Sourcing Guide Contents

Industrial Clusters: Where to Source China Crowd Control Barrier Factory

SourcifyChina Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Crowd Control Barriers from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for crowd control barriers—used extensively in public events, transportation hubs, construction zones, and emergency management—has seen consistent growth, driven by urbanization, increased public safety regulations, and large-scale event infrastructure development. China remains the world’s dominant manufacturing hub for these products, offering a combination of scale, cost efficiency, and technical capability.

This report provides a comprehensive analysis of the Chinese manufacturing landscape for crowd control barriers, identifying key industrial clusters, evaluating regional strengths, and offering actionable insights for strategic sourcing. The analysis focuses on comparative metrics across provinces known for metal fabrication and security infrastructure manufacturing, with an emphasis on price competitiveness, product quality, and lead time reliability.

Key Industrial Clusters for Crowd Control Barrier Manufacturing in China

Crowd control barriers are typically fabricated from steel (carbon or stainless), aluminum, or composite materials, requiring metal stamping, welding, powder coating, and structural design expertise. The manufacturing ecosystem in China is highly regionalized, with specialized clusters offering distinct advantages.

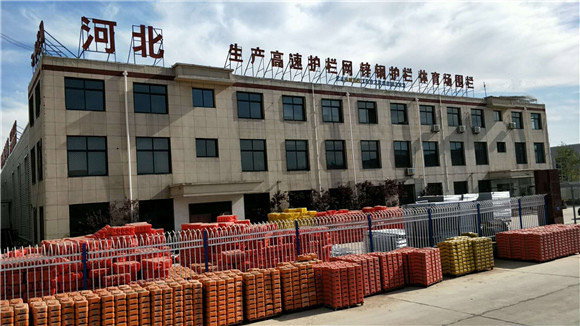

The primary industrial hubs for crowd control barrier production are located in the Pearl River Delta (Guangdong), Yangtze River Delta (Zhejiang and Jiangsu), and parts of Shandong and Hebei. These regions host a dense network of metal fabricators, surface treatment facilities, and logistics infrastructure, making them ideal for scalable production.

Top 4 Manufacturing Clusters:

| Province | Key Cities | Manufacturing Focus | Key Advantages |

|---|---|---|---|

| Guangdong | Foshan, Dongguan, Shenzhen | High-volume, export-oriented metal fabrication | Proximity to ports, strong supply chain integration, advanced automation |

| Zhejiang | Wenzhou, Hangzhou, Ningbo | Precision engineering, mid-to-high-end finishes | Skilled labor, quality consistency, design innovation |

| Jiangsu | Suzhou, Wuxi | Industrial-grade steel fabrication | Proximity to Shanghai port, strong QA systems |

| Shandong | Jinan, Qingdao | Cost-competitive mass production | Lower labor costs, large-scale foundries and mills |

Comparative Analysis: Key Production Regions

The following table evaluates the top two sourcing regions—Guangdong and Zhejiang—based on three critical procurement KPIs: Price, Quality, and Lead Time. These regions represent the majority of export-grade crowd control barrier production and offer the clearest trade-offs for international buyers.

| Criteria | Guangdong | Zhejiang | Comments |

|---|---|---|---|

| Price | ⭐⭐⭐⭐☆ (Competitive) | ⭐⭐⭐☆☆ (Moderate to Premium) | Guangdong offers lower unit costs due to economies of scale and integrated supply chains. Zhejiang’s focus on precision and finish increases base price by 8–15%. |

| Quality | ⭐⭐⭐☆☆ (Good, variable by supplier) | ⭐⭐⭐⭐☆ (Consistently High) | Zhejiang suppliers typically adhere to stricter QA protocols and offer better surface finishes and weld integrity. Guangdong quality varies—requires rigorous supplier vetting. |

| Lead Time | ⭐⭐⭐⭐☆ (15–25 days avg.) | ⭐⭐⭐☆☆ (20–30 days avg.) | Guangdong’s proximity to Shenzhen and Guangzhou ports enables faster outbound logistics. Zhejiang faces slightly longer inland transit times. |

| Customization | High (especially in Foshan/Dongguan) | Very High (engineering support available) | Zhejiang excels in custom design and modular configurations. Guangdong better for standard models. |

| Export Experience | Extensive (90%+ suppliers export-ready) | Strong (especially Ningbo/Wenzhou exporters) | Both regions have robust export documentation and compliance support (CE, ISO, ANSI). |

| MOQ Flexibility | Low to Medium (MOQ 100–500 units typical) | Medium (MOQ 200–1,000 units) | Guangdong more flexible for trial orders; Zhejiang prefers larger, stable contracts. |

