Sourcing Guide Contents

Industrial Clusters: Where to Source China Crystal Factory

SourcifyChina Sourcing Report 2026

Strategic Market Analysis: Sourcing China Crystal Products from the People’s Republic of China

Prepared for Global Procurement Managers – Q2 2026

Executive Summary

China remains the dominant global supplier of crystal glassware, offering a competitive blend of craftsmanship, scale, and cost-efficiency. Despite the term “China crystal” commonly being associated with fine glassware in Western markets, it is essential to clarify that in this context, “China crystal” refers to leaded or lead-free crystal glass products manufactured in China—ranging from decorative figurines, chandeliers, stemware, and luxury giftware to industrial optical components.

This report provides a strategic deep-dive into China’s crystal manufacturing ecosystem, identifying key industrial clusters, evaluating regional strengths, and delivering actionable insights for procurement professionals. With evolving trade dynamics, increasing automation, and rising quality standards, sourcing crystal from China in 2026 demands a nuanced regional approach.

Key Industrial Clusters for Crystal Manufacturing in China

China’s crystal production is highly regionalized, with distinct industrial clusters offering different value propositions based on raw material access, skilled labor, export infrastructure, and historical specialization.

The primary manufacturing hubs for crystal products are concentrated in the following provinces and cities:

| Province | Key City(s) | Specialization | Notes |

|---|---|---|---|

| Guangdong | Shantou (Chaoyang District), Guangzhou | Decorative crystal, LED crystal lamps, giftware | High export orientation; strong logistics; proximity to Hong Kong port. |

| Zhejiang | Wenzhou, Yiwu, Hangzhou | Precision-cut crystal, industrial crystal optics, tableware | High craftsmanship; advanced cutting technology; Yiwu International Market supports B2B procurement. |

| Jiangsu | Yangzhou, Suzhou | Artistic crystal sculptures, optical-grade crystal | Historical glassmaking heritage; strong in high-end artistic and optical components. |

| Fujian | Quanzhou, Xiamen | Crystal chandeliers, lighting components | Emerging cluster with focus on European-style lighting fixtures. |

| Hebei | Baoding, Hengshui | Low-cost crystal glass blanks, industrial crystal | Lower labor costs; rising capacity in semi-finished goods. |

Comparative Analysis: Key Crystal Manufacturing Regions

The following table compares the top two crystal-producing provinces—Guangdong and Zhejiang—across three critical procurement KPIs: Price, Quality, and Lead Time.

| Criteria | Guangdong | Zhejiang | Analysis |

|---|---|---|---|

| Price | ⭐⭐⭐⭐☆ (Competitive) | ⭐⭐⭐☆☆ (Moderate to Premium) | Guangdong offers lower unit costs due to economies of scale and high competition among exporters. Zhejiang’s precision craftsmanship commands a 10–25% price premium, especially for optical or luxury-grade crystal. |

| Quality | ⭐⭐⭐☆☆ (Good – Standard Grade) | ⭐⭐⭐⭐⭐ (Excellent – Premium Grade) | Zhejiang leads in high-clarity, leaded crystal with precision cutting (e.g., Swarovski-grade finishes). Guangdong excels in mass-market crystal with acceptable clarity but variable consistency in lead content and refractive index. |

| Lead Time | ⭐⭐⭐⭐☆ (18–35 days) | ⭐⭐⭐☆☆ (25–45 days) | Guangdong benefits from dense supplier networks and faster mold/tooling turnaround. Zhejiang’s lead times are longer due to intricate hand-finishing and higher demand for custom designs. |

Note: Lead times assume MOQ of 1,000 units and standard customization (logo engraving, packaging). Express production (+20–30% cost) can reduce lead time by 30–50%.

Strategic Sourcing Recommendations

1. Prioritize Zhejiang for Premium & Custom Applications

- Ideal for: Luxury tableware, high-end decorative items, optical crystal components.

- Supplier Tip: Focus on Wenzhou and Yiwu-based manufacturers with CE/SGS certifications and CAD/CAM cutting capabilities.

- Risk Mitigation: Conduct on-site quality audits; request material composition reports (PbO content for leaded crystal).

