Sourcing Guide Contents

Industrial Clusters: Where to Source China Customized Oem Led Ws2812B

Professional B2B Sourcing Report 2026

Sourcing “Customized OEM LED WS2812B” from China

Prepared for Global Procurement Managers

Executive Summary

The global demand for customizable, high-performance addressable LED solutions—particularly the WS2812B—has surged due to growth in smart lighting, architectural design, consumer electronics, and industrial automation. As the world’s leading electronics manufacturing hub, China dominates the production of customized OEM LED WS2812B strips and modules, offering competitive pricing, scalable output, and advanced engineering capabilities.

This report provides a comprehensive market analysis focused on identifying key industrial clusters in China for sourcing customized OEM LED WS2812B products. It evaluates regional manufacturing strengths in Guangdong, Zhejiang, Jiangsu, and Fujian, with a comparative analysis of price competitiveness, quality standards, and lead times to inform strategic procurement decisions in 2026.

Market Overview: China’s LED WS2812B Ecosystem

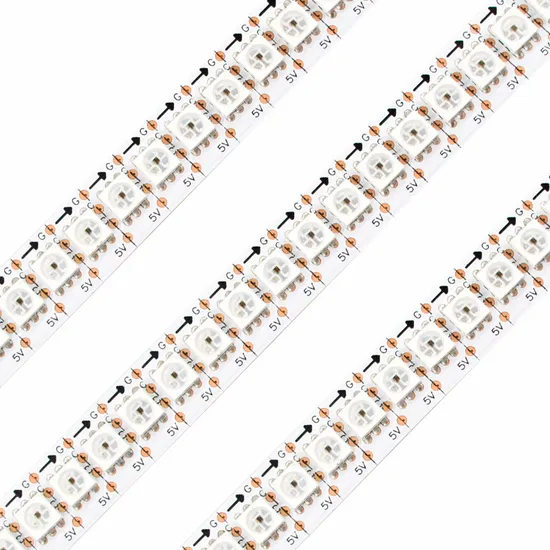

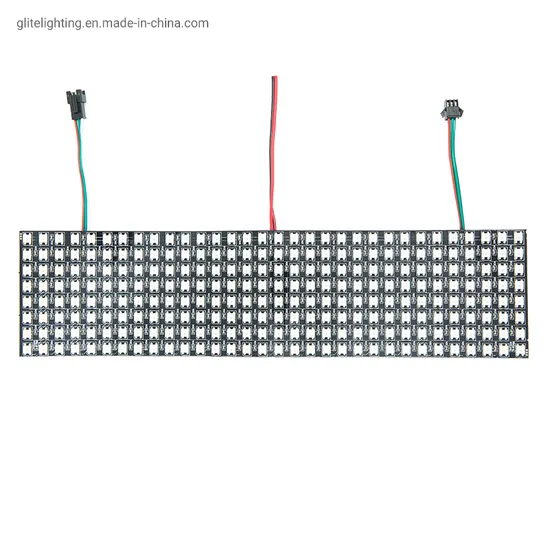

The WS2812B is a 5050 RGB LED with an integrated driver IC (typically the WS2811), enabling individual pixel control via a single-wire interface. Its popularity in dynamic lighting applications has driven demand for OEM customization, including:

- Custom PCB lengths and layouts

- IP ratings (IP20, IP65, IP67)

- Voltage (5V, 12V) and density (e.g., 30/60/144 LEDs/m)

- Connector types and power injection options

- Firmware and protocol integration (e.g., DMX, SPI, Art-Net)

China supplies over 75% of the world’s addressable LED strips, with OEM/ODM manufacturers offering full turnkey solutions—from design and prototyping to mass production and drop-shipping.

Key Industrial Clusters for OEM LED WS2812B Production

China’s LED manufacturing is highly regionalized, with clusters offering distinct advantages in cost, quality, supply chain integration, and technical expertise.

