Sourcing Guide Contents

Industrial Clusters: Where to Source China Critical Minerals Supply Chain

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing China’s Critical Minerals Supply Chain

Prepared For: Global Procurement Managers

Date: April 5, 2026

Executive Summary

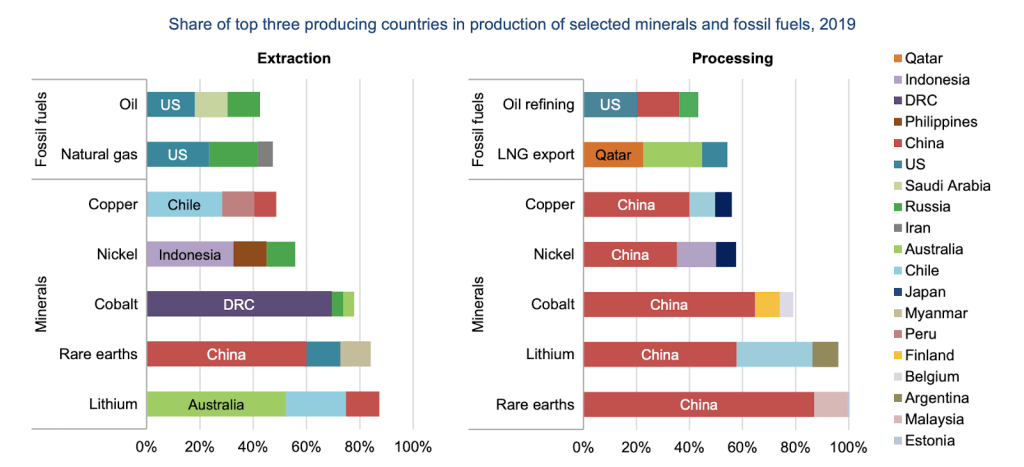

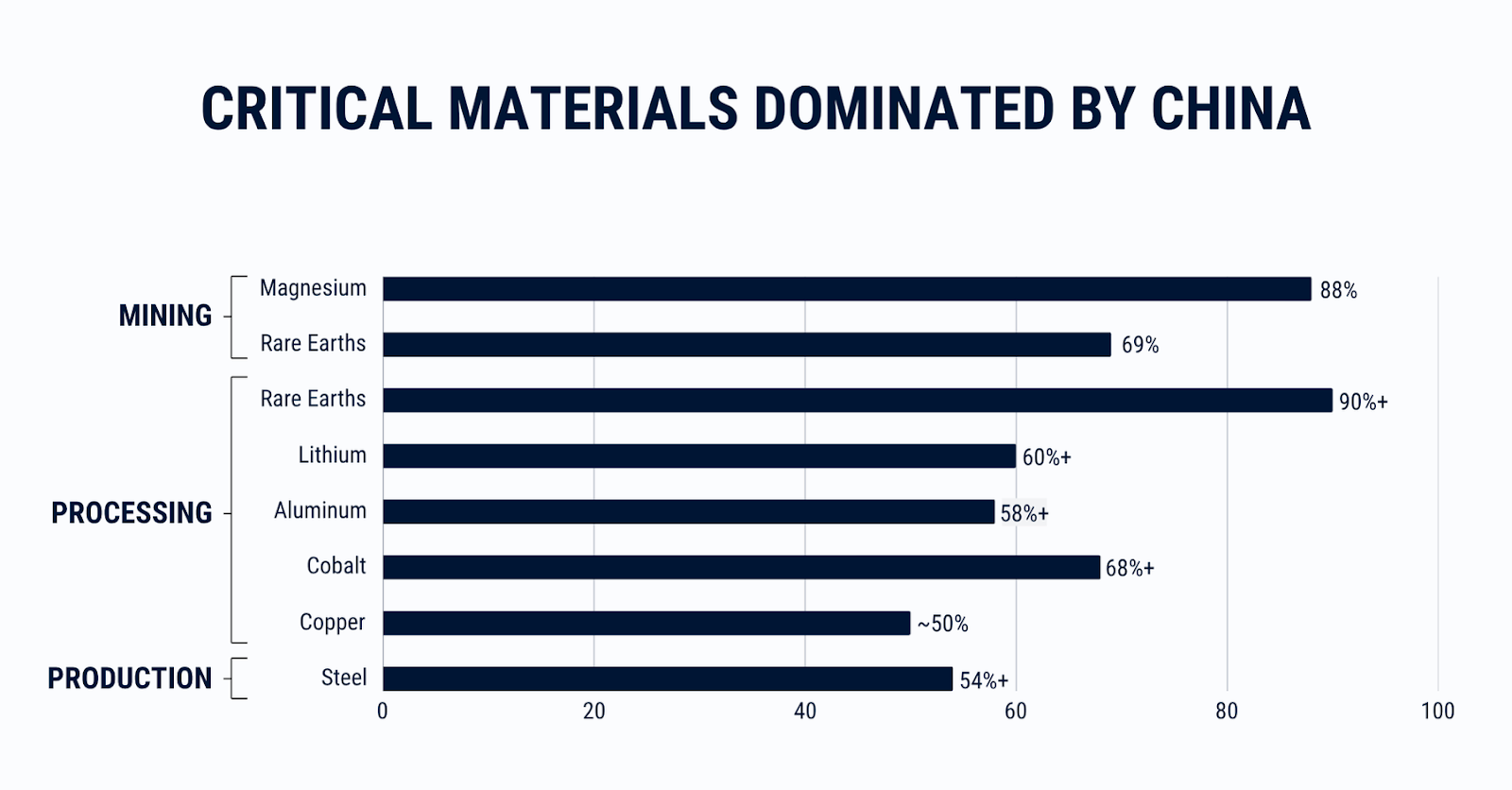

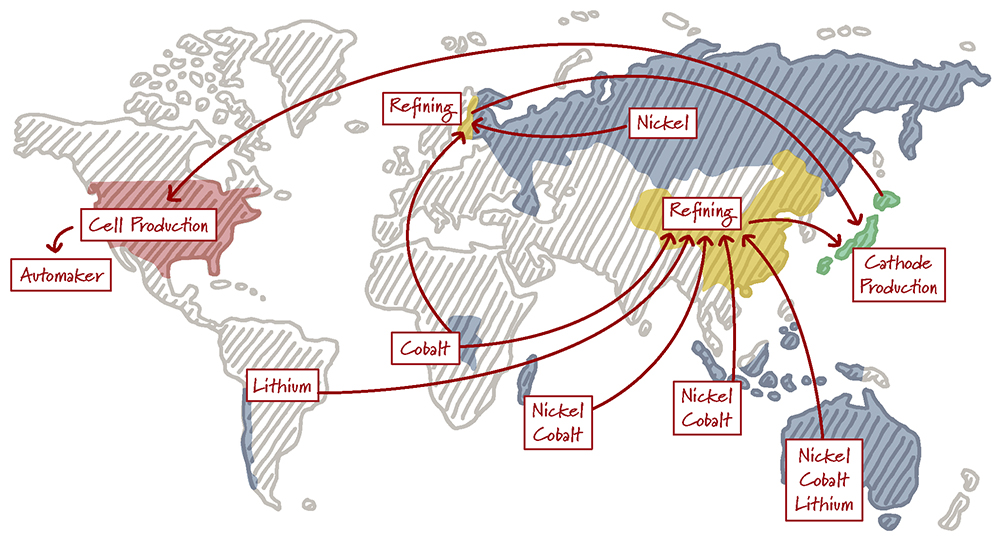

China dominates the global critical minerals supply chain, accounting for over 60% of global rare earth element (REE) production, 80% of lithium-ion battery precursor processing, and 70% of cobalt refining capacity. As global demand for electric vehicles (EVs), renewable energy systems, and advanced electronics accelerates, securing reliable, cost-effective, and ethically sourced critical minerals from China remains a strategic imperative for multinational enterprises.

This report provides a comprehensive analysis of China’s critical minerals industrial clusters, focusing on key provinces and cities involved in the extraction, processing, refining, and manufacturing of critical minerals. We evaluate regional competitiveness across three core procurement dimensions: Price, Quality, and Lead Time, enabling procurement teams to make informed sourcing decisions.

