Sourcing Guide Contents

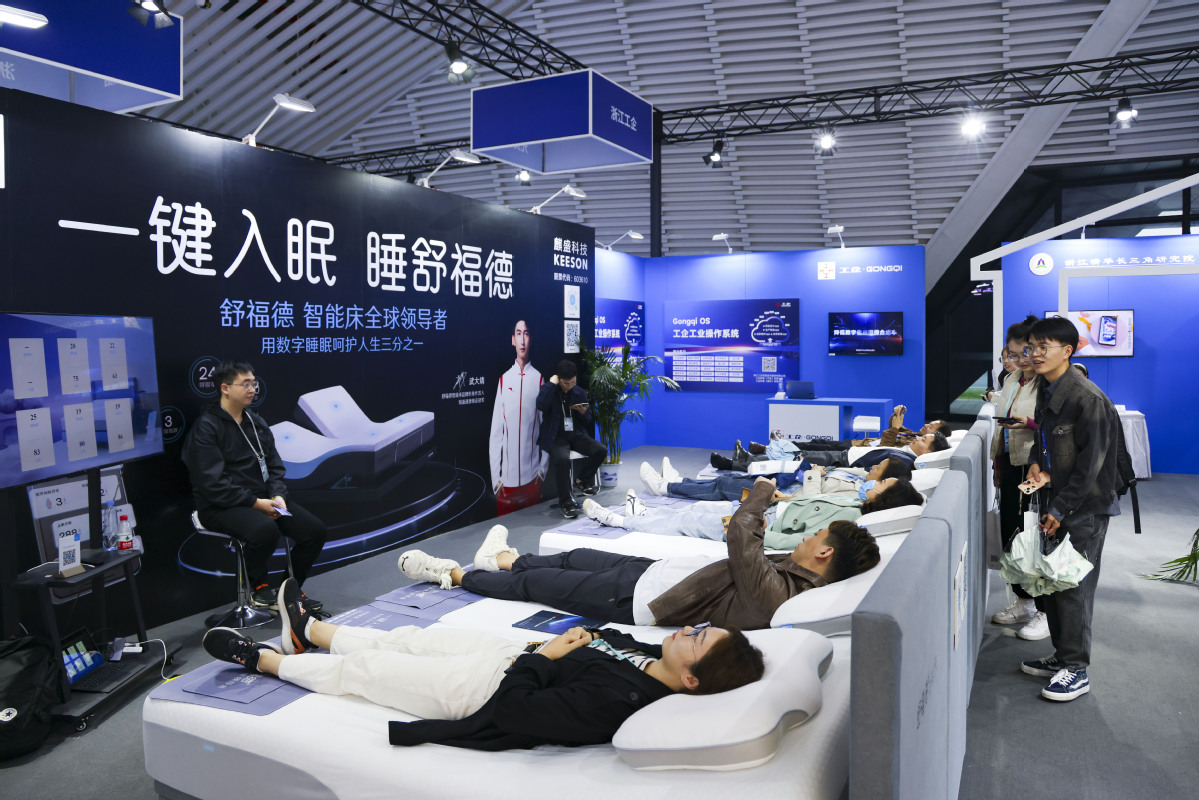

Industrial Clusters: Where to Source China Custom Sleep Trainer Manufacturers

SourcifyChina Sourcing Intelligence Report: China Custom Sleep Technology Manufacturing Landscape (2026 Outlook)

Prepared for Global Procurement Executives | Q1 2026

Executive Summary

The global market for custom sleep technology solutions (encompassing smart mattresses, biometric sleep trackers, therapeutic sleep systems, and AI-driven sleep optimization devices) is projected to reach $18.2B by 2026 (CAGR 14.3%). China supplies 68% of OEM/ODM sleep tech components globally, with specialized clusters evolving beyond basic manufacturing toward integrated IoT and medical-grade solutions. Note: “Sleep trainer” is not an industry-standard term; this analysis covers customizable sleep technology devices per B2B procurement specifications.