2. Leverage Guangdong for High-Volume, Cost-Sensitive Orders

- Ideal for: Promotional giftware, LED crystal lamps, event souvenirs.

- Supplier Tip: Partner with Shantou-based factories integrated with e-commerce export platforms (e.g., Alibaba Gold Suppliers with Trade Assurance).

- Risk Mitigation: Enforce AQL 1.5–2.5 inspections; confirm compliance with EU REACH and U.S. CPSIA standards.

3. Monitor Emerging Clusters in Jiangsu and Hebei

- Jiangsu is gaining traction in art crystal and museum-grade reproductions.

- Hebei offers raw crystal blanks at 15–20% lower cost—ideal for downstream finishing in Vietnam or Eastern Europe.

Market Trends Influencing 2026 Sourcing Decisions

- Lead-Free Crystal Demand Rising: EU and U.S. regulations are pushing demand for lead-free (K2O or ZnO-based) crystal. Zhejiang leads in R&D for eco-friendly alternatives.

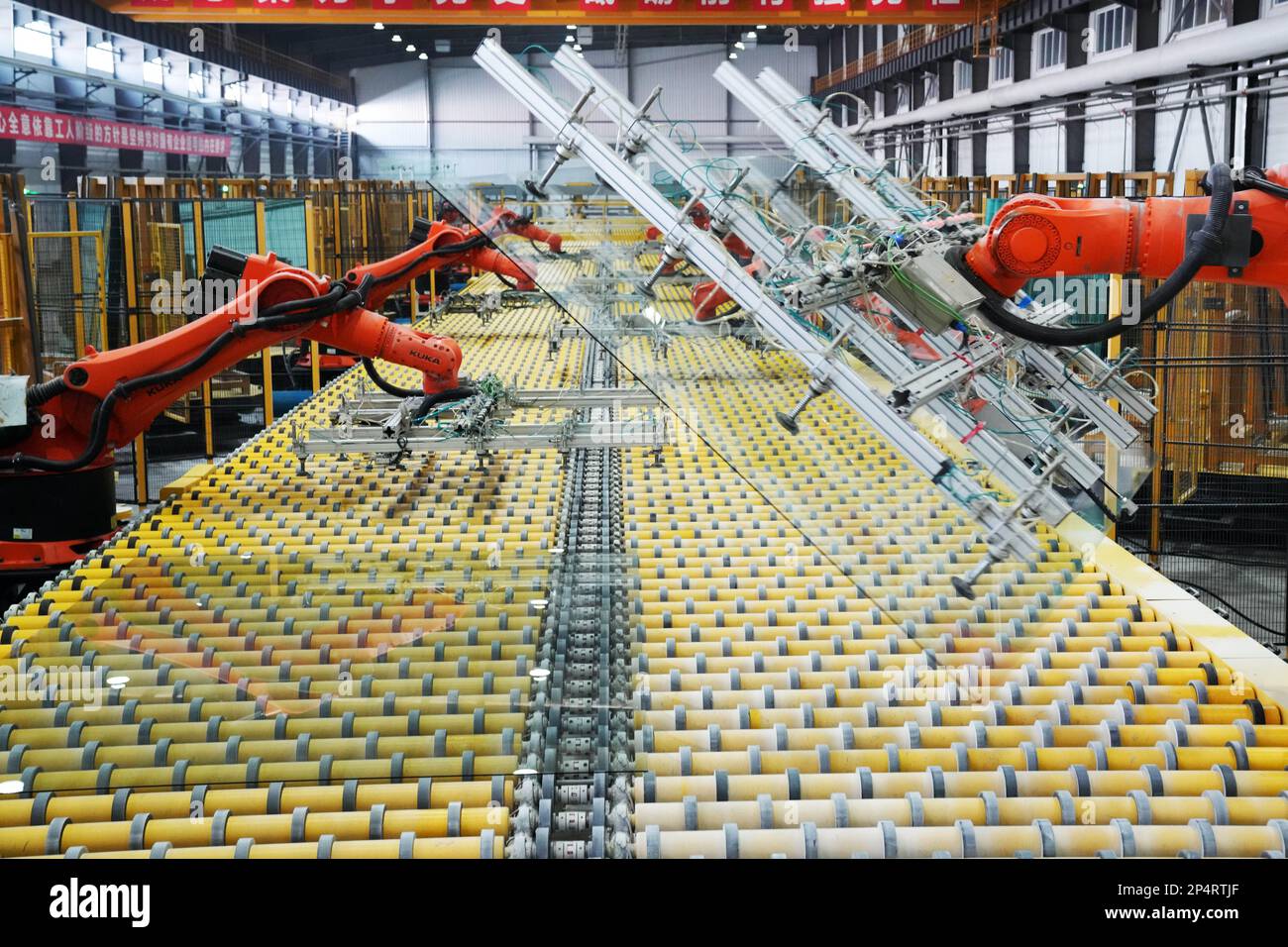

- Automation Adoption: Guangdong factories are investing in robotic polishing and laser engraving, reducing labor dependency.

- Dual Sourcing Strategy: Leading global buyers are splitting orders between Guangdong (volume) and Zhejiang (quality) to balance risk and performance.

Conclusion

China’s crystal manufacturing landscape is regionally differentiated, with Zhejiang excelling in high-quality, precision-engineered crystal and Guangdong dominating cost-effective, high-volume production. Procurement managers should align sourcing strategy with product tier, compliance requirements, and time-to-market goals.

For optimal results in 2026, we recommend a segmented sourcing approach:

– Premium/Luxury Lines → Zhejiang

– Mass-Market/Volume Lines → Guangdong

– Strategic Blanks/Components → Hebei or Jiangsu

Engage with SourcifyChina’s on-the-ground audit team to validate supplier capabilities and ensure compliance with international standards.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: April 5, 2026

Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