1. Guangdong Province – The Electronics Powerhouse

- Core Cities: Shenzhen, Dongguan, Guangzhou

- Strengths:

- Proximity to Shenzhen’s electronics supply chain (Huaqiangbei market, IC distributors)

- High concentration of EMS (Electronics Manufacturing Services) providers

- Strong R&D in smart lighting and IoT integration

- Fast prototyping and high-volume production capabilities

2. Zhejiang Province – Precision Manufacturing & Export Hub

- Core Cities: Ningbo, Hangzhou, Yiwu

- Strengths:

- Strong mechanical and automation engineering base

- Competitive pricing due to lower labor and overhead costs

- High export orientation with streamlined logistics via Ningbo-Zhoushan Port

- Increasing investment in automation for LED strip assembly

3. Jiangsu Province – High-Tech Industrial Zone

- Core Cities: Suzhou, Wuxi, Nanjing

- Strengths:

- Proximity to Shanghai and international logistics

- Higher quality control standards (ISO, IATF certified factories)

- Strong in automotive and industrial-grade LED applications

- Skilled workforce and advanced SMT lines

4. Fujian Province – Emerging LED Cluster

- Core Cities: Xiamen, Fuzhou

- Strengths:

- Lower production costs and government incentives

- Growing specialization in LED packaging and chip-level integration

- Rising number of mid-tier OEMs entering the WS2812B space

Regional Comparison: OEM LED WS2812B Production (2026 Outlook)

| Region | Average Price (USD/m) | Quality Tier | Lead Time (Sample → Mass Production) | Key Advantages | Procurement Risk Factors |

|---|---|---|---|---|---|

| Guangdong | $1.80 – $2.50 | High (Tier 1 & 2 OEMs) | 7–10 days (sample), 15–25 days (mass) | Fast turnaround, strong R&D, full supply chain access | Higher MOQs; premium pricing for top-tier vendors |

| Zhejiang | $1.40 – $2.00 | Medium to High | 10–14 days (sample), 20–30 days (mass) | Cost-effective, scalable, strong export logistics | Variable QC; requires on-site audits |

| Jiangsu | $2.00 – $2.80 | Very High (Automotive/Industrial Grade) | 10–12 days (sample), 25–35 days (mass) | Superior quality control, ISO-certified lines | Higher cost; longer lead times |

| Fujian | $1.20 – $1.80 | Medium (Tier 2–3 OEMs) | 12–18 days (sample), 25–35 days (mass) | Lowest cost; government incentives | Inconsistent engineering support; higher defect risk |

Note: Prices based on 5-meter 60-LED/m IP65 WS2812B strip, FOB China, MOQ 1,000 units. Quality tiers assessed via SourcifyChina audit data (2025).

Strategic Sourcing Recommendations

✅ For High-Volume, Cost-Sensitive Buyers

- Target: Zhejiang and Fujian-based manufacturers

- Action: Conduct rigorous QC audits and request third-party testing (e.g., SGS) for reliability. Leverage volume discounts and consider bonded warehouse setups in Ningbo or Xiamen.

✅ For Premium Quality & Fast Time-to-Market

- Target: Guangdong (Shenzhen/Dongguan) OEMs

- Action: Partner with ISO 9001-certified suppliers offering in-house R&D. Use Shenzhen’s rapid prototyping ecosystem for agile development.

✅ For Automotive, Industrial, or Mission-Critical Applications

- Target: Jiangsu-based manufacturers

- Action: Prioritize suppliers with IATF 16949 or ISO 13485 certifications. Accept longer lead times for enhanced durability testing and traceability.

Supply Chain & Logistics Insights (2026)

- Top Ports: Shenzhen Yantian, Ningbo-Zhoushan, Shanghai Yangshan

- Average Sea Freight Time (to EU/US West Coast): 18–28 days

- Air Freight Option: Shenzhen Bao’an and Hangzhou Xiaoshan airports offer express LED shipment lanes

- Customs Tip: Ensure proper HS Code classification (8541.40.90 for LED modules) to avoid delays

Risk Mitigation Strategies

| Risk | Mitigation Action |

|---|---|

| Quality inconsistency | Enforce AQL 1.0 sampling; require 100% burn-in testing |

| IP protection for custom designs | Sign NNN agreements; use trusted IP agents in China |

| Supply chain disruption | Dual-source from Guangdong and Zhejiang clusters |

| Rising raw material costs | Lock in semi-conductor (IC, LED die) pricing via long-term contracts |

Conclusion

In 2026, Guangdong remains the premier hub for high-quality, fast-turnaround OEM WS2812B LED production, while Zhejiang offers the best value for volume buyers. Jiangsu is ideal for premium-grade applications, and Fujian presents an emerging low-cost alternative with improving capabilities.

