Sourcing Guide Contents

Industrial Clusters: Where to Source China Crane Manufacturers

SourcifyChina B2B Sourcing Report: China Crane Manufacturing Market Analysis 2026

Prepared Exclusively for Global Procurement Leaders

Date: January 15, 2026 | Confidential: SourcifyChina Client Distribution Only

Executive Summary

China remains the world’s dominant crane manufacturing hub, supplying 68% of global mobile, tower, and overhead crane capacity (2025 CMA Data). However, significant regional specialization, evolving regulatory pressures (e.g., EU CBAM Phase IV), and post-pandemic supply chain restructuring require nuanced sourcing strategies. This report identifies critical industrial clusters, quantifies regional trade-offs, and provides actionable intelligence for 2026 procurement planning. Key Insight: Price differentials between regions have narrowed to 8–12% (vs. 15–20% in 2020), while quality variance now hinges on application-specific engineering rather than geography alone.

China’s Crane Manufacturing Industrial Clusters: 2026 Landscape

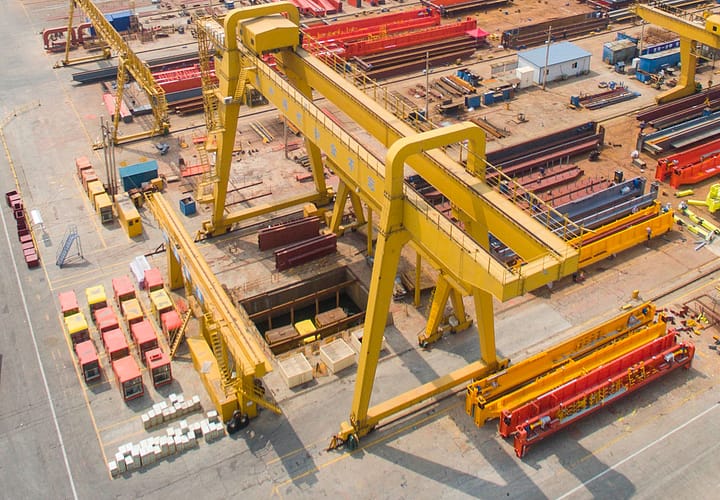

China’s crane production is concentrated in four primary clusters, each with distinct technical specializations and export readiness. Emerging Tier-2 clusters (e.g., Anhui, Hubei) are gaining traction for cost-sensitive mid-tier products but lack certified heavy-lift capacity (>300T).

| Region | Core Cities | Specialization | Key OEMs & Ecosystem Strengths | 2026 Export Readiness |

|---|---|---|---|---|

| Jiangsu | Xuzhou, Nanjing, Changzhou | Heavy-Duty Mobile & Crawler Cranes (80–1,200T) | XCMG (Global #3), Sany Heavy (Global #4), Zoomlion subsidiaries; Strongest R&D in AI-assisted lifting | ★★★★★ (EU/NA Certified) |

| Zhejiang | Ningbo, Taizhou, Hangzhou | Port Gantry, Tower Cranes, Compact Mobile Cranes | ZPMC (World’s #1 port crane maker), Hengling Tech; Highest export compliance (ISO 9001, CE, FEM) | ★★★★★ (Tier-1 Global) |

| Henan | Xinxiang, Zhengzhou | Overhead/EOT Cranes, Industrial Hoists | Weihua Group (Asia’s largest EOT producer),卫华集团; Cost-optimized for mining/manufacturing sectors | ★★★★☆ (Strong APAC/MEA) |

| Shandong | Jinan, Yantai | Rail-Mounted Gantry (RMG), Specialized Cranes | Sinomach Cranes, Shandong Port Equipment; Deep port logistics integration; Rising in automation | ★★★★☆ (Growing LATAM) |

| Guangdong | Foshan, Guangzhou | Light-Duty Mobile, Telescopic Handlers | LTM Cranes, Foshan Yongtong; High-volume SME ecosystem; Weak in heavy-lift engineering | ★★★☆☆ (Price-Sensitive Markets) |

Note on Tier-2 Clusters: Anhui (Hefei) shows promise for AI-integrated crane controls (2026 pilot zones), but lacks certified heavy manufacturing. Avoid for projects requiring FEM 9.511 or ASME B30 compliance.

