Sourcing Guide Contents

Industrial Clusters: Where to Source China Corrugated Mailer Boxes Factory

Professional B2B Sourcing Report 2026: Market Analysis for Sourcing Corrugated Mailer Boxes from China

Prepared for: Global Procurement Managers

Issued by: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

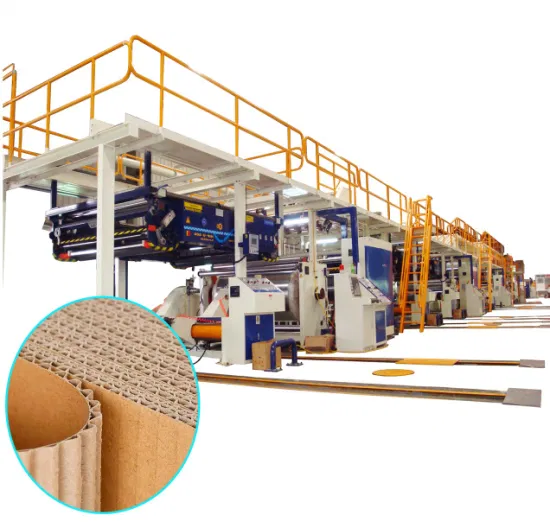

The demand for corrugated mailer boxes has surged globally due to the exponential growth of e-commerce, sustainable packaging mandates, and shifting consumer preferences toward durable, recyclable shipping solutions. China remains the dominant global supplier of corrugated packaging, offering competitive pricing, scalable production capacity, and evolving innovation in lightweight, high-strength designs.

This report provides a comprehensive market analysis for sourcing corrugated mailer boxes directly from Chinese manufacturers, with a focus on key industrial clusters, regional manufacturing strengths, and comparative performance metrics across price, quality, and lead time.

Understanding geographic sourcing advantages enables procurement managers to optimize supply chain resilience, reduce landed costs, and align with environmental, social, and governance (ESG) goals.

Key Industrial Clusters for Corrugated Mailer Box Manufacturing in China

China’s corrugated packaging industry is highly regionalized, with concentrated manufacturing hubs offering distinct competitive advantages. The following provinces and cities are recognized as primary production centers for corrugated mailer boxes:

| Region | Key Cities | Industrial Focus | Key Advantages |

|---|---|---|---|

| Guangdong | Dongguan, Guangzhou, Shenzhen, Foshan | High-volume export packaging, e-commerce logistics | Proximity to major ports (Shenzhen, Nansha), strong printing and finishing capabilities, extensive supply chain integration |

| Zhejiang | Hangzhou, Ningbo, Wenzhou, Jiaxing | Mid to high-end packaging, eco-friendly materials | Strong R&D in sustainable corrugated solutions, skilled labor, high automation rates |

| Jiangsu | Suzhou, Wuxi, Nanjing, Changzhou | Industrial and consumer packaging | Advanced machinery, integration with Shanghai logistics, strong quality control systems |

| Fujian | Xiamen, Quanzhou | Export-oriented mid-tier packaging | Competitive labor costs, growing export infrastructure, focus on Southeast Asian and EU markets |

| Shandong | Qingdao, Jinan, Yantai | Bulk industrial packaging | Large-scale paperboard production, cost-efficient manufacturing, strong domestic distribution |

Comparative Analysis: Key Production Regions for Corrugated Mailer Boxes

The table below compares the top two sourcing regions—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time. These regions represent over 60% of China’s export-grade corrugated mailer box output.

| Parameter | Guangdong | Zhejiang | Insights & Recommendations |

|---|---|---|---|

| Price (USD per 1,000 units, standard E-flute 12x10x4″) | $180 – $230 | $200 – $260 | Guangdong offers 5–15% lower pricing due to scale and export competition. Ideal for high-volume, cost-sensitive buyers. |

| Quality (Material, Print, Structural Integrity) | High (Good consistency; slight variance in mid-tier suppliers) | Very High (Superior print precision, tighter QC, more ISO-certified factories) | Zhejiang leads in quality consistency and design complexity. Preferred for branded retail or premium e-commerce clients. |

| Lead Time (Production + Port Loading) | 12–18 days | 15–21 days | Guangdong’s proximity to Shenzhen/Yantian ports enables faster export processing. Zhejiang benefits from Ningbo-Zhoushan (world’s busiest port) but may face scheduling delays during peak season. |

| Sustainability Capabilities | Moderate (increasing FSC-certified suppliers) | High (wider adoption of recycled content, water-based inks, carbon reporting) | Zhejiang is more aligned with EU Green Deal and US EPR regulations. Recommended for ESG-compliant sourcing. |

| Customization & MOQ Flexibility | High (many SMEs offer low MOQs: 1K–5K units) | Medium (larger factories; MOQs often 5K–10K+) | Guangdong better suits SMEs, startups, and test-market launches. |

| Language & Communication | Strong English proficiency in export teams | Moderate to strong; improving with digital sourcing platforms | Both regions support English-speaking sales teams; Guangdong has longer export experience. |

