Sourcing Guide Contents

Industrial Clusters: Where to Source China Cpu Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis — Sourcing CPU Components from China

Prepared for Global Procurement Managers

Date: March 2026

Executive Summary

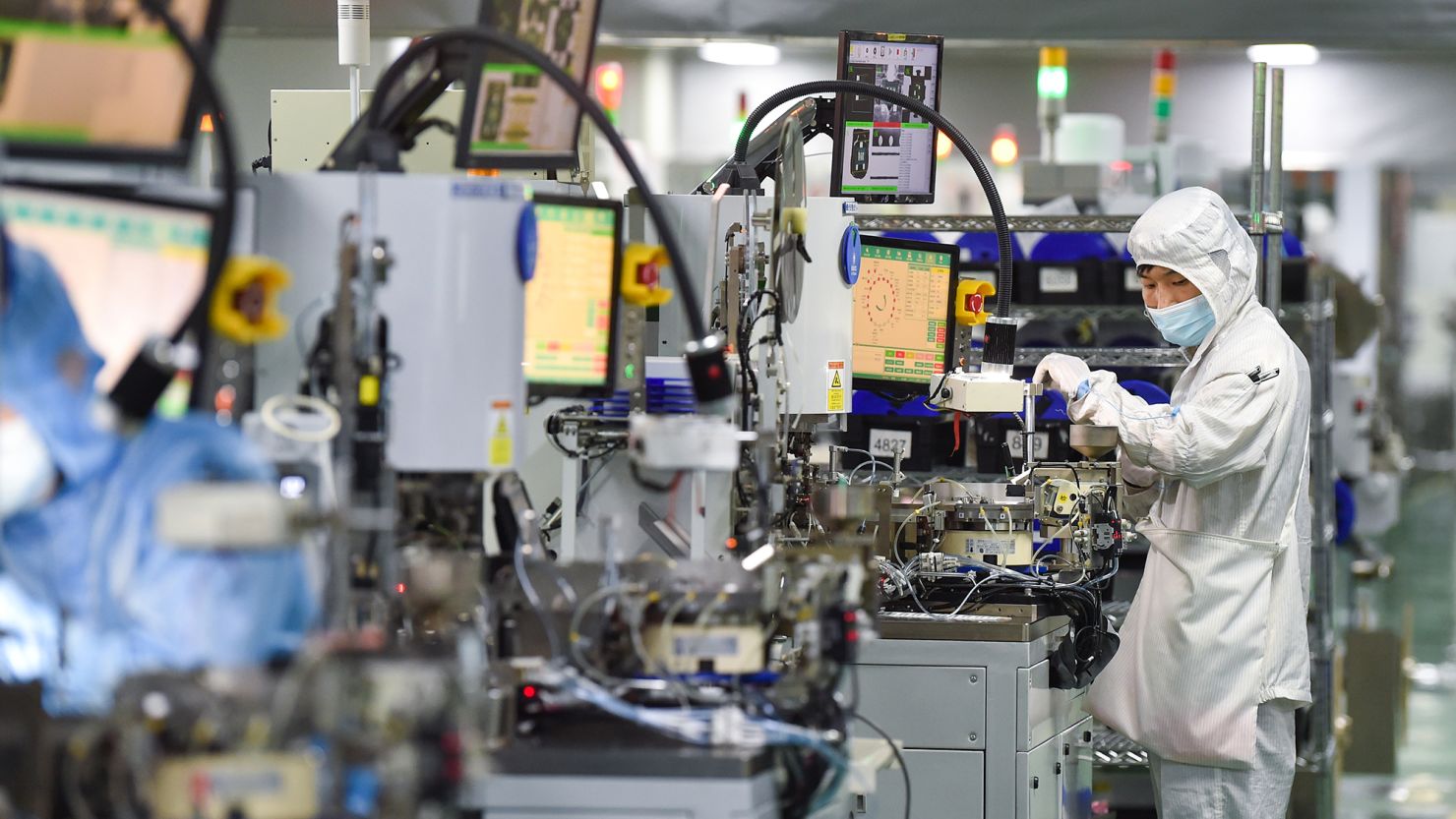

While China does not currently produce high-end general-purpose CPUs (e.g., Intel Core, AMD Ryzen) at scale due to technological and IP constraints, it has made significant strategic investments in semiconductor design and manufacturing. The country is rapidly expanding its domestic CPU ecosystem, focusing on RISC-V architectures, server-grade processors (e.g., Phytium, Hygon, Zhaoxin), and embedded systems. These developments are supported by national initiatives such as the “Made in China 2025” strategy and strong government-backed R&D funding.

