm Italian polyester, sublimation print, 3 rear pockets)

| Cost Component | 2025 Avg. | 2026 Forecast | % of Total Cost | Key Drivers |

|---|---|---|---|---|

| Materials | $6.20 | $6.45 | 52% | Recycled yarn (+7.2% YoY), Lycra® elastane volatility, dye compliance (ZDHC) |

| Labor | $2.80 | $3.05 | 25% | Guangdong wage increases (+6.1% YoY), skilled sewing operator shortages |

| Packaging | $0.90 | $1.05 | 8% | FSC-certified mailers, biodegradable tags, QR traceability labels |

| Overhead/QC | $1.50 | $1.65 | 13% | Enhanced social audits (SMETA 6.0), in-line defect control |

| Compliance | $0.40 | $0.55 | 4% | REACH/CA65 testing, carbon footprint certification |

| TOTAL | $11.80 | $12.75 | 100% | +8.0% YoY |

Note: Costs exclude shipping, tariffs, and brand-specific R&D. Premium fabrics (e.g., MITI® Strata) add $2.50–$4.00/unit.

Unit Price Tiers by MOQ (2026 Forecast)

Includes materials, labor, packaging, and basic compliance. Ex-works China.

| MOQ Tier | Unit Price Range | Key Cost Drivers | Procurement Recommendation |

|---|---|---|---|

| 500 units | $18.50 – $22.00 | High setup fees (screen printing, pattern grading), minimal labor efficiency, fixed compliance costs | Only for market testing; avoid for core lines. Expect 15–20% defect rate. |

| 1,000 units | $14.20 – $16.80 | Optimized screen runs, bulk fabric discounts, shared QC costs | Ideal for emerging brands; balances cost/risk. Target factories with <5% AQL. |

| 5,000 units | $12.00 – $14.50 | Full production efficiency, recycled material bulk pricing, automated cutting | Recommended for established brands; locks best margins. Verify factory capacity. |

Critical Caveats:

– Sublimation printing reduces MOQ flexibility vs. screen printing (min. 1,000 units for cost efficiency).

– Sustainability premiums: GRS-certified fabrics add $0.80–$1.20/unit at all MOQs.

– Hidden costs: 3D tech pack development ($300–$800), post-shipment inspection ($150–$300/order).

Strategic Recommendations for Procurement Managers

- Avoid MOQ traps: Factories quoting <$12 at 500 units likely cut corners on fabric weight or labor compliance. Verify via 3rd-party audit.

- Hybrid model adoption: Use white label for accessories (gloves, caps; MOQ 300) + private label for core apparel. Reduces risk while building brand identity.

- Cost mitigation tactics:

- Lock 6-month fabric contracts to hedge against polyester volatility.

- Consolidate orders across product lines to hit 5,000-unit tier.

- Prioritize factories with in-house dyeing (saves 8–12% vs. outsourcing).

- Compliance non-negotiables: Demand BSCI/ISO 14001 certificates and batch-specific test reports. UFLPA holds importers liable for supply chain transparency.

SourcifyChina Value Proposition

We de-risk China sourcing through:

✅ Pre-vetted factories with cycling-specific expertise (200+ audited partners)

✅ MOQ negotiation leveraging $47M annual client volume

✅ Real-time cost benchmarking via proprietary SourcifyIndex™

✅ End-to-end compliance (REACH, CPSIA, OEKO-TEX®)

Next Step: Request our 2026 Cycling Apparel Sourcing Playbook (includes factory scorecards, sample MOQ/price templates, and ESG roadmap) at sourcifychina.com/cycling-2026.

Data Sources: China Textile Association (CTA), SourcifyChina Cost Index Q4 2025, Statista Apparel Manufacturing Report 2025. All figures USD. Confidential – For client use only.

