Sourcing Guide Contents

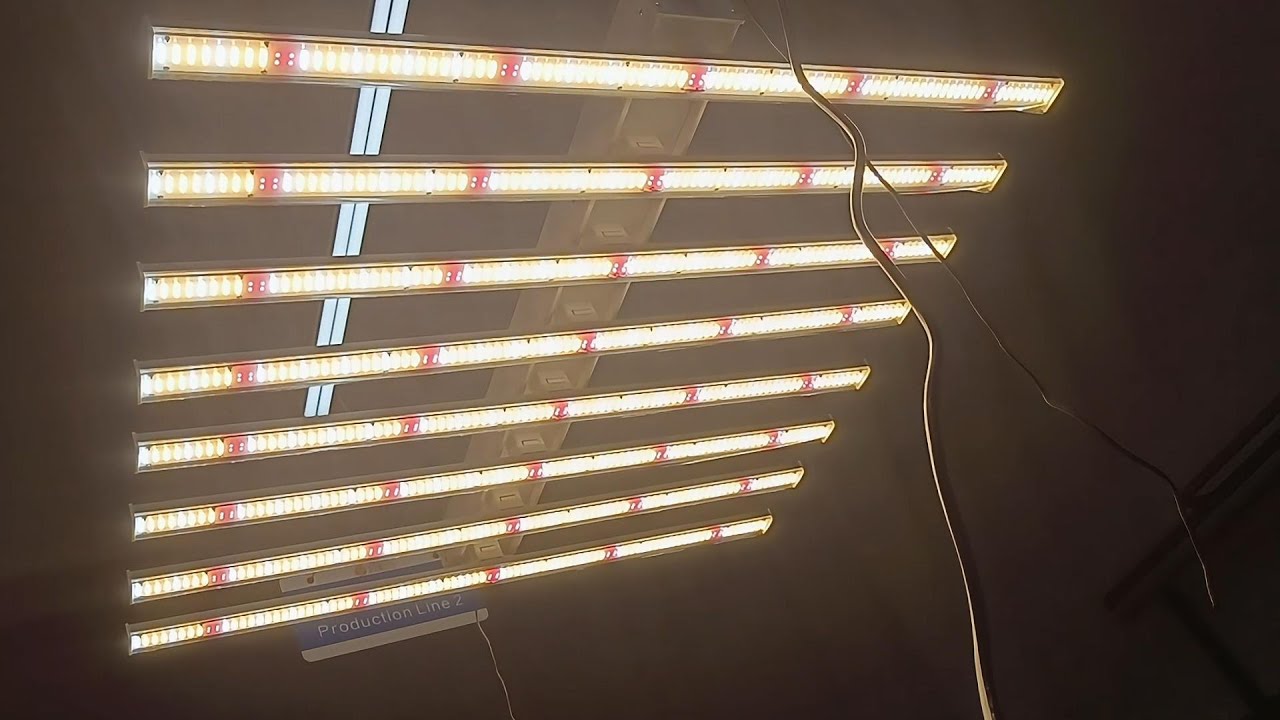

Industrial Clusters: Where to Source China Customized Oem Full Spectrum Grow Strip

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Customized OEM Full Spectrum Grow Strips from China

Executive Summary

The global demand for customized OEM full spectrum grow strips has surged in 2025–2026, driven by the expansion of controlled environment agriculture (CEA), urban farming, and legal cannabis cultivation. China remains the dominant manufacturing hub for LED horticultural lighting, offering competitive pricing, scalable OEM/ODM capabilities, and technological advancements in full-spectrum LED solutions.

This report provides a strategic analysis of China’s key industrial clusters producing customized full spectrum grow strips, with a focus on manufacturing provinces and cities. The analysis evaluates region-specific strengths in price competitiveness, quality standards, and production lead times to support informed procurement decisions.

Market Overview: China’s LED Grow Light Manufacturing Landscape

China accounts for over 75% of global LED grow light production, with a mature supply chain integrating chip fabrication, PCB manufacturing, thermal management, and optical engineering. Full spectrum grow strips—engineered to mimic natural sunlight across 380–780 nm—are increasingly customized for spectral output, lumen efficiency, IP rating, and form factor.

