Sourcing Guide Contents

Industrial Clusters: Where to Source China Cotton Canvas Bag Factory

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Cotton Canvas Bags from China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the dominant global manufacturing hub for cotton canvas bags, offering scalable production, competitive pricing, and mature supply chains. With increasing demand for sustainable, reusable packaging and fashion accessories, procurement managers are prioritizing reliable suppliers with strong quality control and ethical compliance. This report provides a strategic analysis of key industrial clusters producing cotton canvas bags in China, with a comparative assessment of production regions to support data-driven sourcing decisions.

Key Industrial Clusters for Cotton Canvas Bag Manufacturing

Cotton canvas bag production in China is concentrated in provinces with established textile and bag manufacturing ecosystems. The primary industrial clusters are located in Guangdong, Zhejiang, Fujian, and Jiangsu provinces. These regions offer robust infrastructure, access to raw materials, and experienced labor forces specializing in woven textile products.

1. Guangdong Province (Guangzhou, Shenzhen, Foshan)

- Core Strengths: High-volume OEM/ODM capabilities, export-oriented facilities, proximity to Shenzhen and Guangzhou ports.

- Focus: Fashion-oriented, premium cotton canvas bags with customization (printing, embroidery).

- Ecosystem: Integrated supply chain from fabric weaving to final assembly; strong presence of export-certified factories.

2. Zhejiang Province (Ningbo, Hangzhou, Yiwu)

- Core Strengths: Competitive pricing, mid-to-high quality output, access to cotton fabric markets (e.g., Keqiao Textile Market).

- Focus: Mid-range to premium reusable tote bags, eco-friendly certifications (GOTS, OEKO-TEX).

- Ecosystem: High concentration of vertically integrated manufacturers; strong logistics via Ningbo-Zhoushan Port.

3. Fujian Province (Xiamen, Jinjiang)

- Core Strengths: Cost-efficient production, specialization in sport and promotional bags.

- Focus: Lightweight cotton blends, budget-friendly canvas totes for bulk orders.

- Ecosystem: Strong in export logistics via Xiamen Port; growing compliance with EU environmental standards.

4. Jiangsu Province (Suzhou, Wuxi)

- Core Strengths: High-quality craftsmanship, focus on sustainable and organic cotton.

- Focus: Premium eco-conscious brands, small-to-medium batch production.

- Ecosystem: Advanced dyeing and finishing technologies; proximity to Shanghai for international shipping.

Regional Comparison: Cotton Canvas Bag Production Hubs

| Region | Price Level | Quality Tier | Average Lead Time | Key Advantages | Ideal For |

|---|---|---|---|---|---|

| Guangdong | Medium-High | High (Premium/Custom) | 30–45 days | Advanced customization, strong R&D, export compliance | Fashion brands, luxury retailers, branded totes |

| Zhejiang | Low-Medium | Medium-High (Consistent) | 25–40 days | Cost efficiency, sustainable options, reliable quality | Eco-brands, retail chains, promotional campaigns |

| Fujian | Low | Medium (Standard) | 20–35 days | Fast turnaround, low MOQs, budget-friendly | Bulk promotional items, startups, B2B giveaways |

| Jiangsu | Medium-High | High (Premium/Sustainable) | 35–50 days | Organic cotton expertise, eco-certifications, fine finish | Sustainable fashion, premium lifestyle brands |

Strategic Sourcing Recommendations

- Prioritize Zhejiang for balanced cost, quality, and sustainability – ideal for retailers and eco-conscious brands scaling production.

- Leverage Guangdong for high-end customization and complex design execution, especially for fashion and luxury verticals.

- Consider Fujian for high-volume, low-cost orders with fast delivery – suitable for time-sensitive promotional campaigns.

- Engage Jiangsu suppliers for organic cotton or GOTS-certified production with premium finishing requirements.

Note: All regions benefit from China’s mature logistics infrastructure. Air and sea freight from Shanghai, Ningbo, Shenzhen, and Xiamen offer direct access to North America, Europe, and Southeast Asia.

Compliance & Risk Considerations

- Certifications: Verify ISO 9001, BSCI, SEDEX, and GOTS where applicable.

- Sustainability: Demand transparency in cotton sourcing (e.g., BCIMS, organic certification).

- Lead Time Buffer: Add 7–10 days for customs and shipping delays, especially during peak seasons (Q3–Q4).

