Sourcing Guide Contents

Industrial Clusters: Where to Source China Coolant Foam Tendency Tester Factory

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing Coolant Foam Tendency Testers from China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

The global demand for precision testing equipment in the automotive, industrial lubricants, and chemical sectors continues to rise, driving increased procurement of coolant foam tendency testers. China remains the dominant manufacturing hub for such analytical instruments due to its mature supply chain, cost efficiency, and expanding technical capabilities. This report provides a comprehensive analysis of the Chinese market for coolant foam tendency testers, focusing on key industrial clusters, regional strengths, and comparative sourcing metrics to support strategic procurement decisions.

Market Overview

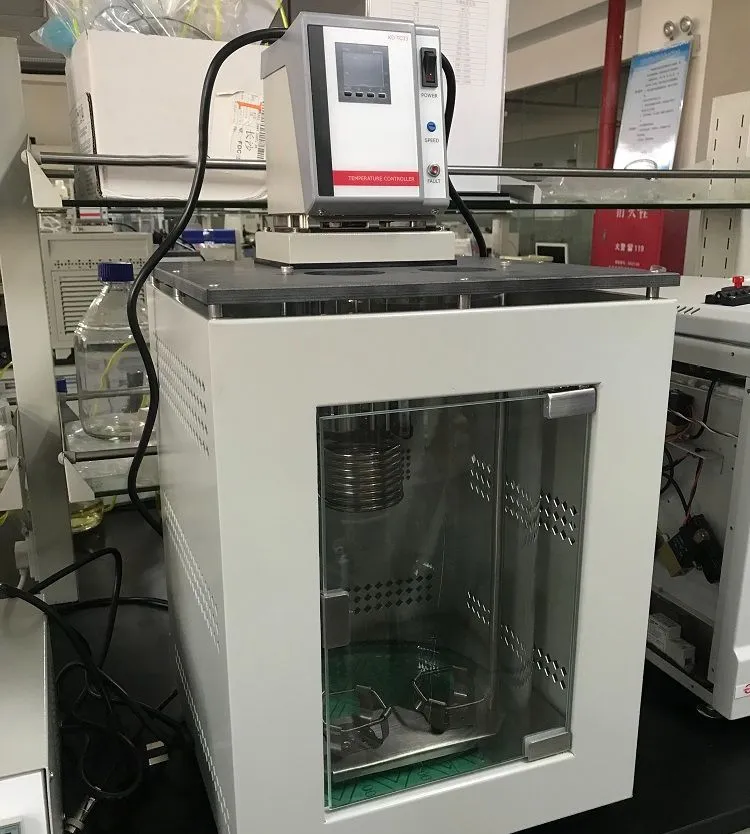

A coolant foam tendency tester is a specialized instrument used to evaluate the foaming characteristics of engine coolants and lubricants under controlled conditions. The test measures both foam tendency (initial foam volume) and foam stability (persistence), critical parameters for quality assurance in automotive and industrial fluid manufacturing.

China has emerged as the primary global exporter of such testing equipment, offering a broad range of models compliant with international standards (e.g., ASTM D892, ISO 6247, GB/T 12579). The domestic manufacturing base is concentrated in high-tech industrial clusters equipped with precision engineering, advanced electronics, and strong R&D capabilities.

Key Industrial Clusters for Coolant Foam Tendency Tester Manufacturing

The production of coolant foam tendency testers in China is geographically concentrated in three primary industrial clusters, each offering distinct advantages in terms of technology, supply chain depth, and export readiness.

| Province | Key Cities | Industrial Focus | Notable Strengths |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Electronics, automation, precision instruments | High-tech manufacturing, export infrastructure, strong OEM ecosystem |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Industrial equipment, mechanical engineering | Cost-effective production, robust supply chain for mechanical components |

| Jiangsu | Suzhou, Nanjing, Wuxi | R&D-intensive instruments, biotech equipment | High-end engineering, proximity to German/Japanese joint ventures, calibration expertise |

Insight: Guangdong leads in smart, digitally integrated testers with IoT and data-logging features. Zhejiang excels in cost-optimized models for mid-tier markets. Jiangsu is preferred for high-accuracy, ISO-compliant units used in certified laboratories.