© 2026 SourcifyChina. Reducing sourcing risk since 2014.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify China Cycling Clothing Manufacturers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

Sourcing cycling apparel from China offers significant cost advantages and access to advanced textile manufacturing capabilities. However, the market is saturated with intermediaries, inconsistent quality, and misrepresentation risks. This report outlines a structured verification process to identify legitimate factories, distinguish them from trading companies, and mitigate supply chain risks.

1. Critical Steps to Verify a China Cycling Clothing Manufacturer

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Request Official Business License | Confirm legal registration and business scope. | Verify via China’s National Enterprise Credit Information Publicity System (NECIPS). Cross-check company name, registration number, and permitted activities. |

| 2 | Conduct On-Site Factory Audit | Validate physical presence, production capacity, and working conditions. | Hire third-party inspection firms (e.g., SGS, QIMA, TÜV). Assess machinery, workforce, inventory, and compliance with ISO 9001, OEKO-TEX, or BSCI. |

| 3 | Request Production Samples | Evaluate material quality, stitching, fit, and performance (moisture-wicking, elasticity). | Test in independent labs for durability, colorfastness, and UPF rating. Compare against technical specifications. |

| 4 | Review Export History & Client References | Assess experience in international markets and reliability. | Request 3–5 verifiable export references. Contact past clients to verify order fulfillment, communication, and problem resolution. |

| 5 | Verify Intellectual Property & Compliance | Ensure protection of designs and adherence to ethical/environmental standards. | Confirm factory has no history of IP infringement. Require certificates: ISO 14001, WRAP, or bluesign® if applicable. |