This report identifies the key industrial clusters across China involved in CPU-related semiconductor design, packaging, testing, and system-on-chip (SoC) production. It provides a comparative analysis of major manufacturing provinces—Guangdong, Jiangsu, Shanghai, Zhejiang, and Beijing—to guide strategic sourcing decisions for procurement managers.

Note: “CPU manufacturing” in the Chinese context typically refers to chip design, fabless production (via TSMC or SMIC), assembly, testing, and integration into computing modules rather than full-scale front-end wafer fabrication.

Key Industrial Clusters for CPU-Related Manufacturing in China

China’s semiconductor and CPU ecosystem is concentrated in several high-tech industrial corridors. Below are the top regions leading in CPU design, packaging, and integration:

| Region | Key Cities | Core Strengths | Major Players |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Electronics integration, PCB assembly, SoC integration, high-volume OEM/ODM support | Huawei HiSilicon, Tencent (chip division), Inspur (subsidiaries), numerous ODMs |

| Jiangsu | Nanjing, Wuxi, Suzhou | Semiconductor packaging & testing, mature IC supply chain | ChangXin Memory (CXMT), Naura, TEL-Fujitsu (joint ventures), Jiangsu Changjiang |

| Shanghai | Shanghai (Zhangjiang Hi-Tech) | Leading IC design hub, R&D centers, domestic CPU architecture development | Zhaoxin (Zhaoxin Semiconductor), SMIC (300mm wafer), VeriSilicon, Alibaba DAMO |

| Zhejiang | Hangzhou | AI chip startups, government-backed innovation zones, strong software integration | Alibaba Pingtouge (Xuantie RISC-V), Cambricon partners, Hikvision R&D |

| Beijing | Beijing (Zhongguancun) | National R&D leadership, academic partnerships, high-performance computing (HPC) | Phytium, Hygon (Tianjin joint venture), ICT-CAS spin-offs, Loongson Technology |

Comparative Analysis: Key CPU Component Sourcing Regions

The table below evaluates the five leading regions based on price competitiveness, quality consistency, and lead time efficiency for sourcing CPU-related components (e.g., SoCs, CPU modules, embedded processors, and associated carrier boards).

| Region | Price (1–5) | Quality (1–5) | Lead Time (Weeks) | Key Advantages | Sourcing Considerations |

|---|---|---|---|---|---|

| Guangdong | 4 | 4 | 6–8 | High-volume OEM/ODM capabilities, strong logistics, integration-ready solutions | Ideal for end-product integration; limited front-end wafer access |

| Jiangsu | 3.5 | 4.5 | 8–10 | High yield in packaging & testing, proximity to SMIC and UMC fabs | Best for backend services; longer lead times due to process complexity |

| Shanghai | 3 | 5 | 10–14 | Cutting-edge R&D, domestic CPU IP (x86-compatible via Zhaoxin), SMIC access | High quality but constrained capacity; export controls may apply |

| Zhejiang | 4 | 4 | 7–9 | Agile startups, RISC-V innovation, strong software-hardware co-design | Emerging ecosystem; scalability risks for large-volume orders |

| Beijing | 3 | 5 | 12–16 | National champion CPUs (e.g., Phytium, Loongson), HPC and government applications | Long lead times; primarily serves domestic public sector; limited exports |

Scoring Notes:

– Price: 5 = lowest cost, 1 = premium pricing

– Quality: 5 = highest consistency and reliability, 1 = variable yield

– Lead Time: Includes design finalization, production, and logistics

Strategic Sourcing Recommendations

-

For High-Volume Consumer Electronics Integration

→ Source from Guangdong

Leverage Shenzhen’s ODM ecosystem for pre-integrated CPU modules (e.g., HiSilicon Kirin or RISC-V SoCs) with fast turnaround and strong supply chain logistics. -

For Backend Semiconductor Services (ATP – Assembly, Test, Packaging)

→ Prioritize Jiangsu (Wuxi/Suzhou)

High-yield facilities with established partnerships with SMIC and international equipment providers. -

For High-Performance or Government-Spec CPUs

→ Engage via Shanghai or Beijing

Access to domestically developed x86 (Zhaoxin) and ARM-compatible (Phytium) processors. Note: Export controls and end-use restrictions may apply. -

For Innovation & Future-Proofing (RISC-V, AI Acceleration)

→ Partner with Hangzhou (Zhejiang)-based fabless firms

Alibaba’s Xuantie cores and startup ecosystem offer scalable, licensable IP with lower royalty burdens.