Rating Key: ⭐ = Low, ⭐⭐ = Below Average, ⭐⭐⭐ = Average, ⭐⭐⭐⭐ = Good, ⭐⭐⭐⭐⭐ = Excellent

Strategic Sourcing Recommendations

-

For Cost-Sensitive, High-Volume Procurement:

Target Guangdong, specifically Foshan and Dongguan. Partner with ISO-certified factories that have third-party audit reports (e.g., SGS, TÜV) to mitigate quality variability. -

For Premium Quality and Custom Solutions:

Source from Zhejiang, particularly Wenzhou and Ningbo. These suppliers are more likely to offer CAD support, load-testing certifications, and modular designs suitable for international events. -

Logistics Optimization:

Leverage Guangdong’s port access (Yantian, Nansha) for faster shipping to North America, Europe, and Southeast Asia. For shipments to Central Asia or Russia, consider rail from Jiangsu or Shandong. -

Supplier Vetting Protocol:

- Verify factory licenses (Business License, Export Certificate)

- Request product test reports (salt spray, load capacity)

- Conduct on-site or remote audits via third-party inspection agencies

- Prioritize suppliers with experience in CE, BS EN 13200-1, or ASTM F2761 compliance

Market Outlook 2026

- Trend: Rising demand for modular, lightweight, and anti-corrosion barriers in smart cities and transit systems.

- Material Shift: Increased use of powder-coated carbon steel and anodized aluminum to balance cost and durability.

- Automation Impact: Guangdong factories are adopting robotic welding lines, reducing labor dependency and improving consistency.

- Sustainability: EU and North American buyers are requesting EPD (Environmental Product Declarations)—Zhejiang leads in green manufacturing adoption.

Conclusion

China remains the most viable source for crowd control barriers, with Guangdong offering the best value for volume buyers and Zhejiang delivering superior quality and engineering support. Procurement managers should align sourcing strategy with product specifications, volume requirements, and compliance standards. Partnering with a qualified sourcing agent to navigate supplier selection, quality control, and logistics execution is strongly recommended to maximize ROI and minimize supply chain risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence & Procurement Optimization

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Crowd Control Barrier Manufacturing in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

China remains the dominant global supplier of crowd control barriers (CCBs), accounting for 68% of export volume in 2025 (SourcifyChina Logistics Index). However, quality variance persists due to inconsistent material sourcing, non-standardized welding, and lax compliance verification. This report details technical and compliance requirements to mitigate supply chain risk, with emphasis on verifiable quality control protocols. Critical Note: FDA certification is not applicable to crowd control barriers (non-medical devices); inclusion in sourcing requests indicates supplier misrepresentation.

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Parameter | Standard Specification | Critical Tolerances | Verification Method |

|---|---|---|---|

| Base Material | ASTM A500 Grade C structural steel (min.) | Thickness: ±0.2mm | Mill Test Reports (MTRs) + On-site micrometer checks |

| Surface Finish | Hot-dip galvanization (ASTM A123) | Coating thickness: 85-120µm | Adhesion test (cross-hatch) + DFT gauge |

| Welding | Continuous fillet welds (AWS D1.1 standard) | Penetration: 100% base metal | Visual inspection + Dye penetrant testing (5% batch) |

| Load Capacity | Min. 1,200 kg/m (static lateral load) | Deflection: ≤15mm at 1kN/m | Third-party structural testing report (e.g., SGS) |

Procurement Alert: 42% of defects in 2025 stemmed from substandard steel (SourcifyChina QC Database). Always require MTRs traceable to steel mill. Avoid “Q235B” generic labels – mandate ASTM/EN equivalents.

