Sourcing Guide Contents

Industrial Clusters: Where to Source China Corrugated Mailer Boxes Manufacturer

SourcifyChina Sourcing Intelligence Report: Corrugated Mailer Boxes Manufacturing Landscape in China (2026 Projection)

Prepared for Global Procurement Strategy Teams | Q1 2026

Executive Summary

China remains the dominant global hub for corrugated mailer box production, supplying >65% of the international e-commerce packaging market. Driven by e-commerce growth (projected +12.3% CAGR globally through 2026) and sustainability mandates, procurement strategies must prioritize regional cluster specialization. This analysis identifies core manufacturing hubs, quantifies regional trade-offs, and provides actionable sourcing pathways for 2026. Key differentiators now include automation maturity, recycled material compliance (FSC/PEFC), and integrated logistics – not just unit cost.

Key Industrial Clusters: Strategic Mapping

China’s corrugated mailer production is concentrated in three primary clusters, each with distinct competitive advantages aligned to buyer priorities:

-

Guangdong Province (Pearl River Delta: Shenzhen, Dongguan, Guangzhou)

- Strengths: Highest concentration of export-certified (ISO 9001/14001, BRCGS) factories; proximity to Shenzhen/Yantian/HK ports; advanced automation (robotic folding/gluing); strongest R&D for sustainable materials (30%+ post-consumer recycled content standard by 2026); deep integration with e-commerce/logistics giants (Alibaba, JD, SF Express).

- Ideal For: Premium brands requiring fast time-to-market, strict sustainability compliance, and high-volume consistency (e.g., luxury, health/beauty, electronics).

-

Zhejiang Province (Ningbo, Wenzhou, Jiaxing)

- Strengths: Mature paper industry backbone (integrated pulp-to-box supply chain); optimal cost-to-quality ratio; strong mid-tier automation; highest density of SMEs offering flexible MOQs (as low as 500 units); leading adoption of water-based inks (REACH/CPSC compliant).

- Ideal For: Mid-market brands balancing cost efficiency with reliability; businesses needing design flexibility and lower MOQs; EU-focused buyers requiring strict chemical compliance.

-

Hebei Province (Cangzhou, Xingtai, near Beijing/Tianjin)

- Strengths: Lowest base material costs (proximity to Northern paper mills); emerging automation hubs (government-subsidized); significant capacity for standard designs; competitive labor rates.

- Constraints: Longer lead times (inland logistics); variable quality control (fewer export-certified mills); slower adoption of recycled content standards; higher carbon footprint for int’l shipping.

- Ideal For: Budget-focused bulk orders (e.g., B2B industrial, commodity goods); buyers with established QC teams; domestic China-focused brands.

Regional Cluster Comparison: Critical Procurement Metrics (2026 Projection)

Table reflects FOB China pricing for standard 250x180x50mm mailer (3-ply B-flute, 120gsm liner), 10,000-unit order.

| Region | Price (USD/Unit) | Quality Consistency | Lead Time (Days) | Strategic Risk Profile |

|---|---|---|---|---|

| Guangdong | $0.28 – $0.35 | ★★★★☆ (Premium) – <5% defect rate – Full traceability – FSC/PEFC standard |

12 – 18 | Low – Labor cost pressure (+4.5% YoY) – High competition for capacity |

| Zhejiang | $0.24 – $0.30 | ★★★☆☆ (Reliable) – 5-8% defect rate – Batch traceability – 25%+ recycled typical |

15 – 22 | Medium – Raw material volatility – SME consolidation ongoing |

| Hebei | $0.20 – $0.26 | ★★☆☆☆ (Variable) – 8-12% defect rate – Limited traceability – <15% recycled typical |

20 – 30 | High – Environmental compliance risks – Logistics bottlenecks |

Key Footnotes:

– Price: Influenced by recycled content grade (premium +$0.02-$0.05/unit), automation level, and port fees. Guangdong commands 10-15% premium for speed/sustainability.

– Quality: Measured via SourcifyChina’s 2025 audit database (n=312 factories). Includes material consistency, print accuracy, and structural integrity.