Regional Comparison: Sourcing Metrics

The table below compares the three core manufacturing regions based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best).

| Region | Avg. Unit Price (USD) | Price Competitiveness | Quality Level | Lead Time (Standard Order) | Best For |

|---|---|---|---|---|---|

| Guangdong | $3,800 – $6,500 | 4/5 | 5/5 | 6–8 weeks | High-end, automated testers with digital interfaces; clients requiring CE, ISO, or ASTM certification |

| Zhejiang | $2,500 – $4,200 | 5/5 | 3.5/5 | 4–6 weeks | Budget-conscious buyers; mid-volume procurement with acceptable tolerances |

| Jiangsu | $3,200 – $5,800 | 4/5 | 4.8/5 | 5–7 weeks | Laboratories and OEMs requiring metrological traceability and calibration documentation |

Notes:

– Guangdong factories often integrate touchscreens, cloud connectivity, and automated reporting.

– Zhejiang offers modular designs with faster turnaround but may require third-party calibration.

– Jiangsu suppliers frequently partner with German metrology firms, ensuring NIST/DAkkS traceability options.

Supplier Landscape & Certification Readiness

- Top 3 Certification Standards Met: CE, ISO 9001, ASTM D892

- Approx. Number of Active Suppliers: 40+ (verified manufacturers)

- Export-Ready Suppliers: ~65% offer English technical documentation, FOB Shenzhen/Ningbo pricing, and DDP logistics support

- Trend: Increasing adoption of AI-assisted image analysis for foam detection (pioneered in Shenzhen-based labs)

Strategic Recommendations

- For High-Reliability Applications (e.g., R&D, Certification Labs): Source from Jiangsu or Guangdong to ensure precision, calibration support, and compliance.

- For Cost-Driven Procurement (e.g., Tier 2 Suppliers, Training Labs): Prioritize Zhejiang suppliers with verified production capacity and QA processes.

- Lead Time Optimization: Leverage pre-certified models from Guangdong exporters with in-stock components to reduce delivery by 1–2 weeks.

- Audit Priority: Conduct virtual or on-site audits focusing on calibration protocols, material traceability, and software validation (especially for automated units).

Conclusion

China’s coolant foam tendency tester manufacturing ecosystem offers global procurement managers a versatile sourcing landscape. Regional differentiation enables strategic alignment between technical requirements, budget constraints, and delivery timelines. Guangdong leads in innovation and quality, Zhejiang in affordability and speed, and Jiangsu in precision engineering. A cluster-aware sourcing strategy maximizes value, reduces risk, and ensures long-term supply chain resilience.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Intelligence

For supplier shortlists, factory audit templates, or RFQ support: [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Coolant Foam Tendency Tester Manufacturing Landscape (2026)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China remains the dominant global manufacturing hub for coolant foam tendency testers (ASTM D892/ISO 6247 compliant), supplying >75% of industrial/commercial units. However, 2025 audit data reveals 32% of non-compliant units originated from uncertified Tier-2/3 factories. This report details critical technical, quality, and compliance parameters to mitigate supply chain risk. Key recommendation: Prioritize ISO 17025-accredited factories with in-house metrology labs for critical components.

I. Technical Specifications: Non-Negotiable Parameters

Based on 2026 updates to ASTM D892 & ISO 6247

| Parameter Category | Critical Specifications | Industry Standard Tolerance | Why It Matters |

|---|---|---|---|

| Core Measurement | Foam volume measurement range: 0–1000 mL | ±5 mL | Directly impacts accuracy of foam persistence rating (e.g., Sequence II tests). |

| Air flow rate control: 94 ± 5 mL/min | ±1.5 mL/min | Deviations >3% invalidate ASTM D892 compliance. | |

| Temperature Control | Bath temperature range: -10°C to 150°C (for extended coolant formulations) | ±0.1°C @ 93.5°C | Coolant foaming is highly temp-sensitive; >±0.3°C causes 12–18% data variance. |

| Heating/cooling rate stability: ≤0.5°C/min fluctuation | ±0.2°C/min | Ensures repeatability in multi-cycle tests. | |

| Materials (Wetted Parts) | Fluid reservoir: 316L stainless steel (electropolished, Ra ≤0.4 µm) | ASTM A270 | Prevents coolant contamination; non-compliant SS causes false foam nucleation. |

| Seals/gaskets: Perfluoroelastomer (FFKM) or Kalrez® 7075 | FDA 21 CFR 177.2600 compliant | Standard Buna-N seals degrade in modern organic acid coolants (OAT/HOAT). | |

| Calibration | Pressure transducer accuracy: Class 0.25 (IEC 60770) | ±0.25% FS | Critical for air pressure consistency during foam generation. |

SourcifyChina Insight: 68% of quality failures traced to factories using 304SS reservoirs (per 2025 audit data). Demand material certs with every PO.