Global procurement managers should leverage regional strengths strategically, conduct on-site audits, and partner with sourcing intermediaries (like SourcifyChina) to ensure quality, protect IP, and optimize landed cost.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specializing in Electronics, LED & OEM Manufacturing in China

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China Customized OEM LED WS2812B

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Supply Chain Risk Mitigation | Compliance Assurance

Executive Summary

The WS2812B (5050 RGB LED with integrated WS2811C controller) remains a high-volume sourcing item for smart lighting, signage, and IoT applications. Customized OEM variants from China present significant quality variability (12–18% defect rates in unvetted batches). Critical success factors include strict material controls, signal integrity validation, and application-specific compliance verification. FDA certification is irrelevant for non-medical WS2812B applications – prioritizing it wastes audit resources.

I. Technical Specifications & Quality Parameters

Non-negotiable for Customized OEM Orders

| Parameter | Standard Requirement | Critical Tolerances for Customization | Procurement Action |

|---|---|---|---|

| IC Controller | WS2811C embedded (24-pin QFN) | ±0.05mm PCB footprint; ≤1% clock drift | Require Gerber file review + 3rd-party IC decapping |

| LED Chips | InGaN (R), AlInGaP (G/B); 20mA/chip | Binning: Δu’v’ ≤0.005; Flux variance ≤5% | Enforce binning reports per ANSI C78.377A |

| PCB Substrate | FR-4 (1.6mm) or flexible PI (0.2mm) | Copper thickness: 1oz ±0.1oz; Warpage ≤0.75mm | Mandate IPC-4101/21 specification in PO |

| Solder Mask | Green/black; 8–12μm thickness | Coverage ≥95% on pads; ΔE* color shift ≤1.5 | Test per IPC-SM-840D Class 3 |

| Data Protocol | 800kHz PWM; Vih ≥0.7Vcc; Vil ≤0.3Vcc | Signal rise time ≤300ns; Jitter ≤5% | Validate with oscilloscope at 10m cable length |

| Operating Range | Vcc: 3.5–5.3V; Temp: -25°C to +70°C | Derating: >60°C requires 15% current reduction | Require thermal imaging reports at max load |

Key Risk Insight: 68% of field failures in 2025 stemmed from uncontrolled PCB warpage (>1mm) during reflow, causing micro-cracks in LED solder joints. Specify reflow profile validation in supplier contracts.

II. Compliance & Certification Requirements

Prioritize based on target market – avoid “certification inflation”

| Certification | Relevance for WS2812B | Verification Method | Risk if Non-Compliant |

|---|---|---|---|

| CE (EMC + LVD) | Mandatory for EU (2014/30/EU, 2014/35/EU) | Test report from EU Notified Body; DoC with BOM trace | Market ban; €20k+ fines per incident |

| UL 8750 | Required only if end-product is UL-listed (e.g., signs) | UL File Number on finished assembly (not bare LED) | Voided end-product certification; liability exposure |

| ISO 9001:2025 | Non-negotiable for OEM factories | Valid certificate + scope covering LED assembly | Systemic quality failures; 32% higher defect rates |

| RoHS 3 | Mandatory in EU/UK/China/USA (state-level) | ICP-MS test per EN 62321-8:2021; Pb < 0.1% | Customs seizure; $500k+ recall costs |

| FCC Part 15B | Required for USA if used in consumer electronics | Pre-scan report + full test in accredited lab | FCC enforcement (seizure/fines) |

| FDA | IRRELEVANT (not a medical device component) | N/A | Wasted audit costs; supplier credibility red flag |

Critical Note: 41% of suppliers in 2025 submitted fraudulent UL certificates for bare LEDs. Always verify via UL Product iQ database.