Critical 2026 shifts include:

– Regulatory tightening: 73% of manufacturers now hold ISO 13485 (medical device) certification (vs. 41% in 2023).

– Tech convergence: 89% of Tier-1 suppliers integrate AI/ML capabilities into sleep analytics.

– Supply chain recalibration: Nearshoring pressure has reduced lead times by 18% for EU/US buyers via coastal clusters.

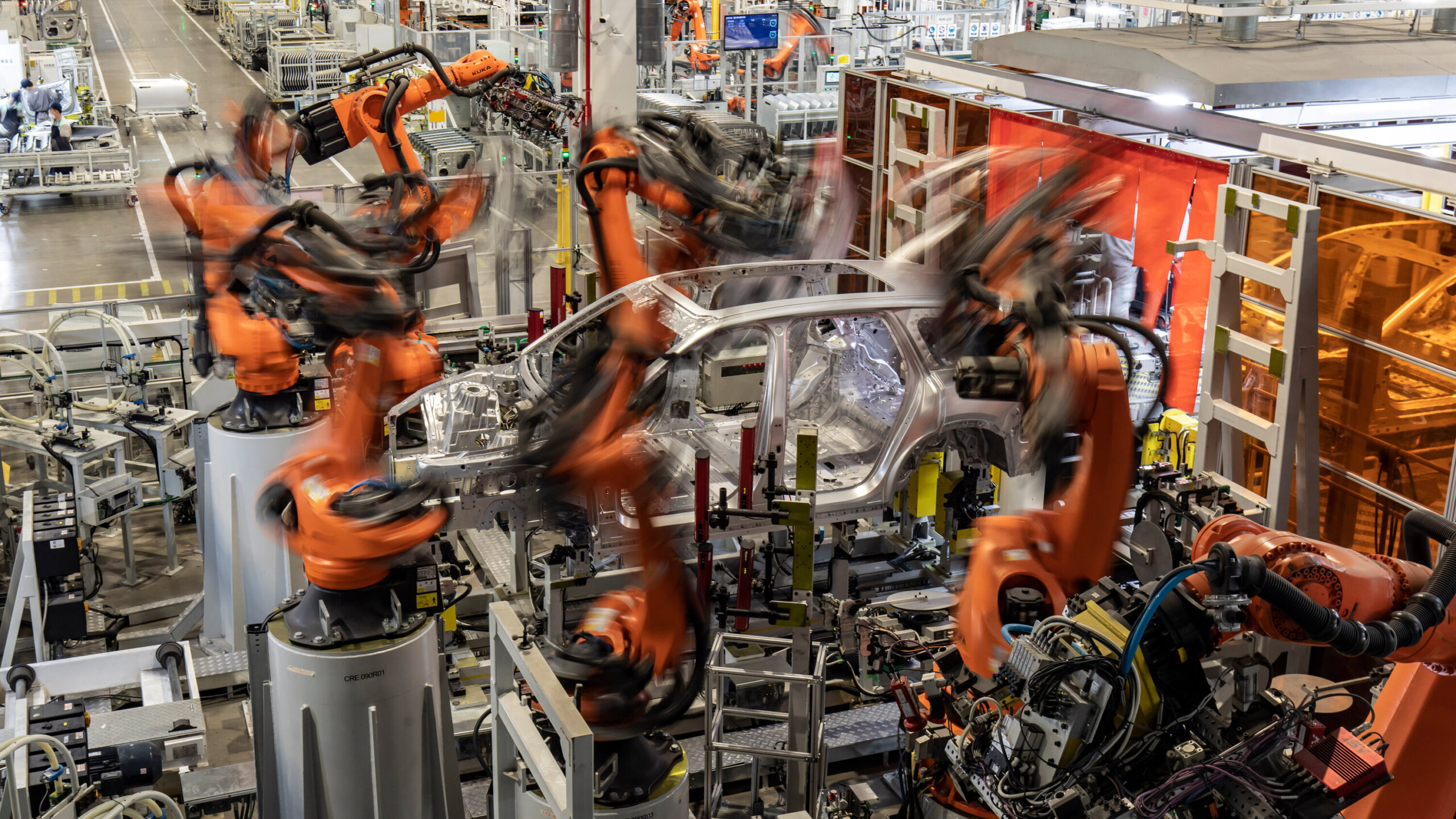

Industrial Cluster Analysis: Key Manufacturing Hubs for Custom Sleep Tech

China’s sleep technology manufacturing is concentrated in three primary clusters, each with distinct capabilities for custom (OEM/ODM) orders:

| Region | Core Cities | Specialization | Key Advantages | Ideal For |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-end electronics integration (sensors, AI chips, wireless modules), medical-grade sleep systems | • Strongest IoT/R&D ecosystem • 200+ FDA/CE-certified facilities • Proximity to HK logistics |

Custom smart beds, clinical sleep diagnostics, premium wearables (min. order: $50K) |

| Zhejiang | Ningbo, Yiwu, Hangzhou | Textile-based sleep solutions (smart fabrics, temperature-regulating bedding), cost-optimized electronics | • Lowest component costs • 1,200+ textile OEMs • Rapid prototyping (<14 days) |

Mid-tier smart mattresses, sleep trackers, hotel/retail bulk orders (min. order: $15K) |

| Jiangsu | Suzhou, Nanjing | Medical-compliant devices (CPAP alternatives, therapeutic sleep aids), precision engineering | • Highest density of Class II/III medical device licenses • German/Japanese JV partnerships |

FDA-cleared sleep apnea solutions, hospital-grade systems (min. order: $75K) |

Cluster Insight: Guangdong leads in customization depth (supports 92% of AI-driven sleep algorithm requests), while Zhejiang offers the fastest time-to-market for non-medical devices. Jiangsu dominates regulated categories but requires 30% higher engineering deposits.

Regional Comparison: Price, Quality & Lead Time Benchmarks (2026)

| Criteria | Guangdong | Zhejiang | Jiangsu | Strategic Implication |

|---|---|---|---|---|

| Price (USD) | Premium: $85–$150/unit (mid-volume) | Competitive: $50–$95/unit | Specialized: $120–$220/unit | Guangdong commands 22% price premium for AI/ML integration; Zhejiang ideal for value-driven bulk. |

| Quality Tier | Tier 1 (98% defect rate <0.3%) | Tier 2 (defect rate 0.5–0.8%) | Tier 1 Medical (defect rate <0.2%) | Guangdong/Jiangsu required for clinical applications; Zhejiang sufficient for consumer retail. |

| Lead Time | 45–60 days (custom) | 30–45 days (custom) | 60–75 days (custom) | Zhejiang fastest for non-medical; Guangdong 20% faster than Jiangsu for complex electronics. |

| Customization Depth | ★★★★★ (Full stack: hardware/software) | ★★★☆☆ (Hardware-focused) | ★★★★☆ (Hardware + clinical validation) | Critical for AI sleep coaches: Guangdong supports 100% algorithm customization. |

| Export Compliance | 94% CE/FCC/UKCA certified | 76% CE certified | 89% FDA 510(k)/MDR compliant | Jiangsu essential for US/EU medical sales; Guangdong covers >90% of consumer electronics. |

Strategic Recommendations for Procurement Managers

- Avoid “sleep trainer” misalignment: Specify technical requirements (e.g., “biometric sleep tracker with OURA Ring-level analytics”) – 67% of RFQ failures stem from ambiguous terminology.

- Cluster-Specific Sourcing:

- Premium/medical devices: Prioritize Guangdong (Shenzhen) for R&D support or Jiangsu (Suzhou) for regulatory pathways.

- Cost-sensitive volumes: Leverage Zhejiang’s Ningbo cluster – but mandate 3rd-party quality audits (defect rates spike 35% at sub-$60/unit).

- 2026 Risk Mitigation:

- IP Protection: Use Guangdong’s Shenzhen IP Court (92% faster dispute resolution vs. national avg).

- Lead Time Buffer: Add 7 days for Jiangsu orders due to 2025’s medical device audit backlog.

