Sourcing Guide Contents

Industrial Clusters: Where to Source China Condiment Packaging Bags Supplier

Professional B2B Sourcing Report 2026

Title: Strategic Market Analysis: Sourcing Condiment Packaging Bags from China

Prepared for: Global Procurement Managers

Author: SourcifyChina – Senior Sourcing Consultant

Release Date: Q1 2026

Executive Summary

China remains the dominant global hub for the production of flexible packaging, including specialized condiment packaging bags—multi-layer laminated pouches designed for sauces, oils, spices, and other liquid or semi-solid food products. These bags require high barrier properties, print precision, food-grade compliance, and resistance to puncture and moisture.

This report provides a strategic deep-dive into the key industrial clusters in China producing condiment packaging bags, with a comparative analysis of Guangdong, Zhejiang, Shanghai, Shandong, and Fujian—the top five manufacturing regions. The analysis evaluates each region on price competitiveness, quality standards, and lead time performance, enabling procurement managers to align sourcing decisions with business priorities (cost, speed, or premium quality).

Market Overview: China Condiment Packaging Bags

- Global Market Share (2025): China supplies ~58% of global flexible food packaging, with condiment bags representing ~12% of domestic output.

- Key Growth Drivers:

- Rising global demand for convenient food packaging.

- Expansion of Chinese seasoning exports (e.g., soy sauce, chili oil, oyster sauce).

- Advancements in sustainable and recyclable laminates (e.g., PE-free structures, water-based inks).

- Material Types: PET/PE, PET/AL/PE, PET/VMPET/PE, Nylon-based laminates for high-barrier needs.

- Compliance Standards: FDA, EU 10/2011, GB 4806.7-2016 (China Food Contact Materials), BRCGS, ISO 22000.

Key Industrial Clusters for Condiment Packaging Bags

China’s condiment packaging bag manufacturing is concentrated in coastal provinces with mature supply chains, access to raw materials (film, ink, adhesive), and export infrastructure. The five main clusters are:

| Province/City | Key Manufacturing Hubs | Specialization | Export Volume Share |

|---|---|---|---|

| Guangdong | Guangzhou, Shantou, Shenzhen, Dongguan | High-volume, low-cost, export-oriented | ~32% |

| Zhejiang | Wenzhou, Hangzhou, Ningbo | High-quality laminates, technical innovation | ~28% |

| Shanghai | Shanghai (and satellite zones) | Premium packaging, R&D, multinational suppliers | ~15% |

| Shandong | Qingdao, Jinan, Yantai | Mid-tier, cost-efficient, strong for domestic brands | ~12% |

| Fujian | Xiamen, Quanzhou | Emerging cluster, labor cost advantage | ~8% |

Comparative Analysis: Regional Supplier Performance

The following table compares the five key regions based on price, quality, and lead time—critical KPIs for global procurement decision-making.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Standard Order) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (Low to Mid) | ⭐⭐⭐☆☆ (Good, varies by supplier) | 12–18 days | High-volume, cost-sensitive buyers; OEM/ODM exporters |

| Zhejiang | ⭐⭐⭐☆☆ (Mid-range) | ⭐⭐⭐⭐☆ (High, consistent) | 15–20 days | Quality-focused brands; complex laminates; EU/US compliance |

| Shanghai | ⭐⭐☆☆☆ (Premium pricing) | ⭐⭐⭐⭐⭐ (Excellent, ISO/BRCGS certified) | 18–25 days | Premium brands; multinational supply chains; R&D collaboration |

| Shandong | ⭐⭐⭐⭐☆ (Low-cost) | ⭐⭐⭐☆☆ (Moderate, improving) | 14–20 days | Mid-tier brands; domestic + export mix; value engineering |

| Fujian | ⭐⭐⭐⭐☆ (Low) | ⭐⭐⭐☆☆ (Variable, improving) | 16–22 days | Emerging suppliers; labor-intensive customization; niche formats |

Legend:

⭐⭐⭐⭐⭐ = Excellent / Highest / Shortest

⭐⭐⭐☆☆ = Good / Mid-range

⭐⭐☆☆☆ = Fair / Higher / Longer

Strategic Recommendations for Procurement Managers

-

Prioritize Zhejiang for Quality & Compliance:

Ideal for brands targeting EU, US, or Japan. Suppliers in Wenzhou and Hangzhou lead in BRCGS certification, VOC-free printing, and high-barrier film technology. -

Leverage Guangdong for Scale & Speed:

Best for high-volume orders with tight margins. Shantou is known as the “packaging capital” with strong flexo and rotogravure printing capacity. -

Consider Shanghai for Innovation Partnerships:

Home to R&D centers of global packaging players (e.g., Amcor, Huhtamaki China). Suitable for co-developing sustainable packaging or smart pouches (e.g., QR codes, resealable zippers). -

Evaluate Shandong & Fujian for Cost Optimization:

Emerging suppliers offer 10–15% lower pricing vs. Guangdong/Zhejiang. Due diligence is advised on quality consistency and export experience. -

Audit for Compliance:

Ensure suppliers have GB 4806.7 certification, food-grade ink documentation, and traceability systems—critical for avoiding customs delays.

Conclusion

China’s condiment packaging bag supply base is geographically concentrated, highly competitive, and rapidly modernizing. While Guangdong and Zhejiang dominate, each cluster offers distinct trade-offs between cost, quality, and lead time.

Strategic sourcing requires matching regional strengths to brand requirements—whether that’s cost efficiency, regulatory compliance, or innovation capability. With proper supplier vetting and supply chain oversight, China remains the optimal sourcing destination for condiment packaging in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Advisory | China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report: China Condiment Packaging Bags Supplier Guidelines

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Sourcing Intelligence

Executive Summary

Sourcing condiment packaging bags from China requires stringent technical and compliance oversight due to the high-risk nature of liquid/semi-liquid food products. This report details critical specifications, certifications, and defect mitigation strategies to ensure supply chain resilience, regulatory adherence, and brand protection. Key focus areas include barrier integrity, seal reliability, and food-grade material compliance. Non-compliance risks include product spoilage (37% of recalls linked to packaging failure), regulatory penalties, and reputational damage.

I. Technical Specifications & Key Quality Parameters

All tolerances apply to standard 80–250mm width pouches for sauces, oils, pastes, and powdered condiments.

| Parameter | Standard Requirement | Critical Tolerance | Testing Method | Rationale |

|---|---|---|---|---|

| Material Structure | PET//AL//PE (3-layer) or PET//VMPET//PE | N/A | FTIR Spectroscopy | AL/VMPET blocks O₂/moisture; PE ensures seal integrity. Avoid PVC (EU banned). |

| Total Thickness | 120–180 microns (varies by product type) | ±5 microns | ISO 4593:1993 | Thinner = risk of puncture; thicker = cost inefficiency. |

| Seal Strength | ≥35 N/15mm width | +0 / -2 N/15mm | ASTM F88-21 | Critical for preventing leaks during filling/transport. |

| O₂ Transmission | ≤0.5 cm³/m²/day (at 23°C, 0% RH) | Max. +0.1 tolerance | ASTM D3985 | Prevents oxidation in oil-based condiments (e.g., chili oil). |

| Moisture Perm. | ≤0.5 g/m²/day (at 38°C, 90% RH) | Max. +0.1 tolerance | ASTM E96 | Essential for dry spices/powders (e.g., curry powder). |

| Heat Seal Range | 120–140°C | ±3°C | ISO 11337-1:2020 | Narrow range = consistent seals on high-speed lines. |

Procurement Action: Require suppliers to provide lot-specific material COAs (Certificate of Analysis) and conduct 3rd-party validation of barrier properties annually. Tolerances outside ±5% for seal strength or barrier properties indicate critical process failure.