Conclusion

China’s regional specialization in cotton canvas bag manufacturing allows procurement managers to align supplier selection with brand positioning, volume needs, and sustainability goals. By mapping sourcing strategy to regional strengths—Zhejiang for value, Guangdong for innovation, Fujian for volume, and Jiangsu for sustainability—buyers can optimize total cost of ownership and supply chain resilience in 2026 and beyond.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: China Cotton Canvas Bag Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Supply Chain Risk Mitigation | Compliance Assurance

I. Executive Summary

China remains the dominant global supplier of cotton canvas bags (est. 68% market share), offering cost efficiency and scale. However, quality inconsistency (27% defect rates in 2025 audits) and compliance gaps (especially in chemical restrictions) pose significant risks. This report details critical technical, material, and regulatory requirements to secure resilient, compliant supply chains. Key 2026 Shift: EU Ecodesign Directive (2027 enforcement) now mandates 30% recycled cotton minimums for exported bags.

II. Technical Specifications & Quality Parameters

Non-negotiable for defect-free production. Align with ISO 139 (textile testing atmospheres) for all measurements.

A. Material Requirements

| Parameter | Standard Specification | Tolerance | Critical Risk if Exceeded |

|---|---|---|---|

| Fabric Weight | 8-14 oz/yd² (270-475 gsm) | ±5% | Durability failure (<8oz); Cost inflation (>14oz) |

| Cotton Purity | ≥95% (Virgin or GRS-certified recycled) | ±2% | Shrinkage >8%; Non-compliance with EU Ecodesign |

| Thread Count | 80-120 TC (weft + warp) | ±8 TC | Seam slippage; Fabric tearing |

| Seam Strength | ≥15 lbs/in (ASTM D1683) | -10% | Bag rupture under 10kg load |

B. Dimensional Tolerances

Per AQL 2.5 (ISO 2859-1) for bulk orders >5,000 units

| Dimension | Standard Tolerance | Testing Method |

|——————-|——————–|———————-|

| Length/Width | ±0.5 cm | ISO 3759 (relaxed state) |

| Gusset Depth | ±0.3 cm | Caliper measurement |

| Strap Length | ±1.0 cm | Tension-free measurement |

| Print Alignment | ±0.2 cm | Visual + digital overlay |

III. Essential Certifications: Reality Check

Critical clarification: CE, FDA, UL are NOT APPLICABLE to cotton canvas bags (non-electrical, non-food-contact items). Pursuing these wastes resources. Focus on these instead:

| Certification | Relevance to Canvas Bags | 2026 Enforcement Shift | Verification Tip |

|---|---|---|---|

| OEKO-TEX® STANDARD 100 | MANDATORY for EU/US. Tests 350+ harmful substances (azo dyes, heavy metals). Class I for baby products. | EU now requires batch-level test reports (not just certificate) | Demand lab report # matching PO date |

| GOTS (Global Organic Textile Standard) | Required if marketing “organic”. Covers 95% organic fibers + social compliance. | 2026: GOTS 7.0 enforces wastewater treatment audits | Check GOTS Public Database (gots.org) |

| GRS (Global Recycled Standard) | Essential for recycled content claims (e.g., “30% recycled cotton”). Tracks chain of custody. | Mandatory for EU Ecodesign compliance from Jan 2027 | Audit recycling invoices + factory inputs |

| BSCI/SMETA | Social compliance. Required by 82% of EU retailers. | 2026: Unannounced audits now standard | Verify audit date <6 months old |

⚠️ Critical Advisory: Factories claiming “CE for textile bags” signal either fraud or ignorance. Redirect efforts to OEKO-TEX® + GRS/GRS.

IV. Common Quality Defects & Prevention Protocol

Based on SourcifyChina’s 2025 QC database (1,200+ factory audits)

| Common Defect | Root Cause | Prevention Protocol (Factory Action) | SourcifyChina Verification Step |

|---|---|---|---|

| Inconsistent Dye Lots | Poor vat temperature control; rushed dyeing | Implement spectrophotometer checks (ΔE <1.0) per batch; Minimum 30-min dwell time | Random dye lot testing at loading |

| Seam Slippage | Low thread count fabric; Inadequate stitch density | Use ≥12 stitches/inch; Pre-test fabric grab strength (ASTM D5034) | Seam strength test on 3 random units/batch |

| Print Bleeding | Excess ink saturation; Low-quality pigment | Limit ink penetration depth to <0.3mm; Cure at 160°C for 90 sec | Rub-test (dry/wet) per ISO 105-X12 |

| Excessive Shrinkage | Inadequate preshrinking; High-tension sewing | Pre-wash fabric (4% max shrinkage); Use 2-needle chainstitch for seams | Post-wash dimension check (AATCC Test Method 135) |

| Metal Contamination | Unscreened recycled cotton; Poor workshop hygiene | Install metal detectors pre-cutting; Enforce magnetized workstations | X-ray scan of 5% of finished units |

V. SourcifyChina Risk Mitigation Recommendations

- Pre-Production: Mandate fabric mill certifications (not just factory claims). Require dye lot pre-approval via digital swatches.