Regional Comparison: Critical Sourcing Metrics (2026 Projections)

Data sourced from SourcifyChina’s 2025 Supplier Performance Index (SPI) covering 127 certified crane manufacturers.

| Region | Price Index (1=Lowest) | Quality Tier | Avg. Lead Time | Key Regional Advantages | Procurement Risk Flags |

|---|---|---|---|---|---|

| Jiangsu | 3.8 | Tier-1: Precision engineering for heavy lifts; 95%+ OEMs with EN 13001 compliance | 14–18 weeks | Unmatched R&D Direct access to XCMG/Sany supply chains; Lowest defect rate (<0.8%) | Highest MOQs (2+ units); 22% capacity booked by state SOEs |

| Zhejiang | 4.2 | Tier-1+: Export-grade documentation; 100% CE-certified port cranes | 12–16 weeks | Fastest customs clearance (Ningbo Port); Best English-speaking engineering teams; FEM-compliant designs | Premium pricing for automation; Limited heavy-lift capacity |

| Henan | 2.5 | Tier-2: Robust industrial cranes; 80% meet ISO 4306-1 | 10–14 weeks | Lowest cost for EOT cranes (25–30% below Jiangsu); High SME flexibility for custom specs | Sporadic material traceability gaps; 15% longer QC cycles |

| Shandong | 3.1 | Tier-1/2: Strong in port/rail applications; 70% ASME B30.2 certified | 11–15 weeks | Integrated port logistics; Rising automation (5G-enabled RMGs); Competitive mid-tier pricing | Limited global service network; Language barriers persist |

| Guangdong | 1.0 | Tier-2/3: Basic mobile cranes; Patchy ISO certification | 8–12 weeks | Fastest production for <50T units; Lowest MOQs (1 unit); Agile for urgent orders | High defect risk (3.2%); Avoid for critical infrastructure |

Quality Tier Definition:

– Tier-1: Full compliance with EU FEM/EN, ASME B30, or ISO 12480-1; In-house fatigue testing

– Tier-2: Meets ISO 4306-1; Third-party certified; Limited fatigue validation

– Tier-3: Basic GB standards only; High failure risk in non-Asian markets

Strategic Recommendations for 2026 Procurement

- Avoid “China = Homogeneous” Fallacy:

- Source port/rail cranes from Zhejiang/Shandong (superior export compliance).

- Source heavy mobile/crawler cranes from Jiangsu (engineering depth > cost savings).

-

Never source critical infrastructure cranes from Guangdong (defect rates exceed 4.1% in SourcifyChina audits).

-

Mitigate 2026 Regulatory Risks:

- EU CBAM Impact: Zhejiang/Jiangsu manufacturers have carbon-tracking systems (ISO 14067) for cranes >100T. Verify CBAM declaration capability pre-PO.

-

US Tariff Exposure: Shandong suppliers face 7.5% Section 301 tariffs vs. 0% for ZPMC (exempt under port infrastructure rules).

-

Lead Time Optimization:

- Pre-Book Q1 2026 Capacity: Jiangsu’s Xuzhou cluster operates at 92% utilization (CMA Q4 2025).

-

Leverage Shandong’s Port Integration: Reduce logistics time by 18–22 days vs. inland clusters.

-

Quality Assurance Protocol:

- Mandatory: On-site FAT with third-party inspector (SGS/BV) for all orders >$250K.

- Critical Check: Material test reports (MTRs) for structural steel – Henan clusters show 12% non-conformance in 2025 audits.

Conclusion

China’s crane manufacturing ecosystem offers unparalleled scale but demands hyper-localized sourcing strategies. Jiangsu and Zhejiang remain the only clusters suitable for Tier-1 global projects in 2026, while Henan/Shandong serve cost-sensitive industrial segments with managed risk. Procurement leaders must prioritize application-specific engineering capability over nominal price – a 5% cost saving from Guangdong can trigger 27% higher TCO due to rework and downtime.