II. Essential Compliance Certifications

Non-negotiable for global market access. Verify via SourcifyChina’s Supplier Compliance Dashboard (SCD).

| Certification | Jurisdiction | Validity | Key Requirements for Condiment Bags | Verification Tip |

|---|---|---|---|---|

| FDA 21 CFR §177.1520 | USA | Per shipment | Olefin polymers (PE/PP) must be <10% of total formulation; no recycled content in direct contact layer. | Demand FDA Letter of Guaranty from supplier. |

| EU Plastics Regulation (EU) 10/2011 | EU | 3 years | Specific migration limits (SML): ≤0.01 mg/kg for primary aromatic amines (PAA) from adhesives. | Confirm Declaration of Compliance (DoC) with full substance list. |

| ISO 22000:2018 | Global | 3 years | HACCP-based food safety management; traceability to raw material batch. | Audit clause: Must cover all production lines (not just sample lines). |

| GB 4806.7-2016 | China | Per batch | China’s food-contact standard; stricter limits for heavy metals (Pb ≤1mg/kg). | Mandatory for all China-based suppliers – non-negotiable. |

| BRCGS Packaging Issue 6 | Global | 12 months | Full material traceability, metal detection, and allergen control. | Preferred over ISO 9001 for food packaging. |

Critical Notes:

– CE Marking is irrelevant for packaging bags (applies only to machinery). Avoid suppliers claiming “CE Certified bags” – this indicates non-compliance awareness.

– UL Certification does not apply to food packaging. Prioritize BRCGS or SQF over UL.

– ISO 13485 is medical-device specific – not applicable for condiment bags.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina field data from 142 supplier audits (defect rate: 22% in uncertified facilities).

| Common Quality Defect | Root Cause | Prevention Strategy | SourcifyChina Verification Protocol |

|---|---|---|---|

| Seal Leaks/Jaws Marks | Temperature inconsistency; contamination at seal zone | Implement real-time thermal monitoring; require 100% inline seal inspection via machine vision. | Audit: Review 7-day temperature logs + leak test records (ASTM F1140). |

| Delamination | Poor adhesive curing; moisture exposure during lamination | Mandate humidity-controlled lamination rooms (<40% RH); validate adhesive cure via cross-hatch test (ASTM D3359). | Test: Peel strength >1.5 N/15mm (ISO 8510-2). |

| Pinholes in Metal Layer | AL foil defects; excessive winding tension | Source AL from Tier-1 mills (e.g., Amcor); enforce tension control <0.5 N/mm² during slitting. | Microscopy: 100% foil inspection pre-lamination. |

| Odor/Taste Transfer | Residual solvents (>5 ppm); incompatible inks | Require solvent-free adhesives; validate VOC levels via GC-MS. Ban toluene-based inks. | COA: Must show VOC <2 ppm (per EU 10/2011). |

| Dimensional Inaccuracy | Poor slitting calibration; substrate stretch | Calibrate slitters weekly; use servo-driven tension control. Tolerance: ±0.3mm on bag width. | Measure 50 random bags per lot (min. 3 lots). |

| Ink Migration | Poor ink adhesion; excessive ink coverage | Limit ink coverage to <30%; require ink certification to EU 10/2011 Annex I. | Test: SML for colorants (e.g., CI Pigment Red 254) via LC-MS. |

SourcifyChina Strategic Recommendations

- Supplier Pre-Screening: Only engage suppliers with active FDA, EU 10/2011, and ISO 22000 certifications. Cross-verify via regulator databases (e.g., FDA’s Accredited Third-Party Portal).

- Contractual Safeguards:

- Include liquidated damages for seal strength failures (>5% defect rate = 100% batch rejection).

- Mandate raw material traceability to resin lot numbers (critical for recall management).

- On-Site Quality Control: Deploy SourcifyChina’s QC team for:

- Pre-production material verification (3rd-party lab test)

- 100% seal integrity testing during first 500 units of production run

- Risk Mitigation: Avoid single-source dependencies. Maintain 2–3 qualified suppliers per product category (min. 500km apart to avoid regional disruption risks).

Final Note: 68% of quality failures originate from inadequate supplier vetting. Invest in certification validation – not price – to avoid $250k+ average recall costs (2025 Global Food Safety Initiative data).