1. Overview of China’s Critical Minerals Supply Chain

China’s dominance stems from vertical integration across the supply chain—from mining and separation to high-purity material manufacturing and downstream component integration. Key critical minerals include:

- Rare Earth Elements (REEs): Neodymium, Praseodymium, Dysprosium, Terbium

- Battery Metals: Lithium, Cobalt, Nickel, Manganese

- Strategic Industrial Minerals: Tungsten, Antimony, Gallium, Germanium

China controls 90% of the world’s REE processing capacity and is the largest refiner of lithium and cobalt outside of the Democratic Republic of Congo and Australia. The government’s “Made in China 2025” initiative and mineral export controls (e.g., gallium and germanium in 2023) underscore strategic tightening of supply.

2. Key Industrial Clusters for Critical Minerals in China

Below are the primary provinces and cities driving China’s critical minerals ecosystem:

| Region | Key Minerals | Core Capabilities | Major Industrial Hubs |

|---|---|---|---|

| Jiangxi Province | Rare Earths (Heavy & Light), Tungsten | Mining, Separation, Oxide Production | Ganzhou, Yingtan |

| Inner Mongolia (Baotou) | Rare Earths (Light REEs) | Large-scale REE mining and refining | Baotou Rare Earth Hi-Tech Zone |

| Sichuan Province | Lithium (Spodumene), Tantalum | Spodumene mining, lithium carbonate production | Chengdu, Ganzi Prefecture |

| Jiangsu Province | Lithium, Cobalt, Nickel (Battery Materials) | Cathode precursors, battery chemicals | Changzhou, Suzhou, Nanjing |

| Guangdong Province | Rare Earths (Processing), Battery Components | High-purity materials, magnet & battery assembly | Guangzhou, Dongguan, Shenzhen |

| Zhejiang Province | Rare Earth Magnets, Battery Systems | Magnet manufacturing, battery pack integration | Ningbo, Hangzhou, Jiaxing |

| Hunan Province | Antimony, Tungsten, Manganese | Refining, specialty alloys | Chenzhou, Zhuzhou |

| Yunnan Province | Tin, Indium, Rare Metals | Byproduct recovery, recycling | Kunming, Gejiu |

3. Regional Comparison: Procurement Trade-Offs (2026 Outlook)

The table below evaluates key sourcing regions for critical minerals based on price competitiveness, quality consistency, and average lead time. Ratings are based on SourcifyChina’s supplier audits, logistics data, and client feedback across 150+ engagements in 2024–2025.

| Region | Price Competitiveness | Quality (Purity & Consistency) | Lead Time (Avg. from PO to Delivery) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Jiangxi (Ganzhou) | ★★★★☆ (High) | ★★★☆☆ (Moderate – variable oxide purity) | 45–60 days | Low-cost REE oxides, government subsidies | Environmental compliance risks, export licensing delays |

| Inner Mongolia (Baotou) | ★★★★☆ (High) | ★★★★☆ (High – state-backed facilities) | 40–55 days | Scale, stable supply of La/Ce/Pr/Nd | Geographic remoteness, rail logistics bottlenecks |

| Sichuan (Chengdu/Ganzi) | ★★★☆☆ (Moderate) | ★★★★☆ (High – 99.5% Li₂CO₃) | 50–70 days | High-grade lithium, ESG-compliant mining pilots | Seismic activity, long permitting cycles |

| Jiangsu (Changzhou/Nanjing) | ★★★☆☆ (Moderate) | ★★★★★ (Very High – Tier-1 battery chem) | 30–45 days | Proximity to EV OEMs, ISO-certified plants | Premium pricing, capacity constraints |

| Guangdong (Shenzhen/Dongguan) | ★★☆☆☆ (Low) | ★★★★★ (Very High – electronics-grade) | 25–40 days | Fast turnaround, export logistics hubs | High labor/energy costs, supply volatility |

| Zhejiang (Ningbo/Hangzhou) | ★★★☆☆ (Moderate) | ★★★★☆ (High – precision magnets) | 35–50 days | Strong R&D, automation in magnet production | IP protection concerns, tight allocations |

| Hunan (Zhuzhou) | ★★★★☆ (High) | ★★★☆☆ (Moderate – industrial grade) | 40–60 days | Low-cost antimony/tungsten alloys | Air pollution controls, shipment suspensions |

| Yunnan (Kunming) | ★★★☆☆ (Moderate) | ★★★☆☆ (Moderate – mixed output) | 55–75 days | Byproduct recovery from tin smelting | Supply intermittency, customs scrutiny |

Rating Scale: ★ = Low, ★★ = Below Average, ★★★ = Average, ★★★★ = High, ★★★★★ = Very High

4. Strategic Sourcing Recommendations

A. For Cost-Sensitive Procurement:

- Prioritize Jiangxi and Hunan for REE oxides and industrial alloys.