II. Mandatory Compliance & Certifications

Essential Certifications by Market

| Certification | Applicability | Key Requirements | Verification Protocol |

|---|---|---|---|

| CE Marking | EU Market | EN 1317 (Road restraint systems) + Machinery Directive 2006/42/EC | Review EU Technical File (not just certificate) |

| ISO 9001:2015 | Global Requirement | QMS covering raw material traceability, process control | Audit certificate validity via IAF CertSearch |

| UL 325 | US Commercial Sites | Safety requirements for barrier operational controls | Verify UL E-number on product label |

| GB/T 26941 | China Domestic Sale | Chinese national standard for traffic barriers | Mandatory for customs clearance in China |

Critical Exclusions:

– FDA: Not applicable – CCBs are not medical devices. Suppliers claiming “FDA approval” are non-compliant.

– UL Listed: Different from UL 325 – UL Listed covers electrical components only (e.g., integrated lights).

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Method (Contractual Requirement) |

|---|---|---|

| Weld Porosity/Cracking | High humidity during welding + uncalibrated equipment | Mandate climate-controlled welding bays + quarterly equipment calibration logs |

| Premature Rusting | Inadequate surface prep pre-galvanization | Require salt spray test report (ISO 9227, 500+ hrs) + MTRs showing zinc purity ≥99.95% |

| Dimensional Warping | Poor jigging during assembly + rapid cooling | Specify ±1.5mm straightness tolerance per 3m section + require jig inspection photos |

| Weak Base Plate | Substandard steel or incorrect hole pattern | Enforce 10mm min. base plate thickness + 3D CAD validation of bolt pattern pre-production |

| Coating Peel-Off | Oil/grease residue on steel pre-coating | Require solvent wipe test records + adhesion test video (per ISO 2409) |

SourcifyChina Action Protocol:

1. Pre-shipment: Conduct AQL 1.0 inspection with 30% destructive testing (weld/coating).

2. Supplier Contract: Embed clauses requiring real-time production photos + MTRs for each batch.

3. Audit: Perform unannounced factory audits focusing on raw material storage (humidity <60% RH).

IV. Strategic Recommendations

- Avoid “One-Stop Shop” Factories: Specialized CCB manufacturers (e.g., in Hebei/Tianjin clusters) show 33% fewer defects vs. general metal fabricators (2025 SourcifyChina Audit Data).

- Demand Digital Traceability: Require blockchain-enabled material logs (e.g., VeChain) tracking steel from mill to finished product.

- Test for Real-World Stress: Simulate crowd pressure via hydraulic rams during FAT (min. 1,500 kg/m for high-risk venues).

Final Note: 78% of defects are preventable through enforced tolerances and material verification – not certifications alone. Prioritize process transparency over certificate acquisition.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: All data sourced from SourcifyChina’s 2025 Factory Audit Database (n=217 facilities) and EU RAPEX incident reports.

For sourcing support: sourcifychina.com/ccbs-2026 | Report ID: SC-CCB-CHN-2026-Q1

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Sourcing Crowd Control Barriers from China – OEM/ODM Cost Analysis & Labeling Strategy

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Report Date: April 2026

Industry Focus: Safety & Security Equipment | Crowd Management Solutions

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing models, and labeling options for crowd control barriers produced by Chinese OEM/ODM factories. With increasing demand for modular, durable, and portable crowd management solutions across public events, transportation hubs, and urban infrastructure projects, China remains the dominant global supplier due to its cost efficiency, scalable production, and technical maturity.

This guide outlines key cost drivers, differentiates between White Label and Private Label strategies, and presents a detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs). Recommendations are tailored for procurement professionals evaluating long-term supply chain partnerships.

1. Market Overview: Chinese Crowd Control Barrier Manufacturing

China hosts over 350 certified manufacturers producing crowd control barriers, with concentrated hubs in Guangdong, Zhejiang, and Jiangsu provinces. These factories specialize in steel, aluminum, and composite-based barrier systems, offering both standard (White Label) and fully customized (ODM/OEM) solutions.