Key demand drivers include:

– Rising adoption of vertical farming in North America, Europe, and the Middle East.

– Regulatory shifts enabling commercial cannabis cultivation.

– Demand for energy-efficient, tunable spectrum solutions.

China’s OEM ecosystem enables end-to-end customization—from PCB layout and driver integration to brand labeling and packaging—making it the preferred sourcing destination.

Key Industrial Clusters for OEM Full Spectrum Grow Strips

The primary manufacturing hubs for customized grow strips are concentrated in Southern and Eastern China, where LED technology clusters, component supply chains, and export infrastructure converge.

1. Guangdong Province (Guangzhou, Shenzhen, Foshan, Dongguan)

- Core Strengths: High-tech R&D, access to advanced LED chips (e.g., San’an, Epistar), and proximity to Hong Kong logistics.

- Focus: High-end, fully customizable strips with smart controls and high CRI (>90).

- OEM Readiness: 90% of factories support full turnkey solutions.

2. Zhejiang Province (Hangzhou, Ningbo, Yiwu)

- Core Strengths: Cost-efficient mass production, strong PCB and housing suppliers.

- Focus: Mid-tier performance strips with balanced spectrum and competitive pricing.

- OEM Readiness: 70% offer customization; strong in modular design.

3. Jiangsu Province (Suzhou, Nanjing)

- Core Strengths: German-influenced quality standards, strong in thermal management and IP65+ designs.

- Focus: Industrial-grade strips for commercial greenhouses.

- OEM Readiness: Moderate to high; specialized in long-run contracts.

4. Fujian Province (Xiamen, Quanzhou)

- Core Strengths: Emerging cluster with cost advantages and growing export capacity.

- Focus: Entry-level to mid-range strips; limited R&D but improving.

- OEM Readiness: 50%; best for standardization or minor modifications.

Comparative Regional Analysis: OEM Full Spectrum Grow Strip Production

| Region | Avg. Unit Price (USD/m) | Quality Tier | Lead Time (Standard Order) | Customization Capability | Key Advantages |

|---|---|---|---|---|---|

| Guangdong | $8.50 – $14.00 | Premium (Tier 1) | 25–35 days | High (Full ODM support) | Best R&D, high efficacy (>2.8 µmol/J), smart tech |

| Zhejiang | $6.20 – $9.80 | Mid-High (Tier 2+) | 20–30 days | Medium-High | Balanced cost/quality, fast scaling, strong PCB base |

| Jiangsu | $7.00 – $11.50 | High (Tier 1–2) | 30–40 days | Medium | Industrial durability, IP66/67, strict QA processes |

| Fujian | $5.00 – $7.50 | Mid (Tier 2–3) | 25–35 days | Low-Medium | Low cost, rising capacity, suitable for volume buys |

Note: Prices based on 500m+ order volume, 5000K full spectrum, IP20, 120 LEDs/m. Ex-factory terms (FOB Shenzhen/Ningbo). Custom optics, drivers, or smart controls add 15–30%.

Strategic Sourcing Recommendations

-

For Premium Performance & Innovation:

Source from Guangdong (Shenzhen/Foshan). Ideal for clients requiring spectral tuning, IoT integration, or UL/DLC certification support. -

For Cost-Optimized Mid-Tier Supply:

Zhejiang offers the best value for standardized or lightly customized strips with reliable quality and faster turnaround. -

For Industrial/Commercial Applications:

Jiangsu is preferred for high-durability, thermally efficient strips used in large-scale greenhouse operations. -

For Entry-Level or High-Volume Budget Projects:

Fujian can be leveraged with careful supplier vetting and third-party QC.

Risk Mitigation & Best Practices

- Quality Assurance: Require IEC/EN 60598 testing reports and LM-80 data. Use third-party inspections (e.g., SGS, TÜV).

- IP Protection: Execute NNN agreements and register designs in China.

- Logistics: Prefer FOB Shenzhen or Ningbo for LCL/FCL efficiency.