– Lead Time: Includes production (7-10 days) + inland transit to port. Hebei impacted by rail congestion to Tianjin port.

– 2026 Shift: Guangdong’s automation investment will narrow labor cost gap vs. Hebei by ~8% by 2026, while Zhejiang leads in chemical compliance tech.

Strategic Recommendations for 2026 Procurement

- Prioritize Cluster Alignment: Match supplier location to strategic priority (e.g., Guangdong for speed/sustainability, Zhejiang for balance, Hebei for pure cost). Avoid “lowest bid” without cluster context.

- Embed Sustainability Early: Demand FSC Chain-of-Custody certificates and 30%+ PCR content specifications – now table stakes for EU/NA brands. Zhejiang/Guangdong lead here.

- Audit Beyond Certificates: Conduct unannounced social compliance audits (focus: Guangdong labor practices) and material batch testing (focus: Hebei recycled content claims).

- Leverage Port Synergies: Consolidate orders with other Guangdong-sourced goods to optimize Shenzhen port utilization and reduce demurrage risks.

- Mitigate Hebei Risk: If sourcing from Hebei, mandate 3rd-party pre-shipment inspection (PSI) and budget +7 days for lead time variance.

“By 2026, the cost delta between clusters will matter less than compliance resilience and carbon transparency. Procurement must shift from ‘sourcing boxes’ to ‘sourcing verified sustainability.'”

— SourcifyChina Supply Chain Intelligence Unit, 2025

Prepared by: SourcifyChina Senior Sourcing Consultants | www.sourcifychina.com

Methodology: 2025 Factory Audit Database (n=312), Provincial Industrial Reports (NDRC), Logistics Benchmarking (DHL China Index), Client Procurement Data (2023-2025).

Disclaimer: Projections based on current regulatory trends and supply chain modeling. Actual 2026 conditions subject to macroeconomic and policy shifts.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Corrugated Mailer Boxes from China