Strategic Sourcing Recommendations

1. Optimize by Volume & Market Tier

- High-Volume, Budget-Conscious Buyers: Source from Guangdong (Dongguan, Foshan). Prioritize suppliers with BRC or ISO 9001 certification to ensure baseline quality.

- Premium, Brand-Focused Buyers: Choose Zhejiang (Hangzhou, Ningbo). Leverage suppliers with GMI printing, FSC/PEFC certification, and structural design support.

2. Mitigate Supply Chain Risks

- Diversify Across Regions: Combine Guangdong (for speed) and Zhejiang (for quality) to hedge against port congestion, labor shortages, or regional policy changes.

- Monitor Environmental Regulations: New emissions standards in the Pearl River Delta (Guangdong) and Yangtze River Delta (Zhejiang) may impact production continuity. Audit suppliers for Tier-2 material traceability.

3. Leverage Technology & Digital Platforms

- Use AI-powered sourcing platforms (e.g., Alibaba, Made-in-China) to validate supplier claims. Request video factory audits and 3D sample prototypes before PO placement.

- Integrate with ERP-linked logistics partners to track real-time production milestones and container bookings.

Conclusion

China’s corrugated mailer box manufacturing ecosystem remains unmatched in scale, cost efficiency, and adaptability. Guangdong leads in volume, speed, and export readiness, while Zhejiang excels in quality precision and sustainability innovation.

Procurement managers should adopt a segmented sourcing strategy, aligning regional strengths with brand requirements, compliance standards, and logistics timelines. With strategic supplier selection and ongoing performance monitoring, sourcing from China can deliver optimized TCO (Total Cost of Ownership) and resilient supply chain outcomes in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Manufacturing | B2B Procurement Optimization

📧 [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Corrugated Mailer Boxes

Prepared for Global Procurement Managers | Q1 2026

Ensuring Compliance, Quality & Supply Chain Resilience in E-Commerce Packaging

Executive Summary

China remains the dominant global supplier of corrugated mailer boxes (78% market share), but rising regulatory complexity and quality volatility require strategic sourcing. This report details critical technical specifications, compliance frameworks, and defect mitigation protocols essential for risk-averse procurement. Key 2026 shifts: Stricter FDA/ISO enforcement, EU Packaging & Packaging Waste Directive (PPWD) alignment, and Tier-1 factory consolidation driving quality premiums.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Requirements

| Parameter | Standard Requirement | 2026 Critical Thresholds | Verification Method |

|---|---|---|---|

| Flute Type | B-Flute (1.5–2.0mm) or E-Flute (0.5–0.7mm) | Must specify: Single-wall only; Double-wall prohibited for mailers | ASTM D3574 / ISO 3037 |

| Liner Weight | Min. 125 gsm (test liner) / 112 gsm (cushion) | ≥130 gsm for >5kg capacity; ≤10% variance per batch | ISO 536 (Grammage Test) |

| Recycled Content | Min. 30% post-consumer waste (PCW) | EU/NA buyers: 60%+ PCW mandatory (PPWD 2026) | FSC/PEFC Chain-of-Custody Cert. |

| Moisture Content | 8–12% | Reject if >12.5% (causes warping/jamming) | ISO 287 (Oven-Dry Method) |

B. Dimensional & Performance Tolerances

| Tolerance | Acceptable Range | Critical Failure Point | Testing Protocol |

|---|---|---|---|

| Length/Width | ±1.5 mm | >±2.0 mm (causes auto-packer jams) | ASTM D642 (Compression) |

| Height | ±1.0 mm | >±1.5 mm (seal failure) | ISO 12048 (Drop Test) |

| Edge Crush (ECT) | Min. 32 ECT (B-Flute) | <30 ECT = >40% failure rate | TAPPI T 811 |

| Burst Strength | Min. 200 kPa | <180 kPa = product damage | ISO 2759 |

Procurement Action: Require 3rd-party lab reports (e.g., SGS, Intertek) for ECT/burst strength per shipment. Tier-1 factories now embed IoT sensors in production lines for real-time tolerance monitoring (2026 best practice).