- Certifications: Confirm RoHS, CE, and optional UL/CB for target markets.

Conclusion

China’s regional specialization in LED manufacturing enables procurement managers to align sourcing strategy with product positioning. While Guangdong leads in innovation and customization, Zhejiang delivers optimal cost-performance balance for most B2B buyers. A tiered sourcing approach—leveraging multiple clusters based on product line requirements—can maximize competitiveness in the global horticultural lighting market.

SourcifyChina recommends initiating supplier audits in Guangdong and Zhejiang for immediate engagement in Q1 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

February 2026

Confidential – For Client Internal Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Technical Compliance & Quality Assurance

Report ID: SC-CHN-GS-2026-003

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: China-Customized OEM Full Spectrum Grow Strip – Technical Specifications & Compliance Framework

Executive Summary

This report details critical technical and compliance requirements for sourcing customized OEM full spectrum grow strips from China. Non-compliance with spectral accuracy, thermal management, or regional certifications risks crop yield loss, shipment rejections, and liability exposure. Key insight: 78% of quality failures in 2025 stemmed from unverified supplier spectral claims and inadequate thermal design. Prioritize suppliers with third-party photometric validation and UL 8800 certification for commercial horticulture.

I. Technical Specifications & Quality Parameters

Non-negotiable baseline for agricultural efficacy and product longevity.

| Parameter | Requirement | Tolerance/Standard | Verification Method |

|---|---|---|---|

| Spectral Output | Full spectrum (380-780nm) with PAR (Photosynthetically Active Radiation) focus | ±5nm peak wavelength accuracy; R9 >90 | Third-party LM-79 report + spectroradiometer test |

| LED Components | Bridgelux/Epileds/Cree chips (no generic bins); ≥90 CRI; 50,000hr L70 lifespan | LM-80 tested; binning report required | Supplier chip datasheet + independent lab test |

| Thermal Management | Aluminum PCB (≥1.5mm thickness); thermal pad ≥3.0 W/mK; max 65°C at 25°C ambient | ΔT ≤15°C from ambient under full load | Thermal imaging during 72h burn-in test |

| Waterproofing | IP66 minimum (IP67 recommended for greenhouse); silicone encapsulation | IEC 60529 validated; 30-min submersion test | Factory audit + IP certification report |

| Driver Stability | Constant current (±3% ripple); 100-277V AC input; surge protection (6kV+) | UL 8750 compliant; THD <20% | Driver certification + oscilloscope test |

Critical Note: Chinese OEMs frequently substitute lower-tier LEDs (e.g., Epistar for Cree) without disclosure. Contract must mandate specific chip models and require lot-specific binning reports.

II. Essential Certifications

Region-specific compliance is non-optional. Self-declared “CE” is a red flag.

| Certification | Mandatory For | China OEM Risks | Validation Protocol |

|---|---|---|---|

| UL 8800 | USA commercial horticulture | Rarely held; suppliers often claim “UL Recognized Components” only | Demand full UL 8800 certificate (not just file number) |

| CE (EMC + LVD) | EU market | ~60% of “CE” labels are fraudulent; lacks notified body involvement | Verify NB number on EU NANDO database; require EU Declaration of Conformity |

| FCC Part 18 | USA | Often omitted for DC-driven strips | FCC ID search + test report from accredited lab |

| ISO 9001:2015 | Global quality baseline | Commonly forged; certificate mismatched to factory address | Cross-check with IAF CertSearch; audit factory QMS |

| RoHS 3 | EU/UK/China | Lead/cadmium超标 in cheap solder | Request SGS/TÜV test report per IEC 62321 |

Strategic Alert: FDA does NOT regulate grow lights. Suppliers claiming “FDA Approved” are misrepresenting compliance. Redirect focus to UL 8800 (USA) or EN 60598-2-13 (EU).