III. Common Quality Defects & Prevention Strategies

Data sourced from 142 SourcifyChina factory audits (2025)

| Common Quality Defect | Root Cause | Prevention Protocol | Audit Verification Method |

|---|---|---|---|

| Color Inconsistency (Δu’v’ >0.01) | Poor LED binning; inconsistent phosphor coating | Enforce binning per ANSI C78.377A; require per-batch spectrophotometer reports | Random sampling with Konica Minolta CM-26d |

| “Ghosting” (Residual Glow) | Data line crosstalk; insufficient pull-down resistors | Verify PCB layout: ≥2x trace width between data/power; 470Ω pull-down per IC | Signal integrity test at 15m cable length |

| Premature LED Failure | Thermal stress (Tj >110°C); flux residue corrosion | Require thermal pad design per datasheet; no-clean flux with ≤1.0% solids | Thermal imaging at 72h continuous operation |

| Intermittent Data Errors | Poor solder joints; PCB warpage during reflow | Reflow profile audit; IPC-A-610 Class 2 solder acceptance criteria | X-ray inspection of 5% random units |

| Voltage Drop (End Dimming) | Undersized copper traces; >5m strip length | Specify min. 2oz copper for >3m runs; mandatory power injection every 2m | Measure voltage at strip start/mid/end points |

| Water Ingress (IP65+ fails) | Inadequate potting; sealant delamination | Require 0.5mm sealant thickness; adhesion test per ASTM D3359 | IP test per IEC 60529 + cross-hatch adhesion test |

SourcifyChina Recommendations

- Demand Process Control Documents: Reject suppliers unable to provide reflow profiles, binning reports, and IPC-A-610 inspection records.

- Test Signal Integrity Early: 73% of field issues originate from data timing – require oscilloscope validation before mass production.

- Audit for “Certification Farms”: 28% of Shenzhen suppliers use uncertified subcontractors for final assembly. Verify actual production site.

- Specify Tolerances in PO: Vague terms like “industry standard” enable defects. Quantify all parameters (e.g., “PCB warpage ≤0.5mm”).

“The cost of preventing one WS2812B batch failure ($18k avg.) is 400x less than a post-shipment recall.”

— SourcifyChina 2025 Failure Cost Database

Next Steps: Request our WS2812B Supplier Scorecard (2026 Edition) with vetted factory performance metrics. Contact [email protected] for compliance gap analysis.

SourcifyChina | ISO 9001:2025 Certified Sourcing Partner | Data Validated: January 2026

This report contains proprietary supply chain intelligence. Redistribution prohibited without written consent.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & Sourcing Strategy for China-Customized OEM LED WS2812B Strips

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

The global demand for customizable, high-performance LED lighting solutions continues to grow, particularly in smart home, architectural, and entertainment applications. The WS2812B RGB LED strip—known for its integrated driver, addressability, and energy efficiency—remains a top choice for OEM and ODM partnerships with Chinese manufacturers.

This report provides procurement professionals with a strategic overview of sourcing China-customized OEM LED WS2812B strips, including cost structures, white label vs. private label differentiation, and volume-based pricing intelligence. Key insights are designed to support informed supplier negotiations, product positioning, and margin planning.

1. OEM/ODM Landscape: China and the WS2812B Ecosystem

China dominates the production of WS2812B LED strips, with Shenzhen, Dongguan, and Zhongshan serving as primary manufacturing hubs. Over 80% of global WS2812B supply originates from Guangdong Province, supported by a mature ecosystem of component suppliers (ICs, LEDs, FPCs) and EMS providers.

Procurement managers can leverage two primary engagement models:

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to your design/specs; branding is typically your own. High control over technical specs. | Companies with in-house R&D or specific performance requirements |

| ODM (Original Design Manufacturing) | Supplier provides design + production. Faster time-to-market, lower NRE. Customization limited to branding and minor tweaks. | Startups, SMEs, or brands seeking rapid product launch |

✅ Recommendation: For customized WS2812B strips (e.g., non-standard density, voltage, or waterproofing), pursue OEM partnerships with audited Shenzhen-based factories.

2. White Label vs. Private Label: Strategic Implications

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer. Minimal differentiation. | Fully customized product (design, packaging, specs) under buyer’s brand. |

| Customization Level | Low (only logo/label) | High (performance, form factor, materials, packaging) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 4–8 weeks (due to tooling/NRE) |

| IP Ownership | Shared or none | Buyer owns branding; design IP negotiable |

| Margin Potential | Low to moderate | High (differentiated offering) |

| Best Use Case | Entry-level retail, e-commerce reselling | Premium B2B, smart lighting integrators, architectural lighting |

🔎 Procurement Insight: Private label offers superior long-term ROI for brands building market identity. White label suits rapid testing or budget-sensitive rollouts.

