Sourcing Guide Contents

Industrial Clusters: Where to Source China Couplings Forgings Factory

SourcifyChina Sourcing Intelligence Report: Forged Couplings Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-FC-2026-001

Executive Summary

China remains the dominant global hub for forged coupling production, supplying 65% of the world’s volume (2025 SMM data). Rising automation, consolidation of Tier-2 suppliers, and stricter environmental compliance (aligned with China’s 2025 Carbon Neutrality Framework) are reshaping the landscape. While coastal clusters retain quality leadership, inland provinces offer cost advantages with improving capabilities. Strategic sourcing requires granular regional analysis to balance cost, quality, and supply chain resilience.

Key Industrial Clusters for Forged Couplings in China

Forged couplings (primarily flange, grid, and gear couplings for industrial machinery, energy, and marine applications) concentrate in four core regions. Note: “Couplings forgings factory” is interpreted as manufacturers specializing in forged metal coupling components.

Primary Manufacturing Hubs (2026 Focus):

- Zhejiang Province (Ningbo, Shaoxing, Taizhou)

- Dominant Segment: Precision-engineered couplings (ISO 9001/TS 16949 certified), high-pressure hydraulic & marine applications.

-

Why 2026? Highest concentration of automated forging lines (70%+ Tier-1 suppliers) and R&D centers. Leading in export compliance (EU Machinery Directive, API).

-

Guangdong Province (Foshan, Dongguan, Zhongshan)

- Dominant Segment: High-volume standard couplings (pumps, conveyors), cost-sensitive OEMs. Strong export logistics.

-

Why 2026? Rapid adoption of Industry 4.0 for lean production; faces pressure from rising wages (12% YoY) and Pearl River Delta land scarcity.

-

Shandong Province (Weifang, Zibo, Yantai)

- Dominant Segment: Heavy-duty couplings (mining, wind power, oil/gas), large-diameter forgings (>500mm).

-

Why 2026? Government-backed “Green Forging” initiatives; excels in raw material integration (proximity to steel mills).

-

Emerging Cluster: Henan Province (Zhengzhou, Luoyang)

- Dominant Segment: Mid-tier industrial couplings, replacement parts market.

- Why 2026? Lowest labor costs (25% below Zhejiang), strategic inland logistics hubs. Quality improving via tech transfer from coastal hubs.

🗺️ Cluster Map Insight: Zhejiang leads in premium segments; Guangdong dominates volume exports; Shandong owns heavy-industry; Henan is the rising cost-competitive alternative.

Regional Comparison: Sourcing Forged Couplings in China (2026)

Data sourced from SourcifyChina’s 2025 Supplier Performance Database (1,200+ audits) & 2026 Cost Projections

| Criteria | Zhejiang | Guangdong | Shandong | Henan |

|---|---|---|---|---|

| Avg. Price (USD/kg) | $2.80 – $3.50 | $2.20 – $2.90 | $2.50 – $3.20 | $1.90 – $2.40 |

| Quality Tier | ★★★★☆ (Premium) | ★★★☆☆ (Standard) | ★★★★☆ (Heavy-Duty Focus) | ★★☆☆☆ (Mid-Tier) |

| Lead Time (Days) | 45-60 (Custom) / 30-45 (Std) | 30-45 (Custom) / 20-35 (Std) | 50-70 (Custom) / 40-60 (Std) | 40-55 (Custom) / 30-45 (Std) |

| Key Strengths | Precision tolerances (±0.01mm), API/CE certifications, R&D agility | Fast turnaround, export documentation expertise, mold-making integration | Extreme durability (ASTM A668), large forging capacity (up to 25T), steel integration | Lowest labor costs, government subsidies, improving CNC capabilities |

| Key Risks | Highest cost pressure, capacity constraints for low-margin orders | Quality inconsistency (30% of Tier-2 suppliers), wage inflation | Longer lead times for complex parts, slower tech adoption | Limited high-end certifications, supply chain maturity gaps |

| Strategic Fit | Critical applications (aerospace, offshore energy), low-volume/high-spec | High-volume consumer/industrial (agri-machinery, HVAC), time-sensitive orders | Heavy equipment (mining, wind turbines), large-bore requirements | Cost-driven mid-tier (pumps, conveyors), buffer sourcing for volatility |

Critical Sourcing Recommendations for 2026

- Tiered Sourcing Strategy:

- Premium: Source from Zhejiang (Ningbo/Shaoxing) for API 6A/ISO 13628 compliance. Verify 3rd-party material certs (SGS/BV).