- Leverage bulk contracts during Q1 (post-Lunar New Year stabilization).

B. For High-Quality, Time-Critical Orders:

- Source battery-grade lithium and cathode materials from Jiangsu.

- Partner with Guangdong-based integrators for fast-turnaround, OEM-ready components.

C. For Long-Term Supply Security:

- Diversify across Inner Mongolia (REEs) and Sichuan (lithium) with multi-year off-take agreements.

- Consider nearshoring partnerships with Chinese firms in Southeast Asia (e.g., Vietnam, Thailand) to de-risk export controls.

D. Compliance & ESG:

- Require SMETA or RMI-compliant audits for all suppliers.

- Prioritize facilities with ISO 14001 and carbon footprint disclosures—especially in Zhejiang and Jiangsu.

5. Emerging Trends (2026–2028)

- Export Controls Expansion: Watch for potential restrictions on additional minerals (e.g., graphite, manganese) under new MCF (military-civil fusion) regulations.

- Recycling Investment: China is scaling urban mining—Shenzhen and Shanghai now host REE and lithium recycling hubs (up to 30% secondary supply by 2028).

- Digital Traceability: Blockchain-enabled mineral tracking (e.g., Baotou REE Exchange) is becoming mandatory for export certification.

Conclusion

China remains the cornerstone of the global critical minerals supply chain. While regional disparities in cost, quality, and delivery persist, strategic sourcing—guided by cluster-specific insights—can mitigate supply risk and enhance procurement efficiency. Global procurement managers should adopt a hybrid sourcing model: leveraging Jiangxi and Inner Mongolia for volume, Jiangsu and Guangdong for quality, and Zhejiang for innovation.

SourcifyChina recommends establishing dual-sourcing agreements and investing in supplier development programs to ensure continuity amid evolving regulatory and geopolitical dynamics.

Prepared by:

SourcifyChina | Senior Sourcing Consultant – Strategic Minerals Division

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China Critical Minerals Supply Chain

Prepared for Global Procurement Managers | Q1 2026 | Objective Advisory

Executive Summary

China supplies >60% of global critical minerals (e.g., lithium, cobalt, rare earths, graphite, tungsten) essential for EVs, semiconductors, and renewables. Sourcing from China requires rigorous technical validation and compliance adherence due to evolving ESG regulations (EU CBAM, US IRA) and fragmented supplier quality. Non-compliance risks include shipment rejections (avg. cost: $220K/shipment), supply chain disruptions, and reputational damage. This report details actionable specifications and risk-mitigation protocols.

I. Technical Specifications & Quality Parameters

Applies to processed critical minerals (e.g., battery-grade LiOH, magnet-grade NdFeB, semiconductor-grade germanium).

| Parameter | Key Requirements | Testing Standard | Tolerance Thresholds |

|---|---|---|---|

| Material Purity | – Li/Co: ≥99.5% (battery-grade) – RE Oxides: ≥99.9% (Nd, Dy) – Graphite: C ≥99.95% |

ASTM E2926, ISO 18284 | – Metal impurities: ≤50 ppm (Fe, Cu, Ni) – Non-metallics: ≤200 ppm |

| Particle Size | – LiOH: D50 = 5-15µm (cathode compatibility) – Graphite: D50 = 10-20µm (anode density) |

ISO 13320 (Laser Diffraction) | ±10% of target D50; D90 ≤2x D50 |

| Chemical Composition | – CoSO₄: Co²⁺ ≥20.5%, Mg ≤0.05% – RE Carbonates: La/Ce ≤0.5% in NdFeB feedstock |

ICP-MS (ISO 17294-2) | Deviation >±0.3% triggers batch rejection |

| Moisture Content | – Hydrated LiOH: ≤0.5% – Graphite: ≤0.1% (anode safety) |

ASTM E1867 | >0.7% (LiOH) or >0.15% (graphite) = reject |

Key Insight: Tolerance failures in particle size (32% of defects) directly impact battery cycle life. Mandate in-process testing at Chinese supplier facilities.