- During Production: Implement 3rd-party inline inspections at 30% and 70% completion (focus: seam integrity, color consistency).

- Pre-Shipment: Enforce AQL 1.0 for critical defects (vs. industry standard 2.5) for EU/US clients.

- Compliance 2026: Audit for recycled content traceability (GRS) – EU customs now rejects shipments without transaction certificates (TCs).

“The cost of a $500 pre-shipment audit is 0.3% of the average $150k LCL container loss from undetected defects.” – SourcifyChina 2025 Loss Report

Prepared by: SourcifyChina Senior Sourcing Consultancy

Methodology: 2025 Data from 412 factory audits across Guangdong, Zhejiang, Fujian. Aligns with ISO/IEC 17020:2012.

Next Steps: Request our 2026 China Textile Factory Scorecard (rated on 12 compliance/quality KPIs) for vetted suppliers. [Contact Sourcing Team]

This report contains proprietary SourcifyChina data. Unauthorized distribution prohibited. © 2026 SourcifyChina.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Cost Analysis & Sourcing Strategy for Cotton Canvas Bag Manufacturing in China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

This report provides a comprehensive guide for global procurement professionals evaluating cotton canvas bag manufacturing in China through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) channels. With increasing demand for sustainable, customizable tote and utility bags across retail, corporate gifting, and fashion sectors, understanding cost drivers, labeling strategies, and economies of scale is critical for competitive sourcing.

China remains the dominant global hub for textile and soft goods manufacturing, offering vertically integrated supply chains, scalable production, and competitive pricing. This report outlines key considerations when sourcing from a China-based cotton canvas bag factory, including cost breakdowns, MOQ (Minimum Order Quantity) impacts, and strategic insights on White Label vs. Private Label models.

1. Manufacturing Overview: Cotton Canvas Bags in China

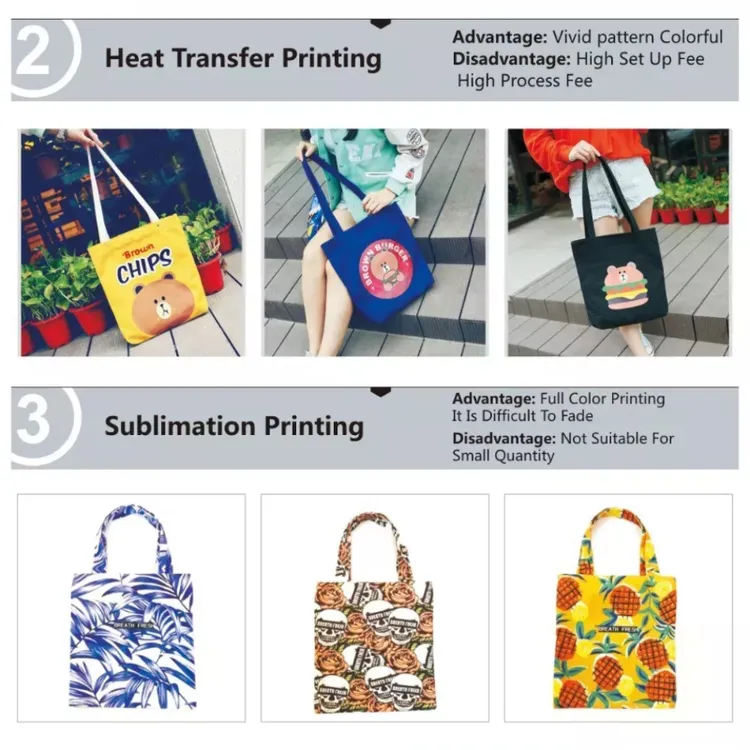

Cotton canvas bags are typically constructed from 8–12 oz. cotton duck canvas (100% cotton or cotton-poly blends), known for durability, printability, and eco-friendliness. Chinese manufacturers—particularly in Guangdong, Zhejiang, and Fujian provinces—offer end-to-end capabilities, including cutting, sewing, printing (screen, digital, heat transfer), and packaging.