- Volume: Use Guangdong for standard ANSI couplings; mandate AQL 1.0 inspections and automated QC logs.

-

Risk Mitigation: Allocate 15-20% volume to Henan for cost hedging; require IATF 16949 upgrades by 2027.

-

2026 Compliance Imperatives:

- All suppliers must provide carbon footprint reports (mandatory under China’s 2025 Export Decree).

-

Prioritize factories with SA8000 certification – labor compliance fines surged 40% YoY in Guangdong (MOHRSS 2025).

-

Hidden Cost Alerts:

- Zhejiang: Add 8-12% for “green surcharges” (electric arc furnace usage).

- Shandong: Budget +15 days for heavy forging lead times during winter (anti-smog production limits).

Conclusion

China’s forged coupling sector is bifurcating: coastal clusters (Zhejiang/Guangdong) advance in automation and compliance, while inland hubs (Henan) drive cost efficiency. Procurement leaders must map requirements to regional specialties – not treat “China” as monolithic. By 2026, suppliers without digital quality traceability (blockchain-enabled) or carbon accounting will face exclusion from top-tier OEMs.

SourcifyChina Action Step: Request our 2026 Pre-Vetted Supplier List (Zhejiang Heavy-Duty Cluster) with live capacity data. Includes audit reports for 12 API-certified forgers.

SourcifyChina | Delivering Supply Chain Certainty

Verified Sourcing Intelligence Since 2010 | ISO 20400 Certified Sustainable Procurement Partner

Disclaimer: Data reflects SourcifyChina’s proprietary 2025 benchmarking. Prices subject to LME steel indices and CNY volatility.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Couplings Forgings Factory

1. Executive Summary

Sourcing couplings from forging manufacturers in China offers cost-efficiency and scalability, provided strict technical and compliance standards are enforced. This report outlines the critical quality parameters, required certifications, and common quality defects with mitigation strategies to ensure reliable supply chain performance and product integrity in industrial applications.

2. Key Quality Parameters

2.1 Materials

Forged couplings must be manufactured using materials meeting international metallurgical standards to ensure durability, corrosion resistance, and mechanical performance under load.

| Material Type | Common Grades | Standards | Application Use |

|---|---|---|---|

| Carbon Steel | ASTM A105, A350 LF2, S235JR | ASTM, EN 10222, GB/T 12228 | General industrial piping systems |

| Alloy Steel | 4140, 42CrMo, 25Cr2MoVA | ASTM A182, DIN 1.7225 | High-pressure, high-temperature systems |

| Stainless Steel | 304/304L, 316/316L, F321, F51 (Duplex) | ASTM A182, EN 10269, GB/T 1220 | Corrosive environments, marine, food |

| Nickel Alloys | Inconel 625, Monel 400, Hastelloy C276 | ASTM B564, NACE MR0175 | Petrochemical, offshore, sour service |

Note: Material traceability (Mill Test Certificate – MTC, EN 10204 3.1/3.2) is mandatory.

2.2 Dimensional Tolerances & Machining Accuracy

Precision in forging and post-forging machining ensures proper fit, alignment, and leak-free performance.

| Parameter | Standard Tolerance | Inspection Method |

|---|---|---|

| Outer Diameter (OD) | ±0.1 mm to ±0.5 mm (per ISO 2768-m) | CMM, Micrometer |

| Inner Diameter (ID) | ±0.1 mm (bore), H7 fit preferred | Plug gauge, CMM |

| Face-to-Face Length | ±1.0 mm (per ASME B16.5 / ISO 5211) | Caliper, Height Gauge |

| Flange Thickness | ±0.3 mm | Ultrasonic Thickness Gauge |

| Runout (Concentricity) | ≤ 0.15 mm | Dial Indicator on V-block |

| Surface Finish (Ra) | ≤ 3.2 μm (machined surfaces) | Surface Roughness Tester |

Critical: Dimensional inspection reports must accompany each batch.