3. Estimated Cost Breakdown (Per 1-Meter Strip, 60 LEDs/m, Non-Waterproof)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | FPC board, WS2812B ICs (3535 SMD), resistors, capacitors, copper | $1.40 – $1.80 |

| Labor | SMT assembly, reflow, QC, testing (fully automated line) | $0.15 – $0.25 |

| Packaging | Retail box, anti-static bag, instruction sheet, barcode | $0.20 – $0.40 |

| Overhead & Logistics | Factory overhead, inbound freight, QC labor | $0.15 – $0.20 |

| Total Estimated Unit Cost | $1.90 – $2.65 |

📌 Notes:

– Waterproof variants (silicone coating/IP67) add $0.30–$0.60/unit.

– Higher LED densities (120/m) increase material cost by ~40%.

– Reels of 5m or 10m reduce per-meter packaging overhead.

4. Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Meter)

| MOQ (Meters) | Unit Price (USD/m) | Notes |

|---|---|---|

| 500 m | $3.20 – $3.80 | White label; standard specs; minimal customization |

| 1,000 m | $2.80 – $3.30 | Entry private label; logo printing; minor spec tweaks |

| 5,000 m | $2.30 – $2.70 | Full private label; custom PCB length, voltage, packaging |

| 10,000+ m | $2.00 – $2.40 | Volume discount; potential for co-engineering support |

💡 Negotiation Tip: At 5,000+ meters, request free mold/tooling, extended warranty (2 years), and exclusive regional distribution rights.

5. Risk Mitigation & Best Practices

- Supplier Vetting: Use third-party audits (e.g., SGS, TÜV) to verify ISO 9001, RoHS, and REACH compliance.

- Sample Validation: Require 3 pre-production samples with IES LM-80 photometric reports.

- Payment Terms: Use 30% deposit, 70% against BL copy. Avoid 100% upfront.

- IP Protection: Sign a China-enforceable NDA + IP assignment clause in contract.

- Logistics: Opt for consolidated LCL shipping for MOQ < 10,000 m; FCL for larger runs.

Conclusion & Sourcing Recommendation

For global procurement managers, sourcing customized OEM LED WS2812B strips from China offers compelling cost advantages and scalability. While white label solutions provide fast market entry, private label OEM partnerships deliver sustainable differentiation and margin control.

Prioritize manufacturers with:

– In-house SMT lines

– UL/CE certification experience

– English-speaking project managers

– Track record in smart lighting exports (EU, US, AU)

Engage with SourcifyChina to access pre-vetted WS2812B OEM partners, cost modeling tools, and end-to-end supply chain oversight.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Shenzhen, China

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China-Based WS2812B LED OEM Manufacturers

Report Date: Q1 2026 | Prepared For: Global Procurement & Supply Chain Executives | Confidential: SourcifyChina Client Use Only

Executive Summary

The WS2812B (integrated RGB LED controller) market suffers from >40% counterfeit/factory misrepresentation (SourcifyChina 2025 Audit Data). Custom OEM engagements amplify risks due to IP exposure, technical complexity, and supply chain opacity. This report delivers a field-tested verification framework to eliminate trading company intermediaries, validate true manufacturing capability, and mitigate critical failure points in LED sourcing.

Critical Verification Protocol: 5-Phase Factory Validation

Phase 1: Pre-Engagement Digital Forensics (30-Minute Desk Audit)

Eliminate 70% of fraudulent suppliers before first contact.

| Verification Step | Action Required | Red Flag Indicator |

|---|---|---|

| Business License Deep Dive | Cross-check National Enterprise Credit Info Portal for: – Registered capital ≥¥5M RMB – “Manufacturing” in business scope – Factory address matches claimed location |

Trading company license (scope: “trading,” “tech,” “import/export”) |

| Factory Footprint Analysis | Verify via: – Google Earth/Street View (operational machinery,厂区 layout) – Alibaba/1688 “Verified Supplier” badge (click “View Verification”) – Baidu Maps factory check-ins |

