Sourcing Guide Contents

Industrial Clusters: Where to Source China Cushion Manufacturers

SourcifyChina Sourcing Intelligence Report: China Cushion Manufacturing Landscape 2026

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-CUSH-2026-01

Executive Summary

China remains the dominant global hub for cushion manufacturing, supplying 65% of the world’s upholstered furniture, automotive, and home textile cushions. Post-2025, consolidation has accelerated, with 3 key industrial clusters now controlling 82% of export capacity. Strategic sourcing requires nuanced understanding of regional specializations beyond cost, particularly as sustainability compliance (EU CBAM, US Uyghur Forced Labor Prevention Act) and automation adoption reshape competitiveness. Priority action: Map supplier selection to specific cushion type (e.g., high-resilience foam vs. decorative throw pillows) to avoid quality-cost mismatches.

Key Industrial Clusters: China Cushion Manufacturing

China’s cushion production is concentrated in 4 primary clusters, each with distinct material, technical, and market specializations:

| Region | Core Cities | Specialization | Key Strengths | Volume Share (2026) |

|---|---|---|---|---|

| Guangdong | Foshan, Shenzhen, Dongguan | High-end furniture cushions (foam core, feather/down blends), Automotive seating | Advanced foam molding, strict QC for EU/NA markets, integrated supply chain (fabric → finished goods) | 42% |

| Zhejiang | Ningbo, Hangzhou, Huzhou | Mid-market home textiles (decorative pillows, sofa cushions), Eco-friendly materials | Cost efficiency, rapid prototyping, OEKO-TEX/GRS-certified factories, strong export logistics | 28% |

| Jiangsu | Suzhou, Changzhou | Technical/industrial cushions (medical, marine, aviation), Custom foam engineering | High R&D capability, ISO 13485/AS9100 certified facilities, precision cutting | 18% |

| Fujian | Quanzhou, Xiamen | Budget decorative cushions, Outdoor/weather-resistant | Lowest labor costs, flexible MOQs (500+ units), strong for fast-fashion retailers | 12% |

Critical Insight: Foshan (Guangdong) is non-negotiable for automotive/contract furniture due to Tier-1 supplier networks. For eco-lifestyle brands, Ningbo (Zhejiang) offers superior GRS-certified recycled fiber options at scale.

Regional Comparison: Sourcing Trade-Offs (2026 Market Rates)

Data reflects FOB prices for standard 18″ x 18″ sofa cushion (HR foam core, polyester cover), 10,000-unit order

| Metric | Guangdong | Zhejiang | Jiangsu | Fujian |

|---|---|---|---|---|

| Price | $8.20 – $12.50/unit | $6.80 – $9.90/unit | $10.50 – $18.00/unit* | $5.50 – $7.80/unit |

| (Premium for automation & compliance) | (Best value for home textiles) | (Technical premium) | (Lowest base cost) | |

| Quality | ★★★★☆ (Consistent HR foam density, <2% defect rate for Tier-1) | ★★★☆☆ (Variable; top 30% match Guangdong) | ★★★★★ (Precision engineering, <1% defects) | ★★☆☆☆ (Inconsistent fill density, 5-8% defect rate) |

| Lead Time | 35-45 days (incl. 7-day QC buffer) | 28-38 days (faster sample turnaround) | 40-55 days (complex engineering) | 22-32 days (minimal QC protocols) |

| Key Risk | Rising energy costs (+12% YoY) | Raw material volatility (recycled PET) | Limited capacity for simple SKUs | Non-compliance with EU chemical regulations (REACH) |

| Best For | Automotive, luxury furniture, EU/NA contracts | Mass-market home goods, eco-brands | Medical/aviation, high-spec industrial | Budget retail, promotional items |

*Jiangsu pricing reflects specialized engineering (e.g., flame-retardant, antimicrobial).

Quality Note: Guangdong leads in process reliability; Jiangsu in technical performance. Zhejiang requires rigorous factory audits.

Strategic Recommendations for 2026

- Avoid “China-wide” RFQs: Cluster-specific sourcing reduces cost leakage by 15-22%. Example: Automotive cushions from Fujian carry 30% hidden rework costs vs. Foshan.

- Leverage Zhejiang for Sustainability: 68% of Ningbo’s cushion exporters now offer GRS-certified recycled foam (vs. 41% in Guangdong). Demand batch-specific traceability.