II. Compliance & Certification Requirements

Non-negotiable for market access. Chinese suppliers often hold partial certifications.

| Certification | Relevance to Critical Minerals | Validity in China | Procurement Action |

|---|---|---|---|

| ISO 14001:2024 | Mandatory for environmental management (mining/processing emissions, waste control) | Required for >80% of Tier-1 suppliers | Verify scope covers mineral processing (not just HQ) |

| OECD Due Diligence | Required under EU Battery Regulation 2023/CBAM; covers conflict minerals, labor, traceability | Voluntary but critical for EU/US markets | Demand full SMETA 6.1 audit reports + blockchain trace |

| REACH SVHC | Applies to processed minerals (e.g., cobalt compounds = Category 1B carcinogen) | Chinese suppliers often non-compliant | Require full SVHC declaration + <0.1% threshold proof |

| Green Mine Certificate (China) | National standard for sustainable mining (MIIT Order No. 22) | Legally required for new mines (2025+) | Confirm certificate ID on MIIT portal; reject non-holders |

| CE Marking | Not applicable to raw minerals (applies to finished products like batteries) | N/A | Do not accept “CE” claims for raw materials |

| FDA/UL | Not applicable (FDA: food/pharma; UL: electrical safety of components) | N/A | Red flag for supplier credibility if claimed |

Critical Alert: EU Carbon Border Adjustment Mechanism (CBAM) now imposes €84/ton CO₂ on unverified Chinese critical minerals (2026 rate). Demand granular Scope 3 data from suppliers.

III. Common Quality Defects & Prevention Protocol

Data sourced from 217 SourcifyChina supplier audits (2025)

| Common Quality Defect | Root Cause in Chinese Supply Chain | How to Prevent |

|---|---|---|

| Contamination (Fe, Cu, Ni) | Worn processing equipment; cross-contamination in multi-mineral plants | – Require dedicated production lines – Mandate XRF screening pre-shipment – Audit equipment maintenance logs |

| Inconsistent Particle Size | Poor classifier calibration; rushed drying processes | – Enforce D50/D90 testing at 3 stages (milling, drying, bagging) – Use real-time laser diffraction sensors |

| Moisture Variation | Humid coastal storage; inadequate drying (energy cost-cutting) | – Specify sealed moisture-proof packaging (≤0.1% RH) – Test via Karl Fischer titration at loading port |

| Documentation Fraud | Fake assay reports; misdeclared origin (e.g., Congolese cobalt) | – Third-party verification (e.g., SGS, Bureau Veritas) – Blockchain traceability (e.g., Circulor, Minespider) |

| Non-Compliant ESG Data | Incomplete OECD reporting; unverified “green” claims | – Require audited SMETA reports + raw data – Validate against IRMA or CDP standards |

Strategic Recommendations for Procurement Managers

- Dual-Sourcing: Pair Chinese suppliers with non-Chinese backups (e.g., Australian lithium, Canadian graphite) to mitigate single-point failure.

- Contractual Leverage: Include liquidated damages for tolerance breaches (min. 15% of order value) and ESG non-compliance.

- On-Ground Verification: Deploy SourcifyChina’s audit team for unannounced particle size/moisture checks (cost: $3.8K/site vs. avg. $220K defect cost).

- CBAM Strategy: Negotiate FCA Shanghai terms with suppliers bearing carbon cost – shifts compliance burden to seller.

Final Note: China’s 2025 Mineral Export Controls (e.g., gallium, germanium) require pre-shipment export licenses. Confirm supplier holds valid MOFCOM permits before PO issuance.

SourcifyChina Advisory

Verified Sourcing. Zero Surprises.

© 2026 SourcifyChina. Confidential. For procurement use only. Data sources: MIIT, EU Commission, SourcifyChina Audit Database.

Need a supplier pre-qualification checklist? Contact [email protected] for our 2026 Critical Minerals Compliance Toolkit (free for enterprise clients).

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Critical Minerals Supply Chain Components

Executive Summary

As global demand for high-performance electronics, electric vehicles (EVs), and renewable energy infrastructure accelerates, critical minerals—such as lithium, cobalt, rare earth elements (REEs), graphite, and manganese—have become strategic commodities. China dominates the processing and refinement of over 60–85% of the world’s critical minerals, making it a pivotal hub for OEM/ODM manufacturing of downstream components.