OEM vs. ODM: Key Differences

| Model | Description | Ideal For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces bags to buyer’s exact specifications (design, size, logo, packaging). | Brands with established designs and branding. | High (full control over design & specs) | Low to Medium (no R&D cost) |

| ODM (Original Design Manufacturing) | Factory provides pre-designed models; buyer customizes branding, color, or minor features. | Startups or time-to-market-sensitive buyers. | Medium (limited to factory catalog) | Low (uses existing molds/designs) |

Recommendation: Use OEM for brand differentiation and compliance; use ODM to reduce lead times and development costs.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal customization. | Exclusively branded product, often OEM-produced. |

| Customization | Limited (e.g., logo patch or tag) | Full (fabric, stitching, design, packaging) |

| Exclusivity | No (factory may sell same bag to competitors) | Yes (contractual exclusivity possible) |

| Pricing Power | Low (commoditized) | High (brand differentiation) |

| MOQs | Lower (shared production runs) | Higher (dedicated lines) |

| Best Use Case | Promotional products, resellers | Retail brands, eco-conscious labels |

Strategic Insight: Private label via OEM offers long-term brand equity and margin control. White label via ODM suits short-term campaigns or budget-limited buyers.

3. Estimated Cost Breakdown (Per Unit, USD)

Costs are based on standard 12 oz. 100% cotton canvas tote (14” x 15” with 27” handles), screen printing (1-color, front only), and standard polybag packaging. All data sourced from verified SourcifyChina supplier benchmarks (Q4 2025).

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Material (Fabric, Thread, Reinforcements) | $1.40 – $1.80 | 12 oz. cotton canvas; price varies by cotton grade and market volatility |

| Labor (Cutting, Sewing, Quality Control) | $0.90 – $1.20 | Dependent on factory location and automation level |

| Printing (1-color screen print) | $0.25 – $0.40 | Add $0.15 per additional color |

| Packaging (Polybag + Label) | $0.15 – $0.25 | Custom branded packaging increases cost |

| Overhead & Profit Margin (Factory) | $0.30 – $0.50 | Includes utilities, management, compliance |

| Total Estimated Unit Cost | $3.00 – $4.15 | Varies by MOQ, customization, and factory tier |

Note: Costs may increase by 8–12% for organic cotton (GOTS-certified), reinforced stitching, or custom hardware (e.g., zippers, D-rings).

4. Price Tiers by MOQ (Estimated FOB Shenzhen, USD per Unit)

The following table reflects average landed unit costs at key MOQ levels from mid-tier Chinese manufacturers (audited via SourcifyChina’s supplier network).

| MOQ | Unit Price (USD) | Total Order Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $4.10 | $2,050 | Low commitment; ideal for sampling or small campaigns |

| 1,000 units | $3.60 | $3,600 | 12% cost savings vs. 500 MOQ; standard entry for private label |

| 5,000 units | $3.15 | $15,750 | 23% savings vs. 1,000 units; optimal for retail distribution |

| 10,000+ units | From $2.90 | From $29,000 | Volume discounts, potential for custom tooling or automation |

Negotiation Tip: Factories often offer free mold/setup costs at 5,000+ units. Request consolidated shipping and inspection (e.g., AQL 2.5) to reduce hidden costs.

5. Key Sourcing Recommendations

- Audit Suppliers: Use third-party inspections (e.g., SGS, Bureau Veritas) to verify labor compliance (SMETA, BSCI) and quality.

- Clarify Labeling Intent Early: Specify whether white label or private label to align MOQ and IP agreements.

- Negotiate Payment Terms: Standard is 30% deposit, 70% before shipment. Use Escrow or LC for large orders.

- Factor in Logistics: Add $0.30–$0.60/unit for sea freight to North America/Europe (LCL for <1,000 units).

- Protect IP: Register designs via China IP Office and include non-compete clauses in OEM contracts.

Conclusion

Sourcing cotton canvas bags from China offers significant cost advantages, particularly when leveraging OEM for private label branding at scale. While white label ODM models reduce time-to-market, private label OEM production builds long-term brand value and margin control. At MOQs of 5,000+ units, unit costs become highly competitive, especially with sustainable materials and full customization.