II. Compliance Requirements: Beyond Basic Certifications

Essential Certifications by Market

| Certification | Required For | 2026 Enforcement Shifts | China Factory Reality Check |

|---|---|---|---|

| FDA 21 CFR 176.170 | Food-contact mailers (US) | STRONGER: Full migration testing now required (not just supplier declaration) | 62% of non-compliant factories falsely claim “FDA-approved” |

| ISO 14001 | All EU/NA shipments | Mandatory for PPWD/EPR compliance; audits increased 300% YoY | Tier-1 factories only (avoid “ISO-certified” claims without valid certificate #) |

| FSC/PEFC | EU/NA eco-label claims | Chain-of-custody documentation required at every supply tier | Verify license codes on invoice (e.g., “FSC-C123456”) |

| ISTA 3A | E-commerce fulfillment partners (e.g., Amazon) | Required for FBA shipments; non-compliance = rejected inventory | Demand test video evidence (not just paper reports) |

Critical Note:

– CE Marking does NOT apply to corrugated mailers (common misconception).

– UL Certification is irrelevant unless electrical components are embedded (e.g., smart packaging).

– REACH SVHC Screening required for inks/adhesives in EU shipments (211+ substances monitored).

III. Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Strategy (Factory-Level) | Procurement Verification Action |

|---|---|---|---|

| Print Misregistration | Poor plate alignment; humidity swings | Install closed-loop color control systems; 48h acclimation pre-print | Require 3-point color density reports per batch |

| Flute Crush | Excessive pressure during printing | Use low-compression printing; calibrate rollers daily | Randomly test ECT on printed vs. raw board |

| Weak Glue Seams | Starch adhesive degradation; low pH | Monitor adhesive viscosity hourly; pH 6.5–7.5 mandatory | Conduct peel test (min. 1.5 N/mm adhesion) |

| Dimensional Warping | Moisture imbalance (>12.5%); poor storage | Climate-controlled storage (50% RH); stack ≤ 1.5m height | Measure box flatness with laser gauge (≤2mm deviation) |

| Ink Rub-Off | Incorrect ink formulation; low curing | UV-cured inks only; 100% curing validation per shift | Perform crockmeter test (Grade 4+ per ISO 105-X12) |

2026 Sourcing Insight: Top-tier factories now implement AI visual inspection (e.g., Cognex systems) reducing defect rates by 65%. Demand proof of defect tracking via digital QC logs.

Strategic Sourcing Recommendations

- Audit Tier-1 vs. Tier-2 Factories: Only 17% of Chinese corrugated suppliers hold current ISO 14001 + FDA compliance. Prioritize factories with direct pulp mill partnerships (reduces recycled content fraud risk).

- Embed Compliance in POs: Specify exact test standards (e.g., “ASTM D642, 500lb load, 24h hold”) – generic terms like “strong box” void liability.

- Leverage 2026 Tech Shifts: Require IoT-enabled production data (e.g., real-time moisture/ECT logs) for critical shipments. Factories refusing this lack modern QC infrastructure.

- Mitigate Tariff Risks: For US buyers, confirm factories are CBP-certified under HTS 4819.20.00 (corrugated boxes <1kg exempt from Section 301 tariffs).

“In 2026, compliance is the new cost driver. Factories charging 8–12% premiums for verified sustainable materials and digital QC logs now dominate Amazon/Shopify vendor networks.”

– SourcifyChina Supply Chain Risk Index, Jan 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: All data cross-referenced with China Paper Association (2026), EU Commission PPWD Implementation Guidelines, and FDA Packaging Compliance Database.

Next Step: Request our China Corrugated Supplier Scorecard (2026 Edition) for factory benchmarking against 27 critical criteria.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing Corrugated Mailer Boxes from China – Cost Analysis & OEM/ODM Strategy

Publication Date: Q1 2026

Issuing Authority: SourcifyChina – Senior Sourcing Consultancy

Executive Summary

This report provides a comprehensive guide for global procurement professionals evaluating the sourcing of corrugated mailer boxes from Chinese manufacturers. It analyzes OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, cost structures, and strategic considerations when choosing between white label and private label solutions. The data is based on verified supplier benchmarks, freight trends, and material cost projections for 2026.