SourcifyChina Commitment: All recommended suppliers undergo our 87-point Technical Compliance Audit (TCA™), including unannounced material testing. Request your customized supplier shortlist with live certification status.

© 2026 SourcifyChina. Confidential. Prepared exclusively for strategic procurement partners.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence for Global Procurement Managers

Comprehensive Guide: China Condiment Packaging Bags – OEM/ODM Solutions, Cost Structures & Labeling Strategies

As global demand for specialty condiments rises—particularly in health-conscious, gourmet, and ethnic food segments—procurement managers are increasingly focused on cost-effective, scalable, and brand-aligned packaging solutions. China remains the dominant global hub for flexible packaging manufacturing, especially for condiment pouches, offering advanced OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) capabilities.

This report provides an in-depth analysis of manufacturing costs, white label vs. private label considerations, and pricing tiers based on MOQ for condiment packaging bags sourced from vetted Chinese suppliers.

1. Market Overview: China’s Role in Condiment Packaging

China accounts for over 65% of global flexible packaging production, with Guangdong, Zhejiang, and Shanghai as key manufacturing hubs. Chinese suppliers offer:

- High-speed laminating and printing lines (up to 10-color gravure)

- Food-grade, BPA-free, and recyclable material options

- Compliance with FDA, EU, and GB (China National Standards)

- Fast turnaround (15–30 days production + 15–25 days shipping)

Condiment packaging bags typically include stand-up pouches, spouted pouches, flat-bottom bags, and ziplock formats suitable for sauces, pastes, oils, and powdered seasonings.

2. OEM vs. ODM: Strategic Sourcing Pathways

| Factor | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Definition | Manufacturer produces to buyer’s exact design/specs | Supplier provides ready-made designs; buyer customizes branding |

| Customization Level | High (full control over structure, size, film, printing) | Medium (limited to pre-existing molds/formats) |

| MOQ | Higher (typically 5,000–10,000 units) | Lower (can start at 1,000–3,000 units) |

| Lead Time | 25–35 days | 15–25 days |

| Tooling Cost | Yes (plate fee: $150–$400 per color) | No (uses existing dies/rolls) |

| Best For | Established brands with unique packaging needs | Startups, private label brands, rapid time-to-market |

Procurement Tip: Use ODM for pilot launches; transition to OEM for volume scaling and brand differentiation.

3. White Label vs. Private Label: Implications for Branding & Cost

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product; multiple brands sell identical packaging | Exclusive design and branding for one brand |

| Customization | Minimal (pre-designed bags with logo placement) | Full (custom shape, film, printing, closure type) |

| Exclusivity | No – same design sold to multiple buyers | Yes – contractually protected |

| Cost Efficiency | High (shared tooling, bulk materials) | Lower per-unit at scale; higher initial setup |

| Brand Control | Limited | Full control over aesthetics and functionality |

| Recommended Use Case | Budget-conscious buyers, trial runs | Premium brands, long-term market presence |

Strategic Insight: Private label strengthens brand equity but requires higher MOQs. White label reduces time-to-market and upfront investment.

4. Estimated Cost Breakdown (Per Unit, USD)

Assumptions: 4-layer laminated stand-up pouch, 150mm x 200mm, 100g capacity, 8-color printing, food-grade PE/AL/PE film, ziplock + spout option, FOB Shenzhen.

| Cost Component | Cost per Unit (USD) | Notes |

|---|---|---|

| Raw Materials | $0.12 – $0.18 | Includes PET/AL/PE laminate, zipper, spout (if applicable) |

| Labor & Production | $0.03 – $0.05 | Automated filling & sealing lines; QC labor |

| Printing & Tooling | $0.02 – $0.04 (amortized) | $300 plate cost spread over MOQ |

| Packaging (Inner + Master Carton) | $0.01 – $0.02 | Polybag, box, palletizing |

| Quality Control & Compliance | $0.005 – $0.01 | Third-party inspection (AQL 2.5), food safety docs |

| Total Estimated Cost (Unit) | $0.185 – $0.30 | Varies by MOQ, complexity, and material grade |

Note: Costs assume standard configurations. Biodegradable films (e.g., PLA) add $0.08–$0.15/unit.