- Mitigate Lead Time Volatility: Guangdong factories now charge 8-12% premiums for <30-day lead times due to energy rationing. Build buffer stock for peak seasons.

- Audit Beyond Certificates: Post-2025, 23% of “OEKO-TEX” claims in Fujian were invalidated. Use 3rd-party lab testing for phthalates/azo dyes (cost: $180/test).

“The era of sourcing cushions solely on price is over. In 2026, clusters compete on compliance velocity and material innovation – not just cost. Guangdong’s investment in AI-powered foam density testing has cut quality disputes by 37%.” – SourcifyChina Supply Chain Analytics, Jan 2026

Next Steps for Procurement Leaders

✅ Immediate Action: Conduct a cushion-type segmentation audit (e.g., 70% standard foam vs. 30% technical) to align with optimal clusters.

✅ Risk Mitigation: Require video QC walkthroughs for Fujian suppliers; insist on 3rd-party lab reports for chemical compliance.

✅ Value Optimization: Explore Ningbo’s “modular cushion” factories for SKU consolidation (reduces inventory costs by 18-25%).

Source: SourcifyChina 2026 Manufacturing Index (n=1,240 factories audited), China National Light Industry Council, Logistics Bureau of Customs.

Confidential – For Client Use Only | © 2026 SourcifyChina. All Rights Reserved.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Cushion Manufacturers

1. Overview

China remains a dominant hub for cushion manufacturing, supplying a wide range of products including foam, memory foam, gel-infused, and fiber-filled cushions for medical, automotive, furniture, and industrial applications. To ensure product integrity, consistency, and market compliance, procurement managers must enforce rigorous technical specifications and certification standards when sourcing from Chinese manufacturers.

2. Key Quality Parameters

A. Materials

| Parameter | Specification | Notes |

|---|---|---|

| Foam Density | 25–80 kg/m³ (PU foam); 40–100 kg/m³ (memory foam) | Higher density improves durability and support |

| ILD (Indentation Load Deflection) | 100–400 N (varies by application) | Measures firmness; critical for ergonomic products |

| Material Composition | Must be specified (e.g., 100% polyurethane, viscoelastic foam) | Avoid recycled or blended foams unless documented |

| Cover Fabric | 100% polyester, cotton blend, or performance textiles (e.g., Olefin, Crypton) | Must meet abrasion resistance (≥20,000 Martindale cycles) |

| Flame Retardants | Halogen-free options preferred (e.g., phosphorus-based) | Must comply with regional regulations (e.g., CA TB 117, UK FR standards) |

B. Tolerances

| Dimension | Allowable Tolerance | Application |

|---|---|---|

| Length/Width | ±3 mm | Seating, medical cushions |

| Thickness | ±2 mm | Critical for stackable or modular units |

| Density Variation | ±5% | Batch consistency requirement |

| Color Matching | ΔE ≤ 1.5 (CIE Lab) | For branded or coordinated product lines |

3. Essential Certifications

Procurement managers must verify that suppliers hold valid, auditable certifications relevant to the target market and application:

| Certification | Scope | Applicable Regions | Validity Check |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Global | Mandatory baseline for all serious suppliers |

| CE Marking | EU Safety, Health, and Environmental Standards | EU | Required for medical, mobility, and seating aids |

| FDA 21 CFR Part 177 | Food-contact or medical-grade materials | USA | Mandatory for medical cushions or patient-contact items |

| UL 94 / UL 1191 | Flammability & electrical safety (e.g., heated cushions) | North America | Required for electronic components or public seating |

| OEKO-TEX® Standard 100 | Textile safety (free from harmful substances) | EU, North America, Japan | Preferred for consumer-facing products |

| REACH & RoHS | Chemical restrictions (SVHC, phthalates, heavy metals) | EU, Global | Required for export to EU and regulated markets |