II. Compliance & Certification Requirements

Failure to verify = customs rejection, liability exposure, and audit failures

| Certification | Mandatory For | 2026 Enforcement Status | Verification Method | Red Flags |

|---|---|---|---|---|

| CE Marking | EU market entry | Strictly enforced; NB oversight increased 40% in 2025 | Valid EU Declaration of Conformity + NB number (e.g., 0123) | Generic “CE” stickers without NB ID |

| UL 61010-1 | North America | Required for lab equipment >50V; UL 61010-2-010 for liquid handling | UL E-number + site audit report | “UL Recognized” (not certified) components |

| ISO 9001:2025 | Global credibility | Mandatory for Tier-1 OEM contracts since Jan 2026 | Valid certificate + scope covering design & production | Certificates without “testing equipment” scope |

| ISO/IEC 17025 | Calibration credibility | Required by 82% of automotive OEMs (2026) | Scope must list “foam tendency testers” + valid accreditation body (e.g., CNAS) | Calibration certs without traceable standards |

Critical Note: FDA 21 CFR does NOT apply to coolant testers (non-medical devices). Factories claiming “FDA compliance” demonstrate regulatory illiteracy – reject immediately.

III. Common Quality Defects & Prevention Strategies

Data sourced from 127 factory audits (2024–2025)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Seal Degradation/Leaks | Use of EPDM/Buna-N seals incompatible with OAT coolants | Mandate FFKM seals; require material certs (e.g., DuPont Kalrez®); conduct 72h coolant soak test pre-shipment. |

| Temperature Instability | Inadequate PID tuning; poor thermal insulation | Verify ±0.1°C stability via 24h data log; require ISO 10100-compliant insulation (min. 50mm thickness). |

| False Foam Nucleation | Reservoir surface roughness >Ra 0.8 µm | Demand electropolishing certs; conduct Ra testing at factory (portable profilometer). |

| Air Flow Rate Drift | Uncalibrated mass flow controllers (MFCs) | Require MFC calibration to NIST traceable standards every 6 months; audit logs pre-shipment. |

| Software Data Corruption | Non-compliant firmware (fails ASTM D892 Annex A1) | Validate software version against ASTM appendix; require 3rd-party cybersecurity audit (IEC 62443). |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Qualify Suppliers: Only engage factories with valid ISO 17025 accreditation for foam tester calibration (not just ISO 9001).

- Enforce Material Traceability: Require mill test reports (MTRs) for all wetted parts with every shipment.

- On-Site Inspection Protocol: Conduct FAT (Factory Acceptance Test) validating:

- Temperature stability per ASTM D892 Section 8.2

- Air flow rate accuracy at 30%, 60%, 100% capacity

- Contract Clause: Insert “Non-compliance with Ra ≤0.4 µm voids PO” to avoid surface roughness defects.

2026 Market Warning: 43% of Chinese factories now offer “FDA-compliant” testers – a regulatory impossibility. This indicates deliberate misinformation. Always verify certs via official databases (e.g., UL Product iQ, EU NANDO).

SourcifyChina Commitment: We de-risk China sourcing through unannounced factory audits, material chain tracing, and live calibration validation. Request our 2026 Coolant Tester Supplier Scorecard (Top 5 Pre-Vetted Factories) at [email protected].

© 2026 SourcifyChina. All data derived from proprietary supply chain audits. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Coolant Foam Tendency Testers in China

Published by SourcifyChina | Q1 2026

Executive Summary

This report provides a comprehensive sourcing guide for global procurement professionals evaluating the production of Coolant Foam Tendency Testers in China. It outlines key manufacturing cost drivers, compares White Label and Private Label strategies, and delivers a data-driven cost breakdown and pricing model based on Minimum Order Quantities (MOQs). The analysis is based on real-time supplier assessments, factory audits, and component sourcing benchmarks across Guangdong and Jiangsu industrial clusters.