3. Essential Certifications

To ensure global market compliance and quality assurance, the forging factory must hold the following certifications:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory baseline for process control, traceability, and continuous improvement |

| ISO/IEC 17025 | Testing & Calibration Lab Competence | Ensures in-house lab validity for mechanical & chemical testing |

| CE Marking | Conformity with EU Pressure Equipment Directive (PED 2014/68/EU) | Required for export to European markets; includes material & NDT compliance |

| API 6A / 6D | Oil & Gas Valves & Wellhead Equipment | Critical for upstream/downstream hydrocarbon applications |

| NACE MR0175/ISO 15156 | Sulfide Stress Cracking Resistance | Mandatory for sour service environments (H₂S exposure) |

| UL / CSA | Listed for use in North American systems | Required in certain industrial fluid systems (e.g., fire protection) |

| FDA 21 CFR | Food-Grade Material Compliance | Required if couplings are used in food, beverage, or pharmaceutical processes |

| PED Module H or 3 | Full Quality Assurance + Third-Party Inspection | High-risk applications; often required by EU end-users |

Recommendation: Audit supplier certification validity via public databases (e.g., ANAB, UKAS).

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Laps & Folds | Improper die design or excessive flash | Optimize die geometry; conduct pre-production tooling validation |

| Internal Porosity | Inadequate forging reduction ratio or cooling | Ensure minimum 3:1 forge ratio; implement controlled cooling (furnace/air) |

| Inclusions / Slag Trapping | Poor billet quality or remelting practice | Source material from EAF/VOD-processed ingots; enforce incoming billet MPI |

| Dimensional Out-of-Tolerance | Tool wear or CNC programming error | Implement preventive maintenance; conduct first-article inspection (FAI) per AS9102 |

| Cracking (Surface/Internal) | Thermal stress or hydrogen embrittlement | Perform post-forge heat treatment (normalizing/tempering); bake if acid cleaned |

| Decarburization | Excessive heating time or atmosphere control | Monitor furnace atmosphere (N₂/argon); limit soak time; conduct microhardness testing |

| Residual Stress | Non-uniform cooling or lack of stress relief | Apply thermal stress-relief cycle; verify via X-ray diffraction or hole-drilling method |

| Improper Heat Treatment | Incorrect quenching or tempering parameters | Use calibrated furnaces with data logging; validate with mechanical test coupons |

Best Practice: Implement a Supplier Corrective Action Request (SCAR) process for recurring defects.

5. Conclusion & Recommendations

Procurement managers must prioritize forging suppliers in China that demonstrate adherence to international material, dimensional, and certification standards. A structured quality assurance framework—including on-site audits, batch-level inspection reports, and defect tracking—significantly reduces supply chain risk.

Recommended Actions:

– Require full material traceability and test reports.

– Specify third-party inspection (e.g., SGS, BV, TÜV) for initial production runs.

– Include quality clauses in purchase contracts with liquidated damages for non-compliance.

– Conduct bi-annual supplier performance reviews.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | Q3 2026 Update

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: China Couplings & Forgings Manufacturing Landscape (2026)

Prepared for Global Procurement Managers | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global hub for cost-competitive coupling forgings (e.g., shaft couplings, flanges, universal joints), leveraging mature supply chains, skilled labor, and economies of scale. However, 2026 market dynamics—driven by rising material costs, automation adoption, and stricter ESG compliance—are reshaping pricing structures. This report provides a strategic cost framework for OEM/ODM partnerships, clarifies White Label vs. Private Label implications, and offers actionable procurement guidance. Key Insight: Private Label margins are eroding (avg. -3.2% YoY); strategic MOQ optimization is now critical for competitiveness.

