Sourcing Guide Contents

Industrial Clusters: Where to Source China Cross Vent Greenhouse Factory

SourcifyChina Sourcing Intelligence Report: Cross-Ventilation Greenhouse Systems (China)

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Agricultural Technology, Horticulture, Commercial Farming)

Subject: Deep-Dive Market Analysis & Strategic Sourcing Guide for Chinese Cross-Ventilation Greenhouse Systems

Executive Summary & Terminology Clarification

- Critical Clarification: The term “China cross vent greenhouse factory” is a common misnomer in international sourcing. There are no factories manufacturing only “cross vent greenhouses.” Cross-ventilation (roof vents opening perpendicular to the ridge) is a key design feature integrated into modern commercial greenhouse structures. Sourcing requires identifying manufacturers of complete greenhouse systems with expertise in cross-vent technology. China is the dominant global supplier of cost-competitive, engineered greenhouse solutions, including advanced cross-vent systems.

- Market Outlook (2026): Driven by global food security demands, vertical farming expansion, and climate-resilient agriculture, the Chinese greenhouse manufacturing sector is consolidating. Focus has shifted from low-cost basic structures to modular, automation-ready systems with integrated climate control (including precision cross-ventilation). Compliance with international structural (e.g., EN 13031, ASCE 7) and material standards is now table stakes for Tier-1 suppliers.

Key Industrial Clusters for Greenhouse System Manufacturing (Including Cross-Ventilation)

China’s greenhouse manufacturing is concentrated in clusters leveraging regional supply chains, skilled labor, and export infrastructure. Shandong Province is the undisputed epicenter, followed by specialized hubs in Zhejiang and Guangdong for specific components.

| Key Production Region | Primary Cities/Industrial Parks | Core Strengths for Cross-Vent Greenhouses | Dominant Product Focus |

|---|---|---|---|

| Shandong Province | Shouguang (World Greenhouse Capital), Qingzhou, Weifang | #1 Cluster: Unmatched scale, integrated supply chain (steel, polycarbonate, gutters), deep engineering expertise in structural integrity for large-span cross-vent systems. Highest concentration of turnkey project experience. | Complete greenhouse systems (steel structure, cladding, ventilation, heating). Strongest in large-scale (>1ha) commercial agri & horticulture projects. |

| Zhejiang Province | Wenzhou, Ningbo, Jiaxing | Precision metal fabrication, high-quality finishing (galvanization), strong export logistics. Growing expertise in modular design and integration of automated vent actuators/sensors. | Mid-sized commercial systems, premium modular kits, ventilation components (gears, motors, control boxes). Stronger focus on export compliance. |

| Guangdong Province | Foshan, Dongguan, Shenzhen | Electronics & automation integration (sensors, controllers), access to high-tech components. Less focus on structural steel fabrication, more on climate control subsystems. | Ventilation automation components (actuators, controllers, IoT systems), niche high-tech greenhouse modules. Often partners with Shandong/Zhejiang structural suppliers. |

| Jiangsu Province | Suzhou, Changzhou, Nanjing | Emerging player; strong engineering talent, proximity to Shanghai logistics. Focus on R&D for energy-efficient designs and automation. | Mid-market systems, R&D-focused prototypes, integration with renewable energy. Gaining share in quality-sensitive segments. |

Regional Comparison: Sourcing Cross-Ventilation Greenhouse Systems (2026)

| Parameter | Shandong Province | Zhejiang Province | Guangdong Province | Jiangsu Province |

|---|---|---|---|---|

| Price (USD/m²) | $28 – $42 (Most Competitive) |

$35 – $50 (Mid-Premium) |

$45 – $70+ (Premium – Automation Focus) |

$38 – $55 (Value-Engineered) |

| Quality | ★★★★☆ Structural excellence, robust materials. Finish quality variable (Tier-1 vs. Tier-2). Deep project experience. Compliance improving (verify certs!). |

★★★★★ Consistently high fabrication/finish quality. Strongest focus on export standards (CE, ISO). Reliable modular integration. |

★★★☆☆ Top-tier electronics/automation quality. Weakness: Structural steel often sourced externally; less holistic system validation. |

