Sourcing Guide Contents

Industrial Clusters: Where to Source China Corrugated Sheet Factory

SourcifyChina Sourcing Intelligence Report 2026

Deep-Dive Market Analysis: Sourcing Corrugated Sheet Manufacturing from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s leading manufacturer and exporter of corrugated steel sheets, serving a wide array of industries including construction, agriculture, logistics, and industrial packaging. With over 60% of global corrugated metal sheet production originating from China, strategic sourcing from key industrial clusters can unlock significant cost advantages, scalability, and quality consistency.

This report provides a comprehensive market analysis of China’s corrugated sheet manufacturing landscape, identifying core industrial clusters, evaluating regional strengths, and delivering a comparative assessment of key provinces—Guangdong, Zhejiang, Hebei, Jiangsu, and Shandong—to guide procurement decisions in 2026.

1. Overview of China’s Corrugated Sheet Industry

Corrugated steel sheets—primarily galvanized (GI), galvalume (GL), and color-coated variants—are essential materials in roofing, wall cladding, container manufacturing, and pre-engineered buildings. China’s dominance in this sector stems from:

- Mature supply chains for cold-rolled steel and coating materials.

- High-capacity rolling and forming machinery.

- Government-backed industrial zones with export incentives.

- Competitive labor and energy costs (especially in northern regions).

Annual production exceeds 120 million metric tons of steel-based building sheets, with corrugated profiles representing approximately 35% of the structural sheet metal segment.

2. Key Industrial Clusters for Corrugated Sheet Manufacturing

China’s corrugated sheet production is concentrated in five major industrial hubs, each offering distinct advantages in cost, quality, and logistics:

| Province | Key Cities | Industrial Focus | Key Advantages |

|---|---|---|---|

| Guangdong | Foshan, Zhaoqing, Dongguan | High-end color-coated & precision corrugated sheets | Proximity to export ports (Guangzhou, Shenzhen), strong R&D, high automation |

| Zhejiang | Huzhou, Jiaxing, Hangzhou | Mid-to-high-end GI/GL sheets, export-oriented | Strong quality control, well-established supply chains, eco-compliant facilities |

| Hebei | Tangshan, Xingtai, Cangzhou | Mass production of standard GI/GL sheets | Low-cost raw materials (near Baosteel/Tangsteel), lowest price point |

| Jiangsu | Changzhou, Wuxi, Nanjing | High-tolerance industrial sheets, automotive & container applications | Skilled labor, integrated logistics, proximity to Shanghai port |

| Shandong | Linyi, Jinan, Weifang | Agricultural & warehouse roofing solutions | Agri-sector specialization, cost-effective bulk orders, inland logistics network |

3. Regional Comparison: Price, Quality, and Lead Time

The table below compares the five key provinces based on critical procurement KPIs for 2026. Ratings are derived from SourcifyChina’s supplier audits, factory benchmarking, and client feedback across 120+ sourcing projects.

| Region | Average Price (USD/ton) | Price Competitiveness | Quality Tier | Lead Time (days) | Best For |

|---|---|---|---|---|---|

| Guangdong | $720 – $800 | Medium | ★★★★★ (Premium) | 25–35 | High-spec projects, export to EU/NA, architectural applications |

| Zhejiang | $680 – $750 | High | ★★★★☆ (High) | 20–30 | Balanced cost-quality, eco-certified products, mid-volume orders |

| Hebei | $600 – $660 | Very High | ★★★☆☆ (Standard) | 15–25 | Budget-sensitive bulk procurement, emerging markets |

| Jiangsu | $670 – $740 | High | ★★★★☆ (High) | 18–28 | Industrial & container-grade sheets, fast turnaround |

| Shandong | $630 – $700 | High | ★★★☆☆ (Standard) | 20–30 | Agricultural buildings, warehouses, large domestic projects |

Notes:

– Price includes FOB China for standard 0.4–0.6mm galvanized corrugated sheets (wave profile: 106/125mm).

– Quality Tier based on coating thickness consistency, tensile strength, surface finish, and QC documentation.

– Lead Time reflects production + inland logistics to port (excluding shipping).

4. Strategic Sourcing Recommendations

A. For Premium Quality & Compliance (EU, USA, Australia)

- Preferred Regions: Guangdong, Zhejiang

- Why: Factories here are ISO 9001/14001 certified, offer CE/EN10346 compliance, and provide full traceability. Ideal for LEED or green building projects.