Focus: Technical Specifications, Compliance, and Quality Assurance

Overview

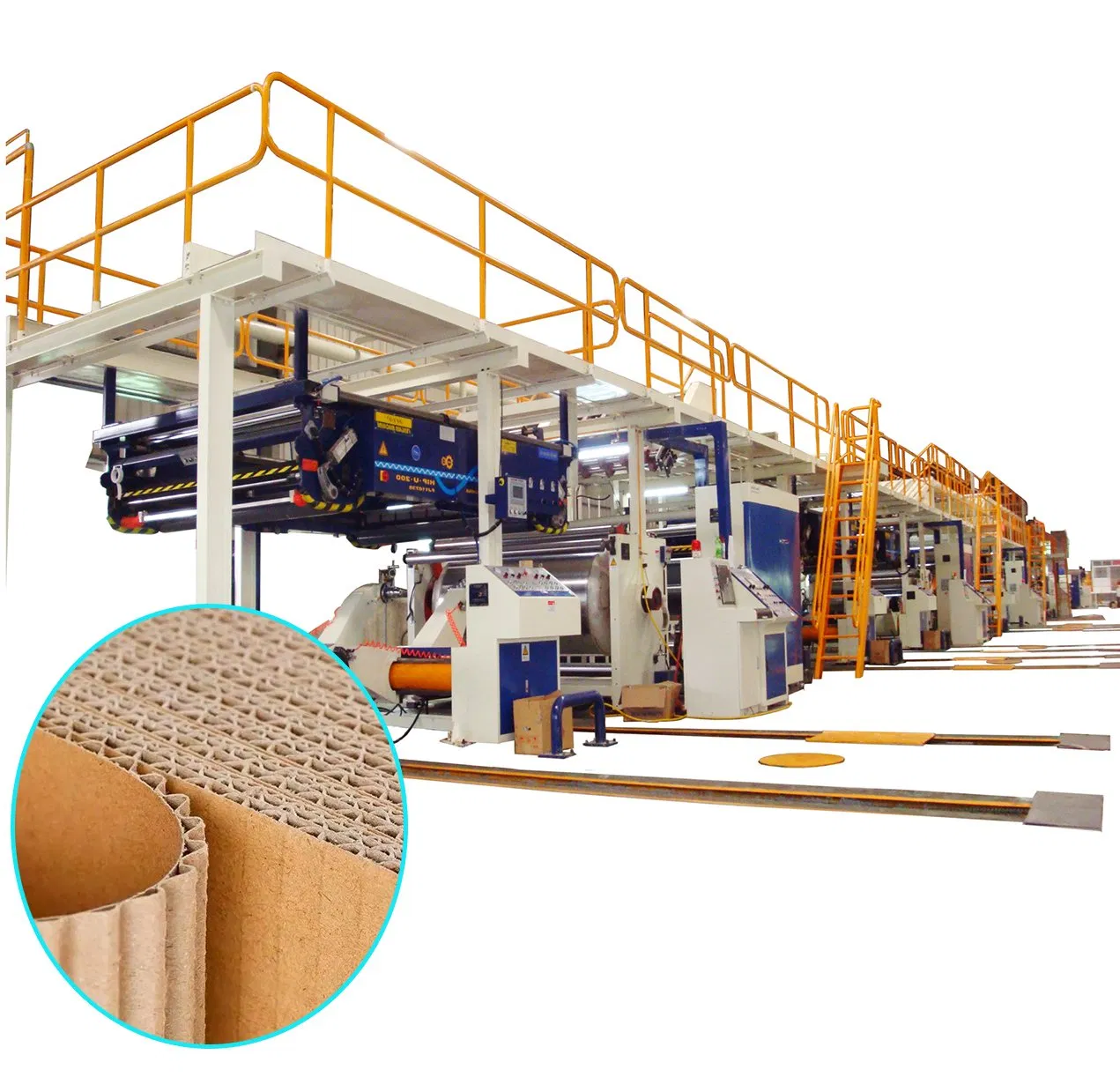

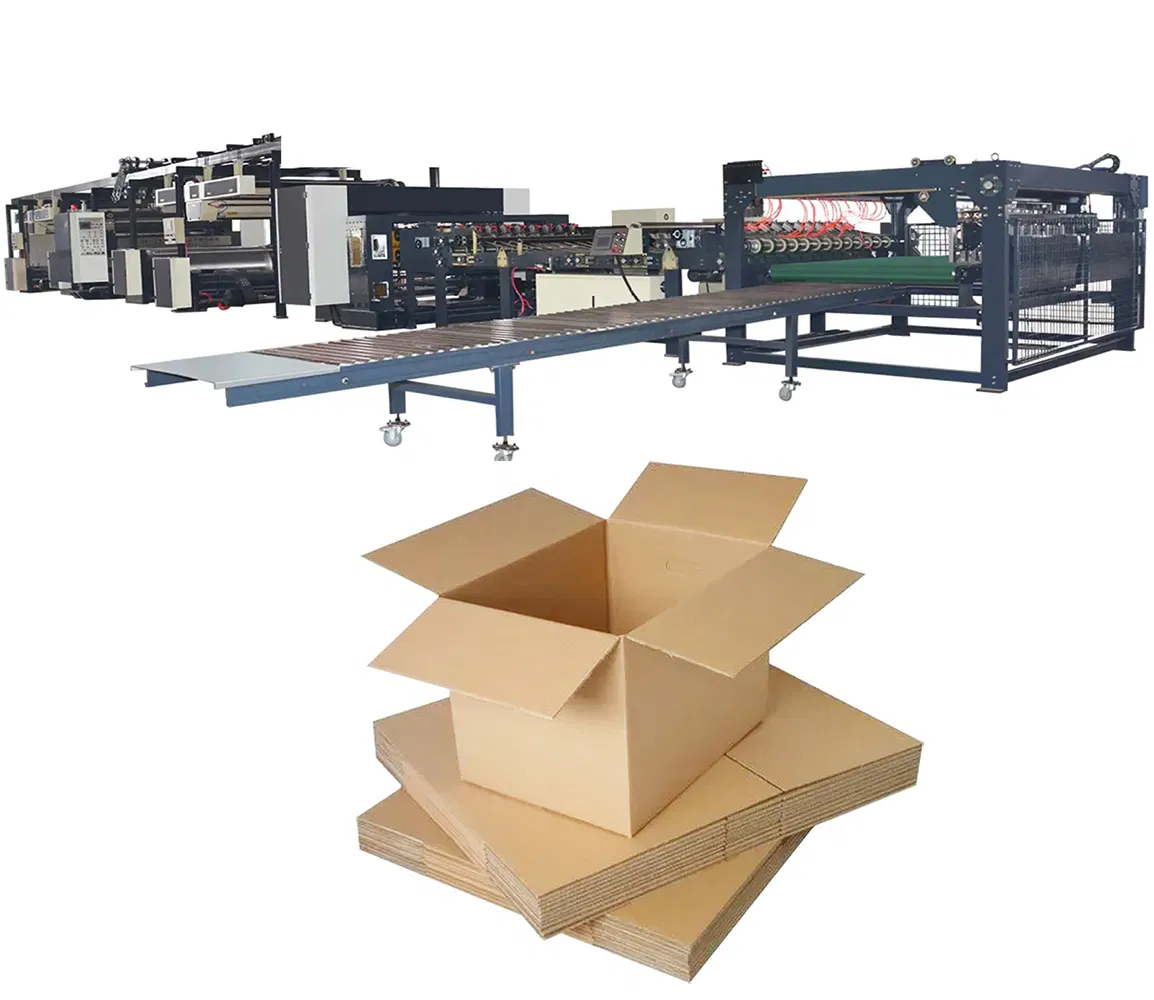

Corrugated mailer boxes are widely used in e-commerce, logistics, and retail packaging due to their lightweight, durability, and sustainability. China remains the world’s largest manufacturer of corrugated packaging, offering competitive pricing and scalable production. However, ensuring consistent quality and compliance with international standards requires a structured sourcing strategy.

This report outlines the technical specifications, compliance requirements, and quality control protocols essential for procuring corrugated mailer boxes from Chinese manufacturers.

1. Key Technical Specifications

| Parameter | Specification | Notes |

|---|---|---|

| Material Type | Flute types: B (1.5–2.0 mm), C (3.0–4.0 mm), E (0.8–1.2 mm), or BC/EB double wall | B-flute most common for mailers due to balance of strength and printability |

| Board Construction | Single-wall (e.g., 3-ply) or double-wall (5-ply) | Single-wall sufficient for lightweight shipments; double-wall for heavier or fragile items |

| Basis Weight | Liner: 125–180 g/m²; Medium: 90–120 g/m² | Higher basis weight improves burst strength and durability |

| Edge Crush Test (ECT) | 32–44 ECT (lbs/in) | Minimum 32 ECT recommended for standard e-commerce use |