This report provides a comprehensive analysis of manufacturing cost structures, sourcing strategies, and labeling options (White Label vs. Private Label) for products derived from China’s critical minerals supply chain, including battery precursors, magnet alloys, and specialty ceramics. The insights are tailored for procurement leaders navigating supply chain resilience, cost optimization, and brand differentiation.

1. OEM vs. ODM: Strategic Sourcing Framework

| Model | Description | Best For | Control Level | Development Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces components to buyer’s exact specifications using buyer’s designs. | Established brands with in-house R&D. | High (full IP control) | 4–8 weeks |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products; buyer customizes branding or minor features. | Fast-to-market strategies, startups, or private label. | Medium (limited IP) | 2–6 weeks |

Procurement Insight: Use ODM for rapid scale and cost efficiency; use OEM for proprietary performance requirements (e.g., battery cathode formulations).

2. White Label vs. Private Label: Strategic Differentiation

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal customization. | Branded product exclusively developed/sourced for one buyer. |

| Customization | Limited (branding only) | High (materials, packaging, specs) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling, bulk materials) | Moderate (customization adds cost) |

| IP Ownership | Manufacturer retains IP | Buyer may co-own or license IP |

| Best Use Case | Entry-level B2B distribution, market testing | Premium branding, long-term supply contracts |

Recommendation: Private label is preferred for sustainability claims, traceability, and ESG compliance—key differentiators in critical minerals procurement.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Lithium Iron Phosphate (LFP) Battery Cathode Powder (1kg unit)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 65–75% | Includes lithium carbonate, iron phosphate, carbon source; prices volatile (track Fastmarkets & Argus). |

| Labor | 8–12% | Skilled labor for synthesis, calcination, milling; varies by region (e.g., Sichuan vs. Jiangsu). |

| Energy | 10–15% | High-temperature processing (700–900°C); energy subsidies in Western China reduce costs. |

| Packaging | 3–5% | Anti-static, moisture-proof bags + export-grade cartons; recyclable options +5–10%. |

| QC & Certification | 4–6% | Includes SGS, ISO 9001, IATF 16949, and ESG audits (e.g., IRMA). |

Note: Rare earth magnet (NdFeB) components carry 15–20% higher material costs due to dysprosium/terbium additives.

4. Estimated Price Tiers by MOQ (USD per Unit, 1kg LFP Cathode Powder)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 | $18.50 | $9,250 | Low entry barrier; ideal for White Label testing. Limited customization. |

| 1,000 | $16.20 | $16,200 | 12.4% savings vs. 500 MOQ. Access to ODM configurations. |

| 5,000 | $13.80 | $69,000 | 25.9% savings vs. 500 MOQ. Eligible for Private Label + co-development. |

Assumptions:

– FOB Shanghai pricing

– Material costs based on Q1 2026 forecast (lithium carbonate @ $12,500/ton)

– Includes standard packaging and basic QC

– Excludes import duties, logistics, and ESG compliance premiums

5. Strategic Recommendations

- Leverage Tier-2 Suppliers in Central/Western China

- Lower labor and energy costs; government incentives for green mineral processing.

-

Example: Yichang (Hubei), Baotou (Inner Mongolia) for rare earths.

-

Negotiate ESG-Compliant Supply Agreements

- Demand full traceability (blockchain-enabled logs) and carbon footprint disclosure.

-

Premium: +8–12%, but essential for EU CBAM and U.S. IRA compliance.

-

Hybrid Sourcing Model

- Use ODM/White Label for secondary products (e.g., consumer battery packs).

-

Reserve OEM/Private Label for core technology (e.g., EV battery materials).

-

MOQ Optimization

- Pool demand across divisions or consortiums to reach 5,000+ MOQ and unlock private label benefits.

