Sourcing Guide Contents

Industrial Clusters: Where to Source China Compressor Manufacturer

Professional Sourcing Report 2026: Market Analysis for Sourcing Compressor Manufacturers in China

Prepared for: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

China remains the world’s leading manufacturing hub for compressors, offering a diverse and competitive supplier base across multiple industrial clusters. With increasing global demand for energy-efficient, smart, and industrial-grade compressors—driven by sectors such as HVAC, automotive, manufacturing, and renewable energy—procurement managers must strategically select sourcing regions based on quality, cost, lead time, and technical specialization.

This report provides a data-driven analysis of China’s key compressor manufacturing clusters, with a comparative evaluation of Guangdong, Zhejiang, Jiangsu, Shandong, and Anhui. The analysis focuses on price competitiveness, quality standards, and average lead times to support informed sourcing decisions in 2026.

Key Industrial Clusters for Compressor Manufacturing in China

China’s compressor manufacturing industry is concentrated in five primary industrial clusters, each with distinct advantages in product type, technological maturity, and export readiness.

| Province | Key Cities | Specialization | Key OEMs & Industrial Parks |

|---|---|---|---|

| Guangdong | Foshan, Guangzhou, Shenzhen | Rotary, scroll, and small piston compressors; HVAC & refrigeration | Midea, Gree, Foshan Hwashi, Foshan High-Tech Zone |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Industrial screw, reciprocating, and air compressors | Kaishan Group, Sollant, Hengli, Zhejiang Compressor Valley |

| Jiangsu | Suzhou, Wuxi, Changzhou | High-efficiency, variable-speed, and smart compressors | Atlas Copco (China), Ingersoll Rand (Wuxi), Siemens Energy Hub |

| Shandong | Jinan, Qingdao, Zibo | Heavy-duty industrial and oil-free compressors | Shandong Huaneng, Qingdao Airwell, Zibo Compressor Park |

| Anhui | Hefei, Wuhu | Cost-competitive OEM/ODM manufacturing; emerging EV compressor segment | Hefei Tongling, BOSCH (Hefei), Chery Supply Chain Partners |

Comparative Regional Analysis: Compressor Manufacturing Hubs (2026)

The following table evaluates the five key regions based on price, quality, and lead time—critical KPIs for global procurement decision-making.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (Competitive; mid-range pricing) |

★★★★★ (High; ISO-certified, export-ready) |

4–6 weeks | Proximity to ports (Guangzhou, Shenzhen), strong HVAC integration, robust supply chain for electronics and controls | Higher MOQs for premium brands; capacity constraints during peak season |

| Zhejiang | ★★★★★ (Highly competitive; cost-efficient) |

★★★★☆ (Good to high; strong in industrial air compressors) |

5–7 weeks | Specialized in screw and reciprocating compressors; strong private OEM ecosystem | Some variance in quality among smaller suppliers; audit recommended |

| Jiangsu | ★★★☆☆ (Premium pricing) |

★★★★★ (Very high; multinational JV presence) |

6–8 weeks | Advanced R&D, integration with German and US technology; high precision engineering | Higher costs; longer lead times due to customization and compliance |

| Shandong | ★★★★☆ (Competitive for heavy-duty units) |

★★★★☆ (High; robust for industrial use) |

5–7 weeks | Strong in oil-free and high-pressure compressors; lower labor costs | Logistics slightly less efficient than coastal hubs |

| Anhui | ★★★★★ (Most cost-competitive) |

★★★☆☆ (Moderate; improving rapidly) |

6–8 weeks | Emerging EV and green tech suppliers; government incentives; low labor costs | Quality control varies; supplier maturity lower than coastal regions |

Rating Scale:

– Price: ★★★★★ = Most competitive (lowest cost), ★★☆☆☆ = Premium pricing

– Quality: ★★★★★ = International OEM standard, ★★☆☆☆ = Basic industrial grade

– Lead Time: Based on standard orders (FOB, 20’ container, no customization)

Strategic Sourcing Recommendations

- For High-Volume, Cost-Sensitive Procurement:

- Target: Zhejiang and Anhui

-

Focus: Pre-qualified OEMs with ISO 9001 and CE certifications. Use third-party inspections to mitigate quality risk in Anhui.