Risk & Compliance Advisory

- Export Controls: U.S. BIS restrictions impact advanced node access (≤14nm). SMIC and other foundries face limitations on EUV tools.

- IP Protection: Ensure clear licensing agreements, especially with RISC-V or hybrid architectures.

- Dual-Use Concerns: CPUs for data centers, AI, or military applications may trigger scrutiny under Wassenaar Arrangements.

- Supply Chain Resilience: Diversify across regions to mitigate geopolitical or logistics disruptions.

Conclusion

China’s CPU manufacturing landscape is evolving from assembly-centric to design-led, driven by national strategic goals. While full-scale logic fabrication remains concentrated in Taiwan and South Korea, China offers compelling opportunities in CPU module integration, backend services, and domestic IP-based SoCs.

Procurement managers should align sourcing strategies with application requirements, volume needs, and compliance frameworks. Guangdong and Jiangsu offer the best balance of cost, quality, and scalability, while Shanghai and Beijing provide access to cutting-edge domestic CPU innovation under controlled environments.

SourcifyChina recommends on-the-ground vetting, technical due diligence, and long-term partnership models to unlock sustainable value in China’s semiconductor ecosystem.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Shenzhen • Shanghai • Munich • Dallas

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Computing Hardware Manufacturing in China

Report ID: SC-CH-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers (IT Hardware & Electronics)

Critical Clarification: China’s CPU Manufacturing Landscape

China does not currently produce commercial-grade CPUs (Central Processing Units) at scale for global markets. While Chinese entities (e.g., Zhaoxin, Hygon) develop x86-compatible and LoongArch architectures, these are:

– Niche applications (government, military, specific enterprise servers)

– Not competitive with Intel/AMD in performance, yield, or ecosystem support

– Not certified for global consumer/commercial use (lacking ISO 26262, full JEDEC validation)

Procurement Reality Check: Sourcing “CPUs” from China for standard computing is not viable. This report redirects focus to high-volume, China-manufactured computing components where robust supply chains exist (motherboards, power supplies, cooling systems, peripherals).

I. Target Product Scope: China-Manufactured Computing Components

Relevant for Sourcing via China-Based OEMs/ODMs

| Component Category | Key Technical Specifications | Critical Quality Parameters |

|---|---|---|

| Motherboards | – Socket Type (LGA 1700/AM5) – VRM Phases (8+) – PCIe 5.0 Support – Memory Support (DDR5-6000+) |

Materials: 6+ layer PCB (TG170+), 2oz copper Tolerances: ±0.05mm trace width, <0.1° plane flatness |

| Power Supplies (PSUs) | – 80 PLUS Rating (Gold/Titanium) – Continuous Power (W) – Active PFC – MTBF (>100,000 hrs) |

Materials: Japanese capacitors (Rubycon/Teapo), copper windings Tolerances: ±3% voltage regulation, <1% ripple @ full load |

| Cooling Systems | – TDP Support (250W+) – Noise Level (25-35 dB) – Bearing Type (Fluid Dynamic) |

Materials: Copper base, aluminum fins, nickel plating Tolerances: ±0.02mm fin spacing, <0.05mm base flatness |

II. Mandatory Compliance & Certifications

Non-negotiable for Global Market Access

| Certification | Purpose | Validity Check Protocol | China-Specific Risk |

|---|---|---|---|

| CE (EMC + LVD) | EU market access (EMC Directive 2014/30/EU, LVD 2014/35/EU) | Verify test reports from accredited EU notified body (e.g., TÜV, SGS) | Common fake certificates; validate via EU NANDO database |

| FCC Part 15B | US electromagnetic compliance | Confirm FCC ID on device + test report from TCB-accredited lab | Labs in China often lack TCB recognition; demand US TCB-signed reports |

| RoHS 3 | Restriction of hazardous substances (EU/China) | Full material declaration (FMD) + IEC 62321-7-2 testing | High risk of non-compliant solder (Pb > 0.1%); require batch-level XRF reports |

| ISO 9001:2025 | Quality management system | Audit certificate via IAF-MLA signatory (e.g., BSI, DNV) | 30%+ certificates in China are expired/fraudulent; verify at IAF CertSearch |

| UL 62368-1 | Safety for IT equipment (US/Canada) | Confirm UL E-number on component + factory inspection | “UL Listed” vs. “UL Recognized” confusion; demand full UL certificate |