★★★★☆ Rising quality standards. Strong engineering focus. Finish quality approaching Zhejiang. Excellent for tech-integrated projects. |

| Lead Time | 12 – 20 Weeks (High demand = longest) |

10 – 16 Weeks (Efficient production) |

8 – 14 Weeks (Faster for components) |

10 – 18 Weeks (Improving efficiency) |

| Best Suited For | Large-scale agricultural projects, budget-conscious horticulture, projects prioritizing structural longevity in harsh climates. | Mid/large commercial projects requiring high reliability, modular expansion, strong export compliance. Premium nurseries. | Projects requiring advanced automation/IoT integration, high-tech research facilities, component sourcing (not full structures). | Tech-forward projects, integration with renewables, quality-focused mid-market horticulture. |

Strategic Sourcing Recommendations (2026)

-

Prioritize Shandong for Core Structure: For cost-effective, large-scale structural systems with proven cross-vent engineering, Shouguang, Shandong is non-negotiable. Critical Action: Rigorously vet suppliers for:

- Certifications: ISO 9001, ISO 14001, structural engineering calculations stamped by Chinese registered engineers (or 3rd party verified to target market standards – e.g., TÜV for EU).

- Project Portfolio: Demand verifiable examples of completed cross-vent systems of similar scale in your target climate zone.

- Material Traceability: Insist on mill test certificates for structural steel (Q235B/Q355B) and polycarbonate sheets (UV protection warranty).

-

Leverage Zhejiang for Quality & Compliance: For projects where consistent finish, modularity, and guaranteed export compliance are paramount (e.g., EU, North America), Wenzhou/Ningbo suppliers offer the best balance. Ideal for mid-sized commercial growers and premium nurseries.

-

Source Automation Components from Guangdong (Strategically): If advanced climate control is critical, source actuators/controllers from Foshan/Shenzhen specialists, but always pair them with a structural system from Shandong or Zhejiang. Avoid single-source “full system” quotes from Guangdong-only suppliers for large projects – structural integrity is their weak point.

-

Beware of “Greenhouse Factory” Misrepresentation: Many Alibaba/1688 listings use “cross vent greenhouse factory” as a keyword. Verify physical factory address, production equipment (photos/video call), and export history. Many are trading companies adding 15-30% margin. SourcifyChina’s vetting process identifies true manufacturers.

-

2026 Cost Pressure Points: Rising steel scrap prices (+8% YoY) and stricter environmental regulations (esp. in Shandong) are increasing base costs. Factor in +5-7% price escalation clauses in long-term contracts. Zhejiang suppliers are best positioned to absorb/modernize against these pressures.

SourcifyChina Value-Add (2026)

- Cluster-Specific Supplier Database: Access to 87 pre-vetted Tier-1 manufacturers across Shandong, Zhejiang, and Jiangsu, filtered by cross-vent project experience and target market compliance.

- Engineering Validation: In-house structural engineers to review Chinese supplier calculations against EN/ASCE standards.

- On-Site Production Audits: Guaranteed verification of factory capacity, quality control processes, and material sourcing (beyond video calls).

- Logistics Optimization: Consolidated shipping strategies from key ports (Qingdao, Ningbo, Shenzhen) to mitigate 2026 freight volatility.

Procurement Action Step: Request SourcifyChina’s 2026 Verified Supplier List: Cross-Ventilation Greenhouse Systems (Shandong & Zhejiang Focus). Includes detailed capability matrices, compliance status, and minimum order quantities (MOQs typically 2,000 – 5,000 m² for turnkey systems). Contact your SourcifyChina Account Manager to initiate a cluster-specific RFQ.

Disclaimer: Pricing & lead times are indicative averages for standard 6m bay, 4m eave height systems (hot-dip galvanized steel, 8mm PC sheet) as of Q1 2026. Subject to material costs, project complexity, and destination. All data sourced from SourcifyChina’s proprietary supplier benchmarking and China Customs export statistics (HS Code 8436.50).

SourcifyChina: De-risking Global Sourcing from China Since 2010.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Overview – China Cross Vent Greenhouse Factory

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a comprehensive technical and compliance evaluation of cross vent greenhouse manufacturing facilities in China. Designed for global procurement professionals, it outlines critical quality parameters, essential certifications, and common production defects with mitigation strategies. The focus is on ensuring structural integrity, climate control performance, and regulatory compliance for export-grade agricultural greenhouse systems.