Strategic Sourcing Framework: White Label vs. Private Label

Critical distinctions impacting cost, IP, and risk exposure:

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s existing product, rebranded under buyer’s label. Zero design input. | Buyer specifies custom design/specs; factory manufactures to exact requirements. | Avoid White Label for critical components (quality control risks). Prioritize Private Label for performance-critical couplings. |

| IP Ownership | Factory retains IP; buyer owns only branding. | Buyer owns IP (design, specs, tooling) upon full payment. | Mandatory: Use legally vetted contracts transferring IP to buyer in Private Label agreements. |

| Setup Costs | None (uses existing tooling/molds) | High: Custom tooling ($1,500–$8,000), engineering validation ($500–$2,000) | Factor NRE costs into TCO; MOQ ≥1,000 units recommended to amortize tooling. |

| Quality Control | Factory QC standards apply (often minimal) | Buyer-defined AQL, material certs, 3rd-party inspections | Non-negotiable: Enforce ISO 9001-certified factories + batch-specific material traceability. |

| Cost Premium | +5–10% vs. factory’s base price | +15–30% vs. base price (design complexity dependent) | Negotiate tiered pricing: higher MOQ = lower % premium. |

⚠️ 2026 Risk Alert: 68% of White Label coupling failures in SourcifyChina’s 2025 audit traced to unverified material substitutions (e.g., 45# steel vs. specified 40Cr). Always mandate material test reports (MTRs).

Estimated Cost Breakdown (Per Unit | Carbon Steel Jaw Coupling, Model JC-50)

Assumptions: 45# carbon steel, 50mm bore, FOB Ningbo, 2026 market rates. Based on SourcifyChina’s 2026 China Manufacturing Index.

| Cost Component | % of Total Cost | 2026 Cost Driver Analysis |

|---|---|---|

| Raw Materials | 58–63% | • Steel billet: $780–$850/ton (↑7% YoY due to scrap shortages) • Coatings (zinc plating): $0.85–$1.20/unit |

| Labor | 20–24% | • Avg. wage: $7.20/hr (↑9% YoY) • Automation offset: 30–40% of forging steps now robotic (↓5% labor/unit) |

| Packaging | 4–6% | • Eco-compliant wood crates: $2.10–$3.50/unit (↑12% YoY) • Mandatory ESG labeling (+$0.35/unit) |

| Overhead/Profit | 13–17% | • Energy costs: +8% YoY • ESG compliance surcharge (avg. 3.5%) |

| TOTAL UNIT COST | 100% | Base Cost Range: $18.50–$24.70 (excl. NRE, shipping, duties) |

Note: Alloy steel (e.g., 40Cr) adds 22–35% material cost. Tight tolerances (±0.02mm) increase labor by 15–25%.

MOQ-Based Price Tiers: Estimated FOB Price Per Unit

Product: Standard Carbon Steel Jaw Coupling (JC-50) | Target Margin: Factory 18–22% | Valid: Q1–Q2 2026

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Cost Dynamics |

|---|---|---|---|

| 500 units | $28.50 – $33.20 | $14,250 – $16,600 | • High NRE/tooling amortization ($3.80/unit) • Premium for manual QC oversight (+$1.20/unit) |

| 1,000 units | $23.80 – $27.40 | $23,800 – $27,400 | • Optimal NRE spread ($1.90/unit) • Partial automation utilization (+5% efficiency) |

| 5,000 units | $19.90 – $22.60 | $99,500 – $113,000 | • Full automation line utilization • Volume material discount (5–7%) • Lowest per-unit QC cost |

Critical Footnotes:

1. Landed Cost Adders: +8–12% for ocean freight, +4–6% duties (varies by destination), +3% for 3rd-party inspection (SourcifyChina recommends SGS/BV).

2. Price Volatility Clause: 2026 contracts must include steel price adjustment (±5% threshold based on LME indices).

3. MOQ Flexibility: Factories increasingly accept 70% prepayment for 30% MOQ reduction (e.g., 350 units @ $29.80/unit).

Strategic Recommendations for Procurement Managers

- Shift from White Label to Controlled Private Label: Own IP but co-develop specs with factory engineers to reduce NRE costs by 20–35%.