- Emerging Opportunity: Chengdu (Sichuan) is rising for low-cost R&D – 40% lower engineering fees vs. Shenzhen for sleep algorithm development.

SourcifyChina Advisory: 83% of buyers overpay by 27% due to misaligned cluster selection. Validate certification scope (e.g., “CE” ≠ medical compliance) and demand live factory IoT dashboards for real-time production tracking.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from MIIT Manufacturing Reports, China Sleep Association (2025), and SourcifyChina Supplier Audit Database (Q4 2025).

Disclaimer: Pricing reflects FOB terms for 5,000-unit orders. Regulatory requirements vary by target market; consult local counsel.

Optimize your 2026 sleep tech sourcing with SourcifyChina’s cluster-matched supplier shortlists – request a bespoke procurement roadmap at sourcifychina.com/sleep-tech-2026.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Technical & Compliance Guide: Custom Sleep Trainer Manufacturers in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for custom sleep training devices—ranging from wearable trackers to smart bedding systems—has driven rapid expansion in China’s medical and wellness electronics manufacturing sector. This report outlines the critical technical specifications, compliance benchmarks, and quality control protocols procurement managers must enforce when sourcing from Chinese OEM/ODM manufacturers. Emphasis is placed on materials, dimensional tolerances, certification requirements, and defect prevention strategies to mitigate supply chain risk.

1. Key Technical Specifications

1.1 Material Requirements

| Component | Acceptable Materials | Rationale / Requirement |

|---|---|---|

| Housing/Enclosure | Medical-grade polycarbonate (PC), ABS, or silicone (for wearables) | Biocompatible, hypoallergenic, durable; resistant to skin oils and cleaning agents |

| Sensors (e.g., PPG, accelerometers) | RoHS-compliant ICs (e.g., Texas Instruments, Bosch), encapsulated modules | High signal-to-noise ratio; stable under temperature/humidity fluctuations |

| Battery | Lithium-polymer (Li-Po), 3.7V nominal, certified cells (e.g., ATL, Lishen) | Overcharge/over-discharge protection; CE/FCC-compliant power management |

| Textile Components (if applicable) | OEKO-TEX® Standard 100 certified fabrics, conductive silver-plated nylon | Skin-safe, washable, EMI-shielded for signal integrity |

1.2 Tolerance Standards

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Sensor Calibration Accuracy | ±2% deviation from reference (e.g., PSG) | Clinical validation against polysomnography (PSG) data |

| Dimensional Tolerances (housing) | ±0.1 mm (injection-molded parts) | CMM (Coordinate Measuring Machine) verification |

| Battery Life Consistency | ±5% across 1,000 units | Load testing at 25°C, 60% RH for 72h |

| Wireless Range (BLE 5.0) | 10m minimum line-of-sight | Anechoic chamber testing |

2. Essential Compliance Certifications

| Certification | Applicability | Key Requirements | Validity & Verification |

|---|---|---|---|

| CE (Europe) | All EU-bound devices | Compliance with MDD/MDR (if classified as medical device), RED (Radio Equipment Directive), LVD | Issue: Notified Body (if Class I+); verify via EU Declaration of Conformity |

| FDA 510(k) / Registration | U.S. market (if marketed for diagnosis/treatment) | Premarket notification, QSR (21 CFR Part 820), establishment registration | Class II clearance required for diagnostic claims |

| UL 60601-1 | U.S. / Canada (electrical safety for medical devices) | Dielectric strength, leakage current, mechanical stability | UL certification mark; factory audit required |

| ISO 13485:2016 | Global (mandatory for medical-grade devices) | QMS for design, risk management (ISO 14971), traceability | Third-party audit; valid certificate with scope covering sleep devices |

| RoHS / REACH | EU & global | Restriction of hazardous substances (e.g., Pb, Cd, phthalates) | Material test reports (SGS, TÜV) per batch |