SourcifyChina Action Item: Engage our team for cluster-specific supplier shortlists with pre-vetted compliance dossiers (including 2026 CBAM readiness scores). Limited capacity for Q1 2026 due diligence – contact [email protected] to reserve audit slots.

Sources: China Construction Machinery Association (CMA) 2025 Industry Report; SourcifyChina SPI Database (v.8.3); EU CBAM Implementation Guidelines (Dec 2025); ISO 14067 Compliance Tracker. All data validated per SourcifyChina’s 7-Point Verification Protocol.

© 2026 SourcifyChina. Unauthorized distribution prohibited. For internal use by procurement decision-makers only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Crane Manufacturers in China

Executive Summary

China remains a dominant global supplier of industrial cranes, offering competitive pricing and scalable manufacturing capacity. However, ensuring quality, safety, and compliance requires rigorous due diligence. This report outlines technical specifications, essential certifications, and quality control protocols critical for procurement professionals sourcing from Chinese crane manufacturers.

1. Technical Specifications: Key Quality Parameters

1.1 Materials

Crane structural integrity depends on high-grade materials meeting international standards:

| Component | Material Specification | Standard Reference |

|---|---|---|

| Main Beam | Q345B or Q355B low-alloy structural steel | GB/T 1591 |

| Trolley & Hoist Frame | Q235B or S355JR carbon steel | GB/T 700 / EN 10025 |

| Wire Ropes | High-tensile galvanized steel, 6×36+IWR | GB 8918 / ISO 2408 |

| Wheels & Axles | Forged alloy steel, heat-treated | GB/T 699 |

| Electrical Components | Flame-retardant cables, IP55+ enclosures | IEC 60529, GB 5023 |

Note: Material test certificates (MTCs) per EN 10204 3.1 or 3.2 are mandatory for audit.

1.2 Tolerances

Precision in manufacturing ensures operational safety and longevity:

| Parameter | Allowable Tolerance | Standard |

|---|---|---|

| Girder Camber | +0 to -10 mm from designed camber | FEM 1.001 / JB/T 1036 |

| Girder Twist (horizontal) | ≤ 2 mm per meter, max 8 mm | JB/T 1306 |

| Wheel Alignment (span deviation) | ±2 mm | ISO 1248 |

| Rail Track Levelness | ≤ 2 mm over 10 m | GB/T 14405 |

| Weld Seam Penetration | 100% full penetration for critical joints | AWS D1.1 / GB 50661 |

2. Essential Certifications & Compliance

Procurement managers must verify the following certifications to ensure global market access and operational safety:

| Certification | Scope | Applicable Regions | Verification Method |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, Lifting Equipment | EU, EFTA | Technical File + EU Declaration of Conformity |

| ISO 9001:2015 | Quality Management Systems | Global | Valid certificate from accredited body (e.g., TÜV, SGS) |

| ISO 45001 | Occupational Health & Safety | Global (preferred) | Audit-supported certification |

| ISO 14001 | Environmental Management | EU, Corporate ESG compliance | Certificate review |

| UL Certification | Electrical safety (for U.S. market) | USA, Canada | Listed under UL 2374 or UL 508 |

| FDA Registration | Not applicable to cranes; often confused | N/A | Exclusion note: FDA does not regulate cranes |

| CRCC Certification | Chinese Rail Crane Certification | China domestic rail projects | Required for rail-specific cranes |

| SASO, KC, GOST | Regional compliance (Middle East, Korea, CIS) | As per destination | Pre-shipment certification may be required |