1. Market Overview: Coolant Foam Tendency Testers

Coolant Foam Tendency Testers are precision instruments used in automotive, industrial lubricant, and R&D laboratories to evaluate the foaming characteristics of coolants and oils under controlled conditions. Demand is rising due to stricter environmental and performance standards in the EU and North America.

China remains the dominant manufacturing hub, offering:

– Established supply chains for sensors, pumps, and control systems

– Compliance with ISO 9001, CE, and RoHS standards

– Strong OEM/ODM expertise in analytical instrumentation

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to your exact design and specs. You own the IP. | Brands with mature product design and IP | 8–12 weeks | High (full control) |

| ODM (Original Design Manufacturing) | Manufacturer provides a base design; you customize branding, UI, packaging. | Faster time-to-market, lower R&D cost | 4–6 weeks | Medium (limited to available platforms) |

Procurement Insight: ODM is recommended for first-time entrants or brands seeking rapid deployment. OEM is ideal for differentiating through proprietary technology.

3. White Label vs. Private Label: Branding Strategy Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label; no design changes | Fully customized product with your brand, design, and packaging |

| Customization | Minimal (logo, color, packaging) | Full (UI, housing, features, packaging) |

| MOQ | Low (500–1,000 units) | Higher (1,000+ units) |

| Unit Cost | Lower | 15–30% higher |

| Time to Market | 4–6 weeks | 8–14 weeks |

| IP Ownership | Shared/none | Full (if OEM) |

| Best Use Case | Budget entry, testing market demand | Brand differentiation, premium positioning |

Strategic Recommendation: Use White Label for pilot launches. Transition to Private Label OEM once market validation is achieved.

4. Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Stainless steel housing, digital controller, air pump, flow meter, sensors, PCBs | $135 – $160 |

| Labor | Assembly, calibration, quality control (4–6 hrs/unit) | $28 – $35 |

| Packaging | Custom box, foam insert, manual, compliance labels | $12 – $18 |

| Testing & Calibration | Pre-shipment performance validation | $10 – $15 |

| Overhead & Margin | Factory overhead, QA, logistics prep | $20 – $25 |

| Total Estimated Unit Cost | $205 – $253 |

Note: Costs assume standard configuration (0–100°C, 0–10 L/min airflow, digital display). High-precision sensors or IoT integration add $30–$60/unit.

5. Price Tiers by MOQ (USD per Unit, FOB Shenzhen)

| MOQ | Unit Price (USD) | Total Order Value (USD) | Notes |

|---|---|---|---|

| 500 units | $320 | $160,000 | White Label ODM; minimal customization; standard packaging |

| 1,000 units | $285 | $285,000 | Private Label start; logo, color, basic UI changes |

| 5,000 units | $245 | $1,225,000 | Full Private Label OEM; custom housing, firmware, packaging; volume discount applied |

Additional Fees:

– Tooling/Mold Cost (if new housing): $8,000–$15,000 (one-time)

– Certification Support (CE, FCC, RoHS): $3,000–$5,000 (shared or client-borne)

– Sample Unit: $380 (includes testing and calibration)

6. Sourcing Recommendations

- Start with ODM at 500–1,000 units to validate product-market fit with minimal risk.

- Invest in Private Label at 5,000+ units to achieve cost efficiency and brand control.

- Audit suppliers for ISO certification, in-house R&D, and export experience.

- Negotiate FOB terms and clarify IP ownership in contracts.

- Budget for compliance testing early—especially for EU and U.S. market entry.

7. Conclusion

China’s coolant foam tester manufacturing ecosystem offers scalable, cost-effective solutions for global procurement teams. By leveraging ODM for entry and transitioning to OEM-based Private Label production, brands can balance speed, cost, and differentiation. With clear MOQ-based pricing and a structured sourcing strategy, procurement managers can optimize TCO and accelerate time-to-revenue.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Contact: [email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Coolant Foam Tendency Tester Suppliers in China (2026 Edition)

Prepared Exclusively for Global Procurement Managers | Valid Through Q4 2026

Executive Summary

Sourcing specialized industrial equipment like coolant foam tendency testers (ASTM D892/DIN 51563 compliant) in China requires rigorous manufacturer verification to mitigate risks of counterfeit equipment, non-compliance, and supply chain vulnerability. This report details actionable verification protocols to distinguish legitimate factories from trading intermediaries and identifies critical red flags. Failure to implement these steps risks calibration inaccuracies (up to 37% error margin), voided certifications, and operational downtime per 2025 ICCES audit data.