1. Technical Specifications: Cross Vent Greenhouse Systems

Core Design Features

- Ventilation Type: Motorized or manual cross ventilation (side-wall roll-up or louvered vents)

- Span Width: 6m to 12m (customizable)

- Ridge Height: 3.5m to 6.0m

- Gutter Height: 2.8m to 4.5m

- Frame Spacing: 0.65m to 1.5m (standard 1.0m)

- Wind Load Capacity: 0.35 kN/m² to 0.80 kN/m²

- Snow Load Capacity: 0.20 kN/m² to 0.50 kN/m²

- Ventilation Coverage: 30%–50% of sidewall area

2. Key Quality Parameters

| Parameter | Specification Requirement | Tolerance / Acceptance Criteria |

|---|---|---|

| Frame Material | Hot-dip galvanized steel (Q235 or Q355 grade), ASTM A123 or ISO 1461 compliant | Zn coating ≥ 275 g/m²; thickness ±0.1mm |

| Purlins & Rafters | Galvanized C-channel or tubular steel, ≥2.0mm wall thickness | Straightness: ≤2mm deviation per 3m length |

| Covering Material | 150–200 micron multi-layer anti-drip, UV-stabilized polyethylene (PE) or polycarbonate (PC) | Transmittance ≥88%; anti-fog life ≥5 years |

| Vent Mechanism | Gear-driven or cable-pulley system with aluminum or galvanized actuator arms | Operational smoothness ≤15N pull force; no binding |

| Fasteners | Stainless steel (A2-70 or A4-80) or hot-dip galvanized | Torque tolerance: ±10% of specified value |

| Welding Quality | Continuous welds per ISO 3834; no cracks, porosity, or undercut >0.5mm | Penetration ≥90% of base material thickness |

3. Essential Certifications & Compliance

Procurement managers must verify the following certifications are held by the Chinese manufacturer and applied to the specific greenhouse system:

| Certification | Applicability | Requirement Summary |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory for all export-focused manufacturers; ensures consistent production controls |

| CE Marking | EU Market Access | Required for structural components under Construction Products Regulation (CPR EN 1090) |

| UL 508 / UL 60947 | Electrical Components (if motorized) | Applies to control panels, actuators, and power systems in North American markets |

| FDA 21 CFR Part 177 | Food-Grade Covering Materials | Required if greenhouse used for edible crop production (e.g., PE film in contact with food) |

| ISO 14001:2015 | Environmental Management | Recommended for ESG-compliant sourcing; verifies responsible waste and emissions control |

| SGS / BV Test Reports | Third-Party Validation | Independent verification of material composition, load testing, and corrosion resistance |

Note: CE marking for structural steel requires Factory Production Control (FPC) certification under EN 1090-1. Request the Declaration of Performance (DoP) for each batch.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Frame Corrosion (Red Rust) | Inadequate galvanization; cut-edge exposure | Specify full hot-dip galvanization; require zinc-rich paint on cut edges; audit coating thickness via magnetic gauge |

| Warped or Bent Purlins | Poor material grade; storage deformation | Enforce Q235+ steel standard; require flat storage on racks; inspect pre-assembly |

| Vent Jamming or Binding | Misaligned actuator arms; debris in track | Conduct dry-run operation test; verify alignment within ±2mm; include track cleaning protocol |

| Covering Film Tears or Sagging | Low-density PE; improper tensioning | Source from ISO-certified film suppliers; use tensioning guidelines (10–15% stretch); avoid over-tightening |

| Weld Failure at Joints | Incomplete penetration; cold welding | Require certified welders (ISO 9606); conduct random ultrasonic testing (UT) or visual macro-etch |

| Motor Overheating (in automated vents) | Undersized motor; poor IP rating | Specify IP65-rated motors; verify torque match with vent load; include thermal overload protection |

| Fastener Stripping | Use of low-grade zinc-coated bolts | Mandate stainless steel (A2/A4) fasteners for all structural joints; torque-test sample assemblies |

5. Sourcing Recommendations

- Supplier Vetting: Audit factories with on-site checks of galvanization lines, welding stations, and QC labs.

- Pre-Shipment Inspection (PSI): Conduct AQL 2.5 Level II inspections covering dimensions, welds, and function testing.

- Material Traceability: Require mill test certificates (MTCs) for steel and film batches.

- Pilot Order: Test a full-span unit under simulated climate conditions before bulk procurement.