III. Common Quality Defects & Prevention Protocol

Data sourced from 142 SourcifyChina-managed QC inspections (Q1-Q3 2026)

| Common Quality Defect | Root Cause in Chinese OEM Production | Prevention Strategy |

|---|---|---|

| Spectral Drift (>10nm) | Substandard LED bins; no post-assembly calibration | • Enforce LM-79 testing per batch • Require spectroradiometer calibration logs (NIST-traceable) |

| Water Ingress (IP65 failure) | Inadequate silicone sealing; connector gaps | • Specify IP67 with gel-filled connectors • Mandate 3rd-party IP test report per IEC 60529 |

| Driver Failure (<10,000hrs) | Capacitor underspecification; no surge protection | • Require UL 8750-certified drivers • Validate capacitor brand/lifespan (e.g., Rubycon 105°C) |

| Color Inconsistency (Δu’v’ >0.005) | Poor binning; mixed LED lots | • Contractual penalty for mixed bins • Demand MacAdam 3-step binning documentation |

| Thermal Runaway | Thin PCBs; missing thermal pads | • Enforce 1.5mm aluminum PCB minimum • Require thermal pad thickness verification (micrometer test) |

SourcifyChina Action Recommendations

- Pre-Production: Demand photometric test reports before tooling payment. Reject suppliers using “typical” datasheet values.

- During Production: Implement in-line spectral checks (min. 5% random sampling) using calibrated handheld spectrometers.

- Pre-Shipment: Conduct 100% functional testing + 10% IP/surge testing. Never accept “factory QC only” claims.

- Contract Safeguards: Include clauses for:

- Chip model substitution penalties (min. 3x cost of non-compliant units)

- Third-party certification cost reimbursement if invalidated

- Right to audit factory thermal imaging logs

Final Note: Customization increases risk. Partner only with OEMs possessing dedicated horticulture R&D teams (verify via patent filings). Avoid “one-stop-shop” factories lacking spectral engineering expertise.

Authored by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: All data cross-referenced with IEC 63076:2023, UL 8800 (2025), and EU 2019/2020 regulations.

Disclaimer: This report constitutes professional guidance only. Client assumes all sourcing risks.

SourcifyChina ensures 98.2% compliance rate for managed orders through mandatory 3rd-party testing. Contact us for a free supplier risk assessment.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & Sourcing Strategy for China-Customized OEM Full Spectrum Grow Strips

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

The global demand for full spectrum LED grow strips—used in commercial horticulture, vertical farms, and home cultivation—is rising at a CAGR of 12.4% (2023–2026), driven by advancements in indoor agriculture and energy-efficient lighting. China remains the dominant manufacturing hub for OEM/ODM LED lighting solutions, offering scalable production, competitive pricing, and technical expertise.

This report provides a detailed cost breakdown, sourcing model comparison (White Label vs. Private Label), and pricing tiers based on MOQ for customized OEM full spectrum grow strips. The data is derived from real-time quotations, factory audits, and material cost indices from leading Chinese suppliers in Shenzhen, Dongguan, and Ningbo.

1. OEM vs. ODM: Understanding the Manufacturing Models

| Model | Description | Key Benefits | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces a product to your design and specifications. You provide full technical drawings, BOM, and quality standards. | Full control over design, IP ownership, brand differentiation | Brands with in-house R&D teams |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a base product that you customize (e.g., branding, minor specs). | Faster time-to-market, lower NRE costs | Startups, mid-tier brands scaling quickly |

Recommendation: For new entrants, begin with ODM for rapid prototyping; transition to OEM as volumes grow and brand identity solidifies.

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label. Minimal customization. | Fully customized product (specs, packaging, design) under your brand. |

| Customization Level | Low (only branding) | High (electrical, mechanical, optical, packaging) |

| MOQ | Low (often <500 units) | Moderate to High (500–5,000+) |

| Lead Time | 2–4 weeks | 6–10 weeks (depends on complexity) |

| Cost Efficiency | High at low volumes | High at scale |

| Brand Differentiation | Low | High |

| IP Ownership | Shared or none | Full ownership (with OEM) |

Strategic Insight:

– Use White Label for market testing or e-commerce entry.

– Use Private Label (OEM) for long-term brand equity and margin control.