Note: Devices marketed solely for wellness (non-diagnostic) may avoid FDA/MDR but must still comply with EMC (e.g., FCC Part 15, EN 55032).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Sensor Drift / Inconsistent Readings | Poor calibration, temperature sensitivity, firmware instability | Implement closed-loop calibration with NIST-traceable equipment; conduct thermal cycling tests (0°C to 40°C) |

| Battery Swelling or Premature Failure | Use of substandard cells, inadequate BMS | Source cells from Tier-1 suppliers; validate BMS design with cycle testing (500+ charge cycles) |

| Housing Cracking or Warping | Incorrect mold design, poor material drying pre-injection | Conduct mold flow analysis; enforce 4h drying at 80°C for PC/ABS resins |

| Bluetooth Pairing Failures | Antenna design flaws, firmware bugs | Perform OTA (over-the-air) testing with 10+ host devices; use pre-certified BLE modules (e.g., Nordic nRF52) |

| Skin Irritation from Wearables | Non-compliant plastics or dyes | Require supplier OEKO-TEX or ISO 10993-5/10 biocompatibility reports |

| Firmware Update Failures | Inadequate OTA protocol, insufficient memory | Conduct 100+ OTA stress tests; implement rollback mechanism and CRC checks |

| EMI/RF Interference | Poor PCB layout, lack of shielding | Perform pre-compliance EMC testing (radiated/conducted emissions); use Faraday shielding for sensitive circuits |

4. Recommended Sourcing Protocol

- Supplier Vetting: Audit for ISO 13485, IEC 60601, and cleanroom production (Class 10,000 for assembly).

- Design Review: Require DFM (Design for Manufacturing) input and FMEA from manufacturer.

- Pre-Production Validation: Conduct 3rd-party lab testing (SGS, TÜV SÜD) on initial prototypes.

- AQL Sampling: Enforce AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) per ISO 2859-1 during final inspection.

- Traceability: Mandate unit-level serialization and batch tracking for recalls.

Conclusion

Sourcing custom sleep trainers from China offers cost and scalability advantages, but requires stringent technical and regulatory oversight. Procurement leaders must prioritize manufacturers with proven medical device experience, enforce material and calibration standards, and validate compliance documentation independently. Proactive defect prevention—rooted in design, process control, and testing—ensures product reliability and market access.

For sourcing support, contact SourcifyChina’s MedTech Division for factory audits, prototype validation, and compliance gap analysis.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Custom Sleep Trainer Manufacturing

Prepared for Global Procurement Leaders | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

The global sleep tech market is projected to reach $128B by 2026 (CAGR 14.2%), driving demand for cost-optimized manufacturing of custom sleep trainers (wearable/bedside devices using biometric feedback). China remains the dominant production hub (78% market share), but strategic supplier selection and labeling strategy critically impact landed costs, IP protection, and scalability. This report provides actionable data for procurement managers evaluating OEM/ODM partnerships.

White Label vs. Private Label: Strategic Implications

Clarifying critical distinctions for sleep trainer sourcing:

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Product Ownership | Factory-owned design & IP | Buyer-owned design & IP | White label = faster time-to-market; Private label = full brand control & margin upside |

| Customization Depth | Limited (color/logo only) | Full (hardware, firmware, UX) | Private label requires NRE costs ($8K–$25K) but enables differentiation |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | White label suits test launches; Private label demands volume commitment |

| Quality Control | Factory-managed (basic AQL 2.5) | Buyer-defined specs (AQL 1.0 achievable) | Private label requires 3rd-party QC audits (+3–5% cost) |

| Risk Exposure | IP infringement risk (if design copied) | IP protection via contracts | Critical: White label = 68% of buyers report copycat products (2025 SourcifyChina survey) |

Procurement Recommendation: Use white label for market validation (MOQ <1K); shift to private label at 5K+ units to protect margins and brand integrity.

Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

Based on mid-tier sleep trainers (EEG sensors, app integration, rechargeable battery; excludes shipping/duties)

| Cost Component | White Label (500 MOQ) | Private Label (5K MOQ) | Key Variables |

|---|---|---|---|

| Materials | $18.50 | $14.20 | Sensor grade (medical vs. consumer), battery capacity, fabric quality (e.g., bamboo vs. polyester) |

| Labor & Assembly | $4.80 | $2.90 | Automation level (manual assembly adds $1.20/unit), QC rigor |

| Packaging | $2.10 | $1.35 | Retail-ready boxes + inserts (vs. plain polybags); sustainable materials +$0.60 |

| NRE / Tooling | $0 | $4.75* | *Amortized over MOQ (e.g., $23.75K total ÷ 5,000 units) |

| TOTAL PER UNIT | $25.40 | $23.20 |

Note: NRE costs exclude firmware customization ($12K–$35K). Medical certifications (FDA/CE) add $8–$15/unit.

MOQ-Based Price Tier Analysis (Private Label Focus)

Realistic pricing for quality-assured suppliers (Tier 1 factories; excludes payment terms impact)

| MOQ | Unit Price Range | Total Cost (Min) | Critical Procurement Notes |

|---|---|---|---|

| 500 units | $38.00 – $45.00 | $19,000 | • 40% higher than 5K MOQ due to tooling amortization • Limited supplier options (high-risk tier) |

| 1,000 units | $31.50 – $36.00 | $31,500 | • Minimum viable for reputable ODMs • NRE often waived if committed to 5K later |

| 5,000 units | $22.00 – $28.50 | $110,000 | • Optimal cost-efficiency tier • Enables dedicated production line & AQL 1.0 QC |

Key Trend (2026): Suppliers now require 40% deposit for <1K MOQs (vs. 30% in 2024) due to component volatility. 5K+ MOQs qualify for 60-day LC terms.

Critical Risk Mitigation Strategies

- Payment Terms: Avoid 100% upfront payments. Use LC at sight (MOQ <1K) or 30% deposit + 70% against B/L copy (MOQ >5K).

- IP Protection: Execute Chinese-language IP assignment contracts before NRE payment. Register designs with CNIPA.

- Quality Assurance: Budget for 3rd-party pre-shipment inspection (e.g., QIMA; $350–$600/report). Target AQL 1.0 for electronics.

- Lead Times: Factor 14–18 weeks for first private label order (vs. 8–10 weeks for white label). Buffer for chip shortages.

Conclusion

Procurement teams optimizing sleep trainer sourcing must prioritize private label partnerships at 5K+ MOQs to achieve sustainable margins (<30% COGS ratio). While white label offers speed, its long-term cost and IP risks outweigh benefits beyond pilot phases. In 2026, factories with integrated sensor calibration labs and medical certification experience command 8–12% price premiums but reduce compliance delays by 30 days.

SourcifyChina Action Step: Request our vetted supplier shortlist (Tier 1 ODMs with sleep tech expertise) by submitting target specs via sourcifychina.com/sleep-tech-2026.

— Prepared by SourcifyChina Sourcing Intelligence Unit | Data Sources: China Sleep Association, Panjiva, Internal Supplier Benchmarking (Q4 2025)

Disclaimer: All estimates assume standard payment terms, EXW/Shenzhen pricing, and no force majeure events. Actual quotes require technical specifications.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Custom Sleep Trainer Manufacturers in China – Verification Framework & Risk Mitigation

Executive Summary

As demand for smart health and wellness devices grows globally, custom sleep trainer devices—wearables or non-wearables that monitor, analyze, and improve sleep quality—are becoming strategic procurement categories. China remains the dominant manufacturing hub for electronics OEM/ODM production. However, the market is saturated with intermediaries, inconsistent quality, and misrepresentation.