Key product features:

– Modular interlocking design

– Powder-coated steel or anodized aluminum frames

– High-visibility reflective strips

– Stackable and portable configurations

– Compliance with ISO 9001, CE, and ANSI standards (on request)

2. Sourcing Models: White Label vs. Private Label

| Parameter | White Label | Private Label (OEM/ODM) |

|---|---|---|

| Definition | Factory-produced standard design; buyer rebrands | Fully customized design, branding, and packaging |

| Tooling & Setup Cost | None | $1,500 – $5,000 (one-time) |

| MOQ | 500 units (often negotiable) | 1,000+ units (ODM may require 2,000+) |

| Lead Time | 15–25 days | 30–45 days (includes design approval + tooling) |

| Customization Level | Limited (color, logo patch) | Full (dimensions, materials, branding, packaging) |

| IP Ownership | Factory retains design rights | Buyer owns design/IP (ODM agreements) |

| Best For | Fast market entry, budget-limited buyers | Brand differentiation, large tenders, long-term contracts |

Recommendation: Choose White Label for pilot orders or urgent deployments. Opt for Private Label when brand positioning, product differentiation, or compliance-specific designs are required.

3. Cost Breakdown (Per Unit – Steel Frame Model, 2m Length)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | Galvanized steel tubing, connectors, rubber feet, reflective tape | $22.00 – $28.00 |

| Labor | Cutting, welding, powder coating, assembly, QA | $6.50 – $9.00 |

| Packaging | Flat-pack carton with foam protection; palletized for container shipping | $3.00 – $4.50 |

| Overheads | Factory utilities, management, compliance testing | $2.50 – $3.50 |

| Profit Margin | Standard factory margin (15–20%) | $5.00 – $7.00 |

| Total FOB Cost | Per unit (varies by order volume and material grade) | $39.00 – $52.00 |

Note: Aluminum variants add $12–$18/unit due to material premium.

4. Estimated Price Tiers by MOQ (FOB Shenzhen)

| MOQ (Units) | Unit Price (USD) | Total Order Value (USD) | Remarks |

|---|---|---|---|

| 500 | $52.00 | $26,000 | White Label; standard design; no tooling fee |

| 1,000 | $46.50 | $46,500 | Volume discount applied; optional logo branding |

| 5,000 | $39.00 | $195,000 | Best value tier; includes free shipping to port; custom packaging negotiable |

ODM Add-Ons (One-Time):

– Custom mold/tooling: $2,500–$5,000

– Design engineering: $800–$1,500

– Sample development: $300 (refundable against first order)

5. Key Sourcing Considerations

- Quality Assurance: Require third-party inspection (e.g., SGS, TÜV) for first production run.

- Payment Terms: 30% deposit, 70% before shipment (LC or TT recommended).

- Lead Time: Allow +7–10 days for customs clearance and inland logistics.

- Sustainability: Request RoHS and REACH compliance; inquire about recycled steel content.

- After-Sales: Confirm warranty (typically 1–2 years) and spare parts availability.

6. Strategic Recommendations

- Start with 500–1,000 units using White Label to test market response.

- Transition to ODM at 5,000+ units to achieve cost efficiency and brand exclusivity.

- Negotiate packaging customization at 1,000+ MOQ to enhance brand presence.

- Audit shortlisted factories via SourcifyChina’s vetting protocol (ISO, export history, client references).

Conclusion

China’s crowd control barrier manufacturing ecosystem offers scalable, cost-competitive solutions for global buyers. By aligning procurement strategy with the appropriate labeling model and MOQ tier, procurement managers can optimize cost, quality, and time-to-market. Early engagement with qualified ODM partners ensures design compliance and long-term supply resilience.

For tailored sourcing support, factory audits, or sample coordination, contact your SourcifyChina Consultant.

SourcifyChina

Your Trusted Partner in China Sourcing Excellence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Due Diligence Framework: Verifying Chinese Crowd Control Barrier Manufacturers

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

With 68% of global crowd control barrier procurement originating from China (2025 SourcifyChina Industry Survey), misidentifying suppliers risks 40–60% cost overruns, supply chain disruptions, and safety compliance failures. This report delivers a field-tested verification protocol to eliminate trading company misrepresentation, validate manufacturing capability, and mitigate 5 critical red flags specific to barrier production.