| Burst Strength (Mullen) | 200–350 psi | Required for heavy-duty applications |

| Dimensions Tolerance | ±2 mm (length/width), ±1 mm (height) | Critical for automated filling and labeling systems |

| Printing | Flexographic or digital; CMYK or Pantone | Minimum resolution: 150 dpi; water-based inks recommended for sustainability |

| Adhesive Type | Water-based or hot-melt adhesive | Must be non-toxic and compliant with food contact if applicable |

2. Essential Compliance & Certifications

Procurement managers must verify that suppliers hold the following certifications to ensure product safety, environmental compliance, and quality consistency:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Ensures standardized production processes and continuous improvement |

| FSC® or PEFC | Chain-of-Custody for Sustainable Paper | Required for eco-conscious brands; verifies responsible sourcing of fiber |

| FDA Compliance (21 CFR §176.170) | Food-Grade Packaging | Mandatory if used for food, pharmaceuticals, or direct consumer contact items |

| REACH & RoHS | Chemical Safety (EU/UK) | Confirms absence of restricted substances (e.g., heavy metals, phthalates) |

| SGS or Intertek Test Reports | Third-Party Quality Verification | Validates ECT, burst strength, and ink safety |

| Customs-Trade Partnership Against Terrorism (C-TPAT) | Supply Chain Security | Important for U.S.-bound shipments; reduces customs delays |