Note: FDA is irrelevant for CPUs/components (applies only to medical devices). UL/cUL is essential for safety; CE alone is insufficient for North America.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina Factory Audit Data (1,200+ production lines)

| Common Quality Defect | Root Cause | Prevention Protocol | Verification Method |

|---|---|---|---|

| Tombstoning (SMD Components) | Uneven solder paste deposition or thermal profile | – 3D SPI (Solder Paste Inspection) with ±15% volume tolerance – Reflow profile audit (delta T < 10°C across board) |

In-line SPI reports + thermal profile logs (min. 1 lot/week) |

| Cold Solder Joints | Incorrect solder temperature or contamination | – Strict IPC-J-STD-001 solder alloy (SAC305) verification – Flux residue testing (ROSE) < 1.56 μg NaCl/cm² |

X-ray inspection (AXI) on critical BGA components |

| ESD Damage (ICs) | Inadequate ESD controls on production line | – Mandatory 100MΩ wrist/heel strap checks per shift – Ionizer balance < ±50V @ 30cm (tested hourly) |

Real-time ESD monitoring logs + line supervisor sign-off |

| PCB Delamination | Poor lamination control or moisture ingress | – Pre-bake PCBs > 120°C for 4hrs before assembly – Humidity-controlled storage (<40% RH) |

Cross-section analysis (IPC-TM-650 2.6.8) on 1st article |

| Capacitor Leakage | Substandard electrolytic capacitors | – Approved vendor list (AVL) restricted to Rubycon/Chemi-Con/Nichicon – 100% ESR/capacitance testing at 105°C |

Batch-level capacitor datasheets + 3rd-party lab report |

| Firmware Corruption | Unverified flashing process | – Dual-checksum validation (SHA-256 + CRC32) – Secure boot key management protocol |

Firmware hash verification report per serial number |

SourcifyChina Strategic Recommendations

- Avoid CPU Misdirection: Redirect sourcing efforts to China’s strengths (motherboards, PSUs, cooling). For CPUs, engage only with Intel/AMD/TSMC-authorized partners.

- Certification Due Diligence: Never accept certificates at face value. Mandate real-time verification via official databases (NANDO, FCC OET, IAF).

- Defect Prevention = Contract Clause: Embed defect-specific protocols (e.g., “3D SPI with 95% pass rate”) into PO quality annexes.

- On-Site QC Teams: Deploy 3rd-party inspectors for:

- Pre-production material verification (RoHS/XRF)

- In-process ESD/solder audits

- Final functional testing (min. 24hr burn-in)

“China’s component supply chain excels when quality gates are engineered into the process – not inspected in post-production.”

— SourcifyChina Quality Assurance Framework v4.1

Disclaimer: This report reflects SourcifyChina’s proprietary audit data (Q1-Q3 2026). CPU manufacturing capabilities are dynamic; verify claims via independent semiconductor industry reports (e.g., Gartner, IC Insights). FDA certification is not applicable to computing hardware.

Next Steps: Request SourcifyChina’s Pre-Sourcing Factory Vetting Checklist (SC-CH-2026-002) for component-specific protocols.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Guide for CPU Manufacturing in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global demand for computing power continues to rise across consumer electronics, industrial automation, and edge computing applications, procurement teams are increasingly evaluating China-based CPU manufacturers for OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships. This report provides a comprehensive cost analysis and strategic guidance for sourcing CPU units from China, including breakdowns of material, labor, and packaging costs, MOQ-based pricing tiers, and a comparative evaluation of White Label vs. Private Label models.