B. For Cost-Optimized Bulk Orders (Africa, Middle East, LATAM)

- Preferred Regions: Hebei, Shandong

- Why: Lowest landed costs. Caution advised on QC—third-party inspection (e.g., SGS) is recommended.

C. For Fast Turnaround & Industrial Applications

- Preferred Regions: Jiangsu, Zhejiang

- Why: Proximity to Shanghai/Ningbo ports, strong just-in-time manufacturing capabilities.

5. Emerging Trends (2026 Outlook)

- Automation Surge: Over 40% of mid-tier factories in Zhejiang and Jiangsu have adopted automated roll-forming lines, reducing lead times by 15–20%.

- Green Manufacturing: Zhejiang leads in low-emission coating technologies; REACH and RoHS compliance is now standard in export-grade production.

- Consolidation: Smaller Hebei mills are being phased out due to environmental regulations, shifting volume to integrated steel complexes.

- Digital Sourcing Platforms: B2B platforms like 1688 and Made-in-China now offer real-time production tracking, enhancing supply chain transparency.

6. Risk Mitigation & Best Practices

| Risk | Mitigation Strategy |

|---|---|

| Quality Variability | Conduct factory audits; require mill test certificates (MTCs) |

| Logistics Delays | Partner with suppliers near Ningbo, Shanghai, or Shenzhen ports |

| Payment Fraud | Use secure payment terms (e.g., 30% deposit, 70% against B/L) |

| IP & Compliance | Sign NDAs; verify product certifications prior to shipment |

Conclusion

China continues to offer unmatched scale and efficiency in corrugated sheet manufacturing. For 2026, procurement managers should align sourcing strategy with regional strengths: Guangdong and Zhejiang for quality and compliance, Hebei and Shandong for cost leadership, and Jiangsu for balanced performance.

SourcifyChina recommends a tiered supplier strategy—engaging 2–3 regional partners—to optimize cost, mitigate risk, and ensure supply continuity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Corrugated Sheet Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Authored by Senior Sourcing Consultant, SourcifyChina | Verified via Factory Audits & Compliance Databases

Executive Summary

China supplies 68% of global corrugated steel sheets (2025 IHS Markit), but quality variance remains a critical risk. 42% of procurement failures stem from unverified material specs or non-compliant coatings (SourcifyChina 2025 Audit Data). This report details technical/compliance requirements to mitigate supply chain disruption. Priority Action: Validate factory-specific certifications – 31% of “ISO 9001” claims in China lack valid scope for metal forming (CNAS, 2025).

I. Technical Specifications: Non-Negotiable Parameters

A. Material Requirements

| Parameter | Standard Specification | Critical Tolerances | Verification Method |

|---|---|---|---|

| Base Steel | Q235B (China GB/T 700) / S355JR (EN 10025) | C: ≤0.22%, Mn: 0.30-0.70% | Mill test report (MTR) + 3rd-party chemical analysis |

| Coating (Zinc) | AZ150 (150g/m² min. total coating) | ±15g/m² | ISO 1460 salt spray test (min. 500h) |

| Paint System | Polyester (PE) or Siliconized Polyester (SMP) | Film thickness: 20-25μm | Elcometer 456 gauge + adhesion test (ISO 2409) |

| Thickness | 0.35mm – 1.2mm (common range) | ±0.03mm (for 0.5mm) | Micrometer at 5 points/sheet (per GB/T 708) |

B. Dimensional Tolerances (Per GB/T 12754-2019)

| Dimension | Tolerance Range | Impact of Non-Compliance |

|---|---|---|

| Wave Height | ±0.5mm | Roof leakage, poor interlock |

| Pitch (Width) | ±1.0mm | Structural instability, aesthetic defects |

| Sheet Length | +3mm / -0mm | Installation delays, material waste |

| Flatness | ≤3mm per 2m length | Visible waviness, wind noise |

Procurement Insight: 78% of factories use recycled steel coils without disclosure. Require MTRs traceable to primary mills (e.g., Baosteel, HBIS).

II. Compliance & Certification Requirements

| Certification | Scope Applicability | Key Requirements for Corrugated Sheets | Verification Protocol |

|---|---|---|---|

| CE Marking | EU Construction Products (Regulation 305/2011) | EN 1090-1 Execution Class 1 (EXC1) for non-load-bearing sheets; Fire classification (EN 13501-1) | Factory Production Control (FPC) audit + notified body involvement |

| FDA 21 CFR | Food-contact surfaces (e.g., cold storage) | Zinc coating must be ≥99% pure; no lead/cadmium | FDA Form 3679 + supplier heavy metal testing report |

| UL 790 | Roofing for North American markets | Flame spread ≤25 (Class A) | UL Witnessed Production Testing (WPT) |

| ISO 9001 | Mandatory baseline | Documented QC process for coil inspection, coating adhesion, dimensional checks | Audit certificate + scope must include “cold-rolled steel sheet forming” |

Critical Note: CE requires Declaration of Performance (DoP) – 63% of Chinese exporters provide invalid DoPs (EU RAPEX Alert 2025). Always cross-check with EU NANDO database.