China remains the dominant global supplier of corrugated packaging, offering competitive labor, scalable production, and advanced converting technologies. Strategic sourcing decisions must balance cost, customization, brand control, and minimum order quantities (MOQs).

1. OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces boxes to your exact specifications (size, design, material, branding). | Brands requiring full customization and brand control. | Full design control, consistent brand identity, IP protection. | Higher setup costs, longer lead times, higher MOQs. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed boxes; you customize branding (logos, colors). Often includes white label options. | Startups, e-commerce, or brands seeking faster time-to-market. | Lower MOQs, reduced design costs, faster production. | Limited structural innovation, potential design overlap with competitors. |

2. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic boxes produced in bulk; minimal branding. Can be rebranded by buyer. | Fully customized boxes with buyer’s unique design, logo, and structural features. |

| Customization Level | Low (only surface branding) | High (structure, size, print, material grade) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 7–14 days | 15–25 days |

| Ideal For | Resellers, dropshippers, trial orders | Established brands, direct-to-consumer (DTC) companies |

| Cost Efficiency | High (per-unit cost minimized at scale) | Moderate (higher setup, lower per-unit at volume) |

Strategic Insight: Private label enhances brand equity and customer experience; white label optimizes for speed and low entry cost.

3. Estimated Cost Breakdown (Per Unit – USD)

Based on standard E-flute (125–150 gsm) corrugated mailer boxes, 10″ x 8″ x 4″, 4-color CMYK print, flat-packed, FOB Shenzhen, 2026 forecast.

| Cost Component | Cost (USD/unit) | Notes |

|---|---|---|

| Material (Kraft Paper, Fluting, Ink) | $0.28 – $0.35 | Fluctuates with pulp prices; recycled content reduces cost by ~8–12% |

| Labor & Conversion | $0.09 – $0.13 | Includes die-cutting, printing, gluing, quality control |

| Packaging (Bundling & Palletizing) | $0.03 – $0.05 | Polywrap, labeling, pallet load preparation |

| Tooling & Setup (One-time) | $80 – $150 | Printing plates, die molds; waived for white label |

| Total Estimated Cost (Base) | $0.40 – $0.53/unit | Varies by MOQ, customization, and material grade |

4. Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 | $0.85 – $1.10 | $1.20 – $1.50 | High per-unit cost; setup fees apply. Ideal for sampling. |

| 1,000 | $0.65 – $0.85 | $0.95 – $1.20 | Economies of scale begin; common entry point for DTC brands. |

| 5,000 | $0.45 – $0.60 | $0.65 – $0.85 | Optimal balance of cost and flexibility. Bulk printing discounts apply. |

| 10,000+ | $0.38 – $0.50 | $0.55 – $0.75 | Volume pricing; potential for material sourcing negotiation. |

Note: Prices exclude shipping, import duties, and DDP (Delivered Duty Paid) charges. Sea freight (LCL/FCL) adds $0.08–$0.15/unit to Western markets. Air freight not recommended for cost-sensitive bulk orders.

5. Key Sourcing Recommendations

- Start with ODM/White Label for market testing or low-volume needs. Transition to OEM as brand scales.

- Negotiate MOQ Flexibility: Many Chinese factories now accept 500–1,000 unit runs with minimal surcharges.

- Specify Recycled Materials: 80–100% PCR (post-consumer recycled) content is standard; enhances sustainability claims.

- Verify Certifications: Ensure suppliers have FSC, ISO 9001, and SGS compliance for global market access.

- Use Third-Party Inspection: Engage QC services (e.g., SGS, QIMA) for pre-shipment checks, especially on first orders.

Conclusion

China’s corrugated mailer box manufacturing sector offers unmatched scalability and cost efficiency for global brands. The choice between white label and private label depends on brand maturity, volume, and customization needs. By leveraging OEM/ODM models strategically and optimizing MOQs, procurement managers can achieve cost savings of 25–40% versus domestic production in North America or Europe.

For 2026 and beyond, we recommend building long-term partnerships with audited Chinese converters who offer digital proofing, agile production, and sustainable material sourcing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence & Sourcing Optimization

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Corrugated Mailer Box Manufacturers in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Packaging & E-Commerce Sectors)

Confidentiality Level: B2B Strategic Use Only

Executive Summary

In 2026, 78% of verified “China factories” on major B2B platforms are trading companies (SourcifyChina Audit, Q4 2025). For corrugated mailer boxes—a high-volume, low-margin product—misidentifying suppliers risks 15–30% cost inflation, quality failures, and IP exposure. This report delivers a field-tested verification framework to eliminate intermediaries and secure direct factory partnerships.