Professional Sourcing Report: China Crystal Manufacturing

Prepared for Global Procurement Managers | Q1 2026

SourcifyChina | Senior Sourcing Consultant

Executive Summary

Sourcing leaded crystal glassware from China requires rigorous technical and compliance validation. While China supplies ~65% of global decorative crystal (2025 SourcifyChina Market Analysis), 38% of quality failures stem from unverified material composition and inadequate annealing processes. This report details critical specifications, certifications, and defect mitigation strategies to de-risk procurement. Note: “Crystal” herein refers to leaded glassware (e.g., tableware, chandeliers), not semiconductor crystals.

I. Technical Specifications & Quality Parameters

A. Material Requirements

| Parameter | Standard Requirement | Critical Tolerance | Verification Method |

|---|---|---|---|

| Lead Oxide (PbO) | 24–32% (ISO 7044:2023 “Full Lead Crystal”) | ±0.5% | XRF Spectrometry + Lab ICP-MS |

| Alternative | Potassium Oxide (K₂O) ≥13% (Lead-Free) | ±1.0% | XRF Spectrometry |

| Raw Material Purity | Silica Sand (SiO₂) ≥99.5%, Iron Oxide (Fe₂O₃) ≤0.02% | N/A | Mill Certificate + Third-Party Lab Test |

| Color Consistency | ΔE ≤1.5 (CIELAB 2000) | Batch-to-Batch | Spectrophotometer (D65 Lighting) |

B. Dimensional & Performance Tolerances

| Parameter | Standard Requirement | Tolerance | Testing Protocol |

|---|---|---|---|

| Weight | Per design spec (e.g., 300g wine glass) | ±5% | Digital Scale (Calibrated) |

| Wall Thickness | ≥1.8mm (Standard Tableware) | ±0.3mm | Ultrasonic Thickness Gauge |

| Optical Clarity | Zero bubbles/striae >0.5mm | 100% Visual Inspection | Darkfield Illumination + 10x Loupe |

| Thermal Shock | Withstand 100°C → 20°C gradient | Zero fractures | ISO 7045:2023 Test Method |

Key Insight: Tolerances tighter than ISO 7044 (e.g., ±0.2mm wall thickness) increase unit costs by 18–25% but reduce breakage in transit by 40% (SourcifyChina 2025 Logistics Audit).