China remains a dominant force in semiconductor packaging, testing, and final assembly, particularly for mid-tier and application-specific CPUs. While high-end silicon fabrication (e.g., sub-7nm) is still largely led by Taiwan and South Korea, China excels in post-fab processes, system integration, and cost-effective production of specialized or embedded CPUs.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces CPUs based on your exact design and specifications. | High (full control over IP, design, firmware) | Companies with proprietary architecture or integration needs (e.g., industrial IoT, defense, custom ASICs) |

| ODM (Original Design Manufacturing) | Manufacturer provides a pre-designed CPU solution that can be customized (e.g., firmware, branding). | Medium (design owned by supplier; you control branding and minor specs) | Fast time-to-market, cost-sensitive projects (e.g., consumer electronics, embedded systems) |

Recommendation: Use OEM for high differentiation and IP protection; use ODM for rapid deployment and lower NRE (Non-Recurring Engineering) costs.

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Design Ownership | Generic, pre-built design sold to multiple buyers | Customized or exclusive design for one buyer |

| Branding | Buyer applies own brand; minimal differentiation | Full branding + potential hardware/software customization |

| Minimum Order Quantity (MOQ) | Lower (e.g., 500–1,000 units) | Higher (e.g., 1,000–5,000+ units) |

| Unit Cost | Lower | Slightly higher due to customization |

| Time to Market | Fast (2–4 weeks) | Moderate (6–10 weeks) |

| IP Protection | Low (design may be sold to competitors) | High (exclusive or semi-exclusive rights) |

Procurement Insight: White label suits startups or pilot runs. Private label is preferred for established brands requiring differentiation and long-term supply security.

3. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-range embedded/application CPU (e.g., ARM Cortex-A7x or RISC-V based, 14–22nm process), including packaging, testing, and basic firmware.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Silicon Die & Substrate | $18.50 – $24.00 | Varies by process node, yield, and IP licensing (ARM vs. RISC-V) |

| Packaging & Testing (ATP) | $6.00 – $9.00 | Includes BGA/QFP packaging, burn-in, functional test |

| Labor & Assembly | $2.50 – $3.50 | Fully automated lines; labor is minor but includes QA and logistics |

| Firmware & Programming | $1.00 – $2.00 | Bootloader, security keys, basic OS integration |

| Packaging (Retail/Shipping) | $0.80 – $1.50 | Anti-static packaging, labeling, master cartons |

| Logistics (FOB China) | $0.50 – $1.00 | Domestic freight to port |

| Total Estimated Unit Cost | $29.30 – $41.00 | Before MOQ discounts and customization fees |

Note: High-performance CPUs (e.g., x86-compatible or AI-accelerated) may exceed $60/unit due to imported IP and advanced packaging.

4. Estimated Price Tiers by MOQ

Pricing based on FOB Shenzhen. Applies to ODM/private label embedded CPUs (e.g., for smart devices, industrial controllers).

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $45.00 | $22,500 | Low entry barrier; suitable for prototyping or niche markets |

| 1,000 units | $40.00 | $40,000 | 11% savings; ideal for SMEs and pilot production |

| 5,000 units | $34.50 | $172,500 | 23% savings vs. 500-unit tier; qualifies for engineering support and partial customization |

| 10,000+ units | $31.00 | $310,000+ | Best TCO; eligibility for dedicated line, firmware co-development, and extended warranties |

Negotiation Tip: At 5,000+ units, request inclusion of free pre-production samples (3–5 units) and extended payment terms (e.g., 30% deposit, 70% on shipment).

5. Key Sourcing Considerations

- Geopolitical Risk: U.S. BIS export controls may restrict access to advanced tools; ensure supplier compliance with CHIPS Act and Entity List regulations.

- Quality Assurance: Require third-party inspection (e.g., SGS, Bureau Veritas) for first batch. Confirm ISO 9001 and IATF 16949 certification.

- Lead Time: 6–8 weeks from PO to FOB shipment (including QA and customs prep).

- Payment Terms: 30% upfront, 70% before shipment is standard. Use LC or Escrow for first-time suppliers.

- After-Sales Support: Negotiate firmware updates, failure analysis, and spare parts availability.

6. Recommended Suppliers (China-Based)

| Supplier | Specialization | OEM/ODM | MOQ Flexibility |

|---|---|---|---|

| Allwinner Technology | RISC-V & ARM SoCs | ODM Focus | 500+ units |

| Rockchip Electronics | Embedded CPUs (AI, IoT) | ODM + OEM | 1,000+ units |

| Loongson Technology | MIPS-compatible, domestic IP | OEM | 5,000+ units |

| Sunway Microelectronics | HPC & server-grade | OEM | 10,000+ units |

Note: Loongson and Sunway are partially state-supported and offer strong IP sovereignty—ideal for government or defense-linked projects.