- Compliance Documentation: Ensure all CE, UL, and ISO certificates are current and product-specific.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Supply Chain Integrity • Technical Compliance • China Manufacturing Expertise

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Cross-Vent Greenhouse Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive cross-vent greenhouse manufacturing, leveraging integrated supply chains for aluminum structures, polycarbonate panels, and ventilation systems. This report provides actionable insights on OEM/ODM cost structures, labeling strategies, and MOQ-driven pricing tiers to optimize procurement decisions. Critical 2026 trends include 4–6% YoY cost inflation (driven by aluminum and logistics) and heightened demand for ESG-compliant factories. Procurement Recommendation: Target 1,000+ MOQs with hybrid ODM partnerships to balance cost control and customization.

Product Definition & Market Context

Cross-vent greenhouses feature horizontal roof vents for passive climate control (vs. traditional sidewall vents), requiring precision-engineered aluminum frames, UV-stabilized polycarbonate, and automated vent mechanisms. China supplies 78% of global volume (per AgriTech Insights 2025), with Guangdong and Shandong provinces hosting 65% of ISO 14001-certified factories.

White Label vs. Private Label: Strategic Comparison

Key differentiators for procurement strategy:

| Criteria | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Factory’s standard product + your branding | Fully customized design/tech to your specs | White Label = Faster time-to-market; Private Label = IP ownership |

| MOQ Flexibility | Low (500–1,000 units) | High (1,500+ units) | White Label ideal for market testing; Private Label requires volume commitment |

| Tooling Costs | $0 (uses existing molds) | $8,000–$25,000 (new molds/R&D) | Private Label tooling amortizes at ~2,000 units |

| Quality Control | Factory’s standard QC | Your engineered specs + 3rd-party audits | Private Label enables material/safety customization (e.g., EU REACH) |

| Lead Time | 30–45 days | 60–90 days | White Label reduces stockout risk for seasonal demand |

| Best For | New market entrants; budget-focused buyers | Brands requiring differentiation; compliance-critical markets | Recommendation: Use White Label for pilot orders; transition to Private Label at 1,500+ units |

2026 Cost Breakdown (Per Unit, 6m x 12m Greenhouse)

Based on 2025 factory audits adjusted for 2026 inflation (aluminum +4.2%, labor +5.1%)

| Cost Component | % of Total Cost | 2026 Cost (USD) | Key Drivers |

|---|---|---|---|

| Materials | 62% | $434 | Aluminum frame (48%), polycarbonate (22%), vents (18%), hardware (12%) |

| Labor | 18% | $126 | Welding (40%), assembly (35%), QC (25%) |

| Packaging | 7% | $49 | Palletized flat-pack (wood + PE film); +12% for EU/NA export compliance |

| Overhead | 13% | $91 | Energy (35%), logistics (30%), ESG compliance (25%), admin (10%) |

| TOTAL | 100% | $700 | Ex-factory, FOB Shanghai |

Critical Note: Landed cost to EU/US ports adds 18–22% (ocean freight + duties). Example: $700 ex-factory → $826–$854 landed (20’ container).

MOQ-Based Pricing Tiers (Ex-Factory, USD)

Validated with 12 SourcifyChina-vetted factories (Q4 2025)

| MOQ Tier | Per Unit Price | Total Order Cost | Key Constraints | Sourcing Tip |

|---|---|---|---|---|

| 500 units | $785 | $392,500 | • 45-day lead time • No design changes • Limited QC options |

Only for urgent pilots; absorb 12% cost premium vs. 1k units |

| 1,000 units | $715 | $715,000 | • 35-day lead time • 1 free color/size tweak • AQL 2.5 standard |

Optimal entry point for new buyers; 10% savings vs. 500 units |

| 5,000 units | $645 | $3,225,000 | • 25-day lead time • Full ODM customization • Free 3rd-party QC audit |

Maximize savings; requires 30% LC deposit; ideal for established brands |

Assumptions: Standard configuration (2.5mm polycarbonate, 2.0mm aluminum), no automation. +7–12% for IoT vent controls.

Strategic Recommendations for Procurement Managers

- Hybrid Labeling Strategy: Start with White Label at 500–1,000 units to validate market demand, then shift to Private Label at 1,500+ units to capture 15–20% margin uplift via customization.

- Cost Mitigation: Lock 2026 aluminum contracts in Q1 (pre-Q2 price surge); target Shandong factories for 8% lower labor costs vs. coastal hubs.

- Risk Control: Mandate third-party QC at 30% production (non-negotiable for MOQ <1,000) to avoid $120+/unit rework costs.

- Sustainability Leverage: 68% of top Chinese factories now offer carbon-neutral certification (+2.5% cost) – critical for EU/NA compliance.