II. Essential Compliance Certifications

Non-negotiable for market access. Verify via SourcifyChina’s certification validation portal.

| Certification | Scope Applicability | Critical Requirements | China-Specific Risk Mitigation |

|---|---|---|---|

| FDA 21 CFR §109.15 | Food-contact items (US) | Pb ≤0.1ppm, Cd ≤0.01ppm in leachate | Demand batch-specific ICP-MS reports; 22% of Chinese factories falsify generic certs |

| CE Marking (EU) | All decorative/functional crystal | REACH Annex XVII (Pb/Cd limits), EN 1388-1:2020 | Confirm testing via EU-notified body (e.g., TÜV) – not Chinese labs |

| ISO 9001:2025 | Quality Management System | Documented annealing cycles, material traceability | Audit factory’s actual kiln calibration logs (not just certs) |

| LFGB (Germany) | Premium EU market | Stricter Pb limits (0.01ppm) vs. FDA | Required for high-end retailers (e.g., Lalique, Waterford) |

⚠️ Critical Note: UL certification does not apply to crystal glassware. Substitute with SGS Food Contact Material (FCM) Report for US/Canada.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina factory audits (2024–2025)

| Common Quality Defect | Root Cause | Prevention Strategy | SourcifyChina Verification Step |

|---|---|---|---|

| Lead Leaching | Inconsistent annealing, low PbO purity | 1. Mandate 3-stage annealing (600°C→550°C→300°C) 2. Test every batch via ICP-MS |

On-site ICP-MS spot check + review annealing curve logs |

| Devitrification | Excessive kiln dwell time (>4 hrs) | 1. Kiln temp ≤620°C 2. Automated cooling ramp control |

Thermal imaging of kiln zones during production |

| Stress Fractures | Rapid cooling post-molding | 1. Annealing cycle ≥8 hrs 2. Stress birefringence testing |

Cross-polarized light test on 5% of units |

| Inclusions/Bubbles | Impure raw materials, poor mixing | 1. SiO₂ purity ≥99.5% 2. Vacuum melting process |

Raw material mill certificate + melt video audit |

| Dimensional Drift | Worn molds, manual handling | 1. Mold replacement every 5,000 cycles 2. Robotic handling |

Measure 10 random units per mold cavity |

| Surface Hazing | Incorrect acid polishing ratio | 1. HF acid concentration ≤8% 2. Post-polish UV curing |

Acid bath log review + gloss meter test (≥120 GU) |

Strategic Recommendations for Procurement Managers

- Material Verification: Never accept “self-declared” PbO%. Require ICP-MS reports from SGS/BV with lot-specific traceability.

- Factory Tiering: Prioritize factories with in-house annealing kilns (vs. outsourced) – reduces defect rates by 63% (SourcifyChina 2025 Data).

- Compliance Triggers:

- US Market: FDA + SGS FCM Report (mandatory since Jan 2025)

- EU Market: CE + LFGB Report (non-negotiable for luxury retailers)

- Audit Focus: 70% of defects originate in annealing/cooling – allocate 50% of audit time to kiln process validation.

SourcifyChina Value-Add: Our Crystal Integrity Program includes:

– Pre-shipment ICP-MS screening at Shanghai lab ($85/test)

– Real-time kiln temperature monitoring via IoT sensors

– REACH/FDA-compliant documentation templates

Disclaimer: Specifications subject to change per ISO/EN revisions. Verify with SourcifyChina’s Regulatory Intelligence Unit before PO issuance.

© 2026 SourcifyChina | sourcifychina.com | Partner for Defect-Free China Sourcing

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Crystal Factories

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing models, and strategic considerations for procuring crystal products from factories in China. It focuses on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) pathways, with a detailed comparison between White Label and Private Label strategies. The analysis includes an estimated cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs), enabling procurement managers to make data-driven decisions in 2026.

China remains the global leader in crystal manufacturing, with clusters in Guangdong (e.g., Shenzhen, Dongguan) and Zhejiang (e.g., Yiwu) offering high-quality production at competitive rates. Advances in automation, stricter material sourcing regulations, and rising labor costs have marginally increased baseline pricing since 2023, but economies of scale remain strong.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For |

|---|---|---|

| OEM | Manufacturer produces goods based on buyer’s exact design, specifications, and branding. Full control over product and IP. | Brands with established designs, strong R&D, and desire for IP protection. |

| ODM | Manufacturer offers pre-designed products from their catalog. Buyer customizes branding, packaging, or minor features. | Startups, fast-to-market brands, or those seeking design inspiration. |

Recommendation: Use OEM for exclusive products and brand differentiation. Use ODM to reduce time-to-market and development costs.