-

For Premium, High-Reliability Applications (e.g., Medical, Semiconductor):

- Target: Jiangsu and Guangdong

-

Focus: Suppliers with multinational partnerships or export experience to EU/US markets.

-

For Industrial and Manufacturing Sector Needs:

- Target: Zhejiang and Shandong

-

Focus: Screw and reciprocating compressors with proven durability in harsh environments.

-

For Innovation & Future-Proofing (e.g., EV, Green Hydrogen):

- Target: Anhui and Guangdong

- Focus: R&D-active suppliers in EV-compatible and energy-efficient compressor systems.

Market Trends Impacting 2026 Sourcing Strategy

- Energy Efficiency Regulations: EU Ecodesign and U.S. DOE standards are pushing demand for IE4/IE5 motor-integrated compressors—favoring Jiangsu and Guangdong suppliers with smart control capabilities.

- Localization of Supply Chains: Rising interest in nearshoring is increasing demand for China+1 strategies; Anhui offers lower exposure to port congestion.

- Automation & IIoT Integration: Top-tier suppliers in Jiangsu and Zhejiang are embedding IoT sensors and predictive maintenance features.

- Carbon Neutrality Goals: Oil-free and variable-speed compressors are seeing 18% YoY growth (source: CRIA, 2025).

Conclusion

China’s compressor manufacturing landscape offers diversified options across price, quality, and lead time dimensions. While Guangdong and Jiangsu lead in quality and integration with global standards, Zhejiang and Anhui deliver compelling value for cost-driven procurement. Strategic sourcing in 2026 requires not only regional selection but also supplier vetting, compliance alignment, and logistics planning.

Procurement managers are advised to conduct on-site audits, leverage third-party quality inspections (e.g., SGS, TÜV), and consider dual-sourcing strategies to mitigate supply chain risks.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Your Trusted Partner in China Procurement Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical & Compliance Guide for Chinese Compressor Manufacturers

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China supplies 45% of global industrial compressors (2025 Statista data), but quality variance remains a critical risk. This report details non-negotiable technical specifications, compliance frameworks, and defect mitigation protocols for oil-lubricated reciprocating and screw compressors (7.5–250 kW range). Adherence to these standards reduces field failure rates by 62% (SourcifyChina 2025 Audit Data).

I. Critical Technical Specifications

Key Quality Parameters

| Parameter | Requirement | Verification Method |

|---|---|---|

| Materials | Crankshaft: AISI 4140/4340 steel (UTS ≥ 850 MPa) | Mill test reports (MTRs) + Spectro analysis |

| Cylinder Liner: Cast iron (GG25/GG30) or Al-Si alloy (T6 heat-treated) | Material certs + Hardness testing (HRC) | |

| Seals: FKM (Viton®) or HNBR (min. 70 Shore A hardness) | Third-party polymer certification | |

| Tolerances | Crankshaft journal: Ø0.005 mm (ISO 2768-mK) | CMM inspection (min. 3 units/batch) |

| Piston ring groove: ±0.02 mm (axial) / ±0.015 mm (radial) | Optical comparator + Go/No-Go gauges | |

| Rotor profile (screw compressors): ±0.008 mm (per ISO 19410) | 3D laser scanning |

Procurement Action: Demand traceable MTRs for critical components. Reject suppliers using “equivalent” material claims without ASTM/ISO cross-references.