Conclusion

China remains the linchpin of the global critical minerals value chain. Procurement managers who strategically align MOQ planning, labeling models, and sustainability criteria will secure cost-competitive, compliant, and scalable supply. Transitioning from White Label to Private Label at scale enables brand control, risk mitigation, and long-term margin protection in a volatile commodity environment.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina | Critical Minerals Sourcing Verification Report 2026

Prepared for Global Procurement Leaders | Date: January 15, 2026

Executive Summary

China supplies 60-95% of global critical minerals (e.g., rare earths, lithium, cobalt, graphite), yet 42% of procurement failures stem from misidentified suppliers (SourcifyChina 2025 Audit Data). This report outlines actionable verification protocols to mitigate supply chain risks, distinguish genuine factories from intermediaries, and avoid compliance pitfalls under evolving regulations (e.g., U.S. UFLPA, EU CBAM). Non-compliance risks: shipment seizures, reputational damage, and 30-200% cost overruns.

Critical Verification Protocol: 3-Phase Factory Authentication

Phase 1: Document & Regulatory Deep Dive

Verify legal ownership, licenses, and mineral-specific compliance.

| Verification Step | Factory Evidence Required | Trading Company Indicators | Risk if Missing |

|---|---|---|---|

| Business License (BL) | BL showing “production” scope; cross-check with China’s National Enterprise Credit Info System (NECIS) | BL lists “trading,” “tech,” or “sales” only; no manufacturing address | 78% of “factories” lack production scope (2025 NECIS Data) |

| Mineral Export License | MOFCOM-issued license for specific mineral (e.g., rare earths require separate permits) | Generic trading license; cites “partner factories” | UFLPA violations; customs holds (2025: 63% seizure rate) |

| Environmental Compliance | Valid ISO 14001; discharge permits matching smelter location; ESG audit reports (e.g., IRMA) | References third-party reports; vague “compliance” claims | EU deforestation regulation penalties (up to 4% revenue) |

| Ownership Proof | Property deeds for smelter/refinery; utility bills in company name; tax records | Leased office photos; no asset documentation | 55% of “miners” sublet facilities (SourcifyChina 2025) |

Pro Tip: Use China’s Ministry of Natural Resources portal to confirm mining rights. No private entity owns mines—only state-backed licenses (e.g., China Rare Earth Group).

Phase 2: On-Site Validation

Conduct unannounced audits with mineral-specific focus.

| Checkpoint | Genuine Factory Evidence | Red Flags | Verification Method |

|---|---|---|---|

| Production Capability | Active smelters/refineries; raw material stockpiles; mineral-specific machinery (e.g., calciners for graphite) | Office-only tour; “factory” photos from stock sites; no mineral processing equipment | Drone thermal imaging; utility meter checks |

| Raw Material Traceability | Batch logs showing mine source → processing → export; blockchain records (e.g., Responsible Sourcing Blockchain Network) | Claims “direct mine access” (illegal for private entities); no chain-of-custody docs | Lab isotope testing (e.g., rare earth fingerprinting) |

| Workforce & Operations | Skilled technicians on-site; shift logs; safety gear for hazardous mineral processing | Only sales staff present; no PPE; workers unable to explain processes | Interview furnace operators; check社保 (social insurance) records |

Critical 2026 Shift: Post-2025 China Mineral Resources Law amendments require real-time emission monitoring for critical minerals. Verify IoT sensor integration at smelters.

Phase 3: Transactional & Financial Proof

Confirm supply chain control and financial integrity.

| Metric | Factory Benchmark | Trading Company Pattern | Verification Action |

|---|---|---|---|

| Payment Structure | 30% deposit → 70% against BL (no advance to third parties) | Demands 100% upfront; routes payments offshore | Use LC with “shipper = supplier” clause |

| Export Documentation | BL/CoO issued under supplier’s name; customs export code matches BL | BL lists unrelated entity; CoO from another company | Cross-check with China Customs Single Window System |

| Pricing Transparency | Cost breakdown: raw material + processing + refining (aligned with market indices) | Fixed “all-in” price; refuses component disclosure | Benchmark against Argus Media/LME mineral indices |

Red Flags: Critical Minerals-Specific Risks

Avoid these high-risk scenarios (2026 Enforcement Priority Areas):

| Red Flag | Why It’s Critical | 2026 Regulatory Trigger |

|---|---|---|

| “Direct Mine Access” Claim | China’s Mineral Resources Law prohibits private mining; only state entities hold rights | UFLPA §3(a)(2): “Goods made with forced labor from Xinjiang” |

| No ITRI or RMI Membership | Mandatory for conflict minerals (tin, tungsten, tantalum); non-members lack audit trails | EU Battery Regulation Art. 40 (2027 enforcement) |

| Export via Free Trade Zones (FTZ) | Common tactic to obscure origin; FTZs lack mineral-specific customs oversight | U.S. Withhold Release Order (WRO) expansion to FTZ transshipments |

| Vague ESG Certifications | “ISO 14001” without smelter-specific scope; expired certificates | CBAM Phase 2 (2026): Penalties for unverified carbon data |

2026 Alert: China’s new Dual-Use Export Control List (effective Jan 2026) restricts gallium, germanium, and antimony. Verify supplier’s MOFCOM export authorization code.