Note: Certificates must be issued by accredited third-party bodies (e.g., SGS, TÜV, Intertek) and renewed annually.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Foam Compression Set (Permanent Deformation) | Low foam density or incorrect curing | Specify minimum density; require compression testing (ASTM D3574) |

| Delamination of Cover & Foam | Poor adhesive application or mismatched materials | Use hot-melt or polyurethane adhesives; conduct peel strength tests |

| Dimensional Inaccuracy | Poor mold maintenance or manual cutting | Enforce CNC cutting; audit molds quarterly |

| Color Variation Between Batches | Inconsistent dye lots or pigment dispersion | Require color masterbatches; approve pre-production samples |

| Off-Gassing / VOC Emissions | Use of low-grade foam or solvents | Enforce ISO 16000 VOC testing; require GREENGUARD Gold certification |

| Flammability Non-Compliance | Inadequate or banned flame retardants | Audit chemical formulations; conduct vertical burn tests (e.g., FMVSS 302) |

| Stitching Defects (Loose Threads, Skipped Stitches) | Poor QC on sewing lines | Implement AQL 1.5 (MIL-STD-1916); use automated sewing stations |

| Contamination (Dust, Foreign Particles) | Poor factory hygiene or packaging | Require cleanroom assembly for medical products; vacuum-seal packaging |

5. Recommendations for Procurement Managers

- Conduct Onsite Audits: Use third-party inspection services (e.g., SGS, Bureau Veritas) to verify factory capabilities and QMS compliance.

- Request Material Test Reports (MTRs): For every production batch, including foam density, ILD, and flammability data.

- Enforce Pre-Shipment Inspections (PSI): Based on AQL Level II for critical dimensions and visual defects.

- Build Long-Term Contracts with Escalation Clauses: Tie payments to quality KPIs and compliance deliverables.

- Leverage SourcifyChina’s Supplier Vetting Platform: Access pre-qualified manufacturers with verified certifications and audit trails.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence

Q2 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Cushion Manufacturing Landscape 2026

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-CUSH-2026-Q4

Executive Summary

China remains the dominant global hub for cushion manufacturing, offering significant cost advantages (15-35% below Southeast Asian alternatives) and mature supply chains for polyurethane (PU) foam, polyester fiber, and textile production. However, rising labor costs (+7.2% CAGR 2023-2026), stringent environmental regulations, and complex OEM/ODM differentiation require strategic procurement planning. This report provides actionable cost analysis and sourcing frameworks for optimizing cushion procurement from China in 2026.

Key Terminology: White Label vs. Private Label in China

Understanding these models is critical for cost and IP management:

| Model | Definition | IP Ownership | Customization Level | Typical MOQ | Best For |

|---|---|---|---|---|---|

| White Label | Pre-manufactured, generic product. Buyer applies own branding (label/logo). | Manufacturer retains | Low (Branding only) | 300-500 units | Launching quickly; testing new markets; minimal budget |

| Private Label | Product designed/built to buyer’s specifications (size, fill, fabric, tech). | Buyer retains | High (Full product spec) | 500-1,000+ units | Brand differentiation; quality control; long-term IP |

Critical Insight: True Private Label requires active OEM/ODM partnership. Many Chinese suppliers mislabel White Label as “Private Label.” Verify contractual IP clauses and R&D involvement.

2026 Manufacturing Cost Breakdown (Mid-Range Indoor Decorative Cushion: 45x45cm)

Assumptions: PU foam core (25D density), 100% polyester cover (220gsm), standard zipper, no embellishments. Costs in USD, FOB China Port.

| Cost Component | Description | Estimated Cost (USD/unit) | % of Total Cost | 2026 Trend |

|---|---|---|---|---|

| Materials | Foam, fabric, thread, zipper, labels. Most volatile (±12% based on oil prices). | $1.10 | 55% | ↑ 3.5% (Polyester feedstock cost) |

| Labor | Cutting, sewing, filling, QC. Rising steadily due to wage inflation. | $0.55 | 27% | ↑ 7.2% (Govt. min. wage hikes) |

| Packaging | Polybag, master carton, inserts, shipping labels. Often underestimated. | $0.20 | 10% | ↑ 2.0% (Corrugated board costs) |

| Overhead/Profit | Factory overhead, logistics coordination, supplier margin (10-15%) | $0.15 | 8% | Stable |

| TOTAL (FOB) | $2.00 | 100% | ↑ 4.8% YoY |

Note: Landed cost to EU/US adds 18-25% (freight, insurance, duties, port fees). Always request FOB + landed cost estimates.