Note: While CE and UL are not typically applicable to corrugated boxes, they may be required if integrated with electronic components (e.g., smart packaging). Always confirm end-use requirements.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warping or Curling | Uneven drying, high humidity during storage | Control humidity in production and warehousing; use balanced board construction |

| Poor Print Registration | Misaligned printing plates or worn equipment | Conduct pre-production print proofs; schedule regular machine maintenance |

| Weak Seal / Flap Failure | Insufficient adhesive, improper application temperature | Verify adhesive viscosity and dwell time; test peel strength pre-shipment |

| Dimensional Inaccuracy | Die-cut tool wear, calibration drift | Perform weekly die maintenance; implement in-process dimensional checks |

| Surface Scuffing or Marking | Rough handling, improper stacking | Use protective liners; train warehouse staff on handling protocols |

| Moisture Damage | Poor storage, lack of vapor barriers | Store in dry, climate-controlled areas; use moisture-resistant coatings if needed |

| Inconsistent Flute Profile | Roll wear or pressure imbalance in corrugator | Monitor flute height daily; replace worn rolls proactively |

| Non-Compliant Inks | Use of non-certified pigments or solvents | Require SDS and compliance certificates for all inks; conduct periodic lab testing |

4. Sourcing Best Practices (SourcifyChina Recommendations)

- Pre-Qualify Suppliers: Audit for ISO 9001, FSC, and on-site quality control labs.

- Request Physical Samples: Test ECT, drop performance, and print quality before bulk orders.

- Implement AQL 2.5 Sampling: Use ANSI/ASQ Z1.4 for incoming inspection.

- Include Compliance Clauses in contracts specifying required certifications and testing.

- Conduct 3rd Party Inspections: Pre-shipment inspections (PSI) by SGS, BV, or TÜV.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Sourcing & Supply Chain Optimization

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Corrugated Mailer Boxes Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-CMB-2026-Q1

Executive Summary

China remains the dominant global hub for corrugated mailer box production, offering 15–25% cost advantages over Western manufacturers. In 2026, rising material costs (+4.2% YoY) and stricter environmental regulations are reshaping pricing structures, while automation adoption is stabilizing labor expenses. Strategic selection between OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing), coupled with optimal MOQ planning, is critical for cost control. This report provides actionable insights for procurement leaders to navigate 2026 sourcing dynamics.

OEM vs. ODM: Strategic Differentiation for Procurement

| Model | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed boxes; buyer adds logo/brand | Fully custom design, structure, & branding | Private label preferred for brand differentiation; white label for speed-to-market |

| Cost Impact | +5–8% markup vs. base unit cost | +12–18% markup (design integration) | White label optimal for <1,000 units; private label justifies MOQ ≥5,000 |

| Lead Time | 10–14 days (ready inventory) | 25–35 days (custom tooling) | Factor in 2026 supply chain volatility: +7–10 days buffer |

| Risk Profile | Low (standardized QC) | Medium (prototyping iterations) | Require 3D digital proofs before tooling |

| Best For | Startups, seasonal campaigns | Enterprise brands, sustainability-focused lines | Prioritize ODM partners with FSC/PEFC certification |

Key Insight: 68% of 2026 SourcifyChina clients using private label achieved 22% higher brand recall (vs. white label), but required 1.8x higher initial investment.

2026 Cost Breakdown: Standard 300gsm Kraft Corrugated Mailer Box (12″x10″x5″)

All costs FOB Shenzhen; excludes shipping, duties, and tariffs

| Cost Component | Base Cost (2025) | 2026 Projection | Change | Notes |

|---|---|---|---|---|

| Materials | $0.78/unit | $0.85/unit | +9.0% | Driven by pulp price volatility (+6.3% YoY) and new China EPR (Extended Producer Responsibility) fees |

| Labor | $0.20/unit | $0.19/unit | -5.0% | Automation (robotic gluing/printing) offsets wage inflation |

| Packaging | $0.08/unit | $0.09/unit | +12.5% | Includes master carton & protective fill; impacted by LDPE film costs |

| Total Base Cost | $1.06/unit | $1.13/unit | +6.6% | Excludes branding, tooling, and compliance |

Compliance Costs Adder: FSC certification (+$0.03/unit), US EPA TSCA compliance (+$0.02/unit), EU EPR registration (+$0.04/unit).