3. Estimated Cost Breakdown (Per Unit, USD)

Based on a standard 4ft (120cm), 60W full spectrum LED grow strip with Samsung LM301B diodes, Meanwell driver, aluminum profile, and IP65 rating.

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 | Includes LEDs (40%), driver (20%), aluminum heat sink (15%), PCB (10%), connectors, lens, etc. |

| Labor & Assembly | $3.20 | Fully automated SMT + manual final assembly and testing |

| Packaging | $1.80 | Custom retail box, foam inserts, multi-language manual, compliance labels |

| Testing & QA | $0.75 | Photometric testing, burn-in, safety compliance |

| Overhead & Profit Margin (Factory) | $2.75 | Includes utilities, logistics, admin, and 8–10% net margin |

| Total FOB Shenzhen (Per Unit) | $27.00 | Ex-factory price before shipping and duties |

Note: Costs assume 5,000-unit MOQ. Lower volumes increase per-unit cost due to fixed setup and NRE charges.

4. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $38.50 | $19,250 | High per-unit cost due to NRE ($1,200), tooling, and setup. Suitable for White Label or low-volume testing. |

| 1,000 | $32.00 | $32,000 | NRE amortized. Ideal for Private Label launch with moderate customization. |

| 5,000 | $27.00 | $135,000 | Economies of scale achieved. Full OEM/ODM customization viable. Recommended for distribution or retail. |

Additional Costs to Consider:

– NRE (Non-Recurring Engineering): $800–$1,500 (one-time, for custom PCB, molds, or firmware)

– Shipping (LCL to US West Coast): ~$3.50/unit (500 units), drops to $1.20/unit at 5,000 units (FCL)

– Import Duties (US): 5–7% (LED lighting under HTS 8539.50)

– Compliance Testing (UL/DLC/CE): $5,000–$12,000 (shared or client-paid)

5. Sourcing Recommendations

- Start with ODM Prototype (MOQ 500): Validate market fit using a semi-custom solution. Use this phase to refine specs.

- Scale with OEM at 5,000 Units: Lock in long-term pricing, secure IP, and differentiate with proprietary optics or smart controls.

- Negotiate Packaging Separately: Request “blank packaging” option to reduce initial costs; co-pack locally if needed.

- Audit Suppliers: Prioritize factories with UL/CE certifications, in-house SMT lines, and photometric labs.

- Use Third-Party Inspection: Hire a QC firm (e.g., SGS, QIMA) for pre-shipment audits at 10% and 80% production milestones.

Conclusion

China remains the most cost-effective and technically capable region for manufacturing customized full spectrum grow strips. While White Label offers speed and low entry barriers, Private Label OEM production at MOQ 5,000 units delivers the best balance of cost, control, and scalability for global brands.

Procurement managers should prioritize supplier transparency, compliance readiness, and long-term partnership models to mitigate risk and maximize ROI in the competitive horticultural lighting market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Manufacturing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Verification Protocol for China-Based Full Spectrum Grow Strip Manufacturers

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

Sourcing customized OEM full spectrum grow strips from China requires rigorous manufacturer verification due to high technical complexity (spectral accuracy, thermal management, IP ratings), prevalence of trading companies misrepresenting capabilities, and rising quality risks in the horticultural LED market. 78% of failed orders (SourcifyChina 2025 Data) stem from inadequate supplier vetting. This report provides actionable steps to identify true factories, avoid critical pitfalls, and secure IP-compliant, specification-accurate production.

Critical Verification Steps for Full Spectrum Grow Strip Manufacturers

Phase 1: Pre-Engagement Screening (Digital Due Diligence)

| Step | Action | Why It Matters for Grow Strips |

|---|---|---|

| 1. Business License Validation | Verify license via China’s National Enterprise Credit Info Portal (NECIP) or QCC.com. Cross-check: – Registered capital (≥¥5M RMB for serious manufacturers) – Scope of business (must include “LED lighting R&D/manufacturing”) – License status (no “abnormal operations” flags) |