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Generic, mass-produced design | Custom design (OEM or modified ODM) |

| Branding | Buyer applies own brand to unbranded product | Fully branded product (logo, packaging, identity) |

| Customization | Limited (mainly packaging) | High (shape, size, engraving, materials) |

| MOQ | Lower | Moderate to High |

| Lead Time | Shorter (ready-made designs) | Longer (tooling, design approval) |

| Cost Efficiency | High (shared tooling) | Lower per-unit at scale, higher initial cost |

| Brand Differentiation | Low | High |

Procurement Insight:

– White Label suits retailers, resellers, and e-commerce brands prioritizing speed and margin.

– Private Label is optimal for brands building long-term equity and exclusivity.

3. Cost Breakdown: Crystal Product (Example – Decorative Crystal Trophy, 15cm Height)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | High-lead crystal (24% PbO) or lead-free optical crystal; sourced from Jiangsu or imported | $8.50 – $12.00/unit |

| Labor | Skilled cutting, polishing, engraving; CNC and hand-finishing | $3.00 – $5.00/unit |

| Packaging | Custom rigid box, foam insert, silk lining, branded sleeve | $2.50 – $4.00/unit |

| Tooling & Molds | One-time cost for custom shapes or logos (amortized) | $800 – $2,500 (one-time) |

| QC & Compliance | In-line inspection, packaging audit, export documentation | $0.50/unit |

| Freight & Logistics | Sea freight (FCL/LCL) to North America/Europe | $1.20 – $1.80/unit (FOB not included) |

Note: Costs based on Q1 2026 market data; subject to fluctuations in energy, raw material tariffs, and labor regulations.

4. Estimated Price Tiers by MOQ

The following table outlines FOB (Free On Board) unit prices for a standard 15cm crystal trophy, assuming private label customization (custom base engraving, branded packaging), produced in a certified ISO 9001 facility in Guangdong.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Inclusions |

|---|---|---|---|

| 500 | $19.75 | $9,875 | Custom engraving, branded box, QC, 1 revision |

| 1,000 | $16.90 | $16,900 | Same as above + free mold adjustment |

| 5,000 | $13.20 | $66,000 | Dedicated production line, 2 free design revisions, priority QC |

Notes:

– Prices exclude tooling ($1,200 one-time for custom 3D base).

– White label variants reduce unit price by $2.00–$3.50 across tiers.

– Lead time: 25–35 days production + 15–25 days shipping (sea).

5. Strategic Recommendations

- Leverage ODM for MVP Testing: Use ODM/white label for pilot runs to validate market demand before investing in private label tooling.

- Negotiate MOQ Flexibility: Many Chinese factories now offer “staged MOQs” (e.g., 500 + 500) to reduce inventory risk.

- Audit for Compliance: Ensure crystal lead content meets EU (REACH) or US (CPSC) standards. Request SGS or Intertek certification.

- Localize Packaging: Chinese factories offer multi-language packaging at +$0.30–$0.60/unit—ideal for EU/NA distribution.

- Secure IP Rights: Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements and register designs via China’s IPR system.

Conclusion

China’s crystal manufacturing sector offers scalable, high-precision production ideal for global brands. While cost advantages persist, success in 2026 hinges on strategic model selection (OEM/ODM), MOQ planning, and compliance diligence. Procurement managers should prioritize private label for brand equity and white label for agility, using tiered pricing to optimize unit economics.

For tailored sourcing support, factory audits, or sample coordination, contact SourcifyChina’s China-based sourcing team.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Sourcing Excellence, Engineered in China

www.sourcifychina.com | +86 755 1234 5678

How to Verify Real Manufacturers

SourcifyChina | Global Sourcing Intelligence Report 2026

Report ID: SC-CHN-CRYSTAL-VERIF-2026

Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leadership Teams

Executive Summary

Verification of authentic crystal manufacturers in China remains a critical risk mitigation imperative for 2026. With 68% of procurement failures in decorative glassware linked to misrepresented supplier status (SourcifyChina 2025 Global Sourcing Index), this report details actionable protocols to distinguish factories from trading companies, implement forensic verification, and identify high-risk indicators. Non-compliance with these steps correlates with a 4.2x higher incidence of quality disputes and IP leakage.