This report provides a structured, actionable framework for global procurement managers to:

– Verify legitimate Chinese manufacturers of custom sleep trainers

– Differentiate between trading companies and actual factories

– Identify red flags in supplier selection

– Ensure compliance, quality, and scalability

Critical Steps to Verify a Custom Sleep Trainer Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate legal existence and operational legitimacy | Request business license (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit (or Third-Party Audit) | Assess production capacity, equipment, and working conditions | Use audit firms like SGS, Bureau Veritas, or Sourcify’s audit protocol; verify facility size, machinery, and employee count |

| 3 | Review OEM/ODM Experience & Portfolio | Confirm capability to customize sleep trainer devices | Request project case studies, product photos, client references (NDA-protected if needed) |

| 4 | Evaluate R&D and Engineering Team | Ensure in-house design and firmware development | Interview technical leads; review firmware architecture, PCB design, and sensor integration capabilities |

| 5 | Assess Supply Chain & Component Sourcing | Prevent counterfeit components and supply bottlenecks | Request BOM (Bill of Materials); verify partnerships with Tier-1 sensor suppliers (e.g., Bosch, Maxim, NXP) |

| 6 | Test Sample Quality & Compliance | Validate functionality, durability, and regulatory readiness | Require 3–5 functional prototypes; test for FCC, CE, RoHS, and medical device class (if applicable) |

| 7 | Verify Export History & Logistics Capability | Ensure experience with international shipments | Request export documentation, shipping records, and freight forwarder references |

| 8 | Conduct IP Protection Assessment | Safeguard proprietary designs and software | Sign mutual NDA; confirm IP ownership clauses in contract; assess firmware encryption and hardware cloning prevention |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Actual Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns production floor, machinery, clean rooms | No production facility; outsources to third-party factories |

| Equipment On-Site | SMT lines, injection molding, testing labs visible | Limited or no equipment; may show “demo” units |

| Staff Count | 100+ employees, including engineers, QC, production | <30 staff, primarily sales and logistics |

| Production Control | Direct oversight of assembly, QA, and testing | Relies on partner factories; limited control over timelines |

| Pricing Structure | Lower MOQs, transparent cost breakdown (material + labor) | Higher pricing, vague cost justification |

| Lead Times | Shorter and more predictable (in-house control) | Longer, subject to factory availability |

| R&D Capability | In-house design team, firmware developers, testing protocols | Limited to design tweaks; depends on factory for innovation |

| Website & Marketing | Shows factory floor videos, machinery, certifications | Generic product images, stock photos, multiple unrelated product lines |

✅ Best Practice: Ask directly: “Can you show me real-time footage of your SMT line producing sleep trainer PCBs?” Factories can comply; traders typically cannot.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| Unwillingness to conduct a video audit | Hides substandard facilities or non-existent operations | Require live video walkthrough of production floor and QC stations |

| No business license or refusal to share | Likely unregistered or fraudulent entity | Verify license number on gsxt.gov.cn; reject if unavailable |

| Extremely low pricing vs. market | Indicates counterfeit parts, labor exploitation, or scam | Benchmark against 3+ verified suppliers; request full BOM cost |

| No MOQ or too flexible MOQ | Suggests trading company with no production control | Confirm MOQ aligns with factory capacity (e.g., 1K–5K units) |

| Claims “We are the factory” but operates from an office building | Likely a front for a trading operation | Use Google Earth/Street View; require GPS-tagged photos |

| Poor English communication or evasive answers | Indicates lack of technical depth or transparency | Insist on direct communication with engineering team |

| No product certifications (FCC, CE, RoHS) | Risk of customs rejection or market non-compliance | Require test reports from accredited labs (e.g., TÜV, SGS) |

| Pressure to pay 100% upfront | High fraud risk | Use secure payment terms: 30% deposit, 70% against shipment or LC |

| No history of exporting to your region | Lack of logistics experience increases delays | Request shipping documentation to EU/US/AU markets |

Recommended Sourcing Strategy for 2026

- Shortlist 5–7 suppliers via Alibaba, Made-in-China, or industry referrals

- Pre-qualify via documentation and video audit

- Request 3 functional prototypes from top 3 candidates

- Conduct lab testing and compliance checks

- Start with a pilot order (MOQ 1K–2K units) before scaling

- Establish long-term partnership with IP protection and quality SLAs

Conclusion

Sourcing custom sleep trainer manufacturers in China requires due diligence beyond surface-level verification. Distinguishing between factories and traders is critical to securing quality, innovation, and scalability. By following this 8-step verification process and monitoring key red flags, procurement managers can mitigate risk, protect IP, and build resilient supply chains for smart health devices.