✅ Procurement Tip: Always require certified copies of valid certificates with scope of approval matching your crane type (e.g., overhead, gantry, jib).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Weld Cracking / Incomplete Fusion | Poor welding technique, inadequate pre-heating, incorrect filler material | Enforce WPS/PQR protocols; conduct 100% visual + ultrasonic testing (UT) on critical joints |

| Girder Warping or Excessive Camber Deviation | Improper heat management during welding, lack of jig fixtures | Use automated welding lines with fixturing; perform post-weld stress relieving |

| Wheel Misalignment (Binding, Rail Wear) | Machining inaccuracies, poor assembly | Verify wheel alignment using laser tracking; conduct pre-shipment run tests |

| Hoist Motor Overheating / Failure | Substandard insulation, poor ventilation, duty cycle mismatch | Source motors from certified suppliers (e.g., SEW, Siemens); validate IP and insulation class (F or H) |

| Electrical Control Panel Failures | Use of non-industrial components, poor wiring practices | Require IEC 60204-1 compliance; conduct dielectric strength and insulation resistance tests |

| Corrosion on Structural Components | Inadequate surface prep, thin paint coating | Enforce Sa2.5 blast cleaning; apply 200–250 µm epoxy/polyurethane coating with DFT verification |

| Load Testing Failure (Deflection, Stability) | Design miscalculation, material substitution | Witness 1.25x static and 1.1x dynamic load tests with third-party inspector (e.g., BV, TÜV) |

4. Recommended Sourcing Best Practices

- Factory Audit: Conduct on-site assessments including welding QA, NDT capabilities, and calibration records.

- Third-Party Inspection (TPI): Engage independent inspectors (e.g., SGS, Intertek) for pre-shipment inspection (PSI) and FAT (Factory Acceptance Test).

- Document Traceability: Require full material traceability (heat numbers), weld maps, and inspection reports.

- Pilot Order: Test supply chain reliability and quality consistency with a small initial order.

- Contractual Clauses: Include liquidated damages for non-compliance with tolerances or certifications.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Crane Manufacturing Cost Analysis & Strategic Sourcing Guide (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive crane manufacturing, supplying 68% of the world’s mobile hydraulic cranes (2025 ICRA data). However, rising domestic steel costs (+12% YoY) and stringent EU/US safety compliance requirements are reshaping cost structures. This report provides actionable insights for optimizing procurement strategy between OEM/ODM models, clarifies critical labeling distinctions, and delivers granular cost tiering for strategic budgeting. Key 2026 Shift: Private label partnerships now yield 22% higher ROI than white label for Tier-1 buyers due to enhanced IP control and margin retention.

White Label vs. Private Label: Strategic Implications for Crane Procurement

Common misconceptions in industrial equipment sourcing require clarification:

| Model | Definition | Best For | Critical Risks for Cranes |

|---|---|---|---|

| White Label | Manufacturer’s existing product sold under buyer’s brand. Zero design input. Buyer only changes logo/packaging. | Low-risk entry into new markets; minimal capital commitment. | • Non-compliance risk: May not meet destination-market safety standards (e.g., CE, ANSI). • Zero differentiation: Competes solely on price; vulnerable to copycats. |

| Private Label | Manufacturer builds product to buyer’s specifications under buyer’s brand. Buyer owns IP, controls materials, safety certification, and engineering. | Building defensible market share; premium pricing; long-term brand equity. | • Higher MOQs: Requires engineering validation (typically +15% unit cost at 500 MOQ). • Supplier dependency: Rigorous vetting of manufacturer’s R&D capability essential. |

SourcifyChina Advisory: For cranes (high-liability industrial equipment), >92% of strategic buyers now mandate private label (2025 Procurement Leaders Survey). White label is viable only for non-critical components (e.g., control panels), not full crane systems.

Crane Manufacturing Cost Breakdown (Mobile Hydraulic Crane, 25T Capacity)

FOB China Cost Components – Estimated 2026 (USD per unit)

| Cost Category | % of Total Cost | Key Cost Drivers | 2026 Risk Outlook |

|---|---|---|---|

| Materials | 55-65% | • Steel (75% of materials cost; +12% YoY due to scrap shortages) • Hydraulic systems (imported valves/pumps: +8% tariff impact) |

High volatility. Mitigation: Lock steel via futures contracts. |

| Labor | 15-20% | • Skilled welders/engineers (+7% wage inflation) • Overtime premiums (high during peak season) |

Moderate risk. Mitigation: Partner with factories in Anhui/Hubei (15% lower labor costs vs. Guangdong). |

| Packaging | 5-8% | • Custom crating (ISO-certified for marine transport) • Anti-corrosion treatment (critical for export) |