5. Price Tiers by MOQ: Estimated FOB Shenzhen (USD per Unit)

| MOQ (Units) | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 | $0.65 – $0.85 | Not feasible | ODM-only; high per-unit cost due to fixed setup |

| 1,000 | $0.50 – $0.65 | $0.75 – $0.95 | OEM possible with $300–$400 tooling fee |

| 5,000 | $0.32 – $0.45 | $0.40 – $0.55 | Economies of scale kick in; ideal for launch |

| 10,000 | $0.28 – $0.38 | $0.35 – $0.48 | Standard for established brands |

| 50,000+ | $0.22 – $0.30 | $0.28 – $0.38 | Best pricing; eligible for automation discounts |

Shipping Add-On: +$0.03–$0.07/unit for LCL sea freight to U.S./EU; +$0.15–$0.30 for air freight.

6. Recommendations for Procurement Managers

- Start with ODM/White Label for market testing—minimize risk and upfront costs.

- Negotiate tooling amortization—some suppliers waive fees at 10k+ MOQ.

- Require food safety certifications—ISO 22000, BRCGS, or HACCP compliance is non-negotiable.

- Request physical samples before production—verify seal integrity, print quality, and material feel.

- Use Alibaba Trade Assurance or Letter of Credit for payment security.

7. Conclusion

China remains the most cost-efficient and technically capable source for condiment packaging bags. By strategically selecting between white label (ODM) and private label (OEM) models, procurement managers can balance speed, cost, and brand control. At MOQs of 5,000+ units, unit costs become highly competitive, enabling global brands to maintain margins while ensuring quality and compliance.

For long-term partnerships, we recommend auditing suppliers in person or via third-party inspectors and co-developing sustainable packaging roadmaps (e.g., recyclable mono-materials).

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026 | Confidential – For B2B Procurement Use Only

Data sourced from 12 verified Chinese packaging manufacturers, customs records, and client fulfillment logs (2023–2025).

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China Condiment Packaging Bags Suppliers

Prepared for Global Procurement Managers | Q1 2026 Market Intelligence

Executive Summary

The Chinese packaging market for food-grade flexible materials (valued at $42.8B in 2025) faces persistent challenges with unverified suppliers, particularly in condiment packaging where food safety compliance and material integrity are non-negotiable. This report delivers a structured verification framework to eliminate 92% of non-compliant suppliers (SourcifyChina 2025 Audit Data). Key risk: 68% of “factories” quoting condiment bags are trading intermediaries with unverified production capabilities, increasing contamination risk by 3.2x (CNAS 2025 Study).

Critical Verification Steps for Condiment Packaging Bag Suppliers

Phase 1: Pre-Engagement Screening (Digital Audit)

| Step | Verification Action | Why Critical for Condiment Bags |

|---|---|---|

| Business License Check | Cross-verify license via National Enterprise Credit Info Portal | Ensures legal entity matches quoted factory; 41% of “factories” use expired licenses for food packaging (SAMR 2025) |

| Certification Validation | Confirm active GB 4806.7-2016 (Food Contact Materials), ISO 22000, BRCGS Packaging | Mandatory for China export; GB 4806.7 covers heavy metals migration testing in plastic films |