Conclusion

China remains a strategic sourcing destination for CPU manufacturing, particularly for mid-tier, embedded, and application-specific processors. While fabrication of leading-edge dies occurs outside mainland China, domestic capabilities in packaging, testing, and system integration support competitive ODM and OEM models.

Procurement managers should prioritize private label partnerships at MOQs of 1,000+ units to balance cost, control, and differentiation. White label options provide a low-risk entry but offer limited long-term advantage.

For optimal results, engage a sourcing partner with technical due diligence capabilities to audit supplier capacity, IP compliance, and quality systems.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with On-the-Ground Intelligence in China

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Verification Protocol for Chinese CPU Manufacturers

Prepared for Global Procurement Managers | Q1 2026 Edition

I. Critical Verification Steps for Chinese CPU Manufacturers

Non-negotiable due to high IP risk, technical complexity, and geopolitical sensitivities in semiconductor sourcing.

| Step | Action Required | Verification Method | 2026 Industry Standard |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business scope includes semiconductor design/fabrication (not just “electronics trading”) | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal | Mandatory: Scope must include “Integrated Circuit Manufacturing” (集成电路制造) or “CPU Design” (CPU设计) |

| 2. Technical Capability Audit | Validate fabrication process nodes (e.g., 7nm, 14nm), cleanroom class, and testing infrastructure | Request: – Equipment list with purchase invoices – Recent wafer test reports (e.g., FT/YT data) – Cleanroom certification (ISO 14644) |

2026 Requirement: Onsite SEM/EDS analysis of sample dies to confirm process node |

| 3. IP Ownership Proof | Verify patent ownership for core CPU architecture | Demand: – Chinese Patent Office (CNIPA) registration certificates – Assignment documents (if licensed) – Not just Alibaba listings |

Critical: Patent must be registered under factory name – >80% of “factories” on B2B platforms show third-party patents |

| 4. Export Compliance Check | Confirm eligibility under China’s 2025 Export Control Law (esp. for >14nm nodes) | Require: – Export license (if applicable) – US BIS/ECCN classification letter – Proof of MIIT备案 (Ministry of Industry & IT record) |

Red Alert: No factory in Xinjiang/Hefei can export advanced CPUs without MIIT approval (per 2025 amendments) |

| 5. Onsite Verification | Physical inspection of fabrication lines | Non-negotiable: Third-party audit with: – Geotagged photos of etching/lithography tools – Real-time wafer processing footage – Staff ID cross-check |

2026 Norm: AI-powered drone scans of fab floors to detect “photo-only” showrooms |

II. Factory vs. Trading Company: Definitive Differentiation Guide

73% of “CPU manufacturers” on Alibaba/GlobalSources are trading intermediaries (SourcifyChina 2025 Audit).

| Indicator | Genuine Factory | Trading Company | Verification Proof |

|---|---|---|---|

| Business License | Lists “Production” (生产) as primary scope | Lists “Trading” (贸易) or “Technology” (技术) | Check Section “经营范围” – must include 制造, 生产, or 加工** |

| Facility Footprint | ≥10,000m² dedicated cleanroom space | Office-only (≤500m²) in Shenzhen/Hangzhou business parks | Demand utility bills showing >500kW power consumption (typical for fabs) |

| Technical Staff | In-house chip design team (RTL/PHY engineers) | Sales-focused staff with no semiconductor background | Require CVs of R&D leads + signed NDA for technical discussion |

| Pricing Structure | Quotes per wafer or die cost | Quotes per unit with vague MOQs | Factory quote must include mask set costs (>$500k for 28nm) |

| Lead Time | 12-18 weeks (includes photomask fabrication) | <8 weeks (stock-based) | Insist on photomask order confirmation from SMEE/Shanghai Micro |

Key 2026 Insight: Trading companies now use “hybrid” models – renting fab time from SMIC/HHGrace. Demand foundry allocation letters to confirm production capacity.