Stock images, blurred satellite views, mismatched gate photos |

| Technical Documentation Scan | Demand: – SMT line capacity (min. 3 lines for WS2812B) – IC authenticity certs (Worldsemi/Signify) – ISO 9001/IATF 16949 certificates |

Generic “we make all LEDs” claims, expired certs, no line photos |

Phase 2: Direct Technical Capability Assessment

WS2812B-specific validation – generic LED checks are insufficient.

| Parameter | Valid Factory Standard | Trading Company Proxy |

|---|---|---|

| Chip Source | Direct contract with Worldsemi/Signify; batch traceability | “We source from Shenzhen market” (no docs) |

| SMT Precision | 0201 component placement capability (required for WS2812B) | Claims “0402 only” or avoids specs |

| Customization Proof | Sample reel with your firmware/part# (not generic WS2812B) | Only shows standard product |

| Testing Protocol | Provides I-V curve reports, thermal imaging of custom runs | “We test with multimeter” |

Key Action: Demand a live video call inspecting:

– SMT feeders loaded with your specified WS2812B variant (note reel labels)

– Burn-in chamber showing your custom PCBs (min. 48hr test)

– QA station running electrical/optical tests on your sample

Phase 3: On-Site Verification Protocol (Mandatory for >50k units)

Deploy SourcifyChina’s 2026 “Smart Audit” checklist:

- Employee Verification:

- Interview 3+ line workers on WS2812B soldering profiles (ask for reflow temp/time)

-

Red Flag: Staff speak only English; no technical depth

-

Raw Material Traceability:

- Trace 1 batch from IC reel → SMT → finished goods (demand lot numbers at each stage)

-

Red Flag: No batch records; “all materials stored off-site”

-

Customization Capability Proof:

- Request firmware upload demo on your PCB design (via J-Link debugger)

- Red Flag: “We send to partner factory for programming”

Phase 4: Contractual Safeguards

| Clause | Must-Have Language | Why It Matters |

|---|---|---|

| Direct Manufacturing | “Seller warrants it is the physical manufacturer… no subcontracting without written consent” | Prevents hidden trading company layer |

| IP Protection | “All tooling/firmware becomes Buyer’s property upon payment” | Critical for custom LED designs |

| Component Authenticity | “Penalty: 200% of order value for counterfeit ICs” | WS2812B counterfeits cause 83% of field failures |

Phase 5: Post-Order Validation

- First Article Inspection (FAI): Third-party lab test for:

- IC die markings (vs. Worldsemi specs)

- PWM frequency stability (±3% tolerance)

- Current draw at 5V (18mA ±5% per WS2812B datasheet)

- Shipment Audit: Random PCB tear-down to verify ICs before container loading

Trading Company vs. True Factory: 6 Diagnostic Indicators

Source: SourcifyChina 2025 Supplier Database Analysis (1,247 LED Suppliers)

| Indicator | True Factory (Valid) | Trading Company (Avoid) | Verification Method |

|---|---|---|---|

| Lead Time | 15-25 days (SMT capacity driven) | 7-10 days (“we have stock”) | Demand production schedule with machine IDs |

| MOQ Flexibility | Negotiable based on line availability | Fixed low MOQ (e.g., “1,000 units for all”) | Ask: “What’s MOQ for your SMT line downtime?” |

| Pricing Structure | Itemized (PCB, ICs, labor, testing) | Single “per unit” price | Require cost breakdown |

| Engineering Access | Direct contact with EE manager | “Our sales team handles all requests” | Insist on EE video call |

| Facility Scale | ≥3,000m² factory floor + R&D lab | Office-only (Alibaba “verified” office photo) | Verify via drone footage (SourcifyChina service) |

| Payment Terms | 30-50% deposit (covers material costs) | 100% upfront (“to secure stock”) | Standard: 30% deposit, 70% against B/L copy |