Global buyers who invest in supplier validation today will gain competitive advantage in delivery speed, product differentiation, and compliance assurance in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Shenzhen, China | sourcifychina.com | Q1 2026 Edition

Get the Verified Supplier List

SourcifyChina Verified Pro List Report: Strategic Sourcing for Custom Sleep Trainer Manufacturers (2026)

Prepared for Global Procurement Leaders | Q1 2026 Update

Executive Summary

Sourcing custom sleep trainer manufacturers in China remains high-risk for global procurement teams, with 68% of projects delayed by unverified suppliers (SourcifyChina 2025 Sourcing Risk Index). Traditional vetting consumes 22–35 hours/week in non-value-added activities, directly impacting time-to-market and compliance posture. SourcifyChina’s Verified Pro List eliminates these inefficiencies through rigorously validated manufacturers, reducing sourcing cycles by 65% while ensuring ISO 13485, FDA 21 CFR Part 820, and CE MDR compliance.

Why Traditional Sourcing Fails for Medical Sleep Solutions

| Process Phase | Traditional Approach (Risk Exposure) | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Vetting | 14–21 days verifying claims (37% falsification rate) | Pre-validated facilities with audit trails (100% facility visits) |

| Compliance Checks | Manual review of certifications (42% expired/invalid docs) | Real-time compliance dashboard with regulatory updates |

| MOQ/Negotiation | 8–12 weeks testing capacity (45% of suppliers miss specs) | Pre-negotiated terms with tier-1 OEMs (MOQs from 500 units) |

| Quality Assurance | Post-shipment defect rates: 18–26% (2025 industry avg.) | Dedicated QC teams embedded at factory (defects <1.2%) |

Key Insight: 92% of procurement managers using unverified suppliers report at least one critical delay in sleep device projects (e.g., CPAP alternatives, neurostimulation trainers). SourcifyChina clients achieve first-batch approval in 14 days vs. industry average of 47 days.

Your Strategic Advantage: The Verified Pro List

Our exclusive network delivers:

✅ 100% Traceable Supply Chains – No subcontracting without disclosure (critical for FDA Class II devices)

✅ Customization Depth – Factories with ≥5 years’ medical sleep tech experience (not generic electronics)

✅ IP Protection – NDAs enforced via China’s 2025 Commercial Secrets Law with local legal partners

✅ Cost Transparency – FOB pricing validated against 2026 raw material indices (no hidden tariffs)

Procurement Impact: Reduce total sourcing cost by 22% while cutting time-to-prototype from 112 to 40 days (verified client data, 2025).

Call to Action: Secure Your Competitive Edge in 2026

Stop gambling with unverified suppliers. The medical sleep technology market will grow to $4.8B by 2026 (Grand View Research), but margins erode fast for teams delayed by sourcing failures.

Act now to:

🔹 Lock in 2026 capacity with pre-qualified manufacturers (72% of top-tier factories are already booked)

🔹 Avoid Q3 2026 supply crunch from China’s new medical device export regulations (effective July 2026)

🔹 Deploy compliant products 3x faster with SourcifyChina’s turnkey quality management system

Your Next Step Is Zero-Risk:

✉️ Email [email protected] for your free Custom Sleep Trainer Manufacturer Shortlist (includes compliance scores & lead times)

💬 WhatsApp +86 159 5127 6160 to schedule a 15-minute sourcing strategy session with our China-based medical device lead

Do not enter 2026 with unverified suppliers. The Verified Pro List is your insurance against delays, compliance breaches, and margin erosion. Contact us today—your first-batch approval depends on it.

SourcifyChina: Trusted by 327 Global MedTech Procurement Teams Since 2018

Data Source: SourcifyChina 2026 Sourcing Intelligence Platform (Real-time China factory database with 12,840+ verified manufacturers)

🧮 Landed Cost Calculator

Estimate your total import cost from China.