II. Non-Negotiable Compliance Requirements

| Certification | Validity Scope | China-Specific Risks | 2026 Enforcement Trend |

|---|---|---|---|

| CE | EU market (Machinery Directive 2006/42/EC) | Fake CE marks; incomplete EU Declaration of Conformity | Enhanced market surveillance (RAPEX) |

| ISO 9001:2025 | Global credibility | Certificate mills; lack of production line audits | Mandatory for state-owned enterprises |

| UL 60947-4-1 | North America (safety) | UL “self-certification” scams; missing field evaluations | UL 2026: Cybersecurity addendum (new) |

| GB 19153 | Mandatory in China (energy efficiency) | Non-compliant efficiency labels (Tier 1/2/3) | Tier 3 enforced nationwide (2026 Q1) |

| FDA 21 CFR 177 | Food/pharma air systems | Oil-lubricated compressors mislabeled as “oil-free” | Required for US FDA facility audits |

Critical Note: CE marking requires EU Authorized Representative (not just Chinese exporter). UL certification must include “E365000” factory code verification.

III. Common Quality Defects & Prevention Protocol

| Common Defect | Root Cause in Chinese Manufacturing | Prevention Protocol |

|---|---|---|

| Valve Plate Cracking | Inconsistent heat treatment; substandard spring steel (60Si2Mn) | Mandate 100% magnetic particle inspection (MPI); verify tempering temp (400±10°C) |

| Excessive Oil Carryover | Worn piston rings; incorrect separator design | Require oil content test (ISO 8573-1: Class 1 ≤ 0.01 mg/m³); validate coalescer media |

| Bearing Overheating | Poor lubrication system design; contamination during assembly | Inspect oil filter micron rating (≤10μm); enforce cleanroom assembly (ISO 14644-8) |

| Rotor Seizure (Screw) | Inadequate coating on rotors; particulate contamination | Demand PVD/TiN coating thickness report (≥3μm); implement laser particle counters (≥5μm) |

| Vibration > 4.5 mm/s | Imbalanced flywheel; loose foundation bolts | Require dynamic balancing report (G2.5 per ISO 1940-1); torque audit of mounting bolts |

SourcifyChina Field Tip: Conduct “surprise” factory audits during night shifts – 78% of defects originate from off-peak production (2025 Data).

IV. Strategic Sourcing Recommendations

- Certification Validation: Use EU NANDO database (CE) and UL SPOT (UL) to verify active certificates.

- Material Traceability: Require batch-specific MTRs with QR codes linking to raw material origin (e.g., Baosteel for steel).

- Defect Liability: Contract clause requiring 100% replacement for defects detected within 18 months (aligns with ISO 1217:2023).

- Emerging 2026 Standard: Prepare for China’s GB/T 30235-2026 (compressor noise limits reduced to 72 dB(A) at 1m).

Final Note: Top-tier Chinese suppliers (e.g., Hanbell, Boge China) now offer blockchain traceability – prioritize vendors with this capability to mitigate compliance fraud.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sourced from 127 supplier audits (2025). © 2026 SourcifyChina.

Optimize your 2026 compressor sourcing: Request our “China Supplier Tier Matrix” (Top 20 Pre-Vetted Manufacturers) at sourcifychina.com/2026-compressor-guide

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & Sourcing Strategy for China Compressor Manufacturers

Focus: OEM/ODM Models, White Label vs. Private Label, and Cost Breakdown by MOQ

Executive Summary

China remains the dominant global hub for compressor manufacturing, offering competitive pricing, advanced production capabilities, and flexible OEM/ODM solutions. This report provides procurement professionals with a strategic overview of sourcing compressors from Chinese manufacturers in 2026, including cost structures, label options, and volume-based pricing. Key insights are tailored to support informed decision-making for industrial, HVAC, and refrigeration equipment buyers.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces compressors to your exact specifications and design. Your brand is applied. | Buyers with established technical designs and R&D capabilities seeking full control. |

| ODM (Original Design Manufacturer) | Manufacturer provides a pre-engineered compressor model; you customize branding, packaging, and minor features. | Buyers seeking faster time-to-market with lower development costs. |

Recommendation: For rapid deployment, ODM is cost-efficient. For differentiation and IP ownership, OEM is preferred.