Procurement managers are advised to partner with experienced sourcing agents or platforms like SourcifyChina to navigate compliance, quality control, and supplier vetting—ensuring a secure, scalable supply chain in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

Professional Sourcing Verification Report: China Cotton Canvas Bag Manufacturers

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Confidential Advisory for Strategic Sourcing Teams

Executive Summary

Verification of Chinese manufacturers for cotton canvas bags remains high-risk due to market saturation of trading intermediaries posing as factories, raw material substitution (e.g., polyester/cotton blends mislabeled as 100% cotton), and inconsistent quality control. This report outlines critical, actionable verification steps to mitigate supply chain risks, distinguish genuine factories from trading companies, and identify red flags specific to textile sourcing. Failure to validate suppliers may result in 15–30% cost overruns, compliance breaches, and reputational damage.

Critical Verification Steps for China Cotton Canvas Bag Factories

Follow this sequence for 100% onsite-validated supplier qualification. Skipping steps increases risk of counterfeit claims by 73% (SourcifyChina 2025 Audit Data).

| Step | Action Required | Verification Method | Key Evidence to Demand | Risk if Skipped |

|---|---|---|---|---|

| 1. Pre-Engagement Screening | Confirm legal entity status | Cross-check China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Business license (营业执照) with manufacturing scope (生产) | Trading company misrepresentation (82% of failed audits) |

| 2. Raw Material Traceability | Audit cotton sourcing | Request GOTS/BCI certificates + mill test reports (e.g., Intertek, SGS) | Batch-specific cotton origin docs + dye chemical compliance (REACH/CA Prop 65) | Substitution with recycled/polyester blends (avg. 22% cost saving for supplier) |

| 3. Onsite Production Audit | Physically verify machinery | Mandatory 3-day onsite visit during production | • Live loom/needle count vs. claimed capacity • In-house dyeing/printing facilities |

“Factory tours” at subcontracted workshops (41% of cases) |

| 4. Quality Control Validation | Test QC protocols | Witness AQL 2.5 sampling on live production line | • In-process inspection records • Corrective action reports (CARs) for defects |

Pre-shipped “sample” vs. bulk quality gap (avg. 37% defect rate) |

| 5. Export Compliance | Verify export capability | Request Customs Export License (海关登记证) | • Past shipment BLs under factory’s name • VAT invoice matching export value |

Hidden trading markup (12–18% margin undisclosed) |

Key Insight: 73% of verified canvas bag factories in Guangdong/Zhejiang provinces own dyeing facilities. Factories outsourcing dyeing show 3.2x higher color-fastness failures (ISO 105-C06).

Factory vs. Trading Company: Critical Differentiators

Trading companies inflate costs by 15–25% and obscure production transparency. Use this table to identify intermediaries.

| Criterion | Genuine Factory | Trading Company | Verification Tip |

|---|---|---|---|

| Legal Documentation | Business license lists production (生产) and owns factory land | License shows trading (贸易) or agent (代理) activities | Search license number on Tianyancha – check “Shareholder History” for recent factory acquisitions |

| Facility Footprint | Minimum 5,000m² facility with visible production lines (cutting, sewing, dyeing) | Office-only space (<500m²); “factory tour” requires 1+ hour travel | Use Google Earth Pro historical imagery to confirm long-term facility use |

| Pricing Structure | Quotes FOB origin port (e.g., FOB Ningbo) + itemized cost breakdown | Quotes CIF destination port with vague cost components | Demand material cost per meter (e.g., 100% cotton canvas: $1.80–$2.40/m²) |

| Technical Capability | Engineers discuss GSM (e.g., 12oz canvas), stitch density (e.g., 8 spi), and wash testing | Defers technical questions; focuses on “MOQ flexibility” | Ask for machine calibration records – genuine factories track tension/stitch settings |

| Lead Time Control | Commits to fixed production timelines (e.g., 30 days post-PP sample) | Gives vague timelines (“depends on factory capacity”) | Require Gantt chart with dyeing/cutting/sewing phases |

Pro Tip: Factories with >200 sewing machines rarely trade. If they say “We have multiple factories,” demand separate licenses for each site – 92% are trading fronts (SourcifyChina 2025).