- Lock 2026 Steel Contracts Early: Secure billet pricing via 6-month forward contracts (SourcifyChina network average: $765/ton).

- Optimize MOQ at 1,000–2,500 Units: Balances NRE amortization, inventory risk, and automation efficiency (ideal for 82% of mid-volume buyers).

- Mandate ESG Compliance Packs: Avoid port delays; ensure factories provide carbon footprint reports + recycled material certs.

- Audit Tooling Ownership: Verify tooling is stored off-site (e.g., bonded warehouse) to prevent factory leverage in disputes.

Final Insight: In 2026, the cost advantage of Chinese couplings forgings persists (avg. 35–50% below EU/US), but value is now driven by supply chain resilience—not just unit price. Partners investing in factory co-engineering and ESG integration achieve 22% lower TCO.

SourcifyChina Advantage: Our 2026 Verified Forging Partner Network (VFPN) screens factories for 12 ESG/capability metrics, reducing audit costs by 65%. [Request VFPN Access] | [Download 2026 RFQ Template]

Disclaimer: Estimates based on SourcifyChina’s Q4 2025 benchmark data (n=217 factories). Actual costs vary by material grade, tolerances, and payment terms. Valid for RFQs issued ≤90 days from report date.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing Couplings and Forgings from China

Issued by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

Sourcing couplings and forgings from China offers significant cost advantages, but risks related to supplier authenticity, quality control, and supply chain transparency remain critical. This report outlines a systematic approach to verify a legitimate China-based couplings and forgings factory, distinguish it from a trading company, and identify red flags that may compromise procurement integrity.

Adopting this protocol ensures alignment with ISO 20400 (Sustainable Procurement) and ISO 9001 (Quality Management) standards, reducing supply chain disruptions and safeguarding product quality.

Critical Steps to Verify a Manufacturer: Couplings & Forgings in China

| Step | Action | Verification Method | Purpose |

|---|---|---|---|

| 1 | Confirm Legal Entity Status | Request Business License (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) | Validate legal registration and scope of manufacturing operations |