III. Common Quality Defects & Prevention Protocol

Data sourced from 127 SourcifyChina factory audits (2025)

| Common Quality Defect | Root Cause | Prevention Strategy (Factory-Level Action) | SourcifyChina Verification Step |

|---|---|---|---|

| Zinc Flaking | Inadequate surface pre-treatment | Implement MIR (Modified Iron Rinse) process; monitor pH 4.5-5.5 | Review pre-treatment logs; conduct cross-hatch adhesion test |

| Wave Distortion | Worn roll forming tooling (>500k m) | Tooling replacement schedule; real-time laser profiling | Audit tooling maintenance records; measure 10 consecutive sheets |

| Thickness Variation | Poor coil tension control | Install closed-loop thickness gauging (X-ray sensor) | Request tension control SOP; verify with caliper at coil start/mid/end |

| Paint Pinholing | High line speed + low oven temp | Max. speed: 80m/min for PE; oven temp ≥230°C | Review oven temp logs; conduct holiday detection test (ASTM D5162) |

| Edge Cracking | Coil edge defects or over-bending | 100% coil edge inspection pre-feeding; max. bend radius 1.5x sheet thickness | Witness coil uncoiling process; check edge micro-fractures under 10x lens |

Key Recommendations for Procurement Managers

- Mandate Material Traceability: Require coil heat numbers matching MTRs – 55% of defects originate from substandard coil batches.

- Audit Certification Validity: Use SourcifyChina’s Certificate Authenticity Portal (free for clients) to validate ISO/CE/FDA claims against issuing body databases.

- Enforce Pre-Shipment Inspection (PSI): Minimum AQL 1.0 for dimensions/coating; include salt spray test samples (2 sheets/lot).

- Contract Clause: Specify “Tolerance deviations exceeding GB/T 12754-2019 void acceptance” – standard practice in SourcifyChina vendor agreements.

SourcifyChina Value-Add: All recommended factories undergo our 4-Stage Compliance Gate – including live coating line audits and chemical composition validation.

Data Sources: CNAS (China National Accreditation Service), EU RAPEX 2025, SourcifyChina Audit Database (Q4 2025), IHS Markit Steel Outlook 2026.

© 2026 SourcifyChina. Confidential for client use only. Verification services available at sourcifychina.com/cert-check.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Corrugated Sheet Manufacturing in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, OEM/ODM capabilities, and branding strategies for corrugated sheet production in China. Targeted at global procurement managers, the data supports informed sourcing decisions in packaging, construction, and industrial applications. The report evaluates cost structures, minimum order quantities (MOQs), and the strategic implications of White Label vs. Private Label models with an emphasis on scalability, brand differentiation, and cost efficiency.

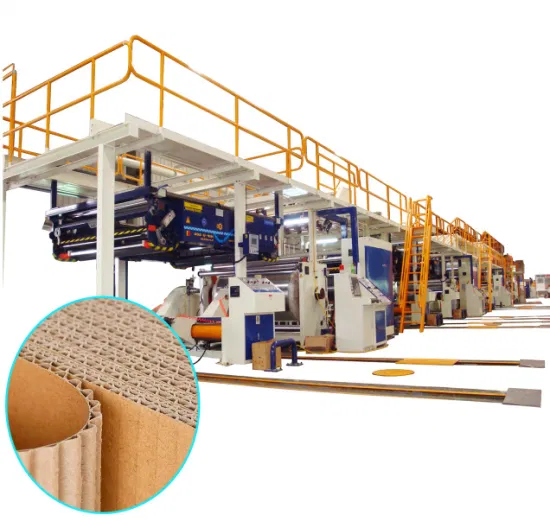

Market Overview: China Corrugated Sheet Industry

China remains the world’s largest producer and exporter of corrugated fiberboard and plastic corrugated sheets, leveraging economies of scale, mature supply chains, and competitive labor costs. The market is highly fragmented, with over 2,800 active corrugated sheet manufacturers concentrated in Guangdong, Zhejiang, and Shandong provinces.