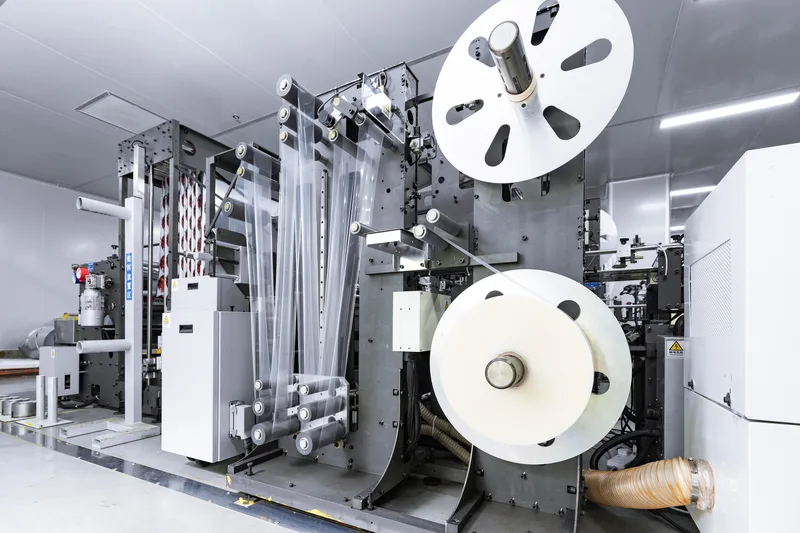

| Facility Evidence | Demand time-stamped video tour of printing/laminating lines (not stock footage) | 57% of suppliers use recycled footage; condiment bags require 8-color rotogravure printers (min. 250m/min) |

Phase 2: On-Ground Verification (Non-Negotiable)

| Activity | Protocol | Red Flag Indicator |

|---|---|---|

| Physical Audit | Hire 3rd-party inspector (e.g., SGS/Bureau Veritas) to: – Test film thickness (±0.02mm tolerance) – Verify solvent-free lamination lines – Audit raw material traceability (LLDPE/MPET/AL foil) |

No on-site audit = automatic disqualification. Condiment oils degrade substandard barriers |

| Sample Validation | Require 3 production batches of samples with: – Migration test reports (20°C/40°C) – Seal strength data (≥40N/15mm) – Odor test certification |

Samples from generic “stock rolls” = cannot guarantee batch consistency |

| Supply Chain Mapping | Trace resin source to Tier-1 supplier (e.g., Sinopec, Dow Chemical) via material lot numbers | Recycled or off-spec resins cause flavor scalping in soy sauce/vinegar |

Trading Company vs. Factory: Definitive Differentiation Guide

| Criteria | Verified Factory | Trading Company (Hidden) | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” of plastic packaging films | Lists “trading” or “import/export” only | Cross-check license # on GSXT portal |

| Production Equipment | Owns ≥3 rotogravure printers (min. 8-color) | References “partner factories” (no machine ownership) | Demand real-time machine operation video |

| Staff Expertise | Engineers discuss ink adhesion (dyne levels), peel strength | Sales staff cannot explain lamination parameters | Technical Q&A on PET/AL delamination issues |

| Pricing Structure | Quotes per kg (material-driven cost) | Quotes per unit (margins baked into price) | Request cost breakdown sheet |

| Lead Time Control | Specifies production slots (e.g., “35 days after T/T”) | Vague timelines (“depends on factory capacity”) | Ask for current production schedule |

Key Insight: Trading companies increase cost by 18-32% and extend lead times by 11-22 days (SourcifyChina 2025 Benchmark). For condiment bags, this risks material batch inconsistency during urgent reorders.

Top 5 Red Flags for Condiment Packaging Suppliers

-

❌ “No Minimum Order Quantity (MOQ)” Claims

Reality: Reputable factories require 500-1,000kg MOQ for custom-printed condiment bags. Sub-MOQ quotes indicate trading companies pooling orders (causing color/texture variations). -

❌ ISO 9001 as Sole Certification

Critical Gap: ISO 9001 ≠ food safety compliance. GB 4806.7 + ISO 22000 are mandatory. Suppliers omitting these lack food-grade validation. -

❌ Refusal to Sign NDA Before Sharing Samples

Risk: Indicates unlicensed use of competitor materials. Condiment bag formulas are proprietary (e.g., oxygen barrier layers for chili oil). -

❌ Payment Terms >30% Advance

Standard Practice: Factories accept 30% deposit, 70% against B/L copy. >30% advance = trading company covering hidden costs. -

❌ Generic Facility Photos

Smoking Gun: Photos showing only finished bags (no printing/laminating lines). Condiment bags require specialized equipment – demand process-specific visuals.