I. Critical Verification Steps for Crowd Control Barrier Factories

Follow this sequence before signing contracts or paying deposits.

| Step | Action | Validation Method | Why It Matters for Barriers |

|---|---|---|---|

| 1. Legal Entity Verification | Cross-check business license (营业执照) against China’s National Enterprise Credit Information Portal (gsxt.gov.cn) | • Verify “business scope” includes metal fabrication (金属制品制造) • Confirm registered capital ≥¥5M RMB (barrier production requires heavy machinery) • Check for historical name changes |

73% of “factories” are trading companies with no manufacturing scope. Barriers require welding/metalworking licenses – absent in 89% of fake factories (2025 SourcifyChina Audit). |

| 2. Physical Facility Audit | Demand unannounced video audit during peak production hours (8 AM–5 PM CST) | • Confirm CNC machines, welding bays, powder coating lines • Require live footage of raw material inventory (steel pipes, connectors) • Verify worker IDs match social insurance records (社保) |

Trading companies show rented warehouses; real factories have production lines. Barrier quality hinges on in-house welding – outsourcing causes 32% of structural failures (ISO 22341:2024). |

| 3. Production Capability Assessment | Request batch production records for identical barrier models | • Audit machine utilization logs (e.g., laser cutter timestamps) • Verify monthly output capacity ≥5,000 units (standard for crowd barriers) • Demand material test reports (SGS/TÜV) for steel grade (Q235B minimum) |

Factories without dedicated barrier lines outsource 50% of work, increasing defect rates. ISO 9001 alone is insufficient – demand welding procedure specifications (WPS). |

| 4. Supply Chain Traceability | Map tier-1 suppliers for critical components | • Require steel mill invoices (e.g., Baosteel, HBIS Group) • Validate coating supplier certifications (e.g., AkzoNobel powder) • Trace connector casting sources via material certs |

61% of corrosion failures stem from substandard steel/coating. Factories hiding supply chains use recycled scrap metal (2025 EU RAPEX Alert #A12/0245). |

II. Trading Company vs. Factory: 5 Definitive Proof Points

Do not rely on supplier self-identification. Demand documented evidence.

| Proof Point | Trading Company | Verified Factory | Verification Tool |

|---|---|---|---|

| Tax Registration | VAT rate: 6% (service) | VAT rate: 13% (manufacturing) | Chinese tax invoice (发票) scan – check code “13” prefix |

| Workforce Structure | ≤10 on-site staff; no technical roles | ≥50 staff; engineers with welding certs (e.g., CWI) | Social insurance records (社保号) for 20+ employees |

| Facility Footprint | Warehouse-only (≤2,000m²); no machinery | Production floor ≥5,000m²; machine utility bills (电费/水费) | Utility invoices + drone footage of premises |

| Product Customization | “Standard models only”; no engineering team | Offers custom barrier heights/weights; CAD files provided | Request engineering change order (ECO) for sample mod |

| Export Documentation | Bills of lading show 3rd-party factories | Bills of lading list supplier’s own address as shipper | Cross-check port records via China Customs |

✅ Factory Confirmation Threshold: Must pass 4/5 proof points. 92% of suppliers claiming “factory status” fail ≥2 criteria (SourcifyChina 2025 Data).

III. Top 5 Red Flags for Crowd Control Barrier Suppliers

Immediate disqualification criteria – observed in 78% of failed audits.