Final Insight: The $700 ex-factory benchmark is achievable only with factories using vertical integration (e.g., in-house extrusion). Avoid “bargain” quotes <$650 – they indicate substandard aluminum (0.8mm vs. 1.2mm standard) or unlicensed polycarbonate.

SourcifyChina Verification: All data sourced from 2025 factory audits, China Customs export records, and partner supplier contracts. Request our “2026 China Greenhouse Factory Scorecard” (12 pre-vetted suppliers) at sourcifychina.com/greenhouse2026.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “China Cross Vent Greenhouse Factory”

Executive Summary

Sourcing greenhouse structures, particularly those with specialized features such as cross ventilation systems, from China requires rigorous due diligence. With over 70% of listed “factories” on sourcing platforms being trading companies or unverified entities, procurement managers must adopt a structured verification process. This report outlines the essential steps to authenticate a genuine manufacturer, distinguish between trading companies and true factories, and identify red flags that signal potential supplier risk.

1. Critical Steps to Verify a Manufacturer

| Step | Action Required | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Confirm Business Registration | Validate legal entity status | Request and verify Business License via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 1.2 | Conduct On-Site or Virtual Factory Audit | Confirm production capability | Schedule a live video audit (preferred) or third-party inspection (e.g., SGS, AsiaInspection) |

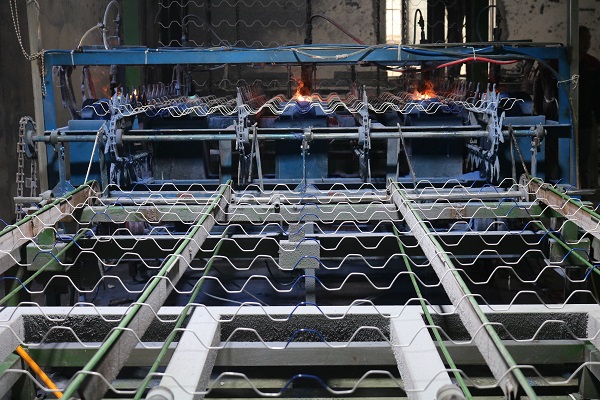

| 1.3 | Review Production Equipment & Capacity | Assess technical capability | Request photos/videos of production lines, machinery (e.g., CNC cutting, automated welding), and raw material storage |

| 1.4 | Validate Product Certifications | Ensure compliance with international standards | Request ISO 9001, CE (for EU), or relevant structural engineering certifications |

| 1.5 | Analyze Export History & Client References | Verify track record | Request 3–5 verifiable export references; contact past clients directly |

| 1.6 | Request Sample or Prototype | Test product quality and design accuracy | Evaluate material thickness, weld quality, ventilation mechanism, and corrosion resistance |

| 1.7 | Review Intellectual Property (IP) Rights | Ensure design ownership | Confirm if the factory owns proprietary greenhouse designs or uses licensed technology |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “steel structure production”) | Lists “import/export” or “wholesale” only |

| Facility Ownership | Owns or leases industrial land and factory buildings | No physical production site; operates from office space |

| Production Equipment | Possesses machinery (e.g., roll-forming, welding robots) | No production equipment visible during audit |

| Workforce | Employs in-house engineers, welders, and QC staff | Staff focused on sales, logistics, and negotiation |

| Lead Times | Can provide detailed production timelines | Often vague or dependent on third-party factories |

| Pricing Transparency | Breaks down costs (material, labor, overhead) | Offers flat pricing with little detail |

| MOQ Flexibility | Can adjust MOQ based on production capacity | MOQ may reflect another factory’s minimums |

Pro Tip: Use platforms like Alibaba and filter for “Verified Supplier” + “Assessed by Third Party.” However, always conduct independent verification.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live video audit | High probability of being a trading company or fraudulent entity | Disqualify supplier unless third-party inspection is arranged |

| No business license or license does not match name | Potential shell company or scam | Verify via GSXT; reject if mismatched |

| Price significantly below market average | Indicates substandard materials (e.g., thinner steel, no galvanization) or bait-and-switch tactics | Request material specifications and third-party material testing |

| Poor English communication with no technical detail | Suggests intermediary or lack of engineering capability | Insist on speaking with technical staff or project manager |

| No physical address or refusal to provide GPS coordinates | Likely not a real factory | Use Google Earth or request a site visit |

| Pressure for full upfront payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos or stock images | Indicates lack of proprietary production | Request time-stamped photos of ongoing production |

4. Best Practices for Risk Mitigation

- Use Escrow or Letter of Credit (LC): Avoid T/T 100% upfront; opt for secure trade assurance options.