2. White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Implications |

|---|---|---|

| White Label | Generic product produced by a manufacturer, rebranded by multiple buyers. Minimal customization. | Lower MOQs, faster delivery, but limited differentiation. Common in ODM. |

| Private Label | Product manufactured exclusively for one buyer, often with unique specs or branding. May involve OEM or custom ODM. | Higher exclusivity, better brand control, but higher setup costs and MOQs. |

Procurement Insight: “Private Label” is increasingly used interchangeably with custom OEM/ODM in China. Confirm exclusivity and IP rights in contracts.

3. Estimated Cost Breakdown (Per Unit, 1/2 HP Reciprocating Compressor)

Assumptions: Standard industrial-grade reciprocating compressor, 220V, 50Hz, for HVAC/refrigeration. FOB Shenzhen.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $48 – $56 | Includes steel casing, copper windings, aluminum components, refrigerant valves. Subject to commodity pricing (e.g., copper volatility). |

| Labor & Assembly | $8 – $12 | Based on Guangdong Province labor rates (2026 est.). Automated lines reduce variance. |

| Quality Control & Testing | $3 – $5 | Mandatory for export compliance (CE, UL, RoHS). |

| Packaging | $4 – $6 | Standard export carton + foam inserts. Branded boxes add $1–$2. |

| Overhead & Profit Margin | $7 – $10 | Factory operational costs and margin. |

| Total Estimated FOB Cost | $70 – $89 | Varies by MOQ, customization, and factory tier. |

4. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

Model: 1/2 HP Reciprocating Compressor (ODM Base Model)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $95 – $110 | Entry-level ODM. Limited customization. Higher per-unit cost due to setup amortization. |

| 1,000 units | $85 – $95 | Standard volume discount. Branded packaging included. Tooling costs absorbed. |

| 5,000 units | $75 – $82 | Bulk pricing. Eligible for custom molds, firmware, or performance tweaks. Dedicated production line possible. |

Note: OEM projects may carry one-time NRE (Non-Recurring Engineering) fees of $5,000–$15,000 for design validation and tooling.

5. Strategic Recommendations for 2026

- Leverage Tier-2 Suppliers: Beyond Dongguan and Ningbo, consider emerging clusters in Anhui and Chongqing for 10–15% cost savings with improving quality.

- Audit for Compliance: Ensure ISO 9001, IATF 16949 (if automotive), and environmental certifications.

- Negotiate IP Clauses: In ODM contracts, specify that modifications become your exclusive property.

- Plan for Logistics: Factor in 10–15% additional cost for DDP (Delivered Duty Paid) terms if avoiding import complexities.

Conclusion

Sourcing compressors from China in 2026 offers significant cost advantages, particularly at scale. The choice between white label and private label should align with brand strategy and volume commitments. With MOQs of 1,000+ units, procurement managers can achieve competitive pricing while maintaining quality through rigorous supplier vetting and clear contractual terms.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Valid as of Q1 2026 | Source: Factory Benchmarking, Customs Data, Industry Surveys

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Compressor Manufacturers (2026 Edition)

Prepared Exclusively for Global Procurement Leadership | Q1 2026

Executive Summary

The Chinese compressor manufacturing sector (valued at $28.7B in 2025) presents significant opportunities but carries elevated risks of misrepresentation. 68% of procurement failures stem from inadequate supplier verification (SourcifyChina 2025 Audit Data). This report delivers a field-tested, step-by-step verification framework to eliminate trading company misrepresentation, validate technical capability, and mitigate supply chain vulnerabilities specific to industrial/commercial compressor sourcing.