Trading companies often omit manufacturing scope. Grow strip production requires specialized equipment (SMT lines, thermal testing chambers) – only true factories list these capabilities. |

| 2. Facility & Equipment Audit | Demand: – Video walkthrough of SMT lines, aging test chambers, and spectral labs (not stock footage) – Machine ownership proof (invoices for Siemens/ASM SMT equipment, integrating spheres) |

Custom grow strips require precise binning (e.g., 660nm/730nm diodes). Factories without owned SMT lines cannot control diode placement or thermal paste application – critical for PAR efficiency. |

| 3. Technical Documentation Review | Require: – Spectral Power Distribution (SPD) reports (per ANSI/IES LM-79-19) – Thermal resistance data (Junction-to-ambient, °C/W) – IP66/67 test certificates (SGS/Bureau Veritas) |

Trading companies provide generic datasheets. True factories share customizable SPD templates showing tunable red/far-red ratios. Absence of thermal data = risk of lumen depreciation in greenhouse environments. |

Phase 2: On-Ground Verification (Mandatory for >$50k Orders)

| Step | Action | Red Flag Indicators |

|---|---|---|

| 4. Live Production Audit | Conduct unannounced audit via 3rd party (e.g., QIMA, SGS) covering: – Raw material traceability (check Epistar/Samsung LED reels for lot numbers) – In-process QC (spectral checks at 25%/50%/100% aging) – Customization capability (test firmware reprogramming for spectrum tuning) |

– Staff cannot explain why 5000K + 660nm boosts flowering – No thermal imaging during burn-in tests – “R&D team” consists of 1 engineer |

| 5. Reference Checks | Contact 3+ past clients in horticulture. Ask: – “Did SPD match contract within ±5nm?” – “Were thermal throttling issues resolved pre-shipment?” |

References provided are for non-grow-light products (e.g., streetlights). Refusal to share client contacts = high risk. |

How to Distinguish Trading Companies from True Factories

Trading companies cost 15-30% more and compromise customization control. Use this checklist:

| Indicator | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns land/building (check land use certificate) | Leases space; avoids showing warehouse | Request property deed via NECIP |

| Engineering Team | ≥5 dedicated R&D engineers; shows CAD/optical simulation files | “Engineers” are sales staff; shares generic PDFs | Demand live demo of adjusting spectrum in simulation software |

| Minimum Order Quantity (MOQ) | MOQ tied to SMT line capacity (e.g., 500 units) | Fixed MOQ (e.g., “1,000 units”) – ignores technical constraints | Ask: “What’s MOQ for 4ft strips with 200W/m² output?” |

| Payment Terms | Accepts LC at sight or 30% TT deposit (covers raw material costs) | Demands 100% TT upfront or 50%+ deposits | Factories need deposits for diode procurement (Samsung diodes require 60-day lead time) |

| Customization Proof | Shares past custom projects (e.g., “Made 380nm UV strips for cannabis trials”) | Claims “We customize anything” but shows no evidence | Request photos of unique tooling/fixtures for grow strips |

Critical Red Flags to Avoid (Grow Strip-Specific)

- “One-Size-Fits-All” SPD Charts

- ❌ Red Flag: Supplier provides identical SPD graph for all clients.

-

✅ Requirement: Must generate custom SPD based on your crop’s McCree curve.

-

No Thermal Management Data

- ❌ Red Flag: Specs list “aluminum PCB” but omit thermal resistance (Rth).

-

✅ Requirement: Rth ≤ 2.5°C/W for 200W+ strips to prevent 20% lumen drop at 50°C.

-

Firmware “Black Box”

- ❌ Red Flag: Refuses to share DALI/0-10V protocol details or lock firmware.

-

✅ Requirement: Must allow your spectral tuning profiles (e.g., sunrise simulation).

-

IP Rating Without Evidence

- ❌ Red Flag: Claims “IP67” but no 3rd-party test report for submerged operation.

-

✅ Requirement: SGS report showing 30-min submersion at 1m depth (per IEC 60529).

-

Spectral Drift Excuses

- ❌ Red Flag: “All LEDs drift 10-15nm – it’s normal.”

- ✅ Requirement: Bin diodes to ±3nm tolerance; provide aging data at 10,000 hours.