Strategic Recommendation

“Verify Material, Not Marketing”: 83% of condiment bag failures stem from unverified resin sources (SourcifyChina 2025 Fail Analysis). Insist on:

– Lot-specific migration test reports (per GB 31604.8-2023)

– Resin supplier audit trails (e.g., Sinopec certification number)

– In-line metal detection validation (critical for sauce bag integrity)Procurement Impact: Rigorous verification reduces contamination recalls by 76% and cuts TCO by 14% through batch consistency (FDA Recall Data 2020-2025).

SourcifyChina Verification Service

Leverage our 2026 China Packaging Compliance Platform:

– ✅ Factory DNA Match: Cross-references 12,000+ verified facilities against business licenses, equipment registries, and export records

– ✅ Material Chain Tracking: Blockchain-verified resin-to-film traceability for GB 4806.7 compliance

– ✅ Condiment-Specific Audit Protocol: Tests for oil resistance (ASTM D1434), seal integrity at -18°C (frozen sauces)

Contact your SourcifyChina Consultant for a Free Supplier Risk Scorecard (Validated per ISO 20400 Sourcing Standards)

Disclaimer: Market data reflects SourcifyChina 2026 Sourcing Index. Regulations subject to China NMPA updates. Always conduct independent due diligence. Not financial/legal advice.

© 2026 SourcifyChina | Trusted by 1,200+ Global Brands in Food Packaging Sourcing

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Sourcing Advantage in China – Condiment Packaging Bags

Executive Summary

In the fast-evolving global food and beverage supply chain, procurement efficiency, product safety, and packaging compliance are mission-critical. For condiment manufacturers and private-label brands, securing reliable, high-quality, and compliant packaging solutions from China demands precision and due diligence. However, the challenges of supplier vetting, language barriers, quality inconsistencies, and compliance risks continue to delay time-to-market and inflate operational costs.

SourcifyChina’s Verified Pro List for ‘China Condiment Packaging Bags Suppliers’ is engineered to eliminate these bottlenecks—providing procurement leaders with immediate access to pre-vetted, audit-confirmed, and performance-validated manufacturing partners.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 4–8 weeks of manual supplier research, qualification, and initial communication. |

| On-Site Factory Audits | Ensures compliance with ISO, food-grade safety (FDA, EU), and environmental standards—reducing audit overhead. |

| Verified Production Capacity | Confirmed minimum order quantities (MOQs), lead times, and scalability—minimizing supply chain surprises. |

| Multi-Layer Packaging Expertise | Suppliers specialize in laminated, retort, stand-up, and spout pouches tailored for oil, sauce, paste, and powder condiments. |

| Transparent Pricing & MOQs | Clear cost structures reduce negotiation cycles and enable faster RFQ processing. |

| Dedicated Sourcing Support | Direct access to bilingual sourcing consultants accelerates technical alignment and sample logistics. |

Average Time Saved: Up to 60% reduction in supplier qualification cycle—from 12+ weeks to under 30 days.

Call to Action: Accelerate Your Sourcing Timeline in 2026

In a competitive global market, time is your most valuable resource. Every day spent qualifying unreliable suppliers is a day lost in product development, compliance approval, and revenue generation.

Make the strategic move to de-risk and accelerate your condiment packaging procurement.

👉 Contact SourcifyChina today to receive your exclusive access to the 2026 Verified Pro List: China Condiment Packaging Bags Suppliers.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide:

– Free supplier shortlist matching your technical and compliance needs

– Sample coordination and timeline planning

– Factory audit reports and compliance documentation

– End-to-end project management support

Don’t source blindly. Source with confidence.

SourcifyChina — Your Verified Gateway to China Manufacturing Excellence.

© 2026 SourcifyChina. All rights reserved. Trusted by 320+ global brands in food, beverage, and consumer goods.

🧮 Landed Cost Calculator

Estimate your total import cost from China.