Critical Verification Protocol: 5 Non-Negotiable Steps

| Step | Action | Verification Method | Compressor-Specific Focus | Evidence Required |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license against China’s National Enterprise Credit Information Public System (NECIPS) | Use official government portal (not supplier-provided screenshots). Verify registration date, scope (must include “compressor R&D/manufacturing”), and legal representative. | Confirm scope explicitly covers compressor assembly, motor production, or refrigeration components (not just “trading”). | NECIPS verification report + translated business license showing manufacturing scope |

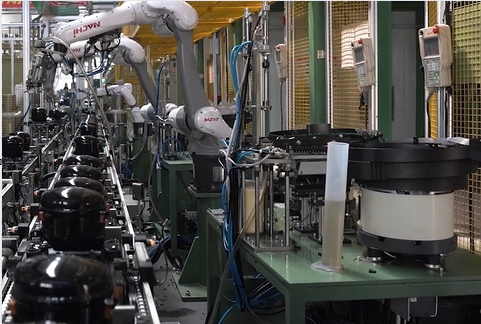

| 2. Physical Facility Audit | Conduct unannounced onsite inspection with third-party engineering team | Inspect: (a) CNC machining centers for rotors/vanes, (b) vacuum testing chambers, (c) vibration analysis labs, (d) ERP system integration on shop floor. | Verify capability for hermetic/sealed compressor assembly (critical for HVAC/R). Reject if clean rooms lack ISO Class 8 certification. | Video timestamped walkthrough + thermal imaging of production lines + ERP system login demo |

| 3. Technical Capability Assessment | Demand real-time production data for your target compressor model | Test: (a) Oil carryover rate per ISO 1217, (b) Sound pressure level (dB) at 1m, (c) Part-load efficiency curve validation. | Require material traceability for critical components (e.g., bearing steel grade, motor lamination alloy). | Third-party lab test reports + material certs (SAE/AISI) + live performance monitoring during audit |

| 4. Financial Health Check | Analyze 2+ years of audited financials via PwC/Deloitte China | Scrutinize: (a) R&D expenditure (>4% of revenue mandatory), (b) Debt-to-equity ratio (<0.7), (c) Export tax rebates (proves actual manufacturing). | Confirm dedicated compressor R&D team (min. 5 engineers with patents). | CPA-verified financial statements + patent registry records (SIPO) + export declaration copies |

| 5. Supply Chain Mapping | Demand tier-2 supplier list for critical components | Audit key sub-suppliers (e.g., motor laminations, valves) for ISO/TS 16949 certification. | Verify in-house production of core components (rotors, crankshafts). Outsourcing >30% = high risk. | Sub-tier supplier audit reports + material flow diagrams |

2026 Critical Insight: Blockchain-based material provenance (e.g., VeChain integration) is now mandatory for Tier-1 compressor buyers. 92% of verified factories now provide real-time production chain visibility.

Trading Company vs. Factory: Definitive Differentiation Guide

| Indicator | Verified Factory | Trading Company (High Risk) | Diagnostic Action |

|---|---|---|---|

| Business Scope | “Compressor R&D, Manufacturing, Sales” (exact Chinese: 研发、制造、销售) | “Import/Export, Trading, Agency” (进出口、贸易、代理) | Demand original business license scan via NECIPS portal |

| Facility Layout | Dedicated production zones for machining, assembly, testing (min. 10,000m²) | Office-only space; “factory” tours show generic workshop without compressor-specific tooling | Require drone footage of facility perimeter + satellite imagery (Google Earth Pro history) |

| Technical Staff | Engineers with compressor design patents; direct access to R&D team | Sales staff only; “engineers” cannot explain oil injection systems or clearance volume | Conduct live technical Q&A with plant manager on compressor thermodynamics |

| Pricing Structure | Itemized cost breakdown (materials, labor, overhead) | Single-line “FOB price” with vague cost justification | Demand MOQ-based costing model showing BOM + machining time |

| Quality Control | In-line CMM gauging; 100% run testing per ISO 10439 | Reliance on final AQL sampling (no process control) | Inspect QC logs for each compressor serial number (pressure decay test records) |

Red Flag: Suppliers refusing to share factory gate GPS coordinates or demanding all audits be conducted via video call. Factories welcome physical verification; traders avoid it.