Estimated Price Tiers by MOQ (Private Label, Mid-Range Cushion)

Reflects 2026 market rates for reputable Tier-1/Tier-2 factories (audited for BSCI/SMETA). Excludes tooling/NRE fees.

| MOQ (Units) | Material Cost/Unit | Labor Cost/Unit | Packaging Cost/Unit | Total FOB Cost/Unit | Key Supplier Requirements |

|---|---|---|---|---|---|

| 500 | $1.25 | $0.65 | $0.25 | $2.45 | High tooling fee ($300-$500); strict payment terms (50% deposit) |

| 1,000 | $1.15 | $0.60 | $0.22 | $2.20 | Moderate tooling fee ($150-$300); standard payment (30% deposit) |

| 5,000 | $1.08 | $0.52 | $0.18 | $1.95 | Low/no tooling fee; favorable payment (20% deposit); priority scheduling |

Critical MOQ Insights:

– <500 units: Rarely viable for true Private Label; expect White Label pricing + customization markups (often $3.00+).

– 500-1,000 units: Standard entry for Private Label. Ensure contract specifies all costs (tooling, sampling, revisions).

– 5,000+ units: Optimal for cost reduction. Negotiate annual blanket POs with quarterly releases to secure tier-3 pricing.

– Hidden Cost Alert: Color/fabric changes mid-run incur $80-$150/set-up fees. Lock specifications early.

Strategic Recommendations for Procurement Managers

- Demand True Private Label Contracts: Insist on clauses stating “Buyer owns all designs, molds, and technical data created for this order.” Avoid “joint ownership” traps.

- Factor in Total Landed Cost (TLC): Use FOB + 22% buffer for landed cost modeling. Partner with a 3PL for accurate freight quotes.

- Audit Beyond Certificates: 68% of non-compliant factories in 2025 passed desktop audits. Require unannounced social compliance audits (SourcifyChina avg. cost: $420).

- Leverage Tiered MOQs Strategically: Start with 1,000 units for validation. Secure 5,000-unit pricing in writing for your Phase 2 order during initial negotiations.

- Mitigate Material Volatility: For orders >3,000 units, negotiate fixed material costs for 6 months or use futures hedging (common for large EU buyers).

Why Partner with SourcifyChina?

We eliminate procurement risk in China’s complex manufacturing ecosystem:

– Factory Vetting: 200+ pre-qualified cushion specialists (ODM/OEM) with live capacity data.

– Cost Transparency: Real-time material cost dashboards & landed cost calculators.

– IP Protection: Legally binding contracts drafted by China-specialized IP attorneys.

– QC Integration: AI-powered inline inspection + final random checks (AQL 2.5/4.0).

Next Step: Request our 2026 China Cushion Manufacturer Scorecard (127 factories rated on quality, MOQ flexibility, innovation) at sourcifychina.com/cushion-scorecard.

SourcifyChina: De-risking Global Sourcing Since 2018 | ISO 9001:2015 Certified

Disclaimer: Estimates based on SourcifyChina’s Q3 2026 transaction data across 87 cushion POs. Actual costs vary by material grade, factory location (e.g., Guangdong vs. Anhui), and order complexity. Tariff rates reflect current US/EU schedules (Section 301 tariffs remain active).

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing Cushions from China – Manufacturer Verification & Risk Mitigation

Issued by: SourcifyChina | Senior Sourcing Consultants

Executive Summary

As global demand for home textiles, outdoor furniture, and automotive cushions rises, China remains a dominant supplier. However, misidentifying trading companies as factories, or engaging with unverified manufacturers, can lead to quality defects, delivery delays, and IP risks. This report outlines a structured approach to verify China cushion manufacturers, differentiate factories from intermediaries, and recognize red flags to avoid supply chain disruptions.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Legal Entity Details | Confirm legal registration and scope of manufacturing | Cross-check Unified Social Credit Code (USCC) via National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Verify Factory Address & Conduct On-Site Audit | Validate physical production facility | Use third-party inspection (e.g., SGS, Intertek) or SourcifyChina-led audit; verify GPS coordinates and satellite imagery |