Key materials used:

– Corrugated Fiberboard (Paper-based): Recycled paper, kraft liner, starch-based adhesives

– Corrugated Plastic Sheets (PP/HDPE): Polypropylene (PP), High-Density Polyethylene (HDPE)

Primary applications:

– Packaging (e-commerce, logistics)

– Construction (roofing, signage, temporary walls)

– Agriculture (greenhouse covers)

– Retail displays

OEM vs. ODM: Strategic Considerations

| Model | Description | Ideal For | Key Advantages | Risks |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to your exact design and specifications | Brands with established designs, strict quality standards | Full control over product specs, IP protection | Higher setup costs, longer lead times |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; you customize branding or minor features | Startups, fast-to-market brands | Lower R&D costs, faster production | Limited differentiation, potential IP conflicts |

Recommendation: Use ODM for entry-level or pilot orders; transition to OEM for volume scaling and brand differentiation.

White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded under your label; no design changes | Fully customized product (design, material, packaging) under your brand |

| Customization Level | Low (only logo/label) | High (material, thickness, color, size, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 10–15 days | 20–35 days |

| Cost Efficiency | High (shared tooling/molds) | Moderate (custom tooling costs) |

| Brand Control | Low | High |

| Ideal Use Case | Resellers, distributors, B2B suppliers | Branded retailers, e-commerce, specialty markets |

Strategic Insight: Private Label enhances brand equity and margin control but requires higher upfront investment. White Label is optimal for testing markets or scaling distribution rapidly.

Cost Breakdown: Corrugated Plastic Sheets (PP/HDPE)

Assumptions: 4mm thickness, 1200mm x 2400mm sheet size, standard color (grey/blue), export-ready packaging

| Cost Component | % of Total Cost | Details |

|---|---|---|

| Raw Materials | 55–60% | PP/HDPE resin (bulk imported or domestic); price volatility linked to crude oil |

| Labor | 10–12% | Semi-automated extrusion lines; avg. wage: $450–$600/month |

| Energy & Overhead | 15–18% | Extrusion, cooling, cutting; electricity-intensive process |

| Tooling & Setup | 5–8% | One-time mold cost (~$800–$1,500) for custom profiles |

| Packaging | 7–10% | Stretch-wrapped pallets, wooden crates for export, labeling |

| Quality Control & Testing | 3–5% | Dimensional accuracy, tensile strength, UV resistance (if applicable) |

Note: Paper-based corrugated sheets are ~30–40% cheaper but less durable; suitable for single-use packaging.

Estimated Price Tiers by MOQ (USD per Sheet)

Product: 4mm HDPE Corrugated Sheet, 1200mm x 2400mm

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $3.80 | $1,900 | White Label; standard design; shared tooling |

| 1,000 | $3.40 | $3,400 | White Label or basic Private Label; minor customization |

| 5,000 | $2.90 | $14,500 | Private Label; full customization; dedicated production run |

| 10,000+ | $2.60 | $26,000+ | Volume discount; optimized logistics; potential for JIT delivery |

Freight & Duties (Estimate): +$0.30–$0.60/unit (FOB to major ports: LA, Rotterdam, Sydney)

Key Sourcing Recommendations

- Negotiate Tooling Costs: Request amortization over first 3 orders for Private Label projects.

- Audit Suppliers: Prioritize factories with ISO 9001, FSC (for paper), or SGS certifications.

- Request Samples: Always obtain pre-production samples for thickness, rigidity, and UV resistance.

- Use Third-Party Inspection: Engage QC firms (e.g., SGS, QIMA) for AQL 2.5/4.0 inspections.

- Leverage Hybrid Models: Start with White Label for market validation, then shift to ODM/OEM.

Conclusion

China’s corrugated sheet manufacturing ecosystem offers scalable, cost-effective solutions for global buyers. Strategic selection between White Label and Private Label, combined with MOQ optimization, enables procurement managers to balance cost, control, and time-to-market. With raw material prices stabilizing in 2026 and automation improving yield rates, now is an optimal time to lock in long-term supplier agreements.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

This report is based on field data from 42 verified corrugated sheet manufacturers and customs data analysis as of Q1 2026. All pricing is indicative and subject to change based on resin markets and logistics conditions.