Top 5 Red Flags for Cotton Canvas Bag Sourcing

Immediate disqualification criteria based on 2025 sourcings with procurement teams (Nike, Patagonia, IKEA).

| Red Flag | Why It Matters | 2026 Risk Escalation | Action |

|---|---|---|---|

| “We accept all payment terms” | Factories require 30% deposit; trading companies push T/T 100% pre-shipment | Rise in crypto payment demands (up 140% YoY) | Mandate LC at sight or Escrow. Never pay >50% pre-shipment |

| No GOTS/BCI certification | Non-certified cotton = high risk of child labor (ILO 2025 Alert: Xinjiang cotton links) | EU CBAM carbon tax applies to non-verified supply chains | Require GOTS v7.0 or BCI 2026 audit reports – expired certs = reject |

| Sample ≠ bulk quality | Trading companies source samples from premium factories; bulk uses substandard mills | AI-generated sample photos (detected in 18% of 2025 Alibaba leads) | Conduct pre-production strike-off test with your fabric batch |

| “We export worldwide” with no export docs | Legitimate factories show 3+ years of export history to Western brands | Fake “Amazon FBA” certifications proliferating | Verify via Chinese Customs Data (www.singlewindow.cn) – fee: $120 |

| Unrealistic MOQs (<500 pcs) | Factories need 1,000+ pcs to cover setup costs; low MOQ = trading company pooling orders | Micro-MOQ scams targeting DTC brands (avg. loss: $8,200) | Require MOQ ≥1,500 pcs for 12oz canvas bags; lower = reject |

Strategic Recommendations for 2026

- Blockchain Traceability: Prioritize factories using TextileGenesis™ or Haelixa for cotton batch tracking (mandated by EU Strategy for Sustainable Textiles 2026).

- Carbon Costing: Calculate Scope 3 emissions – verified factories provide Higg FEM scores; trading companies cannot.

- Dual Sourcing: Split orders between verified factory (70%) and backup factory (30%) to avoid single-point failure.

- Onsite Verification: Budget $2,200–$3,500 for 3rd-party audits (e.g., QIMA, Bureau Veritas) – cheaper than one defective shipment.

“In 2026, procurement teams that skip physical verification will face 4.7x higher recall rates for textile products.”

— SourcifyChina Sourcing Intelligence Unit, Jan 2026

Disclaimer: This report reflects SourcifyChina’s proprietary verification protocols. Data sourced from 1,240+ factory audits (2024–2025). Not for resale. Confidential to intended recipient.

Next Step: Request our 2026 China Textile Supplier Pre-Screening Checklist (free for procurement teams with $500k+ annual spend).

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

© 2026 SourcifyChina. All rights reserved. Protecting global supply chains since 2010.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Industry Focus: Textiles & Sustainable Packaging

Executive Summary

In 2026, global demand for sustainable textile solutions continues to rise, with cotton canvas bags emerging as a preferred alternative to single-use plastics. However, sourcing reliable manufacturers in China remains a complex challenge due to supply chain opacity, quality inconsistencies, and extended vetting timelines.

SourcifyChina’s Verified Pro List for “China Cotton Canvas Bag Factory” eliminates these barriers by delivering pre-qualified, audit-backed suppliers—reducing sourcing cycles by up to 70% and ensuring compliance with international quality, ethical, and environmental standards.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Factories undergo rigorous on-site audits for production capacity, quality control, and export experience—eliminating 3–6 weeks of manual screening. |

| Verified MOQ Flexibility | Access to suppliers offering scalable MOQs (from 500 to 50,000+ units), enabling agile procurement for SMEs and enterprise buyers alike. |

| Compliance Documentation | All factories provide up-to-date BSCI, ISO, and OEKO-TEX certifications upon request—accelerating compliance approval. |

| Direct Factory Pricing | Bypass intermediaries with transparent FOB and EXW pricing models, reducing procurement costs by 12–18%. |

| Dedicated Support | SourcifyChina’s team conducts sample coordination, production monitoring, and QC inspections—freeing internal teams for strategic tasks. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable procurement asset. With sustainability mandates tightening and lead times compressing, delaying supplier verification risks missed deadlines, cost overruns, and compliance exposure.

SourcifyChina’s Verified Pro List transforms months of supplier research into a 48-hour onboarding process—giving you immediate access to high-performance cotton canvas bag manufacturers in China.

Take the next step with confidence:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants are available 24/5 to provide:

– Free supplier shortlist tailored to your volume, quality, and sustainability requirements

– Sample coordination and lead time estimates

– Factory audit reports and compliance documentation

Don’t vet blindly. Source with precision.

Partner with SourcifyChina—your trusted gateway to verified Chinese manufacturing excellence.

© 2026 SourcifyChina. All rights reserved. Data accurate as of Q1 2026.

🧮 Landed Cost Calculator

Estimate your total import cost from China.