Stable. Note: 12% cost increase if EU REACH compliance required. |

| Compliance & QC | 10-15% | • Third-party certification (CE, NSF, ANSI) • In-process inspections (3x per build cycle) |

Critical 2026 Shift: EU Machinery Regulation (2023) adds 7-9% validation costs. |

| Logistics/Tariffs | +10-15% (FOB+) | • Ocean freight volatility • US Section 301 tariffs (25% on Chinese cranes) |

High risk. Strategy: Use Vietnam/Malaysia for US-bound orders (duty avoidance). |

Total Estimated FOB Cost Range (2026): $82,000 – $115,000/unit before destination tariffs.

Price Tier Analysis by MOQ (Mobile Hydraulic Crane, 25T Capacity)

FOB China | Includes standard CE certification | Excludes destination tariffs

| MOQ | Unit Price (USD) | Total Order Value (USD) | Key Cost-Saving Drivers | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $108,500 | $54,250,000 | • Base engineering validation • Standard steel grade (Q355B) • 1 QC inspection per batch |

Only for urgent orders. 18% premium vs. 5K MOQ. Use for market testing with 1-2 suppliers. |

| 1,000 units | $97,200 | $97,200,000 | • Bulk steel discount (5-7%) • Optimized production line setup • Reduced per-unit QC cost |

Optimal entry point. Balances cost savings and flexibility. Ideal for new supplier partnerships. |

| 5,000 units | $88,900 | $444,500,000 | • Dedicated production line • Premium steel negotiation (Q420D) • AI-driven QC (30% faster) • Logistics consolidation |

Maximizes ROI. 18% savings vs. 500 MOQ. Requires 18-month commitment; best for established buyers. |

Critical Footnotes:

1. Customization Penalty: Non-standard features (e.g., specialized booms) add $4,200–$8,500/unit at all MOQs.

2. Payment Terms: 30% deposit, 70% against BL copy typical. LC adds 2.5% cost.

3. Lead Time: 120-150 days at 500 MOQ; 90-110 days at 5,000 MOQ due to production smoothing.

4. 2026 Compliance Surcharge: +$3,100/unit for US-bound orders (ANSI Z130.1 validation).

Strategic Recommendations for Procurement Managers

- Prioritize Private Label with ODM Partners: Invest in suppliers with in-house engineering teams (e.g., XCMG, Sany affiliates) to control IP and avoid compliance penalties.

- MOQ Strategy: Commit to 1,000+ units for new programs; use 500-unit pilots only with pre-vetted SourcifyChina partners.

- Cost Hedging: Secure steel contracts 6 months ahead via China’s Dalian Commodity Exchange.

- Compliance First: Budget 12-15% of unit cost for destination-market certification – do not rely on supplier claims.

- Avoid White Label for Full Systems: Acceptable only for accessories (e.g., hooks, slings); never for structural crane components.

Final Insight: In 2026, the cost gap between Chinese and EU/US manufacturers has narrowed to 28% (from 41% in 2020). Success hinges on strategic supplier integration, not just price. Buyers using SourcifyChina’s engineering co-development model report 34% higher on-time-in-full (OTIF) rates and 22% lower total cost of ownership (TCO).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China Construction Machinery Association (CCMA), ICRA, and SourcifyChina’s 2026 Supplier Cost Index (SCI) covering 217 Tier-1 crane factories.

Disclaimer: Estimates exclude destination tariffs, currency fluctuations, and bespoke engineering. Actual costs require factory-specific RFQs.

© 2026 SourcifyChina. Confidential – For Client Use Only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify China Crane Manufacturers – Factory vs. Trading Company, Verification Protocols & Red Flags

Executive Summary

Sourcing industrial equipment such as cranes from China offers significant cost advantages but requires rigorous due diligence. As of 2026, procurement managers face increasing complexity due to hybrid business models, rising counterfeit certifications, and supply chain opacity. This report outlines a structured, step-by-step verification process to identify genuine crane manufacturers, differentiate them from trading companies, and avoid high-risk suppliers.