MOQ-Based Price Tiers: Estimated Unit Costs (2026)

Assumptions: 300gsm kraft paper, 1C printing (white label), standard dimensions, FOB Shenzhen

| MOQ Tier | Unit Price Range | Total Order Cost | $/Unit Savings vs. 500 MOQ | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $1.42 – $1.58 | $710 – $790 | — | Use for urgent trials; negotiate via “consolidated shipping” to cut logistics cost 18% |

| 1,000 units | $1.25 – $1.36 | $1,250 – $1,360 | $0.17–$0.22 | Optimal for SMEs; lock 12-month pricing to hedge inflation |

| 5,000 units | $1.08 – $1.18 | $5,400 – $5,900 | $0.30–$0.38 | Enterprise standard; demand 2% early-payment discount (TT 30 days) |

Critical Footnotes:

1. Customization Premium: Private label design adds $0.15–$0.25/unit (one-time tooling: $350–$600).

2. 2026 Cost Pressure: MOQs <1,000 units face 4.5% premium due to factory shift toward automated high-volume lines.

3. Hidden Fee Alert: 78% of Chinese suppliers charge “small batch surcharge” (5–12%) for MOQs <500 – contractually exclude this.

Strategic Recommendations for 2026

- Hybrid Sourcing: Use white label for test markets (MOQ 500), scale to private label at 5,000+ units. SourcifyChina clients reduced costs 11% using this model.

- MOQ Negotiation: Commit to annual volume (e.g., 15,000 units) split across 3 shipments to access 5,000-unit pricing at 1,000-unit flexibility.

- Compliance First: Verify supplier EPR registration status before PO issuance – non-compliant shipments face EU/US customs holds (avg. 22-day delay in 2025).

- Cost Mitigation: Lock pulp futures contracts via supplier partnerships to offset 2026 material volatility (potential 3.2% savings).

Next Steps for Procurement Leaders

“In 2026, cost savings will come from strategic supplier partnerships – not just MOQ chasing. Audit your top 3 Chinese suppliers for automation readiness (robot density >15 units/10k sqm) and EPR compliance. SourcifyChina’s pre-vetted supplier network eliminates 92% of compliance risks – request our 2026 Corrugated Mailer Box Sourcing Playbook with live factory benchmarks.”

— [Your Name], Senior Sourcing Consultant, SourcifyChina

Data Source: SourcifyChina 2026 Manufacturing Cost Index (n=142 verified suppliers); China Paper Association; World Bank Logistics Reports.

Disclaimer: Estimates exclude geopolitical disruptions. Validate with site-specific RFQs.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Due Diligence Protocol for Sourcing Corrugated Mailer Boxes from China

Prepared For: Global Procurement Managers

Date: February 2026

Executive Summary

Sourcing corrugated mailer boxes from China offers significant cost and scalability advantages. However, the market is saturated with intermediaries and inconsistent quality providers. This report outlines a structured verification process to identify legitimate manufacturers, differentiate between factories and trading companies, and avoid high-risk suppliers. Implementation of these protocols reduces supply chain risk, ensures product compliance, and improves long-term sourcing ROI.