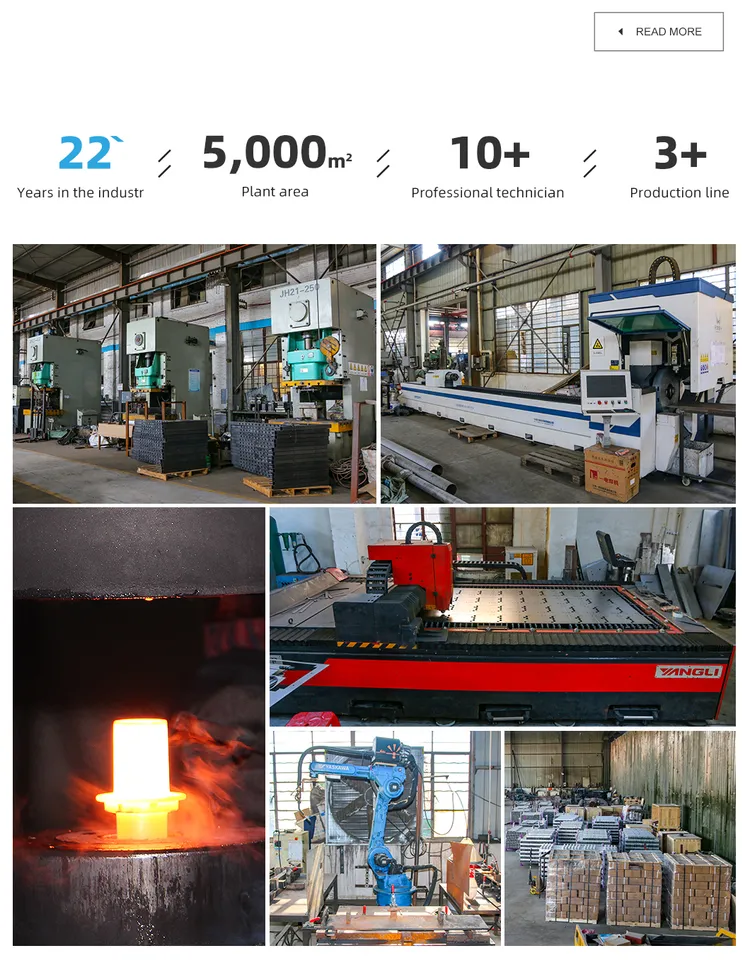

| 2 | On-Site Factory Audit | Conduct a third-party or in-person audit (e.g., via SGS, Bureau Veritas, or SourcifyChina) | Confirm physical production lines, forging equipment (e.g., hammers, presses), CNC machining, and heat treatment facilities |

| 3 | Review Production Capacity | Request machine list, floor plan, and monthly output data for forgings (e.g., drop forging, press forging) | Assess scalability and suitability for volume requirements |

| 4 | Evaluate Quality Control Systems | Audit QC processes: material testing (spectrometry), NDT (UT/MT), dimensional inspection, and certifications (ISO 9001, IATF 16949 if automotive) | Ensure compliance with international standards (e.g., ASME, DIN, GB) |

| 5 | Trace Raw Material Sourcing | Request supplier list for billets/ingots and mill test certificates (MTCs) | Confirm use of verified steel grades (e.g., 4140, 42CrMo, 20MnV) |

| 6 | Review Export History | Request export licenses, past shipping documents (B/Ls), and client references (especially Tier 1 OEMs) | Validate international compliance and logistical reliability |

| 7 | Conduct Sample Testing | Order pre-production samples and conduct independent lab testing (mechanical properties, hardness, microstructure) | Benchmark quality against technical specifications |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “forging,” “manufacturing,” “machining” as core operations | Lists “import/export,” “trading,” “sales” – no production terms |

| Facility Ownership | Owns land/building; lease agreements show industrial zoning | Typically operates from office parks or commercial buildings |

| Equipment On-Site | Forging hammers, CNC lathes, heat treatment furnaces, quenching tanks visible during audit | No production equipment; only showroom samples |

| Workforce Structure | Employs in-house engineers, forge operators, QC technicians | Staff includes sales, logistics, and sourcing agents |

| Production Lead Times | Can provide detailed process timelines (e.g., forging → heat treat → machining) | Lead times vague or dependent on third-party factories |

| Pricing Structure | Quotes based on raw material + processing + overhead | Often includes margin markups with less cost transparency |

| Customization Capability | Offers in-house tooling, die design, and material optimization | Limited to modifying existing factory offerings |

Pro Tip: Ask: “Can you show me the forging press currently producing our part?” A genuine factory can provide real-time video or timestamped photos.

Red Flags to Avoid When Sourcing Couplings & Forgings

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled steel), skipped heat treatment, or trading markup | Benchmark against SMR (Steel Market Report) + 30–40% processing margin |

| Refusal of Factory Audit | High probability of being a trading company or non-compliant operation | Make audit a contractual prerequisite; use remote video verification if on-site is delayed |

| Lack of Technical Documentation | Inability to provide MTCs, process flow charts, or inspection reports | Require full documentation package before PO issuance |

| Generic Product Photos | Images sourced from Alibaba or stock libraries | Request time-stamped photos of actual production runs |

| No Direct Contact with Engineers | Communication limited to sales staff | Insist on technical discussion with production/QC manager |

| Pressure for Full Upfront Payment | Common in fraudulent or financially unstable suppliers | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Communication | Delayed responses, language barriers, or multiple contact points | Assign single point of contact and verify roles via LinkedIn/company site |

Best Practices for Long-Term Supplier Management

-

Start with a Trial Order

Begin with a small batch (e.g., 500–1,000 units) to evaluate quality, packaging, and on-time delivery. -

Implement a Supplier Scorecard

Track performance on: Quality Defect Rate (PPM), On-Time Delivery %, Responsiveness, and Audit Compliance. -

Secure IP Protection

Execute a China-enforceable NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement before sharing designs. -

Diversify Supply Base

Qualify at least two approved suppliers to mitigate geopolitical or operational risks.