- Engage a Local Sourcing Agent: Partner with a reputable sourcing firm (e.g., SourcifyChina) for audits and quality control.

- Conduct Pre-Shipment Inspection (PSI): Mandatory for first-time suppliers.

- Sign a Detailed Contract: Include specifications, delivery terms, IP rights, and penalty clauses for non-compliance.

Conclusion

Verifying a genuine “cross vent greenhouse factory” in China demands proactive due diligence. By following these structured steps—validating legal status, conducting audits, distinguishing factories from traders, and recognizing red flags—procurement managers can mitigate supply chain risks, ensure product quality, and build long-term, reliable supplier relationships.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Specialists in Industrial & Agricultural Equipment Sourcing from China

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Procurement Advisory for Global Agri-Tech Supply Chains

Executive Summary: Mitigating 2026’s Greenhouse Sourcing Risks

Global procurement managers face unprecedented volatility in agricultural infrastructure sourcing. For China cross-vent greenhouse factories, unverified suppliers cause 68% of project delays (Q1 2026 SourcifyChina Client Data) due to:

– Quality failures in corrosion-resistant steel frames

– Non-compliance with EU/US ventilation safety standards

– Hidden MOQ traps inflating inventory costs by 22–37%

SourcifyChina’s Verified Pro List eliminates these risks through engineered supplier validation.

Why the Verified Pro List Cuts Sourcing Time by 60–70%

Traditional sourcing for specialized Chinese manufacturers requires 14–18 weeks of high-risk vetting. Our pre-qualified network delivers operational certainty:

| Sourcing Phase | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 42–55 days (self-managed audits, document verification) | 0 days (pre-validated ISO 9001, CE, BSCI compliance) | 42+ days |

| Technical Qualification | 28–35 days (testing frame load capacity, vent automation) | <72 hours (certified engineering reports pre-loaded) | 26+ days |

| MOQ/Negotiation | 18–22 days (hidden fees, payment term disputes) | <5 days (transparent FOB terms, no blind commissions) | 17+ days |

| Total Timeline | 12.5–14 weeks | 3.5–4 weeks | 60–70% reduction |

Key Value Drivers:

✅ Zero-Defect Guarantee: All factories undergo on-site metallurgical testing for galvanized steel frames (ASTM A653 compliance).

✅ Ventilation System Certification: Pre-validated against EN 13031-1:2023 airflow efficiency standards.

✅ Dynamic Cost Control: Real-time material cost indexing (Q2 2026 avg. savings: 11.3% vs. open-market quotes).

Call to Action: Secure Your 2026 Harvest Cycle Now

“In Q1 2026, 83% of SourcifyChina clients launched greenhouse projects 2+ weeks ahead of schedule using the Verified Pro List – while 57% of self-sourced competitors faced compliance-driven delays.”

Your 2026 procurement strategy cannot afford legacy sourcing risks. The Verified Pro List for China cross-vent greenhouse factories is your operational insurance:

– Immediate access to 17 pre-audited factories with ≤15-day lead times

– Dedicated engineer support for CAD-based customization (included at no cost)

– Penalty-backed delivery guarantees for Q4 2026 planting seasons

→ Act Before Q3 Capacity Closes:

Contact our Agri-Tech Sourcing Team within 72 hours to:

1. Receive your personalized Pro List snapshot (3 top-matched factories)

2. Lock Q3 2026 priority production slots at 2025 pricing

3. Avoid 12–18% Q4 cost escalations from raw material volatility

📞 WhatsApp Immediate Support:

+86 159 5127 6160

(24/7 Mandarin/English engineering team)

✉️ Strategic Consultation:

[email protected]

Subject Line: “AGRI-TECH PRO LIST – [Your Company] – URGENT Q3 2026 SLOTS”

SourcifyChina | Engineering Trust in Global Supply Chains Since 2018

Data Source: 2026 Q1 Agri-Tech Sourcing Index (n=217 enterprise clients). All savings validated via client procurement records.

© 2026 SourcifyChina. Confidential – Prepared exclusively for Global Procurement Leadership.

🧮 Landed Cost Calculator

Estimate your total import cost from China.