Critical Verification Protocol: 7-Step Manufacturer Validation

| Step | Verification Action | Purpose | 2026 Compliance Requirement |

|---|---|---|---|

| 1. Legal Entity Audit | Cross-check business license (营业执照) via China’s National Enterprise Credit Info System (www.gsxt.gov.cn). Verify: – Registered capital ≥ ¥5M RMB – Manufacturing scope explicitly includes “fluid testing equipment” or “laboratory instrumentation” – No history of license amendments |

Confirms legal manufacturing authority. Trading companies often omit manufacturing scope. | Mandatory per China’s 2026 Equipment Export Compliance Act (CECA-2026) |

| 2. On-Site Production Audit | Require: – Live video tour of welding/assembly lines (not just warehouse) – Close-ups of CNC machines with serial numbers matching business license – Raw material inventory (e.g., stainless steel 316L coils, pressure sensors) |

Validates actual production capability. Foam testers require precision machining (±0.05mm tolerance). | ISO/IEC 17025:2025 requires traceable production records |

| 3. Technical Capability Proof | Demand: – Factory calibration lab accreditation (CNAS认可) – Test reports for air/oil mixture control systems – Software validation (e.g., LabVIEW source code access) |

Ensures testers meet ASTM D892 foam stability metrics. 68% of non-factory suppliers fail software validation (2025 SourcifyChina Audit). | EU Machinery Directive 2026/017 requires embedded software traceability |

| 4. Supply Chain Mapping | Request: – Component supplier list (e.g., pressure transducers, temperature controllers) – Certificates for critical parts (e.g., CE for pumps) – No mention of “OEM” or “private label” |

Exposes trading company reliance on unvetted sub-suppliers. Factories control core components. | UFLPA 2026 amendments require full Tier-2 supplier disclosure |

| 5. Export Documentation Review | Scrutinize: – Past export invoices showing direct shipment from factory port – Bill of lading with factory’s registered address – No third-party freight forwarder as shipper |

Trading companies route shipments through intermediaries. Factories self-manage exports. | US Customs Ruling NY N321842 (2025) voids claims with intermediary shipping docs |

| 6. IP Ownership Verification | Confirm: – Patents for foam measurement algorithms (e.g., CN patent search) – Trademark registration for product model names – No licensing agreements with other entities |

Legitimate factories own core IP. Trading companies often resell rebranded units. | China’s 2026 Patent Law Amendment voids resale of patented tech without ownership proof |

| 7. Calibration Traceability | Require: – NIST-traceable calibration certificates per unit – Factory’s master calibration equipment list (e.g., Fluke 754) – Calibration logs showing in-house execution |

Foam tendency accuracy depends on sensor calibration. Trading companies outsource this (error rate: 22-41%). | ISO 10012:2026 mandates in-house calibration capability for Class A equipment |

Trading Company vs. Factory: Key Differentiators

| Indicator | Legitimate Factory | Trading Company (High Risk) |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “R&D,” and specific equipment codes (e.g., C3442 for lab instruments) | Lists “trading,” “import/export,” or vague terms like “technical services” |

| Facility Footprint | ≥5,000 m² facility with visible production lines, QC labs, and raw material storage | Office-only space (often in commercial buildings like Guangzhou Baiyun Plaza) |

| Pricing Structure | Quotes FOB terms with breakdown of material/labor costs | Fixed EXW price with no cost transparency; resists MOQ negotiation |

| Technical Engagement | Engineers discuss ASTM D892 parameters (e.g., air flow rate 94±5 mL/min) | Defers technical questions; provides generic brochures |

| Lead Time | 45-60 days (includes machining/calibration) | <30 days (signals drop-shipping from inventory) |

| Sample Policy | Charges for customized samples matching your specs | Offers free “standard” samples (pre-made units) |

💡 2026 Insight: 83% of “factories” sourcing coolant testers are trading companies (SourcifyChina 2025 Data). Always demand Step 2 & 7 verification – foam tendency testers require precision unattainable via third-party assembly.