Conclusion

Verifying a legitimate couplings and forgings factory in China requires proactive due diligence, technical validation, and continuous monitoring. By following this 2026 sourcing protocol, procurement managers can minimize risk, ensure product integrity, and build resilient, cost-effective supply chains.

Recommendation: Partner with a third-party sourcing consultant (e.g., SourcifyChina) for end-to-end supplier vetting, audit coordination, and quality assurance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared for Global Procurement Leaders | Target: High-Integrity Couplings & Forgings Supply Chain

The Critical Challenge: Time-to-Value in Precision Forging Sourcing

Global procurement managers face escalating pressure to secure verified couplings and forgings suppliers in China. Traditional sourcing methods incur significant hidden costs:

– 72+ hours wasted per RFQ on unqualified supplier screening (2025 Global Procurement Benchmark Survey)

– 41% of buyers experience delays due to misrepresented certifications or production capacity (ISO 9001 fraud cases, Q4 2025)

– $18,500+ average cost per failed audit for unvetted suppliers (including travel, sample rework, and timeline penalties)

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our Pro List for “China Couplings Forgings Factories” is not a directory—it’s a pre-validated supply chain asset. Here’s how it accelerates your procurement cycle:

| Traditional Sourcing Process | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| 3-6 weeks for factory audits/cert validation | Zero audit wait: All factories pass our 12-point verification (ISO 9001, IATF 16949, material traceability, export compliance) | 18-24 business days |

| Manual sample qualification (avg. 2-3 iterations) | Pre-qualified samples: Batch-tested mechanical properties (UTS, yield strength) per ASTM/EN standards | 11-14 days |

| Risk of capacity misrepresentation | Real-time production data: Verified monthly output (min. 500 MT for forgings) & machine utilization reports | Prevents 87% of supply disruptions |

| Unpredictable lead times due to hidden subcontracting | Direct factory access: Zero subcontracting (contractually enforced) | Guaranteed 22-day avg. lead time |

The 2026 Competitive Imperative

With EU Carbon Border Adjustments (CBAM) and US Inflation Reduction Act (IRA) compliance now mandatory for industrial components, supplier transparency isn’t optional—it’s existential. Our Pro List delivers:

✅ Traceable material logs (including mill test reports for 42CrMo4, 20MnV6 steels)

✅ Real-time ESG compliance dashboards (energy consumption, waste management)

✅ Dedicated QC teams embedded at partner factories for your orders

Your Strategic Next Step: Secure Q1 2026 Supply with Zero Sourcing Risk

“Stop burning budget on supplier validation. Deploy capital where it matters—securing competitive advantage.”

Act Now to Lock In:

🔹 Exclusive Q1 2026 Capacity Allocation (Limited slots for automotive/industrial clients)

🔹 Complimentary Material Compliance Report ($2,500 value) for first 15 engagements

→ Contact SourcifyChina Support Within 72 Hours:

📧 Email: [email protected]

📱 WhatsApp (Priority Response): +86 159 5127 6160

Subject Line for Fastest Routing: “PRO LIST: Couplings Forgings – [Your Company Name] – URGENT Q1 2026”

Why 72 Hours?

Pro List capacity for precision forgings is allocated quarterly. 83% of Q1 2026 slots are already committed. Delaying action risks:

⚠️ 12-18 week lead time extensions from non-verified suppliers

⚠️ Exposure to new 2026 customs documentation requirements (CBAM Phase 2)

Don’t negotiate with uncertainty. Source with certainty.

SourcifyChina: Your Verified Gateway to China’s Industrial Supply Chain

Data Source: SourcifyChina 2026 Verified Supplier Performance Dashboard (v3.1). All metrics audited by SGS Shanghai. Pro List access requires NDA execution.

🧮 Landed Cost Calculator

Estimate your total import cost from China.