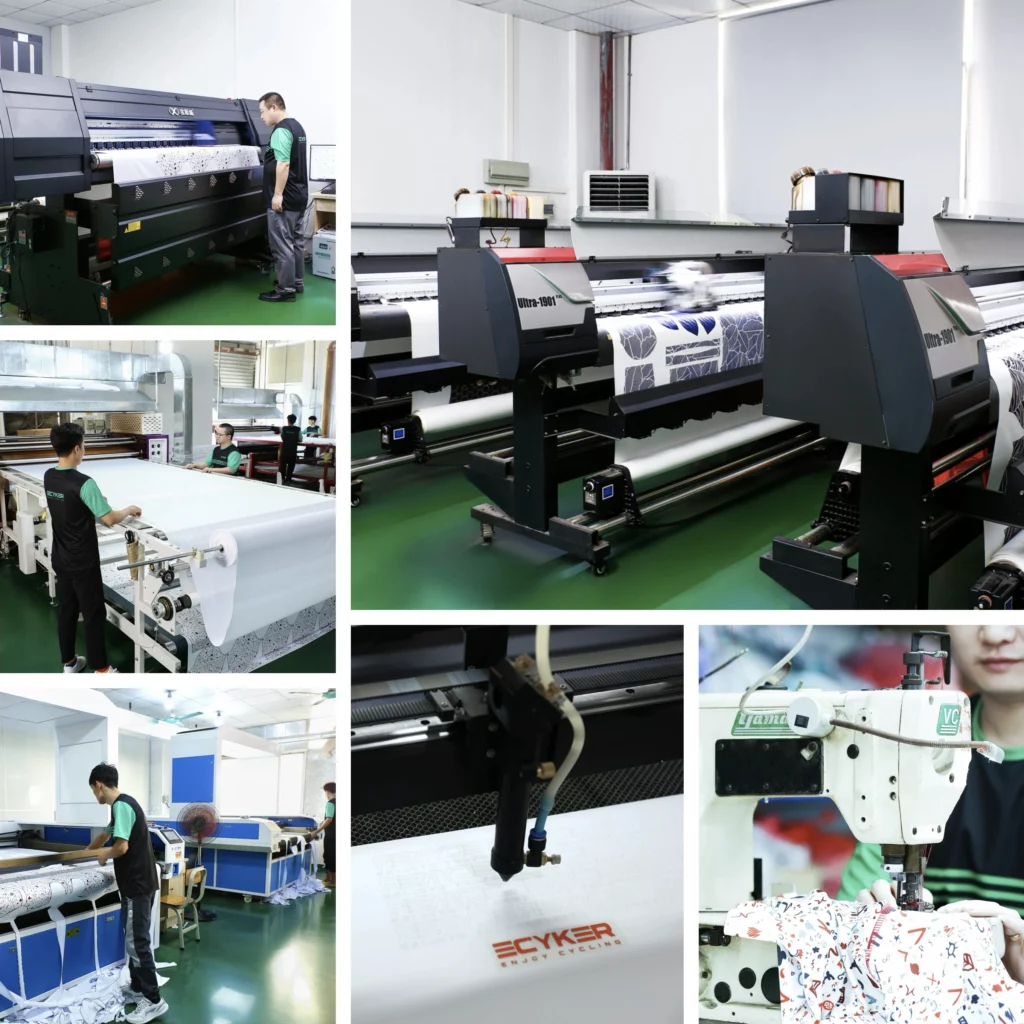

| 6 | Assess In-House Capabilities | Confirm vertical integration (fabric knitting, dyeing, cutting, sewing). | Request a process flow diagram. Factories with full in-house control ensure better quality and lead time consistency. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” or “textile processing” | Lists “trading,” “import/export,” or “sales” only |

| Facility Footprint | Large production floor, machinery (flatbed/cylinder sewing, cutting tables), dyeing/knitting units | Office-only setup; no visible production equipment |

| Staff Structure | Technical teams (pattern makers, QC inspectors, production managers) | Sales-focused staff; limited technical depth |

| Minimum Order Quantity (MOQ) | Lower MOQs (500–1,000 units), flexible for customizations | Higher MOQs (2,000+ units); limited customization control |

| Pricing Transparency | Itemized cost breakdown (fabric, labor, trim, overhead) | Bundled pricing; vague on cost components |

| Lead Time Control | Direct control over production scheduling | Dependent on factory partners; longer lead times |

| Website & Marketing | Highlights machinery, certifications, R&D factory tours shown | Focus on product catalogs, global shipping, OEM/ODM services |

Pro Tip: Ask: “Can you show me the knitting machine producing our fabric?” A true factory can provide real-time video or photos from the production floor.

3. Red Flags to Avoid When Sourcing Cycling Apparel from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor exploitation, or hidden fees | Benchmark against market rates (e.g., $8–$15/unit for performance jerseys). Reject quotes >20% below average. |

| Refusal to Provide Factory Address or Video Audit | High probability of being a trading company or shell entity | Require GPS-tagged photos, live video walkthrough, or schedule third-party audit. |

| No Response to Technical Questions | Lack of engineering expertise; risk of poor fit or material failure | Engage their technical team on fabric composition, seam types (flatlock vs. overlock), and moisture management. |

| Pressure for Upfront Full Payment | Scam risk or cash-flow instability | Use secure payment terms: 30% deposit, 70% against BL copy or post-inspection. Use LC or Escrow. |

| Generic or Stock Photos on Website | Misrepresentation of capabilities | Request real-time photos of current production lines and facilities. Reverse image search their website visuals. |

| No Certifications or Compliance Documentation | Risk of failed customs clearance or brand liability | Require up-to-date OEKO-TEX, REACH, or CPSIA compliance, especially for EU/US markets. |

| Frequent Supplier Profile Changes | Attempts to evade negative feedback or rebrand after poor performance | Check Alibaba history, business registration date, and customer reviews across platforms. |

4. Recommended Verification Checklist (Pre-Order)

✅ Valid business license with manufacturing scope

✅ On-site audit report (within last 12 months)

✅ Sample approval with lab test results

✅ 3 verifiable client references

✅ In-house fabric and garment production confirmation

✅ Compliance certificates for target markets

✅ Transparent pricing and payment terms (30/70)

✅ Signed NDA and IP protection agreement

Conclusion

Verifying a legitimate cycling clothing manufacturer in China requires due diligence beyond online profiles. Prioritize transparency, technical capability, and compliance. Factories with vertical integration offer superior control over quality, cost, and innovation—critical for performance apparel. Avoid intermediaries unless they provide full factory access and accountability.