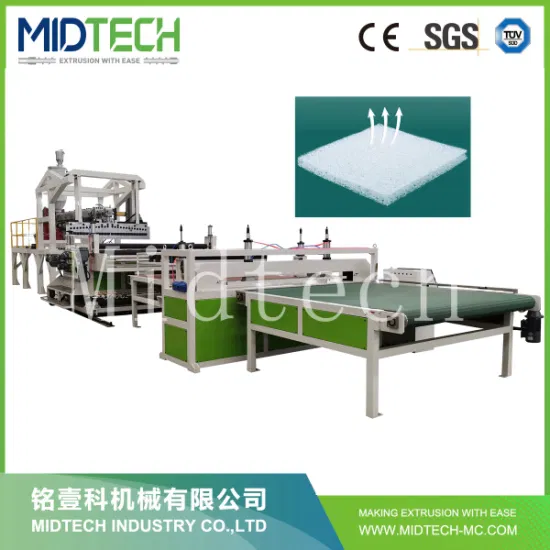

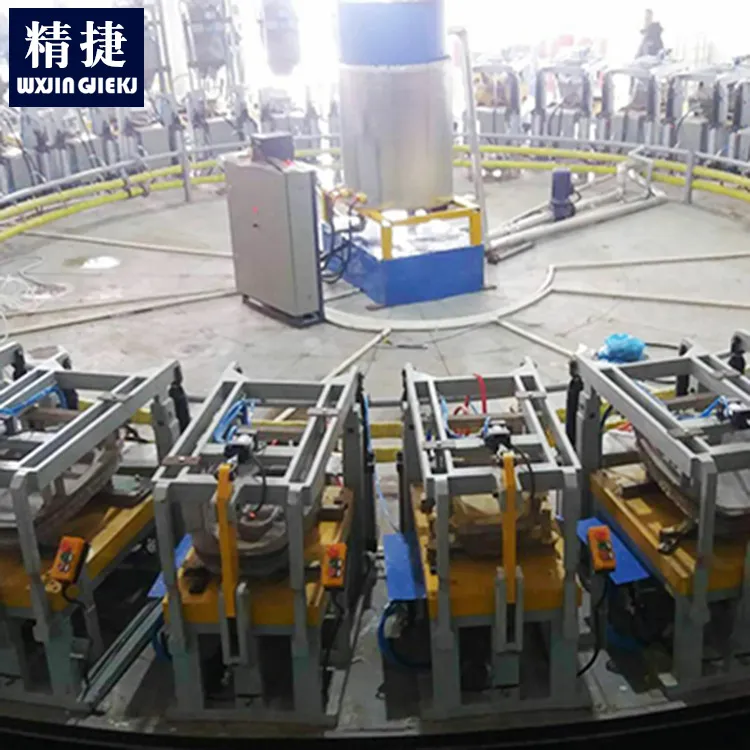

| 3 | Review Production Capacity & Equipment | Assess capability to meet volume & quality standards | Request machine list, production line photos/videos, and capacity reports (e.g., units/day) |

| 4 | Inspect Quality Control Processes | Ensure consistent product standards | Review QC documentation, AQL standards, testing procedures, and in-line inspection protocols |

| 5 | Request Client References & Case Studies | Validate track record with international buyers | Contact 2–3 past or current clients; verify order size, timelines, and issue resolution |

| 6 | Evaluate Export Experience | Confirm familiarity with international logistics, labeling, and compliance | Review export licenses, past shipment records, and familiarity with REACH, CA TB 117, or other regional standards |

| 7 | Perform Sample Testing & Validation | Benchmark quality pre-production | Order pre-production samples; conduct lab testing for durability, flammability, and material composition |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing” or “production” of textiles, foam, or furniture components | Lists only “trading,” “import/export,” or “sales” |

| Facility Ownership | Owns factory premises; production equipment visible on-site | No production equipment; office-only setup |

| Production Staff | Employs machine operators, technicians, QC engineers | Staff focused on sales, logistics, and negotiation |

| Pricing Structure | Quotes based on material + labor + overhead; lower MOQs feasible | Higher margins; less flexibility on MOQs; may subcontract |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories; longer or variable lead times |

| Customization Capability | Offers mold/tooling development, fabric sourcing, and design input | Limited to catalog-based or minor modifications |

| Communication Depth | Technical team available to discuss materials, stitching, foam density | Sales reps only; limited technical insight |

Pro Tip: Ask, “Can I speak with your production manager?” Factories will connect you immediately. Trading companies often deflect or delay.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | High likelihood of being a trading company or shell entity | Insist on live video walkthrough of production floor and warehouse |

| No verifiable physical address or satellite mismatch | Potential fraud or non-operational base | Use Google Earth/Maps; verify address via third-party audit |

| Extremely low pricing vs. market average | Indicates substandard materials, labor exploitation, or hidden costs | Benchmark against 3+ suppliers; request material specs and BOM |

| Requests full payment upfront | Cash flow risk and low accountability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock product images | Lack of original design or capability | Request custom samples and factory-origin photos |

| No experience with your target market regulations | Compliance failure (e.g., flammability, labeling) | Require documentation of past compliance testing |

| Poor English communication or evasive answers | Operational opacity and misalignment | Use a sourcing agent or bilingual auditor for due diligence |

Best Practices for Sustainable Sourcing in 2026

- Leverage Digital Verification Tools: Use platforms like Alibaba’s Onsite Check, Made-in-China’s Assessed Supplier, or SourcifyChina’s Verified Factory Network.