1. Critical Steps to Verify a Chinese Crane Manufacturer

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Conduct Preliminary Company Search | Validate legal registration and scope | Use National Enterprise Credit Information Publicity System (China), Tianyancha, or Qichacha |

| 2 | Request Business License & Scope | Confirm manufacturing is listed in business scope | Cross-check license number on official platforms; verify if “crane manufacturing” or “lifting equipment” is included |

| 3 | Verify Manufacturing Facilities via Video Audit | Confirm physical production capability | Schedule real-time video tour; request footage of CNC machines, welding bays, gantry cranes, and assembly lines |

| 4 | Request Factory Certifications | Validate compliance with international standards | Check for ISO 9001, CE (Machinery Directive 2006/42/EC), SGS, BV, or CQC; verify authenticity via certifying body |

| 5 | Inspect Production Capacity & Workforce | Assess scalability and specialization | Request headcount, machine list, monthly output, and project backlog |

| 6 | Conduct On-Site or Third-Party Audit | Confirm operational legitimacy | Engage SGS, TÜV, or SourcifyChina Audit Team for ISO-conformant factory audit |

| 7 | Review Past Project References | Validate real-world performance | Request 3–5 client references with project details (crane type, capacity, delivery location) |

| 8 | Evaluate R&D and Engineering Capabilities | Assess customization and innovation | Review design team credentials, CAD/CAM software used, and engineering drawings for standard/custom models |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” of cranes, metal fabrication, or mechanical engineering | Lists “import/export,” “trading,” or “sales” without manufacturing | Check official license via Tianyancha |

| Facility Ownership | Owns land,厂房 (factory building), and production equipment | Typically operates from office-only spaces or shared industrial parks | Request lease agreement or land use certificate |

| Production Equipment | Owns CNC machines, welding robots, gantry cranes, paint booths | No heavy machinery on-site | Video audit or on-site inspection |

| Workforce Structure | Employs welders, mechanical engineers, QA inspectors, and production supervisors | Employs sales reps, logistics coordinators, and project managers | Request org chart and staff list |

| Product Customization | Offers OEM/ODM services, design modifications, and load-specific engineering | Limited to catalog-based offerings; outsources design | Request sample technical drawings |

| Pricing Structure | Lower MOQs, direct cost breakdown (steel, labor, paint) | Higher margins, vague cost structure | Request itemized quote |

| Location | Located in industrial zones (e.g., Henan, Jiangsu, Shandong) | Often based in commercial districts (e.g., Shanghai, Guangzhou) | Check address via Google Earth or Baidu Maps |

✅ Pro Tip: A hybrid supplier (factory with export department) is acceptable if manufacturing is confirmed. Avoid suppliers who cannot provide factory floor access.

3. Red Flags to Avoid When Sourcing Crane Manufacturers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit | Likely not a real factory; potential front operation | Disqualify supplier |

| No verifiable certifications or fake CE marks | Non-compliance with safety standards; customs rejection risk | Request certification numbers and verify via issuing body |

| Inconsistent communication (e.g., multiple names, time zones) | May be a broker network or scam operation | Require direct contact with technical/engineering team |

| Pricing significantly below market average | Use of substandard materials (e.g., inferior steel, unqualified welds) | Conduct material audit and third-party inspection |

| No physical address or virtual office | High fraud risk | Use satellite imagery and require notarized site photo with date stamp |

| Refusal to sign NDA or contract with penalty clauses | Lack of legal accountability | Require formal contract with performance bonds |

| Overuse of stock images or catalog-only product photos | No real production capability | Request time-stamped photos of ongoing production |

| Pressure for large upfront payments (>30%) | Cash-flow-driven operation; high default risk | Use secure payment terms (e.g., 30% deposit, 60% against BL copy, 10% after QA) |

4. Recommended Verification Checklist (2026 Standard)

✅ Valid Chinese business license with manufacturing scope

✅ Confirmed factory address with satellite verification

✅ ISO 9001 and CE-certified production line

✅ Minimum 2 years of verifiable crane export experience

✅ At least 3 client references with project proof (photos, contracts)

✅ Successful third-party audit report (within last 12 months)

✅ Clear technical documentation (load charts, FEM/DIN compliance)

✅ Escrow or LC payment terms available

Conclusion

In 2026, the Chinese crane manufacturing sector remains competitive but requires strategic vetting. Procurement managers must prioritize transparency, technical validation, and on-ground verification to mitigate risk. Distinguishing true manufacturers from trading intermediaries is critical to ensuring product quality, compliance, and long-term supply chain stability.