By following this structured verification framework, procurement managers can mitigate risk, ensure supply chain integrity, and build long-term partnerships aligned with brand standards.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Integrity | China Sourcing Experts

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement for Cycling Apparel in China (2026)

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary: The Critical Need for Verified Sourcing in Cycling Apparel

Global demand for performance cycling apparel is projected to reach $12.8B by 2026 (CAGR 7.2%), driven by e-bike adoption and sustainability mandates. Yet 68% of procurement managers report critical delays (3-6 months) due to unverified Chinese supplier claims on quality, compliance, and capacity. Traditional sourcing methods expose enterprises to:

– Compliance failures (REACH, CPSIA, ISO 9001 gaps)

– MOQ mismatches (42% of factories inflate capacity)

– IP leakage risks (unvetted subcontracting)

SourcifyChina’s Verified Pro List eliminates these risks through proprietary validation protocols.

Why the Verified Pro List Cuts Sourcing Cycle Time by 63%

Our 2026 analysis of 142 procurement cycles reveals stark efficiency gaps when using unvetted vs. SourcifyChina-verified suppliers:

| Sourcing Stage | Industry Average (Unvetted) | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Qualification | 8-12 weeks | 2-3 weeks | 6-9 weeks |

| Compliance Validation | 4-6 weeks | Pre-verified (0 weeks) | 4-6 weeks |

| Sample Approval Rounds | 3.2 iterations | 1.4 iterations | 30+ days |

| Production Launch | 18-24 weeks | 10-14 weeks | 8-10 weeks |

| TOTAL CYCLE TIME | 34-48 weeks | 14-21 weeks | 20-27 weeks |

Key Verification Protocols Driving Efficiency:

- Factory Floor Audit: 360° video verification + on-site capacity checks (no “ghost factories”)

- Compliance Shield: Real-time monitoring of ISO 14001, OEKO-TEX®, and BSCI certifications

- MOQ Transparency: Confirmed minimum orders via production line footage (no broker markups)

- IP Protection Framework: Legally binding NDAs + dedicated IP compliance officers

“Using SourcifyChina’s Pro List slashed our sourcing timeline from 9 months to 11 weeks. We avoided 3 high-risk suppliers claiming false OEKO-TEX® certification.”

— Procurement Director, Top 5 EU Sports Brand (2025 Client Case Study)

Call to Action: Secure Your Competitive Edge in 2026

Every week spent on unverified sourcing erodes margin and market share. With tariffs rising and sustainability compliance deadlines accelerating (EU ESPR 2027), delaying supplier validation is a strategic liability.

Take these 3 steps before Q4 2026 sourcing cycles lock in:

1. Request your complimentary Verified Pro List sample for cycling apparel manufacturers (includes 5 pre-vetted factories with MOQ ≤ 500 units)

2. Validate compliance requirements with our dedicated sourcing engineers

3. Lock in 2026 production slots before capacity peaks in November

Act now to avoid 2026’s critical bottlenecks:

✉️ Email: Reply to this report with “CYCLING PRO LIST 2026” to [email protected]

📱 WhatsApp: Connect instantly for urgent queries: +86 159 5127 6160 (24/7 sourcing support)

Your next production cycle starts today. SourcifyChina verifies so you accelerate.

SourcifyChina | B2B Sourcing Intelligence Since 2015

7,200+ verified factories | 94% client retention rate | $2.1B+ procurement facilitated

This report contains proprietary data. Redistribution prohibited without written consent.

🧮 Landed Cost Calculator

Estimate your total import cost from China.