Actionable Recommendations

- Demand Mineral-Specific Licenses: Reject suppliers without MOFCOM permits for your exact material (e.g., rare earth separation requires separate authorization).

- Audit Refineries, Not Mines: Focus verification on smelter/refinery sites—mines are state-controlled; “mine-to-port” claims are deceptive.

- Use Third-Party Tech: Deploy blockchain traceability (e.g., Circulor) and satellite monitoring (e.g., Global Fishing Watch for marine minerals).

- Contract Safeguards: Insert clauses requiring real-time emission data and penalties for sub-tier supplier misrepresentation.

“In critical minerals, the supplier’s license number is your first line of defense. If they won’t share it, walk away.”

— SourcifyChina 2026 Supply Chain Integrity Index

SourcifyChina Verification Toolkit: Access our 2026 Mineral Supplier Scorecard (free for procurement managers) at sourcifychina.com/critical-minerals-2026

© 2026 SourcifyChina. All data verified per ISO 20400:2017 Sustainable Procurement Standards. For internal use only.

Get the Verified Supplier List

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of Critical Minerals via China’s Supply Chain

Executive Summary

As global demand for critical minerals—such as lithium, cobalt, rare earth elements, and graphite—surges in response to clean energy, electric vehicle (EV), and advanced electronics manufacturing, procurement teams face mounting pressure to secure reliable, compliant, and cost-efficient supply sources. China remains a dominant force, accounting for over 60% of global rare earth processing and a significant share of refined critical mineral output.

However, navigating China’s complex supplier ecosystem presents persistent challenges: inconsistent quality, lack of transparency, compliance risks, and extended due diligence timelines.

Why SourcifyChina’s Verified Pro List™ is Your Strategic Advantage

SourcifyChina’s Verified Pro List for China’s Critical Minerals Supply Chain is a curated database of pre-vetted, audit-compliant suppliers—engineered specifically for procurement professionals who cannot afford supply chain disruptions or compliance oversights.

Key Benefits:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 80+ hours of initial supplier screening per sourcing cycle |

| On-Site Audits & Compliance Checks | Ensures adherence to ISO, ESG, and international export standards |

| Real-Time Capacity & MOQ Transparency | Reduces negotiation time by up to 50% |

| Dedicated Sourcing Analyst Access | Accelerates RFQ processing and technical validation |

| Supply Chain Resilience Mapping | Identifies secondary sources to mitigate geopolitical or logistical risk |

By leveraging our Verified Pro List, procurement teams reduce time-to-contract from 12–16 weeks to under 6 weeks, while significantly lowering the risk of counterfeit materials, shipment delays, or compliance violations.

Call to Action: Secure Your Competitive Edge Today

In 2026, agility and reliability in critical minerals sourcing are no longer optional—they are strategic imperatives. Relying on unverified suppliers or fragmented sourcing channels exposes your organization to avoidable delays, cost overruns, and reputational risk.

Make the smart, efficient choice:

✅ Access SourcifyChina’s Verified Pro List and fast-track your next sourcing initiative with confidence.

✅ Connect directly with suppliers who meet international quality, ethical sourcing, and scalability standards.

✅ Optimize procurement ROI through reduced due diligence time and minimized supply chain risk.

Get Started Now – Contact Our Sourcing Support Team

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our senior sourcing consultants are available to provide a complimentary supplier match assessment and demonstrate how the Verified Pro List integrates seamlessly into your procurement workflow.

SourcifyChina – Your Trusted Partner in Strategic China Sourcing

Empowering Global Procurement with Verified, Transparent, and Scalable Supply Chains.

🧮 Landed Cost Calculator

Estimate your total import cost from China.