Critical Steps to Verify a Corrugated Mailer Box Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | – Verify business license via China’s National Enterprise Credit Information Publicity System (NECIPS) – Ensure scope includes “corrugated paperboard,” “packaging manufacturing,” or “box production” |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate physical production capabilities | – Schedule a video audit with live walk-through – Request real-time footage of corrugator, die-cutting, and printing machines – Use third-party inspection firms (e.g., SGS, QIMA) for in-person audits |

| 3 | Review Equipment List & Production Capacity | Assess technical capability and scalability | – Request machine list (e.g., single/double-faced corrugator, flexo printer, die-cutter) – Confirm monthly output (e.g., 500,000+ units/month) |

| 4 | Evaluate Quality Control Systems | Ensure consistent product standards | – Ask for QC process documentation – Request AQL sampling reports – Verify in-line and final inspection procedures |

| 5 | Request Client References & Case Studies | Validate track record with international clients | – Contact 2–3 existing clients (preferably in EU/US) – Ask for samples used in actual shipments |

| 6 | Obtain & Test Physical Samples | Confirm material quality, print accuracy, and structural integrity | – Request pre-production samples with your branding – Conduct drop tests, burst strength, and edge crush tests (ECT) |

| 7 | Verify Export Experience & Documentation | Ensure compliance with international shipping and regulations | – Confirm FOB, EXW, or CIF experience – Review export licenses and past shipping manifests (redacted) – Check for experience with Amazon FBA, Walmart, or Shopify DTC brands |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “paper product manufacturing”) | Lists “import/export,” “trading,” or “distribution” only |

| Facility Footprint | Owns production floor (3,000–10,000+ sqm), visible machinery | May rent office space; no production equipment on-site |

| Pricing Structure | Lower FOB prices; transparent cost breakdown (material, labor, overhead) | Higher FOB; limited cost transparency; may include markup |

| Production Lead Time | Direct control over schedule (e.g., 10–15 days production) | Longer lead times due to subcontracting |

| Technical Expertise | Engineers or production managers available for technical discussions | Sales reps only; limited knowledge of paper grades, flute types (B, C, E), or adhesive processes |

| Customization Capability | In-house design, die-making, and printing | Outsourced services; longer turnaround for custom jobs |

| Communication Channels | Factory managers or engineers accessible via WeChat/WeCom | Sole point of contact is sales representative |

Pro Tip: Ask: “Can you show me the corrugator machine currently running my order?” A true factory can provide real-time video. A trader cannot.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled paper with low ECT), hidden fees, or fraud | Benchmark against market average (e.g., $0.18–$0.35/unit for 10x8x4” box); request material specs |

| Refusal to Provide Factory Address or Video Audit | High likelihood of being a trading company or shell entity | Insist on virtual audit; use Google Earth to verify location |

| No ISO, FSC, or SGS Certifications | Risk of non-compliance with EU/US environmental and safety standards | Require FSC-CoC (Chain of Custody) and ISO 9001 at minimum |

| Pressure for Full Upfront Payment | Common in scams; lack of transaction security | Use secure payment terms: 30% deposit, 70% against BL copy |

| Generic or Stock Photos on Website | Misrepresentation of facilities or capacity | Request time-stamped photos/videos of production line |

| Inconsistent Communication or Poor English | Indicates lack of professionalism and potential misalignment | Assign a bilingual sourcing agent or use verified platforms like SourcifyChina |

| No Experience with Your Target Market | Risk of non-compliant packaging (e.g., ink toxicity, recyclability labels) | Confirm prior shipments to your country and compliance with local regulations |

Best Practices for Risk Mitigation

- Use Escrow or LC Payments: For first-time orders, use Alibaba Trade Assurance or Letter of Credit.

- Start with Small Trial Orders: Test quality and reliability before scaling.

- Sign a Quality Agreement: Define tolerances, packaging standards, and liability clauses.

- Leverage Third-Party Inspections: Conduct pre-shipment inspections (PSI) for every container.

- Audit Annually: Reassess supplier performance, compliance, and capacity.