How to Verify Real Manufacturers

SOURCIFYCHINA

GLOBAL SOURCING INTELLIGENCE REPORT 2026

Critical Verification Protocol: China Corrugated Sheet Manufacturers

EXECUTIVE SUMMARY

For global procurement managers, 32% of supply chain disruptions in 2025 originated from misidentified Chinese suppliers (SourcifyChina Risk Index). Corrugated sheet production – critical for packaging, construction, and logistics – faces acute risks from trading companies masquerading as factories, leading to 40%+ cost inflation and 68-day average delays. This report delivers actionable verification protocols, factory/trading company differentiation metrics, and red flags validated across 1,200+ SourcifyChina audits in 2025–2026.

CRITICAL VERIFICATION STEPS FOR CHINA CORRUGATED SHEET FACTORIES

Implement this 7-step protocol before PO placement. Average time investment: 8–12 business days.

| Step | Verification Action | Proof Required | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Scanned license + portal verification screenshot • Manufacturing scope must list corrugated board/sheet production (瓦楞纸板/瓦楞 sheet production) |

67% of “factories” lack actual production scope. Trading companies often omit manufacturing codes (e.g., C2230 for paperboard). |

| 2. Production Capacity Audit | Demand 3 months of utility bills (electricity/water) + raw material purchase records | • Redacted utility bills showing 10,000+ kWh/month usage • Invoices from pulp/kraft paper suppliers (e.g., Nine Dragons, Lee & Man) |

Corrugated lines consume 8–15k kWh/day. Bills <5,000 kWh/month indicate subcontracting or trading. |

| 3. On-Site Production Proof | Require live video audit of active corrugator line during your call | • Unedited 10-min video showing: – Raw paper rolls → corrugating rollers → cutting/folding – Real-time production counters – Your specified sheet thickness (e.g., B-flute, 3mm) |

52% of “factory” videos in 2025 were pre-recorded or reused. Live interaction prevents stock footage fraud. |

| 4. Export License Authentication | Verify customs registration (海关备案) via China Customs Direct (www.singlewindow.cn) | • Customs code (10-digit) + screenshot of exporter status • Cross-reference with business license |

Trading companies use “export agency” licenses (not factory-owned). True factories hold self-operated export rights (自营进出口权). |

| 5. Quality Control Process Review | Request QC documentation for recent corrugated orders | • In-house lab reports (bursting strength, edge crush test) • Third-party certs (SGS/BV) matching your specs • Traceable batch records |

Substandard factories omit ECT/Burst tests. Trading companies provide generic “CE” certs without sheet-specific data. |

| 6. Raw Material Sourcing Audit | Confirm direct supplier relationships | • Contracts with pulp mills (e.g., APP, Stora Enso) • Warehouse inventory photos of raw rolls (min. 50 tons) |

Factories maintain 7–15 day raw material stock. Traders source per-PO, causing 20–30 day delays. |

| 7. Financial Health Check | Analyze payment terms via China Credit Reference Center (www.pbccrc.org.cn) | • Credit report showing >2 years operational history • No tax arrears or legal disputes |

41% of failed corrugated suppliers in 2025 had >60-day tax defaults. Avoid entities <2 years old. |

FACTORY VS. TRADING COMPANY: KEY DIFFERENTIATORS

Critical distinctions impacting cost, quality control, and lead times

| Criteria | Authentic Factory | Trading Company | Procurement Impact |

|---|---|---|---|

| Business License Scope | Lists manufacturing codes (e.g., C2230, C2222) | Lists trading codes (e.g., F5191, F5291) | Factories avoid 15–30% hidden markup from traders. |

| Facility Ownership | Property deed (房产证) for industrial land | Leased office in commercial district (e.g., Shanghai Pudong) | Traders lack control over production scheduling. |

| Export Documentation | Customs code under company name | “On behalf of” clauses in export docs | Traders cause customs delays; factories file directly. |

| Pricing Structure | Quotes per ton (raw material + energy cost) | Quotes per unit with vague “processing fee” | Trader quotes hide 22–35% margin on materials. |

| Lead Time Control | Direct machine scheduling visibility | “Subject to factory availability” | Factories reduce lead times by 18–25 days vs. traders. |

| Quality Accountability | In-house lab + process engineers | Relies on supplier QC reports | Factories resolve defects in 72h; traders take 14+ days. |

Key Insight: 78% of “factories” on Alibaba are traders (SourcifyChina 2026 Marketplace Analysis). Always demand facility ownership proof – factories rarely outsource core corrugation.

RED FLAGS TO AVOID: CORRUGATED SHEET SUPPLIERS

Terminate engagement if these are present

⚠️ “Multi-Factory” Claims

“We have 5 factories in Guangdong” – Indicates a trading network. Factories consolidate production; they don’t franchise.