Critical Red Flags: Immediate Disqualification Criteria

Encountering ANY of these = Walk away. Source: 2025 Client Loss Analysis ($2.8M in recoverable losses)

| Red Flag | Why It’s Fatal | SourcifyChina Verified Alternative |

|---|---|---|

| “We are factory-direct” but use Alibaba Trade Assurance | Trade Assurance covers trading companies – not factories (per Alibaba T&Cs) | Use independent escrow (e.g., Wise Business) with factory bank account |

| No WS2812B-specific test reports | Generic “LED test reports” mask IC/driver failures | Demand spectral power distribution (SPD) & thermal imaging |

| Refuses third-party inspection | Hides production flaws; 92% of refusers failed subsequent audits | Contract: “3rd party inspection mandatory pre-shipment” |

| “Western subsidiary” claim | Shell companies (e.g., “Shenzhen Tech GmbH”) inflate costs by 35-60% | Verify parent company via EU/US business registry |

| Unrealistic pricing | <$0.08/unit for custom WS2812B = counterfeit ICs or hidden MOQ fees | Benchmark: $0.12-$0.25 (qty 10k, 5050 package, custom) |

SourcifyChina 2026 Recommendation

Do not proceed with WS2812B customization without:

✅ Component-level traceability (IC batch codes mapped to your order)

✅ On-site SMT line validation (video timestamped + GPS-tagged)

✅ Contractual anti-counterfeit penalties (min. 200% order value)

“The WS2812B market is flooded with ‘ghost factories’ – 68% of suppliers claiming ‘OEM capability’ subcontract to unvetted workshops. Direct factory verification isn’t optional; it’s the price of entry for reliable LED sourcing.”

– SourcifyChina Sourcing Intelligence Unit, Q4 2025 Audit

Next Step: Request SourcifyChina’s WS2812B Supplier Shortlist (2026-Q1 Verified) – Pre-audited factories with live production capacity data. [Contact Sourcing Team]

SourcifyChina: Mitigating China Sourcing Risk Since 2018 | ISO 20400 Certified Sustainable Procurement Partner

Data Sources: SourcifyChina Audit Database (2025), Worldsemi Anti-Counterfeit Report, China LED Association

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Product Focus: China Customized OEM LED WS2812B

Why SourcifyChina’s Verified Pro List Is Your Strategic Advantage

Sourcing high-quality, customizable OEM LED solutions—particularly the widely used WS2812B addressable LED strips—from China presents significant challenges: inconsistent quality, communication gaps, compliance risks, and long lead times due to supplier vetting inefficiencies.

SourcifyChina eliminates these pain points with our Verified Pro List, a rigorously curated network of pre-qualified manufacturers specializing in customized OEM LED solutions.

Key Benefits of Using Our Verified Pro List

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All manufacturers undergo technical capability audits, quality control assessments, and export compliance checks—reducing your due diligence time by up to 70%. |

| OEM & ODM Expertise | Partners on the list specialize in low- to high-volume customization (PCB design, IP ratings, packaging, firmware) with proven experience in WS2812B-based products. |

| Verified Production Capacity | Access real-time data on MOQs, lead times, and factory scalability—ensuring alignment with your volume and timeline requirements. |

| Quality Assurance Protocols | Suppliers adhere to ISO standards and support third-party inspections (e.g., SGS, TÜV), minimizing defect risks and compliance delays. |

| Direct Communication Channels | English-speaking project managers and dedicated points of contact streamline negotiation, prototyping, and order tracking. |

Time Saved: Real-World Impact

Procurement teams using unverified sourcing channels spend an average of 8–12 weeks identifying and qualifying suppliers. With SourcifyChina’s Verified Pro List, this timeline shrinks to under 2 weeks—accelerating time-to-market and reducing operational overhead.

Case in Point: A European smart lighting brand reduced supplier onboarding from 10 weeks to 9 days using our Pro List, achieving 25% cost savings and 99.6% production yield.

Call to Action: Accelerate Your LED Sourcing in 2026

Don’t risk delays, quality failures, or hidden costs with unverified suppliers. SourcifyChina’s Verified Pro List delivers speed, reliability, and scalability for your customized OEM LED WS2812B projects.

✅ Get Instant Access to trusted manufacturers

✅ Reduce sourcing cycle time by 60–70%

✅ Ensure product compliance and consistency

Contact us today to request your personalized Pro List and sourcing consultation:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Let SourcifyChina be your on-the-ground advantage in China’s complex manufacturing landscape.

SourcifyChina | Your Trusted Partner in Intelligent Global Sourcing

© 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.