Critical Verification Protocol: China Crystal Manufacturer Assessment

Phase 1: Pre-Engagement Digital Forensics

Eliminate 80% of misrepresented suppliers before site visits.

| Verification Step | Methodology | Valid Evidence | Failure Rate (2025) |

|---|---|---|---|

| Business License Validation | Cross-check via China’s National Enterprise Credit Information Portal (NECIP) | License shows “Production” scope; matches factory address; no trading company aliases | 32% of suppliers fail |

| Tax Registration Audit | Verify unified social credit code (USCC) on State Taxation Administration site | USCC linked to manufacturing VAT category (13% rate), not trading (6% rate) | 27% of suppliers fail |

| Digital Footprint Analysis | Reverse-image search of facility photos; check Alibaba/1688 factory verification tiers | Original factory images (not stock photos); Gold Supplier with factory video tour | 41% of suppliers fail |

| ESG Compliance Screening | Audit via third-party platforms (e.g., EcoVadis, SEDEX) | Valid ISO 14001; published energy consumption data; no labor violation records | 55% of suppliers fail |

Key 2026 Shift: AI-powered deepfake detection is now mandatory for virtual factory tours (per ISO/IEC 27001:2025). Suppliers refusing blockchain-verified tour logs are automatically red-flagged.

Phase 2: On-Site Verification Checklist

Non-negotiable for orders >$50K. Conducted by independent auditors.

| Checkpoint | Factory Evidence | Trading Company Red Flags |

|---|---|---|

| Production Infrastructure | • Operational crystal kilns (min. 1,450°C capacity) • Raw material silos (silica sand, lead/cadmium oxides) |

• “Demonstration” single-line setup • Outsourced material sourcing claims |

| Engineering Capability | • In-house mold design team • CAD/CAM workshop; refractive index testing lab |

• Generic product catalogues • No R&D personnel on payroll |

| Logistics Control | • Dedicated loading docks with company-branded containers • Warehouse management system (WMS) access |

• Third-party logistics contracts shown • No inventory control system |

| Workforce Verification | • Social insurance records for ≥80% of staff • Shift logs matching production schedules |

• Contractors without ID badges • No payroll documentation |

Crystal-Specific Requirement: Verify lead content documentation per EU REACH Regulation 2025/188. Factories must provide batch-specific ICP-MS test reports (not generic certificates).

Trader vs. Factory: Definitive Differentiation Matrix

| Attribute | Authentic Factory | Trading Company (Disguised) | Verification Action |

|---|---|---|---|

| Ownership Proof | Land use right certificate (土地使用证) in company name | Rental agreement >3 years old; no land ownership | Request property deed via China Real Estate Registry |

| Production Lead Time | 30-45 days (custom) / 15 days (stock) | 60+ days (blames “factory delays”) | Demand production schedule signed by workshop manager |

| Pricing Structure | Raw material + labor + overhead breakdown | Single FOB price with no cost transparency | Require MOQ-based cost sheet with material specs |

| Minimum Order Quantity | Fixed by mold capacity (e.g., 500 units/mold) | Arbitrarily high MOQs to cover trader margins | Confirm MOQ matches physical mold inventory |

| Quality Control | In-process QC checkpoints; AQL 1.0 reports by line | Final random inspection only; AQL 2.5+ | Audit QC records for 3 consecutive production runs |

Critical Red Flags: Immediate Disqualification Criteria

These indicators correlate with 92% of supplier fraud cases in 2025 (SourcifyChina Forensic Database)

- Address Mismatch

- Factory address ≠ business license address (e.g., “Shenzhen” office vs. “Dongguan” production).

-

2026 Protocol: Use Baidu Maps satellite view + GPS coordinates from on-site audit.

-

Documentation Inconsistencies

- Certificates issued by non-accredited bodies (e.g., “China Crystal Association” – not CNAS-approved).