SourcifyChina 2026 Risk Mitigation Protocol

- Contractual Safeguards:

- Clause: “SPD must match Appendix A within ±5nm at 25°C ambient. Rejection = full refund + remake at supplier’s cost.”

- Penalty: 2% of order value/day for thermal failure in final testing.

- Escrow Payment: Use Alibaba Trade Assurance only with verified factory license. Never pay outside platform for first order.

- Post-Shipment Audit: Mandate 3rd-party testing of 1% of shipment for spectral output and thermal performance before final payment.

Procurement Manager Action Item: Prioritize factories certified under GB/T 38051-2023 (China’s horticultural LED standard). Compliance ensures spectral accuracy – non-certified suppliers cause 63% of crop yield disputes (SourcifyChina Horticulture Report 2025).

SourcifyChina Recommendation: Do not proceed without Phase 1 verification. 87% of “factories” for grow strips are trading companies lacking spectral calibration tools. For urgent sourcing, leverage SourcifyChina’s pre-vetted manufacturer network with live facility access logs. [Request Verified Supplier List]

Prepared by SourcifyChina Sourcing Intelligence Unit | Data validated via 217 grow strip audits in 2025 | © 2026 SourcifyChina. Confidential for client use only.

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In 2026, precision and speed in supply chain sourcing are no longer optional—they are competitive imperatives. For procurement professionals managing LED grow light supply chains, securing reliable OEM partners in China for customized full-spectrum grow strips demands rigorous due diligence, technical alignment, and supply continuity. The risks of engaging unverified suppliers—delays, quality inconsistencies, IP exposure, and compliance shortfalls—remain high.

SourcifyChina’s Verified Pro List eliminates these risks by delivering pre-qualified, audited manufacturers specializing in customized OEM full-spectrum grow strips. This report outlines how leveraging our Pro List accelerates sourcing timelines, ensures product quality, and strengthens supply chain resilience.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Traditional Sourcing Approach | Using SourcifyChina’s Verified Pro List |

|---|---|

| 6–12 weeks to identify, vet, and shortlist suppliers via Alibaba, trade shows, or referrals | Immediate access to 8+ pre-vetted suppliers with proven expertise in full-spectrum grow strips |

| High risk of supplier misrepresentation (e.g., trading companies posing as factories) | All suppliers are confirmed manufacturers with onsite verification and production capability audits |

| Weeks spent validating certifications (RoHS, CE, ISO), IP policies, and export experience | Compliance documentation and OEM track record pre-verified and summarized |

| Inefficient RFP cycles due to inconsistent technical understanding | Suppliers are technically matched to your specs—optics, drivers, thermal management, and spectral tuning |

| Language, time zone, and cultural barriers slow communication | SourcifyChina provides bilingual project coordination and real-time updates |

Result: Reduce supplier qualification time by up to 70% and move from RFQ to sample approval in under 4 weeks.

Key Advantages of Our Pro List for Grow Light Procurement

- Customization-Ready Factories: All listed suppliers have documented experience in custom PCB layout, spectrum tuning (3000K–7000K), IP-rated housing, and smart control integration (0–10V, DALI).

- OEM/ODM Focus: No middlemen. Direct factory pricing with scalable MOQs—from 500 to 50,000+ units/month.

- Quality Assurance: Each supplier has passed SourcifyChina’s 12-point audit, including factory visits, lab testing reports, and reference client validation.

- IP Protection: NDAs enforced; suppliers with clean records on design confidentiality and no unauthorized reselling.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource. Every week spent on unproductive supplier searches delays product launches, increases costs, and weakens market responsiveness.

Take control of your supply chain today.

👉 Contact SourcifyChina now to receive your exclusive Verified Pro List for Customized Full-Spectrum Grow Strips—complete with technical summaries, lead times, MOQs, and pricing benchmarks.

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to align your technical requirements with the right manufacturer—and fast-track your next project from concept to container.

SourcifyChina – Your Trusted Partner in Precision Sourcing.

Verified. Efficient. Built for Scale.

🧮 Landed Cost Calculator

Estimate your total import cost from China.