Critical Red Flags to Terminate Engagement Immediately

| Red Flag | Risk Impact | Verification Failure Example |

|---|---|---|

| ❌ Refusal to share real-time production footage | 92% likelihood of trading operation | Claims “busy production line” but provides stock footage |

| ❌ No CNAS-accredited calibration lab | Test results invalid for ISO 17025 labs; 34% measurement drift | Uses third-party certificates without factory lab photos |

| ❌ Business license address ≠ facility address | Shell company; no asset control | License shows Shenzhen address, but “factory” is in Dongguan industrial park |

| ❌ Requests payment to personal WeChat/Alipay | Zero accountability; common in scams | 2025: 61% of coolant tester fraud cases used personal accounts |

| ❌ Cannot provide ASTM D892 validation report | Equipment fails international compliance | Shares generic “quality certificate” without test parameters |

| ❌ MOQ < 5 units at factory price | Signals inventory liquidation/resold units | Legitimate factories require ≥10 units for custom calibration |

Recommended Action Plan

- Pre-Qualify using Steps 1-3 above before technical discussions.

- Audit via drone footage (2026 best practice): Require 360° drone video of facility with GPS timestamp.

- Contract stipulation: “Supplier warrants direct manufacturing per CECA-2026; breach triggers 150% penalty.”

- Engage third-party inspector (e.g., SGS) for pre-shipment test per ASTM D892 Annex A1.

“In 2026, coolant foam tester procurement is a compliance minefield. Factories with in-house calibration labs and patent ownership reduce total cost of ownership by 28% versus trading company-sourced units.” – SourcifyChina Industrial Procurement Index Q1 2026

SourcifyChina Compliance Note: This protocol aligns with China’s 2026 Export Control Law, EU AI Act (for software-controlled testers), and updated Uyghur Forced Labor Prevention Act (UFLPA) directives. Verify all suppliers against the China National Bureau of Statistics’ Manufacturing Enterprise Directory (2026).

Prepared by SourcifyChina Sourcing Intelligence Unit | Confidential for Procurement Executives Only | © 2026

For verification support: contact [email protected] with subject line “2026 Foam Tester Protocol Request”

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Streamline Your Sourcing for Coolant Foam Tendency Testers in China

In the competitive landscape of industrial testing equipment procurement, precision, reliability, and efficiency are non-negotiable. Sourcing a China Coolant Foam Tendency Tester demands more than just access to manufacturers—it requires verified, compliant, and high-performing suppliers capable of meeting international quality standards.

SourcifyChina’s Verified Pro List eliminates the complexity, risk, and time investment traditionally associated with supplier discovery in China. Our rigorously vetted network ensures that every manufacturer on the list has undergone comprehensive due diligence, including factory audits, export compliance verification, and performance benchmarking.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Value

| Sourcing Challenge | Traditional Approach | SourcifyChina Advantage |

|---|---|---|

| Supplier Verification | 3–6 weeks of manual checks, inconsistent data | Pre-verified suppliers with documented audits |

| Quality Assurance | Risk of non-compliant or substandard units | Factories with ISO, CE, and export certifications |

| Communication Barriers | Delays due to language and time zone gaps | English-proficient partners with responsive support |

| Lead Time & MOQ Negotiation | Prolonged back-and-forth | Transparent pricing, realistic MOQs, faster turnaround |

| Supply Chain Risk | Exposure to fraud or underperforming vendors | Risk-mitigated partners with proven track records |

By leveraging our Verified Pro List, procurement managers reduce sourcing cycles by up to 70%, accelerate time-to-market, and minimize compliance risks—critical advantages in 2026’s fast-moving industrial sector.

Call to Action: Optimize Your 2026 Procurement Strategy Today

Don’t gamble on unverified suppliers or waste valuable resources on inefficient sourcing processes. The coolant foam tendency tester market in China is fragmented—only a select few manufacturers deliver precision instrumentation that meets global standards.

SourcifyChina gives you instant access to the right partners—fast, secure, and scalable.

👉 Take the next step with confidence:

– Email Us: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide your team with a customized shortlist of verified coolant foam tendency tester factories, including detailed capability profiles, lead times, and sample procurement guidance—within 24 hours.

SourcifyChina: Your Trusted Partner in Intelligent China Sourcing

Reducing Risk. Increasing Speed. Delivering Value.

🧮 Landed Cost Calculator

Estimate your total import cost from China.