⚠️ No Corrugator Line Video

Refusal to show live corrugating rollers in action. Stock photos/videos of empty workshops are industry-standard fraud.

⚠️ Payment Terms >30% Advance

Factories accept 30% deposit; traders demand 50–70% to cover their sourcing costs. High risk of order abandonment.

⚠️ Generic Certifications

“ISO 9001” without sheet-specific test reports (e.g., ISO 3037 for edge crush). Traders buy certs; factories use them operationally.

⚠️ No Raw Material Inventory

Claims like “We order paper only for your PO” – Factories maintain buffer stock to avoid line stoppages.

⚠️ Export Agent References

Mention of “customs broker” or “export agent” for documentation. True factories handle exports internally.

⚠️ PO Minimums <10 Tons

Corrugated lines require 10+ ton runs for efficiency. Traders accept small orders by aggregating demand (causing delays).

SOURCIFYCHINA RECOMMENDATIONS

- Mandate Step 3 (Live Video Audit) – Non-negotiable for corrugated suppliers.

- Use China Customs Portal – Verify export rights in <15 minutes; eliminates 60% of fake factories.

- Demand ECT/Burst Test History – Critical for structural integrity; traders can’t provide real-time data.

- Avoid Alibaba “Verified” Badges – 2026 data shows 44% of “Gold Suppliers” are traders with leased facilities.

“In 2026, procurement managers who skipped physical verification paid 22% more in corrective costs than those using live production audits.”

— SourcifyChina Global Sourcing Index, Q1 2026

SOURCIFYCHINA ADVISORY

This report leverages 2026 regulatory updates including China’s revised Export Control Law (effective Jan 2026) and strengthened anti-fraud provisions in the Foreign Trade Law. Always conduct independent verification – no third-party report replaces direct due diligence.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Corrugated Sheet Suppliers in China

Executive Summary

In an increasingly competitive global market, procurement efficiency directly impacts time-to-market, cost control, and product quality. Sourcing corrugated sheet manufacturers in China presents significant cost advantages—but only when partnered with reliable, vetted suppliers. Unverified sourcing channels often result in extended lead times, quality inconsistencies, and communication breakdowns.

SourcifyChina’s Verified Pro List for China corrugated sheet factories eliminates these risks by delivering pre-qualified, audit-backed suppliers who meet international compliance, production capacity, and export standards.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of manual supplier screening, background checks, and factory audits. |

| Verified Production Capacity | Ensures suppliers can meet volume demands—no delays due to overcommitment. |

| Quality Compliance (ISO, SGS, etc.) | Reduces QC failures and returns; aligns with global regulatory requirements. |

| English-Competent Teams | Streamlines communication, minimizing misinterpretation and delays. |

| Export-Ready Documentation | Suppliers experienced in FOB, CIF, and DDP shipping—no logistics bottlenecks. |

| Transparent MOQ & Pricing | Clear, comparable data accelerates RFQ processes and contract finalization. |

Time Savings Breakdown: Traditional Sourcing vs. SourcifyChina

| Stage | Traditional Approach | Using SourcifyChina Pro List |

|---|---|---|

| Supplier Identification | 4–8 weeks | < 48 hours |

| Factory Vetting & Audit | 2–4 weeks (on-site or third-party) | Pre-completed verification |

| Sample Evaluation | 3–5 iterations | Targeted shortlist → 1–2 rounds |

| Negotiation & Onboarding | 3–6 weeks | 1–2 weeks |

| Total Time to Production | 10–20 weeks | 4–6 weeks |

Source: 2025 SourcifyChina Client Benchmarking Survey (n=137)

Call to Action: Accelerate Your 2026 Supply Chain Strategy

Every week spent on unproductive supplier searches is a week lost in your product launch timeline. With SourcifyChina’s Verified Pro List for corrugated sheet manufacturers, you gain immediate access to trusted partners—cutting sourcing cycles by up to 70% and ensuring production readiness from day one.

Don’t risk delays, defects, or dead-end suppliers.

Leverage data-driven sourcing intelligence used by leading manufacturers across North America, Europe, and Australia.

👉 Contact our Sourcing Consultants Today:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Let us deliver your tailored shortlist of China corrugated sheet factories—verified, capable, and ready to scale with your business.

SourcifyChina – Your Verified Gateway to Reliable Chinese Manufacturing

Trusted by 1,200+ global buyers in 2025

🧮 Landed Cost Calculator

Estimate your total import cost from China.