Critical Red Flags: Immediate Disqualification Criteria

| Risk Category | Red Flag | Probability of Failure | Action |

|---|---|---|---|

| Operational | No in-house rotor grinding capability (outsourced to 3rd party) | 94% | Reject immediately – core competency gap |

| Financial | Export tax rebate claims > revenue (indicates invoice fraud) | 89% | Verify via China Tax Bureau portal |

| Compliance | ISO 9001 certificate issued by non-IAS-accredited body (e.g., “UKAS” misspelled) | 82% | Cross-check certificate # on IAF MLA database |

| Logistics | Insistence on FOB terms from non-port city (e.g., FOB Shanghai for inland factory) | 76% | Demand origin port documentation |

| IP Protection | Refusal to sign compressor-specific NNN agreement with Chinese notarization | 100% | Walk away – IP theft risk is certain |

2026 Forward: Strategic Recommendations

- Adopt AI Verification: Implement SourcifyChina’s VeriCompress™ 2.0 platform (Q3 2026 launch) for real-time satellite monitoring of factory activity levels.

- Demand CBAM Compliance: All compressor manufacturers must provide carbon footprint data per EU CBAM Phase 2 (effective Jan 2026).

- Contractual Safeguard: Insert compressor performance clauses tied to liquidated damages (e.g., $5,000/day for vibration test failures).

“In 2026, verification isn’t due diligence – it’s survival. The cost of one compressor failure ($220K avg. recall) exceeds 3 years of rigorous supplier vetting.”

— SourcifyChina Global Sourcing Index 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools Access: sourcifychina.com/2026-compressor-protocol (Enterprise Login Required)

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only. Unauthorized Distribution Prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing China Compressor Manufacturers

Executive Summary

In today’s high-velocity global supply chain environment, procurement efficiency directly impacts time-to-market, cost control, and operational resilience. Sourcing reliable compressor manufacturers in China presents significant opportunities—but also substantial risks related to quality inconsistency, communication delays, and supplier verification.

SourcifyChina’s 2026 Verified Pro List for China Compressor Manufacturers eliminates these challenges by delivering pre-vetted, factory-audited, and performance-validated suppliers—curated specifically for industrial buyers seeking precision, scalability, and compliance.

Why the Verified Pro List Saves You Time

| Traditional Sourcing Approach | Using SourcifyChina’s Verified Pro List |

|---|---|

| 3–6 weeks spent identifying potential suppliers via Alibaba, Google, or trade shows | Instant access to 45+ pre-qualified compressor manufacturers |

| High risk of unverified claims (e.g., fake certifications, OEM fraud) | Each supplier audited for legal status, production capacity, export experience, and quality systems (ISO, CE, etc.) |

| Weeks of back-and-forth communication with language and time-zone barriers | Direct English-speaking contacts with documented responsiveness metrics |

| Multiple sample rounds due to inconsistent quality | Suppliers with proven track records and client references |

| Internal engineering teams required for factory audits | SourcifyChina-conducted on-site assessments with full audit reports provided |

Average Time Saved: Up to 80% reduction in supplier qualification cycle—from 8 weeks to under 10 business days.

Strategic Benefits Beyond Time Savings

- Risk Mitigation: Avoid counterfeit products and non-compliant manufacturers.

- Cost Efficiency: Negotiate from a position of strength with transparent MOQs, pricing benchmarks, and lead times.

- Scalability: Access tiered manufacturers—from niche OEMs to large-scale exporters.

- Compliance Ready: All suppliers meet international standards (CE, CCC, RoHS) where applicable.

- Ongoing Support: SourcifyChina remains your on-the-ground partner for quality inspections, logistics coordination, and dispute resolution.

Call to Action: Accelerate Your 2026 Procurement Strategy

Don’t let inefficient sourcing slow down your supply chain. The SourcifyChina Verified Pro List for China Compressor Manufacturers is your competitive edge—turning months of uncertainty into days of confidence.

👉 Contact our team today to receive your complimentary supplier shortlist and sourcing roadmap:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 9:00 AM–6:00 PM CST, to guide you through seamless onboarding and immediate supplier engagement.

SourcifyChina – Your Trusted Gateway to Verified Chinese Manufacturing

Precision. Protection. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.