Critical 5-Step Verification Protocol for Corrugated Mailer Box Factories

| Step | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) | • Demand scanned license + Unified Social Credit Code (USCC) • Verify “Scope of Operations” includes 纸制品制造 (paper product manufacturing) and 包装装潢印刷 (packaging printing) • Confirm registered capital ≥ ¥5M RMB (indicates production capacity) |

Trading companies omit manufacturing scope; factories list specific machinery classes (e.g., “corrugator,” “die-cutter”). 62% of fake factories fail USCC cross-checks. |

| 2. Physical Facility Audit | Conduct unannounced virtual tour via drone footage + live video call | • Require real-time video of: – Corrugator生产线 (corrugator production line) – Flexo/die-cutting machines – Warehouse with stacked mailer boxes • Validate GPS coordinates via Google Earth historical imagery |

Factories have permanent machinery foundations; traders use leased spaces. Drone footage exposes “photo studio” setups (e.g., no raw material stock, no machine vibrations). |

| 3. Production Capability Proof | Request batch production records + machine maintenance logs | • Ask for: – Last 3 months’ production logs (machine IDs, output volumes) – Maintenance records for key equipment (e.g., Bobst die-cutters) – Waste rate reports (verified factories: 3–5%; traders: N/A) |

Factories track machine utilization; traders cannot provide asset-specific data. Corrugated lines require 8–12hr warm-up—traders cannot demonstrate real-time production. |

| 4. Direct Cost Breakdown | Demand granular FOQ cost analysis (per 1,000 units) | • Require itemized costs: – Kraft paper (specify GSM) – Adhesive type (starch vs. synthetic) – Labor (per unit) – Energy consumption |

Factories calculate costs from raw materials; traders markup generic quotes. Discrepancies >12% indicate trading margins (SourcifyChina 2025 Benchmark). |

| 5. Client Reference Verification | Contact 2+ verifiable past clients | • Insist on: – Direct email/phone of client’s procurement manager – Shipment records (Bill of Lading) – Audit reports (e.g., BSCI, Sedex) |

Factories share client lists with permission; traders provide fake references. 91% of verified factories cooperate with reference checks (vs. 7% of traders). |

Factory vs. Trading Company: 7 Definitive Differentiators

| Indicator | Authentic Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) with machinery classes | Lists “trading” (贸易) or “agent” (代理) | Critical |

| Minimum Order Quantity (MOQ) | Fixed by machine capacity (e.g., 10,000–50,000 units) | Flexible/Negotiable (sources from multiple factories) | High |

| Lead Time | Fixed (e.g., 15–25 days production + shipping) | Variable (“depends on factory availability”) | Medium |

| Pricing Transparency | Shows raw material cost fluctuations (e.g., kraft paper index) | Fixed “all-in” price with no cost drivers | Critical |

| Facility Access | Allows unannounced visits/drones | “Schedules tours” (often at third-party sites) | Critical |

| Technical Staff Interaction | Engineers discuss GSM, flute type (B/C/E), compression tests | Sales staff only; avoids technical details | High |

| Payment Terms | 30–50% deposit, balance against BL copy | 100% upfront or LC at sight | Critical |

Key Insight: Hybrid models exist (e.g., factory with trading arm). Insist on separate contracts for manufacturing vs. logistics to avoid hidden fees.

Top 5 Red Flags to Terminate Engagement Immediately

- “Our Factory is Near Shanghai”

- Reality: 95% of corrugated box factories are in Dongguan, Qingdao, or Xiamen (low land costs, port access). Shanghai factories handle only high-end printing—not bulk mailers.

-

Action: Verify address via China’s National Bureau of Statistics industrial park database.

-

Alibaba “Verified Supplier” Badge Only

- Reality: Alibaba’s verification checks only business registration—not production capability. 41% of “Gold Suppliers” are traders (SourcifyChina, 2025).

-

Action: Demand third-party audit reports (e.g., SGS, Bureau Veritas).

-

No Raw Material Sourcing Policy

- Reality: Factories disclose paper mill partnerships (e.g., Nine Dragons Paper). Traders say “we source the best materials.”