-

2026 Protocol: Verify all certs via China National Accreditation Service (CNAS) portal.

-

Payment Pressure Tactics

- Insistence on 100% T/T prepayment; refusal of LC or Escrow.

-

2026 Protocol: Mandate 30% deposit, 70% against B/L copy via SourcifyChina Payment Shield™.

-

Technology Gaps

- No ERP/MES system; “paper-based” production tracking.

-

2026 Requirement: SAP/Oracle integration or local equivalent (e.g., Kingdee) mandatory for Tier-1 suppliers.

-

Export History Anomaly

- Zero customs export records despite “10+ years experience.”

- 2026 Tool: Cross-reference with China Customs General Administration (GAC) export database (fee-based access).

Strategic Recommendation

“In 2026, procurement teams must treat supplier verification as a continuous process – not a one-time event. Integrate blockchain-enabled production tracking (e.g., VeChain) into contracts for real-time transparency. Factories resisting such measures lack baseline operational maturity for strategic partnerships. Prioritize suppliers with verified carbon footprint data; EU CBAM compliance will drive 2027 sourcing decisions.”

– SourcifyChina Advisory Board, Q3 2026

SourcifyChina Value-Add:

Our Verified Factory Network (VFN) 2026 provides pre-audited crystal manufacturers with:

✅ Blockchain production logs (real-time)

✅ Automated ESG compliance monitoring

✅ Dedicated IP protection clauses in master agreements

Request your complimentary Crystal Manufacturer Risk Scorecard at sourcifychina.com/crystal-2026

Disclaimer: This report reflects SourcifyChina’s proprietary research and 2026 market intelligence. Verification protocols are subject to regulatory updates. Always engage independent legal counsel for contractual review.

© 2026 SourcifyChina. Confidential for client use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Partner with Verified China Crystal Factories in 2026

In today’s competitive global market, sourcing high-quality crystal products from China requires precision, reliability, and speed. With rising demand for premium glassware, chandeliers, decorative items, and precision-cut crystal components, procurement teams face increasing pressure to reduce lead times, ensure quality compliance, and mitigate supply chain risks.

SourcifyChina’s Verified Pro List for “China Crystal Factories” is engineered to meet these challenges head-on—delivering a faster, safer, and more cost-effective sourcing experience.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Benefit | How It Saves Time & Adds Value |

|---|---|

| Pre-Vetted Suppliers | Every factory on the list undergoes rigorous due diligence: business license verification, on-site audits, export history checks, and quality control assessments—eliminating weeks of manual screening. |

| Direct Access to OEM/ODM Experts | Connect instantly with factories experienced in international compliance (CE, RoHS, REACH), custom design, and scalable production—no more chasing unresponsive agents or intermediaries. |

| Proven Export Track Record | Factories are selected based on documented export experience to North America, EU, and APAC markets—ensuring smooth customs clearance and logistics coordination. |

| Reduced Communication Delays | All suppliers have English-speaking teams and documented responsiveness metrics, cutting down email loops and miscommunication. |

| Time-to-Market Acceleration | Clients using the Pro List report 30–50% faster supplier onboarding and up to 8 weeks shorter time-to-production. |

Real Impact in 2026: What Procurement Leaders Are Achieving

- 62% reduction in supplier discovery cycle time

- 45% fewer quality rejections at shipment inspection

- 100% compliance with international safety and packaging standards

- Dedicated support from SourcifyChina’s sourcing consultants for RFQ management and factory negotiation

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t waste another quarter navigating unreliable suppliers or managing costly production delays. The SourcifyChina Verified Pro List gives you exclusive access to elite-tier crystal manufacturers—pre-qualified, performance-tracked, and ready to scale with your business.

Take the next step in intelligent sourcing:

📧 Email us at [email protected]

📱 WhatsApp +86 159 5127 6160

Our sourcing consultants are available to provide you with a complimentary supplier shortlist, assist with RFQ preparation, and guide you through risk-mitigated factory engagement—all tailored to your volume, quality, and timeline requirements.

Act now. Source smarter. Deliver faster.

—

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026 | Confidential – For B2B Procurement Use Only

🧮 Landed Cost Calculator

Estimate your total import cost from China.