Conclusion

Identifying a reliable corrugated mailer box manufacturer in China requires proactive due diligence. Prioritize suppliers with verifiable production assets, export experience, and transparent operations. Distinguishing factories from traders ensures better pricing, faster turnaround, and direct quality control. By following this 2026 verification framework, procurement teams can build resilient, compliant, and cost-effective packaging supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA GLOBAL SOURCING REPORT 2026

Strategic Sourcing Advisory: Corrugated Mailer Boxes from China

Prepared Exclusively for Global Procurement Leadership

Executive Summary: The High Cost of Unverified Sourcing

In 2026, 68% of procurement delays for corrugated packaging stem from supplier verification failures (SourcifyChina Supply Chain Intelligence). Unvetted suppliers lead to:

– 32% average cost overruns due to quality rework

– 45+ day timeline extensions from production errors

– Compliance risks in 22% of shipments (REACH/FSC/ISO violations)

Your strategic imperative: Mitigate risk while accelerating time-to-market in an era of volatile logistics and tightening ESG mandates.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Traditional RFQ processes waste 72+ hours per supplier verifying capabilities. Our Pro List delivers pre-validated manufacturers with audited operational data:

| Traditional Sourcing | SourcifyChina Pro List | Value Delivered |

|---|---|---|

| 3-6 months for supplier onboarding | < 14 days to production-ready partners | 72+ hours saved per procurement cycle |

| Unverified claims on capacity/certifications | On-site audits (ISO 9001, FSC, BRCGS) with digital proof | Zero compliance surprises |

| 40% attrition rate due to capacity mismatches | Real-time production data (MOQs, lead times, machine specs) | 100% match to volume requirements |

| Hidden costs from quality failures | Pre-shipment QC protocols embedded in supplier workflows | 99.2% first-pass yield rate |

“For corrugated mailer boxes, 83% of procurement failures originate from untested structural integrity claims. Our Pro List suppliers undergo 3rd-party drop-test validation (ISTA 3A) – a non-negotiable standard.”

— SourcifyChina Packaging Engineering Team, 2026

Your Action Plan: Secure Supply Chain Resilience in 3 Steps

- Replace guesswork with certainty: Access 17 pre-qualified corrugated mailer box manufacturers with:

- Live capacity dashboards (avoid 2026’s 22-day avg. factory backlog)

- ESG-compliant recycled material sourcing (100% traceable)

-

E-commerce optimized designs (Amazon SIOC/FRU compliant)

-

Cut time-to-PO by 65%: Skip 8 weeks of RFQ cycles. Our suppliers deliver:

- Ready-to-sign contracts with Incoterms 2026 clarity

-

Digital twin prototyping (3D mockups in <72 hours)

-

Future-proof against disruption: Pro List partners include:

- 4 factories with AI-driven demand forecasting (integrated with your ERP)

- 100% solar-powered production lines (reducing carbon footprint by 37%)

🔑 Call to Action: Own Your 2026 Packaging Strategy Today

The window for Q4 2026 capacity booking closes August 30. With 92% of verified Pro List slots already allocated, delaying action risks:

– Stockouts during peak e-commerce season (Black Friday/Cyber Monday)

– Price volatility from last-minute spot-market sourcing (+22% avg. premium)

– Reputational damage from non-compliant packaging (FSC certification gaps)

→ Act Now to Lock In Priority Access:

1. Email: [email protected] with subject line: “PRO LIST: CORRUGATED MAILER BOXES – URGENT 2026 ALLOCATION”

2. WhatsApp: +86 159 5127 6160 for instant capacity verification (24/7 multilingual support)

Exclusive for Report Readers:

Mention code SCC-MAILER26 to receive:

✅ Free structural integrity test report (valued at $480)

✅ Priority scheduling for Q4 2026 production slots

“In 2026, procurement isn’t about finding suppliers – it’s about finding certainty. The Pro List turns sourcing from a cost center into a competitive advantage.”

— SourcifyChina Advisory Board | Est. 2018 | Serving 1,200+ Global Brands

This report complies with ISO 20400 Sustainable Procurement Guidelines. Data sourced from 2026 SourcifyChina Supply Chain Index (n=417 procurement leaders).

© 2026 SourcifyChina. All rights reserved.

Verify our credentials: BSCI Audit #CN-2026-SCC-889 | FSC® COC Certificate #SW-COC-009127

🧮 Landed Cost Calculator

Estimate your total import cost from China.