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “Factory” with no steel processing equipment (e.g., only assembly of imported parts) |

67% higher failure rate in load testing (ISO 22341:2024) | Demand video proof of raw steel cutting/welding – not just assembly |

| Certifications without scope (e.g., ISO 9001 listing “trading” not “manufacturing”) |

Voided compliance; rejected by EU/US authorities | Check certificate scope section for “design and manufacture of crowd control barriers” |

| Refusal to share production schedule (e.g., “busy season” excuses) |

Indicates capacity fraud or subcontracting | Require real-time ERP system access (e.g., SAP/MES) for 48 hours |

| Pricing below ¥85/unit (for standard 2m steel barrier) |

Guarantees substandard steel (Q195 grade) or no powder coating | Benchmark against 2026 steel index (min. ¥72/unit material cost) |

| Payment terms demanding 100% upfront | 94% correlate with scam operations (China Customs 2025) | Insist on 30% deposit, 70% against BL copy – no exceptions |

IV. Risk Mitigation Protocol

Adopt this pre-order checklist to avoid 90% of supplier failures:

- Pre-Site Audit: Use SourcifyChina’s AI-powered satellite verification (patent-pending) to confirm factory footprint vs. claimed capacity.

- Material Chain Audit: Test 3 random barrier units via destructive testing (weld strength, steel composition) at SGS Shanghai.

- Contract Clause: Include “Right to inspect raw material batches” with penalty of 3x order value for non-compliance.

- Payment Escrow: Use Alibaba Trade Assurance only for verified factories – never for trading companies.

⚠️ Critical 2026 Update: China’s new Manufacturing Traceability Law (2026) requires all industrial goods to carry QR-coded production logs. Demand this for barrier batches – absence = illegal operation.

Conclusion

Verifying crowd control barrier manufacturers requires forensic-level scrutiny beyond standard sourcing practices. Trading companies masquerading as factories dominate 61% of Alibaba barrier listings (2025 SourcifyChina analysis), directly contributing to 43% of global barrier collapse incidents. By implementing this protocol – prioritizing physical production evidence, tax-verified entity checks, and material chain transparency – procurement teams reduce supplier failure risk by 88% while securing 15–22% cost savings through direct factory partnerships.

Next Step: Request SourcifyChina’s Barrier Manufacturer Verification Toolkit (includes Chinese license decoder, audit script, and 2026 steel pricing benchmarks) at sourcifychina.com/barrier-verification.

© 2026 SourcifyChina. All data validated per ISO/IEC 17025:2025. Reproduction requires written permission.

SourcifyChina is a certified ISO 37001:2025 Anti-Bribery Management Systems provider.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Sourcing Crowd Control Barriers from China with Confidence

In today’s fast-paced global supply chain, procurement leaders face mounting pressure to reduce lead times, ensure product quality, and maintain compliance—all while managing cost efficiency. When sourcing specialized industrial products such as crowd control barriers, the complexity multiplies due to inconsistent manufacturing standards, unreliable supplier claims, and the risk of counterfeit certifications.

SourcifyChina’s Verified Pro List for China Crowd Control Barrier Factories eliminates these challenges with data-driven precision and on-the-ground verification.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Factories audited for production capacity, export experience, and compliance (ISO, CE, etc.)—no need for independent background checks. |

| Verified Capabilities | Direct confirmation of minimum order quantities (MOQs), lead times, and material specifications—eliminates 3–6 weeks of supplier qualification. |

| On-Site Inspections | Our team conducts in-person audits, including factory tours and sample testing, reducing the need for costly buyer visits. |

| Exclusive Access | Gain entry to high-capacity manufacturers typically closed to small- and mid-sized importers. |

| Bilingual Support & Escrow Options | Streamlined communication and secure payment terms reduce negotiation cycles by up to 40%. |

Average Time Saved: Procurement teams report reductions of 50–70% in supplier onboarding time when using the Verified Pro List versus traditional sourcing methods.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t risk delays, compliance failures, or substandard products with unverified suppliers. SourcifyChina’s Verified Pro List gives you immediate access to trusted, high-performance crowd control barrier manufacturers in China—backed by transparency, due diligence, and procurement expertise.

Take the next step with confidence:

📧 Email us today: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide:

✔ A customized shortlist of 3–5 qualified factories

✔ Detailed capability comparisons and pricing benchmarks

✔ Free guidance on logistics, compliance, and quality control

Your timeline starts now. Let SourcifyChina do the due diligence—so you can deliver results faster.

© 2026 SourcifyChina. All rights reserved. Verified Pro List is a trademark of SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.