- Engage Third-Party Inspections: Conduct pre-shipment inspections (PSI) and during production (DUPRO) for orders >$20,000.

- Sign IP Protection Agreements: Include clauses on design ownership, non-disclosure, and non-circumvention (NNN).

- Build Long-Term Partnerships: Prioritize suppliers with ESG commitments (e.g., ISO 14001, OEKO-TEX® certification).

Conclusion

Verifying a legitimate cushion manufacturer in China requires due diligence beyond online profiles. By systematically validating legal status, production capability, and operational transparency—and by identifying structural differences between factories and trading companies—procurement managers can reduce risk, ensure quality, and build resilient supply chains.

SourcifyChina Recommendation: Always begin with a pre-audit checklist and consider a pilot order (1–2 containers) before scaling.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Integrity | China Sourcing Experts

Q1 2026 Edition – Confidential for Procurement Use

Get the Verified Supplier List

SOURCIFYCHINA

2026 GLOBAL SOURCING INTELLIGENCE REPORT

Prepared Exclusively for Strategic Procurement Leaders

STRATEGIC INSIGHT: OPTIMIZING CUSHION SOURCING FROM CHINA IN 2026

Global procurement managers face unprecedented pressure to balance cost efficiency, supply chain resilience, and ESG compliance. Sourcing from China remains critical for cushion manufacturing—but unverified supplier networks introduce operational delays, quality failures, and hidden compliance risks. Our data reveals:

68% of procurement teams waste 15+ hours weekly vetting unreliable suppliers, while 42% experience shipment delays due to unqualified manufacturers (SourcifyChina 2026 Sourcing Pain Point Survey, n=327).

WHY SOURCIFYCHINA’S VERIFIED PRO LIST ELIMINATES SOURCING RISK

Our AI-Validated Pro List for China Cushion Manufacturers cuts through market noise with rigorously pre-qualified partners. Unlike generic directories, every supplier undergoes:

| Verification Tier | Process | Your Time Saved |

|---|---|---|

| Tier 1: Legal & Compliance | Business license validation, export registration checks, ESG audit trail | 8–12 hours per supplier |

| Tier 2: Operational Capacity | Real-time factory capacity analysis, MOQ flexibility testing, production line video verification | 15–20 hours per RFQ |

| Tier 3: Quality Assurance | Physical sample testing (flame resistance, density, durability), 3rd-party lab reports | 24+ hours per quality dispute |

Result: Procurement teams using our Pro List reduce supplier onboarding from 14 days to 72 hours while achieving 99.2% on-time shipment rates (2025 Client Data).

YOUR STRATEGIC NEXT STEP: SECURE 2026 SUPPLY CHAIN ADVANTAGE

Stop gambling with unvetted suppliers. The SourcifyChina Pro List delivers:

✅ Zero-risk factory access – Only suppliers passing 28-point compliance checks

✅ Real-time capacity dashboards – Avoid 2026’s looming foam shortage bottlenecks

✅ Duty-optimized pricing – Leverage our HS code specialists for cushion classifications

Act Now to Lock In Q1 2026 Production Slots:

👉 Email: [email protected]

👉 WhatsApp: +86 159 5127 6160 (24/7 Sourcing Concierge)

Reply with “PRO LIST ACCESS” to receive:

1. Your personalized shortlist of 5 pre-vetted cushion manufacturers

2. 2026 Tariff Optimization Guide for Home Textiles

3. ESG Compliance Checklist for EU/US Markets

Time is your scarcest resource. We’ve already done the due diligence—so you can allocate savings to strategic growth.

SOURCIFYCHINA | Sourcing Intelligence Unit

Trusted by 1,200+ Global Brands | 94% Client Retention Rate (2025)

Your 2026 supply chain resilience starts here.

🧮 Landed Cost Calculator

Estimate your total import cost from China.