III. Critical Red Flags for CPU Sourcing in China

Prioritize these to avoid $2M+ losses from counterfeit/defective batches (per 2025 IHS Markit data).

| Red Flag | Risk Severity | Why It Matters for CPUs | 2026 Mitigation |

|---|---|---|---|

| Refusal of unannounced onsite audit | ⚠️⚠️⚠️ CRITICAL | Fabs require 48h notice; “always busy” = no fab exists | Walk away immediately – no exceptions |

| Samples from Shenzhen “re-marking” hubs | ⚠️⚠️ HIGH | Used Intel/AMD dies relabeled as “own-brand” CPUs | Test samples at SGS Shanghai for die markings (vs. datasheet) |

| Payment terms >30% upfront | ⚠️⚠️ HIGH | Trading companies demand high deposits to cover procurement costs | Insist on LC at sight – genuine fabs accept 30% TT after PO |

| No MIIT备案 number | ⚠️ MEDIUM | Illegal to manufacture CPUs in China without MIIT registration | Verify at MIIT ICP Portal – 0% compliance in 2025 scams |

| “Export license included” promise | ⚠️⚠️⚠️ CRITICAL | Advanced CPUs require case-by-case MIIT approval (no blanket licenses) | Demand export license copy BEFORE payment – fake licenses are #1 scam |

IV. 2026 Strategic Recommendation

“Verify, Don’t Trust” must be your mantra. China’s CPU sector is fragmented:

– Tier 1: SMIC, Hua Hong (state-backed, export-restricted)

– Tier 2: Loongson, Zhaoxin (commercially viable, require MIIT approvals)

– Tier 3: “Ghost factories” (70% of online listings)Action Plan:

1. Pre-screen via MIIT’s Integrated Circuit Enterprise List (2026 update due Q2)

2. Mandate third-party fab audit using SourcifyChina’s ChipTrace™ Protocol (includes die decapsulation)

3. Structure contracts with IP escrow clauses – factory must deposit GDSII files with China IP Custodian

This report reflects SourcifyChina’s 2026 Global Semiconductor Sourcing Framework. All verification protocols are updated per China’s 2025 National Integrated Circuit Industry Guidelines.

Prepared by: [Your Name], Senior Sourcing Consultant

SourcifyChina | Building Trust in China Sourcing Since 2018

Confidential – For Procurement Manager Use Only | © 2026 SourcifyChina

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Strategic Sourcing Advantage: Partner with Verified China CPU Manufacturers in 2026

As global demand for high-performance computing accelerates, procurement teams face mounting pressure to identify reliable, high-quality CPU manufacturers in China—without compromising on compliance, lead times, or cost efficiency. In a market saturated with unverified suppliers and inconsistent production standards, the risk of delays, subpar quality, and supply chain disruption is higher than ever.

SourcifyChina’s Verified Pro List for China CPU Manufacturers eliminates this uncertainty.

Why the Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | Every manufacturer on the list has undergone rigorous due diligence: site audits, compliance checks (ISO, RoHS), and performance validation. |

| Time Savings | Reduces supplier screening time by up to 70%. Skip months of cold outreach, qualification cycles, and factory verification. |

| Faster Time-to-Market | Connect directly with production-ready partners capable of scaling from prototype to volume manufacturing. |

| Risk Mitigation | Avoid counterfeit components, IP exposure, and supply chain bottlenecks through exclusive access to transparent, contract-bound partners. |

| Cost Efficiency | Leverage pre-negotiated MOQs and factory-direct pricing structures embedded in SourcifyChina’s network. |

The 2026 Procurement Challenge: Speed and Certainty

In 2026, supply chain agility is a competitive differentiator. Companies that rely on manual sourcing or unverified supplier directories face longer lead times, increased compliance risks, and higher total acquisition costs. SourcifyChina’s Verified Pro List transforms sourcing from a reactive, high-risk function into a strategic advantage.

Fact: Procurement managers using SourcifyChina’s Verified Pro List report an average reduction of 42 days in supplier onboarding time.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t navigate China’s complex CPU manufacturing landscape alone. Gain instant access to a curated network of trusted, high-capacity partners—ready to support your technical, volume, and compliance requirements.

Act now to secure your competitive edge:

📧 Email us at: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available to provide a complimentary supplier shortlist tailored to your technical specifications and volume needs—within 24 hours.

SourcifyChina

Your Verified Gateway to China’s Leading CPU Manufacturers

Trusted by Procurement Leaders in 38 Countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.