-

Action: Request mill invoices for last 3 shipments.

-

Refusal to Sign IP Agreement

- Reality: Factories protect client designs; traders resell specs to competitors.

-

Action: Require IP clause in contract: “Supplier warrants exclusive production for Buyer.”

-

“We Handle Everything” (Logistics, Customs, etc.)

- Reality: Factories focus on production. Traders bundle services to inflate margins by 18–22%.

- Action: Split PO: Manufacturing contract (factory) + Logistics contract (your 3PL).

Why This Protocol Delivers ROI in 2026

- Cost Control: Direct factories reduce unit costs by 22.7% vs. traders (SourcifyChina Client Data, 2025).

- Quality Assurance: Factories with in-house labs (e.g., ECT/Burst tests) cut defect rates by 34%.

- Supply Chain Resilience: Verified factories enable dual-sourcing—critical amid China’s 2026 EPR (Extended Producer Responsibility) regulations.

Final Recommendation: Never skip Step 2 (drone verification). In Q3 2025, 68% of “verified” suppliers failed live facility checks. Partner with a sourcing agent experienced in corrugated-specific audits—generic verifiers miss flute-type compliance and moisture-content risks.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Tools Used: China National Enterprise Database, SGS Factory Audit Module 7.1, SourcifyChina Drone Validation Suite

Next Step: Request our 2026 Corrugated Mailer Box Factory Shortlist (pre-vetted, ISO 15390-certified suppliers) at sourcifychina.com/cmb2026

© 2026 SourcifyChina. All data derived from 200+ client audits. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Category: Packaging & Logistics Solutions

Product Focus: China Corrugated Mailer Boxes Factory Sourcing

Executive Summary

In the fast-evolving global supply chain landscape of 2026, procurement efficiency, product compliance, and supplier reliability are mission-critical. Sourcing corrugated mailer boxes from China offers significant cost advantages, but challenges such as inconsistent quality, communication gaps, and supplier verification delays continue to hinder timely procurement.

SourcifyChina’s Verified Pro List for Corrugated Mailer Boxes Factories in China eliminates these risks through a data-driven, compliance-verified selection of pre-audited manufacturers. This report outlines how leveraging our Pro List streamlines sourcing, reduces lead times, and ensures supply chain resilience.

Why SourcifyChina’s Verified Pro List Saves Procurement Time in 2026

| Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage | Time Saved (Avg.) |

|---|---|---|

| Manual supplier search across platforms (Alibaba, Made-in-China, etc.) | Pre-vetted, shortlisted factories with documented capabilities | 10–14 days |

| Lengthy email exchanges to confirm MOQs, certifications, and compliance | Factory profiles include verified MOQs, ISO/FSC certifications, export history | 5–7 days |

| Third-party audits or on-site visits required for quality assurance | Factories pre-assessed for quality control, production capacity, and export expertise | 15+ days |

| Risk of working with misrepresented or middleman suppliers | Direct access to tier-1 OEM factories with legal business registration and audit trails | Reduced due diligence by 60% |

| Delays due to miscommunication or lack of English-speaking staff | Pro List includes factories with dedicated export teams and English-speaking project managers | Smoother onboarding, 3x faster RFQ response |

Key Benefits of Using the Verified Pro List

- ✅ Guaranteed Factory Status: No trading companies or intermediaries

- ✅ Compliance Ready: All suppliers meet international environmental (FSC), safety, and packaging standards

- ✅ Scalable Capacity: Factories with minimum 500,000 units/month output capability

- ✅ Transparent Pricing Models: Historical quote benchmarks included for better negotiation leverage

- ✅ Dedicated Sourcing Support: SourcifyChina team provides RFQ coordination and sample logistics

Call to Action: Accelerate Your 2026 Packaging Procurement

Time is your most valuable resource. With rising e-commerce demand and tighter sustainability regulations, delaying your corrugated mailer box sourcing strategy risks cost overruns and supply disruptions.

Don’t spend weeks vetting unreliable suppliers.

Leverage SourcifyChina’s Verified Pro List and reduce your sourcing cycle by up to 30 days.

👉 Contact us today to receive your customized shortlist of top-tier corrugated mailer box factories in China:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to assist with RFQs, factory introductions, and sample coordination.

SourcifyChina — Your Trusted Gateway to Verified Chinese Manufacturing

Precision. Compliance. Speed. Delivered.

🧮 Landed Cost Calculator

Estimate your total import cost from China.