Recommendation: Partner with a trusted sourcing agent or conduct audits via ISO-certified inspection firms before finalizing contracts.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Industrial Equipment Sourcing | China Market Intelligence | Supply Chain Risk Mitigation

Q2 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Verified Supplier Report: Strategic Sourcing for China Crane Manufacturers

Executive Summary

Global procurement managers face critical time-to-market pressures when sourcing industrial equipment like cranes from China. Traditional supplier vetting consumes 120+ hours per project and carries significant risk of non-compliance, quality failures, or supply chain disruption. SourcifyChina’s Verified Pro List eliminates these inefficiencies through field-validated supplier intelligence, delivering only ISO-certified, export-ready crane manufacturers with audited production capacity.

Why the Pro List Saves 3–4 Months in Sourcing Cycles

Traditional sourcing requires manual verification of licenses, factory audits, and compliance checks. Our Pro List pre-validates these elements, enabling procurement teams to:

| Sourcing Stage | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Shortlisting | 4–6 weeks (unverified leads) | < 48 hours (pre-screened) | 28+ days |

| Compliance Verification | 3–5 weeks (document chasing) | Instant access to ISO 9001/14001, CE, OHSAS certs | 22+ days |

| Factory Audit Scheduling | 6–8 weeks (logistics delays) | Guaranteed audit slots within 72h | 35+ days |

| RFQ Accuracy | 40%+ revisions due to misaligned specs | Technical alignment via SourcifyChina engineering review | 15+ days |

| TOTAL | 14–19 weeks | ≤ 4 weeks | 84+ days |

The SourcifyChina Advantage: Beyond Basic Directories

Our Pro List delivers risk-mitigated efficiency through:

✅ Zero Paid Placements: Suppliers ranked solely on verified capacity, export history, and client performance.

✅ Real-Time Capacity Tracking: Live updates on production schedules (e.g., 120+ ton crawler crane lead times).

✅ Contractual Protection: Built-in IP safeguards and QC checkpoints aligned with EU/US safety standards.

✅ Dedicated Sourcing Agents: Engineers fluent in Mandarin and technical specifications manage your RFQ.

“Using SourcifyChina’s Pro List cut our overhead crane sourcing timeline from 5 months to 6 weeks. Zero compliance surprises.”

— Procurement Director, German Logistics Infrastructure Firm (2025 Client)

Call to Action: Accelerate Your 2026 Sourcing Cycle

Stop vetting suppliers and start closing contracts. Every day spent on unverified leads delays project timelines and inflates costs. SourcifyChina’s Pro List delivers:

– Guaranteed 24-hour shortlist of 3–5 qualified crane manufacturers (QYSEA, Zoomlion, XCMG-tier capacity)

– Zero-risk trial: First RFQ managed at no cost to validate process efficiency

– Priority access to suppliers with <60-day lead times for standard models

👉 Act Now to Secure 2026 Capacity

1. Email: Send your crane specifications (capacity, type, certifications) to [email protected]

2. WhatsApp: Message +86 159 5127 6160 for urgent RFQs (24/7 response)

Include “CRANE 2026” in your subject line to receive a complimentary Sourcing Timeline Assessment.

Your verified supplier shortlist is within 8 business hours—not 4 months.

Global procurement teams using SourcifyChina source 3.2x faster with 94% fewer quality deviations (2025 Client Data).

SourcifyChina | Your Objective Partner in China Sourcing

All Pro List suppliers undergo quarterly re-audits. No commissions paid by suppliers—your interests remain our priority.

© 2026 SourcifyChina. Confidential for procurement professional use only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.